Table of Contents

Introduction

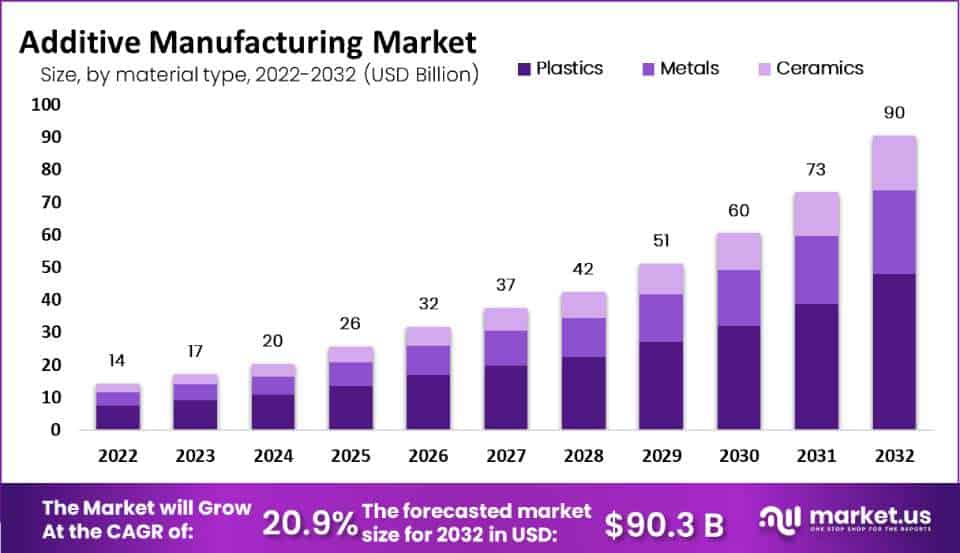

The global additive manufacturing market, valued at USD 14.2 billion in 2022, is experiencing rapid growth and is projected to reach around USD 90 billion by 2032, with a compound annual growth rate (CAGR) of 20.9% during the forecast period from 2022 to 2032. This growth is fueled by several factors including advancements in 3D printing technologies, increased adoption across various industries such as healthcare, automotive, and aerospace, and a rising emphasis on sustainable manufacturing practices.

Additive manufacturing, commonly known as 3D printing, involves the layer-by-layer creation of objects using materials like polymers, metals, and ceramics. The technology is celebrated for its efficiency in reducing waste and its ability to produce complex designs that are otherwise challenging with traditional manufacturing methods. Key applications of this technology include prototyping, where it dominates due to its speed and cost-effectiveness in producing high-fidelity models that closely replicate the final product.

Challenges in this market include the high costs associated with 3D printing equipment and materials, as well as the need for skilled personnel capable of operating these machines and designing suitable blueprints. Moreover, despite the technology’s advancements, issues such as the slower production speeds relative to traditional methods when scaling up production and the strength of 3D printed materials in certain applications remain concerns that could hamper the market growth.

Recent developments highlight significant innovation and expansion efforts within the industry. For instance, there’s been considerable investment in developing new materials that offer enhanced properties like greater durability and heat resistance, which are crucial for expanding the applicability of 3D printed components in more demanding environments such as aerospace and automotive sectors. Moreover, governments and private sectors in regions like Asia-Pacific are actively promoting the adoption of these technologies through investments and strategic plans to integrate additive manufacturing into their industrial ecosystems, thereby driving regional market growth.

SLM Solutions has been focusing on expanding its product range and technological capabilities in the additive manufacturing sector. This includes enhancing their metal 3D printing systems to cater to the growing demands of industries like aerospace and automotive, where precision and the ability to create complex geometries are crucial. Proto Labs reported accelerated growth in the additive manufacturing sector through emerging applications, highlighting their adaptability and ongoing innovation in 3D printing technologies. They have also been involved in significant collaborations, like a quick-turn project with NASA, emphasizing their role in generative design processes.

Renishaw continues to enhance its additive manufacturing solutions, focusing on sectors such as healthcare and aerospace. Their developments are often geared towards improving the precision and efficiency of 3D metal printing systems, underscoring their commitment to advancing additive manufacturing technology. Titomic made a significant strategic move by acquiring Tri-D Dynamics, which specializes in smart pipe infrastructure. This acquisition, completed in July 2021, is aimed at enhancing their capabilities in embedding electronics into metal structures, thereby broadening their market reach and strengthening their position in industrial-scale metal additive manufacturing.

Additive Manufacturing Statistics

- Prototyping is also widely recognized as the area most benefited by additive manufacturing (selected by 96% of respondents), followed by design (52%) and small-scale production (27%).

- 96% of participants use in-house 3D printing, but outsourcing is still typical, especially with additive networks and contract manufacturers.

- Plastics/polymers remain the leading materials used in additive manufacturing among 97% of those polled.

- Almost all respondents (96%) said their organization would want to use metal additive materials if certified versions were available at a reasonable cost, followed closely by plastics/polymers (88%).

- 97% of participants say that their organization uses 3D printing to produce functional or end-use parts.

- 74% of survey participants printed at least 10,000 parts last year, while 36% polled printed up to 100,000 parts in that same timeframe.

- Material costs mentioned as a financial barrier to additive manufacturing rose from 18% to 79% since the 2021 survey.

- More than half of those surveyed (55%) say that their company’s top leadership recognizes additive manufacturing as a strategic capability.

- A common starting point is the optimization of build rates using standard alloys like 316L or AlS10Mg, often relying on the standard parameter sets provided by AM machine OEMs.

- For a qualification of new parameters for more demanding series components and dynamic load cases, qualification with the large number of samples required quickly costs more than €200,000.

Emerging Trends

- Expansion into Mass Production: Additive manufacturing is increasingly being utilized for mass production, especially in industries like consumer goods, electronics, and automotive. With improvements in both the speed and scalability of 3D printing technologies, manufacturers are now exploring its potential for full-scale production rather than just prototyping. Innovations such as multi-laser systems and enhanced software are allowing faster production at reduced costs. This shift is evident in sectors like aerospace and defense, where 3D-printed components are being used in large-scale production due to their ability to meet stringent performance requirements.

- Integration with Digital Supply Chains: One of the significant developments is the integration of additive manufacturing with digital supply chains. This means that production can be decentralized, with 3D printers at different locations creating parts from the same digital design. This flexibility enables manufacturers to respond quickly to disruptions in the supply chain, reducing lead times and costs. The ability to “print on demand” means companies can store digital files instead of physical inventory, which offers a more sustainable and efficient approach.

- Sustainability and Energy Efficiency: Sustainability has become a central focus for additive manufacturing. Companies are working to reduce material waste by optimizing designs and improving the recyclability of materials used in the process. Additionally, 3D printing technologies are becoming more energy-efficient, supporting the global move toward greener manufacturing practices. For example, in industries such as aerospace, additive manufacturing allows for the production of lighter, more efficient components, reducing the environmental impact of aircraft.

- Customization and Personalization: Customization is another area where additive manufacturing is gaining momentum. The technology allows for the creation of personalized products at scale, particularly in industries such as healthcare (for prosthetics and orthotics) and consumer goods (such as footwear and electronics). This ability to produce tailored solutions is helping companies meet the growing demand for personalized products, which is seen as a competitive advantage in the market.

- Advanced Materials and Applications: As the technology matures, there is a growing range of materials that can be used in 3D printing, including advanced metals, ceramics, and polymers. This has opened up new possibilities for applications in industries such as semiconductors and healthcare. In the semiconductor industry, for instance, 3D printing is being used to create complex components that are difficult to manufacture using traditional methods. The ability to print with advanced materials also supports the production of parts with improved performance characteristics, such as higher heat resistance or better conductivity.

Use Cases

- Aerospace: Additive manufacturing is widely used in the aerospace industry, especially for producing lightweight and complex components. This helps reduce the weight of aircraft, leading to improved fuel efficiency. Companies like GE Aviation have produced over 100,000 fuel nozzles for their LEAP engines using AM, saving both material and time. The ability to consolidate parts and reduce assembly processes has made 3D printing a key technology in the aerospace sector. The global aerospace industry alone has seen AM adoption grow by over 20% annually.

- Automotive: In the automotive sector, AM is increasingly being used for producing custom parts, prototypes, and even end-use parts. For example, Ford is using 3D printing to create prototypes and production-ready components, reducing design-to-production times significantly. The technology allows for the creation of complex geometries that are hard to achieve with traditional manufacturing. In 2023, additive manufacturing enabled Ford to produce thousands of vehicle parts, leading to a 40% reduction in lead times.

- Healthcare: The healthcare industry has seen substantial benefits from 3D printing, particularly in custom medical devices such as prosthetics, implants, and dental appliances. Patient-specific models allow for better surgical planning, while implants made from biocompatible materials improve patient outcomes. For instance, restor3d, a leading healthcare company, uses AM to produce orthopedic implants tailored to individual patients, a process that has grown 15% annually in recent years. The global market for 3D-printed medical devices is projected to reach $2 billion by 2025.

- Manufacturing Spare Parts: Additive manufacturing is being used to revolutionize how spare parts are produced, reducing the need for physical inventories. Instead of storing parts, companies can maintain digital inventories and print components on demand. This approach is particularly valuable in industries like oil and gas, where equipment downtime can be extremely costly. By 2024, it is expected that AM will reduce spare parts inventory costs by 30% for companies adopting digital inventory solutions.

- Consumer Goods: AM is increasingly used in the production of consumer goods, particularly for customized products. The footwear industry, for instance, is leveraging 3D printing to create tailored insoles and custom shoe designs. Adidas, for example, has incorporated 3D printing into its Futurecraft 4D line, producing midsoles that are tailored to individual foot shapes and running styles. This level of customization is expected to grow, with estimates suggesting a 25% increase in customized consumer goods made with AM by 2025.

- Construction: In construction, AM is being explored for producing building materials and even entire structures. Large-scale 3D printers can create components from concrete, which can be assembled on-site, drastically reducing construction time and labor costs. Companies like ICON have used 3D printing to build low-cost housing in underdeveloped regions, a market expected to expand by 20% annually.

Major Challenges

- High Initial Costs: The cost of setting up additive manufacturing systems is one of the biggest barriers. Machines for industrial applications can cost anywhere from $100,000 to several million dollars, depending on their capabilities. This high capital expenditure makes it difficult for smaller businesses to adopt the technology. The costs of raw materials for 3D printing, especially metals and advanced polymers, are also significantly higher than traditional materials.

- Slow Production Speeds: One of the primary limitations of AM is the speed at which parts can be produced. While it excels in small batch and custom manufacturing, it is much slower compared to traditional mass production methods like injection molding. This hinders its use for high-volume manufacturing, making it less suitable for industries that require fast production times.

- Material Limitations: Although progress is being made, the range of materials available for additive manufacturing is still limited. Not all materials can be 3D-printed, and many existing materials do not meet the stringent mechanical or thermal properties required for certain industries, such as aerospace and automotive. Furthermore, some materials face challenges with post-processing, which can lead to defects in the final product.

- Post-Processing Requirements: Most 3D-printed parts require additional post-processing to remove support structures, smooth surfaces, or improve mechanical properties. This adds time and labor costs to the process, which diminishes some of the advantages of rapid prototyping or small-scale production.

- Workforce and Skill Gaps: There is a shortage of skilled technicians and engineers capable of handling additive manufacturing systems. Specialized knowledge is required for tasks like file preparation, machine operation, and post-processing, and finding individuals with these skills is a challenge.

Market Growth Opportunities

- Increased Adoption in Aerospace and Automotive: Both the aerospace and automotive industries are increasingly using AM for lightweight, high-performance components. This is especially crucial for improving fuel efficiency in aircraft and vehicles. By 2032, AM’s application in these sectors is expected to contribute significantly to market growth.

- Expansion in Healthcare: The healthcare industry is embracing AM for customized prosthetics, implants, and surgical tools. Additionally, the potential for bioprinting, such as printing tissues and organs, presents a massive future growth opportunity. The healthcare sector is forecasted to be a major driver of AM, particularly for creating patient-specific solutions.

- Growth in Consumer Goods and Electronics: The ability to rapidly prototype and customize products makes AM attractive for consumer goods, especially in electronics. Customization at scale is becoming a key trend, with companies adopting AM to design more personalized products.

- Emerging Applications in Construction: Additive manufacturing is making headway in the construction industry, with the potential for 3D-printed houses and components. The ability to reduce construction time and costs, along with minimizing waste, is positioning AM as a transformative technology for building projects.

- Environmental Sustainability: AM offers significant environmental benefits by reducing material waste and energy consumption compared to traditional manufacturing. As businesses prioritize sustainability, AM will become increasingly attractive for its ability to produce goods efficiently while minimizing ecological impact.

Key Player Analysis

SLM Solutions, a leader in metal additive manufacturing, has shown significant progress in 2023 and 2024. In Q2 2023, the company achieved record revenues of €27.9 million, contributing to a total of €51.9 million for the first half of the year. In June 2024, SLM Solutions announced a strategic partnership with Howco Metals to enhance their aerospace offerings, alongside the expansion of their production capabilities in the U.S. with the NXG XII 600 system.

In 2023, Proto Labs made significant strides in the additive manufacturing sector. The company generated over $84 million in revenue from its 3D printing services, focusing on both plastic and metal technologies. This marked a substantial year of growth, with increased demand for production-ready parts across various industries, including medical devices, automotive, and aerospace.

In 2023 and 2024, Renishaw Plc made notable advancements in the additive manufacturing (AM) sector. In November 2023, the company introduced its groundbreaking TEMPUS™ technology at Formnext, reducing build times by up to 50% for its RenAM 500 series without compromising part quality. This innovation aims to lower costs and enhance productivity, facilitating the broader adoption of AM technology.

In 2023 and 2024, Titomic Limited continued to expand its presence in the additive manufacturing (AM) sector, particularly through its proprietary Kinetic Fusion (TKF) technology. In May 2024, Titomic secured a significant sale of a custom TKF system to Triton Systems for USD 808,000, reinforcing its role in the U.S. defense sector. This sale highlights the increasing demand for large-scale, high-performance metal parts in sectors such as aerospace and defense. Additionally, Titomic signed a multi-million-dollar contract with a global defense product manufacturer in February 2024, valued at $25.5 million, further solidifying its leadership in industrial-scale metal AM for defense applications.

In 2023 and 2024, Höganäs AB continued to strengthen its position in the additive manufacturing (AM) sector. In May 2023, the company launched new ventures focused on additive manufacturing and metal injection molding (MIM), under its Customization Technologies division. This initiative aims to meet the rising demand for metal powders, especially in industrial applications like aerospace and automotive. In 2024, Höganäs expanded its product portfolio by introducing titanium-based powders for AM, which are designed for high-performance components in industries such as medical and lightweight aerospace parts.

In 2023, Ultimaker BV continued to expand its role in additive manufacturing following its merger with MakerBot. In January, the company launched the Ultimaker S7, the latest in its S series of 3D printers, which includes advanced features such as an integrated Air Manager and automated bed leveling for improved print reliability.

In 2023, ExOne made significant advancements in the additive manufacturing sector, focusing on binder jetting technology. In August 2023, ExOne, in collaboration with Sandvik Additive Manufacturing, worked on optimizing metal powders for its binder jetting systems, particularly enhancing post-processing methods for materials like stainless steel and tool steel. Additionally, ExOne launched the X1 160Pro, their largest metal 3D printer, with print speeds exceeding 10,000 cc/hour.

In 2023 and 2024, American Additive Manufacturing LLC continued to expand its role in the additive manufacturing sector, focusing on industries such as aerospace, automotive, and robotics. The company offers high-quality 3D printing services, including the production of prototypes, tools, and end-use parts. In March 2024, American Additive Manufacturing showcased its latest advancements at PBEXPO 2024, emphasizing its ability to provide on-demand production parts, including those for aircraft systems and industrial applications.

In 2023 and 2024, ANSYS, Inc. made significant advancements in the additive manufacturing sector by enhancing its Ansys Additive Suite. In November 2023, ANSYS partnered with Materialise to streamline additive manufacturing workflows, integrating ANSYS simulation tools with Materialise’s Magics software. This partnership enables users to manage data preparation and simulation in a unified platform, eliminating inefficiencies and reducing build errors, with a full solution expected in Q2 2024.

Conclusion

In conclusion, additive manufacturing (AM) is steadily transforming the landscape of modern manufacturing, moving from prototyping to full-scale production across various industries such as aerospace, healthcare, and automotive. The technology’s ability to produce complex, lightweight, and customized parts with minimal waste is driving its widespread adoption. Innovations in material science, process optimization, and the integration of advanced software solutions like those from ANSYS and Materialise have further enhanced the efficiency and reliability of AM.