Table of Contents

Introduction

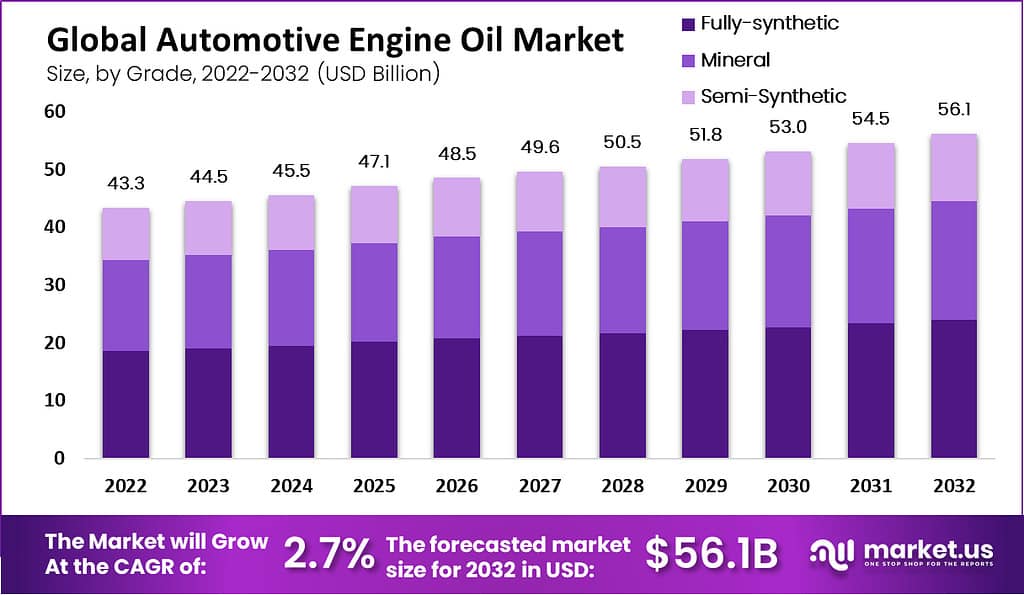

The global Automotive Engine Oil Market is projected to grow from USD 43.3 billion in 2023 to USD 56.1 billion by 2033, at a compound annual growth rate (CAGR) of 2.7%. Several factors contribute to this growth, including the increasing demand for high-performance vehicles, advancements in engine technologies, and the growing awareness about the benefits of regular vehicle maintenance. The rising production and sales of both passenger and commercial vehicles, particularly in emerging economies, have significantly driven demand for automotive engine oil.

Synthetic oils are playing a key role in market expansion due to their superior performance, longevity, and ability to enhance engine efficiency. Fully synthetic oils, which offer better lubrication and lower friction, have become the fastest-growing segment in the market. This trend is bolstered by the increasing demand for high-quality, eco-friendly engine oils, particularly in Europe and Asia-Pacific. Asia-Pacific leads the market, accounting for over 40% of global revenue in 2021, driven by rapid urbanization, industrial growth, and the expanding automotive industry in countries like China and India.

However, the market faces several challenges. Price fluctuations due to volatile crude oil prices and rising competition in the sector are significant concerns for manufacturers. The introduction of electric vehicles (EVs) also poses a long-term challenge, as EVs do not require conventional engine oil. Despite this, the demand for traditional engine oils remains strong, especially for diesel and gasoline-powered vehicles, which continue to dominate global transportation.

Recent developments in the automotive engine oil market include a shift towards synthetic and semi-synthetic oils, which provide better engine protection and extended oil change intervals. For instance, Valvoline and Shell have introduced innovative products catering to modern engine requirements. Additionally, environmental regulations are pushing manufacturers to develop low-viscosity, eco-friendly oils that comply with new emission standards.

In March 2023, Valvoline completed the sale of its Global Products business to Aramco for $2.65 billion. This deal allows Valvoline to focus solely on its retail services, aiming to expand its automotive services segment. The transaction is part of Valvoline’s strategy to drive growth and enhance shareholder value by investing in its retail footprint and franchisee growth.

Additionally, in 2021, Valvoline launched its Full Synthetic Extended Protection motor oil, utilizing innovative Dual Defense Additive Technology. This product is designed to maximize engine longevity by combating wear and deposits. While specific automotive engine oil developments for Wurth Group are limited, the company has continued to strengthen its position in automotive supplies, including lubricants, by expanding its global distribution network and improving product accessibility in new markets.

Castrol has focused on environmental sustainability with the development of low-carbon products. Recently, Castrol has invested in creating carbon-neutral lubricants, targeting the growing market of eco-conscious consumers. Castrol’s synthetic oil products continue to see high demand, especially in regions like Europe and North America.

ExxonMobil remains a significant player in the engine oil market with ongoing product innovations, particularly in synthetic oil development. The company is pushing boundaries with products like Mobil 1 synthetic motor oil, known for its ability to enhance engine performance under extreme conditions. ExxonMobil has also strengthened its foothold in the Asia-Pacific region, focusing on expanding its lubricants market in China and India, which are projected to see significant growth in vehicle sales.

Statistics

- Using this type of oil means you won’t need to change it as frequently as you would a regular oil, being able to work for an average of 5000 miles to 10,000 miles, whereas regular oil should be changed after 3,000 miles.

- A semi-synthetic oil on the other hand is a blend between regular motor oil and fully synthetic. They come with SAE Ratings around 5W-30, 10W-40 or 15W-40.

- The shelf life of engine oil is around 4 to 5 years

- To extend their lifespan and optimize their effectiveness, regular tire rotation is typically recommended by manufacturers at intervals between 5,000 and 8,000 kilometers.

- For the first 1,000-1,200km, it is advised to keep the engine revving under 2000 rpm in the case of a diesel engine and between 2500-2700 rpm for a petrol car.

- Approximately 11.5% of fuel energy in typical passenger cars is wasted owing to frictional losses in automobile engines.

- In tribal-contact rubbing situations, molybdenum disulfides formed at 100 °C.

- According to relevant statistics, more than 50% of the malignant faults of mechanical equipment are caused by lubrication failure and excessive wear.

- The approximate life of 6.4 l engine oil is 8000 miles (about 12800 km), while the approximate life of 6.7 L engine oil is 12500 miles (about 20000 km).

- Combined with the statistical analysis method, it is obtained that the failure mileage of lubricating oil is 7600 km at a 90% confidence level.

- Kinematic viscosity at 40 °C and 100 °C – low-shear viscosity – determined according to ASTM D445, whereas the alternative method according to ASTM D7042 delivers comparable results.

- High-shear viscosity (10/s) at a high temperature of 150 °C – HSHT viscosity – determined according to ASTM D4683, CEC L-36-A-90 (ASTM D 4741) or ASTM DS481.

- Borderline pumping temperature of max. 60 000 mPa.s at defined temperatures depending on the viscosity grade of the oil according to SAE J300.

- You can easily conclude, based on its name, that this type of oil is for vehicles with more than 75,000 miles.

- That’s why grades like 15W-40 and 20W-50, for example, were developed for use in warm climates, since the first number (before ‘W’) is relatively high in comparison to oils with ‘0’ or ‘5’, for example, which are more suitable for colder regions.

Emerging Trends

- Growing Demand for Synthetic Oil: Synthetic engine oils are gaining popularity due to their superior performance compared to traditional mineral oils. These oils offer better protection against wear, oxidation, and extreme temperatures, while also extending oil change intervals. This shift is driven by the increasing focus on fuel efficiency and engine longevity. Synthetic oils also cater to modern engine designs that demand higher protection, making them ideal for high-performance and turbocharged engines.

- Environmental Sustainability: There is a noticeable trend toward producing more environmentally friendly engine oils. Consumers and manufacturers are opting for low-viscosity oils that improve fuel efficiency and reduce carbon emissions. This is especially relevant as governments implement stricter environmental regulations on vehicle emissions. Companies like Castrol are developing carbon-neutral lubricants, aiming to meet the demands of eco-conscious customers.

- Electric Vehicles (EVs) and Hybrid Technologies: Although electric vehicles do not use traditional engine oils, hybrid vehicles and the increasing complexity of internal combustion engines (ICEs) are prompting demand for specialized lubricants. The focus is shifting toward developing oils that can cater to the specific needs of hybrid powertrains and improve their overall efficiency.

- Technological Advancements in Lubricants: Engine oils are being reformulated with advanced additive technologies to enhance their performance. For instance, Valvoline’s Full Synthetic Extended Protection oil uses dual-defense additive technology, which helps fight deposits and wear, ensuring longer engine life.

Such advancements in lubricant technology are crucial in meeting the evolving requirements of modern engines, which operate at higher temperatures and under more demanding conditions. - Increasing Vehicle Longevity and Maintenance: With more consumers keeping their vehicles for longer periods, the demand for high-mileage engine oils has risen. These oils are specifically designed to protect older engines, reduce leaks, and improve engine cleanliness. This trend reflects the growing emphasis on preventive maintenance.

- Regional Market Growth: The Asia-Pacific region continues to dominate the global automotive engine oil market due to the growing vehicle population in countries like China and India. With increasing urbanization and industrial growth, demand for both synthetic and mineral oils is expected to rise significantly in the coming years.

Use Cases

- Passenger Cars: Engine oil is crucial for the regular maintenance of passenger vehicles. It lubricates moving engine parts, reduces friction, and prevents wear and tear. In regions with high vehicle density, such as Asia-Pacific and North America, the frequent need for oil changes helps keep engines running efficiently, reducing the risk of breakdowns and extending the vehicle’s life. With millions of passenger cars on the road globally, synthetic and high-mileage oils are increasingly used to optimize fuel efficiency and meet stricter emissions standards.

- Heavy-Duty Vehicles: For trucks and buses, especially those involved in long-haul transportation, engine oil plays a vital role in keeping engines running under heavy loads and high temperatures. These vehicles require engine oil that can withstand prolonged use without degrading. High-viscosity oils and synthetic blends are popular in this segment because they offer better protection against engine wear and reduce the need for frequent oil changes. Diesel engine oil is particularly important in this context, with high resistance to soot buildup and contamination.

- Motorcycles: Motorcycles, especially high-performance models, require specialized engine oils to deal with the higher RPMs (revolutions per minute) compared to cars. The oil not only lubricates the engine but also cools critical components, preventing overheating during extended rides. For example, synthetic oils are preferred in motorcycles for their superior heat management and ability to maintain viscosity under extreme conditions, providing better protection and performance.

- Hybrid Vehicles: As hybrid vehicles become more common, they require a unique type of engine oil that works in conjunction with both internal combustion engines and electric motors. These engines start and stop frequently, which can lead to more rapid oil degradation. Specialized engine oils for hybrid vehicles ensure better performance and protection, minimizing wear caused by frequent engine restarts and ensuring optimal lubrication during both electric and fuel-driven operations.

- Commercial Fleets: Companies managing large fleets of delivery vehicles, such as those in the logistics and transportation sectors, rely on engine oils that maximize uptime and reduce maintenance costs. Fleet operators often opt for high-mileage synthetic oils that extend oil change intervals, leading to lower maintenance downtime. These oils are formulated to handle the demands of continuous operation, particularly in urban areas where stop-and-go traffic can place additional stress on engines.

- High-Performance Sports Cars: High-performance engines in sports cars, which generate more heat and power, require premium synthetic oils to provide superior lubrication at high speeds. These oils maintain stability under extreme pressure and temperatures, ensuring optimal engine performance and protection during aggressive driving. Synthetic oils also help in reducing engine deposits, which can be particularly important in high-output engines that run hotter than regular cars.

- Off-Road Vehicles: Off-road vehicles, including SUVs and trucks used in construction or agriculture, often operate in harsh environments with dust, dirt, and uneven terrain. These vehicles need engine oil that offers protection from contaminants and provides superior film strength to prevent engine damage in rugged conditions. Synthetic oils are often used in off-road vehicles due to their ability to maintain performance in extreme temperatures and resist oxidation.

- Marine Engines: In the marine industry, engine oils for boats and ships are essential for lubricating engines exposed to high humidity and saltwater conditions. Marine engine oils are designed to prevent corrosion and maintain their viscosity even in the presence of water. This type of oil is vital for preventing engine rust and ensuring smooth operation, particularly in commercial ships that operate continuously over long distances.

Major Challenges

- Fluctuating Raw Material Prices: The price of crude oil, a key ingredient in engine oil, is highly volatile. This volatility directly impacts the cost of manufacturing both synthetic and mineral-based oils. As global oil prices fluctuate due to political instability, supply chain disruptions, and market demand, manufacturers struggle to maintain consistent pricing for engine oils.

- Environmental Regulations: Increasing environmental concerns and stringent regulations on emissions and waste disposal are pushing the automotive engine oil industry to adapt. Manufacturers are under pressure to develop eco-friendly products that reduce carbon emissions and are biodegradable. This challenge increases the cost of research and development, as companies must invest in cleaner formulations that still meet performance standards.

- Rising Popularity of Electric Vehicles (EVs): Electric vehicles, which do not require traditional engine oil, are gaining popularity. As governments and consumers move towards cleaner alternatives, the demand for engine oil in traditional combustion engines is expected to decline. This shift poses a long-term challenge for engine oil manufacturers, as they need to innovate and find new applications for their products.

- Technological Advancements in Engine Design: Modern engines are becoming more advanced, with manufacturers focusing on higher efficiency and lower emissions. These engines require specialized lubricants that can perform under more extreme conditions, such as higher temperatures and pressures. Meeting these new technical requirements challenges oil manufacturers to continuously innovate.

- Market Competition: The engine oil market is highly competitive, with numerous global and regional players. This competition drives price wars, reducing profit margins and making it difficult for smaller companies to survive.

Market Growth Opportunities

- Increased Adoption of Synthetic Oils: Synthetic engine oils offer superior performance compared to conventional oils, especially in extreme temperatures and demanding driving conditions. As vehicle engines become more advanced and require better protection, the demand for synthetic oils is expected to grow significantly. This trend is particularly strong in developed regions like North America and Europe, where consumers seek higher fuel efficiency and longer-lasting engine performance.

- Rising Vehicle Ownership in Emerging Markets: The rapid urbanization and growing middle-class population in emerging markets such as China, India, and Southeast Asia are driving a surge in vehicle ownership. As more vehicles hit the roads in these regions, the demand for engine oil, particularly for new passenger and commercial vehicles, is set to increase. Manufacturers have the opportunity to tap into these high-growth regions by offering affordable and region-specific engine oil solutions.

- Focus on Fuel Efficiency and Environmental Standards: With increasing global pressure to reduce carbon emissions, governments are implementing stricter regulations for vehicle efficiency and environmental protection. Engine oil manufacturers are developing lower-viscosity oils that help reduce fuel consumption and emissions. These environmentally friendly products are creating new growth avenues, particularly in regions where emission standards are becoming more stringent.

- Expansion in Electric and Hybrid Vehicle Markets: While electric vehicles (EVs) do not use conventional engine oil, hybrid vehicles still rely on engine oil for their internal combustion engines. As the hybrid vehicle market grows, there is an opportunity to develop specialized lubricants that cater to these new powertrains, ensuring smooth operation and extended engine life in hybrid systems.

Key Player Analysis

Valvoline Inc. has been actively evolving in the automotive engine oil sector throughout 2023 and 2024, with a significant focus on retail services after divesting its global products division in 2023. The company’s key activities include providing high-quality preventive automotive maintenance services, such as oil changes, battery replacements, and tire rotations, through its extensive network of over 1,900 service centers across North America.

Würth Group GmbH, a global leader in the production and sale of fastening and assembly materials, has seen significant growth in its automotive sector in 2023 and 2024. The company’s focus on automotive products, including engine oils, falls under its broader chemical and industrial supply division. Würth has continued to strengthen its position by expanding its product lines to cater to the evolving needs of the automotive industry, particularly focusing on lubricants and maintenance supplies for vehicles.

In 2023 and 2024, Castrol Ltd. has been actively advancing its presence in the automotive engine oil sector, with notable innovations and strategic initiatives. As part of its 125th anniversary celebrations in 2024, Castrol launched its new “Onward, Upward, Forward” strategy. This approach focuses on enhancing its offerings in electric vehicle (EV) fluids while continuing to improve the efficiency of internal combustion engine (ICE) oils. Castrol introduced products like Castrol ON EV Fluids for electric vehicles and expanded its high-performance Castrol EDGE range, specifically targeting SUVs, hybrids, and European cars.

TotalEnergies has been actively expanding its presence in the automotive engine oil sector through its well-known Quartz line of lubricants. In 2023 and 2024, the company focused on developing innovative products designed to meet the evolving needs of modern engines. The Quartz 9000 series, for instance, has been recognized for its Age-Resistance Technology, which offers up to 74% less wear than industry limits, providing long-lasting protection against friction and engine wear. These advanced lubricants are particularly suited for high-performance and smaller, more compact engines that operate under intense conditions, such as high pressure and temperature.

Eni GmbH, a subsidiary of Eni S.p.A., continues to make strides in the automotive engine oil sector through its lubricants division. In 2023 and 2024, the company emphasized its premium engine oil line, Agip, catering to modern engine needs with high-performance synthetic oils. Eni’s products are designed to meet both conventional internal combustion engines (ICE) and hybrid vehicles, addressing the growing demand for energy-efficient and durable lubricants.

In 2023 and 2024, Amsoil Inc. continued to strengthen its presence in the automotive engine oil market by expanding its synthetic oil offerings and making strategic acquisitions. In May 2023, Amsoil acquired Benz Oil, a Wisconsin-based company specializing in industrial and metalworking fluids, to enhance its automotive and industrial lubricants capabilities. This acquisition allowed Amsoil to integrate additional expertise and expand its product range to serve a broader market, including industrial applications alongside its core automotive products.

In 2023 and 2024, Petronas Lubricants International (PLI), a subsidiary of Malaysia’s national oil company Petronas, has been actively expanding its presence in the automotive engine oil market with several key developments. In April 2024, Petronas renewed its strategic partnership with Mercedes-Benz, focusing on advanced fluid technology solutions to enhance vehicle performance and fuel efficiency. This collaboration aims to push innovations in engine oil and electric vehicle (EV) fluids, demonstrating the company’s commitment to future mobility.

In 2023 and 2024, Fuchs Petrolub (now Fuchs SE after its July 2023 rebranding) has seen solid progress in the automotive engine oil market. The company focused on expanding its product portfolio in specialty lubricants, particularly to cater to modern, high-performance engines and electric vehicles (EVs) demands. In the first half of 2024, Fuchs generated €1.764 billion in sales revenues, which was slightly lower than the previous year, largely due to currency fluctuations.

Conclusion

In conclusion, the automotive engine oil market is poised for steady growth, driven by the increasing demand for synthetic oils, advancements in engine technologies, and rising vehicle sales, especially in emerging markets. Synthetic oils are expected to dominate due to their superior performance, fuel efficiency, and environmental benefits. However, challenges such as fluctuating raw material costs and the growing popularity of electric vehicles (EVs) may limit the demand for traditional engine oils in the long term.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)