Table of Contents

Introduction

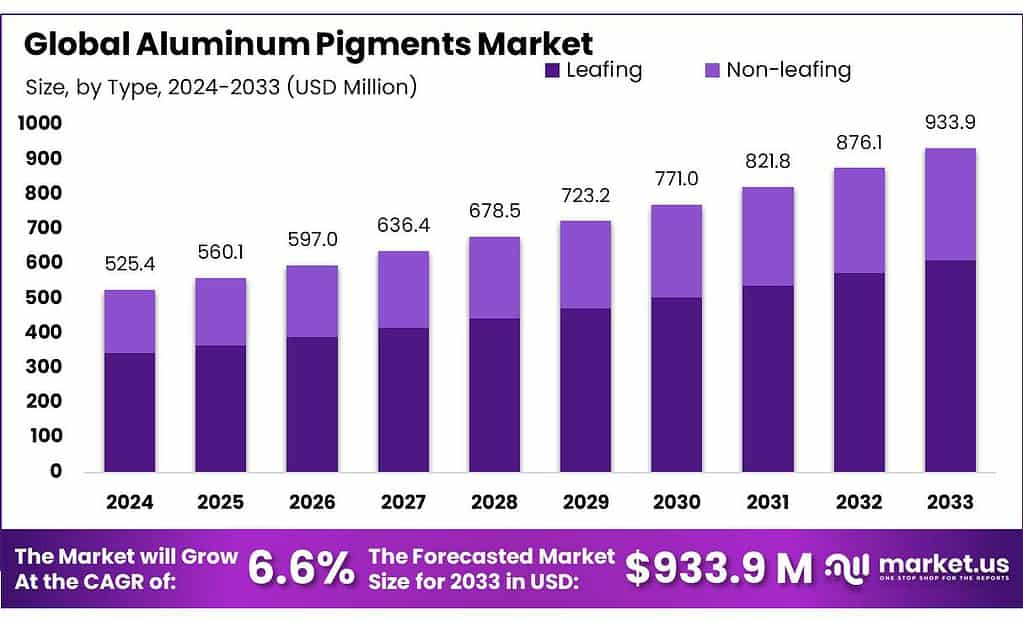

The Global Aluminum Pigments Market is projected to expand significantly, with its valuation expected to rise from USD 524.4 million in 2023 to around USD 933.9 million by 2033. This growth, representing a Compound Annual Growth Rate (CAGR) of 6.6% over the next decade, is driven by increasing applications in coatings and plastics for the automotive, cosmetics, and construction sectors.

However, the market faces challenges, such as stringent environmental regulations concerning volatile organic compounds (VOCs) and the fluctuating costs of raw materials, which could impact production and pricing strategies. Recent developments have seen technological advancements in waterborne and solvent-free pigment formulations, which are gaining traction due to their lower environmental impact. These innovations are pivotal in sustaining market growth amidst regulatory challenges and shifting consumer preferences towards more sustainable products.

ALTANA has intensified its focus on innovation by launching a new series of aluminum pigments that are tailored for high-performance applications in the automotive and electronics sectors. This move not only enhances their product offerings but also strategically positions them to capture a larger share of these lucrative markets.

Arasan Aluminium Industries (P) Ltd. has expanded its manufacturing capabilities with the inauguration of a new production facility in South India. This expansion, aimed at doubling their production capacity, positions Arasan to meet the growing demand in the Asia-Pacific region, which is witnessing rapid growth in the industrial and automotive sectors.

Asahi Kasei Corporation has recently entered into a partnership with several automotive manufacturers to develop specialized aluminum pigments designed for electric vehicles (EVs). This collaboration is anticipated to drive advancements in material science, catering specifically to the unique needs of the EV market.

BASF SE has made significant strides in sustainability by developing a new range of eco-friendly aluminum pigments that reduce environmental impact. These pigments are designed to comply with stringent global environmental regulations, helping manufacturers meet sustainability goals without compromising on quality.

Carl Schlenk AG has participated in a strategic merger with a North American pigment producer to enhance its global distribution network and improve its service delivery across the continent. This merger not only expands their geographical footprint but also enriches their expertise and product diversity, making them more competitive in the global market.

Key Takeaways

- Market Size: Expected to reach USD 933.9 million by 2033, growing from USD 524.4 million in 2023, at a CAGR of 6.6%.

- Regional Dominance: APAC leads with a 38.5% market share, valued at USD 201.9 million in 2023.

- By Туре: Leafing pigments held a 65.4% market share in 2023 for reflective coatings; and non-leafing for uniform protection.

- By Form: Pellet form dominates with a 35.8% share in 2023, favored for ease of application in industrial settings.

- By Application: The paints & coatings sector accounted for 48.4% of the market share in 2023, crucial for automotive and decorative applications.

Dynamic Properties of Aluminum Pigments

- The pigments obtainable at the market possess a narrow particle size distribution of about 5 to 30 μm and a high aspect ratio.

- The sparkle effect of the pigments in coating applications is controlled by the quantity of the added pigment. The effect is visible already at concentrations of 0.1% in the paint system. The intensity steadily increases to pigment concentrations of about 2%.

- The specific rate of breakage of aluminum particles in bench scale ball mill is described by the function Si = 0.072 xi1.4716 where the experimental data for the specific rate of breakage of aluminum powder converted from one ball size to another large productive one.

- The produced flake powders are brilliant, flowable, and leaf-like types with a specific surface area of about 4.5 m2/gm and powder activity of about 90% which is suitable for many applications.

- The color stability of lac dye and its lakes was investigated at ambient temperature and at 45 °C, in sunlight, fluorescent light, and darkness, for 3 months.

Advanced Coating Applications of Aluminum

- Iriodin pigments meet the latest findings in product safety and environmental compatibility and are non-flammable, electrically non-conductive, and temperature stable up to 800°C.

- Aluminum pigments with an aspect ratio (d50/h) of more than 200, preferably over 300, are considered very thin and provide high covering power

- The pigments exhibit a roughness value (R) of 0.35 to 0.9, with 0.4 to 0.8 being the preferred range.

- Aluminum pigments obtained by wet grinding typically have an active aluminum content of 93 to 97%. In contrast, the pigments described in this patent have a lower content of 85 to 93%, with the remainder being aluminum oxide and fatty acids bound to the surface.

- The pigments have a narrow distribution of thicknesses, with a d95 value of less than 200 nm, preferably less than 150 nm.

Emerging Trends

- Sustainability and Environmental Compliance: There is a growing trend towards the development of eco-friendly aluminum pigments. Manufacturers are increasingly focusing on products that comply with stringent environmental regulations, aiming to reduce the use of solvents that contribute to volatile organic compounds (VOCs). This shift is not only a response to regulatory pressures but also aligns with the broader market demand for sustainable and ‘green’ products.

- Waterborne and Solvent-Free Pigments: In line with the sustainability trend, waterborne and solvent-free aluminum pigments are gaining popularity. These pigments offer significant environmental benefits, including reduced VOC emissions and better recycling capabilities. They are particularly appealing in industries like automotive and construction, where environmental impact is a growing concern for consumers.

- Technological Innovations in Application Techniques: Advancements in application technologies are enabling more efficient and precise uses of aluminum pigments. New spraying techniques and equipment improvements are helping manufacturers achieve more consistent finishes with enhanced visual effects, which are crucial for applications in cosmetics and consumer electronics.

- High-Performance Pigments for Specialty Applications: There is an increasing demand for high-performance aluminum pigments that offer enhanced properties such as heat resistance, light reflectivity, and corrosion resistance. These pigments are being tailored for use in high-end applications across various industries, including automotive, aerospace, and consumer electronics, where durability and performance are key.

- Globalization of Supply Chains: As markets globalize, there is a trend toward the diversification of supply chains for aluminum pigments. Companies are expanding their operations and distribution networks globally to better serve emerging markets, particularly in Asia and Africa, where industrial and manufacturing sectors are booming.

Use Cases

- Automotive Paints and Coatings: Aluminum pigments are a staple in automotive applications, where they provide a metallic sheen to exterior paint. These pigments contribute to the aesthetic and protective qualities of automotive finishes. The automotive coatings market, which is expected to reach USD 23.58 billion by 2026, relies heavily on aluminum pigments for both their visual appeal and functional properties like heat reflection.

- Plastic and Composite Materials: In the plastics industry, aluminum pigments are used to impart a metallic look to consumer goods, packaging, and components. This application capitalizes on the lightweight nature of aluminum, adding minimal additional weight while providing a high-quality finish. The global market for plastic compounds is growing at a CAGR of around 5%, with aluminum pigments playing a key role in adding value to plastic products.

- Personal Care and Cosmetics: Aluminum pigments are crucial in the cosmetics industry, particularly in products like nail polish and eye shadows, where they provide a shimmering or pearlescent effect. This sector is growing, with a projected market size of USD 805 billion by 2023. The use of aluminum pigments in cosmetics not only enhances product appeal but also reflects light, giving a brightening effect that is highly valued by consumers.

- Printing Inks: Aluminum pigments are used in printing inks for labels, packaging, and decorative printing. They are particularly valued in applications requiring vivid, metallic effects that attract consumer attention. The global market for printing inks, set to grow at a CAGR of 4.32% from 2021 to 2026, increasingly incorporates these pigments to achieve distinctive and appealing visual effects on various substrates.

- Protective Coatings: Aluminum pigments are also incorporated into protective coatings used in marine, industrial, and architectural applications. These pigments enhance the aesthetics of protective coatings while contributing to their functional properties such as corrosion resistance and UV stability. The protective coatings industry, valued at USD 15.21 billion in 2020, utilizes aluminum pigments to meet both performance and aesthetic requirements in harsh environments.

Major Challenges

- Environmental Regulations: Stricter environmental laws globally are a significant hurdle. Aluminum pigment production often involves processes that can release volatile organic compounds (VOCs) and other hazardous materials. For instance, the European Union’s REACH regulations impose stringent controls on chemical substances, influencing how pigments must be manufactured and used. Compliance with these evolving standards requires ongoing investment and adaptation, potentially increasing costs for manufacturers.

- Raw Material Price Volatility: The prices of raw materials required for manufacturing aluminum pigments, such as aluminum powder, are subject to fluctuations due to market dynamics like supply chain disruptions, geopolitical tensions, and changes in trade policies. For example, aluminum prices have seen an increase of approximately 30% over the past year due to supply chain constraints and increased demand in key sectors. This volatility can complicate budgeting and financial planning for pigment producers.

- Technological Advancements: Keeping pace with rapid technological changes in application methods and pigment formulations is a challenge. As industries such as automotive and cosmetics demand more sophisticated and environmentally friendly pigments, the pressure mounts on pigment manufacturers to continually invest in R&D. Failing to innovate could result in reduced market share as competitors introduce more advanced alternatives.

- Competition from Substitutes: The rise of substitutes like pearlescent pigments, which can offer similar visual effects and potentially lower environmental impacts, poses a challenge. These materials are being increasingly preferred, especially in applications demanding high luster and unique color effects without the metallic sheen of aluminum pigments.

- Health and Safety Concerns: The manufacturing and handling of aluminum pigments raise health and safety concerns. Exposure to aluminum dust can be hazardous, and stringent health regulations may require significant safety measures, adding to operational costs. For instance, industries must invest in ventilation systems and protective equipment to safeguard workers, as dictated by occupational safety standards.

Market Growth Opportunities

- Expansion into Emerging Markets: Developing economies in Asia, Africa, and South America are witnessing rapid industrialization and urbanization, leading to increased demand for products that utilize aluminum pigments such as automotive paints, personal care products, and construction materials. For instance, the Asia-Pacific region is expected to see the highest growth in the automotive sector, with a projected CAGR of over 8% through 2025, creating substantial demand for aluminum pigments.

- Innovation in Eco-Friendly Products: There is a growing trend towards environmentally sustainable products across industries. Aluminum pigment manufacturers have the opportunity to innovate by developing eco-friendly pigments that meet stringent environmental standards. For example, the global market for green coatings is expected to reach USD 118.99 billion by 2027, growing at a CAGR of 5.1%. Producers of aluminum pigments can tap into this market by offering products that contribute to the production of environmentally friendly coatings.

- Technological Advancements in Product Applications: By investing in research and development, companies can create more sophisticated and specialized pigments that offer enhanced functionality, such as improved light reflection and UV resistance. These high-performance pigments can be marketed for use in high-end applications in the automotive, aerospace, and electronics industries, where there is a willingness to pay a premium for advanced materials.

- Strategic Partnerships and Collaborations: Collaborating with players in downstream industries like automotive, cosmetics, and printing could open new avenues for growth. Such partnerships can lead to the development of customized pigment solutions that are specifically tailored to meet the unique needs of these industries, thereby enhancing product acceptance and increasing market penetration.

- Regulatory Compliance as a Competitive Advantage: As regulatory pressures increase, companies that proactively comply with new environmental standards can gain a competitive advantage. By positioning themselves as leaders in sustainability, pigment manufacturers can not only avoid the costs associated with non-compliance but also attract customers who are committed to environmental stewardship.

Key Players Analysis

ALTANA, through its ECKART division, stands as a global leader in manufacturing aluminum effect pigments, which are utilized in diverse sectors such as automotive coatings, plastics, and printing inks. The acquisition of Silberline has enhanced ALTANA’s portfolio and global reach, particularly strengthening its presence in North America and Asia. This strategic expansion aligns with their ongoing commitment to innovation and quality in the specialty chemicals industry.

Arasan Aluminium Industries (P) Ltd., established in 1981, has developed into a leading manufacturer of aluminum powders and pastes, including specialized products for the aluminum pigments sector. Their offerings span atomized aluminum powder and both leafing and non-leafing aluminum pastes, tailored for various industrial applications like pyrotechnics, lightweight concrete, and coatings. Their commitment to quality and innovation is supported by robust R&D collaborations and an ever-expanding production capacity, ensuring they meet the growing demands of the industry.

Asahi Kasei Corporation is recognized for its high-quality aluminum pastes, which are used across various applications including automotive and home appliances. Their pastes are noted for enhancing metallic effects and colors in paints, coatings, and inks. Asahi Kasei focuses on delivering superior brightness and fineness through its innovative processing techniques, which ensure safety and environmental compliance.

BASF SE is a prominent player in the aluminum pigments market, primarily contributing through its coatings division. The company leverages its global presence and substantial R&D capabilities to innovate and enhance the performance of aluminum pigments. These pigments are extensively utilized in automotive, construction, and packaging applications to improve aesthetics and durability.

Carl Schlenk AG is a leading manufacturer specializing in metal effect pigments, including aluminum pigments, used across various industries such as automotive and coatings. Their products are known for enhancing the visual appeal and functionality of applications by providing metallic effects and improved surface properties.

Carlfors Bruk, with a century of expertise, specializes in producing both leafing and non-leafing aluminum pigments. These products are utilized extensively in the coatings industry, enhancing aesthetics and durability across various applications, including automotive and decorative sectors. Their commitment to quality is underpinned by ISO 9001 certification, positioning them as a key player in the global market for aluminum pigments.

DIC Corporation is a global leader in the pigments market, including aluminum pigments. They focus on high-quality metallic pigments under their Benda Lutz brand, which is well-regarded for superior aesthetics and processibility across various applications like coatings and plastics.

FX Pigments Pvt. Ltd specializes in manufacturing aluminum pigments, offering innovative color solutions for various industries. Their products include aluminum-based pigments that are integral to applications across textiles, coatings, and plastics, emphasizing vibrant and lasting color effects.

GEOTECH specializes in aluminum effect pigments, offering a diverse range of products that are highly valued in the cosmetics, plastics, and coatings industries. Their pigments are known for enhancing product appearances with striking visual effects, making them a prominent player in the market for specialty pigments.

Hefei Sunrise Aluminium Pigments Co., Ltd. is a leading manufacturer of aluminum pigments in China, recognized for its diverse range of products including pastes, powders, and pelletized pigments. Their products are integral to industries such as automotive, appliances, and coatings, known for high quality and versatility.

Kolortek Co., Ltd. is a distinguished manufacturer of effect pigments, particularly known for its high-quality aluminum and pearl pigments. These pigments are utilized across various industries, including cosmetics and coatings, where they enhance product appeal with vibrant and unique visual effects. Kolortek’s commitment to innovation is supported by robust R&D efforts, ensuring its pigments meet global regulatory standards and consumer demands.

Metaflake Ltd, established in 1996, revolutionizes the aluminum pigments industry with its environmentally friendly water-milled technology, producing high-quality pigments free from harmful hydrocarbon residues. These pigments are extensively utilized in coatings, inks, and plastics, providing brilliant, metallic effects. The company is a pioneer in adopting sustainable manufacturing practices, significantly impacting the global market with its innovative products.

Nippon Light Metal Holdings Co., Ltd. specializes in developing innovative aluminum products, including aluminum pigments. The company focuses on sustainability and has patented a unique method for creating aluminum flake pigments, which are used across various industries due to their distinct characteristics and reliable production techniques.

Silberline Manufacturing Co. Inc. is recognized for producing high-quality aluminum pigments that enhance the visual appeal and functional properties of automotive paints, plastics, and printing inks. Their products are integral in adding metallic and sparkling effects, driving innovation in pigment technology and application.

Sun Chemical is a key player in the aluminum pigments sector, recognized for their Paliocrom® line of aluminum effect pigments, which are utilized in automotive and high-performance industrial coatings to deliver vibrant, chromatic colors with excellent hiding power and saturation. This range is especially favored for its brilliant metallic effects and durability in various applications.

Toyal America Inc. is a leader in the production of aluminum pigments, providing a wide array of products including pigments, pastes, flakes, and powders specifically designed for high-value automotive and industrial coatings. Their innovative manufacturing processes enable the creation of high-quality pigments that are used globally, catering to various sectors with their technologically advanced aluminum powders and pigments. Toyal America is recognized for its commitment to technological advancements and its capability to meet the demands of the coatings industry worldwide.

Conclusion

The Aluminum Pigments market is poised for substantial growth, driven by its diverse applications across several key industries such as automotive, cosmetics, and coatings. Despite facing challenges such as stringent environmental regulations and raw material price volatility, the market offers robust opportunities for expansion, particularly in emerging markets and through the development of eco-friendly products.

Companies that focus on innovation, sustainability, and strategic partnerships will be better positioned to capitalize on these opportunities and navigate potential obstacles. Embracing technological advancements and adhering to regulatory standards will be crucial for maintaining competitiveness and achieving sustained growth in the global Aluminum Pigments market.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)