Table of Contents

Introduction

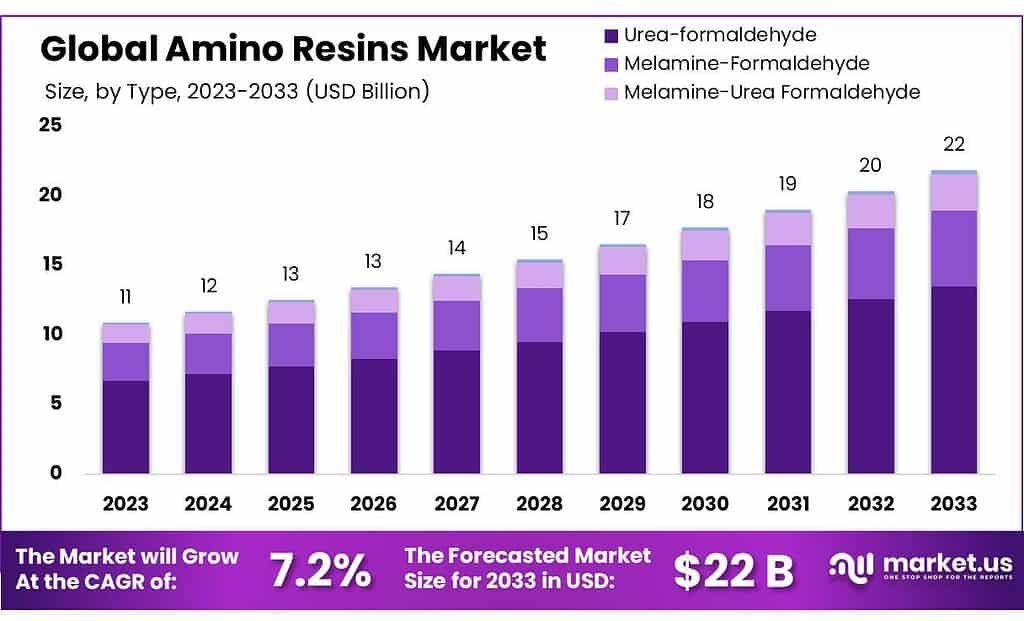

The global Amino Resins Market is anticipated to experience significant growth, expanding from USD 10.9 billion in 2023 to approximately USD 22 billion by 2033, with a compound annual growth rate (CAGR) of 7.2%. This growth is driven by rising demand in key sectors such as paints, coatings, adhesives, and the automotive industry, where amino resins are valued for their excellent adhesive and thermal properties. The transition of populations from rural to urban areas, particularly in Asia, has also boosted the construction sector, further propelling the demand for amino resins.

However, the market faces challenges, including the environmental concerns associated with formaldehyde emissions during resin production, which can pose health risks and environmental hazards. This has led to increased regulatory scrutiny and a shift towards more sustainable, bio-based resin systems, presenting both a challenge and an opportunity for innovation within the industry.

Recent developments in the market highlight the focus on sustainability and efficiency. For example, major players like BASF SE have introduced biomass-balanced amino resins, aiming to replace fossil-based materials in their products with renewable alternatives. This not only addresses environmental concerns but also aligns with global sustainability trends, potentially opening new market opportunities and applications for amino resins.

BASF SE: BASF has been proactive in expanding its product portfolio towards more sustainable solutions. In April 2023, BASF announced a collaboration with the SWISS KRONO Group to launch a new range of biomass-balanced amino resins. This initiative is part of BASF’s strategy to replace fossil-based materials with renewable ones in their product mix, highlighting the company’s commitment to sustainability.

DIC Corporation: A significant move in the market was DIC Corporation’s acquisition of BASF’s global pigments business, BASF Colors & Effects (BCE), completed in June 2021. This acquisition has significantly expanded DIC’s pigments portfolio and strengthened its global footprint, particularly in the European market. The acquisition aims to combine the complementary technologies and resources of both companies, enhancing their capabilities to meet diverse customer demands in the pigments sector.

Key Takeaways

- Market Size and Growth: Expected to grow from USD 10.9 billion in 2023 to USD 22 billion by 2033, with a CAGR of 7.2%.

- Dominant Resin Type: Urea-formaldehyde holds over 61.4% market share, valued for its quick curing and cost-effectiveness.

- Laminate Flooring Demand: Captures a 36.6% market share, favored for its durability and aesthetic appeal in flooring.

- Building and Construction: Largest end-use sector with a 46.5% share, employing resins in flooring and panel products.

- Indirect Sales Channel: Predominates with a 71.2% share, extending market reach through distributors and resellers.

- The Amino Resins Market is witnessing robust growth, with the Asia Pacific region emerging as a dominant player, commanding a leading market share of 38.2%

Amino Resins Statistics

- Amino resins totaling 1.44 billion pounds were consumed in 1993 through adhesive and bonding applications, mainly fibrous and granulated wood products.

- Polymer concrete typically has a composition of about 10% resin and 90% aggregate.

- The aggregate is made up of 50% pea gravel, 35% fine sand, and 15% fly ash.

- According to statistics provided by the major exporters, the largest flows of exports of «Amino-resins, phenolic resins and polyurethanes, in primary forms» in 2022:

- Exports from Belgium to Germany: (2.29% of the world exports, $501 million according to external trade statistics of Belgium)

- Exports from China to the Netherlands: (1.41% of the world exports, $309 million according to external trade statistics of China)

- Exports from China to the USA: (2.31% of the world exports, $507 million according to external trade statistics of China)

- Exports from China to Vietnam: (1.41% of the world exports, $310 million according to external trade statistics of China)

- Exports from Germany to Belgium: (1.5% of the world exports, $328 million according to external trade statistics of Germany)

- Exports from Germany to Italy: (1.94% of the world exports, $426 million according to external trade statistics of Germany)

- Exports from Japan to China: (1.53% of the world exports, $335 million according to external trade statistics of Japan)

- Exports from Korea to China: (1.41% of the world exports, $309 million according to external trade statistics of Korea)

- Exports from USA to Canada: (3.76% of the world exports, $823 million according to external trade statistics of USA)

- Exports from USA to Mexico: (2.28% of the world exports, $500 million according to external trade statistics of USA)

- According to statistics provided by the major importers, the largest flows of imports of «Amino-resins, phenolic resins and polyurethanes, in primary forms» in 2022:

- Imports to Canada from the USA (2.47% of the world imports, $555 million according to external trade statistics of Canada)

- Imports to China from Japan (1.63% of the world imports, $367 million according to external trade statistics of China)

- Imports to China from Korea (1.42% of the world imports, $321 million according to external trade statistics of China)

- Imports to China from Other Asia, nes (1.41% of the world imports, $317 million according to external trade statistics of China)

- Imports to India from China (1.46% of the world imports, $328 million according to external trade statistics of India)

- Imports to Italy from Germany (2.05% of the world imports, $460 million according to external trade statistics of Italy)

- Imports to Poland from Germany (1.39% of the world imports, $313 million according to external trade statistics of Poland)

- Imports to the USA from China (2.27% of the world imports, $509 million according to external trade statistics of USA)

- Imports to the USA from Germany (1.91% of the world imports, $430 million according to external trade statistics of USA)

- Imports to Vietnam from China (1.56% of the world imports, $351 million according to external trade statistics of Vietnam)

Emerging Trends

Emerging trends in the Amino Resins market are closely tied to technological advancements and growing environmental concerns, which are shaping the industry’s trajectory. A prominent trend is the increased demand for sustainable and eco-friendly resin products. Companies are progressively integrating bio-based materials into amino resins to reduce reliance on fossil-based resources. This shift is not only driven by regulatory pressures but also by consumer preferences for sustainable products.

Another key trend is the development of amino resins with enhanced performance characteristics such as improved durability and resistance to heat and chemicals. These advancements are particularly relevant in the construction and automotive sectors, where amino resins are used extensively for coatings, adhesives, and composite materials.

The market is also seeing innovations in amino resin applications in non-traditional sectors. For example, new uses in electrical and electronics manufacturing are emerging, where amino resins are valued for their insulating properties. Additionally, there’s growing utilization in the textile industry for finishing treatments that improve fabric qualities like wrinkle resistance and shrinkage control.

Furthermore, the geographical expansion of the market, particularly in the Asia-Pacific region, is a significant trend. This region’s rapid industrial growth, coupled with increasing urbanization and higher income levels, is boosting demand for amino resins used in building materials and home furnishings.

Use Cases

- Automotive Industry: Amino resins are essential in the automotive sector, especially in coatings. They are used to enhance the finish of vehicles, providing a smooth and durable surface that is resistant to environmental and chemical damage. This use not only improves the aesthetic appeal of vehicles but also offers protection against corrosion and UV rays

- Construction and Housing: In the construction industry, amino resins are primarily used as binders in wood products like particle board and medium-density fiberboard (MDF). These resins improve the moisture resistance and structural integrity of these materials, making them ideal for use in furniture and housing structures.

- Electrical and Electronics: Due to their excellent insulating properties, amino resins are used in the manufacturing of electrical components. These resins help in enhancing the safety and durability of electrical appliances by providing flame retardancy and insulation, crucial for preventing fires and ensuring consumer safety.

- Textile Industry: In textiles, amino resins are used to enhance the quality of fabrics. They are applied as finishing agents that impart wrinkle resistance and improve the durability of the fabric, which is particularly valuable in creating garments that maintain their shape and appearance over time.

- Paper Products: Amino resins are used in the paper manufacturing process to improve the paper’s strength and finish. By acting as adhesives, they enhance the inter-fiber bonding, which is critical for high-quality paper products.

Key Players Analysis

BASF SE has been proactive in the amino resins sector, particularly emphasizing sustainability and innovation. The company has launched Kaurit® ZERO and Kauramin® BALANCE, which are biomass-balanced amino resins, aiming to replace fossil-based materials with renewable ones in their production processes. This initiative is part of BASF’s broader strategy to reduce the carbon footprint of their products and promote more sustainable solutions in the wood-based panel industry. These efforts demonstrate BASF’s commitment to environmental sustainability while maintaining product quality and performance.

Chemique Adhesives & Sealants Ltd continues to be recognized for its significant role in the amino resins market, particularly in adhesive applications. While specific recent innovations or projects from Chemique were not highlighted in the latest search, the company is known for its expertise in developing bespoke adhesive systems that cater to a wide range of industrial needs. Their products are widely appreciated for their performance and reliability in various applications.

Acron: Acron is actively involved in the amino resins market, leveraging its expertise in the chemical sector to cater to a broad range of industrial applications. The company’s involvement enhances the production capabilities in the amino resins sector, particularly benefiting from the rising demand in construction and automotive industries. Acron’s strategic focus is likely centered on maintaining a competitive edge by aligning with market demands and advancements in material sciences.

Arclin Inc.: Arclin Inc. is a significant player in the amino resins market, particularly known for its contributions to the construction and manufacturing industries. The company focuses on producing specialized resins that are crucial for the production of composite wood products, among other applications. Arclin’s products are integral in meeting the demand for high-quality resins used in a wide range of industrial applications, showcasing a commitment to innovation and quality in their offerings.

DIC Corporation: DIC Corporation plays a significant role in the amino resins market, specializing in the production of coatings and adhesives that are widely utilized across various industries. Their products are appreciated for their quality and effectiveness, particularly in enhancing the performance of coatings and inks through superior binding properties. DIC’s contribution to the amino resins sector is marked by its focus on innovation and sustainability, aiming to meet the evolving demands of the market.

Eastman Chemical Company: Eastman Chemical Company has a longstanding presence in the chemical industry, including a robust involvement in the amino resins sector. They provide a variety of resin intermediates used in manufacturing coatings, composites, adhesives, and inks. Eastman is known for its broad product offerings and technical expertise, which enable it to produce resins that meet stringent performance and environmental standards. Their focus on customer service and sustainable solutions further solidifies their position as a key player in the market.

Ercros SA has innovated in the amino resins market through its ErcrosGreen+ range, emphasizing sustainability by significantly reducing formaldehyde emissions. This development aligns with stringent environmental standards, particularly in Europe, the USA, and Japan, making their products suitable for sensitive applications in construction. Ercros’s production facilities in Tortosa are central to these advancements, showcasing their commitment to environmental responsibility and high-quality chemical production.

Dynea AS, recognized as a leader in the amino resins industry, specializes in providing high-quality resins used predominantly in wood adhesives. Their products are integral to creating durable and reliable wood composites, catering to a wide range of industrial applications. Dynea’s focus on innovation and quality has positioned them as a key player in the global market, where they continue to influence product standards and industry practices.

Ercros SA is prominent in the amino resins market, particularly noted for its ErcrosGreen+ range. This product line stands out due to its advanced technology that significantly reduces formaldehyde emissions, aligning with stringent international environmental standards. Ercros emphasizes sustainability and innovation in its operations, particularly in its Tortosa-based R&D center, which is dedicated to enhancing the environmental profile and performance of its resin products. This focus reflects Ercros’s commitment to sustainable development and quality in the chemical industry.

Dynea AS is renowned for its specialization in amino resins, primarily used in wood adhesives and coatings. Their products are essential for creating durable wood composites that are critical in various industrial applications. With a commitment to quality and innovation, Dynea has established itself as a key player in the global amino resins market. Their focus on developing high-performance resins has enabled them to maintain a strong presence in the industry, catering to the needs of a diverse clientele.

Hexion: Hexion has established itself as a leader in the amino resins industry, with a history extending over a century. The company leverages a global supply network and expert technical assistance to deliver high-quality amino resins. Hexion’s product offerings are diverse and customizable, catering to a broad range of applications including coatings and adhesives. Their focus on innovation allows them to meet the specific needs of their customers, making their resins suitable for a variety of industrial uses.

Georgia-Pacific Chemicals has been focusing on innovation within the amino resins sector, particularly in developing sustainable adhesive solutions. They have successfully scaled up their production capacity for soy-based amino resins, which positions them as a leader in the sustainable adhesives market. This initiative demonstrates their commitment to eco-friendly product alternatives and aligns with the increasing regulatory and consumer demand for greener products.

Synpol Products Private Limited is a key player in the amino resins market, known for producing a variety of amino resins including butylated urea, melamine, and benzoguanamine formaldehyde resins. These resins are primarily used in the coatings industry for both industrial and household appliances. Synpol’s products are designed to support mass production applications with their suitability for baking processes, which meet the demands of volume production with minimal area and time requirements.

Uniform Synthetics is recognized for its expertise in the production of amino resins, among other synthetic resins. The company focuses on delivering high-quality resins that are used across various applications including coatings, adhesives, and sealants. Their commitment to quality and customer satisfaction is evident in their product offerings and business operations, although specific recent developments or detailed activities in the amino resins sector were not highlighted in the latest searches.

Wanhua Ecoboard Co. Ltd specializes in the development and manufacturing of environmentally friendly materials, including amino resins. They focus on sustainable practices within the industry, aiming to produce materials that are not only effective but also minimize environmental impact. The details of their specific activities or products in the amino resins market were not extensively covered in the latest available data. For up-to-date information on their specific offerings in amino resins, direct contact or further detailed industry reports would be required.

Conclusion

In conclusion, the Amino Resins market is poised for significant growth, driven by its versatile applications across diverse industries such as automotive, construction, and electronics. The market’s expansion is supported by the increasing demand for products that offer excellent adhesive properties, durability, and resistance to heat and chemicals. Innovations and advancements in the production of more environmentally friendly amino resins are also helping to mitigate the impact of stringent environmental regulations that have previously restrained market growth.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)