Table of Contents

Introduction

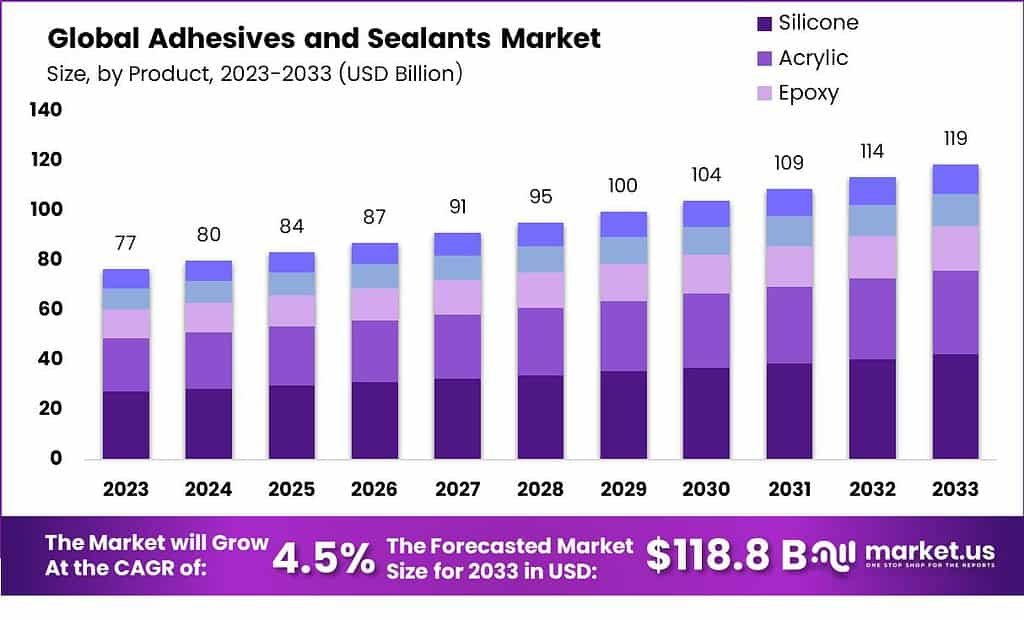

The global Adhesives and Sealants Market, valued at USD 77 billion in 2023, is projected to expand significantly, reaching around USD 119 billion by 2033, with a compound annual growth rate (CAGR) of 4.5% over the forecast period. This growth is underpinned by several factors, including advancements in chemical engineering, rising construction and automotive production, and increasing demand for sustainable and high-performance materials.

Significant challenges facing the market include stringent environmental regulations, the need for compliance with volatile organic compound (VOC) emissions standards, and the high costs associated with external testing. Innovations in eco-friendly products and water-based adhesives are critical to navigating these challenges, as they offer reduced VOC emissions and are aligned with environmental standards set by regulatory bodies like the Environmental Protection Agency (EPA)

Recent developments in the sector include strategic investments by major players like Henkel AG, which is enhancing its capabilities in smart adult care solutions through acquisitions. Moreover, the market is witnessing a shift toward digitization to improve efficiency and meet labeling standards, which is crucial for compliance and operational excellence.

3M Company, known for its innovation, launched a new medical adhesive in February 2023, which offers a 28-day wear time, significantly longer than its predecessors. This development aims to support various sensors and health monitors used in medical applications, promising enhanced patient comfort and reduced need for frequent changes.

Ashland Inc. was part of a notable acquisition where its performance adhesives business was purchased by Arkema in February 2022. This move is intended to bolster Arkema’s capabilities in high-performance adhesives, particularly for the electronics market. Avery Dennison Corporation has been focusing on expanding its product portfolio and reinforcing its market presence through strategic acquisitions and innovations. For instance, they are enhancing their offerings in the high-performance packaging and labeling sectors, which are critical components of their growth strategy.

Key Takeaways

- Market Size Projection: Adhesives and Sealants Market is to reach USD 119 billion by 2032, growing at a steady 4.5% CAGR, with USD 77 billion expected in 2023.

- Dominant Product Type: In 2023, silicone led with over 35.6% market share. Acrylic, epoxy, polyurethanes, and specialized products also played vital roles.

- Leading Application: The construction sector commands a 35.7% market share. Packaging, automotive, consumers, and other applications contribute significantly to market dynamics.

- Regional Analysis: Asia Pacific led in 2023 with a 41.2% market share, driven by industrial development in China and India.

Adhesives and Sealants Statistics

- In the year 2024, till June 2024, 5 acquisitions happened in the Adhesives and Sealants sector.

- Last year, in 2023, a total of 7 acquisitions happened in the Adhesives and Sealants sector.

- In the year 2022, till December 2022, 1 IPO happened in the Adhesives and Sealants sector.

- The Adhesives and Sealants sector saw total funding of more than $2.05B in the last 10 years. The most amount of funding was in 2019 at more than $2.04B.

- The United States has 79 Adhesives and Sealants startups, the most by any country, followed by India which has 69 startups and the United Kingdom which has 21.

- In the last 10 years, Adhesives and Sealants startups in Switzerland have received the highest funding among all countries – $2.04B. Japan follows with $1.15M and United States with $250K.

- Henkel’s Adhesive Technologies business unit reportedly generated around 30% of its sales with products that were launched onto the market in the last five years.

- We aim to increase our revenues by 15%, supported by a growth of our workforce at this rate as well. We also plan to re-invest a share of 15% of our revenues in R&D.

- It is also known that 81.5% of dental caries found in children 6-36 months of age occur in the posterior teeth.

- Ten deciduous molars obtained no longer than 6 months after exfoliation13 were disinfected in 0.5% chloramine solution at 4 °C and cleaned with pumice and water slurry.

Emerging Trends

- Eco-friendly Innovations: The industry is increasingly moving towards green solutions to reduce environmental impact. This includes the development of adhesives and sealants that minimize or eliminate volatile organic compounds (VOCs) and other hazardous substances. Market demands and regulatory pressures are driving the growth of water-based and hot-melt adhesives, which are seen as more environmentally friendly due to their lower solvent content.

- Advanced Technology Integration: Hot-melt adhesives are gaining popularity due to their advantages such as high production speed, short setting time, and the capacity for being reactivated by heating. These adhesives are increasingly used in various sectors, including packaging, automotive, and furniture, where strong, durable adhesion is required.

- Rising Demand from Key Industries: The construction and automotive sectors are prominent consumers of adhesives and sealants. These industries demand products that provide not only strength and durability but also flexibility and ease of use. Sealants and adhesives are extensively used in building applications such as tiling, flooring, and panel laminations, as well as in automotive applications where they contribute to vehicle lightweighting and performance efficiency.

- Geographical Expansion: The Asia Pacific region remains a significant growth area for the adhesives and sealants market. Rising industrial activities, infrastructure development, and increasing automotive production in countries like China, India, and Southeast Asia are major drivers. This regional market is also influenced by increasing population and urbanization, which boosts demand for construction and industrial applications.

- Focus on Durability and Performance: There is a continuous push to improve the performance characteristics of adhesives and sealants, making them more resistant to environmental factors such as temperature variations, moisture, and chemicals. This is particularly important in applications like aerospace, marine, and automotive, where materials are exposed to harsh conditions

Use Cases

- Construction: In the construction industry, adhesives and sealants are indispensable for tasks such as decking coatings, window replacements, and expansion joint replacements. Structural sealants are crucial for supporting glass, ceramic, metal, and composite panels.

- Automotive: Adhesives are heavily used in the automotive industry for assembling and repairing vehicle parts. Epoxy adhesives, for example, are employed for bonding engine components and body panels due to their resistance to high temperatures, impacts, and vibrations.

- Packaging: Hot melt adhesives are favored in the packaging sector due to their quick-setting properties, making them ideal for rapid production lines. They are used to seal packaging materials like cartons and bags.

- Electronics: In the electronics industry, silicone adhesives are utilized for sealing and protecting components against environmental elements, owing to their flexibility and high-temperature resistance. This type of adhesive is crucial for applications that involve frequent temperature fluctuations.

- Aerospace: The aerospace sector relies on various adhesives, including epoxies, for bonding components in airplanes and other spacecraft. These adhesives are selected for their ability to withstand extreme pressures and humidity conditions.

- Woodworking: Urethane adhesives are popular in woodworking due to their strong bonding capabilities with wood materials and their resistance to moisture and wear, making them suitable for both indoor and outdoor projects.

Major Challenges

- Supply Chain Complexity and Uncertainty: The industry continues to navigate a complex and often unpredictable supply chain environment. Issues such as forecasting customer needs accurately, managing stock levels effectively, and dealing with fluctuations in the availability of raw materials like glycerin, citric acid, and sodium chlorite are significant hurdles. These materials are crucial for various applications ranging from water treatment to pharmaceutical production, and disruptions can lead to production delays.

- Rising Raw Material Costs: Dramatic increases in the costs of raw materials and other inputs such as energy are a persistent concern. These costs have been driven up by various factors, including economic sanctions, global conflicts, and the residual effects of the COVID-19 pandemic. The adhesives and sealants industry, particularly manufacturers of hot melt adhesives, has had to reformulate products and alter supply chains to cope with these challenges.

- Regulatory and Environmental Pressures: There is an increasing push towards sustainability within the industry, leading to greater use of water-based technologies and low-temperature-cure products. These initiatives aim to reduce volatile organic compound (VOC) emissions and energy consumption. However, the industry also faces stringent regulatory challenges, such as proposed increases in Toxic Substance Control Act (TSCA) user fees and new Risk Management Plan (RMP) rules that could impose additional costs and compliance burdens.

- Technological and Market Adaptations: The industry is also undergoing significant transformations as it adapts to new market demands and technological advancements. For example, the automotive industry is shifting towards using more adhesives and sealants to achieve lighter, stronger, and safer vehicles. This shift is driven by the need to meet stringent fuel efficiency standards and improve safety performance.

Market Growth Opportunities

- Sustainable and High-Performance Materials: There is a rising demand for sustainable and environmentally friendly adhesives and sealants, especially products that are solvent-free or water-based. This trend is driven by stringent environmental regulations and a growing industry commitment to reducing volatile organic compound (VOC) emissions. Innovations in this area are likely to continue, offering significant growth opportunities.

- Expansion in Construction and Packaging: The construction and packaging industries are major drivers of demand for adhesives and sealants. The construction sector, in particular, is benefiting from the use of silicone and acrylic sealants in applications like glazing, waterproofing, and insulation due to their flexibility, chemical stability, and resistance to weather conditions. The packaging industry also shows strong growth potential, especially with the increasing demand for packaged goods and e-commerce, boosting the need for effective sealing solutions.

- Growth in Developing Regions: The Asia-Pacific region, including rapidly developing economies like China and India, is experiencing significant growth in the adhesives and sealants market. This growth is spurred by urbanization, increased manufacturing activities, and infrastructural developments. As these regions continue to industrialize, the demand for adhesives and sealants in construction, automotive, and packaging applications is expected to rise significantly.

- Technological Advancements: Advancements in adhesive technologies, such as hot-melt adhesives which are valued for their high production speed and lack of VOC emissions, present further growth avenues. These technologies are finding increased applications in industries such as automotive and electronics, where efficient, durable bonding solutions are critical.

- DIY and Home Improvement Markets: The growing trend towards DIY projects and home improvements, partly accelerated by the global pandemic, has increased the use of adhesives and sealants by consumers directly. This trend is especially prevalent in developed economies and offers a lucrative opportunity for market expansion.

Key Players Analysis

3M Company is a significant player in the adhesives and sealants market, renowned for its innovative product development. In February 2023, 3M introduced a medical adhesive with a 28-day wear time, designed to enhance patient comfort and reduce disruptions by prolonging the duration devices can remain adhered to the skin. This product is part of 3M’s broader strategy to leverage technology to meet specific customer needs in healthcare and other industries.

Ashland Inc. actively participates in the adhesives and sealants sector, focusing on producing specialty chemicals including adhesives that find applications across various industries. Ashland’s performance materials are known for their high quality and reliability, serving a wide range of sectors from automotive to construction, underlining their commitment to innovation and market expansion.

Avery Dennison Corporation is actively engaged in the adhesives and sealants market, focusing on developing solutions that integrate with the rapidly evolving digital and technological landscape. The company is expanding its capabilities in intelligent labeling and other adhesive technologies that address complex challenges in various industries including logistics, retail, and food. Avery Dennison’s approach is geared towards enhancing product functionality while boosting sustainability and efficiency across global supply chains.

H.B. Fuller is prominent in the adhesives and sealants sector, emphasizing innovation and strategic growth through acquisitions. In June 2023, the company acquired Beardow Adams, a move that significantly enhanced its market reach and capabilities in the industrial adhesives sector. This acquisition aligns with H.B. Fuller’s strategy to expand its product portfolio and improve its service offerings across multiple key markets, thereby boosting its operational efficiencies and profitability.

Henkel AG has demonstrated robust performance in the adhesives and sealants sector, particularly with its Adhesive Technologies business unit, which showcased significant organic sales growth in 2023. This success is attributed to strategic initiatives that enhance customer orientation and sustainability in their operations. Henkel continues to lead with innovations tailored to meet dynamic market demands while focusing on strategic growth and efficiency improvements.

Sika AG excels in the adhesives and sealants market with a strong focus on the construction and manufacturing sectors. The company is known for its expertise in developing solutions that enhance the durability and performance of building materials. Sika’s commitment to innovation is evident in its extensive product range that includes high-performance adhesives and sealants, contributing to its sustained growth and strong market presence globally.

Pidilite Industries has maintained a leading position in India as a manufacturer of adhesives and sealants, known for iconic brands like Fevicol and Dr. Fixit. The company has achieved a strong market presence not only through its diverse product portfolio but also through consistent investments in research and development, allowing it to innovate and meet evolving customer needs. With a substantial global footprint, Pidilite continues to expand its reach and enhance its brand value, reinforcing its status as a major player in the adhesives sector.

Huntsman Corporation excels in the adhesives and sealants industry, particularly noted for its innovation in high-performance materials. The company focuses on developing products that are crucial for industrial applications, including automotive and construction sectors, where durable and efficient adhesives are vital. Huntsman’s commitment to technological advancement and sustainability in product development positions it well within the global market to address the challenges of modern industrial demands.

Wacker Chemie AG is a global leader in the adhesives and sealants market, particularly known for its silicone-based solutions. The company is pivotal in the development of innovative products catering to diverse industries such as construction, automotive, and electronics. In 2023, Wacker Chemie AG focused on expanding its capacity for silicone adhesives and sealants, notably at its Nünchritz site in Germany, to meet the growing demand for high-quality adhesives. Their continuous investment in research and development has solidified their reputation as a key player in providing sustainable and effective bonding solutions across various sectors.

RPM International Inc. is a prominent company in the adhesives and sealants industry, recognized for its range of high-performance products. RPM’s portfolio includes a variety of brands and technologies that serve both industrial and consumer markets globally. The company is committed to innovation and quality, with ongoing developments to enhance its product offerings and meet the stringent demands of industries such as construction, manufacturing, and DIY projects. RPM International Inc. continually adapts its strategies to align with market needs, ensuring robust growth and sustainability in its operations.

Conclusion

The adhesives and sealants market is positioned for dynamic growth and diversification, driven by increasing demands across the construction, automotive, and packaging industries. As the market expands, significant opportunities emerge, particularly in the development and adoption of sustainable and high-performance materials. Innovations that reduce environmental impact and meet stringent regulatory standards are setting the direction for future developments.

Additionally, the rising trend toward DIY projects and home improvements, particularly in developed economies, opens new avenues for market penetration. With technological advancements and the global push towards sustainability, the adhesives and sealants industry is expected to continue its upward trajectory, adapting to the evolving needs of a broad array of industries and consumers.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)