Table of Contents

Introduction

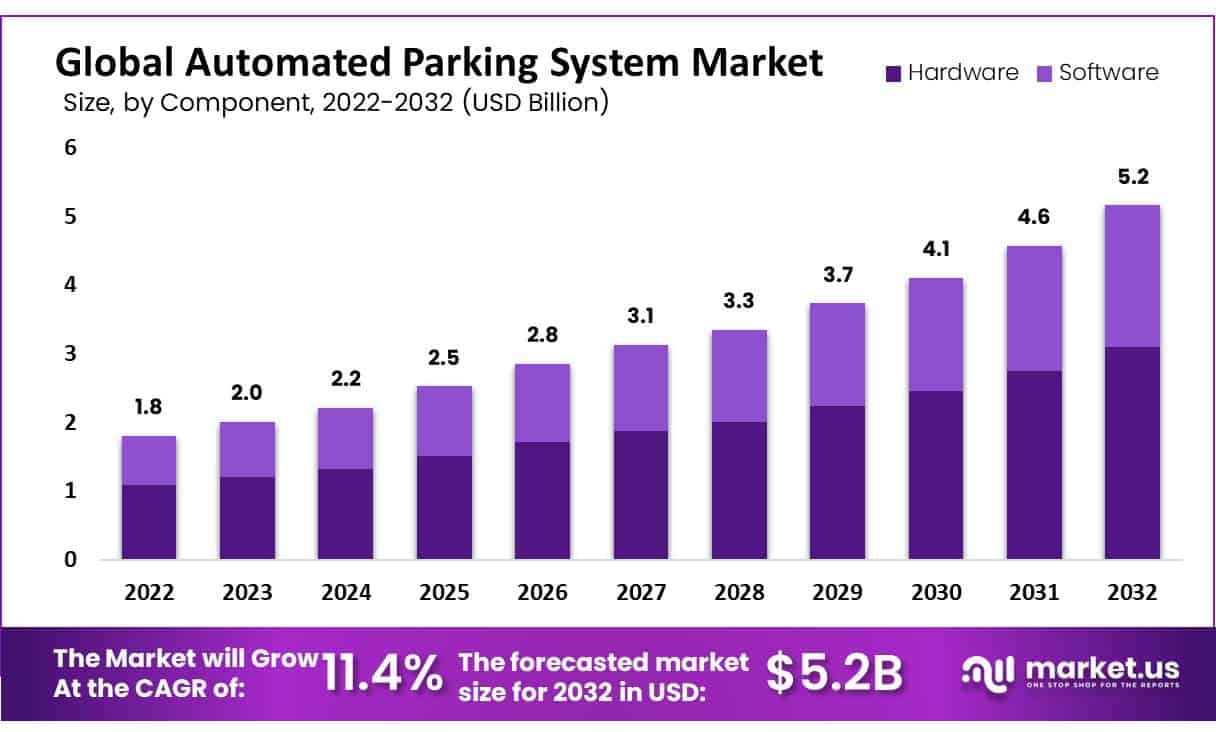

The global Automated Parking System (APS) Market, valued at approximately USD 1.8 billion in 2022, is anticipated to grow significantly, reaching an estimated USD 5.2 billion by 2032, with a compound annual growth rate (CAGR) of 11.4% from 2023 to 2032. This growth is driven by several key factors, including rapid urbanization, the increasing number of vehicles, and the associated challenges of traffic congestion and parking shortages in major cities worldwide.

One of the primary growth drivers for the APS market is the escalating demand for efficient parking solutions in urban areas where space is at a premium. As cities expand and populations grow, the scarcity of parking spaces has become a critical issue, leading to increased interest in automated solutions that maximize parking capacity within limited spaces. APS offers a viable solution by utilizing vertical stacking, robotic systems, and intelligent parking management to optimize space and reduce land use.

The adoption of APS is further propelled by advancements in smart city initiatives and the growing trend of autonomous vehicles. These systems are increasingly integrated into smart city frameworks, offering real-time data on parking availability and traffic flow, thereby enhancing urban mobility. Additionally, the rise of autonomous vehicles is expected to boost the demand for APS, as these systems can seamlessly integrate with self-parking technologies, providing a more convenient and efficient experience for users.

Despite the promising growth prospects, the APS market faces several challenges. The high initial capital investment required for the installation of automated parking infrastructure is a significant barrier, particularly for smaller developers and municipalities. Moreover, concerns about system reliability, safety, and cybersecurity also pose challenges to widespread adoption. Addressing these issues will be crucial for the market to achieve its full potential.

Recent developments in the APS market reflect a growing emphasis on innovation and strategic partnerships. Key players are focusing on enhancing their product offerings through mergers, acquisitions, and collaborations with technology and real estate firms. For instance, companies are increasingly developing fully automated systems that offer higher efficiency, reduced emissions, and enhanced safety compared to traditional parking methods.

Regionally, Europe holds the largest share of the APS market, driven by stringent regulations on land use, a high degree of urbanization, and a strong demand for eco-friendly technologies. Meanwhile, the Asia Pacific region is expected to witness the fastest growth, supported by rapid urbanization, government initiatives for smart city projects, and the increasing prevalence of vehicle ownership.

Fata Automation, Inc. Product Expansion: Fata Automation has enhanced its range of automated parking solutions, offering systems such as crane, puzzle, shuttle, silo, and tower systems. These systems are designed to optimize parking space utilization and improve operational efficiency. The puzzle system, for example, can utilize around 95% of the floor area, making it one of the densest parking solutions available. Technological Improvements: Fata has focused on integrating advanced technologies such as crane mechanisms for simultaneous horizontal and vertical movements, as well as shuttle systems that use autonomous shuttles for efficient vehicle retrieval and parking.

Fehr Lagerlogistik AG has been actively involved in strategic collaborations to expand its market presence, particularly in Europe. The company is known for its high-density parking solutions and has been focusing on increasing the automation level in its systems, aiming to reduce the need for human intervention and improve parking efficiency. The company continues to innovate in parking technology, focusing on solutions that minimize land usage and support urban sustainability efforts.

Klaus Multiparking has been actively involved in strategic acquisitions to strengthen its market position. The company has also partnered with real estate developers to integrate its parking systems into new residential and commercial projects, especially in high-density urban areas. Klaus Multiparking continues to lead innovation by developing new parking systems that maximize space efficiency and reduce environmental impact. The company has also focused on increasing the safety features of its systems, which is crucial for gaining consumer trust in automated solutions.

Automated Parking System (APS) Statistics

- The global semi-automatic parking system market size is expected to reach USD 160.51 million by 2024, with a market share of 72.92%.

- Europe is the largest revenue market. The Europe automatic parking system market size is estimated to be USD 990.27 million in 2024, with a market share of 41.30%.

- The Asia Pacific and North American markets are expected to rank second and third with 27.46% and 21.30%, respectively.

- Unlike current conventional parking solutions, automated parking requires from 50% to a mere third of the land to build the required parking spaces for your development.

- the National Parking Association claimed a surface lot of that size could normally accommodate 25 to 30 automobiles. Our newest facility, the Ibn Battuta Gate car park in Dubai, U.A.E., is a seven-level, 57-foot high facility with 765 spaces within a 276-foot by 98-foot space.

- The results show that the parking system designed in this study can control the parking error, has a smaller parking error than ZigBee, and has more than 25.64% less parking time than ZigBee, and more than 34.83% less time than manual parking.

- CNNs parking time is 5.8 seconds, ZigBee parking time is 7.8 seconds, and manual parking time is 8.9 seconds. On the whole, the time consumption of CNN intelligent parking navigation system is 25.64% less than that of ZigBee and 34.83% less than that of manual parking.

- When there are 20 vacant parking spaces, the energy consumption of CNNs is 24 MW, ZigBee’s energy consumption is 46 MW, and that of CNNs is about 47.8% lower than ZigBee.

- When the number of vehicles reaches 120, the energy consumption of CNNs reaches 110 MW, ZigBee energy consumption is 101 MW, and CNNs is higher than ZigBee energy consumption by 8.1%.

- The World Record for the largest automated parking system with 2,314 spaces belongs to the Al Jahra Court Complex in Kuwait.

- The biggest automated parking system was Emirates Financial Towers (EFT) in Dubai with 1,191 parking spaces which earned its standing in 2010.

- Lueth says intelligent parking solutions are delivering significant results in New York City, San Francisco, London, and Berlin. According to IoT Analytics data, 11% of parking spaces worldwide are now smart and that number is expected to increase to 16% by 2023.

- IBM’s global parking survey estimated that over 30 percent of traffic slowdowns in a city are caused by drivers searching for a parking spot.

- Scalable solutions for Parking Systems are available, using 4 Fisheye Cameras with >180° FoV and 8-12 Ultrasonic Sensors to detect everything around the vehicle.

Emerging Trends

- Integration with Smart City Infrastructure: As urbanization accelerates, cities are increasingly turning to smart technologies to manage space efficiently and reduce congestion. Automated parking systems are being integrated into broader smart city initiatives, utilizing IoT (Internet of Things) and AI-driven technologies to optimize traffic flow and provide real-time data on parking availability. This trend is particularly strong in regions with high urban density, such as Asia and Europe.

- Adoption of Autonomous Vehicles (AVs): The rise of autonomous vehicles is creating a synergistic relationship with automated parking systems. AVs require advanced parking solutions that can communicate with the vehicle to park without human intervention. This trend is pushing APS developers to innovate and create systems that are fully compatible with AV technologies, which is expected to become a standard requirement as AV adoption grows.

- Sustainability and Green Building Practices: There is a growing emphasis on sustainability in urban development, which is driving the adoption of APS. These systems reduce the need for extensive parking lots and lower carbon emissions by minimizing the time vehicles spend idling while searching for parking. Moreover, APS contributes to green building certifications by optimizing land use and integrating with renewable energy sources.

- Advanced User Experience with Mobile Apps: User convenience is a critical factor in the adoption of APS. Developers are increasingly offering mobile apps that allow users to reserve parking spots in advance, pay for parking, and retrieve their vehicles with minimal effort. These apps also provide real-time updates on parking availability and estimated wait times, enhancing the overall user experience.

- Customization and Modular Systems: There is a shift towards more flexible and modular APS designs that can be customized to fit specific site requirements. This trend is particularly important for developers who need to integrate parking solutions into existing structures or who are working with limited space. Modular systems offer scalability, allowing parking facilities to grow as demand increases.

- Increased Focus on Security and Safety: As automated systems become more widespread, there is an increasing focus on enhancing security features. This includes the implementation of advanced surveillance systems, secure access controls, and redundancy features to ensure that systems remain operational even in the event of a failure. These safety features are becoming a standard expectation in high-end APS installations, especially in regions with strict regulatory standards.

- Cost Reduction and Efficiency Improvements: The cost of implementing APS has traditionally been a barrier, but ongoing advancements in technology are making these systems more affordable. Innovations in materials, automation technology, and energy efficiency are helping to lower both initial installation costs and ongoing operational expenses, making APS a more viable option for a broader range of applications.

- Global Expansion and Localization: While APS technology has been more prevalent in regions like Europe and Japan, there is a growing interest in other parts of the world, including North America and emerging markets in Asia and the Middle East. Companies are localizing their solutions to meet the specific needs and regulatory requirements of these new markets, driving the global expansion of APS technologies.

Use Cases

- Urban Residential Complexes: In densely populated urban areas, residential buildings often lack sufficient parking spaces, leading to congestion and inefficient land use. APS can be integrated into high-rise residential complexes, providing vertical parking solutions that maximize space usage. For example, a residential tower in New York City utilizes an automated parking system that accommodates 24 vehicles in a space that would traditionally fit only 12, effectively doubling the parking capacity.

- Commercial Office Buildings: Office buildings in busy business districts face a high demand for parking, especially during peak hours, leading to time wastage and frustration for employees and visitors. APS in commercial buildings can streamline parking by automatically allocating spots and reducing the time needed to find parking. A commercial building in Tokyo implemented an APS that reduced parking time by 50%, significantly improving the user experience and reducing congestion around the building.

- Airports: Airports handle thousands of passengers daily, with many needing long-term parking. Traditional parking lots can be sprawling, making it difficult for passengers to find parking and walk to terminals. Automated parking systems can offer a compact, multi-level parking solution close to terminals. At Düsseldorf Airport in Germany, an APS was implemented to provide 2,000 parking spaces within a confined area, improving convenience for travelers and optimizing space.

- Shopping Malls: Shopping malls attract large crowds, particularly during weekends and holidays, leading to parking shortages and traffic jams. Shopping malls can integrate APS to manage peak-time parking demand. A mall in Dubai adopted an APS that increased its parking capacity by 35% without requiring additional land, allowing for smoother traffic flow and enhanced customer satisfaction.

- Hospitals: Hospitals need to ensure quick and easy access to parking for patients, visitors, and staff, often in limited urban spaces. APS can provide efficient parking solutions, ensuring that critical space is used effectively. A hospital in Singapore uses an automated parking system that prioritizes quick access for emergency vehicles and staff while offering additional parking for visitors.

- Luxury Hotels: Luxury hotels in urban centers face the challenge of providing ample and secure parking for high-end clientele in areas with limited space. APS can be integrated into hotel designs to offer valet-style parking without the need for extensive ground-level space. A luxury hotel in Hong Kong implemented an APS that provides secure parking for guests’ vehicles while using 40% less space than a conventional garage.

- Public Transportation Hubs: Public transportation hubs such as train stations often suffer from a lack of adequate parking, leading to underutilization of public transport options. APS at transportation hubs can encourage the use of public transport by providing secure, convenient parking. A train station in Amsterdam implemented an APS that reduced parking time by 60%, making it easier for commuters to park and ride.

- Entertainment Venues: Large entertainment venues such as stadiums and theaters often face overwhelming parking demands during events, leading to traffic congestion and long wait times. An APS can efficiently manage the inflow and outflow of vehicles during events. A stadium in Munich incorporated an APS that increased its parking capacity by 25% and reduced exit times by 40%, greatly enhancing the visitor experience.

Major Challenges

- High Initial Costs: Implementing an automated parking system requires significant upfront investment, which includes the cost of advanced machinery, robotics, and software integration. These costs can be prohibitive for smaller developers or municipal projects with limited budgets. For example, a fully automated parking system can cost up to $35,000 per parking space, compared to $20,000 for a conventional parking space. This high capital expenditure remains a significant barrier to wider adoption, particularly in regions with lower income levels or less dense urban areas.

- Complex Maintenance and Operating Costs: APS involves complex mechanical and electronic systems that require regular maintenance to ensure reliability and safety. The maintenance costs can be high, especially in systems that handle a large volume of vehicles daily. Any mechanical failure can lead to significant downtime, affecting the overall operation of the facility and leading to potential loss of revenue. Additionally, these systems require skilled personnel for operation and troubleshooting, which can further add to operational costs.

- Technological Reliability and Safety Concerns: Automated parking systems depend heavily on technology, including sensors, robotics, and software. If these components fail, it could lead to vehicles getting stuck or even damage to vehicles, raising concerns about the reliability and safety of the system. The integration of new technologies, such as AI and IoT, also introduces cybersecurity risks, as these systems could be vulnerable to hacking, which could compromise user data or disrupt operations.

- User Acceptance and Adaptation: Despite the potential benefits, some users are hesitant to trust automated systems with their vehicles due to fears of malfunction or damage. There is also a learning curve associated with using APS, particularly for older users who may be less familiar with digital interfaces. This reluctance can hinder the widespread acceptance and use of automated parking solutions, especially in regions where traditional parking methods are deeply ingrained.

Market Growth Opportunities

- Urbanization and Smart City Development: The rapid growth of urban populations is creating a pressing need for efficient space utilization in cities. As cities become more crowded, the demand for smart infrastructure, including automated parking systems, is rising. Governments and municipal bodies are increasingly integrating APS into smart city projects to optimize land use, reduce congestion, and improve urban mobility. For instance, cities like Singapore and Tokyo are already implementing APS as part of their smart city initiatives, opening up significant growth opportunities for APS providers.

- Increasing Vehicle Ownership: The global increase in vehicle ownership, particularly in emerging markets, is driving the need for innovative parking solutions. With more cars on the road, traditional parking methods are becoming insufficient, leading to a greater demand for APS that can maximize parking space efficiency. Regions like Asia-Pacific, which is expected to see a substantial rise in vehicle ownership, present a lucrative market for APS developers.

- Environmental Sustainability: As cities and corporations prioritize sustainability, APS offers a compelling solution by reducing the carbon footprint associated with traditional parking. Automated systems reduce the time vehicles spend idling while looking for parking, thus cutting down emissions. Moreover, APS facilities typically require less land and can incorporate green spaces, aligning with the growing global emphasis on environmental conservation. This trend is particularly strong in Europe, where green building practices are driving the adoption of APS.

- Integration with Autonomous Vehicles (AVs): The rise of autonomous vehicles presents a unique opportunity for the APS market. AVs require advanced parking solutions that can communicate seamlessly with the vehicle’s systems, enabling self-parking. As AV technology becomes more widespread, the demand for compatible APS is expected to grow, providing a new avenue for market expansion. Companies that can offer APS solutions tailored to AVs will be well-positioned to capitalize on this emerging trend.

Key Player Analysis

Fata Automation, Inc., a company with a long history in industrial automation, has made significant strides in the Automated Parking System (APS) sector. In 2023, Fata Automation focused on expanding its APS offerings by introducing a range of systems, including crane, puzzle, shuttle, silo, and tower systems. These systems are designed to maximize parking space efficiency and cater to various urban and commercial needs. For example, in July 2023, Fata launched a new shuttle system that integrates autonomous shuttles for faster vehicle retrieval, aiming to reduce parking times by up to 35%. By September 2023, Fata had also enhanced its puzzle system to offer higher-density parking solutions, utilizing approximately 95% of available floor space, making it one of the most space-efficient options in the market. The company continues to innovate, aiming to address the growing demand for smart, efficient, and sustainable parking solutions in densely populated urban areas.

Fehr Lagerlogistik AG, operating under the brand Skyline Parking AG, has been actively expanding its footprint in the Automated Parking System (APS) sector throughout 2023. In March 2023, the company launched a new high-density parking solution designed to optimize urban space usage by implementing advanced vertical parking technologies. By June 2023, Fehr had completed the installation of a large-scale APS in a major European city, which significantly reduced the required parking area by over 40% compared to traditional methods. In October 2023, the company announced further innovations in their APS technology, integrating AI-driven management systems that enhance operational efficiency and vehicle retrieval times. These developments reflect Fehr Lagerlogistik AG’s commitment to leading the market with cutting-edge, space-saving parking solutions tailored for densely populated urban areas.

Unitronics 1989 RG Ltd. has been actively advancing its presence in the Automated Parking System (APS) sector throughout 2023. In February 2023, the company launched a new series of fully automated parking systems designed to integrate seamlessly with smart city infrastructures. This launch emphasized the use of IoT (Internet of Things) for real-time monitoring and efficient space management. By May 2023, Unitronics had completed a significant project in a major North American city, implementing their APS in a large residential complex, which increased parking efficiency by 30% compared to traditional parking solutions. In August 2023, Unitronics introduced enhancements to their software platforms, enabling better data analytics and predictive maintenance, which are critical for reducing operational downtime and enhancing the user experience. These developments underscore Unitronics’ commitment to leveraging advanced technology to meet the growing demand for efficient and smart parking solutions in urban environments.

Klaus Multiparking GmbH has been an innovative leader in the Automated Parking System (APS) sector throughout 2023, focusing on expanding its product offerings and global presence. In March 2023, the company introduced a new version of its “MasterVario” system, which offers enhanced flexibility and space utilization for both residential and commercial buildings. This system can accommodate various vehicle sizes and is particularly designed for high-density urban environments. By June 2023, Klaus Multiparking completed a major installation in a luxury condominium in New York, integrating their advanced parking solutions to maximize parking capacity in a limited space. In September 2023, the company announced a partnership with a prominent real estate developer in Dubai to implement APS in several upcoming high-rise projects, aiming to improve parking efficiency and reduce the environmental footprint. These initiatives highlight Klaus Multiparking’s ongoing commitment to delivering state-of-the-art parking solutions that meet the needs of modern urban development.

Westfalia Technologies Inc. has been actively expanding its role in the Automated Parking System (APS) sector throughout 2023, focusing on integrating advanced technologies to enhance parking efficiency and space utilization. In February 2023, Westfalia introduced a new version of its automated parking system that features enhanced robotic retrieval mechanisms, reducing vehicle retrieval times by 20%. By April 2023, the company completed a significant project in Philadelphia, implementing their APS in a mixed-use development, which provided over 250 parking spaces in an area traditionally able to accommodate only 150, demonstrating a significant improvement in space efficiency. In August 2023, Westfalia announced a collaboration with a major automotive company to develop APS solutions tailored for electric vehicles, focusing on integrating EV charging stations within the parking systems. This partnership is set to support the growing market for electric vehicles by offering combined parking and charging solutions, further positioning Westfalia as a leader in the APS market.

Amano Corporation has been actively contributing to the Automated Parking System (APS) sector, focusing on developing advanced solutions to address the growing demand for efficient parking in urban areas. In January 2023, Amano introduced a new series of parking management systems that integrate cloud-based technologies, allowing for real-time monitoring and data analytics to optimize parking operations. By March 2023, the company had implemented a significant APS project in Tokyo, which incorporated AI-driven features to enhance parking space utilization and reduce wait times for vehicle retrieval by 15%. Additionally, in June 2023, Amano announced a collaboration with a leading smart city developer in Singapore to deploy their APS solutions as part of a larger urban development project, aiming to streamline traffic flow and improve parking efficiency in high-density areas. These developments reflect Amano Corporation’s ongoing commitment to leveraging technology to solve complex urban parking challenges.

Flowbird Group has been actively innovating in the Automated Parking System (APS) sector, particularly focusing on integrating digital payment solutions and smart city technologies. In February 2023, Flowbird launched a new parking management platform that leverages cloud technology to provide real-time data analytics and mobile payment options, enhancing the user experience in urban areas. By April 2023, the company had successfully deployed its APS solutions in a large-scale project in Paris, where they introduced contactless payment systems integrated with local transportation networks, enabling seamless mobility for users. In July 2023, Flowbird expanded its collaboration with several European cities, focusing on integrating APS with broader smart city initiatives, which include traffic management and environmental monitoring. These developments highlight Flowbird Group’s commitment to advancing urban mobility through innovative parking solutions that align with the growing trend toward smart, connected cities.

In the Automated Parking System (APS) sector, IBM Corporation has been leveraging its expertise in artificial intelligence (AI) and cloud computing to drive innovation and efficiency. In March 2023, IBM introduced a new AI-powered parking management system designed to optimize space utilization and reduce operational costs in urban environments. This system utilizes real-time data analytics and machine learning algorithms to predict parking space availability and manage traffic flow within parking facilities. By June 2023, IBM had partnered with several smart city projects in North America to integrate its APS solutions with broader urban infrastructure, focusing on enhancing mobility and reducing congestion. Additionally, in August 2023, IBM announced the development of a blockchain-based payment system for automated parking, aimed at increasing transparency and security in transactions. These initiatives reflect IBM’s strategic focus on integrating advanced technologies into the APS sector to create more efficient and sustainable urban environments.

Robotic Parking Systems, Inc. has been a pioneer in the Automated Parking System (APS) industry, focusing on developing high-capacity, efficient parking solutions that utilize robotic technology. In January 2023, the company introduced an upgraded version of its robotic parking system, which increases storage capacity by 20% and reduces vehicle retrieval times to under two minutes. This upgrade was particularly aimed at addressing the needs of densely populated urban areas where space is at a premium. By April 2023, Robotic Parking Systems had completed a major installation in Dubai, where its technology was used to create one of the largest automated parking facilities in the region, capable of accommodating over 1,200 vehicles. In July 2023, the company announced a new initiative to integrate renewable energy sources into its parking systems, making them more sustainable and aligning with global efforts to reduce carbon emissions. These developments highlight Robotic Parking Systems, Inc.’s commitment to advancing the efficiency and environmental sustainability of urban parking solutions.

Siemens AG has been actively advancing its role in the Automated Parking System (APS) sector by leveraging its expertise in smart infrastructure and digitalization. In February 2023, Siemens launched an innovative APS solution that integrates its cutting-edge building management systems with automated parking technology. This new system aims to optimize parking efficiency in smart cities by utilizing IoT sensors and AI-driven analytics to manage parking spaces dynamically and reduce energy consumption. By May 2023, Siemens had successfully implemented this system in a major urban development project in Munich, enhancing parking capacity by 30% while also reducing the operational carbon footprint. Additionally, in July 2023, Siemens announced a collaboration with a leading European automotive manufacturer to develop an APS specifically designed for electric vehicles, which includes integrated charging stations and energy management systems. These initiatives reflect Siemens’ commitment to pioneering sustainable and efficient parking solutions that align with the evolving demands of urban environments.

Conclusion

In conclusion, the Automated Parking System (APS) market is poised for significant growth as urbanization intensifies and the demand for efficient, space-saving parking solutions increases. With advancements in technology, including the integration of IoT, AI, and renewable energy, APS is becoming a critical component of smart city infrastructure.

Companies like Siemens AG, Robotic Parking Systems, and others are leading the charge by developing innovative solutions that not only maximize parking capacity but also contribute to sustainability efforts. As cities continue to expand and vehicle ownership rises, APS offers a viable solution to address the challenges of limited urban space and environmental impact, positioning itself as an essential element in the future of urban planning and development.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)