Table of Contents

Introduction

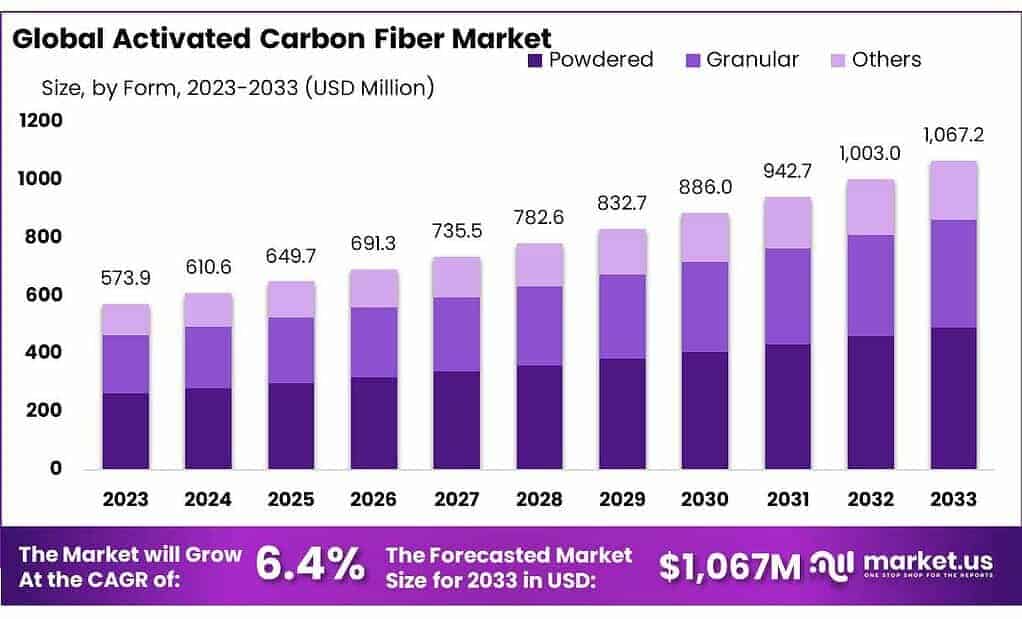

The global Activated Carbon Fiber (ACF) Market is projected to experience substantial growth, with its size expected to reach approximately USD 1,067.2 Million by 2033, up from USD 573.9 Million in 2023. This growth represents a compound annual growth rate (CAGR) of 6.4% during the forecast period from 2023 to 2033.

Activated carbon fibers, known for their superior adsorption properties, are increasingly utilized in a wide range of applications, including air and water purification, industrial filtration, and environmental protection. The rising demand for ACF in environmental management, particularly in the removal of pollutants and harmful gases, is driving the market’s growth.

Additionally, the growing awareness of environmental issues, coupled with regulatory pressures to reduce pollution, is boosting the popularity of activated carbon fiber products in various industries. Market opportunities are expanding due to technological advancements in ACF production, which have led to improvements in performance and cost-effectiveness.

The market is also benefiting from the growing trend toward sustainability, as ACF materials are viewed as more eco-friendly alternatives to traditional filtration media. Furthermore, the increasing demand for air and water treatment in both developed and emerging economies is contributing to the market’s expansion.

As the adoption of ACF continues to grow across diverse sectors such as automotive, electronics, and healthcare, the market is poised for significant growth in the coming years. Companies are also focusing on research and development to enhance ACF’s properties and expand its applications, opening up new opportunities in advanced filtration systems, energy storage, and other innovative applications.

Key Takeaways

- Projected Growth: The market expected to reach USD 1067.2 million by 2033, growing at 6.4% CAGR from 2023.

- Popular Forms: Powdered ACF dominates with a 64.3% market share in 2024, followed by granular and other forms.

- Leading Type: Pitch-based ACF will hold a 45.3% market share in 2024 due to its exceptional adsorption properties.

- The typical pH range for optimal adsorption performance of activated carbon fiber can range from 6 to 8.

- Activated carbon fiber typically has a surface area ranging from 1000 to 3000 square meters per gram.

Activated Carbon Fiber Statistics

- The carbon was carbonized and then activated using H₃PO₄ (phosphoric acid) and KOH (potassium hydroxide).

- After activation, the carbon was pyrolyzed at 650 °C for 1.5 hours under inert conditions.

- The average yield for carbonized carbons was 19%.

- The average yield for activated carbons was 13.8%.

- The average pore diameter for activated carbons was 1.3 μm.

- KOH-activated carbons exhibited a higher pore density, with 2.15 pores per micrometer.

- The H₃PO₄-activated carbons contained more than 90% carbon atoms, indicating a high carbon content.

- The average particle size of H₃PO₄-activated carbon was 36.38 nm.

- The average particle size of KOH-activated carbon was 32.8 nm.

- H₃PO₄-activated carbon produced from NaOH-treated jute maintained 84% stability even after heating to 500 °C.

- H₃PO₄-activated carbon had 0.56% thermal resistance, indicating improved heat tolerance.

- Jute fiber, a key raw material for activated carbons, contains more than 70% α-cellulose, making it a high-potential source for activated carbons, second only to cotton fiber, which has the highest cellulose concentration.

- Waste tea activated carbon (WTAC) was used for the adsorption of acid blue 25 dye, with a maximum adsorption capacity of 203.34 mg/g.

- WTAC successfully removed 97.88% of the dye from the solution.

- Spherical activated carbons are characterized by excellent abrasion resistance and a small particle size range of 0.5–0.8 mm.

- These carbons contain more than 80% micropores, contributing to their high adsorption capacity and durability.

Emerging Trends

- Increasing Demand in Environmental Applications: ACF is being widely adopted for air and water purification due to its high efficiency in removing pollutants, toxic gases, and heavy metals. Regulatory pressures around air quality and wastewater treatment are pushing industries to seek sustainable and effective filtration solutions.

- Rising Use in Energy Storage Systems: ACF is gaining traction in energy storage applications, particularly in supercapacitors and batteries. The material’s high surface area and conductivity properties make it suitable for enhancing the performance of energy storage devices.

- Advancements in Automotive Industry: The automotive sector is incorporating ACF in vehicle air filtration systems to improve cabin air quality. ACF is also being explored for fuel cells, where its high adsorption capacity helps with the efficient storage of hydrogen.

- Growth in the Healthcare Sector: ACF is increasingly being used in medical devices, particularly for the filtration of harmful substances in blood dialysis, wound dressings, and air purifiers. The growth of the healthcare sector, especially in emerging economies, is driving demand for advanced filtration materials like ACF.

- Sustainability and Eco-friendly Materials: There is a growing trend towards eco-friendly production processes for ACF, with manufacturers exploring alternative raw materials such as biomass. The emphasis on sustainable practices in manufacturing is expected to accelerate as environmental regulations tighten.

- Advancements in Manufacturing Technologies: Technological innovations, including improvements in activation and carbonization processes, are lowering the cost of ACF production. Automation and scalable manufacturing techniques are enhancing the commercial viability of ACF for broader industrial applications.

- Emerging Markets and Geographies: Developing regions, particularly in Asia-Pacific, are seeing increased adoption of ACF in industries like automotive, electronics, and environmental management. Countries such as China, India, and Southeast Asian nations are becoming key markets due to rapid industrialization and urbanization.

- Shift Toward High-Performance Adsorbents: ACF is being positioned as a high-performance alternative to traditional adsorbents like activated carbon in applications requiring faster adsorption rates and higher efficiency. The growing demand for precision filtration in specialized industries, such as pharmaceuticals, is driving interest in ACF as a superior option.

Use Cases

- Air and Water Filtration: ACF is widely used in air filtration systems, especially in purifiers for industrial and residential use. It effectively removes harmful gases like volatile organic compounds (VOCs), odors, and pollutants from indoor air. ACF is utilized in water filtration to remove contaminants such as heavy metals, pesticides, and other toxic chemicals. Its high adsorption capacity makes it a valuable material in both municipal and industrial water purification systems.

- Energy Storage Devices (Supercapacitors and Batteries): ACF is used in energy storage devices like supercapacitors. Its high surface area allows it to store and discharge energy quickly, making it ideal for applications requiring rapid bursts of energy, such as in electric vehicles and renewable energy systems. In lithium-ion and sodium-ion batteries, ACF is used to improve charge-discharge efficiency. The material enhances the conductivity and performance of these energy storage systems.

- Automotive Industry: ACF is increasingly used in automotive cabin air filters to improve air quality inside vehicles by removing pollutants, allergens, and odors. In hydrogen fuel cells, ACF is used as a material to improve hydrogen storage and facilitate more efficient reactions in fuel cell applications.

- Healthcare and Medical Applications: ACF is used in medical applications such as blood dialysis, where it helps remove toxins from the blood in patients with kidney failure. ACF’s ability to adsorb toxic substances is leveraged in advanced wound care products, where it helps reduce infection risk and promote healing. Hospitals use ACF-based air purifiers to remove airborne bacteria, viruses, and particulate matter, ensuring a clean environment for patients and healthcare staff.

- Gas Adsorption and Pollution Control: ACF is used in industries to remove harmful gases from exhaust systems, such as in chemical plants, oil refineries, and power stations. It helps reduce pollutants like sulfur dioxide, nitrogen oxides, and other harmful volatile organic compounds (VOCs). ACF is used in protective gear, such as gas masks, to adsorb harmful gases and vapors, providing protection against chemical, biological, and radiological threats.

- Food and Beverage Industry: ACF is used in the food and beverage industry to remove odors and impurities from edible oils, beverages, and other products. It helps enhance product purity and taste. In packaging, ACF is used to extend the shelf life of food products by absorbing ethylene gas, which is responsible for the ripening of fruits and vegetables.

- Electronics and Semiconductor Manufacturing: Air and Water Purification in Cleanrooms: ACF is used in the semiconductor and electronics industries to maintain ultra-clean environments in production facilities. It helps filter out dust, particles, and other contaminants that could affect the manufacturing process of sensitive electronics. Humidity Control: ACF is also used in controlling moisture in electronics packaging, helping protect components from corrosion or damage due to humidity.

Major Challenges

- High Production Costs: The production of ACF is energy-intensive and requires specialized equipment and raw materials, which increases costs significantly. For instance, the process of activation, which involves heating carbon fibers at high temperatures, requires significant energy input. This makes ACF more expensive than traditional activated carbon, limiting its adoption in cost-sensitive industries.

- Limited Raw Material Availability: ACF is primarily produced from precursor materials like rayon, polyacrylonitrile (PAN), or petroleum pitch. The availability of high-quality raw materials for ACF production is limited, which can lead to supply chain disruptions or fluctuations in prices. Moreover, the dependence on petroleum-based raw materials may face regulatory scrutiny due to sustainability concerns.

- Performance Limitations: Despite its superior adsorption properties, ACF’s performance can be limited by several factors, such as pore structure, surface area, and functional groups. This can affect its efficiency in certain applications, particularly when compared to other advanced filtration materials.

- Technological and R&D Barriers: Innovation in ACF production techniques, such as improving pore structure and surface functionalization, is essential to make the material more efficient and cost-effective. However, the high costs and technical expertise required for R&D activities can be a barrier, especially for smaller companies. Additionally, scaling up lab-scale innovations to commercial-scale production remains a challenge.

- Competition from Alternative Materials: The increasing availability of alternative filtration materials, such as zeolites, metal-organic frameworks (MOFs), and other advanced composite materials, poses competition to ACF in several applications. These materials may offer superior performance in certain conditions, especially in terms of capacity and regeneration ability.

- Environmental Impact and Sustainability Concerns: While ACF is considered more sustainable than other materials due to its ability to be regenerated and reused, its production process can still have a considerable environmental footprint. The energy-intensive nature of its production and the use of chemical activation agents can be problematic from a sustainability perspective, particularly in markets with strict environmental regulations.

- Regulatory Challenges: The ACF industry must comply with various regulations, especially in sectors like air and water purification, where safety standards are stringent. The lack of standardization in ACF product specifications across different regions can create challenges for manufacturers looking to scale their products globally.

Market Growth Opportunities

- Rising Environmental Concerns: As environmental issues such as air and water pollution become more pressing, there is an increased demand for effective filtration and purification technologies. Activated carbon fiber, with its superior adsorption properties, is used extensively in air purification systems, water treatment plants, and even in medical applications for poison removal.

- Growing Demand in Industrial Air Purification: The industrial sector is one of the primary consumers of activated carbon fiber due to its efficiency in removing harmful gases, VOCs (volatile organic compounds), and odors from exhaust emissions. As regulatory pressures on industries to reduce their carbon footprints tighten, companies are turning to advanced filtration solutions like ACF to meet emission standards.

- Expansion in the Energy Storage Sector: Activated carbon fiber has found its place in energy storage applications, particularly in supercapacitors and batteries, due to its high surface area, conductivity, and fast charge/discharge cycles. With the growing demand for renewable energy storage solutions and the global push towards electric vehicles (EVs), ACF is expected to see increased adoption.

- Increasing Use in Medical Applications: Activated carbon fibers are also being explored for medical uses, such as in hemodialysis and poison removal from the human body. As the medical industry continues to evolve with innovative solutions for treating toxins and drug overdoses, ACF is expected to see wider adoption in healthcare settings.

- Rising Demand from the Automotive Industry: With increasing consumer focus on environmental sustainability and stricter emission regulations, the automotive industry is increasingly adopting ACF-based solutions in vehicle air filtration and cabin air purifiers. Moreover, ACF is also gaining traction in the development of carbon-neutral vehicles.

- Geographic Expansion in Emerging Markets: Emerging markets, particularly in Asia-Pacific and Latin America, are seeing growing demand for ACF products. These regions are facing significant industrial pollution challenges, which has led to a surge in demand for air and water filtration systems.

- Technological Advancements: Ongoing research and development in the field of activated carbon fiber manufacturing processes are improving the efficiency and reducing the cost of production. Advanced activation techniques and new pre-treatment methods are expected to reduce material costs, opening new market opportunities in cost-sensitive sectors and enabling broader adoption.

Key Players Analysis

Anshan Sinocarb Carbon Fibers Co. Ltd., based in China, is a key player in the production of activated carbon fibers (ACF) and related products. The company specializes in the manufacturing of high-performance carbon fiber materials used in a variety of applications, including air and water purification, gas separation, and environmental protection. Sinocarb’s products are renowned for their excellent adsorption capabilities, which are essential for industries requiring filtration and purification solutions.

Awa Paper Mfg. Co. Ltd., located in Japan, is primarily recognized for its production of paper and synthetic materials, including activated carbon fiber products. The company manufactures a variety of industrial materials used in air and water filtration, as well as in protective clothing and medical applications. Awa Paper’s activated carbon fibers are used for their superior adsorptive properties, particularly in the fields of environmental remediation and purification.

Cabot Corporation, headquartered in the United States, is a leading global specialty chemicals and materials company, with significant expertise in the production of activated carbon and activated carbon fiber products. The company’s activated carbon fibers are widely used in filtration and purification applications, including air, water, and industrial gas treatment. Cabot is known for its high-quality products that exhibit excellent adsorption capacity and durability.

Hayleys Group, a diversified multinational conglomerate based in Sri Lanka, has expanded its portfolio to include the production of activated carbon fibers. With a focus on sustainability and environmental solutions, Hayleys offers high-performance ACF products that are essential in industries such as air and water purification, as well as chemical filtration. The company’s activated carbon fibers are widely used for their superior adsorptive properties, especially in environmental remediation technologies.

Kuraray Co., Ltd., based in Japan, is a prominent manufacturer of activated carbon fibers (ACF), known for their application in air and water filtration, medical products, and industrial processes. Kuraray’s ACF products are renowned for their high surface area, exceptional adsorption properties, and versatility, making them ideal for use in a wide range of environmental and industrial applications.

Kureha Corporation, a Japanese chemical and materials company, is known for its development of high-performance activated carbon fibers (ACF) used in a variety of filtration applications. The company’s activated carbon fibers are particularly effective in air purification, gas adsorption, and water treatment, meeting the needs of industries such as automotive, environmental protection, and manufacturing. Kureha emphasizes innovation and the development of specialized carbon fiber products that offer enhanced adsorption capacity, high durability, and resistance to environmental factors.

Mitsubishi Chemical Corporation, part of the Mitsubishi Chemical Holdings Group in Japan, is a leading global producer of advanced materials, including activated carbon fibers (ACF). The company’s ACF products are utilized in diverse sectors, including environmental applications such as air and water purification, as well as in industrial gas filtration. Mitsubishi’s activated carbon fibers are known for their high efficiency in adsorbing harmful substances, making them essential for clean technology solutions.

Murata Manufacturing Co. Ltd., a renowned Japanese electronics manufacturer, has ventured into the production of activated carbon fibers (ACF) used in specialized applications such as air purification and electrochemical devices. Murata’s ACF materials are praised for their high adsorption efficiency and are utilized in various industrial processes, including gas separation and environmental protection. The company combines its expertise in advanced materials with its strong R&D capabilities to produce innovative, high-performance ACF products.

Nantong Senyou Fiber Products Co. Ltd., based in China, specializes in the production of activated carbon fibers (ACF) for a wide range of industrial and environmental applications. The company manufactures high-quality ACF materials that are used in air and water filtration, as well as in protective equipment and chemical processing. Nantong Senyou’s products are designed to offer high surface area and efficient adsorption properties, making them ideal for the removal of harmful gases and pollutants.

Neenah Gessner GmbH, a subsidiary of Neenah Paper, is a global leader in the production of high-quality activated carbon fiber products. The company focuses on the development of ACF materials for air and water filtration, offering solutions for both industrial and consumer applications. Neenah Gessner’s activated carbon fibers are known for their exceptional adsorption properties, especially in the removal of volatile organic compounds (VOCs) and other pollutants.

Nippon Kynol, Inc., based in Japan, is a leading manufacturer of activated carbon fibers (ACF) used in environmental protection, filtration, and industrial applications. The company produces ACF materials known for their high adsorption capacity, long service life, and resistance to chemical degradation. Nippon Kynol’s activated carbon fibers are widely utilized in air purification, water treatment, and chemical filtration processes.

Osaka Gas Chemicals Group, part of Osaka Gas Co. Ltd. in Japan, is involved in the production of advanced materials, including activated carbon fibers (ACF) for use in air and water purification systems. The company’s ACF products are highly effective in the removal of volatile organic compounds (VOCs), odors, and other pollutants, making them essential in environmental protection applications. Osaka Gas Chemicals continues to innovate, developing next-generation ACF materials with improved adsorption capacity and resistance to wear and degradation.

SGL Carbon SE, based in Germany, is a leading global supplier of carbon-based products, including activated carbon fibers (ACF) for a wide range of industrial applications. The company’s ACF materials are used primarily for air and water filtration, as well as for energy storage and other industrial processes. SGL Carbon’s activated carbon fibers are recognized for their high surface area, durability, and effectiveness in adsorbing harmful substances.

Solvay S.A., headquartered in Belgium, is a leading global chemical and advanced materials company that produces activated carbon fibers (ACF) for a range of applications, including air and water purification and gas separation. Solvay’s ACF materials are known for their exceptional adsorption properties, making them highly effective in removing pollutants and toxins from air and water.

Spintek Filtration Inc. is a North American company specializing in filtration solutions, including activated carbon fibers. Their focus lies on providing cutting-edge filtration products for various industries, such as water treatment, air purification, and industrial gas separation. Spintek’s activated carbon fiber products are engineered for high adsorption capacity and long service life, which is crucial in applications that require continuous filtration. They offer customized solutions for clients looking to optimize efficiency in their filtration processes.

Takeda Pharmaceutical Company Limited While primarily known as a global pharmaceutical leader, Takeda Pharmaceutical Company has ventured into the activated carbon fiber sector through its environmental and sustainability initiatives. The company utilizes activated carbon fiber in the development of medical-grade filtration systems that purify air and water in healthcare and laboratory settings. These materials support Takeda’s commitment to reducing environmental impact, particularly in maintaining clean and safe environments for medical processes.

Teijin Limited, a Japanese multinational, is a major player in high-performance materials, including activated carbon fiber. The company manufactures a range of ACF products used in diverse industries such as automotive, environmental protection, and industrial filtration. Teijin’s activated carbon fibers are known for their excellent adsorption capacity, which helps in applications ranging from air purification to the removal of harmful chemicals in industrial processes.

Toyobo Co. Ltd., based in Japan, is a leading manufacturer of various chemical products, including advanced materials like activated carbon fibers. Their ACF products are used in diverse sectors such as water and air purification, environmental protection, and industrial applications. Toyobo’s activated carbon fibers are known for their excellent adsorption properties, providing effective filtration solutions. The company places a strong emphasis on innovation, offering products that not only enhance performance but also meet stringent environmental standards.

Unitika Ltd., a Japanese corporation, is involved in producing high-performance materials, including activated carbon fibers. The company’s ACF products are designed to meet the growing demand for advanced filtration systems in industries such as automotive, environmental management, and medical applications. Unitika’s activated carbon fibers are recognized for their high efficiency in adsorbing pollutants and contaminants, contributing to cleaner air and water. They offer superior performance in both gas and liquid-phase filtration.

Wacker Chemie AG is a German multinational with a wide-ranging portfolio, including high-performance materials such as activated carbon fibers. The company’s ACF products are used in air purification, water treatment, and various industrial filtration applications. Wacker’s activated carbon fibers offer excellent adsorption capacity and are particularly effective in environments where high efficiency and long-lasting performance are required.

Conclusion

The activated carbon fiber (ACF) market is poised for steady growth, driven by its broad applications across industries such as air and water purification, gas separation, and energy storage. The material’s high adsorption capacity, coupled with its lightweight and flexible nature, makes it increasingly popular for environmental and industrial applications. As awareness of environmental concerns rises, demand for ACF-based products, particularly in air and water treatment, is expected to expand, benefiting from increased regulations and sustainability initiatives.

Key drivers of growth include advancements in ACF production technologies, which are making the material more cost-effective and efficient. Additionally, the growing emphasis on green and sustainable solutions is likely to accelerate market adoption. However, challenges related to high production costs and the limited availability of raw materials may present some barriers to market expansion. Despite these challenges, the market’s positive growth outlook is supported by ongoing research and development, which is expected to drive innovation and new applications for ACF.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)