Table of Contents

Introduction

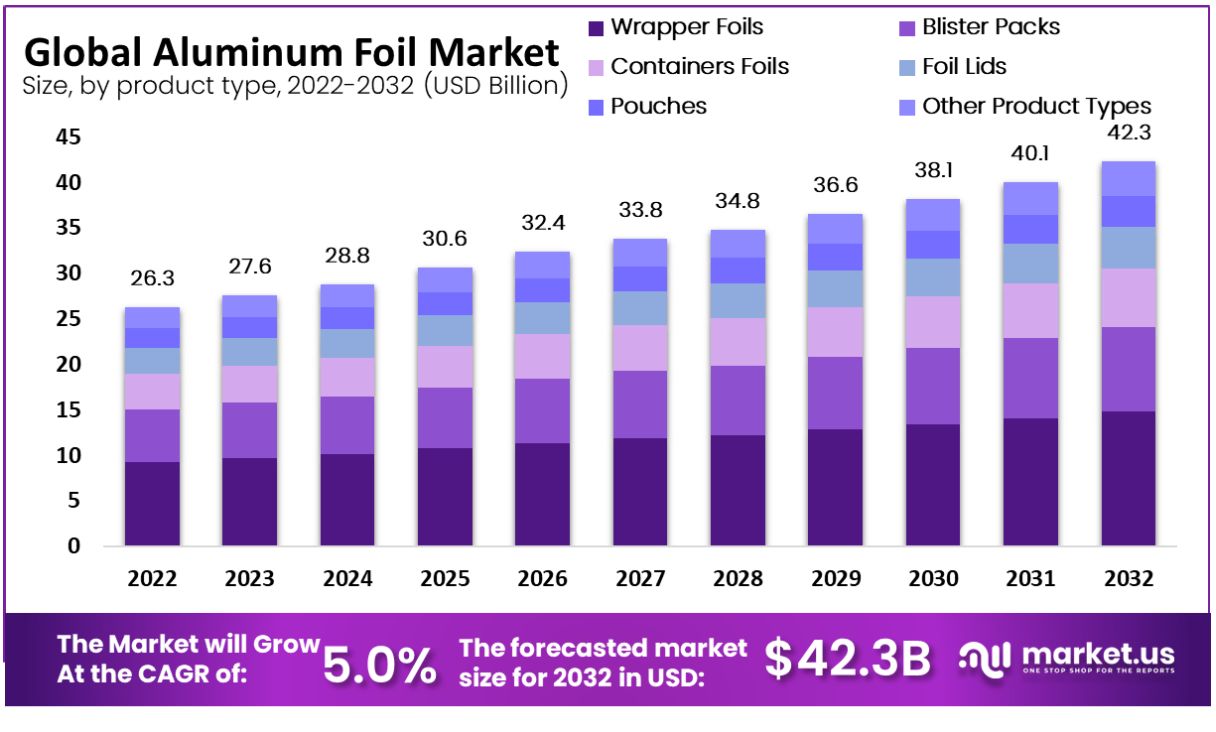

The global aluminum foil market is poised for robust growth, projected to increase from USD 26.3 billion in 2022 to USD 42.3 billion by 2032, at a compound annual growth rate (CAGR) of 5.0%. This growth can be attributed to the expanding applications across various industries, including food and beverage, pharmaceuticals, and electronics, driven by aluminum foil’s excellent barrier properties against moisture, light, and oxygen.

One of the primary growth drivers in the market is the increasing demand for sustainable packaging solutions. Aluminum foil is highly valued for its ability to extend the shelf life of food products and its superior protection for pharmaceuticals. Its non-toxic nature also makes it suitable for preserving the aroma and quality of food products. Additionally, the ongoing expansion of the pharmaceutical sector, particularly in India, where the market for pharmaceutical packaging is booming, further boosts the demand for aluminum foil.

However, the industry faces several challenges. Environmental concerns regarding the production and disposal of aluminum foil, including energy consumption and waste generation, pose significant hurdles. Moreover, the availability of alternative packaging materials with competitive barrier properties and lower carbon footprints could hamper market growth. These alternatives include various plastics and paper-based solutions that offer similar benefits at potentially lower costs.

Recent developments in the market highlight the strategic initiatives by leading companies to expand and innovate. Investments in new production facilities, mergers and acquisitions, and efforts to reduce the carbon footprint of aluminum foil production illustrate the dynamic nature of the market. These developments not only enhance production capabilities but also align with global sustainability goals.

ACM Carcano is a prominent player in the aluminum foil market but specific recent strategic developments were not highlighted in the latest reports.

Amcor Plc has been very active in expanding its global footprint. In August 2023, Amcor announced a significant investment of $200 million to establish a new aluminum foil plant in Vietnam, aiming to cater to the growing Southeast Asian market. This move is expected to bolster their production capabilities and meet the rising demand for aluminum foil in the region.

Overall, while the aluminum foil market is set to grow significantly, it must navigate environmental challenges and competition from alternative materials to maintain its market position and capitalize on emerging opportunities across various sectors.

Key Takeaways

- Aluminum foil market size was valued to be worth USD 26.3 billion in 2022. From 2023 to 2032, it is estimated to reach USD 42.3 billion growing at a CAGR of 5.0 %.

- Product Type Analysis: The wrapper foils segment took the lead in the market, commanding the largest market revenue share of 35% in 2022.

- End User Industry Analysis: The food & beverage industry segment led the market, holding the largest market revenue share of 38% in 2022. The growth of this segment is propelled by the rising demand for both fresh and packaged foods.

- Regional Analysis: Asia Pacific stood out in the market, boasting the largest market revenue share of 53% in 2022.

Aluminum Foil Statistics

- Europe’s aluminum foil rollers saw 2021 finish on a record high, as the sector delivered overall growth of 3,9% compared with the previous 12 months.

- Exports continued to decline, down almost 15% in 2021

- Aluminum foil is foil made of aluminum. It is less than 0.2 mm (7.9 mils) thick.

- Approximately 75% of aluminum foil is used for packaging of foods, cosmetics, and chemical products

- 25% is used for industrial uses. It can easily be recycled.

- Aluminum foils thicker than 25 μm (1 mil) do not allow oxygen and water to pass through.

- The inferred temperatures have a maximum of about 93eV and were found to agree within 25% with the simulated results at times after 1ns

- The scope includes aluminum foil having a thickness of 0.2 mm or less, in reels exceeding 25 pounds, regardless of width.

- In 2022, Aluminium Foil was the world’s 232nd most traded product, with a total trade of $18.9B.

- Aluminium Foil grew by 21.3%, from $15.5B to $18.9B.

- In 2022 Aluminium Foil was the world’s 232nd most traded product (out of 1,218).

- In 2022, the top exporters of Aluminium Foil were China ($6.56B), Germany ($1.9B), Italy ($958M), Japan ($804M), and the United States ($734M).

- Approximately 75% of European production (2013: over 840,000t) is used for packaging and household foil and 25% is used in technical applications.

- European domestic and professional consumers use more than 120,000t of household foil annually.

- It is possible to roll aluminum to about 0.025 mm to avoid pinholes but at this thickness, it is too expensive to package biscuits.

Emerging Trends

- Sustainability and Recycling: There’s a growing emphasis on eco-friendly packaging solutions globally. This trend is especially prominent in regions like China, where the market is adapting to the government’s push for environmentally friendly consumption practices. The recyclability of aluminum foil is driving its adoption, particularly in the food and beverage industry, which demands sustainable packaging that doesn’t compromise the shelf life or quality of products.

- Market Expansion in Asia-Pacific: The Asia-Pacific region is witnessing significant growth due to increasing urbanization and rising disposable incomes, which are boosting the demand for packaged foods and pharmaceutical products. This region, particularly China and India, is experiencing a surge in the use of aluminum foil for packaging owing to its excellent barrier properties that ensure product preservation.

- Technological Innovations: Companies are investing in research and development to produce new types of aluminum foil that offer better performance and are more environmentally friendly. Innovations include the development of higher resistance foils that can withstand various environmental factors, making them suitable for a wider range of applications, including pharmaceuticals and industrial uses.

- Increased Demand from Various Industries: Besides traditional uses in food packaging, aluminum foil is increasingly used in pharmaceuticals, cosmetics, and tobacco, where its barrier properties are crucial for protecting products from moisture and contamination. There’s also a notable rise in its use in the construction and automotive industries, particularly in insulation and energy-saving applications.

- Shift from Plastic: With the global push against plastic waste, aluminum foil is becoming a preferred alternative due to its recyclable nature and superior barrier qualities compared to plastic and paper packaging. This shift is supported by governmental regulations and consumer preference for more sustainable packaging options.

Use Cases

- Food Packaging: Aluminum foil is extensively used in food packaging due to its excellent barrier properties, which protect food from light, moisture, and air, thereby extending shelf life and maintaining freshness. It’s commonly used for packaging everyday items like coffee, tea, snacks, and ready meals. In the food service industry, aluminum foil containers are popular for their durability and compatibility with various heating methods, making them suitable for ovens, microwaves, and grills.

- Pharmaceuticals: In the pharmaceutical industry, aluminum foil is used for packaging to protect medications from moisture, oxygen, and bacteria. It is especially prevalent in blister packs, which provide a barrier to protect health-sensitive products. Laminated foils are also employed for packaging granules, powders, and gels because they offer improved mechanical strength and barrier protection.

- Industrial Applications: Aluminum foil is utilized in various industrial applications, such as insulation and cable protection. It reflects about 96% of radiant heat, making it ideal for thermal insulation in buildings. Perforated and laminated types of foil are used to prevent condensation and enhance mechanical stability, respectively. In electronics, foil is used for its conductivity in applications like insulating cables and other components.

- Battery Manufacturing: Ultra-thin aluminum foil is critical in the production of lightweight and flexible batteries, particularly for portable devices. Laminated aluminum foil, which comprises multiple layers bonded together, is used to increase the mechanical strength and stability of batteries, making it crucial for high-performance applications.

Key Players Analysis

ACM Carcano: ACM Carcano Antonio S.p.A., established in 1880, has evolved into a key player in the aluminum foil rolling and converting sector. They manage a fully integrated and traceable production process that ensures high-quality aluminum foil production, adhering to GMP and European standards such as UNI EN ISO 9001:2008 and UNI EN ISO 14001:04. Carcano emphasizes environmental responsibility, and sustainability in operations, and holds a significant presence in international markets across various industries, including pharmaceuticals and food & beverage.

Amcor Plc: Amcor is a global leader in developing and producing packaging solutions, including aluminum foil for various applications. They focus on sustainable packaging solutions that are recyclable and continuously innovate to enhance environmental performance. Amcor’s extensive operations allow it to meet growing global demands efficiently, providing tailored packaging solutions that address the specific needs of its diverse clientele across the food, pharmaceutical, and other sectors.

Assan Alüminyum is a key player in the aluminum foil industry, recognized as one of Europe’s largest manufacturers with an annual foil production capacity of up to 130 thousand tons. The company operates out of Turkey and serves various sectors including packaging, construction, and automotive. Assan Alüminyum emphasizes sustainability in its operations, evidenced by its commitment to renewable energy projects and waste reduction, aligning with its membership in the Aluminium Stewardship Initiative which underscores its dedication to environmental and social governance standards.

Ess Dee Aluminium specializes in pharmaceutical and food packaging solutions in India, offering a range of aluminum foil products like blister and strip packs. The company’s focus is on delivering high-quality packaging that ensures product safety and compliance with health regulations. Ess Dee Aluminium leverages advanced technology to meet the stringent standards required in pharmaceutical packaging, making it a notable entity in the aluminum foil market.

Eurofoil specializes in producing and marketing aluminum foil and packaging, operating from sites in Luxembourg and France. They produce a wide range of aluminum foils, catering to sectors like food packaging, industrial applications, and HVAC systems. Eurofoil is noted for its innovation in the field, including a significant project to expand its casting capacity, which boosts its supply chain security and market leadership in Europe.

Hindalco Industries Limited, a leading name in the global metals business, is renowned for its extensive operations in aluminum production, from mining and refining to finished goods. They provide a wide range of aluminum products including foils used extensively in packaging solutions across various industries. Hindalco is committed to sustainability, employing state-of-the-art technology to enhance product quality and environmental standards.

Henan Huawei Aluminium Co. Ltd is a significant player in the aluminum foil industry, known for its extensive range of aluminum foil products. They cater to various market needs by producing high-quality aluminum foils used in multiple applications, including packaging, electrical, and thermal insulation. The company prides itself on its innovative approach to manufacturing and sustainability, continuously seeking new ways to improve product quality and environmental efficiency.

Laminazione Sottile has nearly a century of expertise in rolling aluminum products, positioning itself as a pivotal figure in the aluminum foil sector. Their offerings are diverse, ranging from food packaging to more industrial applications like HVAC systems and automotive parts. The company emphasizes sustainability and innovation, developing new technologies to enhance the performance and environmental friendliness of their products. They provide tailored solutions to meet the specific needs of their global clientele, ensuring high quality and versatility in their aluminum foil products.

Shanghai Metal Corporation (SMC) is a significant figure in the aluminum foil sector, recognized for its comprehensive array of products including pharmaceutical, packaging, and industrial foils. SMC leverages advanced manufacturing technologies, such as flatness control systems from Siemens and gauge control systems from Honeywell, to ensure high-quality production. The company’s aluminum foil is renowned for its barrier properties, making it ideal for sensitive packaging applications. SMC also focuses on environmental sustainability, ensuring its products are recyclable and meet global standards.

UACJ Foil Corporation, part of the UACJ Group, stands as a prominent player in the aluminum foil industry, especially in Asia. Specializing in the production of foil products for a variety of applications, UACJ Foil Corporation caters to both industrial and consumer markets. Their products are integral to the packaging, electronics, and automotive industries, underscoring their commitment to quality and innovation. The company emphasizes the development of advanced foil products that meet stringent quality and environmental requirements, making it a key supplier in global markets.

Xiamen Xiashun Aluminium Foil Co. Ltd. is recognized as a leading manufacturer of light-gauge aluminum foil, particularly excelling in the production of six- to seven-micron aluminum foil, predominantly used in flexible packaging for the food and beverage industry. Established in 1988 and headquartered in Xiamen, China, Xiamen Xiashun operates with a clear focus on sustainability and innovation. The company’s extensive facilities underscore its status as one of the world’s foremost providers of high-quality aluminum foil, with a strong commitment to environmental stewardship as evidenced by its membership in the Aluminium Stewardship Initiative.

Zhejiang Junma Aluminum Industry does not have publicly available detailed information specific to their operations in the aluminum foil sector as readily as other companies like Xiamen Xiashun. For more precise and detailed information about Zhejiang Junma Aluminum Industry, direct inquiries or searches that target industry reports or company-specific releases might be necessary.

Conclusion

Aluminum foil stands out as a highly versatile material across various industries due to its exceptional barrier properties, which effectively protect against moisture, light, and oxygen. This makes it an indispensable resource in food packaging, where it helps in preserving freshness and extending shelf life. Its application in the pharmaceutical sector underscores its critical role in safeguarding medications from environmental factors, thus maintaining their efficacy. Additionally, aluminum foil’s usage in insulation and electronics highlights its functional diversity, driven by its thermal and electrical conductivity. As industries increasingly focus on sustainability, the recyclable nature of aluminum further enhances its appeal, aligning with global environmental goals. The ongoing innovations in aluminum foil manufacturing, aimed at improving efficiency and performance, are set to keep this material at the forefront of industrial and commercial applications, reflecting its enduring value and adaptability.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)