Table of Contents

- Introduction

- Editor’s Choice

- Air Fryer Market Overview

- Air Fryer Production Volume Statistics

- Revenue Generation Through Air Fryers

- Air Fryer Price Statistics

- Air Fryer Ownership Statistics

- Air Fryer Sales Statistics

- Popular Foods Cooked in Air Fryers

- Widely Searched Air Fryer Recipes

- Key Reasons for Air Fryer Adoption Among Households

- Temperature for Cooking Various Foods in an Air Fryer

- Cost of Cooking in an Oven vs. Air Fryer

- Cost Efficiency and Impact of Air Fryers vs. Ovens Among Consumers

- Energy Efficiency of Different Air Fryer Models by Capacity and Wattage

- Wi-Fi and Bluetooth-enabled Air Fryers Statistics

- Obstacles to Air Fryer Ownership Statistics

- Innovations and Developments in Air Fryers

- Regulations for Air Fryers

- Recent Developments

- Conclusion

- FAQs

Introduction

Air Fryer Statistics – An air fryer is a kitchen appliance that cooks food using hot air circulation. Mimicking the effects of deep frying with significantly less oil.

It features a heating element and a powerful fan that rapidly circulates hot air around the food. Resulting in a crispy texture and even cooking.

Air fryers are versatile, capable of frying, baking, roasting, and grilling, and offer the advantage of reduced fat content and quicker cooking times compared to traditional methods.

They are user-friendly, with simple controls and easy-to-clean components. Making them a popular choice for healthier, efficient cooking.

Editor’s Choice

- The global air fryer market revenue is projected to reach $1,803 billion by 2032.

- The competitive landscape of the global air fryer market is diverse and features several key players. Koninklijke Philips N.V. holds the largest market share at 15%.

- The air fryer market revenues by country show diverse levels of market penetration and sales performance. China leads with a significant revenue of $1,635 million.

- The average price per unit of air fryers is expected to reach $91.12 by 2029.

- In South Korea in 2021, the distribution of air fryer ownership by type among respondents showcased a clear preference for certain models. Basket-type air fryers were overwhelmingly the most popular, with 64% of respondents owning this type.

- Based on a U.K. survey, the most popular foods cooked in air fryers are led by chips. With a commanding 73% of respondents using their air fryers for this purpose.

- In the U.K., more than half of the households that own an air fryer (53%) cite cost-efficiency as a significant reason for their purchase. Highlighting that air fryers are cheaper to run than traditional ovens.

- The survey on obstacles to air fryer ownership reveals several key reasons why consumers hesitate to purchase these appliances. Limited counter space is the most significant hurdle, cited by 45% of respondents. Indicating that practical kitchen constraints are a major factor.

Air Fryer Market Overview

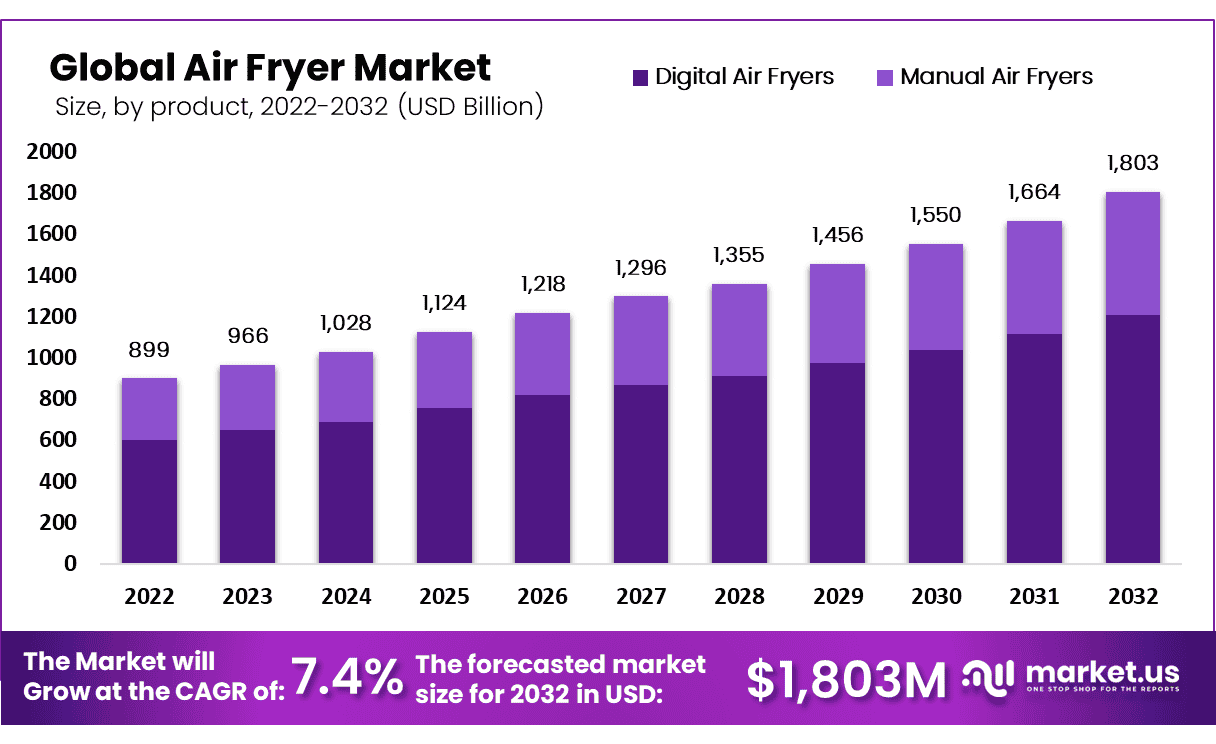

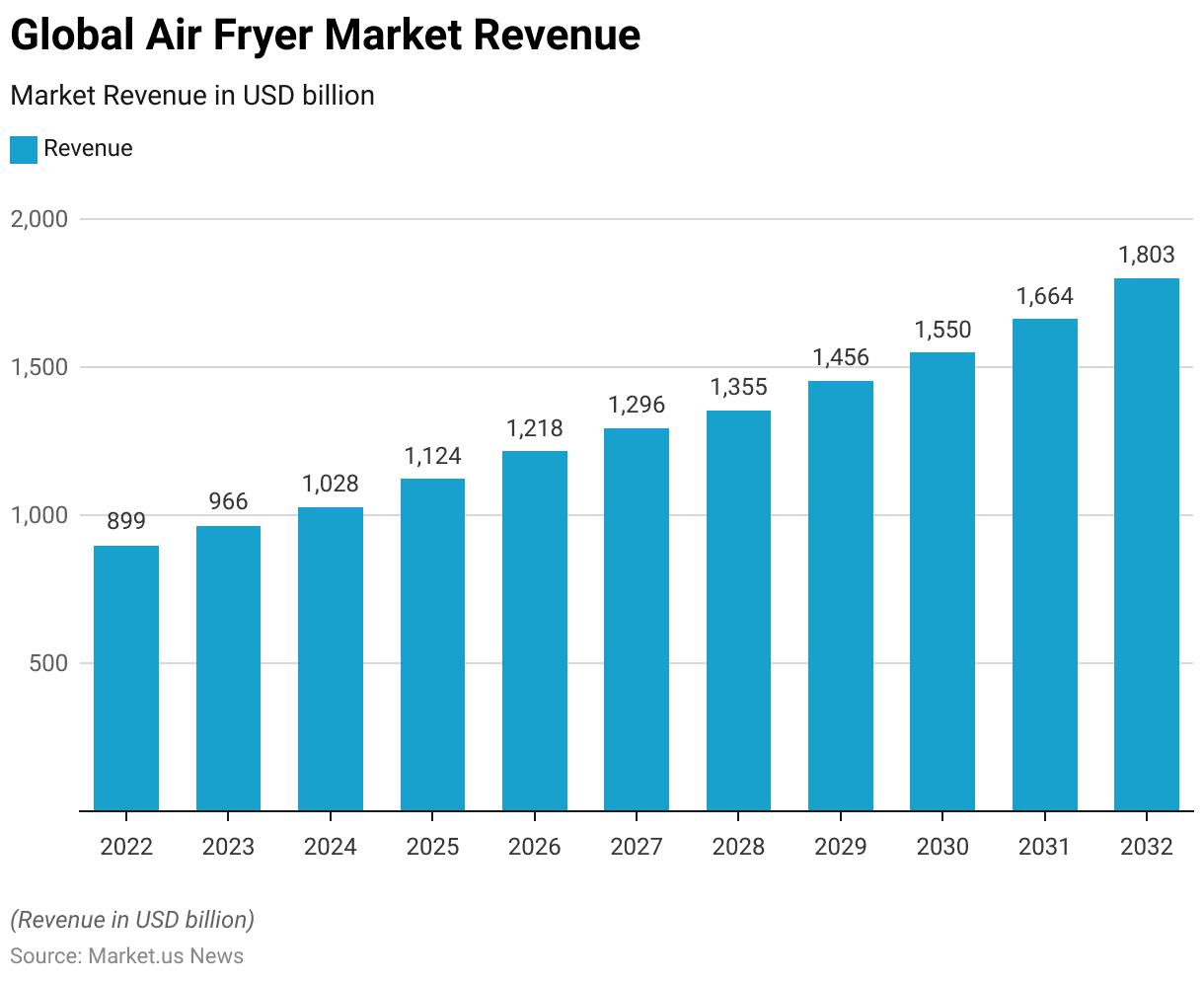

Global Air Fryer Market Size Statistics

- The global air fryer market revenue is projected to experience a consistent upward trend over the next decade at a CAGR of 7.40%.

- In 2022, the market was valued at $899 billion.

- It is forecasted to increase to $966 billion in 2023, reaching $1,028 billion by 2024.

- A more substantial growth is anticipated in the following years, with the market revenue estimated to be $1,124 billion in 2025 and continuing to rise to $1,218 billion by 2026.

- The upward trajectory is expected to maintain momentum. With the revenue reaching $1,296 billion in 2027 and further to $1,355 billion by 2028.

- The growth pace seems to accelerate slightly in the later years, with projections showing a market size of $1,456 billion in 2029, $1,550 billion in 2030, and finally reaching $1,664 billion in 2031.

- By the end of 2032, the market is expected to surpass this to reach a revenue of $1,803 billion. Demonstrating the robust demand and increasing popularity of air fryers globally.

(Source: market.us)

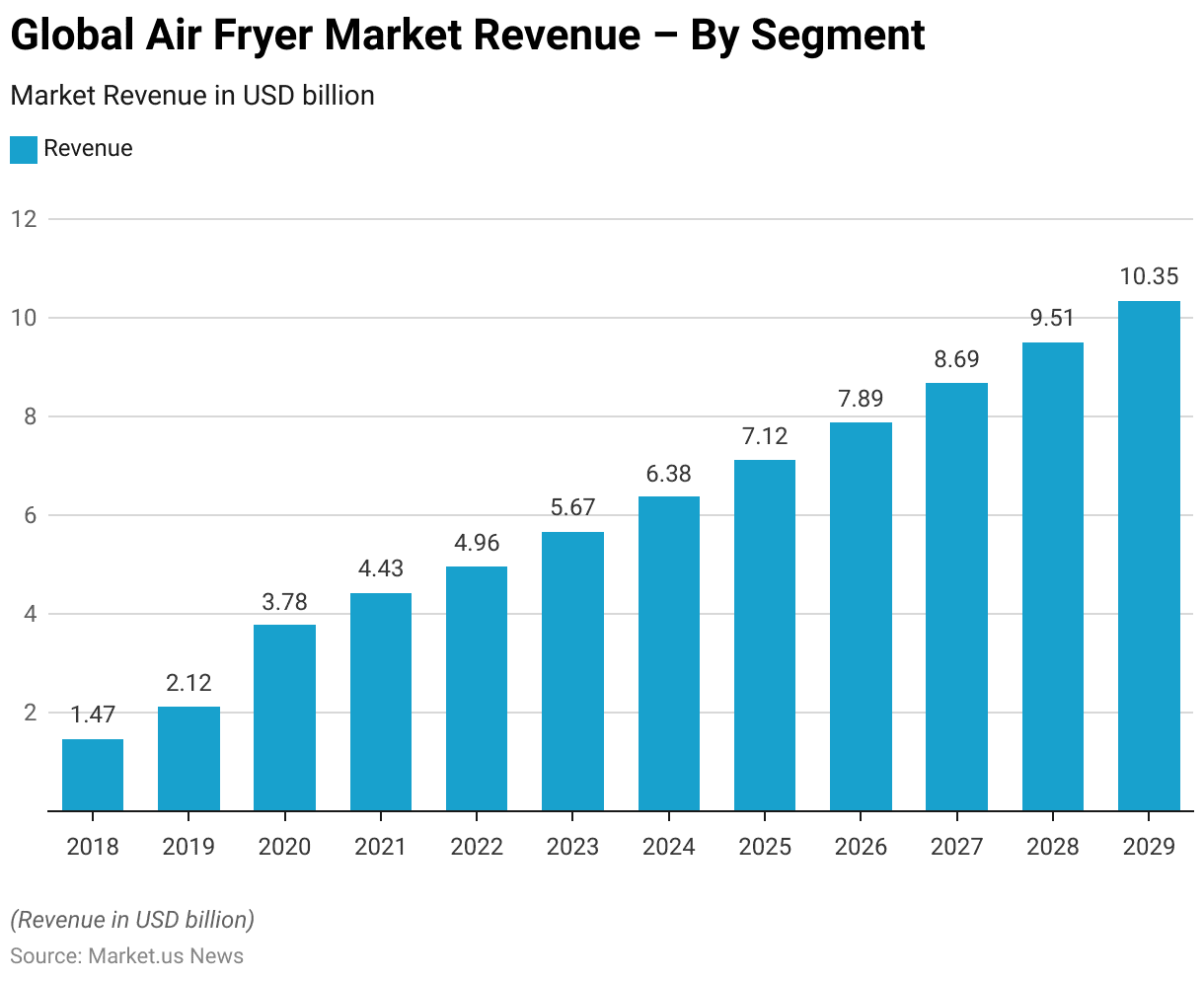

Global Air Fryer Market Revenue – By Segment Statistics

- The global air fryer market, when analyzed by segment revenue. Has shown remarkable growth from 2018 through to the forecasted figures for 2029.

- Starting with a market size of $1.47 billion in 2018, the revenue climbed to $2.12 billion in 2019.

- The growth accelerated significantly in 2020, reaching $3.78 billion. Followed by a more modest increase to $4.43 billion in 2021.

- The upward trend continued, with the market achieving $4.96 billion in 2022 and then further rising to $5.67 billion in 2023.

- It is expected to grow steadily in the subsequent years. Reaching $6.38 billion in 2024. $7.12 billion in 2025, and $7.89 billion in 2026.

- The growth is projected to maintain a steady pace. With the market expanding to $8.69 billion by 2027, $9.51 billion by 2028, and reaching $10.35 billion by the end of 2029.

- This consistent increase underscores the growing consumer interest and adoption of air fryers across the globe.

(Source: Statista)

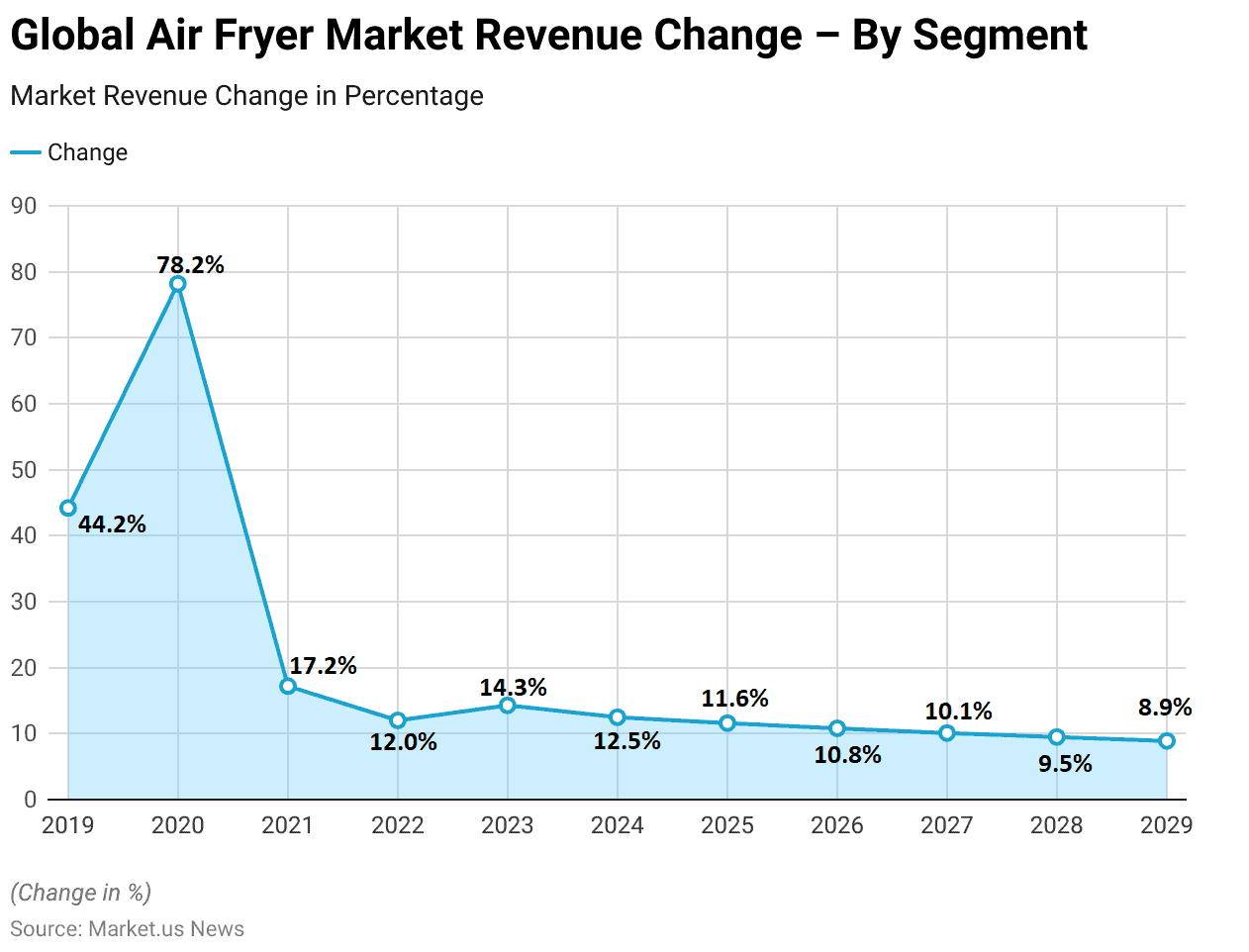

Air Fryer Market Revenue Change – By Segment Statistics

- The percentage change in global air fryer market revenue by segment from 2019 through 2029 shows a notable pattern of fluctuation and a gradual decline in growth rates.

- In 2019, the market experienced a robust increase of 44.2%.

- This surge intensified in 2020, with an exceptional growth rate of 78.2%.

- However, from 2021 onwards, there was a notable moderation in the pace of growth. The market grew by 17.2% in 2021, followed by a further decrease to 12.0% in 2022.

- The trend continued with a slight rebound to 14.3% in 2023 before tapering off to 12.5% in 2024.

- From 2025 onwards, the growth rates consistently declined. Registering at 11.6% in 2025, 10.8% in 2026, and 10.1% in 2027.

- The decrease continued with the market expanding by 9.5% in 2028 and further slowing down to 8.9% by 2029.

- This trend reflects a maturing market, where initial high growth rates gradually normalize as the product gains widespread acceptance and market saturation approaches.

(Source: Statista)

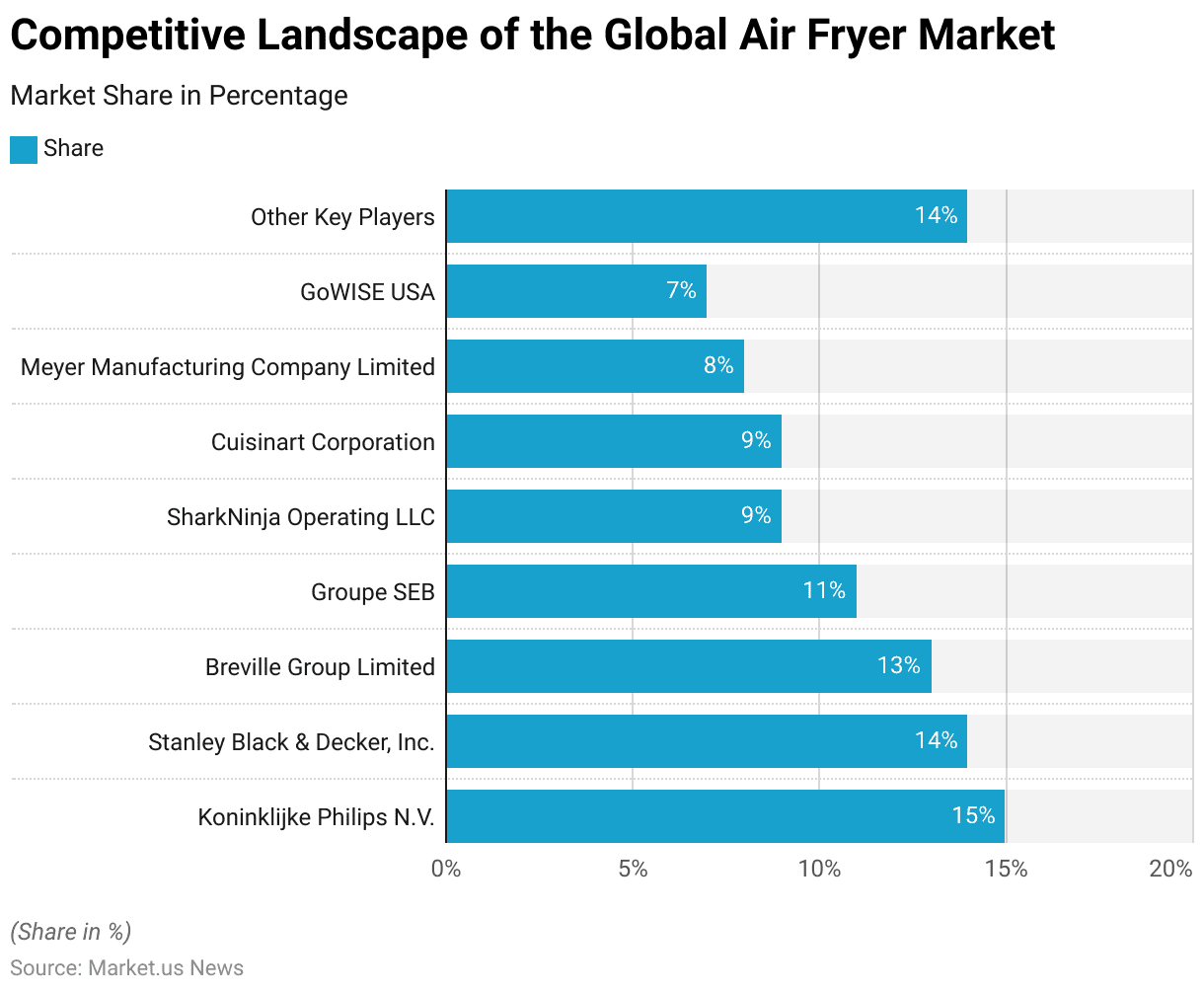

Competitive Landscape of the Global Air Fryer Market

- The competitive landscape of the global air fryer market is diverse and features several key players.

- Koninklijke Philips N.V. holds the largest market share at 15%. Closely followed by Stanley Black & Decker, Inc. with 14%.

- Breville Group Limited captures a significant portion as well, commanding 13% of the market.

- Groupe SEB comes next with an 11% share.

- Both SharkNinja Operating LLC and Cuisinart Corporation have a substantial presence, each holding 9% of the market.

- Meyer Manufacturing Company Limited accounts for 8%, while GoWISE USA has a 7% share.

- Other key players collectively hold 14% of the market share, highlighting a competitive and fragmented market environment. Where multiple companies are vying for leadership and innovation in the air fryer industry.

(Source: market.us)

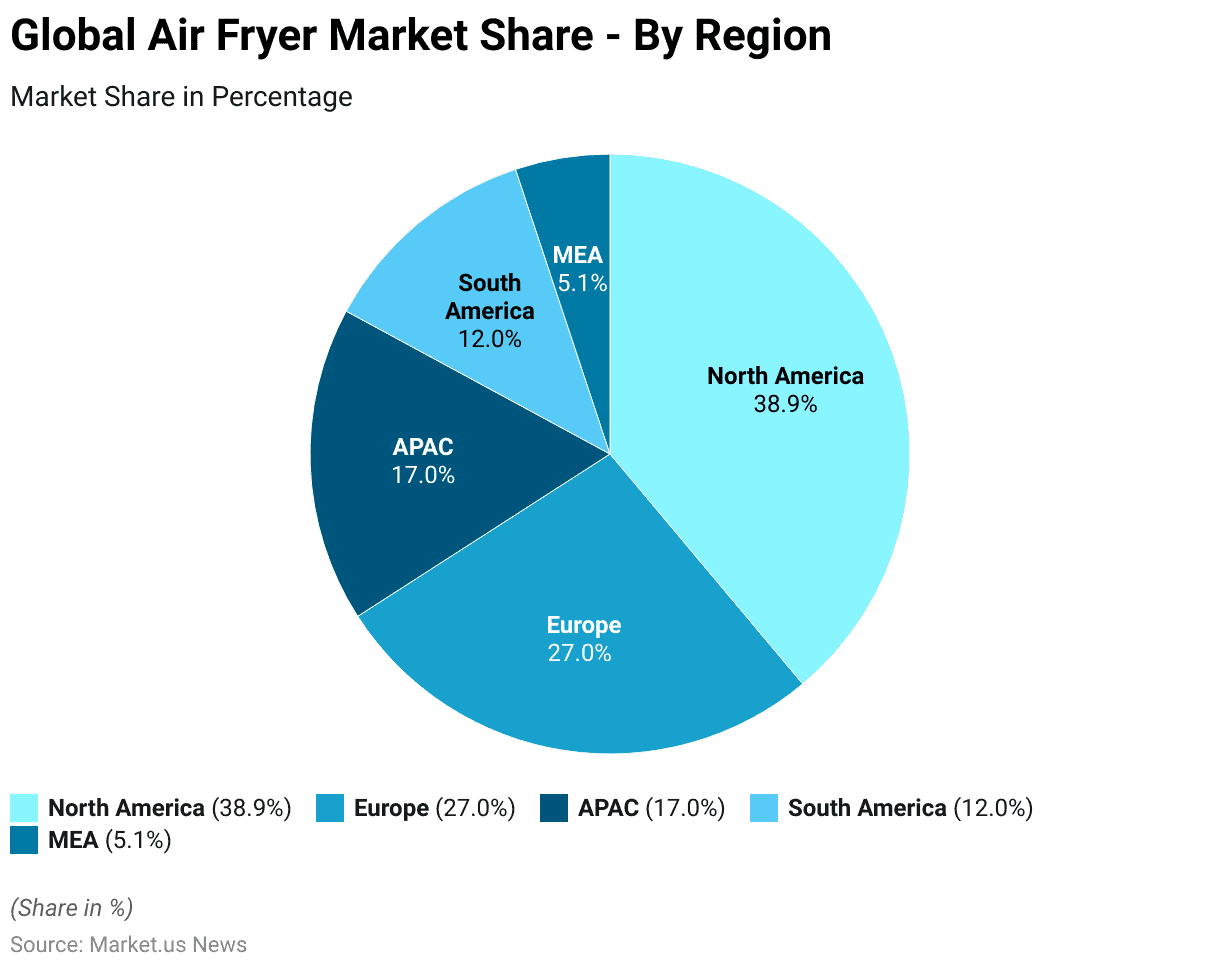

Regional Analysis of the Global Air Fryer Market

- The global air fryer market share is distributed unevenly across various regions. Reflecting differing levels of market penetration and consumer preferences.

- North America leads with the highest market share at 38.9%. Indicative of strong consumer demand and the widespread adoption of health-conscious cooking technologies in this region.

- Europe follows with a substantial 27.0% share, driven by similar trends towards healthier lifestyle choices.

- The Asia-Pacific region holds a 17.0% share, showing growing acceptance and increasing market presence.

- South America captures a smaller portion of the market at 12.0%. At the same time, the Middle East and Africa (MEA) have the least, at only 5.1%. This could be attributed to less exposure to and availability of such modern cooking appliances.

- This geographical breakdown underscores the varying stages of market development and potential growth opportunities in each region.

(Source: market.us)

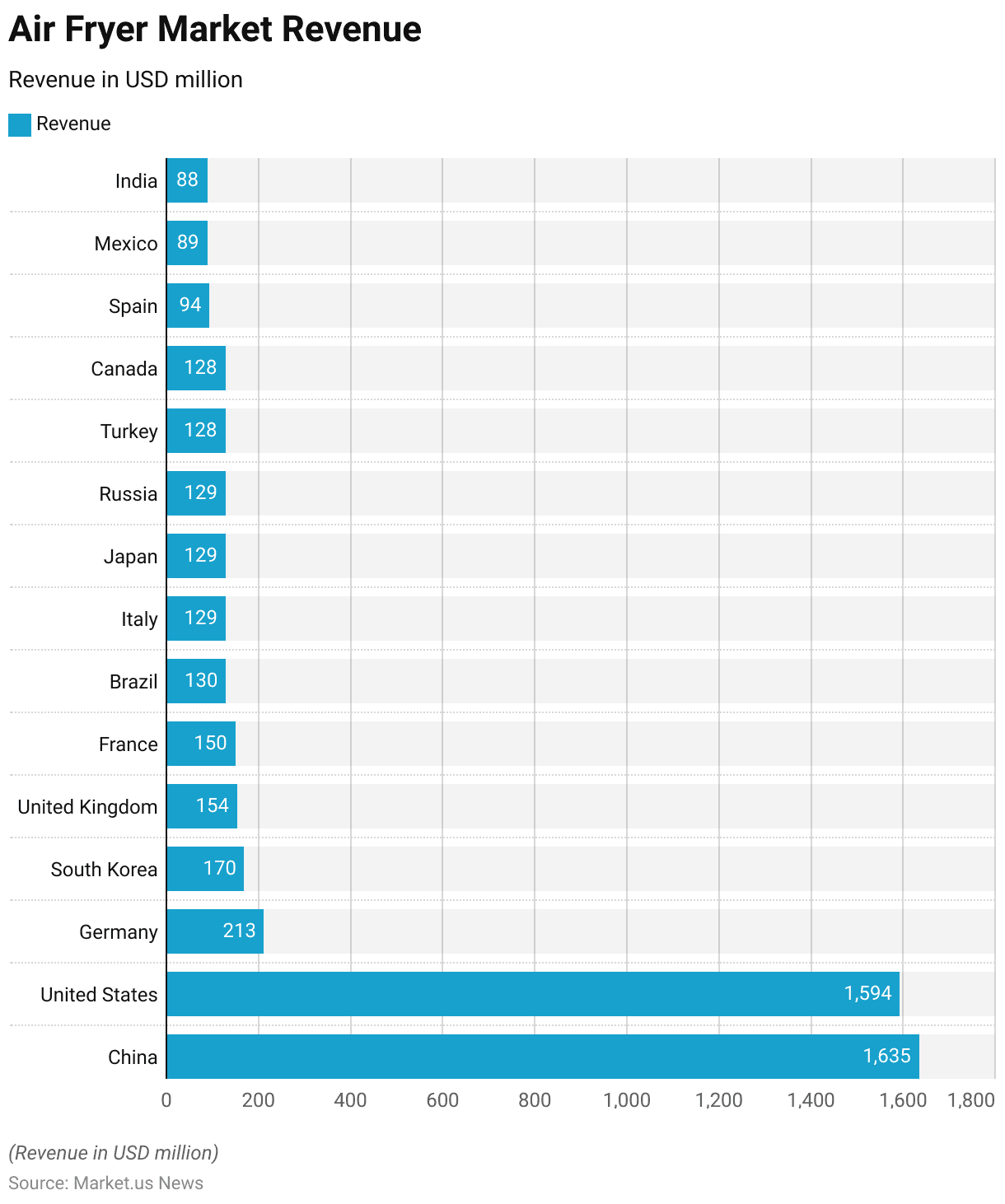

Air Fryer Market Revenue– By Country

- The air fryer market revenues by country show diverse levels of market penetration and sales performance.

- China leads with a significant revenue of $1,635 million, closely followed by the United States at $1,594 million, demonstrating robust demand in both markets.

- Germany holds the third position but with a substantially lower revenue of $213 million.

- South Korea and the United Kingdom also show notable market sizes. With revenues of $170 million and $154 million, respectively.

- France’s market closely trails at $150 million.

- In Latin America, Brazil’s market stands at $130 million, slightly higher than Italy, Japan, and Russia, each recording revenues of $129 million.

- Turkey and Canada have nearly equivalent market revenues at $128 million.

- Spain, Mexico, and India follow, with revenues of $94 million, $89 million, and $88 million, respectively. Indicating growing but still developing market conditions in these regions.

- These figures reflect varying consumer acceptance and economic conditions influencing the air fryer market across different countries.

(Source: Statista)

Air Fryer Production Volume Statistics

Global Air Fryer Production Volume – By Segment Statistics

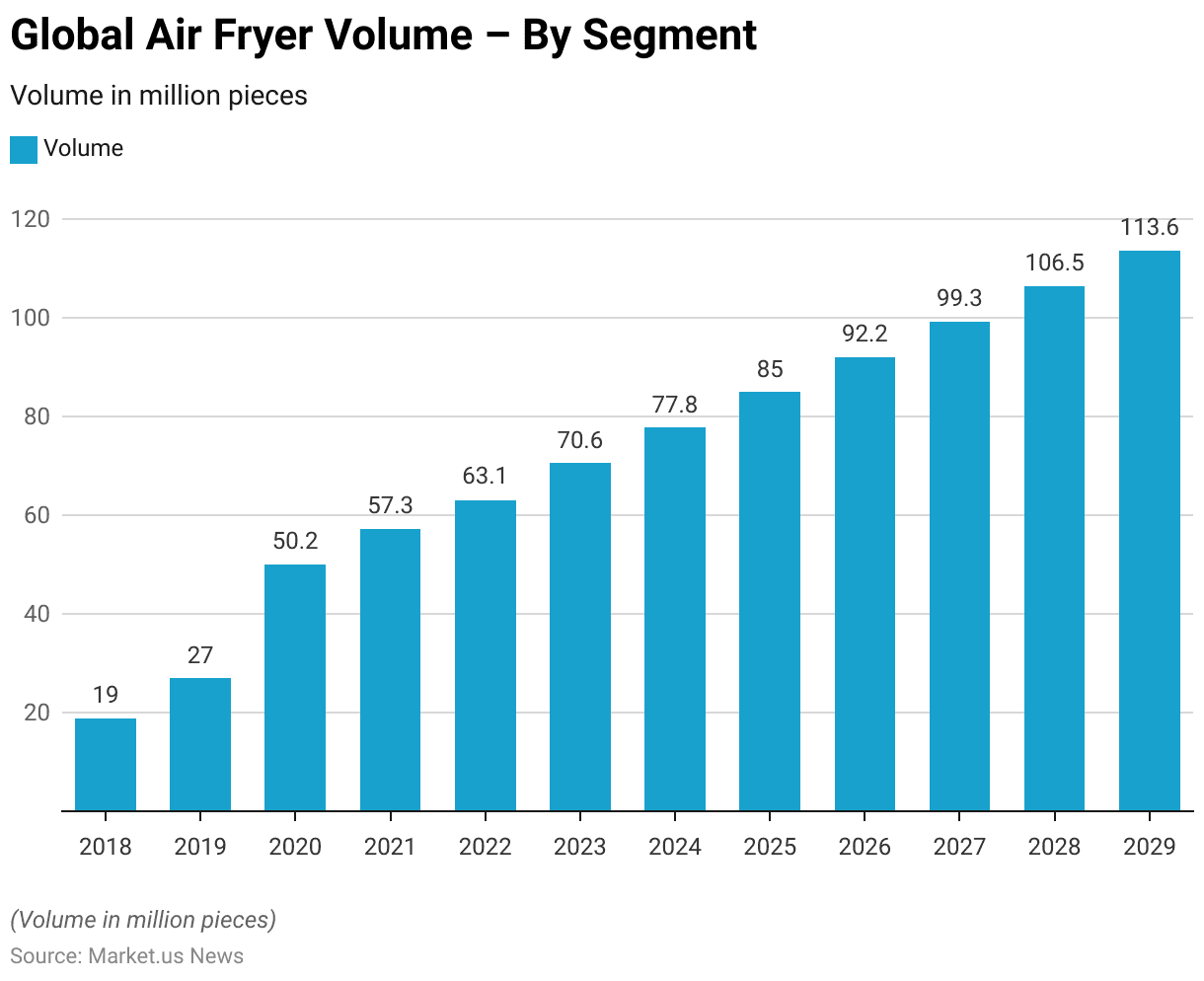

- The production volume of global air fryers, segmented by year. Indicates a consistent upward trajectory from 2018 through the projected data for 2029.

- In 2018, approximately 18.95 million units were produced.

- This figure saw a notable increase in 2019, reaching 27.04 million units.

- The year 2020 marked a significant jump in production volumes. Doubling to 50.18 million units, reflecting growing consumer interest and market expansion.

- This trend continued with production volumes reaching 57.33 million units in 2021, followed by 63.14 million units in 2022.

- The subsequent years saw further increases, with volumes rising to 70.63 million units in 2023 and expected to continue growing to 77.8 million units in 2024.

- By 2025, the production is anticipated to reach 84.99 million units. Increasing to 92.18 million units in 2026 and further to 99.33 million units in 2027.

- The growth is projected to continue, with volumes expected to reach 106.5 million units in 2028 and 113.6 million units by 2029.

- This sustained increase underscores the robust growth and continued market potential for air fryers globally.

(Source: Statista)

Global Air Fryer Production Volume Growth – By Segment Statistics

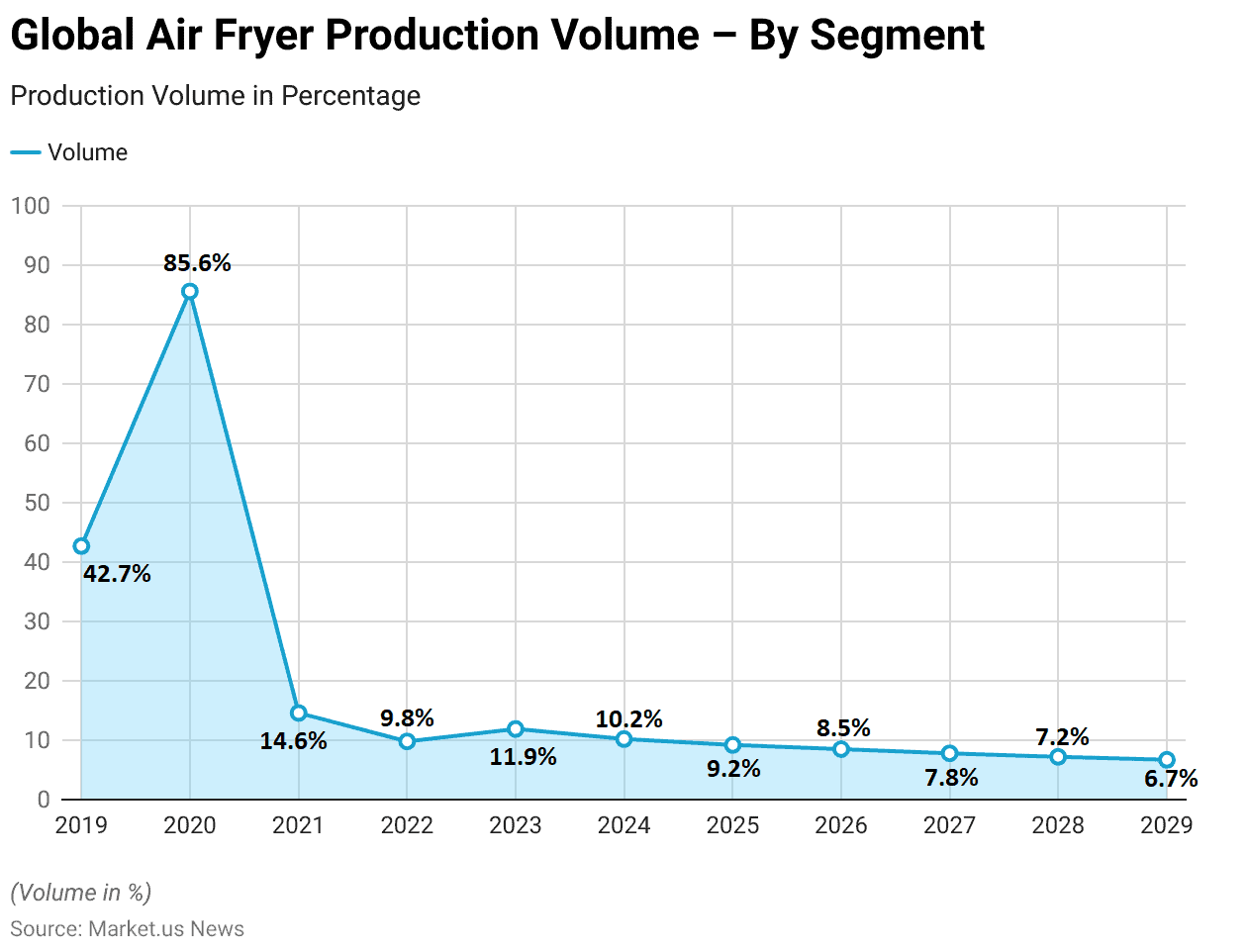

- The annual percentage change in the global air fryer production volume from 2019 to 2029 shows a dramatic increase initially. Followed by a steady decline in growth rates over the subsequent years.

- In 2019, the production volume surged by 42.7%, followed by an extraordinary increase of 85.6% in 2020, reflecting a significant spike in demand.

- However, from 2021 onwards, the rate of growth moderated significantly. With an increase of 14.6% that year.

- This trend of slowing growth continued, with production volume growth rates decreasing to 9.8% in 2022 and slightly rising to 11.9% in 2023.

- Over the next several years, the growth rates further tapered off: 10.2% in 2024, 9.2% in 2025, 8.5% in 2026, 7.8% in 2027, 7.2% in 2028, and finally dipping to 6.7% by 2029.

- This pattern indicates a maturing market where rapid expansion phases give way to more stable, albeit slower, growth trajectories.

(Source: Statista)

Revenue Generation Through Air Fryers

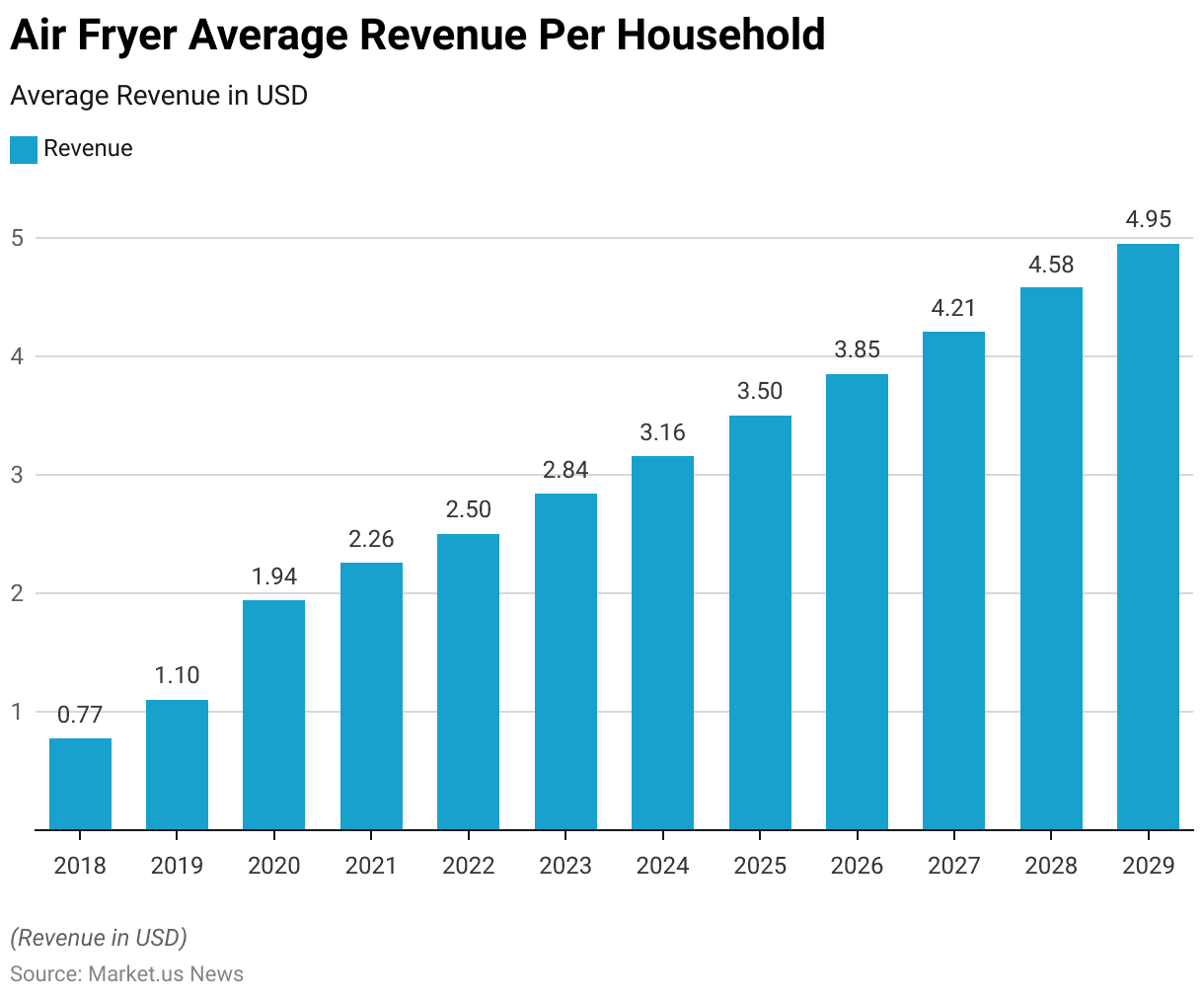

- The average revenue per household generated through air fryers has exhibited a consistent upward trend from 2018 to the projected figures for 2029.

- In 2018, the revenue was relatively low at $0.77 per household.

- This figure gradually increased to $1.10 in 2019 and more significantly to $1.94 by 2020, possibly reflecting a surge in adoption or an increase in unit prices.

- The upward momentum continued, with revenue reaching $2.26 in 2021 and $2.50 in 2022.

- Each subsequent year saw a steady rise in revenue per household: $2.84 in 2023, $3.16 in 2024, and $3.50 in 2025.

- The growth pattern persisted, with revenue increasing to $3.85 in 2026, $4.21 in 2027, $4.58 in 2028, and eventually peaking at $4.95 in 2029.

- This steady increase over the years indicates growing household expenditure on air fryers. Likely due to the rising popularity of the product and possibly the introduction of more advanced and expensive models.

(Source: Statista)

Air Fryer Price Statistics

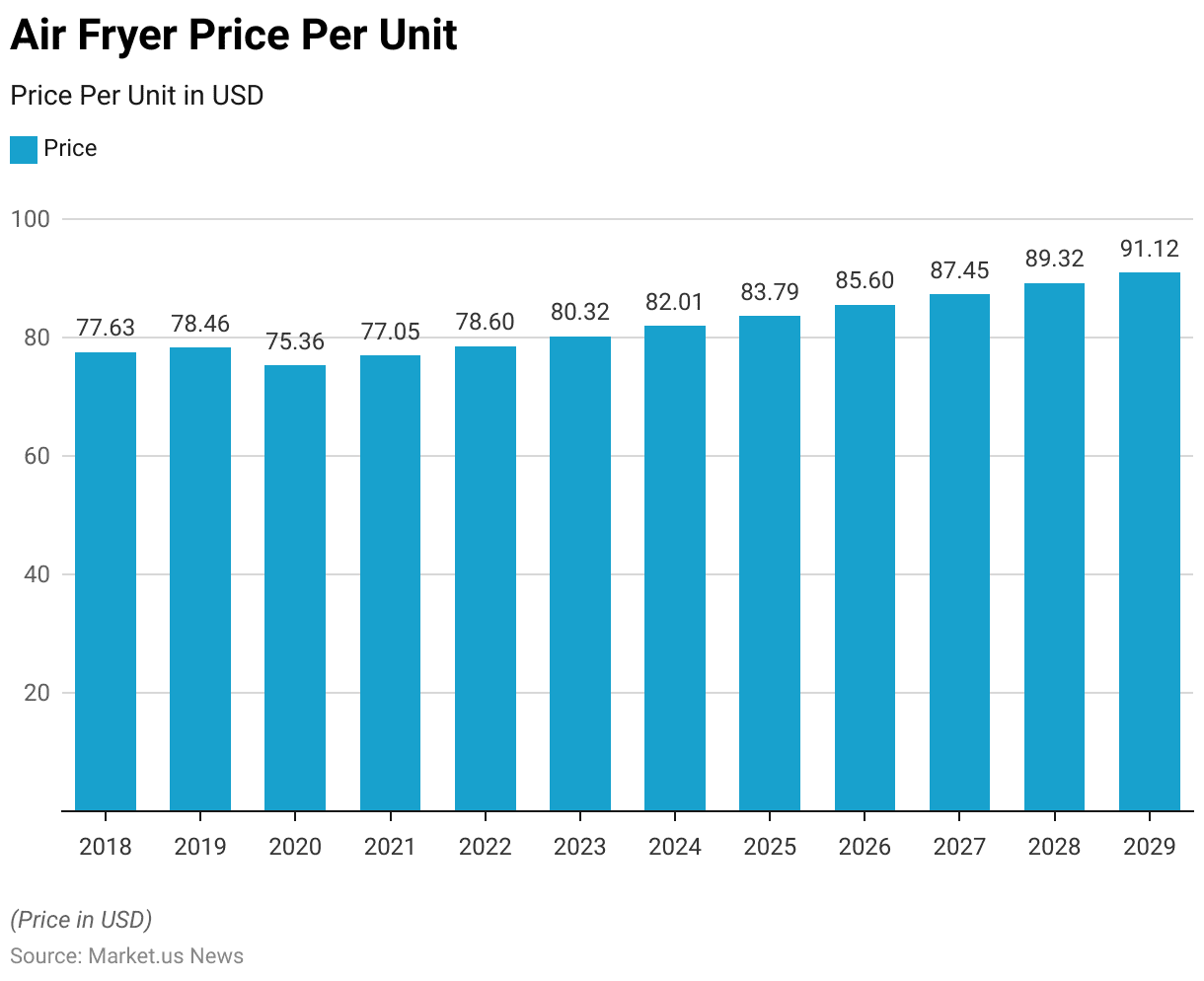

- The average price per unit of air fryers has shown a gradual increase from 2018 to the forecast year of 2029.

- Starting in 2018, the average price was $77.63, which slightly rose to $78.46 in 2019.

- In 2020, there was a noticeable decrease to $75.36, potentially due to market dynamics or increased competition.

- However, prices began to climb again, reaching $77.05 in 2021 and further increasing to $78.60 in 2022.

- The upward trend in pricing continued steadily over the following years, with the price per unit rising to $80.32 in 2023, $82.01 in 2024, and $83.79 in 2025.

- This pattern persisted, with the prices reaching $85.60 in 2026, $87.45 in 2027, $89.32 in 2028, and eventually $91.12 by 2029.

- This consistent increase in price per unit over the years indicates a robust market condition where demand possibly outstrips supply. Leading to higher prices, or reflects the introduction of more advanced features and technologies in air fryers.

(Source: Statista)

Air Fryer Ownership Statistics

Average Volume Per Household

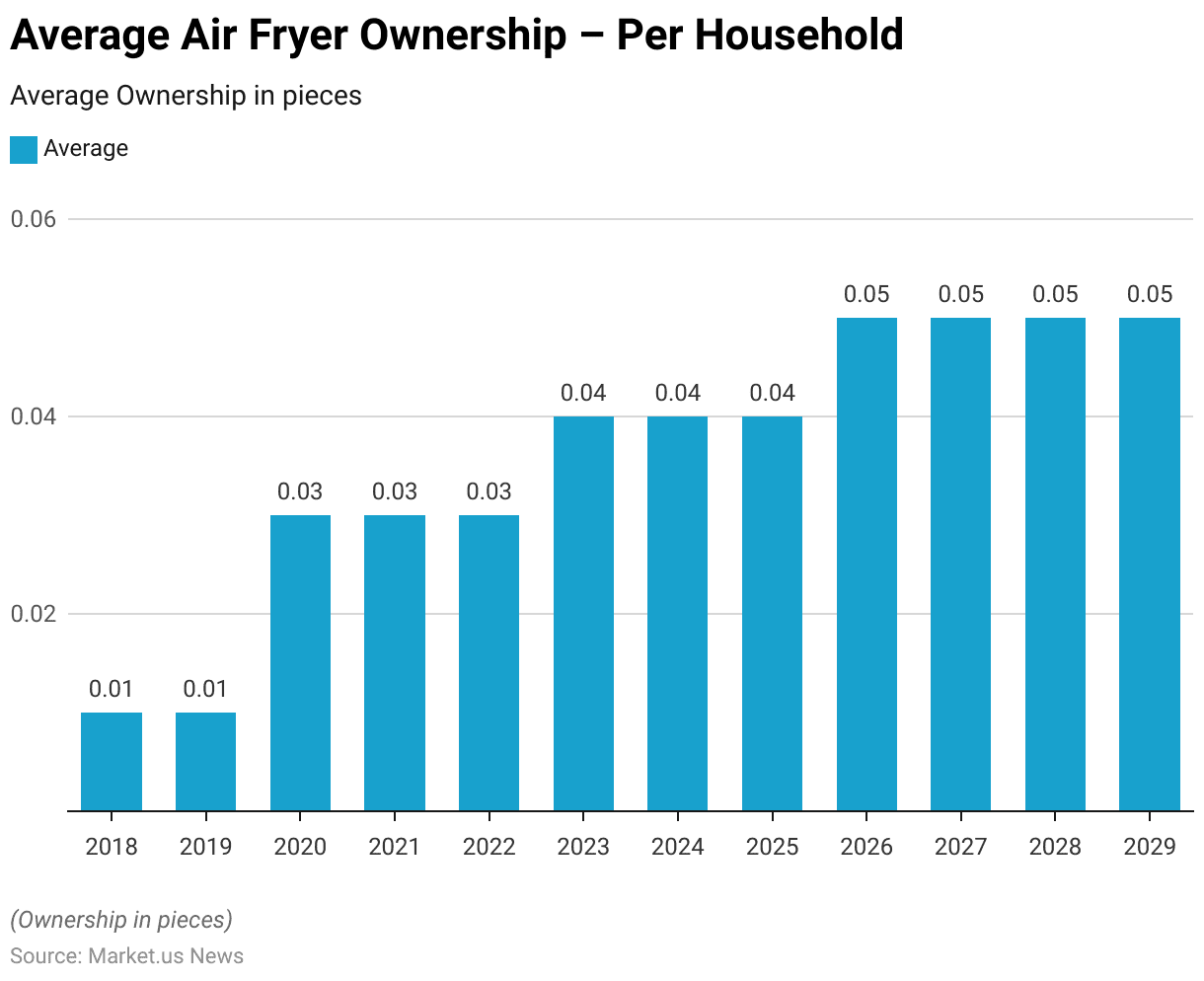

- The average air fryer ownership per household from 2018 to 2029 illustrates a gradual increase in the penetration of air fryers into domestic settings.

- Initially, in 2018 and 2019, the average ownership was minimal, standing at just 0.01 pieces per household.

- This figure experienced a noticeable increase in 2020, tripling to 0.03 pieces per household, likely influenced by rising consumer awareness and the adoption of healthier cooking practices.

- The ownership rate stabilized at 0.03 pieces through 2021 and 2022.

- By 2023, there was a slight increase to 0.04 pieces per household, maintained through 2024 and 2025.

- A further incremental rise occurred in 2026, where the average ownership reached 0.05 pieces per household, a rate that is projected to hold steady through 2029.

- This trend reflects a growing consumer inclination towards convenient and healthier cooking solutions, represented by the increasing presence of air fryers in homes.

(Source: Statista)

Air Fryer Ownership – By Type Statistics

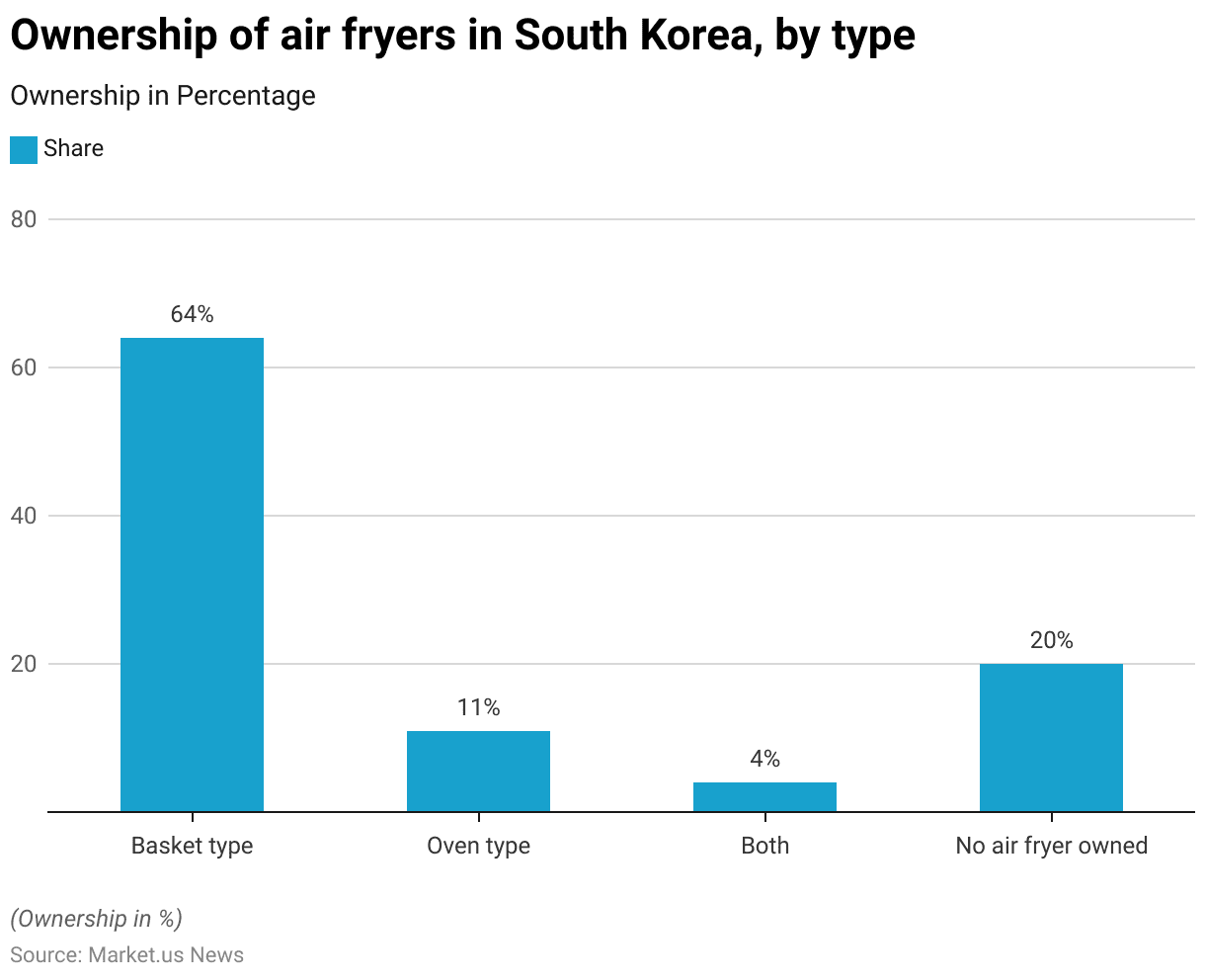

- In South Korea in 2021, the distribution of air fryer ownership by type among respondents showcased a clear preference for certain models.

- Basket-type air fryers were overwhelmingly the most popular, with 64% of respondents owning this type.

- Oven-type air fryers, while less prevalent, were owned by 11% of respondents.

- A smaller segment, 4%, reported owning both basket-type and oven-type air fryers, indicating a dedicated use of air frying technology in their cooking routines.

- Despite the popularity of air fryers, 20% of respondents did not own any air fryers, highlighting a significant portion of the population not engaging with this cooking technology at the time.

- This data reflects varied preferences and adoption levels of air fryer technologies within South Korea.

(Source: Statista)

Air Fryer Sales Statistics

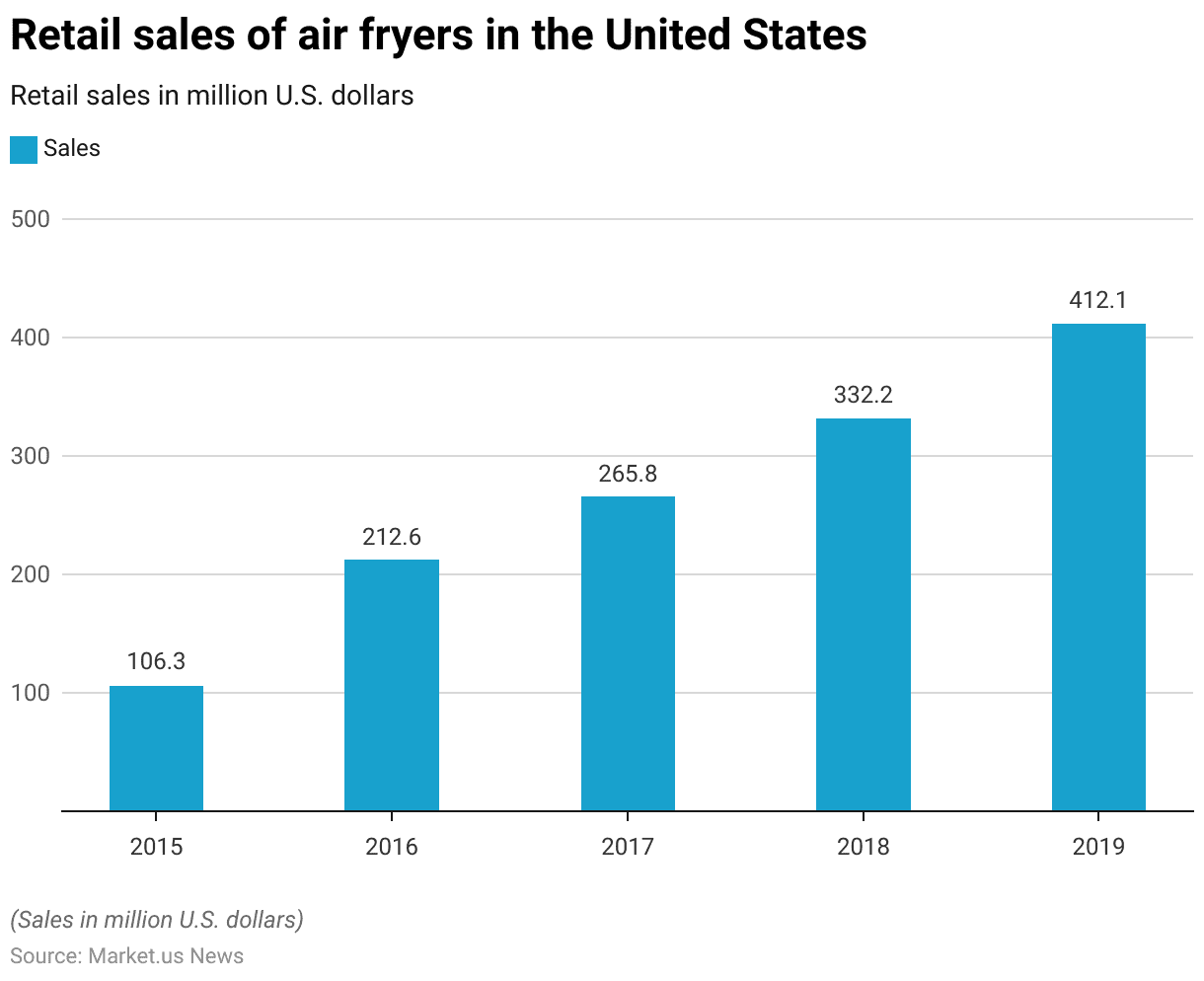

- The retail sales of air fryers in the United States have shown substantial growth from 2015 to 2019.

- Starting in 2015, the sales were recorded at $106.3 million.

- This figure more than doubled by 2016, reaching $212.6 million, indicating a significant surge in consumer interest and market penetration.

- The growth continued, with sales reaching $265.8 million in 2017.

- By 2018, the sales had climbed further to $332.2 million.

- The upward trend persisted into 2019, with sales peaking at $412.1 million.

- This consistent year-over-year increase highlights the expanding popularity of air fryers as a kitchen appliance in the U.S. market, driven by the consumer shift towards healthier cooking options and convenience.

(Source: Statista)

Popular Foods Cooked in Air Fryers

Most Popular Foods Cooked in Air Fryers Generally

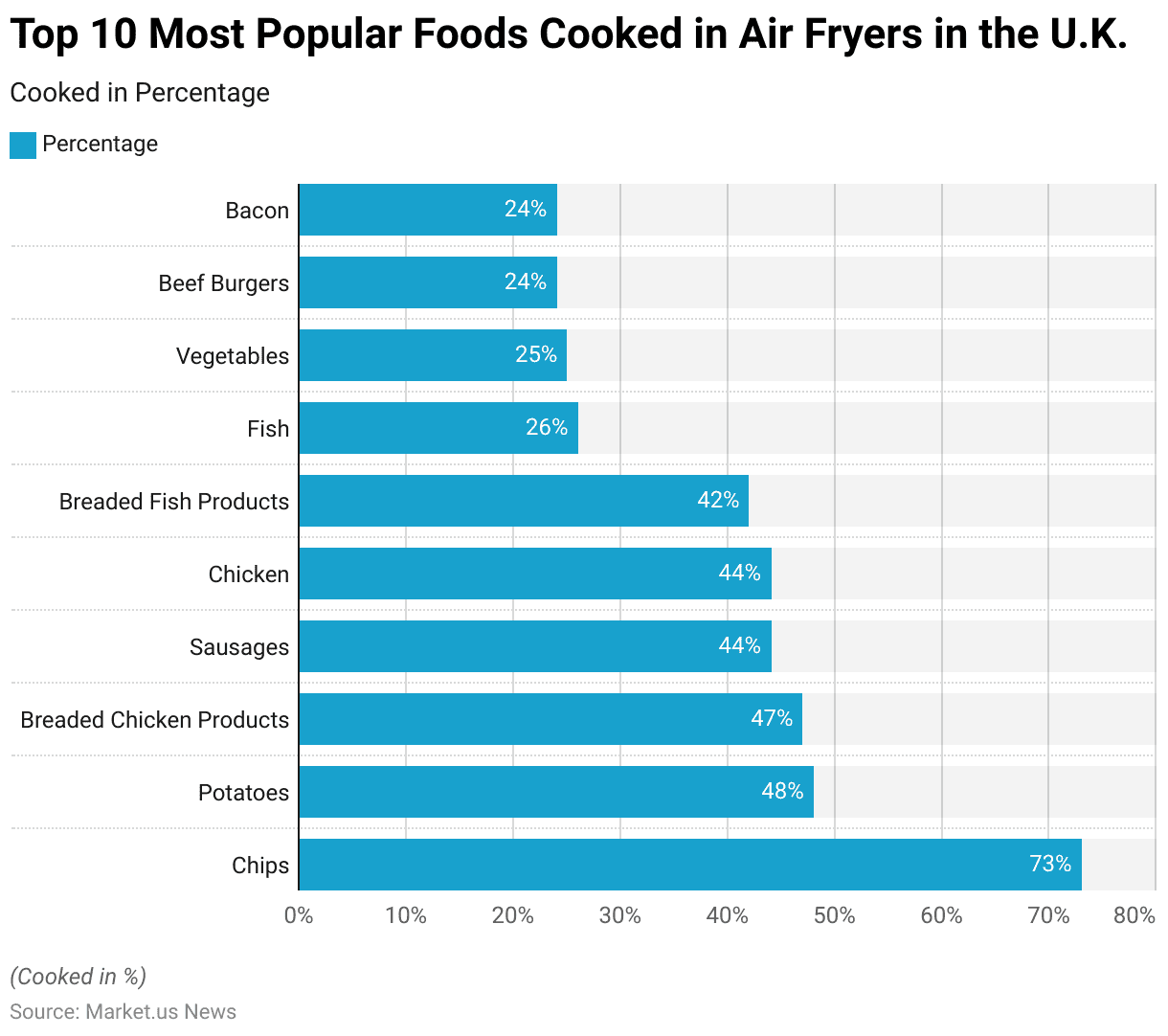

- Based on a U.K. survey, the most popular foods cooked in air fryers are led by chips, with a commanding 73% of respondents using their air fryers for this purpose.

- Potatoes come in second at 48%, closely followed by breaded chicken products at 47%.

- Sausages and chicken are tied in popularity, each favored by 44% of users.

- Breaded fish products are also prominently featured and chosen by 42% of respondents.

- The survey indicates lesser but significant use for cooking fish and vegetables, with 26% and 25%, respectively.

- Rounding out the top ten, beef burgers and bacon each hold a 24% preference among users.

- This data highlights the versatility of air fryers in preparing a wide range of both meat and vegetable dishes, underlining their growing popularity in U.K. kitchens.

(Source: Leatherhead Food Research)

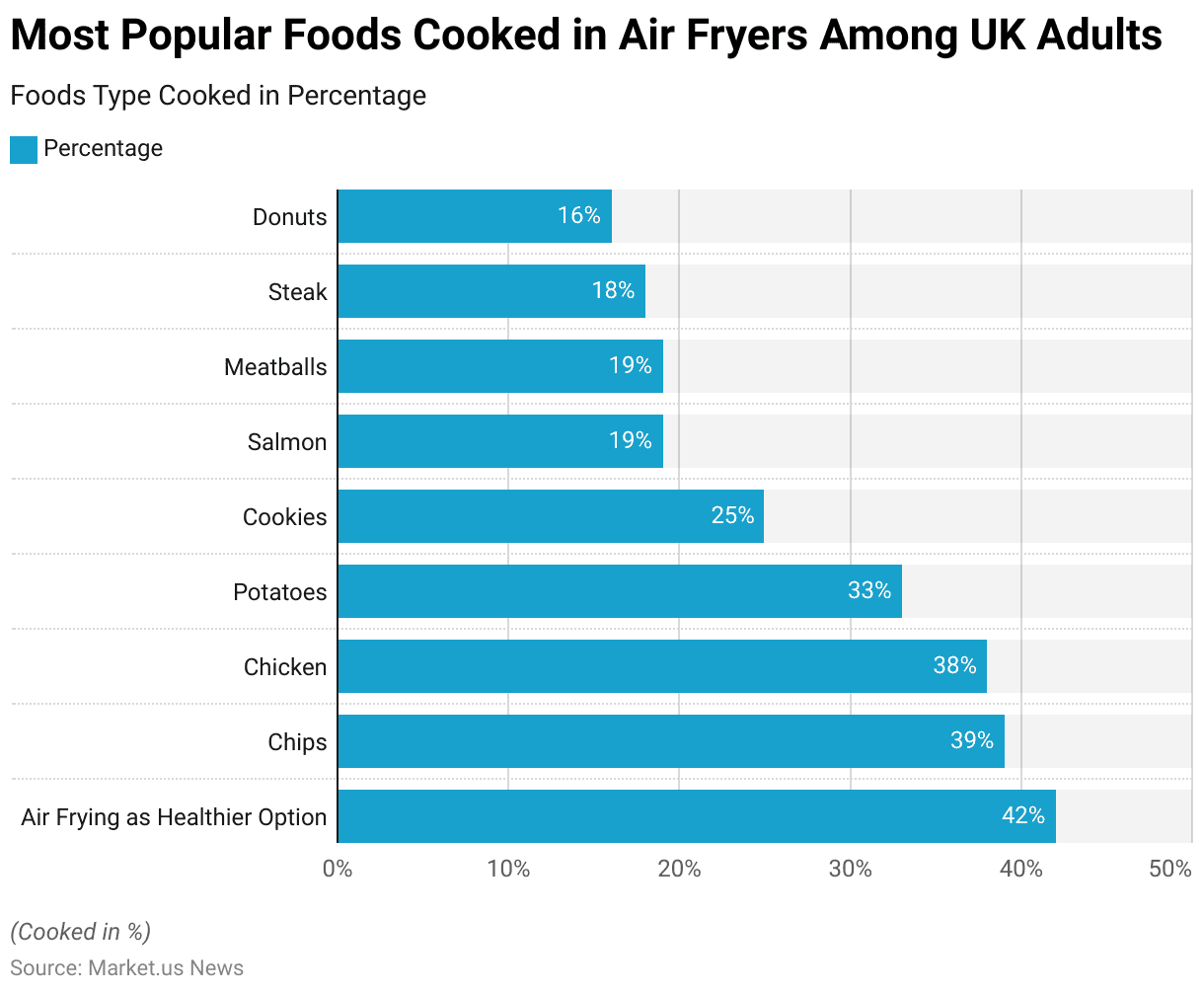

Most Popular Foods Cooked in Air Fryers Among Adults

- Air frying has become a leading viral food trend in the U.K., with 42% of adults incorporating it into their cooking routine as a healthier alternative to deep frying.

- The most popular foods to air fry are chips (39%), chicken (38%), and potatoes (33%).

- Additionally, less common items like salmon (19%), meatballs (19%), and steak (18%) are also frequently air fried.

- Sweet treats have gained popularity, too, with cookies being air-fried by 25% of users and doughnuts by 16%.

- This trend highlights the versatility of air fryers for both savory meals and desserts.

(Source: Samsung)

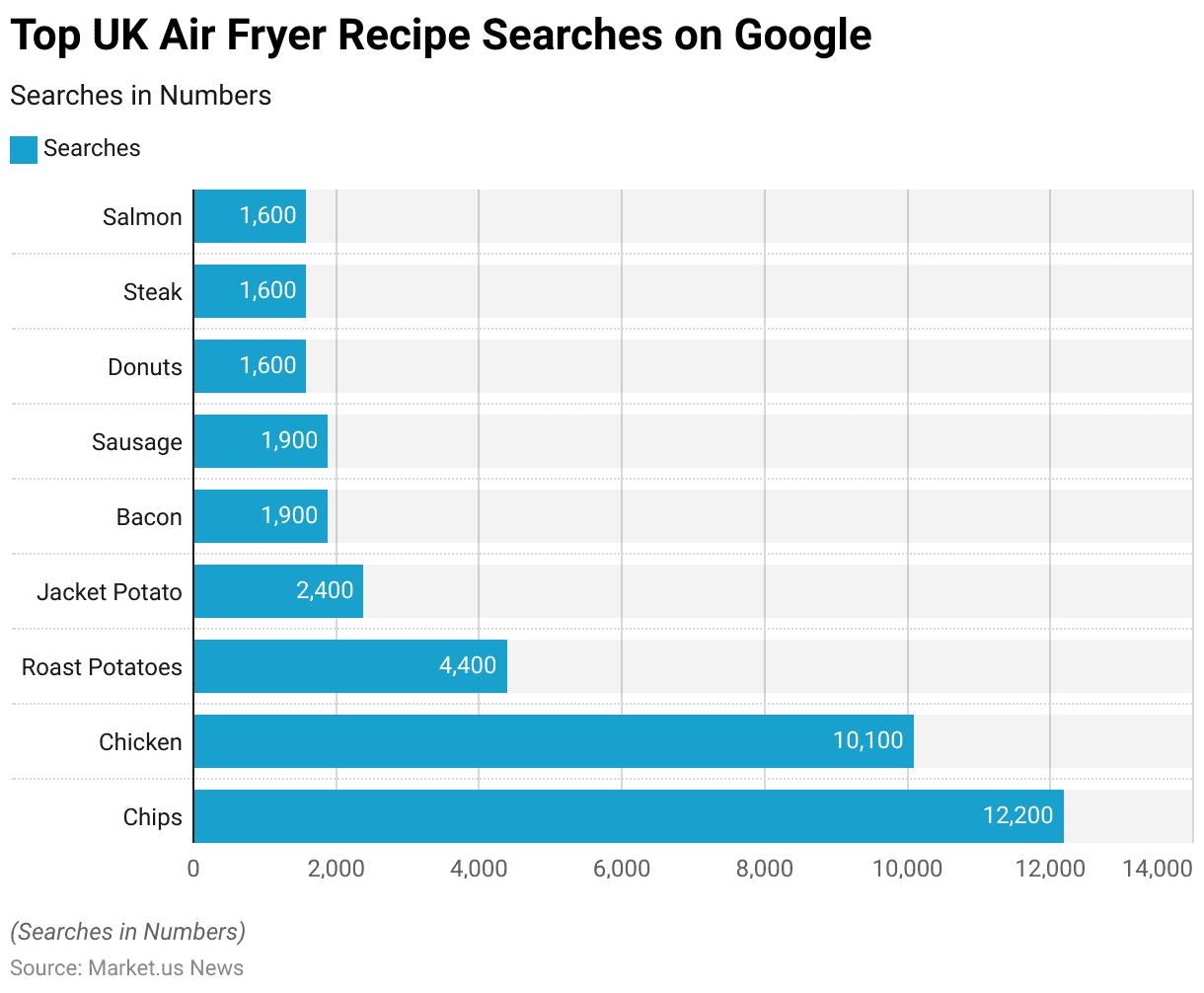

Widely Searched Air Fryer Recipes

- In April 2022, the most searched air fryer recipes in the U.K. on Google showed a clear preference for traditional and comfort foods.

- The recipe for “Chips” led the list with 12,200 searches, indicating a strong favorite among air fryer users.

- Following closely was “Chicken”, with 10,100 searches, another staple in home cooking.

- “Roast Potatoes” also proved popular, accumulating 4,400 searches.

- Lesser but still significant interest was shown in “Jacket Potato” with 2,400 searches.

- Both “Bacon” and “Sausage” received 1,900 searches each, showcasing their appeal for easy, quick air fryer meals.

- “Donuts,” “Steak,” and “Salmon” each garnered 1,600 searches, reflecting a diverse interest in utilizing air fryers for a variety of dishes, from breakfast options to main courses and desserts.

- This data highlights the versatility of air fryers and their growing role in modern U.K. kitchens.

(Source: Liana’s Kitchen)

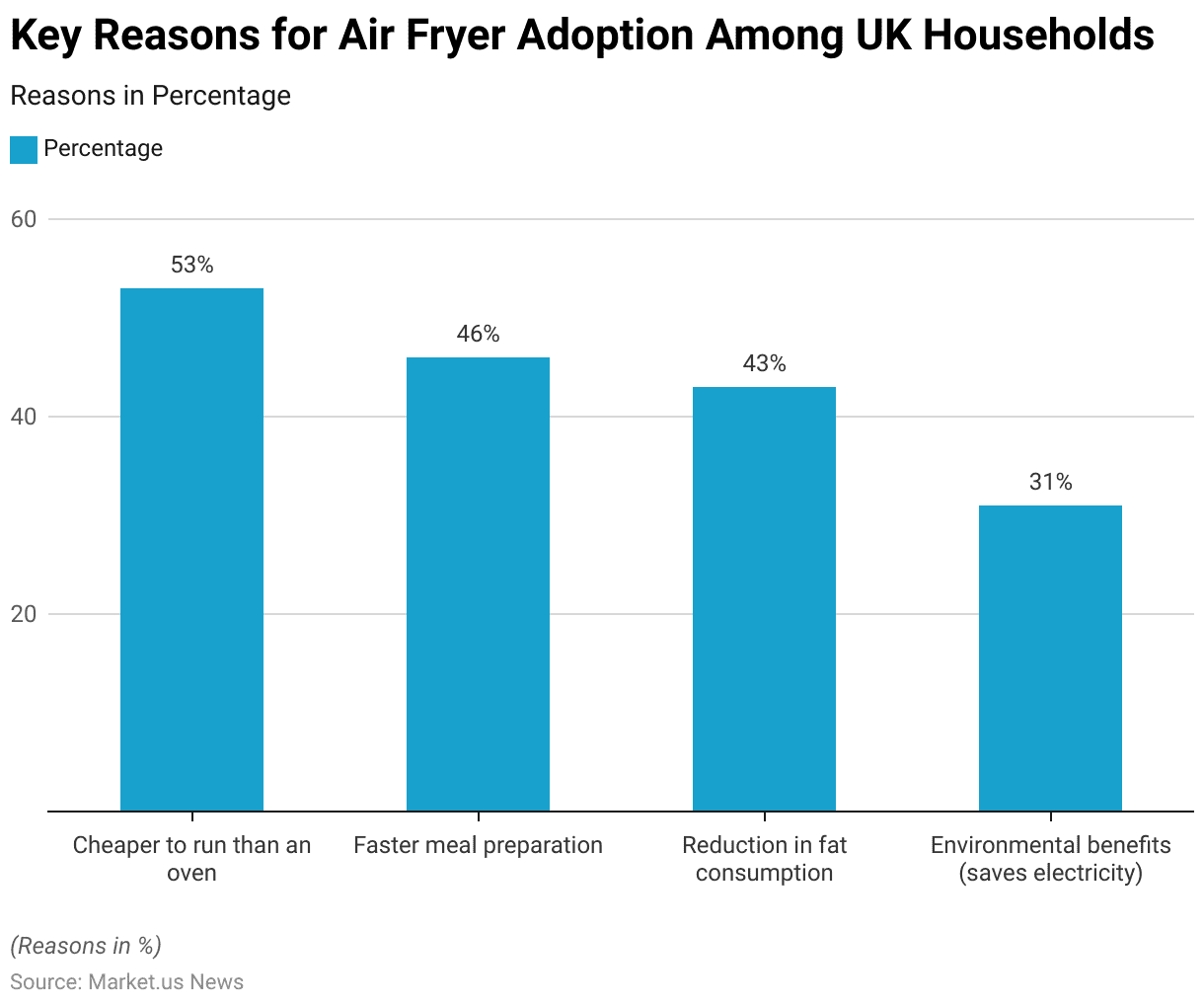

Key Reasons for Air Fryer Adoption Among Households

- In the U.K., more than half of the households that own an air fryer (53%) cite cost-efficiency as a significant reason for their purchase, highlighting that air fryers are cheaper to run than traditional ovens.

- This consideration is especially prevalent among the 55+ age group, where 65% of air fryer owners identify reduced operational costs as a motivating factor.

- Additionally, 46% of owners are influenced by the ability of air fryers to cook meals more quickly, while 43% of users appreciate the reduction in fat consumption that air frying offers.

- Environmental considerations also play a role; nearly one-third of owners (31%) chose air fryers due to their faster cooking times, which contribute to saving electricity and reducing energy use.

- These factors collectively underscore the growing popularity of air fryers as a cost-effective, health-conscious, and environmentally friendly cooking option.

(Source: Leatherhead Food Research)

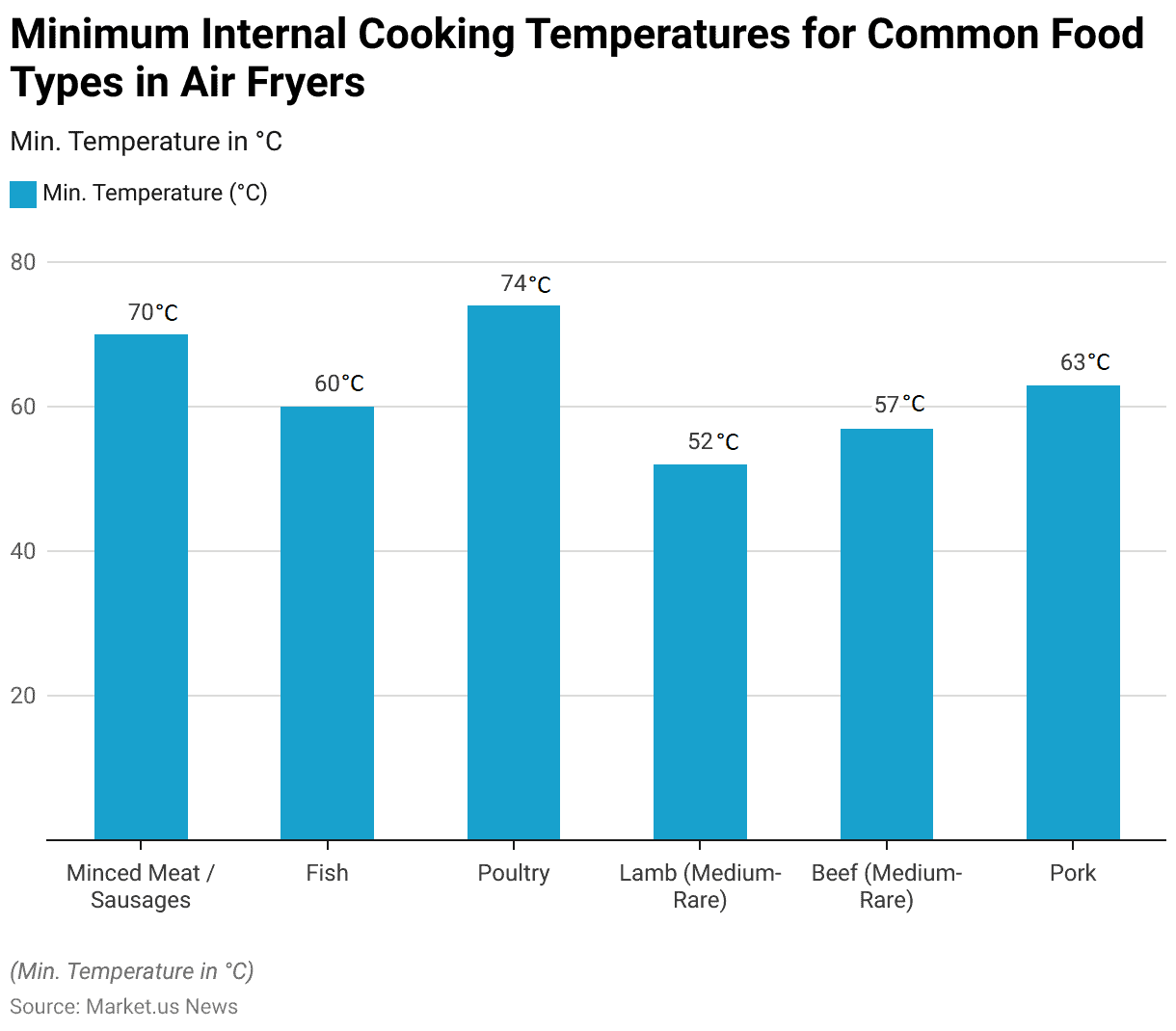

Temperature for Cooking Various Foods in an Air Fryer

- The minimum internal cooking temperatures for various food types cooked in air fryers vary based on the type of meat.

- For minced meat and sausages, the recommended minimum temperature is 70°C, while fish require a lower temperature of 60°C to be safely cooked.

- Poultry needs to reach a higher internal temperature of 74°C.

- For medium-rare lamb, the minimum temperature is 52°C, and for medium-rare beef, it is 57°C.

- Pork should be cooked to a minimum internal temperature of 63°C.

- These guidelines ensure that the food is thoroughly cooked and safe for consumption.

(Source: Samsung)

Cost of Cooking in an Oven vs. Air Fryer

- The comparison of cooking costs between using an oven and an air fryer reveals significant savings when opting for the latter.

- For instance, cooking chips in an oven costs approximately 35.38 pence, whereas using an air fryer reduces the cost to just 14.62 pence.

- Similarly, the expense of cooking chicken thighs shows a notable difference; it costs between 35.38 and 47.16 pence in an oven, compared to only 16.08 to 20.47 pence in an air fryer.

- This data highlights the economic benefits of using air fryers over traditional ovens, potentially influencing consumer preferences towards more energy-efficient kitchen appliances.

(Source: Liana’s Kitchen)

Cost Efficiency and Impact of Air Fryers vs. Ovens Among Consumers

- Air fryers are considered economical, particularly when compared to traditional ovens.

- A typical 1,500 W air fryer costs around 51p per hour of use, but since the average cooking time is 30 minutes or less, the cost per use is approximately 17p.

- In contrast, a standard 2,200 W electric oven costs around 85p per hour and typically requires the full hour to heat up and cook food, making it much more expensive per use.

- Consumers who invest in a £150 air fryer and use it daily instead of an oven can break even in about six months.

- Additionally, a recent survey by Expert Reviews found that 32% of U.K. air fryer owners have noticed a decrease in their energy bills, and over a third of adults report purchasing fewer takeaway meals due to owning an air fryer.

- This data underscores the cost-effectiveness and energy savings that air fryers offer to consumers.

(Source: The Eco Experts)

Energy Efficiency of Different Air Fryer Models by Capacity and Wattage

- The most energy-efficient air fryers are those that use lower wattage relative to their capacity.

- Small air fryers, typically with a capacity of one to two liters, are highly energy-efficient, using between 800 and 1,000 watts.

- An example is the Tower air fryer, which offers a model with 1.5 liters of capacity and operates on just 800 watts, making it a popular and affordable choice.

- For those looking for larger air fryers with near-oven capacity but lower electricity usage, the Ninja Air Fryer MAX AF160UK is a good option, offering a 5.2-litre capacity while consuming only 1,750 watts.

- In general, larger air fryers, with capacities over five liters, tend to use between 1,500 and 1,800 watts, providing a balance between capacity and energy efficiency.

(Source: The Eco Experts)

Wi-Fi and Bluetooth-enabled Air Fryers Statistics

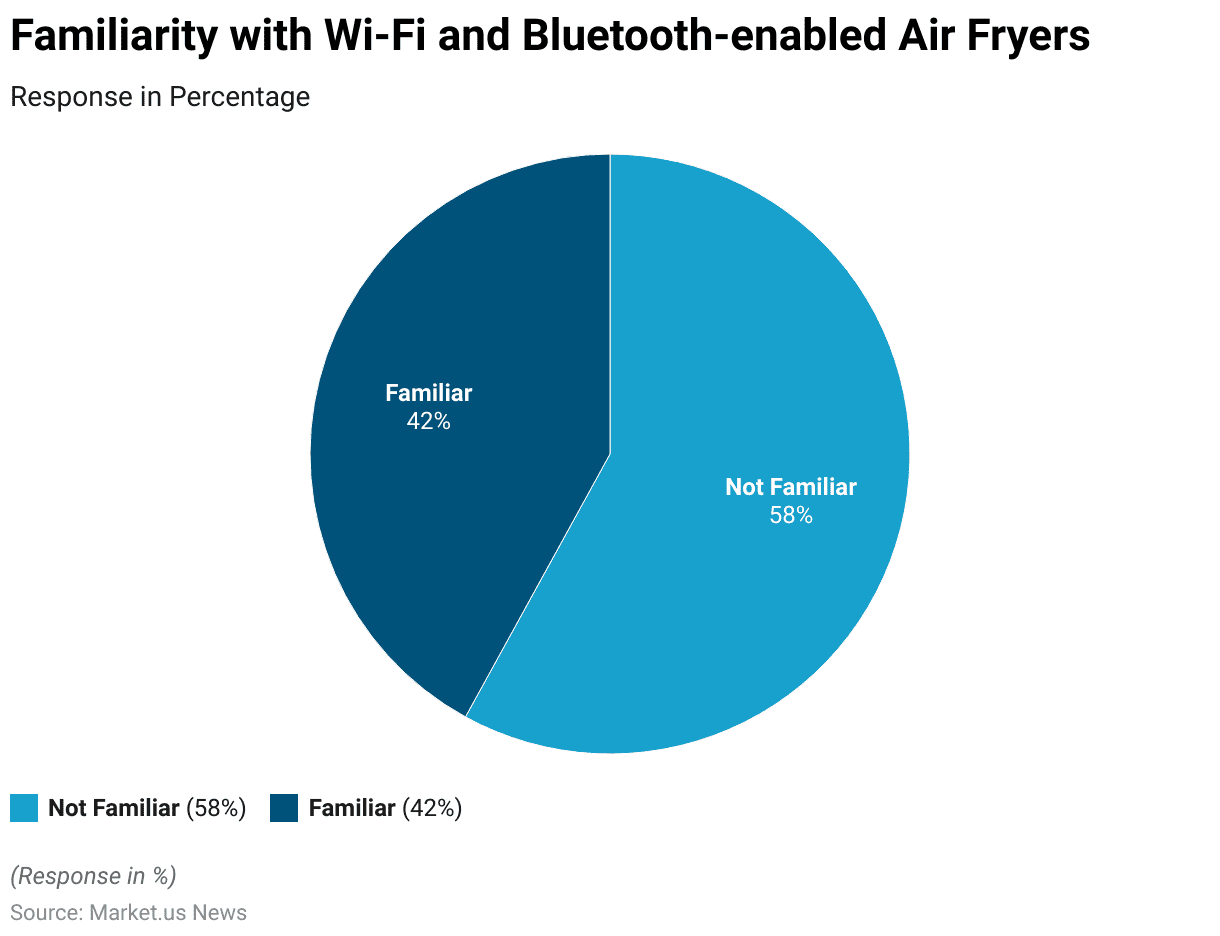

Familiarity with Wi-Fi and Bluetooth-enabled Air Fryer Statistics

- In a survey assessing the familiarity with Wi-Fi and Bluetooth-enabled air fryers, 58% of respondents indicated that they are not familiar with these technologically advanced kitchen appliances.

- Conversely, 42% of the respondents are familiar with such air fryers, suggesting a relatively balanced level of awareness among the surveyed population.

- This data highlights the growing interest in and the potential market for smart kitchen appliances, although a significant proportion of potential consumers still require education on these products.

(Source: Chef Lola’s Kitchen)

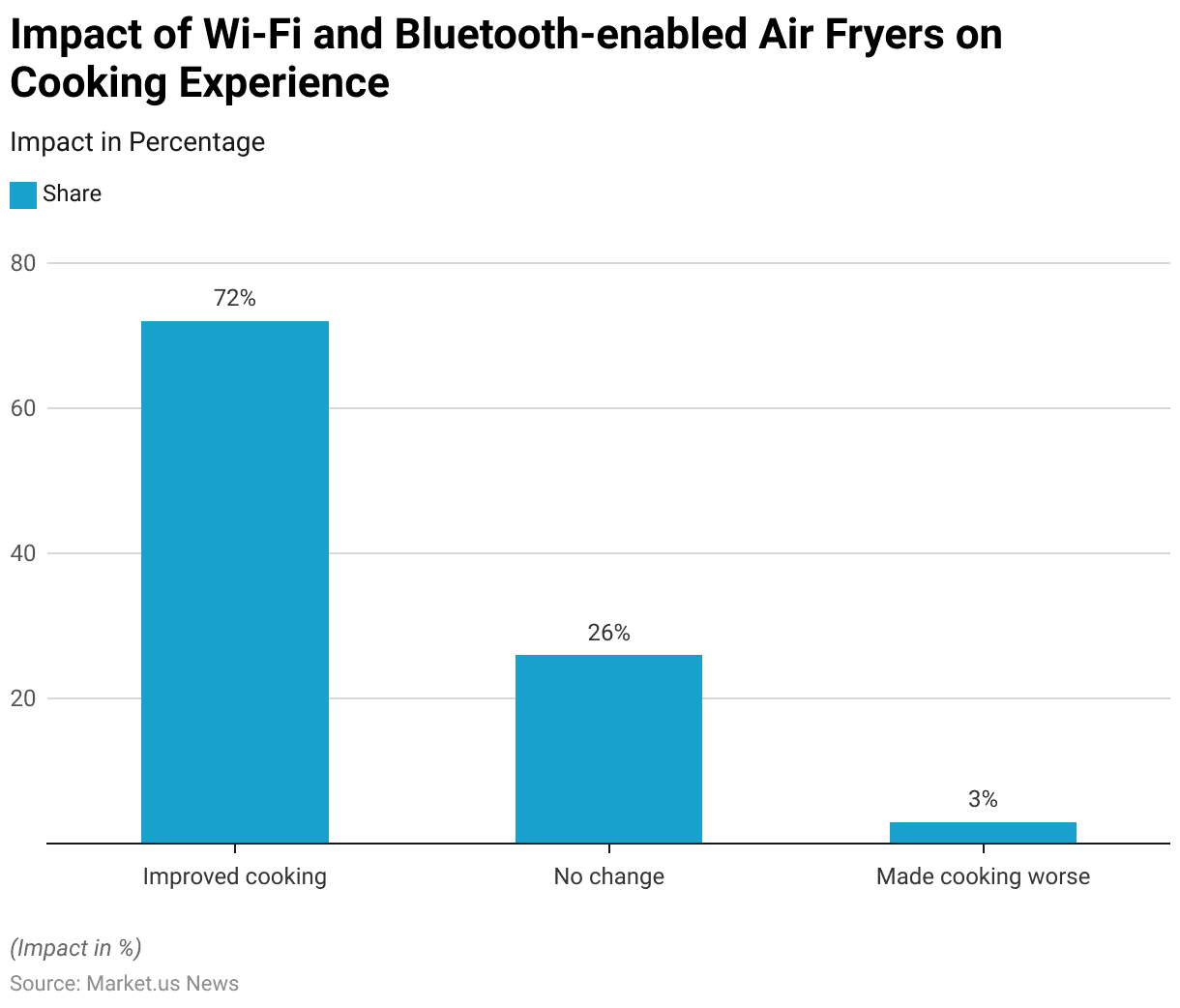

Impact of Wi-Fi and Bluetooth-enabled Air Fryer on Cooking Experience Statistics

- The impact of Wi-Fi and Bluetooth-enabled air fryers on the cooking experience has been predominantly positive, according to survey responses.

- A significant 72% of respondents reported an improved cooking experience, attributing this enhancement to the added convenience and precision these smart features offer.

- However, 26% of the respondents noticed no change in their cooking routine, indicating that the advanced features did not make a significant difference for them.

- A small fraction, 3%, felt that these technologies made cooking worse, which could be due to complexities in using new technologies or integration issues with other smart home devices.

- This data illustrates the varying degrees of user satisfaction and adaptation to innovative kitchen technologies.

(Source: Chef Lola’s Kitchen)

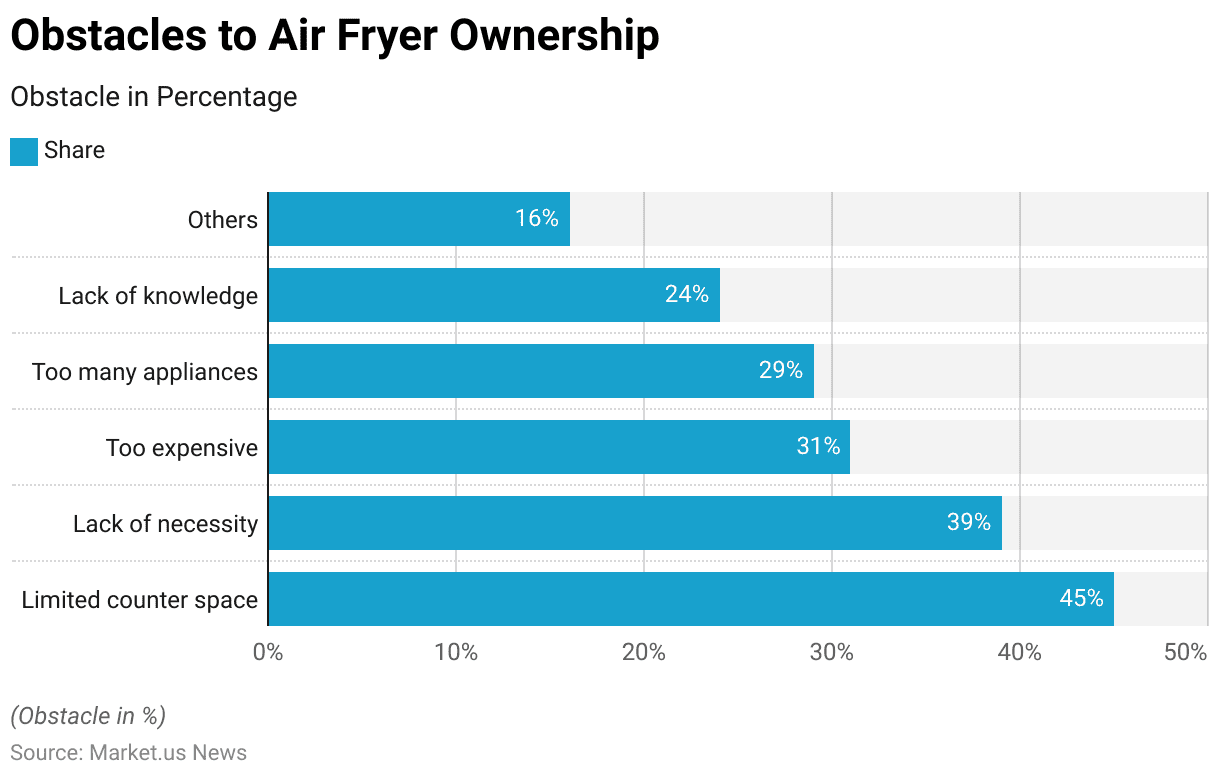

Obstacles to Air Fryer Ownership Statistics

- The survey on obstacles to air fryer ownership reveals several key reasons why consumers hesitate to purchase these appliances.

- Limited counter space is the most significant hurdle, cited by 45% of respondents, indicating that practical kitchen constraints are a major factor.

- Close behind, 39% of respondents feel that air fryers are not a necessity, reflecting a perception that they may not provide sufficient value or utility.

- The cost factor also plays a significant role, with 31% considering air fryers too expensive.

- Furthermore, 29% of people indicate that they already own too many appliances to justify another one, while 24% admit a lack of knowledge about how to use air fryers effectively.

- Lastly, 16% cited other reasons for not purchasing an air fryer, which could include varied personal or specific concerns not directly addressed in the survey.

- This data underscores the diverse challenges manufacturers face in convincing potential buyers of the benefits of air fryers.

(Source: The Eco Experts)

Innovations and Developments in Air Fryers

- In the evolving landscape of kitchen technology, air fryers have emerged as a beacon of innovation, integrating advanced functionalities that enhance the culinary experience.

- Recent developments showcase a trend towards smart connectivity, with air fryers equipped with features like digital touchscreens, programmable settings, and Wi-Fi capabilities for remote control via smartphone apps.

- For instance, companies like Ninja have introduced models such as the Ninja Double Stack and Ninja Combi. These incorporate space-saving designs alongside versatile cooking options, allowing for the simultaneous preparation of multiple dishes.

- Significantly, the market is also seeing a push towards integrating artificial intelligence to automate cooking processes and personalize recipes, reflecting a broader shift towards adaptive kitchen technology.

- Companies are capitalizing on these tech advancements to cater to growing consumer demand for convenience, efficiency, and healthier cooking methods, as air fryers use little to no oil, promoting a healthier lifestyle.

- Moreover, the commercial viability of these innovations is underscored by their market performance, with the global air fryer market expected to grow significantly, driven by these continuous technological enhancements and a rising inclination towards health-conscious food options.

(Source: BCC Research, DID Electrical)

Regulations for Air Fryers

- Regulations for air fryers vary significantly across countries, influenced by multiple directives and standards aimed at ensuring safety, environmental compliance, and consumer protection.

- In the European Union, air fryers, as kitchen appliances, must adhere to several regulations, such as the Low Voltage Directive (LVD) and the Electromagnetic Compatibility (EMC) Directive, which ensure that the appliances are safe to use and do not emit harmful electromagnetic interference.

- Additionally, the Restriction of Hazardous Substances (RoHS) Directive limits the use of hazardous materials in electronic devices, including air fryers.

- Compliance with these directives is mandatory for products to be marketed in the E.U., and manufacturers must provide a Declaration of Conformity (DoC) and ensure products bear the C.E. marking, signifying compliance with E.U. standards.

- Moreover, market dynamics, such as the growing popularity of digital air fryers over manual ones due to their convenience and advanced features, reflect broader consumer trends toward healthier and more efficient cooking solutions.

- This shift is also supported by an increase in online sales platforms, which have expanded market reach globally, especially highlighted during the COVID-19 pandemic when consumers turned more to online shopping.

- However, these regulations not only ensure product safety and environmental stewardship but also influence market trends and consumer preferences, driving innovation and competitive dynamics in the air fryer market.

(Source: Compliance Gate)

Recent Developments

Acquisitions and Mergers:

- Whirlpool acquires Yummly: In 2023, Whirlpool Corporation completed the acquisition of Yummly, a smart appliance company known for its recipe app and integration with smart kitchen devices. This acquisition is part of Whirlpool’s strategy to enhance its smart kitchen portfolio, including air fryers with smart cooking features.

- SharkNinja merges with Instant Brands: In 2024, SharkNinja, a leading kitchen appliance manufacturer, merged with Instant Brands, the company behind the Instant Pot and air fryers. This merger aims to dominate the small kitchen appliance market, particularly in the growing air fryer segment, as both companies expand their product lines.

New Product Launches:

- Philips launches the XXL Smart Airfryer: In early 2023, Philips introduced the XXL Smart Airfryer, which features app connectivity, allowing users to control cooking times and temperatures remotely. The air fryer also includes AI-powered cooking programs that automatically adjust settings based on the type of food being prepared.

- Instant Brands releases Vortex Pro Air Fryer: In late 2023, Instant Brands launched its Vortex Pro Air Fryer, with a 10-quart capacity, offering multi-cooking functionality such as air frying, baking, and roasting. This product caters to families looking for larger air fryers that provide versatile cooking options.

Funding:

- Chefman secures $50 million for product development: In 2023, kitchen appliance brand Chefman raised $50 million to expand its air fryer product line and invest in smart kitchen innovations. The funding is intended to enhance its R&D and improve the integration of smart technologies in its appliances.

- Cosori raises $25 million for global expansion: In 2024, Cosori, a popular air fryer brand, secured $25 million in funding to expand its international presence and develop new models with energy-efficient and eco-friendly features to meet increasing consumer demand for sustainable appliances.

Technological Advancements:

- Smart air fryers with voice control: Smart air fryers are incorporating voice control capabilities with platforms like Amazon Alexa and Google Assistant. By 2025, 30% of air fryers are expected to feature voice-activated controls, allowing users to set cooking times and temperatures hands-free.

- Energy-efficient air fryers: With growing consumer awareness of energy consumption, manufacturers are focusing on energy-efficient models. By 2026, energy-efficient air fryers are projected to make up 40% of the market, driven by consumers seeking to reduce electricity usage while cooking.

Market Dynamics:

- Growth in the air fryer market: This growth is fueled by the rising popularity of healthy cooking alternatives and the increasing demand for convenient, fast-cooking appliances.

- Rising demand for multi-functional air fryers: Consumers are increasingly looking for air fryers with multi-cooking functions like roasting, grilling, and dehydrating. By 2025, 50% of air fryer sales are expected to come from models offering multiple cooking modes, as users seek versatile kitchen appliances.

Conclusion

Air Fryer Statistics – Air fryers have emerged as a popular kitchen appliance, offering a healthier alternative to traditional frying by using much less oil.

They are valued for their convenience, cooking food quickly with minimal monitoring and easy cleanup. Moreover, these devices are not only capable of frying but also handle baking and grilling, making them versatile tools in the kitchen.

Further, enhanced with features like Wi-Fi and Bluetooth, some models integrate seamlessly into smart home systems, allowing for remote control and monitoring.

Despite their benefits, air fryers can be bulky and sometimes expensive, with a learning curve that might deter some users.

Nonetheless, their energy efficiency and ability to cook healthier meals quickly align with the growing consumer focus on health and convenience, cementing their role in modern cooking practices.

FAQs

An air fryer is a kitchen appliance that cooks by circulating hot air around the food using the convection mechanism. A mechanical fan circulates the hot air around the food at high speed, cooking the food and producing a crispy layer via the Maillard effect.

Air fryers provide a healthier alternative to deep frying because they require significantly less oil to achieve a similar taste and texture. The reduction in oil usage can decrease overall calorie intake and lower the risk of fat-related health issues.

An air fryer can serve multiple functions and potentially replace several appliances in the kitchen. Besides air frying, many units can also roast, bake, and grill. This versatility can save space and reduce the need for multiple appliances.

Air fryers are versatile and can be used to cook a variety of foods, including vegetables, meat, fish, and even baked goods. They are particularly effective for giving a crispy texture to frozen foods like french fries and chicken nuggets.

Some recipes and models of air fryers recommend preheating to achieve the best cooking results, though not all require it. It typically takes only a few minutes to preheat.