Table of Contents

Introduction

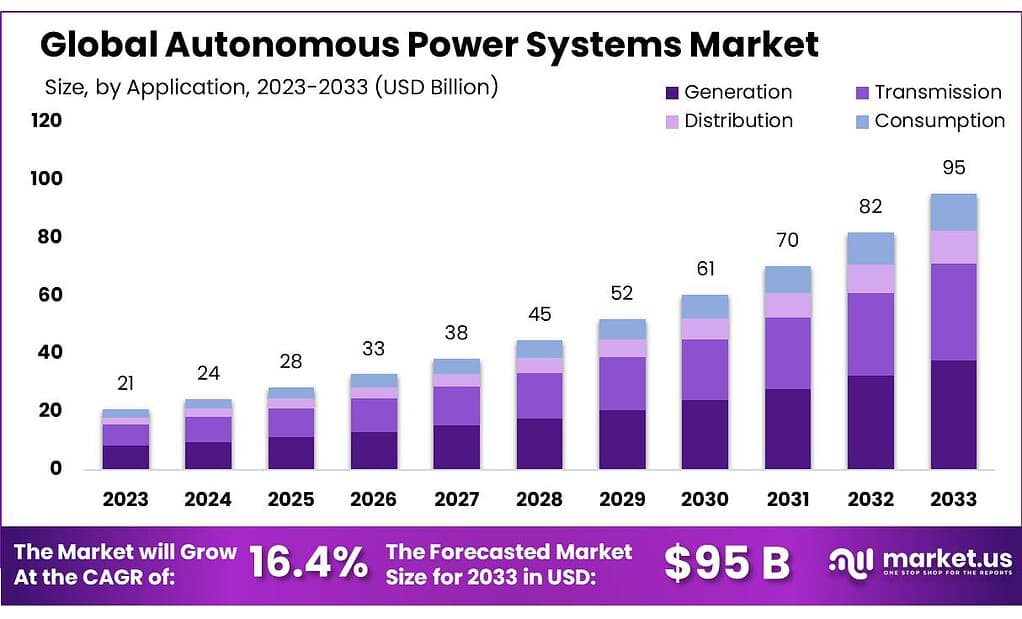

The global autonomous power systems market, poised for significant growth, is forecasted to surge from USD 21 billion in 2023 to USD 95 billion by 2033, growing at a CAGR of 16.4% during this period. This market’s expansion is fueled by rising demand for clean, reliable, and autonomous energy solutions across various sectors including telecommunications, healthcare, and education, where uninterrupted power is crucial.

Several factors contribute to this growth. Technological advancements are enabling more efficient energy management systems, and there is a growing emphasis on sustainable energy, which aligns with global environmental targets. Additionally, the commercial sector’s increasing reliance on autonomous systems for continuous power supply is driving market expansion.

Recent developments in the autonomous power systems market highlight significant activities among key players such as ABB Ltd, Aclara Technologies LLC, and Cisco Systems Inc., reflecting a dynamic industry focused on expansion and technological integration.

ABB Ltd has been actively expanding its portfolio through strategic acquisitions. In 2024 alone, ABB completed multiple acquisitions including the Födisch Group, which strengthens its position in continuous emission monitoring, and the SEAM Group, bolstering its services in electrification across the U.S. These acquisitions are part of ABB’s broader strategy to enhance its technological capabilities and market reach in various sectors including smart automation and energy services.

Aclara Technologies LLC was acquired by Hubbell Incorporated in 2018, marking a significant enhancement of Hubbell’s leadership in utility markets. This acquisition has allowed Hubbell to integrate Aclara’s advanced metering infrastructure and smart infrastructure solutions into its offerings, thereby expanding its capabilities in providing critical components with sophisticated communication functionalities.

Key Takeaways

- Market Growth: The Autonomous Power Systems market is Forecasted to reach USD 95 billion by 2033, from USD 21 billion in 2023, with a CAGR of 16.4%.

- Dominant Component: Software holds over 63.5% share, crucial for efficient energy management.

- Technology Preference: Wireless technology commands a 59.3% market share for flexibility and scalability.

- Application Focus: The distribution segment leads with over 39.6% market share, ensuring reliable power supply.

- End-User Dynamics: The commercial sector dominates with more than 56.4% market share.

- The average energy storage capacity of an APS ranges from 10 kWh to 1 MWh, depending on the application and size.

- The use of APS can reduce greenhouse gas emissions by up to 90% compared to conventional fossil fuel-based power generation.

- In 2022, the residential sector accounted for over 60% of the global APS installations.

Autonomous Power Systems Statistics

- According to the International Renewable Energy Agency, currently the installed capacity of renewable energy sources is 2536.85 GW.

- According to various expert estimates, the share of renewable energy sources is expected to vary between 30% and 40% in the global energy mix by 2030

- The number of unique autonomous networks in the routing system of the Internet exceeded 5,000 in 1999, 30,000 in late 2008, 35,000 in mid-2010, 42,000 in late 2012, 54,000 in mid-2016 and 60,000 in early 2018.[13] The number of allocated ASNs exceeded 100,000 as of March 2021.

- There are two different formats to represent ASNs: 2-byte and 4-byte.

- As a result of the energy analysis, Seoul, Ulsan, and Toronto have energy self-sufficiency rates of 62%, 65.1%, 57.7%, and 60.2%, respectively.

Emerging Trends

- Emerging trends in the autonomous power systems market are being driven by advancements in several key technologies and strategic shifts in the industry. One prominent trend is the increasing incorporation of Internet of Things (IoT) technology, which enables better connectivity and integration of various components within autonomous systems. IoT facilitates real-time data acquisition and analysis, significantly enhancing the efficiency and responsiveness of autonomous power systems.

- Artificial Intelligence (AI) continues to be a critical driver in the sector, improving decision-making processes and operational efficiencies. AI algorithms optimize energy consumption and maintenance schedules, predict system failures, and enhance overall system management.

- Another significant trend is the adoption of advanced driver assistance systems (ADAS) and vehicle connectivity, which are pivotal in autonomous vehicle technologies. These systems not only improve the safety and reliability of autonomous operations but also enhance the integration of renewable energy sources by optimizing energy distribution and storage.

- Additionally, there is a growing focus on cybersecurity within the autonomous power systems market, spurred by the increased connectivity and reliance on digital technologies. Ensuring the security of these systems is paramount as they become more integrated and exposed to cyber threats.

Use Cases

- Energy Sector: Autonomous robots and drones are transforming the way energy infrastructures, like power plants and transmission lines, are monitored and maintained. These technologies perform routine inspections and maintenance tasks, improving operational efficiencies and safety. For example, Siemens Energy has deployed autonomous robots equipped with advanced navigation and sensory technology to inspect power plants autonomously, ensuring operational reliability and security even with minimal human intervention.

- Healthcare and Emergency Services: In critical sectors like healthcare, autonomous power systems are being integrated to ensure reliable power supply for emergency services and hospital facilities. This ensures that life-saving medical equipment operates without interruption during power outages or other disturbances.

- Urban and Residential Development: For urban and community energy systems, autonomous technologies are used to manage and optimize energy usage in real-time, contributing to the development of smart cities. For instance, the National Renewable Energy Laboratory (NREL) has demonstrated solutions where autonomous systems manage energy resources across neighborhoods, enhancing sustainability and resilience against power disruptions.

- Industrial and Commercial Applications: In industrial settings, autonomous power systems are crucial for managing large-scale energy demands with high reliability. These systems use sophisticated control algorithms to balance energy production and consumption, minimizing wastage and enhancing overall efficiency.

Major Challenges

- High Energy Consumption and Emissions: One of the primary concerns is the substantial energy required by the computing systems within autonomous vehicles, which could lead to high greenhouse gas emissions. For instance, the computing needed for autonomous vehicle operations could potentially consume as much energy as all the data centers globally if widespread adoption occurs without advances in hardware efficiency.

- Safety and Reliability Concerns: Ensuring the safety and reliability of autonomous systems remains a formidable challenge. There is a critical need for sophisticated algorithms and hardware that can perform reliably under various operational conditions without compromising safety. Current efforts focus on developing systems that can efficiently handle complex tasks like merging on highways with minimal human intervention.

- Integration and Interoperability Issues: As autonomous systems become more prevalent across different sectors, integrating them into existing infrastructures and ensuring they can operate harmoniously with legacy systems is complex. This involves not only technological compatibility but also aligning with regulatory standards and safety protocols.

- Technological and Operational Complexity: The complexity of designing and maintaining autonomous power systems, especially those that interact with unpredictable environments, is another significant hurdle. This complexity increases the risk of system failures and security vulnerabilities, which must be meticulously managed to avoid disruptions.

Market Growth Opportunities

- The autonomous power systems market is poised for robust growth, driven by several key factors and emerging trends. One of the most promising areas is the integration of renewable energy sources into autonomous power systems, which not only enhances energy resilience but also reduces operating costs significantly. Microgrids, in particular, are expected to lead market growth due to their ability to operate independently from traditional power grids, offering enhanced flexibility and reliability for integrating diverse energy sources such as solar and wind.

- Commercial and residential sectors are forecasted to show strong growth in demand for autonomous power systems. The commercial sector is increasingly adopting these systems to reduce energy costs and improve energy efficiency, while in the residential sector, there’s a growing trend towards solar photovoltaic systems, which are bolstered by the autonomy and efficiency provided by modern power systems.

- The technological advancement in software and wireless technologies is another growth driver. Software solutions are crucial for efficient energy management, and wireless technology offers significant advantages in terms of installation flexibility and cost-effectiveness, which are critical for the scalability of autonomous power systems across various applications.

Key Players Analysis

In 2023, ABB Ltd significantly advanced its role in the autonomous power systems sector, emphasizing its commitment to the energy transition towards a net-zero future. The company made remarkable strides in reducing its greenhouse gas emissions by 76% compared to 2019 levels, and it aims to further decrease these emissions in the coming decades. ABB’s products sold in 2023 are expected to avoid 74 megatons of emissions over their lifetimes, demonstrating the company’s focus on sustainable and efficient energy solutions.

Aclara Technologies LLC has not been highlighted with specific developments for 2023 or 2024 in the data reviewed. Generally, Aclara, as part of the Hubbell family since 2018, focuses on smart infrastructure solutions, particularly in smart meters and sensors for electricity, water, and gas utilities. Their work typically supports the enhancement of grid efficiency and reliability, crucial for autonomous power systems, but no specific updates or projects for 2023 or 2024 have been detailed in the latest available resources.

In 2023 and 2024, Cisco Systems Inc. has been making significant advancements in the autonomous power systems sector by integrating AI-enriched networking, security, and observability solutions. These efforts are part of their broader strategy to enhance the connectivity and security of digital infrastructures across industries, including energy. Cisco’s innovations are geared towards creating a smarter, more secure energy future by harnessing the power of IoT and AI to manage and optimize energy systems, especially in integrating and managing renewable energy sources.

General Electric Company (GE), meanwhile, continues to be a key player in the energy sector, focusing on power generation and distribution technologies that support the transition to renewable energy. GE has been involved in various projects around the world, aimed at enhancing the efficiency and reliability of energy systems. This includes the development of advanced power grid technologies and renewable energy projects, reinforcing their commitment to sustainable energy solutions.

In 2023 and 2024, IBM Corporation has been focusing on leveraging its IBM Power Systems to enhance its hybrid cloud strategy, integrating advanced AI capabilities to support diverse industries like retail and healthcare. By deploying AI workloads from core systems to cloud and edge environments, IBM aims to optimize data management and analytics, providing clients with powerful tools for real-time decision-making and operational efficiency. The introduction of the IBM Power S1012 server in 2024 exemplifies this strategy by delivering significant performance improvements and robust support for AI inferencing at the edge, tailored especially for small to medium-sized enterprises seeking to enhance their technological capabilities.

Itron Inc has also been active in the autonomous power systems market, although specific year-wise updates for 2023 or 2024 were not available from the recent data. Generally, Itron’s work focuses on intelligent metering solutions and smart grid technologies that support efficient energy management and distribution. Their products play a crucial role in modernizing electrical grids to accommodate renewable energy sources and improve grid reliability.

Open Systems International Inc (OSI), now part of Emerson, continues to drive significant advancements in the autonomous power systems sector through their SCADA systems and grid management solutions. As of 2023 and 2024, OSI has been instrumental in enhancing grid performance and efficiency, especially for utilities managing diverse energy resources across extensive networks.

Oracle Corporation has significantly expanded its capabilities in the autonomous power systems market through its advancements in cloud database management systems and the introduction of new technologies. In 2023, Oracle was recognized for its leadership in cloud database systems, particularly for transaction processing and data warehousing, which are crucial for managing large-scale, autonomous power systems.

Oracle’s technologies, including their Globally Distributed Autonomous Database, play a pivotal role in enhancing data scalability, availability, and sovereignty across global operations, thereby supporting complex autonomous power systems efficiently and securely. Oracle’s focus on integrating AI and machine learning into these systems further enables optimized energy management and grid performance.

In 2023 and 2024, Schneider Electric SA has been actively advancing its digital and AI capabilities within the autonomous power systems sector. The company has integrated AI and machine learning into its EcoStruxure Autonomous Production Advisor, enhancing real-time monitoring and optimization of industrial processes.

Schneider’s AI initiatives are aimed at improving operational efficiency and sustainability, contributing to their leadership in energy management and automation. Additionally, Schneider Electric has focused on growing its service offerings and software solutions, consistently increasing its backlog, which reflects strong customer demand across its various business segments.

Siemens AG has continued to strengthen its position in the autonomous power systems market by leveraging its extensive expertise in electrification, automation, and digitalization. The company’s focus on innovative technologies such as IoT, AI, and decentralized energy systems has enabled it to deliver integrated solutions that enhance the efficiency and reliability of power grids globally. Siemens’ strategy includes expanding its digital services and software applications, which play a crucial role in smart grid and smart infrastructure projects, helping to meet the growing demands for sustainable and efficient energy solutions.

Wipro Ltd has been actively expanding its capabilities in the autonomous power systems sector, with a strong focus on integrating advanced technologies like AI, machine learning, and robotics. In 2023, Wipro collaborated with the Indian Institute of Science to launch the Wipro IISc Research and Innovation Network, aiming to push the boundaries in autonomous systems, robotics, and 5G technology.

This partnership is designed to accelerate innovation and application in these areas, leveraging both Wipro’s industry expertise and the academic prowess of IISc. The collaboration has enabled Wipro to develop sophisticated solutions such as large-scale simulators for autonomous systems and a fully autonomous vehicle platform known as Wipod. This platform represents a significant advancement in Wipro’s autonomous technologies, embodying the company’s commitment to developing cutting-edge solutions that enhance mobility and autonomy in various sectors.

Conclusion

The autonomous power systems market is set to experience substantial growth over the next decade, fueled by increasing adoption in both residential and commercial sectors. This growth is underpinned by the integration of renewable energy sources, technological advancements in software and wireless technologies, and a growing emphasis on sustainability and energy resilience.

Key market drivers include the reduction of operating costs and the enhancement of system reliability and flexibility through microgrids and advanced energy management systems. As the market evolves, stakeholders will likely witness significant opportunities in deploying these innovative solutions to meet the escalating global demand for efficient and sustainable energy solutions.