Table of Contents

Introduction

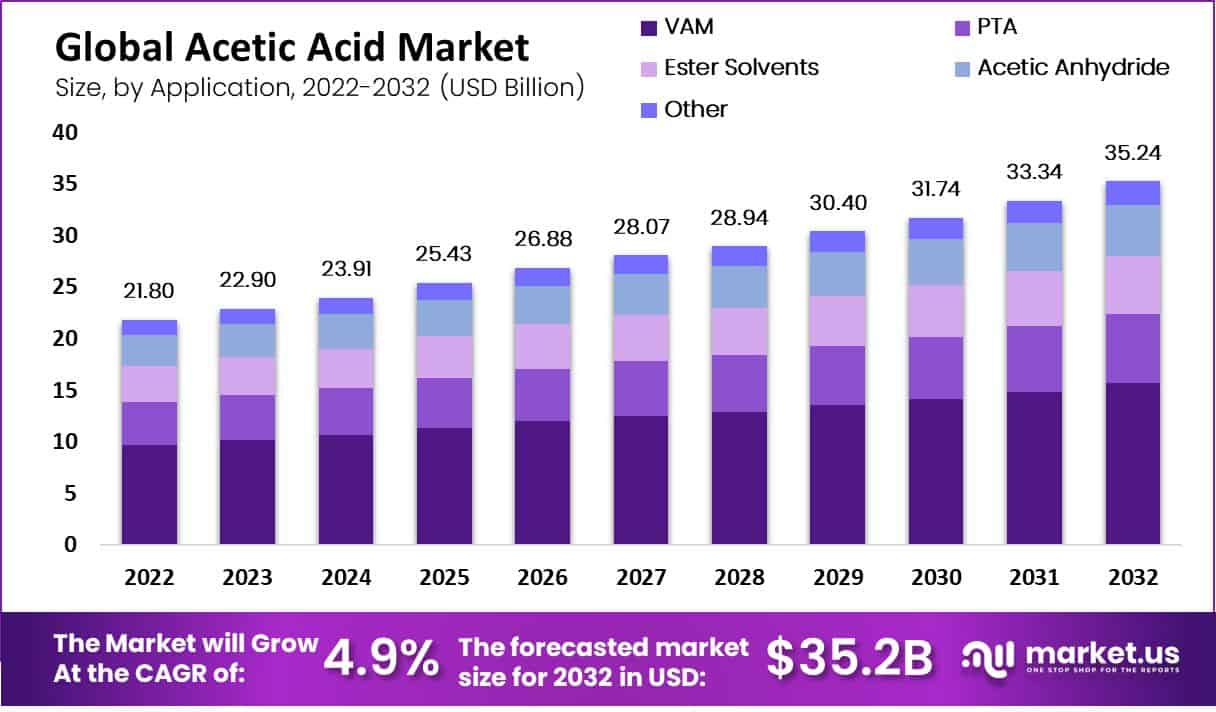

The global acetic acid market is poised for significant growth, with an expected market size of approximately USD 35.2 billion by 2032, up from USD 21.8 billion in 2022, reflecting a compound annual growth rate (CAGR) of 4.90% during the forecast period of 2022 to 2032. This growth is driven primarily by the extensive application of acetic acid as a key chemical intermediate in various industries, including plastics, textiles, food and beverages, and pharmaceuticals.

One of the main drivers of this market is the rising demand for vinyl acetate monomer (VAM), which accounts for a substantial portion of acetic acid consumption. VAM is essential in producing polymers used in paints, adhesives, and coatings, all of which are seeing increased demand globally, particularly in the construction and automotive sectors. Additionally, purified terephthalic acid (PTA), another derivative of acetic acid, is crucial in producing PET plastics, widely used in packaging, textiles, and beverage bottles, further bolstering market growth.

The Asia-Pacific region dominates the acetic acid market, accounting for approximately 69% of global consumption in 2022. The region’s growth is fueled by its robust polymer and chemical manufacturing sectors, particularly in China, which is a major producer and consumer of acetic acid. The increasing demand for acetic acid in the region is driven by its application in textiles, construction, and automotive industries. Moreover, North America and Europe also contribute significantly to the market, with growing investments in production capacity and the expansion of key industries such as pharmaceuticals and chemicals.

Recent developments in the market include strategic expansions and joint ventures by major companies such as Celanese Corporation and INEOS. These initiatives are aimed at increasing production capacities to meet the rising global demand for acetic acid and its derivatives.

Eastman Chemical Company has focused on increasing its production capacity for acetic acid and its derivatives. In recent years, the company invested in expanding its facility in the U.S. to meet the growing demand for chemicals in various end-use industries, particularly plastics and coatings. Eastman has launched several initiatives aimed at reducing the environmental impact of its chemical production processes. These include efforts to improve energy efficiency and reduce carbon emissions associated with acetic acid production.

Celanese Corporation has announced several expansions of its acetic acid production capacities, notably in Clear Lake, Texas. The expansion, announced in 2021, is expected to significantly increase the company’s output, helping it meet the growing global demand for acetic acid, particularly in Asia-Pacific. In 2021, Celanese entered a joint venture with Southwest China’s Sichuan Energy Investment Chemical Co., Ltd., aimed at producing acetic acid and other derivatives to support regional demand in China, further solidifying its presence in the Asia-Pacific market.

LyondellBasell has introduced several new chemical products that leverage acetic acid in their production processes. These new products are targeted at the high-growth sectors of packaging and automotive materials. LyondellBasell has entered into strategic partnerships with various companies to enhance its supply chain and distribution networks, especially in North America and Europe, ensuring a steady supply of acetic acid to key customers in these regions.

SABIC has been actively involved in mergers and acquisitions to strengthen its position in the global acetic acid market. Notably, SABIC’s acquisition of a significant stake in Clariant in 2018 has allowed it to integrate its acetic acid production with Clariant’s extensive chemicals portfolio, enhancing its market reach. SABIC has also announced plans to expand its acetic acid production capacity in the Asia-Pacific region, particularly in China, to meet the increasing demand from the plastics and textiles industries in this rapidly growing market.

Acetic Acid Statistics

- Pure acetic acid, often called glacial acetic acid, is a corrosive, colorless liquid (boiling point 117.9 °C [244.2 °F]; melting point 16.6 °C [61.9 °F]) that is completely miscible with water.

- One of the most common ways consumers may come into contact with acetic acid is in the form of household vinegar, which is naturally made from fermentable sources such as wine, potatoes, apples, grapes, berries, and grains. Vinegar is a clear solution generally containing about 5 percent acetic acid and 95 percent water.

- Acetic acid has an OSHA permissible exposure limit (PEL) of 10 parts per million (ppm) over an 8-hour work shift.

- When acetic acid is at 99.5 percent concentration, it is referred to as glacial acetic acid.

- At 100 ppm, marked lung irritation and possible damage to the lungs, eyes, and skin might result.

- More than 65% of the acetic acid produced in the world ends in the form of polymers, mainly as derivatives of vinyl acetate and cellulose acetate.

- A more intense color was observed at the maximum run temperature of 483.2 K for a concentrated mixture of organic acid, for which a 0.01%

- iron content was determined by spectrophotometry.

- The determination is specific to acetic acid. The sensitivity of the assay is based on 0.005 AU and a sample volume of 2.00 mL.

- Acetic acid is produced both synthetically and by bacterial fermentation, which is a metabolic process that converts sugar to acids, gases, or alcohol, and about 75% of Acetic acid made for use in the chemical industry is made by carbonylation.

- A Taguchi design with L9 analysis revealed that the highest yield of acetic acid production occurred at 34°C in the medium containing 2% (v/v) ethanol and 2% (w/v) yeast extract.

- The temperature and yeast extract concentrations of 76.70% and 6.29% were the most and least effective factors in acetic acid production, respectively. The acetic acid production yield after 24h under the optimized condition was measured as 97%.

- Vinegar is at least 4% acetic acid by volume, making acetic acid the main component of vinegar apart from water and other trace elements.

Emerging Trends

Increasing Demand for Bio-Based Acetic Acid: A significant trend in the acetic acid market is the growing demand for bio-based acetic acid. This shift is driven by increased environmental awareness and the need for sustainable chemical production. Bio-based acetic acid is produced from renewable resources such as biomass, which reduces the carbon footprint associated with traditional fossil-based production methods. Companies are investing in research and development to improve the efficiency and scalability of bio-based acetic acid production, making it a more viable alternative for various industrial applications.

Expansion in Asia-Pacific: The Asia-Pacific region, particularly China and India, is witnessing rapid industrialization, leading to increased demand for acetic acid in various industries such as textiles, plastics, and food processing. China, already a dominant player in the global acetic acid market, continues to expand its production capacities to meet both domestic and export demands. The region’s growing consumer base and expanding manufacturing sector are expected to drive the market further, making Asia-Pacific a key area of focus for acetic acid producers globally.

Growth in Vinyl Acetate Monomer (VAM) Applications: Vinyl Acetate Monomer (VAM), a major derivative of acetic acid, is seeing increased application in producing adhesives, paints, and coatings. This growth is particularly strong in the construction and automotive industries, where VAM-based products are in high demand. As these industries continue to expand, particularly in developing regions, the demand for acetic acid used in VAM production is expected to rise significantly.

Technological Advancements in Production Processes: Innovations in acetic acid production technology are emerging as companies seek to improve efficiency and reduce costs. This includes the development of new catalysts and processes that lower energy consumption and increase yield. For example, advancements in methanol carbonylation, the most common method of acetic acid production, are helping manufacturers optimize their operations, reduce waste, and enhance overall productivity.

Increased Focus on Environmental Regulations: With the growing emphasis on environmental sustainability, regulatory bodies worldwide are imposing stricter guidelines on chemical production processes, including acetic acid. Companies are being pushed to adopt cleaner technologies and reduce emissions associated with acetic acid manufacturing. This trend is leading to the adoption of more environmentally friendly production methods, such as the use of bio-based feedstocks and the development of closed-loop systems that minimize waste.

Rising Use in the Pharmaceutical Industry: Acetic acid and its derivatives are increasingly used in the pharmaceutical industry for producing various drugs and active pharmaceutical ingredients (APIs). The rising demand for pharmaceuticals, driven by global population growth and increased healthcare access, is boosting the demand for acetic acid in this sector. This trend is expected to continue as pharmaceutical companies seek reliable and efficient chemical inputs for their production processes.

Use Cases

Production of Vinyl Acetate Monomer (VAM): Acetic acid is primarily used in producing Vinyl Acetate Monomer (VAM), which accounts for a significant portion of its global consumption. VAM is a key ingredient in manufacturing polymers like polyvinyl acetate and polyvinyl alcohol, widely used in adhesives, coatings, paints, and textiles. The demand for VAM is particularly strong in the construction and automotive sectors, which rely on these polymers for various applications, including coatings and sealants. Globally, around 40% of the acetic acid produced is utilized in VAM production.

Synthesis of Purified Terephthalic Acid (PTA): Another critical use of acetic acid is in the synthesis of Purified Terephthalic Acid (PTA), a precursor for producing polyethylene terephthalate (PET) plastics. PET is commonly used in making plastic bottles, packaging materials, and synthetic fibers for clothing. The global demand for PET is substantial, particularly in the beverage and textile industries. According to recent estimates, the PTA production process consumes about 20% of the global acetic acid supply.

Food Industry Applications: Acetic acid, particularly in its diluted form as vinegar, is widely used in the food industry as a preservative, flavoring agent, and pH regulator. It is used in pickling processes, condiments, and as a souring agent in various food products. The food-grade acetic acid market is growing due to the increasing demand for processed and convenience foods, particularly in emerging markets. The food industry’s use of acetic acid contributes to its consistent demand worldwide.

Pharmaceutical Industry: In the pharmaceutical industry, acetic acid plays a vital role in synthesizing various chemical compounds and active pharmaceutical ingredients (APIs). One of the most well-known applications is in the production of acetylsalicylic acid, commonly known as aspirin. Additionally, acetic acid derivatives are used in producing antibiotics and other essential medicines. The pharmaceutical industry’s reliance on acetic acid is growing, driven by the increasing global demand for medications.

Textile Industry: Acetic acid is used in the textile industry as a dyeing and printing aid. It helps fix dyes on fabrics and is used to adjust the pH of dye baths, ensuring better color retention and quality of the final product. The global textile industry’s expansion, particularly in Asia-Pacific, is fueling the demand for acetic acid. This application represents a significant portion of acetic acid consumption, especially in countries like China and India, where textile manufacturing is a major industry.

Chemical Manufacturing: Beyond VAM and PTA, acetic acid is used as a key raw material in producing various other chemicals, including acetic anhydride, esters (like ethyl acetate), and acetate salts. These chemicals are widely used in producing paints, coatings, solvents, and adhesives. The chemical industry’s ongoing expansion, particularly in regions like North America and Europe, is driving the demand for acetic acid.

Cleaning and Descaling Agent: Acetic acid is also used as a cleaning agent due to its ability to dissolve mineral deposits, grease, and grime. It is commonly used in household cleaning products and industrial descaling operations, particularly in food processing and manufacturing facilities. The growing awareness of environmentally friendly cleaning products has increased the use of acetic acid in green cleaning solutions.

Major Challenges

Volatility in Raw Material Prices: Acetic acid production heavily relies on methanol and carbon monoxide as key raw materials. Fluctuations in the prices of these raw materials, often driven by changes in global oil and gas markets, can significantly impact production costs. For example, any disruption in the supply of natural gas, which is a precursor for methanol, can lead to higher production costs, affecting the profitability of acetic acid manufacturers.

Environmental Regulations: Stringent environmental regulations are a significant challenge for acetic acid producers. The production process of acetic acid, particularly through methanol carbonylation, can generate significant emissions of carbon dioxide and other pollutants. Governments worldwide are increasingly enforcing regulations to limit these emissions, compelling companies to invest in cleaner technologies or risk penalties. Compliance with these regulations often requires substantial investment, which can be a financial burden, especially for smaller producers.

Competition and Market Saturation: The acetic acid market is highly competitive, with numerous global players vying for market share. This intense competition can lead to market saturation, particularly in developed regions like North America and Europe. Companies are often forced to reduce prices to maintain their market position, which can erode profit margins. Additionally, the entry of new players with advanced technologies or lower-cost production capabilities can further intensify competition.

Dependence on Key End-Use Industries: The demand for acetic acid is closely tied to the performance of key end-use industries such as plastics, textiles, and food processing. Any downturn in these industries, such as reduced demand for PET plastics or a slowdown in textile manufacturing, can directly affect the demand for acetic acid. For instance, the global economic slowdown during the COVID-19 pandemic led to reduced demand in several end-use sectors, adversely impacting the acetic acid market.

Market Growth Opportunities

Rising Demand for Sustainable and Bio-Based Products: The global push toward sustainability presents a significant growth opportunity for bio-based acetic acid. Consumers and industries are increasingly seeking environmentally friendly alternatives to petrochemical-based products. Companies investing in bio-based acetic acid production can tap into this growing demand, particularly in regions like Europe and North America, where environmental regulations are stringent and consumer awareness is high. This shift could lead to new market segments and increased market share for bio-based acetic acid producers.

Expansion in Emerging Markets: Emerging economies, particularly in Asia-Pacific and Latin America, offer substantial growth opportunities for acetic acid due to rapid industrialization and urbanization. The increasing demand for textiles, plastics, and packaged foods in countries like China, India, and Brazil drives the need for acetic acid. For example, China’s role as a major global hub for polymer and textile production significantly boosts acetic acid consumption. Expanding production facilities and distribution networks in these regions can help companies capitalize on the growing market demand.

Growing Application in Pharmaceuticals: The pharmaceutical industry’s expansion provides a promising growth avenue for acetic acid. As the global population ages and healthcare access improves, the demand for medications and medical products increases. Acetic acid is a critical raw material in producing various pharmaceuticals, including aspirin and other essential drugs. Companies that position themselves as reliable suppliers of high-quality acetic acid to the pharmaceutical industry can benefit from this growing demand.

Innovations in Chemical Derivatives: Advancements in chemical derivatives of acetic acid, such as purified terephthalic acid (PTA) and vinyl acetate monomer (VAM), present further opportunities. These derivatives are essential in producing PET plastics, adhesives, and coatings, all of which are seeing rising demand in packaging, automotive, and construction industries. Investing in research and development to improve the production processes and efficiency of these derivatives can lead to expanded market opportunities for acetic acid producers.

Key Players Analysis

Eastman Chemical Company has been a significant player in the acetic acid market, primarily through its production facilities like the one in Texas City, which was recently sold to INEOS. This facility was a part of Eastman’s broader chemical intermediates segment, and the sale includes a transition of the acetic acid operations while retaining Eastman’s plasticizer business. Eastman continues to produce acetyl products at other locations, such as its Tennessee operations, emphasizing its ongoing commitment to the acetyls market segment.

Celanese Corporation is a leading producer of acetic acid, utilizing its large-scale and integrated global manufacturing network to supply various markets. The company focuses on the efficient production of acetic acid through advanced manufacturing processes and technologies. Celanese uses acetic acid as a fundamental building block to produce a range of chemical products, including vinyl acetate monomer (VAM) and other acetyl derivatives. This strategic focus on acetic acid underscores its importance to Celanese’s overall operations and its role in serving global chemical markets.

LyondellBasell plays a significant role in the acetic acid market through its production of glacial acetic acid and other derivatives. The company uses acetic acid primarily for manufacturing vinyl acetate monomer (VAM) and purified terephthalic acid (PTA), which are crucial for producing paints, adhesives, plastics, and textiles. With production facilities in the United States and a broad international distribution network, LyondellBasell focuses on serving major markets across North America, Europe, and Asia, emphasizing its global reach and integrated supply chain.

SABIC is actively involved in the acetic acid market, leveraging its global presence and integrated petrochemicals platform. The company focuses on the production and supply of acetic acid used in various chemical processes and applications, including the production of vinyl acetate monomer and other acetyls. SABIC’s strategy includes enhancing its production capabilities and expanding its market reach to address the growing demand for acetic acid and its derivatives globally.

HELM AG is actively involved in the acetic acid market, focusing on sustainable and innovative practices. They have entered into a notable partnership with the climate tech startup Again Bio to distribute and commercialize bio-based acetic acid, which is produced through a process that converts CO2 into chemicals, reducing carbon emissions. This partnership reflects HELM’s commitment to sustainability and its strategy to enhance its distribution capabilities with environmentally friendly products. HELM leverages its extensive experience and global network to support this initiative, indicating a strategic move towards more sustainable chemical solutions+

Airedale Chemical Company Limited engages in the distribution and supply of acetic acid, offering this chemical in various concentrations to meet diverse industrial needs. Acetic acid at Airedale is used across multiple applications, including as an ingredient in cleaning products and as a food preservative. The company’s focus on providing tailored solutions to its clients reflects its adaptability and commitment to meeting the specific requirements of different industries. Airedale’s operations underscore a robust capability in handling and supplying chemicals tailored to customer specifications, which is critical in the competitive acetic acid market.

IOCL is involved in the acetic acid market as part of its broader portfolio in the petrochemical sector. The company utilizes its integrated refining capabilities to produce acetic acid, which is a critical feedstock for various chemical processes. IOCL’s position in the industry is bolstered by its extensive infrastructure and expertise in managing large-scale chemical productions, making it a key player in India’s chemical industry landscape.

GNFC is a prominent manufacturer of acetic acid in India, using the Methanol Carbonylation Route, a technology that highlights their innovative approach in chemical production. As a major player in the chemical sector, GNFC provides acetic acid in various concentrations, catering to a wide range of industrial applications. Their production emphasizes both quality and environmental considerations, aligning with global standards for chemical manufacturing.

Pentokey Organy, established in 1986, manufactures and trades in various organic chemicals including acetic acid. The company focuses on producing high-quality chemicals such as Ethyl Acetate and Acetaldehyde alongside acetic acid. Pentokey Organy leverages advanced technologies to meet diverse customer needs across industries like textiles and pharmaceuticals, underscoring its capability to deliver stable and high-quality supplies.

Ashok Alco Chem Limited is engaged in the manufacture and supply of acetic acid, emphasizing its role in various chemical processes. The company utilizes its expertise in organic chemicals to serve multiple sectors, ensuring high-quality production that meets industrial needs. Ashok Alco Chem is recognized for its commitment to maintaining robust manufacturing standards, which is vital for sustaining its market presence in the competitive acetic acid industry.

Conclusion

The acetic acid market is experiencing robust growth, driven by its diverse applications across multiple industries including chemicals, textiles, and food and beverages. The market’s expansion is underpinned by the increasing demand for vinyl acetate monomer and purified terephthalic acid, essential in producing paints, coatings, and plastics. Additionally, the shift towards sustainable and eco-friendly products is influencing market dynamics, with advancements in production technologies enhancing efficiency and sustainability.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)