Table of Contents

Introduction

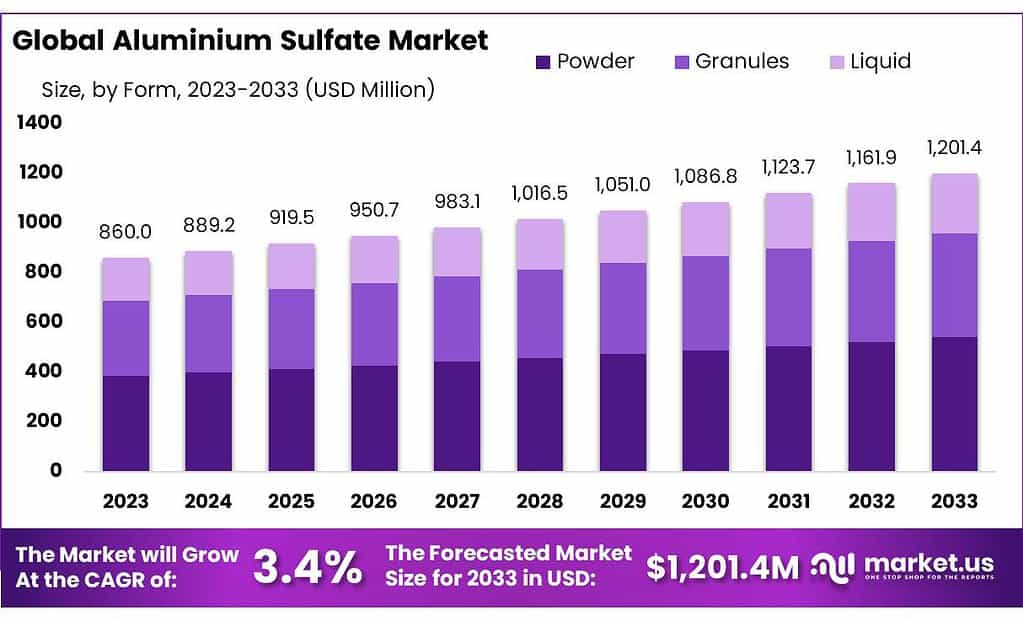

The Aluminium Sulfate Market is poised for steady growth, forecasted to expand from USD 860.0 million in 2023 to approximately USD 1201.4 million by 2033, with a CAGR of 3.4% over the decade. This market’s expansion is largely attributed to its critical role in water treatment and paper manufacturing, driven by the escalating need for clean water and sustainable packaging solutions.

Challenges in this market revolve around the high costs associated with production and the complexities involved in transportation, which may hamper market growth. Additionally, the fluctuating prices of raw materials could pose further challenges.

Recent developments in the Aluminium Sulfate Market include technological advancements and increased R&D activities, particularly in the pharmaceutical sector, which are expected to boost the market’s growth. Furthermore, major companies like Chemtrade, GEO, and Nippon Light Metal continuously enhance their strategies to fortify their market position.

In the Aluminium Sulfate Market, key players have been actively strategizing to strengthen their market positions with recent developments that highlight an ongoing emphasis on expansion and technological integration. Affinity Chemical recently announced the construction of two new aluminum sulfate manufacturing plants in the Southern and Midwestern United States. This expansion, detailed in a September 2020 announcement, brings their total to eight facilities, indicating a strategic move to enhance production capabilities and regional reach.

C & S Chemical has also been actively involved in market activities, although specific recent developments were not highlighted in the latest reports. They remain a significant player in the market, offering a wide range of aluminum sulfate products tailored to various applications. Chemtrade continues to be a major figure in the market, leveraging its extensive network and capabilities to serve a diverse range of industries requiring aluminum sulfate, from water treatment to paper manufacturing. The company’s strategic initiatives typically focus on optimizing operational efficiency and expanding its customer base across global markets.

Regionally, Asia Pacific leads in market share due to the presence of major paper manufacturing companies. North America also holds a significant portion of the market, supported by increasing water treatment applications and aluminum sulfate used in food additives.

Key Takeaways

- Market Size and Growth: Expected to reach USD 1201.4 million by 2033, growing at a CAGR of 3.4% from USD 860.0 million in 2023.

- Regional Dominance: Europe led with a 37.8% market share, valued at USD 325.0 million in 2023. North America is also significant.

- Product Types: Ferric Alum (65.5% market share) for water treatment and non-ferric Alum for purity-sensitive applications.

- Product Forms: Powder form dominated (45.3% market share), followed by granules and liquid forms.

- Applications: Water treatment largest segment (39.1% market share), followed by paper & pulp, food & beverages, textiles, and personal care.

- Distribution Channels: Indirect sales are predominant (65.4% market share), with direct sales serving specific industrial needs.

Aluminum Sulfate Statistics

- Molar Mass: The molar mass of aluminum sulfate is approximately 342.15 g/mol.

- pH Value: aluminum sulfate solutions have a pH value ranging from 3.0 to 4.0.

- Solubility: At 20°C, aluminum sulfate has a solubility of 87 g per 100 mL of water.

- Density: The density of aluminum sulfate is 2.71 g/cm³.

- Boiling Point: The boiling point of aluminum sulfate is 214°F.

- Melting Point: The melting point of aluminum sulfate is 770°C.

- Solubility in Water: 31.2 g/100 mL (0°C), 36.4 g/100 mL (20°C), 89.0 g/100 mL (100°C).

- Commercial Standard: Minimum 17% for solid, 8% for liquid.

- RMIC Values: Arsenic 30 mg/kg, Cadmium 7 mg/kg, Chromium 30 mg/kg.

- Impurities Limits: Lead 30 mg/kg, Mercury 1 mg/kg, Selenium 7 mg/kg.

- Maximum Dosage: 150 mg/L for water treatment.

- Patient Demographics: 101 patients enrolled, 74 men and 27 women, average age of 58.9 years.

- Effective Rate: The overall effective rate was 97.03%, with complete tumor necrosis in 94 patients.

- Adverse Events: Treatment-related adverse events occurred in 20 patients (19.80%).

- Follow-Up: Median follow-up time for patients was 13.8 years, with 22 patients having no recurrence and 7 relapsed.

- Application Rate: Typical application rates range from 2 to 5 kg per square meter, depending on soil conditions.

Emerging Trends

Emerging trends in the Aluminium Sulfate market highlight significant shifts toward sustainability and the adaptation to evolving environmental regulations. A notable trend is the increasing demand for environmentally friendly substitutes for aluminum sulfate. This is driven by growing consumer and regulatory pressures for cleaner technologies and sustainable products. As a result, the industry is seeing a rise in innovations focused on less harmful alternatives and more efficient manufacturing processes to meet these green standards.

Additionally, there is a marked increase in the use of aluminum sulfate in diverse applications beyond its traditional uses. It’s finding greater application in the food and beverage industry, driven by global demand for food safety and quality. The pharmaceutical sector is also expanding its use of aluminum sulfate, supported by intensive research and development activities. This is indicative of the broadening scope of applications where aluminum sulfate plays a crucial role due to its properties as a coagulant and purifying agent.

Technological advancements are another critical trend. These advancements are not only improving the efficiency and effectiveness of aluminum sulfate in its applications but are also addressing the challenges of production cost and environmental impact. This includes developing production methods that are less resource-intensive and more compliant with stringent global environmental standards.

Use Cases

- Water Treatment: Aluminium sulfate is a powerhouse in water purification, commonly used in both drinking water and wastewater treatment facilities. It helps in the coagulation and flocculation process, which is vital for removing impurities from water. This process involves neutralizing the charges on suspended particles, which then aggregate and settle to the bottom, making the water clear and safe for consumption.

- Paper Manufacturing: In the paper industry, aluminum sulfate is used to aid in the sizing process, helping to improve the quality and durability of paper. Although it has been partially replaced by synthetic agents, it is still used in certain types of paper, particularly those requiring specific absorption qualities for inks.

- Textile Industry: In textile manufacturing, aluminum sulfate plays a critical role as a mordant in dyeing. It helps fix dyes to fabrics, ensuring that colors are vivid and resistant to washing out. This use is particularly important for ensuring the longevity and colorfastness of textiles.

- Environmental Management: Beyond its industrial applications, aluminum sulfate is also used for environmental management, such as controlling algal blooms in ponds and lakes. It helps to clear up turbidity and control algae growth by aggregating pollutants, which can then be removed from the water.

- Personal Care and Pharmaceuticals: Aluminium sulfate is used in products like deodorants and as an adjuvant in vaccines, helping to improve the effectiveness of the vaccines by enhancing the body’s immune response to the vaccine’s active ingredients.

Key Players Analysis

Affinity Chemical in the Aluminium Sulfate sector focuses on providing high-quality alum with a commitment to transparency, competitive pricing, and customer-centric service. They are known for building collaborative partnerships with customers and supply chain partners, emphasizing local production to ensure consistent supply and cost-efficiency. Affinity Chemical also prides itself on environmentally responsible practices in its manufacturing processes.

C & S Chemical specializes in the production of aluminum sulfate used primarily in water treatment applications. Although specific recent developments were not highlighted, C & S Chemical continues to be a significant player in the industry, maintaining its focus on product quality and reliable supply to meet the needs of various sectors, including municipal and industrial water treatment.

Chemtrade is a prominent supplier in North America’s Aluminium Sulfate market, recognized for its extensive production capabilities across over 40 facilities. The company provides a diverse range of Aluminium Sulfate products including standard, low-iron, iron-free, and food-grade options. Chemtrade is dedicated to meeting specific customer needs with customized solutions, ensuring high-quality products and compliance with environmental standards through Responsible Care®, a U.N. recognized safety and sustainability initiative.

Drury Industries, although specific recent developments are not highlighted, remains a key player in the Aluminium Sulfate sector. The company focuses on maintaining a strong market presence through consistent product quality and supply chain efficiency, serving a broad range of industrial applications.

GAC Chemical is a key player in the Aluminium Sulfate sector, operating out of Searsport, Maine. The company specializes in producing high-quality chemical products for various industrial uses, including water treatment where Aluminium Sulfate plays a crucial role as a coagulant. GAC Chemical emphasizes its delivery capabilities, offering flexible packaging and 24/7 shipping options to meet diverse client needs efficiently. They focus on maintaining high standards in product quality and customer service, reinforcing their reputation in the market.

GEO Specialty Chemicals is recognized for its comprehensive range of chemical products, including Aluminium Sulfate, which is widely used in water treatment processes. The company focuses on innovation and quality, ensuring their products meet the required safety and environmental standards. GEO Specialty Chemicals operates across various sectors, continually adapting to the evolving demands of the industry to provide effective solutions and maintain its market presence.

Kemira is a global leader in the production of inorganic coagulants for water treatment, offering a wide range of aluminum-based coagulants. Their products are designed for efficient particle removal and are manufactured globally to ensure fast delivery and high supply security. Kemira focuses on sustainability, using by-products as raw materials to lower the carbon footprint of their coagulants.

Nankai Chemical Co., Ltd. is recognized in the aluminum sulfate market for its contributions to several industries. Their detailed involvement and specific activities within the sector were not highlighted in the most recent sources available during this search. For up-to-date information on their role in the aluminum sulfate sector, I recommend checking their official website or industry publications.

Nippon Light Metal is actively engaged in the production of aluminum sulfate, leveraging its expertise as a comprehensive aluminum manufacturer. They produce inorganic coagulants, including aluminum sulfate, using in-house raw materials like aluminum hydroxide and hydrochloric acid. Their production facilities across Japan help meet domestic demands efficiently, earning them top-class recognition in the market for their high-quality products.

Sanfeng Environmental Group Co., Ltd., while not directly referenced in recent searches about their specific activities in the aluminum sulfate sector, is known for its focus on environmental protection technologies. For detailed and current activities of Sanfeng Environmental in the aluminum sulfate sector, checking their latest corporate releases or industry-specific publications would provide the most accurate information.

USALCO is a leading manufacturer of aluminum-based chemicals, including high-quality aluminum sulfate, widely used in both municipal and industrial markets. They produce aluminum sulfate by dissolving alumina trihydrate in sulfuric acid and water, ensuring it meets stringent quality standards. USALCO’s aluminum sulfate is used in potable water treatment, wastewater treatment, and various industrial applications, offering solutions for turbidity removal, phosphorus removal, and algae control. Their products are known for their effectiveness and compliance with American Water Works Association standards.

Conclusion

The Aluminium Sulfate Market is experiencing steady growth driven by its widespread use in water treatment, paper manufacturing, and various industrial applications. Key drivers include the increasing demand for clean water, the expansion of the pharmaceutical and food industries, and the ongoing innovations in production processes. However, challenges such as raw material price fluctuations and stringent environmental regulations could impact growth. The market’s regional dynamics show North America and Asia as leading markets due to robust industrial and municipal infrastructure needs and high production capacities.