Table of Contents

Introduction

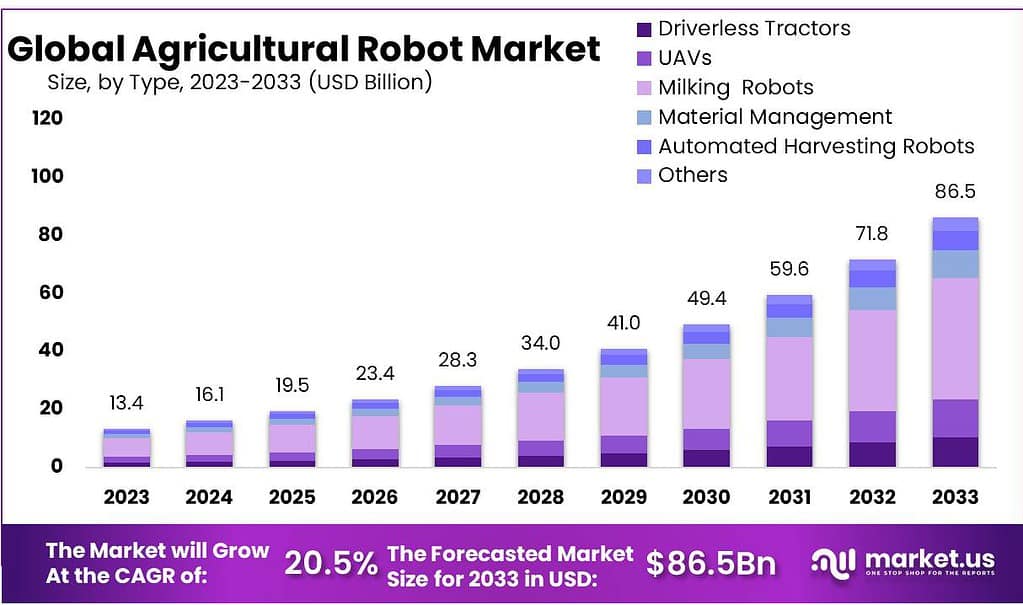

The global agricultural robot market is projected to experience significant growth, with forecasts estimating the market size to expand from USD 13.4 billion in 2023 to approximately USD 86.5 billion by 2033, marking a compound annual growth rate (CAGR) of 20.5% . This growth trajectory is influenced by several key factors, including labor shortages and the escalating cost of manual labor, which are driving the adoption of robotic solutions across the agricultural sector. The automation facilitated by these robots aids in tasks such as planting, milking, and crop monitoring, enhancing overall farm productivity and efficiency

Challenges remain, notably the high costs associated with implementing these advanced technologies, particularly affecting small to medium-sized farms. The initial investment in and maintenance of agricultural robots can be substantial, posing a barrier to widespread adoption. This economic hurdle underscores the disparity in technology access between larger, more financially equipped farms and their smaller counterparts.

Recent developments within this market reflect its dynamic nature and the rapid pace of technological advancement. Innovations in drone technology and autonomous vehicles are particularly notable. Drones, for instance, are being increasingly utilized for crop monitoring and precision spraying, contributing to more sustainable farming practices by reducing the need for chemical pesticides and enhancing crop health diagnostics.

AGCO Corporation, a major name in the industry, has continued to strengthen its market position by focusing on the integration of smart robotics into its product offerings, aiming to enhance the efficiency of farming operations through technology.

Autonomous Solutions, Inc. has been pivotal in advancing autonomous technology in agriculture, developing vehicles and systems that allow for more precise and controlled farming practices, thereby contributing to the growth of the sector.

Key Takeaways

- Market Growth Projection: The Agricultural Robots Market is anticipated to surge to approximately USD 86.5 billion by 2033, from a baseline of USD 13.4 billion in 2023, exhibiting an impressive CAGR of 20.5%.

- Primary Product Types: Milking Robots lead the market in 2023, holding a dominant 48.6% share, transforming dairy farming through automation. Drones and driverless tractors are also witnessing substantial growth, fueled by increased funding and industrialization.

- Offering Dynamics: Hardware comprises over 55% of the market, encompassing physical robots like automated tractors and drones. Software plays a pivotal role in powering these robots’ functionalities, while services ensure their operational efficiency.

Agricultural Robots Statistics

- Towed weight of up to 230 kg does not effectively reduce the speed of the robot.

- Robots are considered as an integral element of Agriculture 4.0, which comes as an evolution of precision agriculture, enabling farmers to utilize the minimum required quantities for specific areas.

- More than 24% agricultural cost is spent on agricultural laborers, so it is necessary to include new technologies to keep farmers protable so that the minimum needs of the workers are required

- Interestingly, over 90% of robots are used in factories and manufacturing facilities, according to inc.com.

- Another pioneer, AgroIntelli, will be favouring their latest Robotti LR model above their initial 150D model from next year on. Robotti 150D will remain available as a pre-owned model.

- The 11 types of robots that are new to the catalogue this year already have 208 units active in the market.

- To compare the level of robotisation, it’s common to look at robot density, which can be expressed by the number of robots per 10,000 employees.

Emerging Trends

The agricultural robot market is experiencing several emerging trends that are shaping its future trajectory. One significant trend is the increasing integration of automation and robotics in farming operations to address labor shortages, enhance efficiency, and improve productivity. This includes the deployment of various types of robots for tasks such as planting, harvesting, weeding, and spraying, which automate repetitive field chores and reduce human errors.

Another notable trend is the adoption of advanced technologies like artificial intelligence (AI) and machine learning (ML) in agricultural robots. These technologies enable robots to perform complex tasks such as data collection, crop monitoring, and decision-making more effectively. AI applications in agriculture are extending to areas like predictive analytics for weather and crop yield estimation, and automated disease detection, which helps in proactive farm management.

Precision agriculture is also a key trend, utilizing technologies such as variable rate technology (VRT) and digital sensors to optimize resource use and crop management. These technologies allow for more precise application of inputs like water, fertilizers, and pesticides, which not only boosts productivity but also reduces environmental impact.

Moreover, the focus on sustainability is driving the development of robots that support climate-smart agriculture practices. This includes innovations that minimize the impact of farming on climate change by reducing reliance on chemical inputs and optimizing natural resource management

Use Cases

- Precision Planting and Seeding: Agricultural robots enhance the precision in planting and seeding processes. These robots can plant seeds at the exact depth and spacing required, improving crop yield potential and minimizing seed wastage. They are particularly useful in large-scale operations where uniformity and precision significantly impact productivity and costs.

- Weed Control: Robots equipped with cameras and AI can identify weeds and perform targeted weeding without harming the crops. This reduces the need for chemical herbicides, promoting more sustainable farming practices. Some robots use mechanical methods to remove weeds, while others apply precise amounts of herbicide directly to the weeds, significantly reducing chemical usage.

- Harvesting: Robotics technology has made significant strides in automating the harvesting process, particularly for crops like fruits and vegetables where traditional methods are labor-intensive. These robots can identify ripe produce using vision sensors and harvest them without damaging the plant or the fruit, increasing efficiency and reducing labor costs.

- Crop Monitoring and Health Assessment: Drones and ground-based robots equipped with advanced sensors can monitor crop health across large areas by capturing real-time data on plant health, soil conditions, and moisture levels. This information helps farmers make informed decisions about irrigation, fertilization, and pest control, potentially leading to increased crop yields.

- Livestock Management: In dairy farming, robotic milking systems allow cows to be milked on demand, improving milk quality and animal welfare. These systems monitor the health of each animal, providing data that can be used to optimize feeding and health management.

- Data Collection and Analysis: Agricultural robots are pivotal in collecting vast amounts of data from the field. This data, processed using AI and machine learning algorithms, enables farmers to analyze crop performance, predict yields, and make strategic decisions to enhance productivity and sustainability.

Major Challenges

- High Initial Costs: The development and deployment of agricultural robots involve significant capital investment, primarily due to the advanced technologies and engineering required for manufacturing robust and efficient robots. This high cost limits the accessibility of these technologies, especially for small to medium-sized farms.

- Technological Complexity: Agricultural robots integrate complex technologies such as AI, machine learning, and advanced sensor systems. While these technologies enhance the capabilities of robots, they also add to the complexity of operating, maintaining, and repairing these machines. This technological complexity requires skilled personnel and can be a barrier to widespread adoption.

- Labor Challenges: The agricultural sector already faces labor challenges such as high risks of injury, demanding working conditions, and increasing wages. Although robots can alleviate some of these issues by reducing the need for manual labor, the transition involves retraining workers and potentially overcoming resistance from traditional farming communities.

- Regulatory and Safety Concerns: As with any automated technology, there are significant safety and regulatory hurdles. The operation of autonomous machinery in open environments poses potential risks, and regulatory frameworks are still evolving to address these challenges effectively.

- Integration with Existing Systems: Integrating advanced robots with existing farm systems and processes can be challenging. Many farms operate with legacy systems that are not designed to sync with modern technology, requiring additional investment in system upgrades and integration.

Market Growth Opportunities

- Diversification into New Applications: There’s a rising trend in utilizing agricultural robots for a variety of farming tasks beyond traditional uses. These include not only crop management and dairy farming but also newer areas like indoor farming and precision agriculture. This diversification allows robots to cater to a broader range of agricultural needs, improving productivity and efficiency across different farming environments.

- Technological Integration and Innovation: Advancements in AI and machine learning are enhancing the capabilities of agricultural robots, making them smarter and more adaptable to various agricultural conditions. The software segment, in particular, is expected to grow significantly due to these advancements, with a CAGR of 26.5% anticipated. This growth is driven by the software’s ability to optimize irrigation, fertilization, and disease management, which in turn boosts productivity and resource efficiency.

- Expansion in Emerging Markets: Regions such as Asia Pacific and Latin America are seeing increased adoption of agricultural robots due to rising labor costs and the push for higher agricultural productivity. In these regions, startups are securing significant funding to develop robotic solutions that cater to local farming needs, which is further expected to boost market growth.

- Government Incentives and Support: Various government initiatives and subsidies aimed at modernizing agriculture and reducing labor dependency are also significant drivers. Programs like the European Commission’s Robs4Crops project illustrate the commitment to integrating robotics into farming, which is expected to propel market growth further.

Key Players Analysis

In 2023, Agribotix LLC has been active in the agricultural robot sector, focusing on drone-enabled technologies to enhance farm productivity. Their integrated solutions, such as the FarmLens cloud-based data platform, offer comprehensive field data analysis, optimizing agricultural operations through advanced imaging and actionable insights. This technology enables precise monitoring and management of farm conditions, supporting sustainable farming practices by improving yield predictions and input management.

AGCO Corporation is a key player in the agricultural robot market, integrating robotics and automation into their product offerings to enhance agricultural productivity. In 2023, AGCO has been actively expanding its technological capabilities in robotics, contributing to advancements in automated farming solutions. This includes the development of autonomous tractors and other robotics that improve efficiency and precision in farming operations, thereby addressing the growing global demand for food and sustainable agricultural practices.

In 2023, Autonomous Solutions, Inc. (ASI) has been at the forefront of integrating advanced autonomous technology into agricultural practices. They have focused on enhancing precision agriculture through innovative solutions like their Mobius software, which enables coordinated control over multiple farming vehicles. This technology optimizes field operations and improves safety by managing vehicles to avoid obstacles, thereby addressing critical labor shortages and increasing farm productivity efficiently.

BouMatic Robotics B.V., renowned for its advancements in the agricultural robot sector, especially in dairy farm automation, continues to lead with innovations aimed at improving efficiency and animal welfare. Their robotic systems, which include automated milking solutions, are designed to enhance the productivity of dairy operations by optimizing milking processes and reducing labor costs, thereby ensuring high standards of milk quality and animal health.

In 2023, CNH Industrial made significant strides in the agricultural robot sector by introducing new automation and autonomy solutions designed to increase productivity and reduce labor demands on farms. Notably, their technology now includes driverless tillage and advanced baling automation, which allows operations to be controlled remotely, enhancing efficiency and reducing operator fatigue. This shift towards autonomous systems is part of CNH’s broader strategy to integrate more sustainable and innovative technologies across their product lines.

CLAAS, on the other hand, has been advancing its own agricultural robotics initiatives, focusing on enhancing the automation of harvesting equipment and tractors. Their efforts include the development of more intelligent and connected machinery that can operate with minimal human intervention, aimed at improving the efficiency and precision of agricultural operations. This approach not only addresses labor shortages but also contributes to more sustainable farming practices by optimizing resource use and reducing waste.

In 2023, DroneDeploy has been instrumental in enhancing agricultural productivity through its advanced drone mapping and data analysis tools. These tools enable farmers to quickly map their fields, conduct detailed crop assessments like stand counts, and make informed management decisions directly from the field’s edge, without the need for internet connectivity. This integration of cutting-edge technology into everyday farming operations is helping to streamline workflows and improve crop management practices significantly.

GEA Group has focused on integrating automation and robotics into the dairy farming sector, enhancing efficiency and animal welfare. Their innovations include automated milking systems, which improve not only the milking process but also overall herd management, thereby increasing productivity and ensuring consistent milk quality. These systems are part of GEA’s broader commitment to advancing agricultural technology by developing sustainable and automated solutions that address contemporary farming challenges.

In 2023, Harvest Automation Inc. has made strides in the agricultural robotics sector with its HV-100 robot, designed to enhance efficiency in nurseries and small farm areas. This robot is specialized for material handling tasks like spacing, collection, and arrangement of pots, operating round-the-clock in various environmental conditions. With its capability to handle common container sizes and operate autonomously alongside humans without special environmental setups, the HV-100 is a practical solution for repetitive tasks, helping to reduce labor needs and enhance work efficiency.

Trimble Inc. continues to integrate advanced technologies into the agricultural sector, focusing on precision agriculture products that enhance farming efficiency and productivity. Their solutions include GPS systems, drones, and software analytics that assist in farm management by improving planting accuracy, optimizing resource usage, and increasing crop yields. Trimble’s commitment to innovation helps farmers navigate the complexities of modern agriculture by providing tools that support more precise and informed farming decision.

In 2023, AgEagle Aerial Systems, Inc. solidified its position as a pivotal player in the agricultural robotics sector, recognized among the top 20 AI and robotics companies revolutionizing agriculture. AgEagle specializes in providing drone-based data solutions that enhance crop management, reduce input costs, and increase yields through precise monitoring and insights. The company has expanded its product line with the launch of the eBee VISION drone, which offers high-resolution imaging and is tailored for intelligence, surveillance, and reconnaissance applications, reflecting its commitment to innovation in unmanned aerial systems.

Naio Technologies focuses on creating autonomous agricultural robots designed to assist in various farming tasks, such as weeding, seeding, and harvesting. Naio’s robots aim to reduce the labor required for these tasks, offering solutions that improve efficiency and sustainability in farming practices. Their use of advanced robotics helps address the growing labor shortages in agriculture, making it possible for farmers to manage their operations more effectively with less manpower.

In 2023, Deere & Company, also known as John Deere, has made significant advancements in the agricultural robot sector, particularly with its development and deployment of autonomous tractors. These tractors are equipped with cutting-edge technologies including 360-degree cameras, artificial intelligence (AI), and advanced sensor systems, which allow them to operate without a human driver. John Deere’s focus on AI and robotics has enabled more efficient field operations by automating tasks like planting, tillage, and crop care, which significantly enhances farm productivity. The company’s dedication to innovation in autonomous farm equipment is aimed at addressing key industry challenges such as labor shortages and the need for increased food production due to the growing global population.

In 2023, Deepfield Robotics, a Bosch start-up, continued to make significant contributions to the agricultural robot sector with their advanced machine, Bonirob. This robot is designed to enhance the efficiency of plant breeding and reduce the environmental impact of traditional farming methods by mechanically weeding without the use of herbicides. Bonirob operates with a high degree of accuracy and utilizes machine learning to differentiate between crops and weeds based on detailed visual data. Its capability to perform in-field analytics assists in determining the most robust plant varieties under real farming conditions. This technology not only optimizes agricultural productivity but also supports sustainable farming practices by reducing chemical usage and improving crop selection processes.

Conclusion

However, the sector faces challenges including the high cost of initial investment and technological complexity, which may hinder adoption especially among small to medium-sized farms. Despite these challenges, the integration of cutting-edge technologies like artificial intelligence and machine learning continues to enhance the capabilities of these robots, making them more efficient and adaptable to various agricultural needs.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)