Table of Contents

Introduction

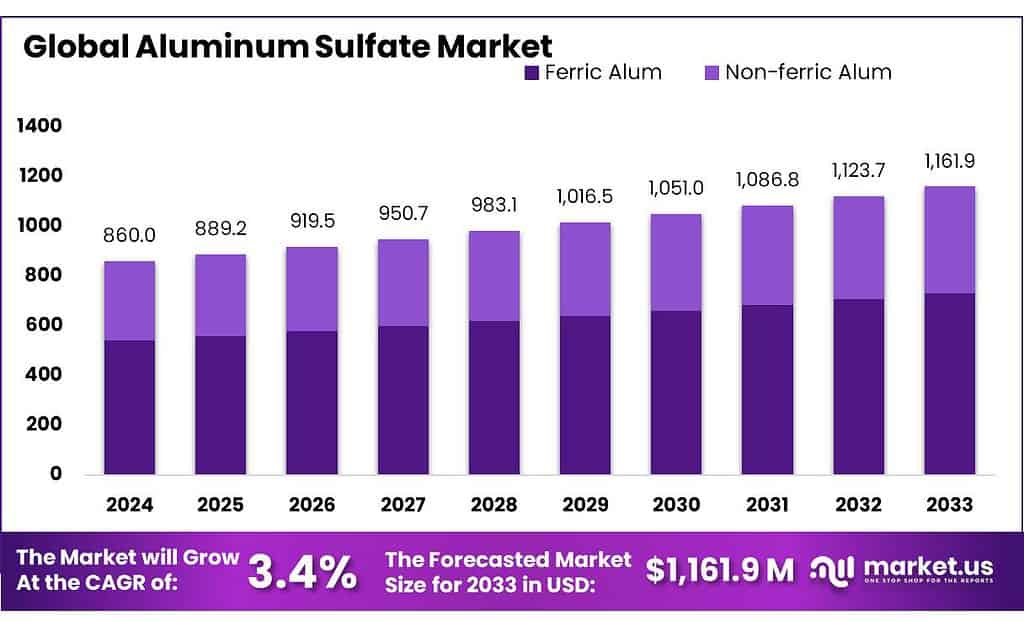

The global aluminum sulfate market is projected to grow from USD 860 million in 2024 to USD 1161.9 million by 2033, marking a steady CAGR of 3.4% during this period. This growth is primarily fueled by the increasing demand for water treatment and the paper and pulp industries. Aluminum sulfate serves as a critical agent in water purification, helping to coagulate impurities and remove them from water, which is crucial for both drinking and industrial uses.

However, the market faces certain challenges, including stringent environmental regulations that dictate the use and disposal of chemicals, potentially limiting market growth. These regulations are increasingly strict, emphasizing the need for environmentally friendly and sustainable production processes. The industry is also impacted by the volatility in the prices of raw materials, which can affect production costs and market stability

Recent developments in the market have been geared towards enhancing the efficiency and environmental sustainability of production methods. Major companies in the sector are focusing on strategic acquisitions, innovations, and expanding their global reach to consolidate their market position. For instance, companies like Chemtrade Logistics and Kemira are investing in research and development to innovate more efficient and eco-friendly coagulant products, which are crucial for maintaining compliance with global environmental standards.

Chemtrade Logistics Inc. continues to be a dominant force in North America, focusing on the production and supply of a variety of aluminum sulfate grades. The company has developed specialized products such as acidulated Alum-based products and Clar+Ion® products, designed for optimal pH treatment and improved water treatment processes, respectively. These innovations are tailored to meet specific industry needs, enhancing performance and environmental sustainability.

Affinity Chemical prides itself on its entrepreneurial approach, offering a collaborative and transparent partnership with its clients. This approach has allowed Affinity to establish a reliable supply chain and competitive pricing structure, effectively meeting the diverse needs of its customers across various industries including municipalities and the pulp and paper sector. Affinity’s business model is underpinned by a strong commitment to customer service and flexibility in product offerings.

Key Takeaways

- Aluminum Sulfate Market size is expected to be worth around USD 1161.9 Million by 2033, from USD 860 Million in 2023, growing at a CAGR of 3.4%.

- Ferric Alum held a dominant market position, capturing more than a 63.4% share of the aluminum sulfate market.

- Standard Grade aluminum sulfate held a dominant market position, capturing more than a 54.4% share.

- Powder form of aluminum sulfate held a dominant market position, capturing more than a 45.5% share.

- Water Treatment held a dominant market position in the aluminum sulfate market, capturing more than a 38.7% share.

- Direct Sales held a dominant market position in the aluminum sulfate market, capturing more than a 65.4% share.

- Europe holds a commanding position, dominating the market with a 37.8% share and valued at USD 325 million.

Aluminum Sulfate Statistics

- The compound decomposes to γ-alumina and sulfur trioxide when heated between 580 and 900 °C. It combines with water forming hydrated salts of various compositions.

- Initially, the system was heated up until solid particles dissolved, then linear cooling rate was applied between 45 °C and 20 °C in 180 min.

- Pyridine-adsorbed sample was first degassed ex-situ under vacuum at about 120°C for 0.5 h.

- Aluminum sulfate application (300 ppm or in combination with sucrose 2%, 4%) in cut gladiolus “Pink friendship” flowers had shown an increase in flower diameter.

- The RMIC values are based on a maximum dosage of 150 mg aluminum sulfate * /liter of water and are to be compared to impurity concentrations obtained by using sample procedures described in this monograph.

- Aluminum (Al), also spelled aluminum, chemical element, a lightweight, silvery-white metal of main Group 13 (IIIa, or boron group) of the periodic.

- Two different doses of aluminium sulphate fertiliser were applied: 740 kg ha-1 and 1110 kg ha ⁻¹ .

- The concentration of sulfur ash of ammonium sulfate prepared as explained in the annex in a test sample of 1 g must not exceed 5 g/kg.

- Mix 5 ml of concentrated sulfuric acid (R) and 0.5 ml of an previously prepared iron (II) sulfate solution in a concentration of 5 pp 100 (m/v) in a test tube. Without mixing, pour 5 ml of the solution obtained by dissolving 2 g of ammonium sulfate in 10 ml of water. Quantitatively analyze the distilled ammonia using 0.1 M hydrochloric acid. Let n be the number of milliliters used 100 g of ammonium sulfate contains 1.7 n g of ammonia (NH3).

- 100 g of ammonium sulfate contains 16.80 p g of sulfuric acid (H2SO4). (Sulfuric acid content greater than 73.5 pp 100.).

- Ammonium sulfate is an analytical reagent with a molar mass of 132.14 g/mol.

Emerging Trends

- Diversification of Applications: Beyond traditional uses in water treatment and paper manufacturing, aluminum sulfate is finding new applications across various industries. Its use is expanding in pharmaceuticals, food additives, and environmental management. For example, it’s being employed in the textile industry as a mordant in dyeing processes and in environmental management to control algal blooms and manage waste water turbidity.

- Innovation and Technological Advancements: There is a strong focus on developing new production methods and enhancing the effectiveness of aluminum sulfate in its applications. Technological advancements are enabling more efficient manufacturing processes and the development of products with specific properties tailored to niche market needs.

- Sustainable and Eco-Friendly Solutions: As environmental concerns continue to rise, there is an increasing push towards sustainable practices in the production and use of aluminum sulfate. Companies are investing in eco-friendly production methods and striving to reduce the environmental footprint of their operations. This trend is driven by stringent governmental regulations aimed at minimizing the environmental impact of chemical products.

- Geographical Expansion: The demand for aluminum sulfate is particularly strong in the Asia-Pacific region, driven by rapid industrialization and the expansion of water treatment infrastructure. However, North America and Europe also remain significant markets due to their advanced industrial bases and stringent environmental regulations. The market in these regions is characterized by a focus on sustainability and high-quality standards.

Use Cases

- Water Treatment: Aluminum sulfate is extensively used as a coagulant in water treatment processes. It helps clarify water by removing impurities and suspended particles, making it safer for consumption. The chemical reacts with water to form a gel-like substance that traps contaminants, which are then easily removed.

- Paper Manufacturing: In the paper industry, aluminum sulfate is used to improve paper quality by acting as a sizing agent. It enhances the paper’s resistance to ink penetration and strengthens the paper fibers, making it more durable.

- Textile Industry: Aluminum sulfate serves as a mordant in fabric dyeing, helping to fix dyes onto fabrics more effectively. This application ensures that colors are vibrant and long-lasting.

- Firefighting: Some fire retardant foams include aluminum sulfate as an ingredient. It aids in suppressing fires by smothering the flames and depriving them of oxygen.

- Gardening and Agriculture: It is used to adjust soil pH levels, especially for acid-loving plants. Aluminum sulfate lowers the soil’s pH, creating favorable conditions for these plants to thrive.

- Pharmaceuticals and Cosmetics: In personal care products, such as deodorants and antiperspirants, aluminum sulfate is used to reduce sweat and body odor. Additionally, it plays a role in the medical field as a styptic to treat small abrasions and as an adjuvant in vaccines to enhance immune responses

Major Challenges

- Environmental Regulations: Strict environmental regulations significantly impact the production and use of aluminum sulfate. The industry must comply with regulations concerning the handling, storage, and disposal of chemicals, which can increase operational costs and complicate manufacturing processes.

- Competition from Alternatives: The market faces increasing competition from alternative coagulants such as ferric sulfate and polyaluminum chloride, which can offer similar performance often at a lower cost. This competition pressures aluminum sulfate producers to innovate and potentially reduce prices to maintain market share.

- Technological and Operational Limitations: The production of aluminum sulfate involves complex processes that require significant capital investment and technological expertise. Additionally, any inefficiencies in these processes can lead to higher production costs and environmental risks, further straining the operational capabilities of manufacturers.

- Supply Chain Issues: Fluctuations in the availability and prices of raw materials, such as aluminum trihydrate and sulfuric acid, can affect production costs and lead to supply chain disruptions. Moreover, geopolitical tensions and global economic conditions also pose risks to stable supply chain operations.

- Water Pollution and Environmental Impact: Improper disposal and handling of aluminum sulfate can lead to significant environmental issues, including water pollution and habitat disruption. This not only affects the ecological balance but can also result in legal and reputational risks for companies involved.

Market Growth Opportunities

- Expansion in Water Treatment Applications: Aluminum sulfate is extensively used as a coagulant in water treatment processes. The increasing global emphasis on clean water and the expansion of water treatment facilities, especially in rapidly urbanizing regions, are key drivers for this segment. This application alone held a dominant market share in 2023 and is expected to continue leading due to rising demands for potable water and effective wastewater management systems.

- Industrial and Chemical Processing: The chemical is also critical in industrial processes such as paper manufacturing and dyeing where it helps in water purification, paper sizing, and fixing dyes in textiles. These industries are growing, particularly in Asia-Pacific, which is the fastest-growing regional market due to its expanding industrial base and infrastructural developments.

- Pharmaceuticals and Food Sector: Aluminum sulfate is used in the pharmaceutical and food sectors as an acidity regulator and stabilizer, adding another layer of demand as these industries adhere to stringent health and safety regulations.

- Innovations and Eco-friendly Solutions: There is an increasing trend towards sustainable and environmentally friendly manufacturing practices. Innovations that reduce the environmental impact of aluminum sulfate production and enhance the efficiency of its applications in various industries could open new avenues for market growth.

- Regional Developments: Regions like North America and Europe continue to show robust demand due to regulatory support for sustainable practices and high-quality standards. However, the most substantial growth opportunities are presented in the Asia-Pacific region, driven by economic development, rising literacy rates, and an increase in industrial activities.

Key Player Analysis

Aditya Birla Chemicals has a prominent position in the global aluminum sulfate market, showcasing a diverse portfolio that includes advanced materials and chemical solutions across various industries. In 2023, the company emphasized its leadership in the market by participating in major international trade shows to display its innovative product solutions, focusing on sustainable and advanced materials which play a critical role in different sectors including water treatment and pharmaceuticals. The company’s strategy includes enhancing its product offerings and maintaining high-quality standards to meet global demands.

Affinity Chemical focuses on a customer-centric approach, providing reliable and high-quality aluminum sulfate to various sectors including water treatment and paper manufacturing. The company ensures product reliability and customer satisfaction through strategic supply chain management and maintaining competitive pricing. This approach helps Affinity Chemical meet the specific needs of its clients effectively, solidifying its position in the market.

C&S Chemicals, Inc. in 2023, maintains its reputation as a reliable supplier of aluminum sulfate, focusing on high product quality and customer satisfaction. The company caters to diverse industrial applications, ensuring the consistent supply and quality of its products to meet the various needs of its clients. This approach has solidified C&S Chemicals’ position in the aluminum sulfate market, emphasizing reliability and client satisfaction as core aspects of its business strategy.

Chemtrade Logistics Inc. strategically focuses on expanding its presence in the aluminum sulfate market through acquisitions and partnerships, particularly targeting the water treatment and chemical sectors. The company also emphasizes sustainability, adopting eco-friendly production methods to align with global environmental standards. This dual strategy of growth and responsibility helps Chemtrade maintain a competitive edge in the market.

Feralco AB in 2023 focused on integrating its subsidiary Feracid into Feralco Environnement, which is part of their larger strategy to streamline operations and enhance service delivery in the aluminum sulfate market. The company specializes in the production of high-grade aluminum sulfate used in water treatment, paper, and various industrial processes. Feralco AB continues to prioritize environmental sustainability and efficient water management solutions, reinforcing its commitment to quality and eco-friendly practices across Europe.

GAC Chemical Corporation has reinforced its status as a leader in the production of high-quality chemical products, including aluminum sulfate, which is utilized mainly in water treatment processes. In 2023, the company continued its focus on serving diverse industries such as pulp and paper, municipal water treatment, and agriculture, highlighting its comprehensive approach to market demands and environmental stewardship. GAC Chemical’s dedication to quality and customer service remains central to its operations, as the company strives to meet the stringent needs of its clients across various sectors.

GEO Specialty Chemicals has established itself as a prominent player in the aluminum sulfate market, recognized for its extensive range of chemical products. As of 2023, GEO Specialty Chemicals has been actively involved in the production and marketing of aluminum sulfate, particularly focusing on applications in water treatment and papermaking. The company is noted for its ULTRAFLOC and ULTRAPAC brands, which are aluminum-based flocculants and coagulants widely used for their effectiveness in water purification and industrial processes.

Gulbrandsen Chemicals has been proactive in expanding its global footprint in the aluminum sulfate market. In 2023, the company initiated operations at a new plant in Jakarta, Indonesia, focusing on producing aluminum-based water treatment products for the Southeast Asia and Australia/New Zealand markets. This facility reflects Gulbrandsen’s commitment to sustainability and regulatory compliance, aiming to meet the growing demand for water treatment solutions in the region.

Holland Company has been actively producing and supplying aluminum-based products since 1967, establishing itself as a key player in the water purification and treatment market. In 2023, Holland Company continues to deliver high-quality solutions like Aluminum Sulfate and Polyaluminum Chloride, focusing on tailored applications that meet both regulatory requirements and client-specific needs. Their deep experience in the industry allows them to provide reliable, cost-effective products from their headquarters in Western Massachusetts, servicing a broad range of industries including municipalities and various corporations.

Kemira Oyj has established a robust presence in the aluminum sulfate market, particularly noted for its innovation and customer-centric approach. Kemira’s focus extends across multiple applications of aluminum sulfate, including water treatment where the demand for effective coagulants continues to grow. They are known for developing specialized coagulant products that enhance both the efficiency and environmental sustainability of water treatment processes. Kemira’s commitment to R&D and tailored solutions helps it to meet the needs of a diverse clientele, ensuring compliance with global environmental standards

Conclusion

In conclusion, aluminum sulfate remains a vital component in many industrial processes with promising market prospects, driven by technological advancements and an increasing emphasis on sustainability. Firms in the market will need to navigate the balance between innovation, environmental stewardship, and operational efficiency to leverage growth opportunities and enhance market position.

Moreover, the market is witnessing a shift towards more sustainable and environmentally friendly practices, with innovations aimed at reducing the environmental impact of production processes and enhancing application efficiency. However, challenges such as competition from alternative products and stringent environmental regulations necessitate continual innovation and adaptation by market players.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)