Table of Contents

Introduction

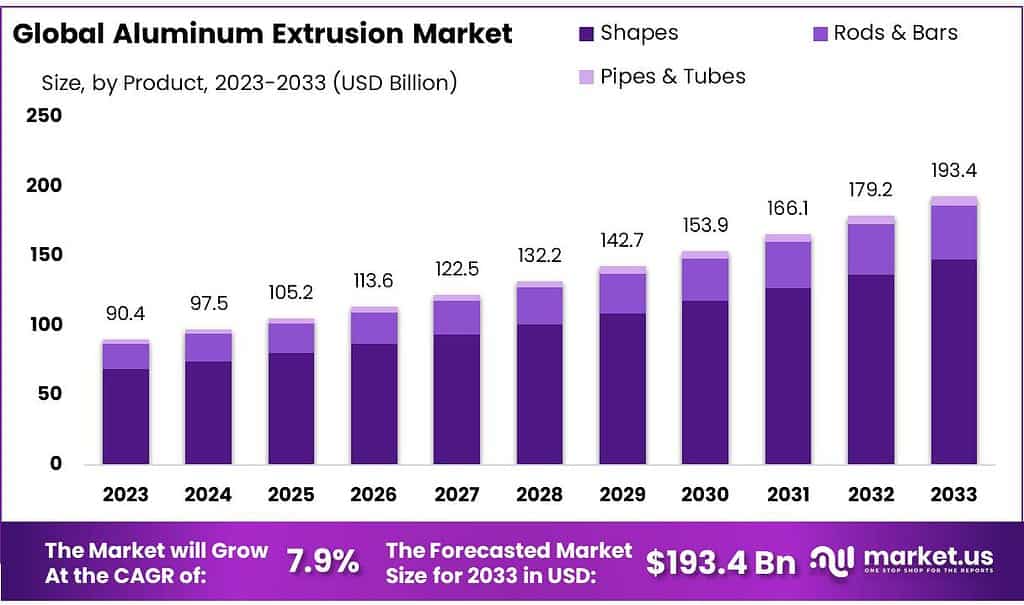

The global aluminum extrusion market is projected to grow significantly, with its market size expected to reach USD 193.4 billion by 2033, up from USD 90.4 billion in 2023, at a compound annual growth rate (CAGR) of 7.9% over the forecast period. This growth can be attributed to several factors, including the rising demand in industries such as automotive, transportation, and construction.

In the automotive sector, increasing regulatory pressure to reduce greenhouse gas emissions is driving the adoption of aluminum extrusions, particularly for electric vehicles (EVs) and lightweight internal combustion engine vehicles. The use of aluminum in vehicles, such as the Ford F-150, helps reduce overall vehicle weight, thereby enhancing fuel efficiency and lowering emissions. Components like chassis, roof rails, and engine parts benefit from aluminum’s lightweight and corrosion-resistant properties. This is expected to continue fueling demand in this sector, with automotive applications projected to grow at a robust rate over the next decade.

The construction industry is another major driver for aluminum extrusions, accounting for over 60% of the market in 2023. The material’s lightweight and durable nature make it ideal for use in windows, facades, and other structural applications. In countries such as China, where rapid urbanization and infrastructure development are ongoing, the demand for aluminum extrusions is expected to remain high. This trend is mirrored in other developing regions, including Southeast Asia, where housing and commercial building projects continue to rise.

However, the market faces challenges, particularly from the volatility of raw material prices and the energy-intensive nature of the production process. The cost of aluminum can fluctuate due to global supply chain disruptions, trade tensions, and economic instability, making it difficult for manufacturers to manage costs effectively. Furthermore, energy consumption in the extrusion process is high, which, combined with fluctuating energy prices, can impact the profitability of production.

Despite these challenges, advancements in manufacturing technology and a focus on sustainability are creating opportunities for further growth. For example, renewable energy applications, such as solar panels and wind turbines, are increasingly using aluminum extrusions due to their durability and ability to withstand harsh environmental conditions. Moreover, innovations in alloy compositions and extrusion processes are enhancing product performance, making aluminum more competitive against alternative materials such as steel.

Recent developments in the aluminum extrusion market have been shaped by various strategic initiatives from key players, including acquisitions, partnerships, and product innovations, as companies seek to strengthen their market presence and capitalize on growing demand.

Sapa Extrusion: Sapa, a global leader in the aluminum extrusion industry, has been involved in multiple strategic initiatives. The company, which is now part of Norsk Hydro ASA, completed the acquisition of Sapa Group in 2017, further solidifying its global position. Since then, Sapa has invested heavily in expanding its production capacity across multiple regions, especially in Europe and North America, to meet the growing demand from the automotive and construction sectors. This acquisition enabled Norsk Hydro to integrate extrusion technology and increase its global market share.

Trefinasa Mexico: Trefinasa Mexico, a significant player in the Latin American market, has expanded its extrusion operations to cater to the growing demand for lightweight materials in automotive and industrial applications. In recent years, the company has focused on upgrading its production capabilities, introducing advanced aluminum extrusion technologies to enhance product quality and efficiency. Additionally, Trefinasa has entered strategic partnerships with automotive companies to develop high-performance, lightweight components, which are critical for the region’s evolving transportation sector.

Bristol Aluminum: Bristol Aluminum, a key player in the U.S. market, has been actively involved in product innovations and facility expansions. The company launched new extrusion lines aimed at producing custom aluminum profiles for sectors such as construction, energy, and consumer goods. These new products emphasize high precision and customization, catering to specific client needs. Furthermore, Bristol Aluminum has focused on expanding its footprint by investing in new extrusion facilities and upgrading its existing ones to increase capacity and efficiency.

Key Takeaways

- Market Growth and Projection: The Aluminum Extrusion market is set to grow significantly, with an expected value of around USD 193.4 billion by 2033, exhibiting a CAGR of 7.9% from 2023.

- Primary Growth Drivers: Automotive and Transportation Demand: Increasingly stringent environmental regulations are pushing for greater adoption of aluminum in both internal combustion engines and Electric Vehicles (EVs).

- Segment Analysis: Product Dominance: Shapes account for the largest share (76.5%) in the market due to their versatility in construction, automotive, and consumer goods.

- Application Impact: Construction Sector Usage: In 2023, Building and Construction held the largest share (61.3%) due to the extensive use of aluminum extrusions in structures, windows, and facades.

Aluminum Extrusion Statistics

- During the aluminum extrusion process, temperatures can range from 375 to 500 degrees Celsius, which is still below the boiling point for aluminum alloys, set at about 660 degrees Celsius.

- The Model S ‘preserved 64.5% of driver residual space’ as a result of ‘nesting multiple deep aluminum extrusions’ in the car’s side rail to absorb impact energy.

- There is a robust recycling network in North America. Studies show over 90% of aluminum from buildings and vehicles is recycled at end-of-life.

- Consumed by North American extruders at a rate of 4 billion pounds of scrap in 2021, 55% of their material need. With 170 locations in 40 states and provinces, most likely, there is an extruder nearby.

- In 2019, pre-pandemic, the U.S. consumed over 75,000 trillion BTUs of energy. In 2019, pre-pandemic, the U.S. consumed over 75,000 trillion BTUs of energy.

- Over 1 billion tons of primary aluminum have been produced since 1888: 75% of it is still in productive use.

- In total, recycling represents roughly 35% of global aluminum production

- Recycling aluminum requires only about 8% of the energy required for primary aluminum production.

- As per the data laid out by the International Aluminium Institute (IAI), it can be witnessed that China had a massive haul of 38,837,000 tonnes of primary aluminum in 2021, which grew by 1,593,000 tonnes over a year to reach 40,430,000 tonnes in 2023.

- In June 2023, the total aluminum production in China was 3,377,000 tonnes, which escalated Month-on-Month by 93,000 tonnes to 3,470,000 tonnes in July 2023.

- In 2021, the total aluminum production was estimated to be 4,499,000 tonnes, which grew by 92,000 tonnes to 4,591,000 tonnes in 2022.

- Cold extrusion takes place at lower temperatures (less than 150 °C, about 300 °F), at which the aluminum remains solid but is forced through the molding hole under high pressure.

- Hot extrusion of aluminum takes place at very high temperatures of up to 500 °C (~930 °F), at which the aluminum becomes soft and easy to form.

- Taiwan Production: Basic Metal: Aluminum Extrusion data was reported at 16,532.000 Metric Tons in Sep 2018.

- Taiwan Production: Basic Metal: Aluminum Extrusion data is updated monthly, averaging 15,191.000 Metric Tons from Jan 1982 (Median) to Sep 2018, with 441 observations.

- The data reached an all-time high of 21,001.000 Metric Ton in Mar 1994 and a record low of 4,348.000 Metric Ton in Feb 1984.

- All these dies have been used in presses with 203 mm containers and 22,000 MN force or 178 mm container and 16,000 MN force, all of them were made of H-13 steel and the billet material was Al-6063 in all cases.

- The Stepwise method leaves out of the model those variables that show a critical level greater than 0.10 (rejection probability).

Emerging Trends

- Lightweighting in Automotive and Transportation: A key trend driving the aluminum extrusion market is the shift towards lightweight materials in the automotive sector. Manufacturers are increasingly adopting aluminum extrusions to reduce vehicle weight, improve fuel efficiency, and lower emissions. This trend is particularly strong in electric vehicles (EVs), where aluminum is used extensively in battery housings, chassis, and other structural components. As the demand for EVs continues to grow, aluminum extrusion is becoming a crucial material in automotive design.

- Sustainability and Circular Economy: With the global focus on reducing carbon footprints, the aluminum extrusion market is seeing a growing emphasis on sustainability. Aluminum is highly recyclable, and companies are investing in processes that enable the recycling of aluminum extrusions to reduce waste and energy consumption. Many manufacturers are incorporating recycled aluminum in their production, aligning with global trends toward a circular economy. This reduces the reliance on primary aluminum production, which is more energy-intensive, while also meeting regulatory demands for eco-friendly materials.

- Energy Efficiency in Buildings: Aluminum extrusions are increasingly being used in the construction industry for energy-efficient buildings. Aluminum’s thermal properties, combined with its strength and lightweight nature, make it an ideal material for windows, doors, and facades. The rise of green building certifications, such as LEED, is pushing the demand for aluminum extrusions that contribute to energy savings by improving insulation and reducing heating and cooling costs. This trend is particularly noticeable in urban centers, where sustainable construction practices are becoming the norm.

- Technological Advancements in Extrusion Processes: Technological innovations are transforming aluminum extrusion processes, making them more efficient and cost-effective. The development of advanced die technology and automation in extrusion presses is enabling more precise and complex shapes to be extruded, which opens up new applications for aluminum across industries. Additionally, new alloy compositions are being introduced to enhance the performance of extruded products, particularly in high-stress applications like aerospace and heavy machinery.

- Growth in Renewable Energy Applications: The renewable energy sector is another area where aluminum extrusions are gaining traction. Aluminum is used in solar panel frames, wind turbine components, and electrical transmission systems due to its corrosion resistance, lightweight, and high strength. As global investments in renewable energy infrastructure increase, the demand for aluminum extrusions in this sector is expected to grow.

- Customization and Demand for High-Performance Products: There is a growing demand for customized aluminum extrusions that meet specific industry requirements. Sectors like aerospace, automotive, and electronics are increasingly seeking high-performance, precision-engineered extrusions. This trend is pushing manufacturers to invest in R&D to develop products that meet stringent performance criteria, such as high strength, corrosion resistance, and thermal conductivity.

Use Cases

- Automotive and Transportation: Aluminum extrusion plays a crucial role in modern vehicle design, particularly in reducing vehicle weight to improve fuel efficiency and reduce emissions.

- Chassis and body structures: Aluminum extrusions help reduce vehicle weight by 30-40% compared to steel, significantly improving fuel efficiency. With the rise of EVs, extruded aluminum components are used to house and protect batteries, enhancing thermal management and reducing overall vehicle weight.

- Crash management systems: Aluminum extrusions are used in components like bumpers and side-impact protection beams because of their ability to absorb energy during collisions.

- Construction and Architecture: Aluminum is widely used in the construction industry due to its strength, corrosion resistance, and ability to be extruded into complex shapes:

- Window frames and facades: Aluminum extrusions are common in commercial and residential buildings, where they provide lightweight, durable solutions for window frames, doors, and facades.

- Structural elements: Aluminum extruded beams and columns are used in green building projects due to their recyclability and energy-saving properties. These materials can improve energy efficiency by 20-30% in buildings, contributing to sustainable construction efforts.

- Renewable Energy: Aluminum extrusions are increasingly used in renewable energy infrastructure, especially in solar and wind energy systems:

- Aerospace and Aviation: Aluminum’s lightweight and high strength make it a preferred material in the aerospace industry:

- Aircraft frames and fuselage: Aluminum extrusions are critical in manufacturing aircraft parts like fuselage frames, wing components, and landing gear. These parts contribute to a significant reduction in aircraft weight, improving fuel efficiency by up to 15% in some designs. Extruded aluminum is used for seat tracks, cabin walls, and other interior components, providing durability without adding unnecessary weight.

- Consumer Electronics and Appliances: Aluminum extrusions are essential in the production of modern electronic devices and home appliances:

- Heat sinks and enclosures: Aluminum’s excellent thermal conductivity makes it a popular choice for heat sinks in electronic devices such as computers, smartphones, and LED lights. It helps dissipate heat effectively, prolonging the life of electronic components. Many home appliances, including refrigerators, washing machines, and ovens, use aluminum extrusions for structural frames due to their corrosion resistance and lightweight, leading to easier transportation and installation.

- Industrial Machinery: Aluminum extrusions are frequently used in the construction of conveyor systems and machine frames in factories, offering high strength while keeping equipment lightweight and easy to assemble. The use of extruded aluminum in robotic arms helps reduce weight while maintaining the necessary strength for precision and efficiency in manufacturing processes.

- Marine Industry: Aluminum extrusions are commonly used in boats and yachts for structural frameworks, reducing the overall weight by up to 20%, which helps increase fuel efficiency and speed. In offshore oil and gas platforms, aluminum extrusions are used for lightweight but durable structural elements that resist saltwater corrosion, thus extending the lifespan of these installations.

Major Challenges

- Raw Material Price Volatility: The cost of aluminum, the primary material used in the extrusion process, can fluctuate significantly due to global supply and demand, geopolitical tensions, and market instability. This volatility makes it difficult for manufacturers to maintain consistent pricing and manage profitability.

- Energy-Intensive Production: Aluminum extrusion requires significant energy for heating and shaping aluminum billets. As energy prices rise, particularly in regions with high energy costs, production becomes more expensive, impacting the overall cost structure and profitability for manufacturers.

- Environmental Regulations: Stringent environmental regulations regarding emissions and energy consumption are increasing in regions like North America and Europe. Compliance with these regulations often requires investment in new, eco-friendly technologies, which can increase operational costs for companies.

- Competition from Alternative Materials: While aluminum offers many benefits, it faces competition from other materials like steel, plastic, and composites, which can be cheaper or offer better performance in specific applications. This competition poses a threat to the growth of aluminum extrusion in certain industries.

- Supply Chain Disruptions: The aluminum extrusion industry is dependent on a complex global supply chain, including raw material suppliers and distribution networks. Disruptions due to natural disasters, geopolitical events, or logistical challenges can cause production delays, increase lead times, and raise costs.

- Technological Barriers for Small Manufacturers: Keeping up with rapid advancements in extrusion technology and investing in innovative manufacturing processes can be difficult for smaller companies. These businesses may struggle to remain competitive against larger firms with greater resources.

Market Growth Opportunities

- Growing Electric Vehicle (EV) Market: The shift towards electric vehicles presents significant growth potential for aluminum extrusion. Aluminum is essential in producing lightweight EV components such as battery housings, chassis, and body structures. As the demand for EVs increases, manufacturers are likely to use more aluminum extrusions to enhance vehicle range and performance, thus reducing the overall vehicle weight and improving energy efficiency.

- Expansion in Renewable Energy: Aluminum extrusion is increasingly used in renewable energy systems, particularly in solar panels and wind turbines. Aluminum’s lightweight, corrosion-resistant properties make it ideal for framing solar panels and components in wind turbines. As global investment in renewable energy infrastructure grows, aluminum extrusions will play a larger role, especially as countries aim to meet sustainability goals.

- Infrastructure and Construction Boom: The ongoing urbanization and infrastructure development in emerging markets, particularly in Asia-Pacific and the Middle East, is creating a demand for aluminum extrusions. Aluminum is used extensively in building materials, including window frames, facades, and structural components. The emphasis on energy-efficient buildings further increases the demand for aluminum due to its superior insulation properties.

- Sustainability and Recycling: The recyclability of aluminum offers a competitive advantage, as industries prioritize eco-friendly materials. With increased regulatory pressure to reduce carbon emissions, the demand for recycled aluminum extrusions is likely to rise. Companies that invest in sustainable aluminum production and recycling processes can capitalize on this opportunity.

- Technological Advancements: Innovations in extrusion processes and the development of advanced aluminum alloys open up new applications across sectors like aerospace, marine, and consumer electronics. The ability to extrude more complex shapes and create stronger, lighter products presents significant growth potential for manufacturers.

Key Player Analysis

Sapa Extrusion, now part of Norsk Hydro ASA, has continued to strengthen its aluminum extrusion capabilities throughout 2023 and into 2024. In January 2023, the company expanded its U.S. operations by investing in advanced extrusion presses, focusing on producing lighter, stronger profiles for the growing electric vehicle and renewable energy sectors. In March 2023, Sapa announced the opening of a new research and development center in Sweden aimed at innovating extrusion technologies for automotive lightweighting.

Trefinasa Mexico has been actively involved in aluminum extrusion production, particularly focusing on extruded aluminum tubes and profiles for industries like automotive, electrical, and renewable energy. In 2023, the company worked on enhancing its extrusion line to meet growing demand, with its production capacity expected to increase in line with market development. Notably, Trefinasa introduced improvements in February 2023 with the acquisition of a new induction oven, increasing energy efficiency by 28%, which aligns with its commitment to eco-friendly manufacturing. By mid-2023, Trefinasa expanded its production of extruded aluminum profiles used in insulated cables and automotive components, emphasizing sustainability and product quality. This focus on both product diversification and energy efficiency positions the company to meet growing global demand in various industries.

Bristol Aluminum, based in Levittown, Pennsylvania, has been actively expanding its aluminum extrusion services since 2023. In January, the company introduced new custom extrusion options, leveraging its advanced CNC machining technology to cater to complex customer designs. By March 2023, Bristol Aluminum upgraded its finishing capabilities, adding new powder coating services to enhance durability and aesthetics for various industrial applications. In June 2023, the company reported a 15% increase in production efficiency due to the integration of a new four-axis vertical machining center, allowing for higher precision in extrusion processes.

AMG Alpoco is a leading global producer of atomized aluminum powders, which are widely used in various industries such as aerospace, automotive, and metallurgy. In 2023, the company focused on expanding its production capabilities to meet the rising demand for high-purity aluminum powders, which are crucial in advanced manufacturing sectors. By mid-2023, AMG Alpoco had ramped up production of air and gas-atomized aluminum powders, strengthening its presence in the aerospace sector, where these materials are essential for lightweight and high-strength components.

Bonnell Aluminum, a leading manufacturer of custom aluminum extrusions, has been active in 2023 and 2024 with various industry engagements and strategic developments. In February 2023, Bonnell received recognition for its high-quality extrusion work with an award from PACCAR, highlighting its excellence in automotive components. By August 2023, the company supported efforts in the U.S. Aluminum Extruders Coalition to address unfair trade practices, aligning with federal rulings on anti-dumping policies. Looking ahead, in May 2024, Bonnell expanded its operations by enhancing its precision capabilities through the adoption of new extrusion technologies, aimed at serving sectors such as construction, automotive, and industrial equipment. These efforts reflect Bonnell’s commitment to innovation and industry leadership in the aluminum extrusion market.

Vitex Extrusion, a division of Momentum Manufacturing Group, has seen significant expansion in its aluminum extrusion capabilities in recent years. In 2023, the company continued to invest heavily in its Franklin, New Hampshire facility, completing the second phase of a $23 million expansion project. This phase added 35,000 square feet to its production space and included the installation of advanced automated handling equipment.

International Extrusions, a U.S.-based aluminum extrusion company, continues to expand its production capacity and technological advancements in 2023 and 2024. The company focuses on providing high-quality custom-extruded aluminum products for various industries, including construction, transportation, and consumer goods. In early 2023, International Extrusions implemented new automation technologies in its facilities to increase production efficiency and reduce lead times. By mid-2023, the company reported a significant improvement in output and announced plans to further invest in sustainable extrusion processes, aimed at reducing energy consumption and material waste.

FRACSA ALLOYS, a 100% Mexican-owned company, plays a prominent role in the aluminum extrusion sector by producing high-quality aluminum alloys. In 2023, FRACSA focused on expanding its production capabilities, reaching an annual production volume of 100,000 metric tons. The company specializes in manufacturing continuous casting ingots, and traditional ingots, and supplying liquid aluminum to various industries, including automotive and industrial sectors. In line with the growing demand for sustainable materials, FRACSA has emphasized the recycling of aluminum scrap and implementing new technologies to boost efficiency and reduce costs. Looking ahead to 2024, FRACSA plans further investments to enhance productivity and meet increasing customer demands in both domestic and international markets.

Conclusion

In conclusion, the aluminum extrusion market is positioned for substantial growth in the coming years, driven by its increasing application across various industries such as automotive, construction, renewable energy, and consumer electronics. The demand for lightweight, durable, and sustainable materials continues to rise, particularly in sectors prioritizing energy efficiency and environmental sustainability. The growing adoption of electric vehicles and renewable energy systems further boosts the need for aluminum extrusions, which are crucial for improving performance and reducing carbon footprints.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)