Table of Contents

- Introduction

- Editor’s Choice

- Autonomous Vehicles Market Overview

- Number of Autonomous Vehicles Globally

- Driverless Car-Related Patents Statistics

- Increase in Vehicles Equipped with Hardware for Fully Autonomous Driving

- Autonomous Vehicles Sales Statistics

- Advanced Driver-Assistance System (ADAS) and Autonomous-Driving (AD) Statistics

- Consumer Preferences

- Interest in AVs According to Demographics

- Challenges and Obstacles to Adoption of AVs

- Future of Autonomous Vehicles

- Strategic Initiatives and Trends

Introduction

According to Autonomous Vehicles Statistics, Autonomous vehicles are also referred to as self-driving cars. Operate independently using advanced sensors, cameras, radar, and AI technology.

They are classified into six autonomy levels, from basic driver assistance to full automation, and are capable of managing all driving tasks under any circumstances.

Essential components include environmental sensors, AI for decision-making, and connectivity for real-time data exchange.

Benefits include improved safety, efficient traffic management, enhanced accessibility, and potential environmental advantages.

Challenges such as regulatory complexities, technological constraints in challenging conditions, and public trust remain significant obstacles.

Nonetheless, ongoing advancements in autonomous driving technology by companies like Waymo and Tesla are driving progress in this field.

Editor’s Choice

- The global autonomous vehicles market revenue reached USD 208.0 billion in 2023.

- The market is expected to continue its rapid growth, reaching USD 2,874.0 billion in 2031 and USD 4,206.4 billion in 2032. With semi-autonomous vehicles contributing USD 2,326.14 billion and fully autonomous vehicles generating USD 1,880.26 billion.

- In the autonomous vehicles market, transportation applications hold a dominant position, capturing 65% of the market share.

- By the end of the decade, the number of autonomous vehicles worldwide is anticipated to reach 125,660 units in 2030. Underscoring the rapid advancement and adoption of autonomous vehicle technology.

- Between January 2010 and July 2017, Bosch led the field in worldwide patent filings related to autonomous driving, with a total of 958 patents.

- By 2029, autonomous vehicle sales are expected to surge to 41.34 million units, and by 2030, they are projected to reach an impressive 58 million units.

- Several factors have been identified that would increase consumer confidence in autonomous vehicles (AVs). According to respondents, 64% believe that a significant increase in safety is essential.

Autonomous Vehicles Market Overview

Global Autonomous Vehicles Market Size

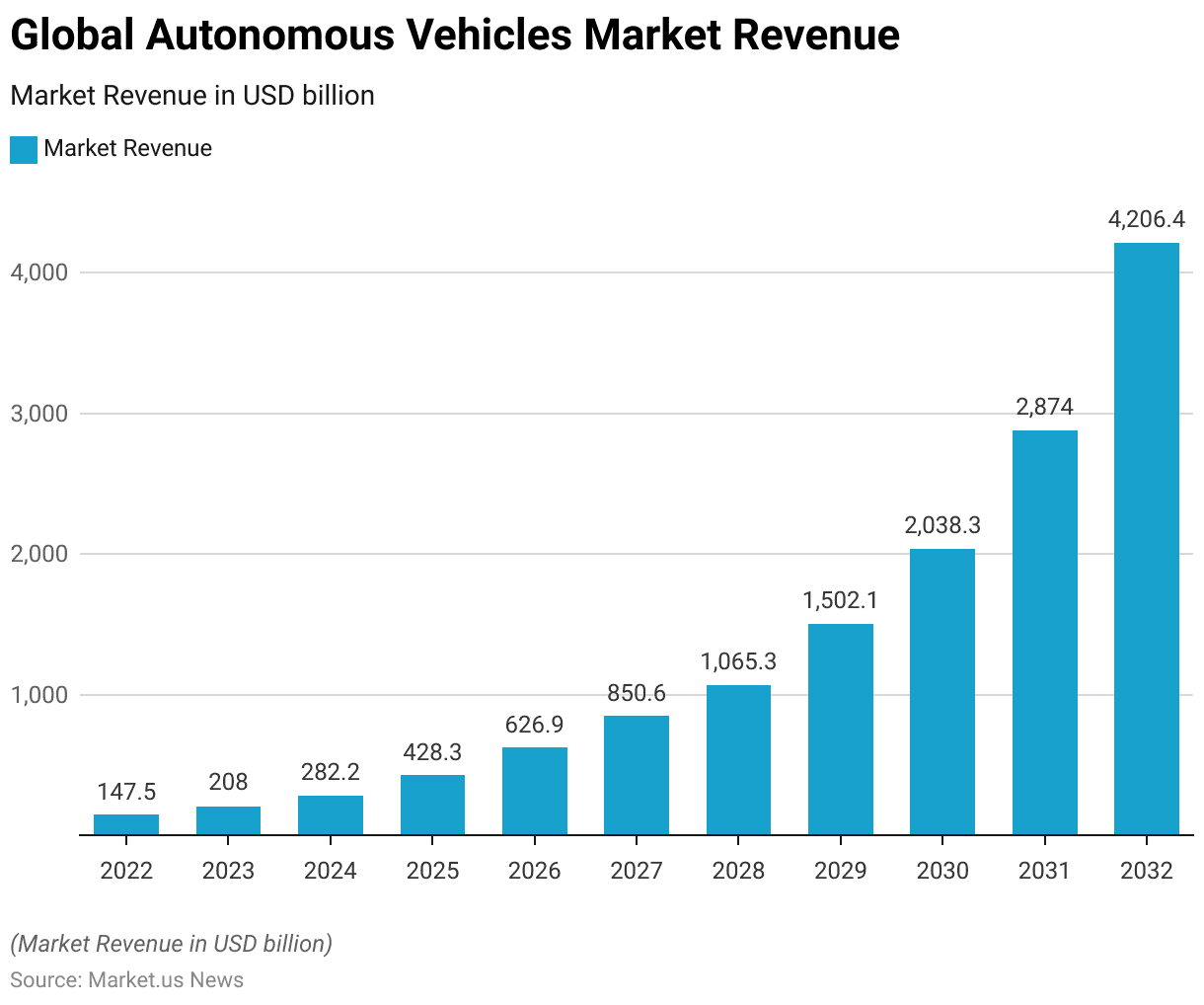

- The global autonomous vehicles market has shown substantial growth over the past decade at a CAGR of 41.0%. With revenue increasing from USD 147.5 billion in 2022 to USD 208.0 billion in 2023.

- The momentum is predicted to continue into the early 2030s, with the market anticipated to generate USD 2,874.0 billion in 2031 and an impressive USD 4,206.4 billion by 2032.

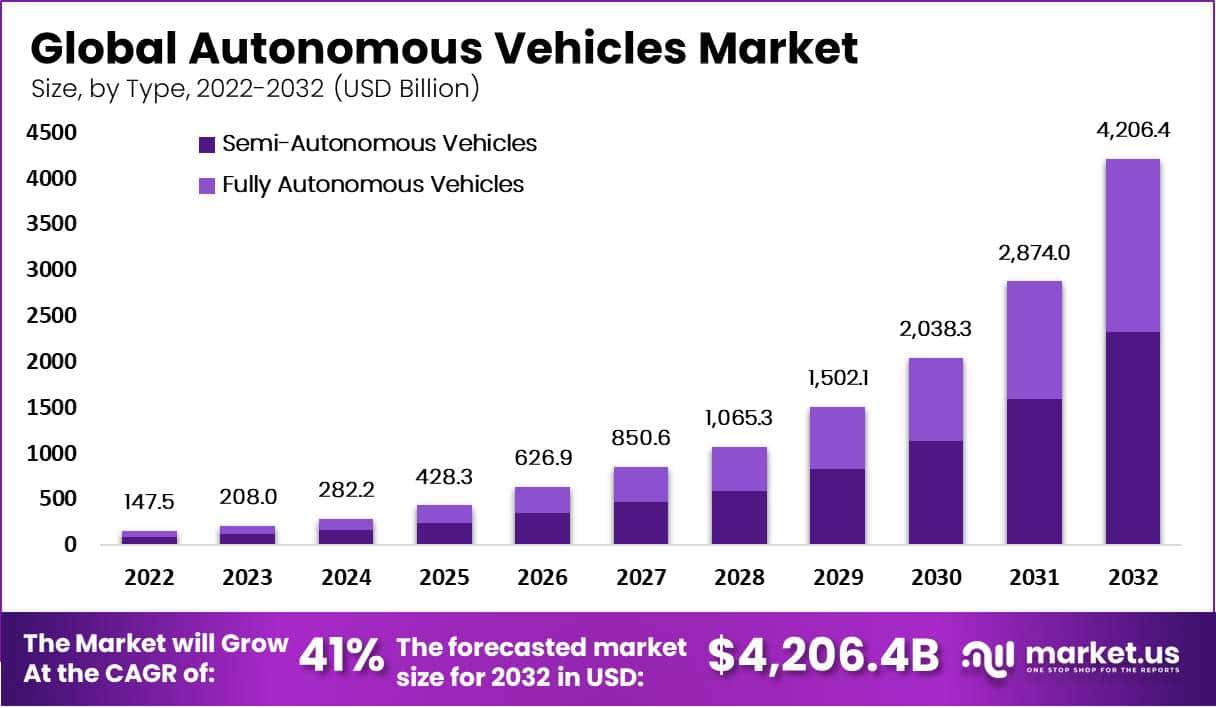

Autonomous Vehicles Market Size – By Type

- The global autonomous vehicles market has experienced significant growth across both semi-autonomous and fully autonomous segments.

- In 2022, the total market revenue was USD 147.5 billion, with semi-autonomous vehicles contributing USD 81.57 billion and fully autonomous vehicles generating USD 65.93 billion.

- The market is expected to continue its rapid growth, reaching USD 2,874.0 billion in 2031 and USD 4,206.4 billion in 2032, with semi-autonomous vehicles contributing USD 2,326.14 billion and fully autonomous vehicles generating USD 1,880.26 billion.

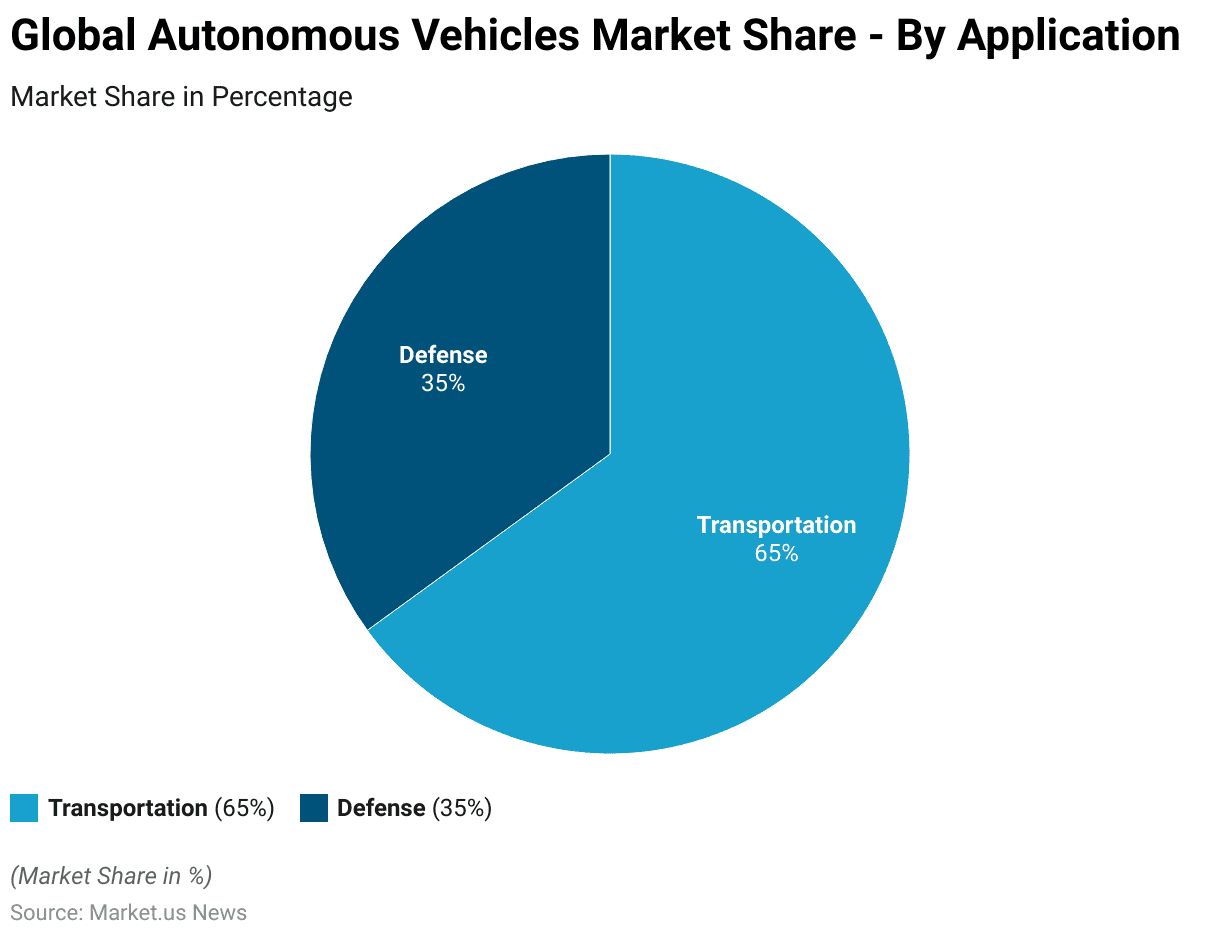

Global Autonomous Vehicles Market Share – By Application

- In the autonomous vehicles market, transportation applications hold a dominant position, capturing 65% of the market share.

- Meanwhile, the defense sector accounts for 35% of the market share. Highlighting the increasing integration of autonomous vehicles in military operations for purposes such as surveillance, reconnaissance, and logistics.

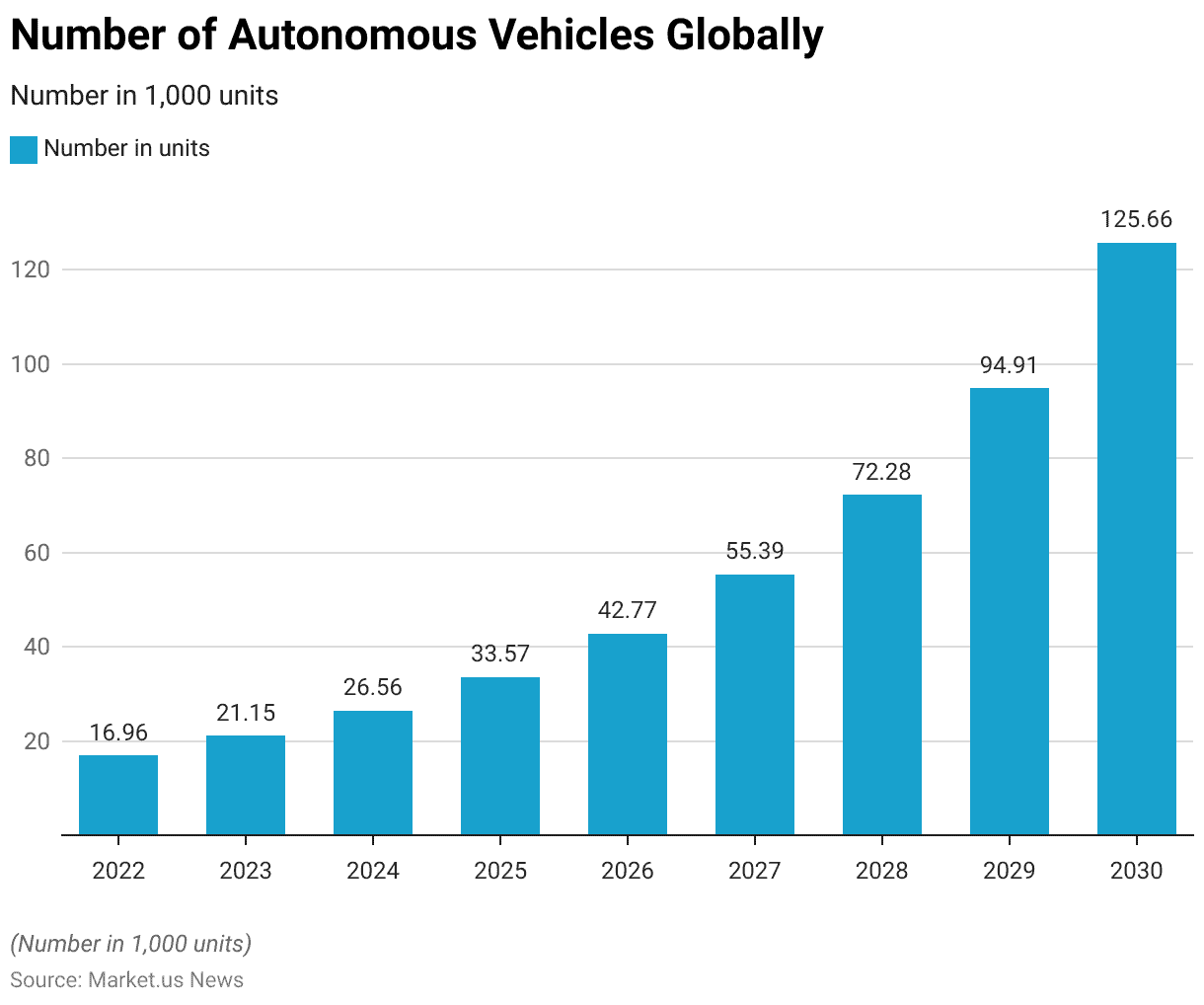

Number of Autonomous Vehicles Globally

- The global number of autonomous vehicles has steadily increased over recent years.

- In 2022, there were approximately 16,960 autonomous vehicles in operation worldwide.

- By the end of the decade, the number of autonomous vehicles worldwide is anticipated to reach 125,660 units in 2030. Underscoring the rapid advancement and adoption of autonomous vehicle technology.

Driverless Car-Related Patents Statistics

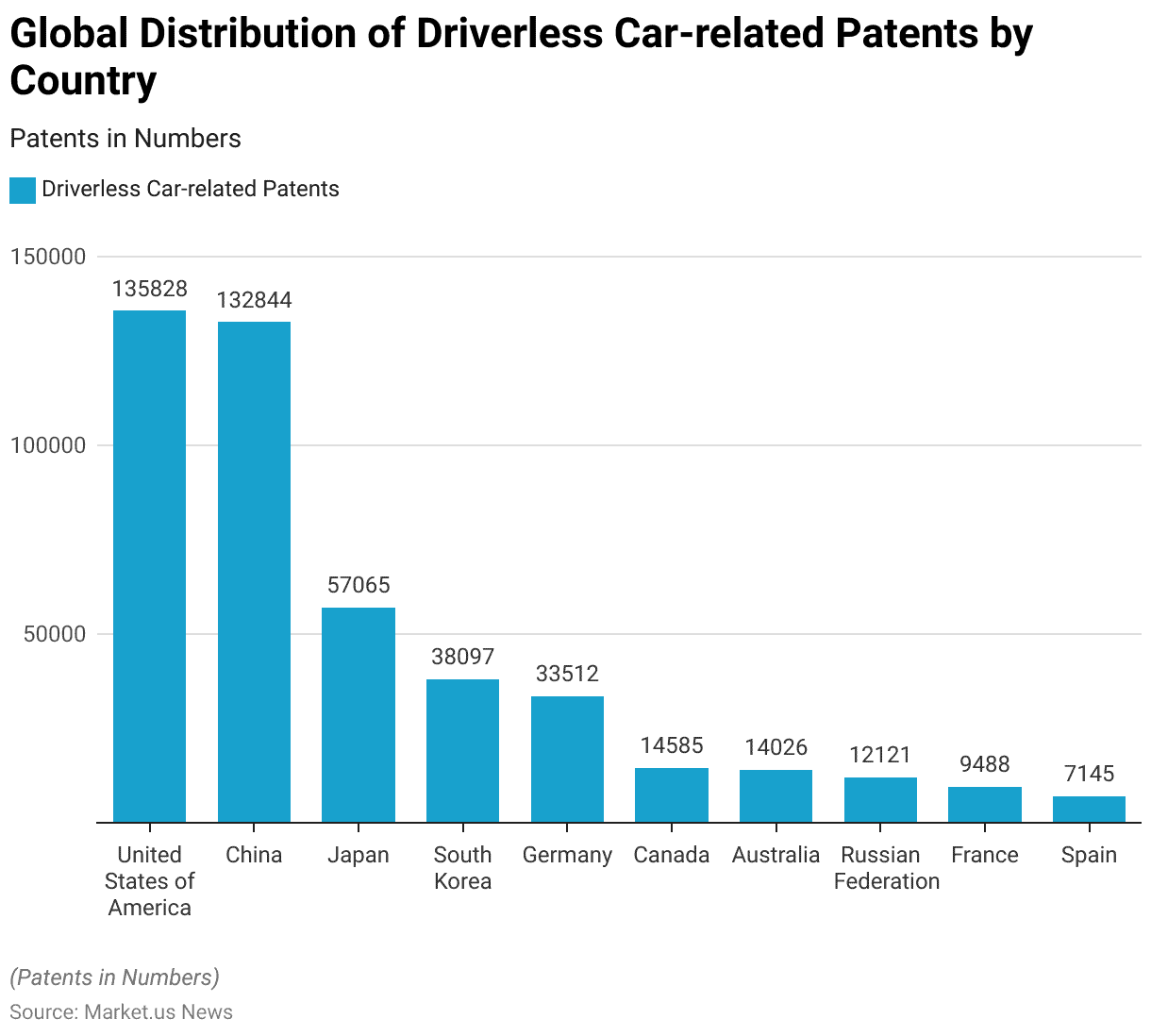

Global Distribution of Driverless Car-related Patents by Country

- The distribution of driverless car-related patents across various countries highlights significant global innovation in autonomous vehicle technology.

- The United States leads with an impressive 135,828 patents, followed closely by China with 132,844 patents.

- Japan holds 57,065 patents, indicating its strong position in the field.

- South Korea and Germany have also contributed significantly, with 38,097 and 33,512 patents, respectively.

- Canada and Australia each have substantial patent counts, with 14,585 and 14,026, respectively.

- The Russian Federation has amassed 12,121 patents, while France and Spain have 9,488 and 7,145 patents, respectively.

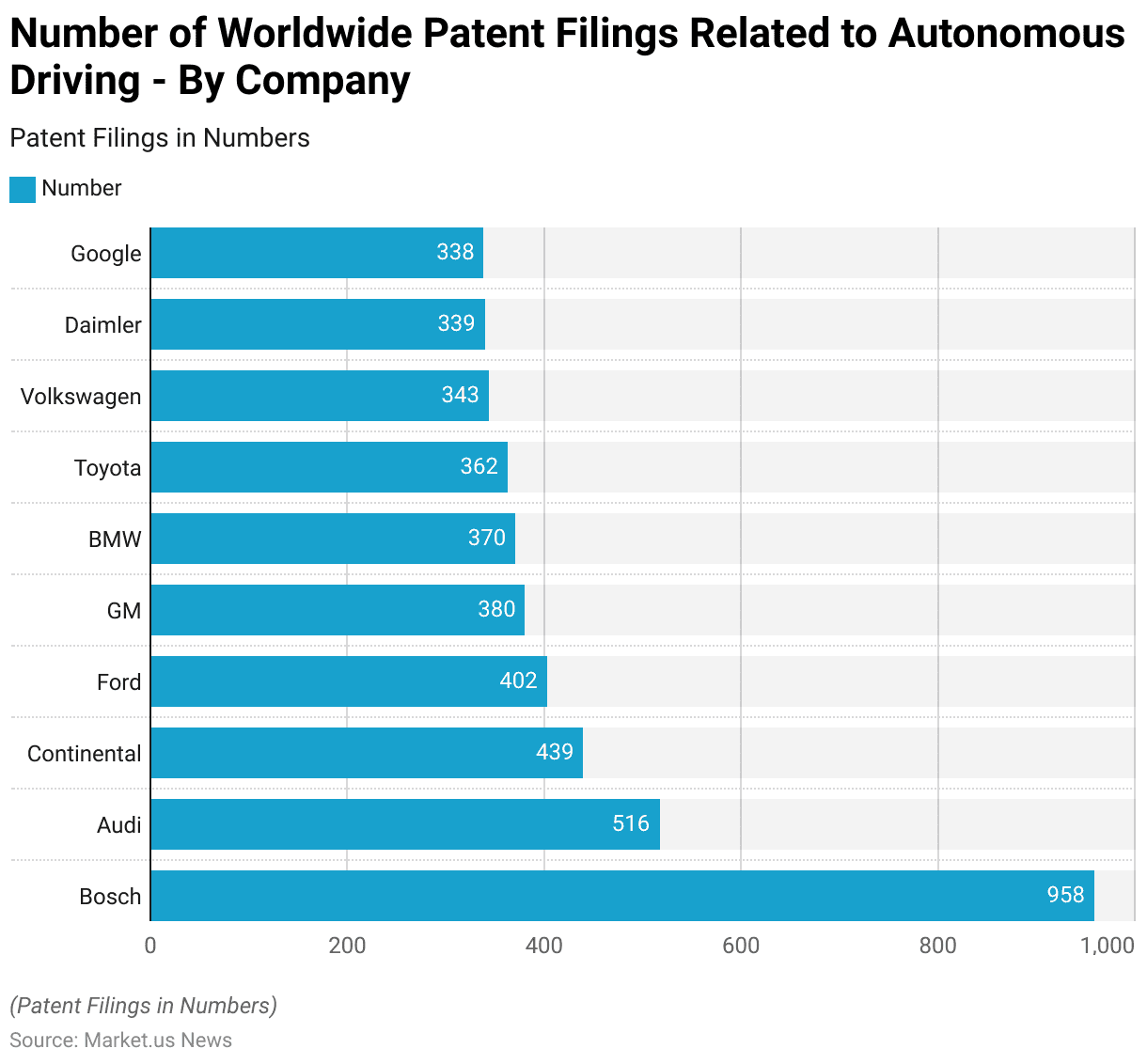

Worldwide Patent Filings Related to Autonomous Driving by Company

- Between January 2010 and July 2017, Bosch led the field in worldwide patent filings related to autonomous driving, with a total of 958 patents.

- Audi followed with 516 patents, demonstrating its strong commitment to innovation in this sector.

- Continental filed 439 patents, while Ford and GM contributed 402 and 380 patents, respectively.

- BMW and Toyota were also prominent players, with 370 and 362 patents filed.

- Volkswagen and Daimler filed 343 and 339 patents, respectively.

- Google, a significant non-automotive company in this space, filed 338 patents.

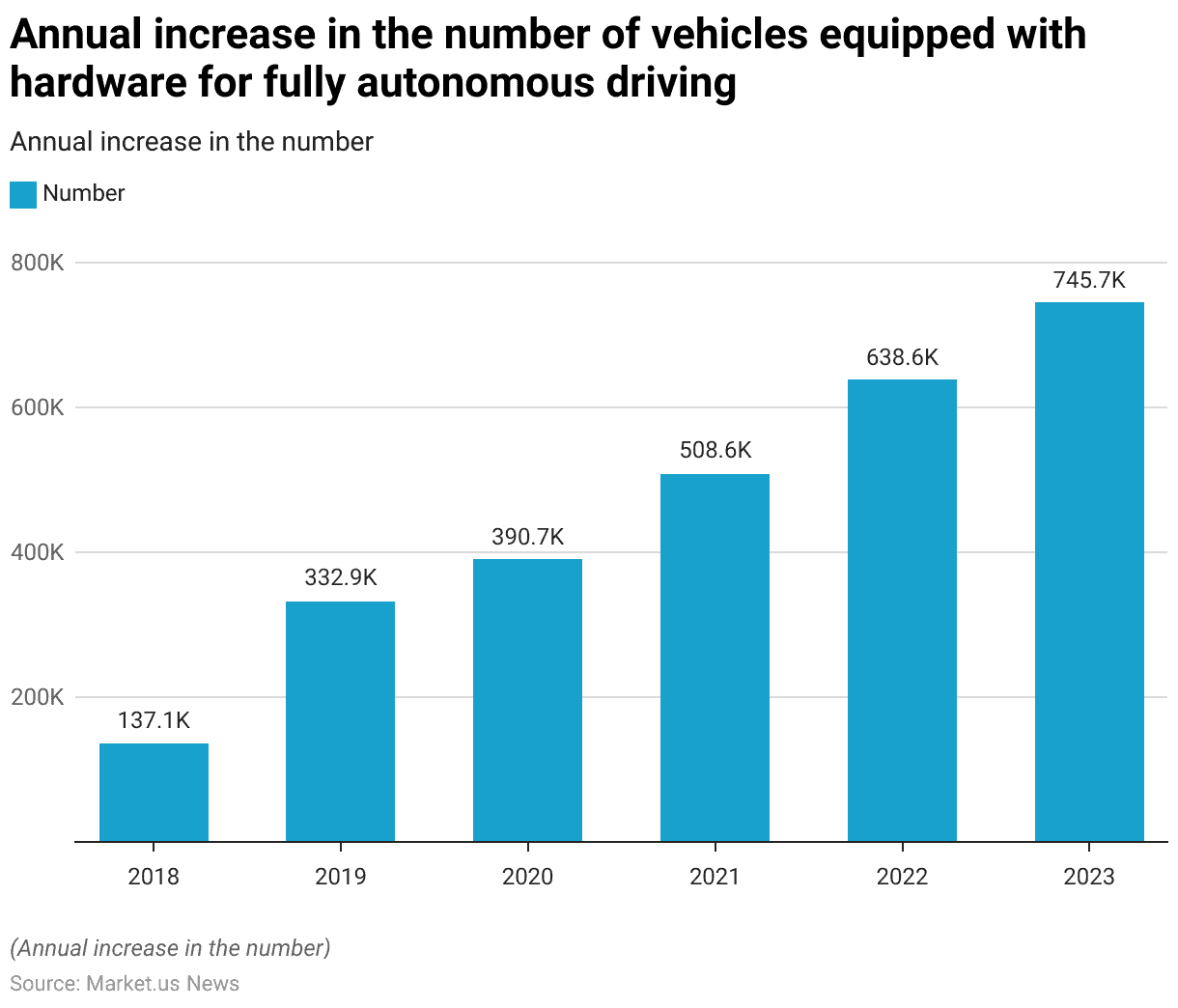

Increase in Vehicles Equipped with Hardware for Fully Autonomous Driving

- The annual increase in the number of vehicles equipped with hardware for fully autonomous driving has shown a remarkable upward trend from 2018 to 2023.

- In 2018, the increase was 137,129 vehicles. This number grew substantially to 332,932 vehicles in 2019.

- In 2023, the annual increase reached 745,705 vehicles. Underscoring the rapid adoption and implementation of fully autonomous driving technology over these years.

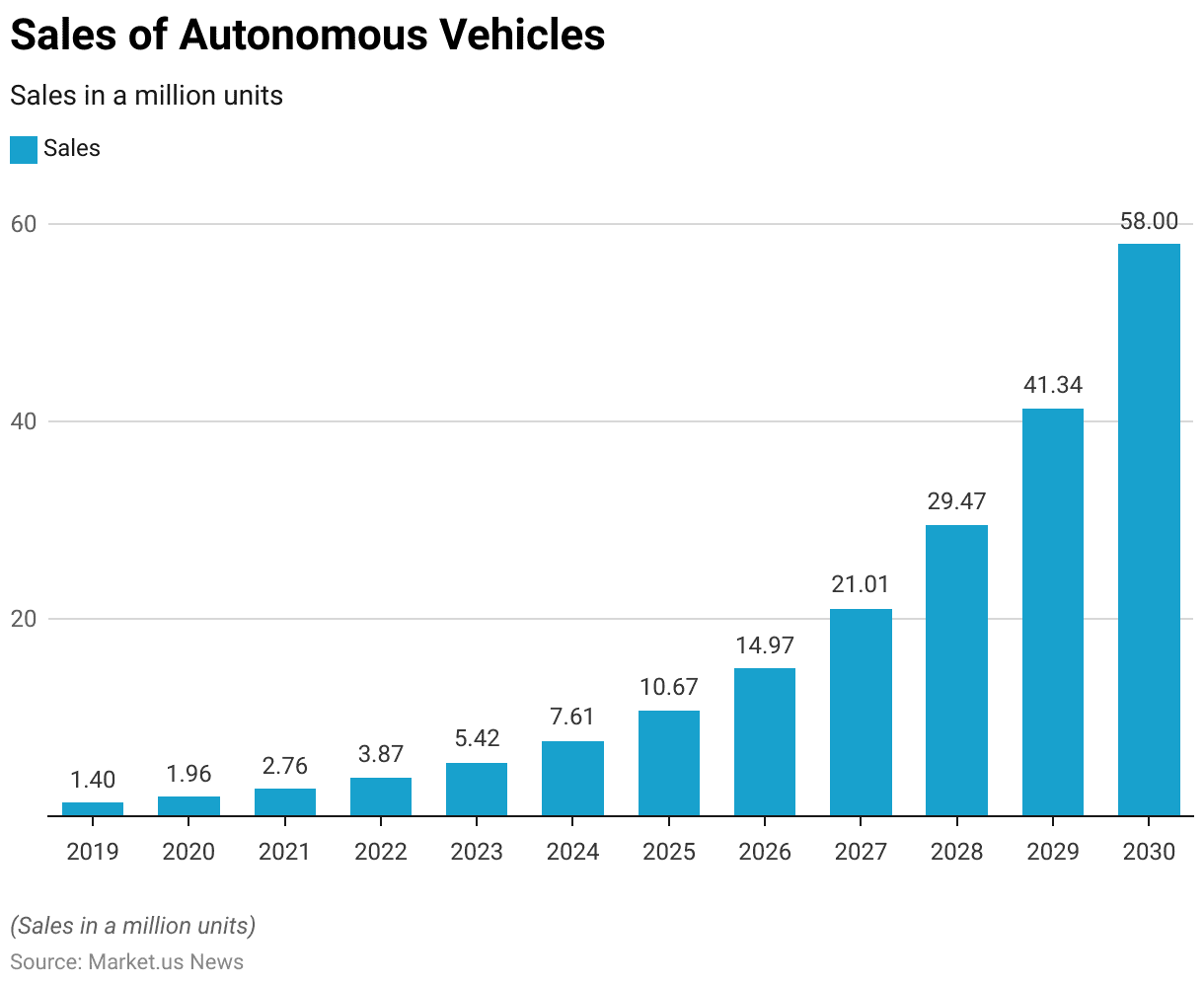

Autonomous Vehicles Sales Statistics

- The sales of autonomous vehicles have shown a remarkable upward trajectory from 2019 to 2030.

- In 2019, the sales were 1.4 million units, which increased to 1.96 million units in 2020.

- By 2029, sales are expected to surge to 41.34 million units, and by 2030. They are projected to reach an impressive 58 million units.

Advanced Driver-Assistance System (ADAS) and Autonomous-Driving (AD) Statistics

Advanced Driver-Assistance System (ADAS) and Autonomous-Driving (AD) Sales and Revenue

- Current vehicles typically offer basic Advanced Driver Assistance Systems (ADAS), but significant advancements in autonomous driving (AD) capabilities are imminent.

- Ultimately, cars aim to achieve Society of Automotive Engineers (SAE) Level 4 autonomy, enabling driverless operation under specific conditions.

- According to a consumer survey by McKinsey in 2021. There is a strong consumer demand for AD features, with a willingness to pay for them. This growing demand is projected to generate substantial revenue, potentially reaching billions of dollars.

- Vehicles equipped with lidar-based Level 2+ (L2+) capabilities incur component costs ranging from $1,500 to $2,000, with higher costs for Level 3 (L3) and Level 4 (L4) options.

- McKinsey’s analysis suggests that ADAS and AD technologies could contribute between $300 billion and $400 billion to the passenger car market by 2035.

Consumer Preferences

Indicators of Consumer Interest in Fully Owning Autonomous Vehicles (AVs)

- Indicators of consumer interest in fully owning autonomous vehicles (AVs) have shown varying trends between 2020 and 2021.

- The readiness to switch to AVs fluctuated, with respondents indicating a range from 9% to 35% in 2020, which slightly narrowed to 10% to 26% in 2021.

- Trust in the safety of AVs experienced a decline, dropping from 40% in 2020 to 35% in 2021. Reflecting growing concerns about the reliability of autonomous technology.

- Additionally, consumer support for government regulation of AVs decreased significantly, from 67% in 2020 to 53% in 2021.

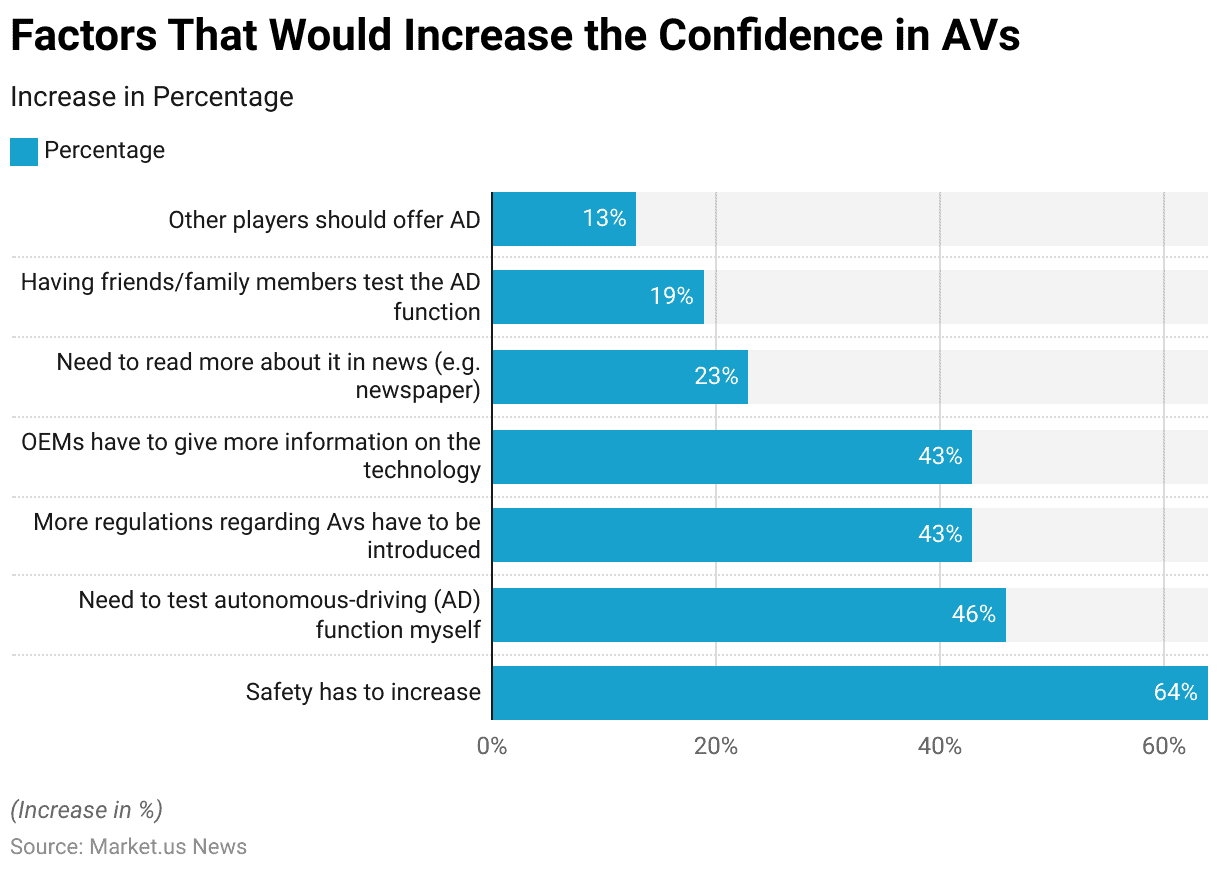

Factors That Would Increase the Confidence in AVs

- Several factors have been identified that would increase consumer confidence in autonomous vehicles (AVs).

- According to respondents, 64% believe that a significant increase in safety is essential.

- Additionally, 46% feel the need to personally test the autonomous driving (AD) function to build trust.

- More regulations regarding AVs are seen as crucial by 43% of respondents, while an equal percentage think that original equipment manufacturers (OEMs) need to provide more information on the technology.

- Reading more about AVs in the news would boost confidence for 23% of respondents, and 19% would feel more assured if friends or family members tested the AD function.

- Lastly, 13% of respondents indicated that having other players in the market offer AD would also enhance their confidence in AVs.

Interest in AVs According to Demographics

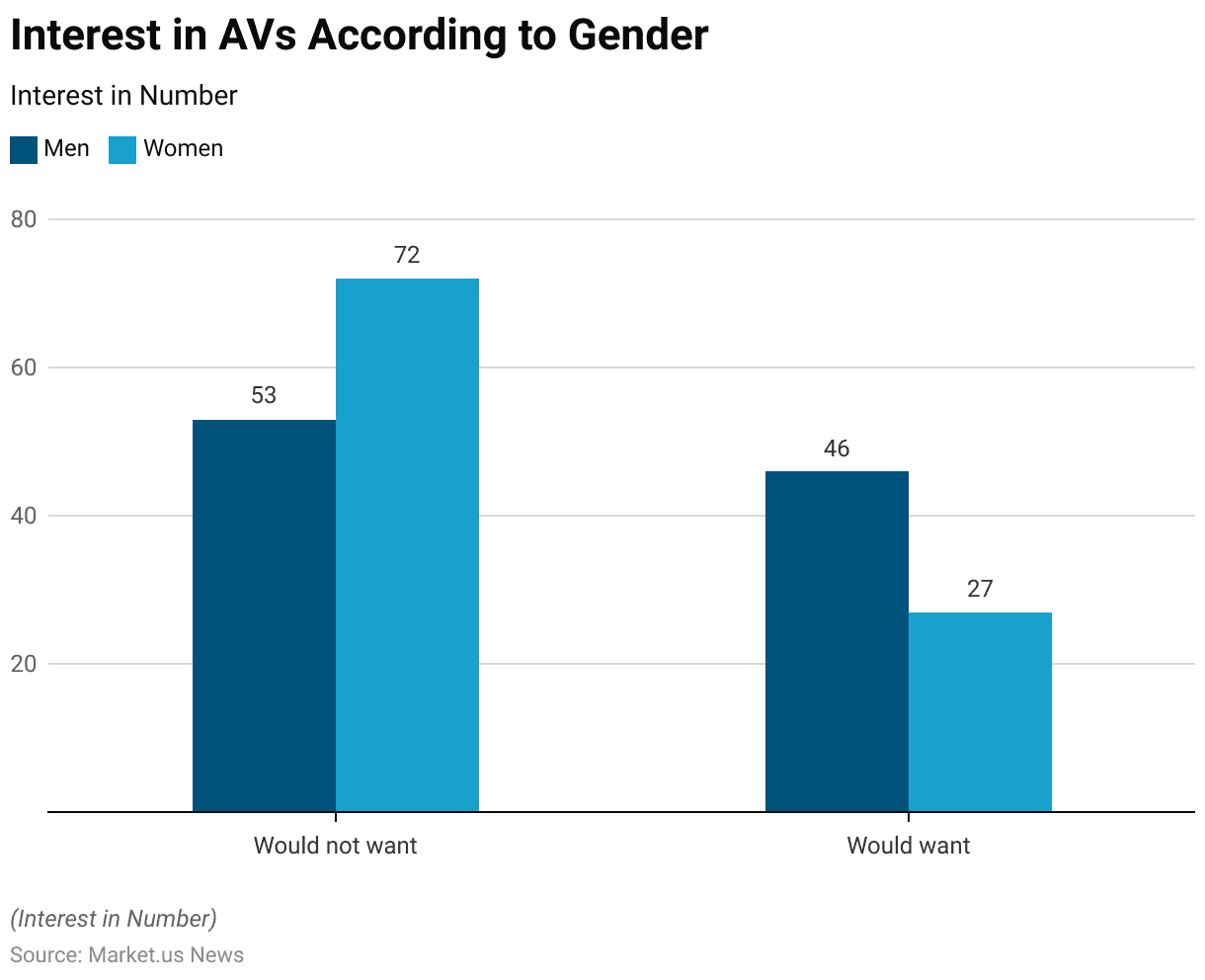

Gender

- The willingness to ride in a driverless passenger vehicle varies significantly between genders among U.S. adults.

- Among men, 46% say they would definitely or probably want to ride in a driverless passenger vehicle if given the opportunity, while 53% would not want to.

- In contrast, the majority of women are more hesitant, with 72% indicating they would not want to ride in a driverless vehicle and only 27% expressing interest.

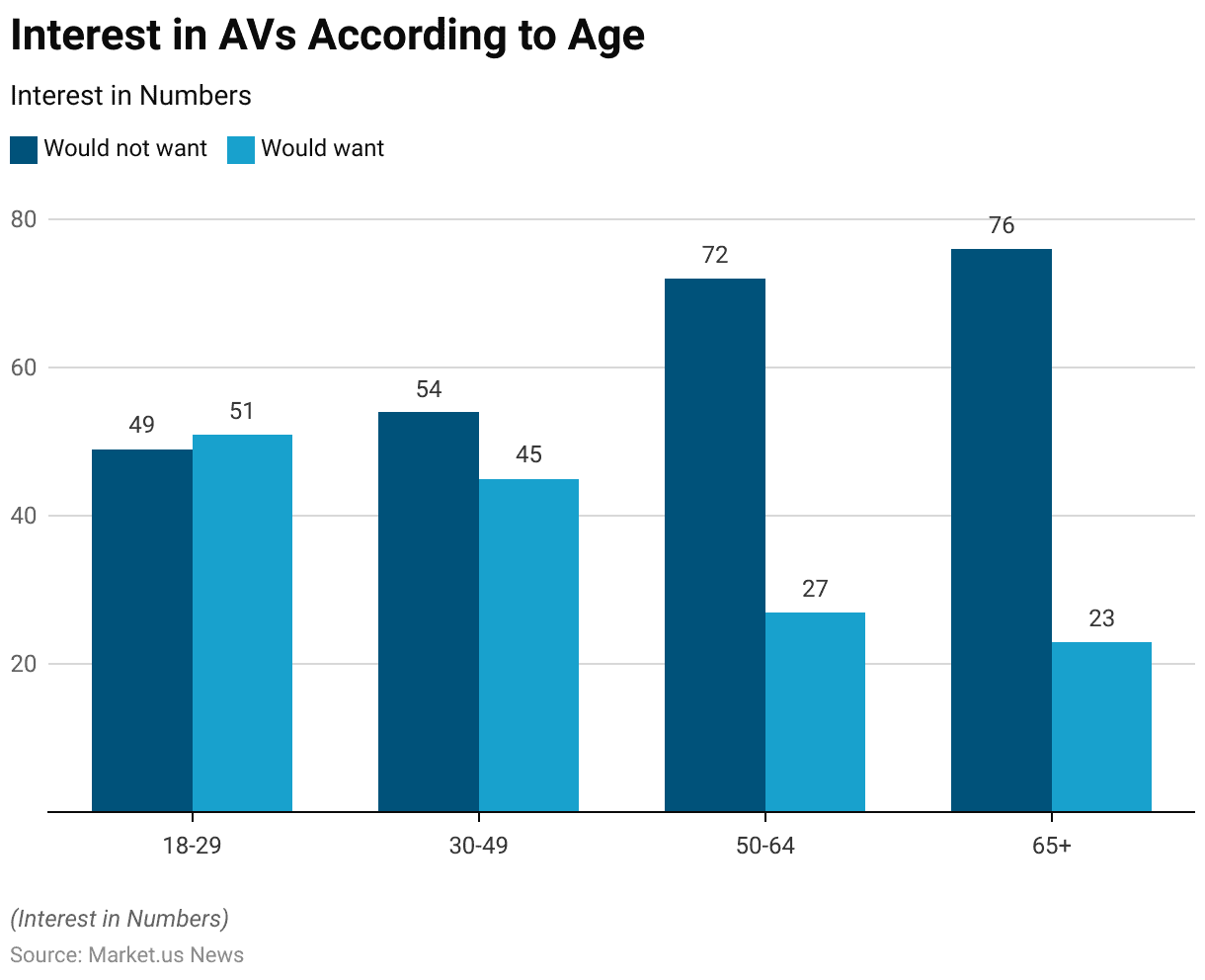

Age

- The willingness to ride in a driverless passenger vehicle among U.S. adults varies significantly across different age groups.

- In the 18-29 age group, 51% say they would definitely or probably want to ride in a driverless vehicle, with 49% expressing reluctance.

- For those aged 30-49, the percentage of those willing to ride drops to 45%, while 54% would not want to.

- The hesitancy increases further in the 50-64 age group. Where 72% would not want to ride in a driverless vehicle, and only 27% are willing.

- Among adults aged 65 and older, 76% would not want to ride in a driverless vehicle. With just 23% expressing interest.

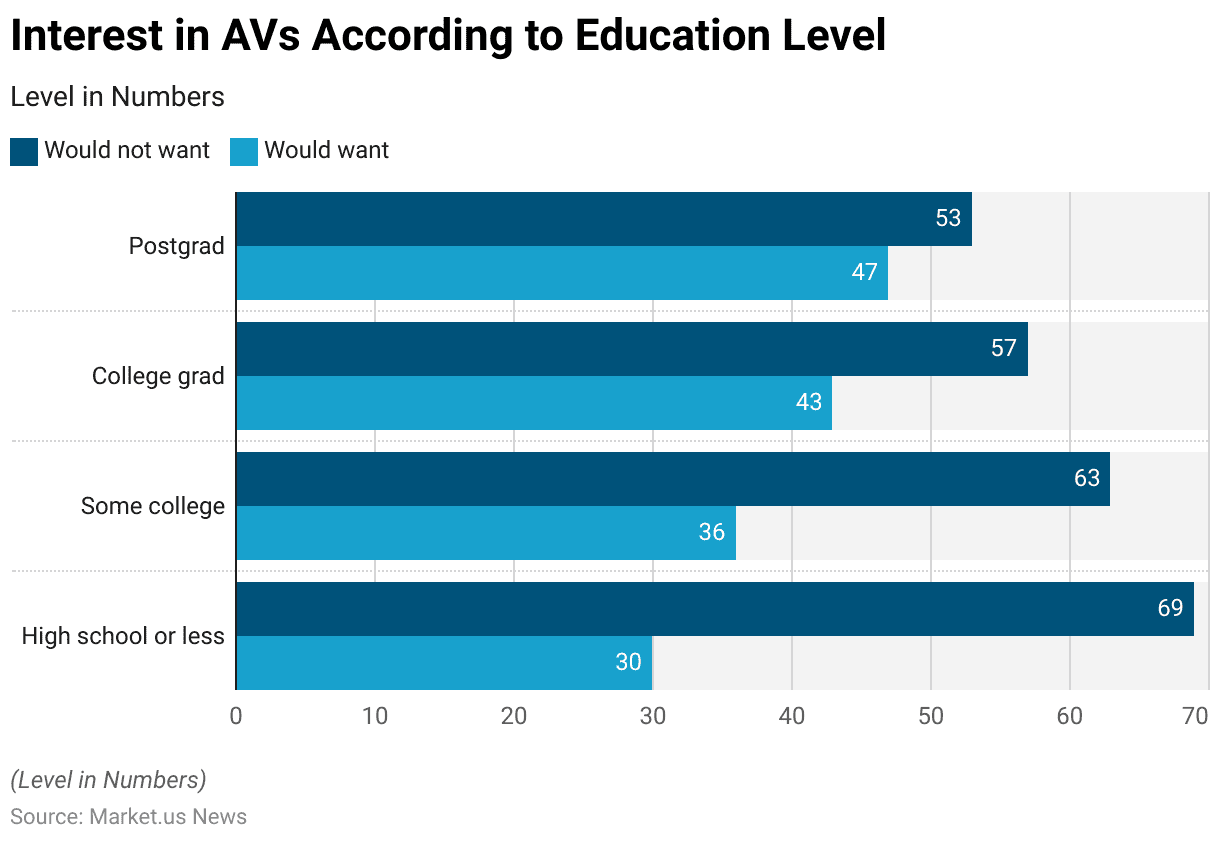

Education Level

- The willingness of U.S. adults to ride in a driverless passenger vehicle varies by education level.

- Among those with a high school education or less, 30% say they would definitely or probably want to ride in a driverless vehicle, while 69% would not want to.

- For individuals with some college education, 36% express a willingness to ride in a driverless vehicle, whereas 63% are reluctant.

- The percentage of willing respondents increases among college graduates, with 43% willing to ride and 57% not wanting to.

- The highest level of acceptance is seen among those with postgraduate education, where 47% are willing to ride in a driverless vehicle, and 53% would not want to.

Challenges and Obstacles to Adoption of AVs

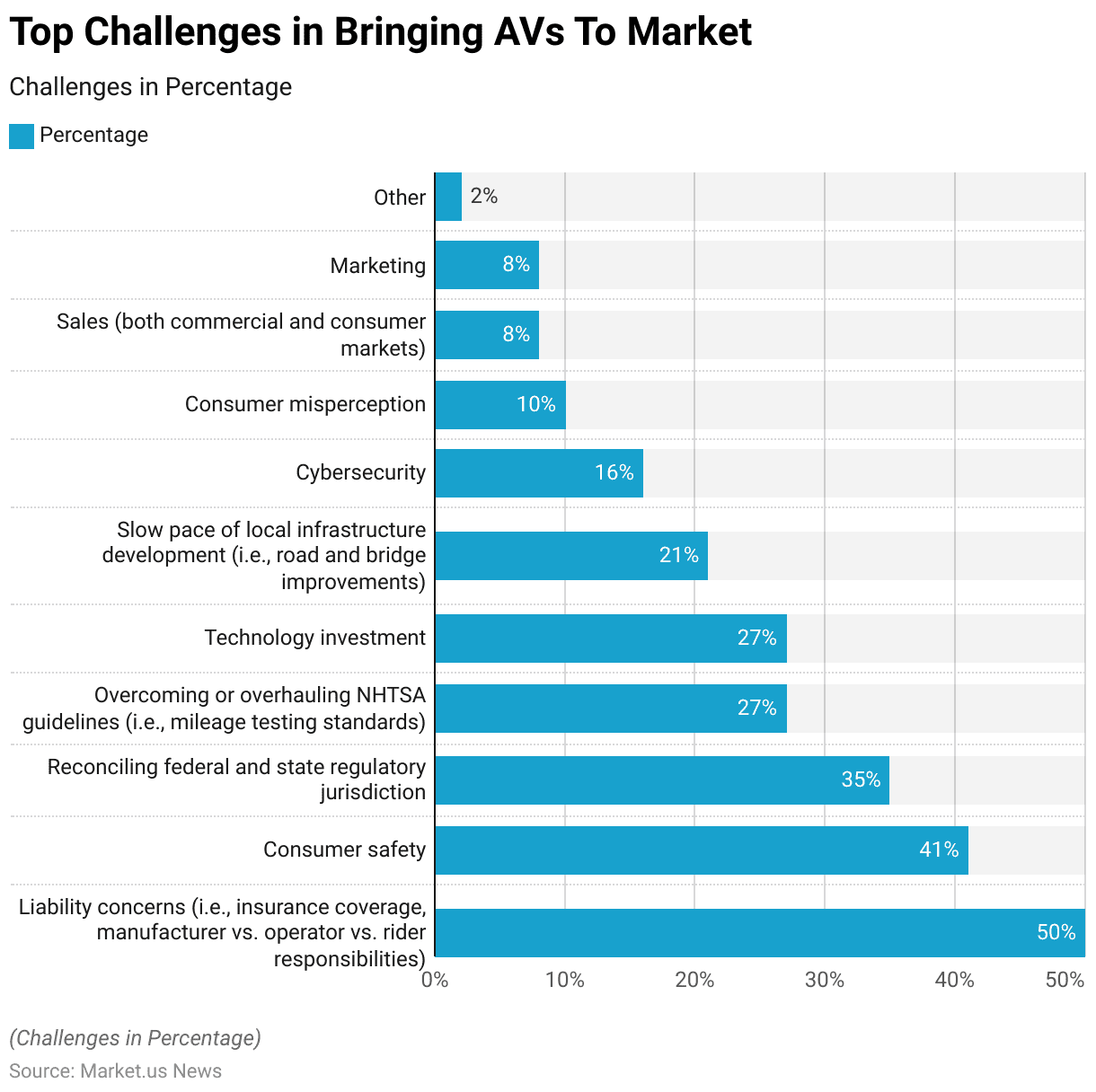

Top Challenges in Bringing AVs to Market

- The autonomous vehicles (AVs) market faces several significant challenges as it moves towards mainstream adoption.

- Liability concerns, encompassing issues such as insurance coverage and the responsibilities of manufacturers, operators, and riders, are highlighted by 50% of respondents as a top challenge.

- Consumer safety is also a major concern, cited by 41% of respondents. The reconciliation of federal and state regulatory jurisdictions presents difficulties for 35% of those surveyed.

- Overcoming or overhauling NHTSA guidelines, particularly mileage testing standards, is a challenge for 27% of respondents, matching the concerns over technology investment.

- The slow pace of local infrastructure development, including necessary road and bridge improvements, is identified by 21% of respondents.

- Cybersecurity issues are also significant, noted by 16% of respondents.

- Consumer misperception about AVs poses a challenge for 10% of respondents, while both sales in commercial and consumer markets and marketing efforts are concerns for 8% of respondents each.

- Finally, 2% of respondents mention other unspecified challenges.

Future of Autonomous Vehicles

Expected Commercial Availability of Autonomous Ride-Hailing and Delivery Services in Major Cities

- The anticipated timeline for the commercial availability of autonomous ride-hailing and delivery services in major cities varies by region.

- In India, 9% of respondents believe these services will be available before 2025, 28% expect availability between 2025 and 2030, 35% foresee it between 2030 and 2035, 23% predict it will be after 2035, and 5% think it will never happen.

- In Western Europe, 15% anticipate availability before 2025, 40% between 2025 and 2030, 32% between 2030 and 2035, 11% after 2035, and 2% believe it will never occur.

- In Japan, 20% expect these services before 2025, 40% between 2025 and 2030, 28% between 2030 and 2035, 11% after 2035, and 1% think it will never happen.

- In China, 26% predict availability before 2025, 38% between 2025 and 2030, 25% between 2030 and 2035, 9% after 2035, and 2% believe it will never occur.

- In the U.S., 26% foresee these services before 2025, 39% between 2025 and 2030, 26% between 2030 and 2035, 8% after 2035, and 1% think it will never happen.

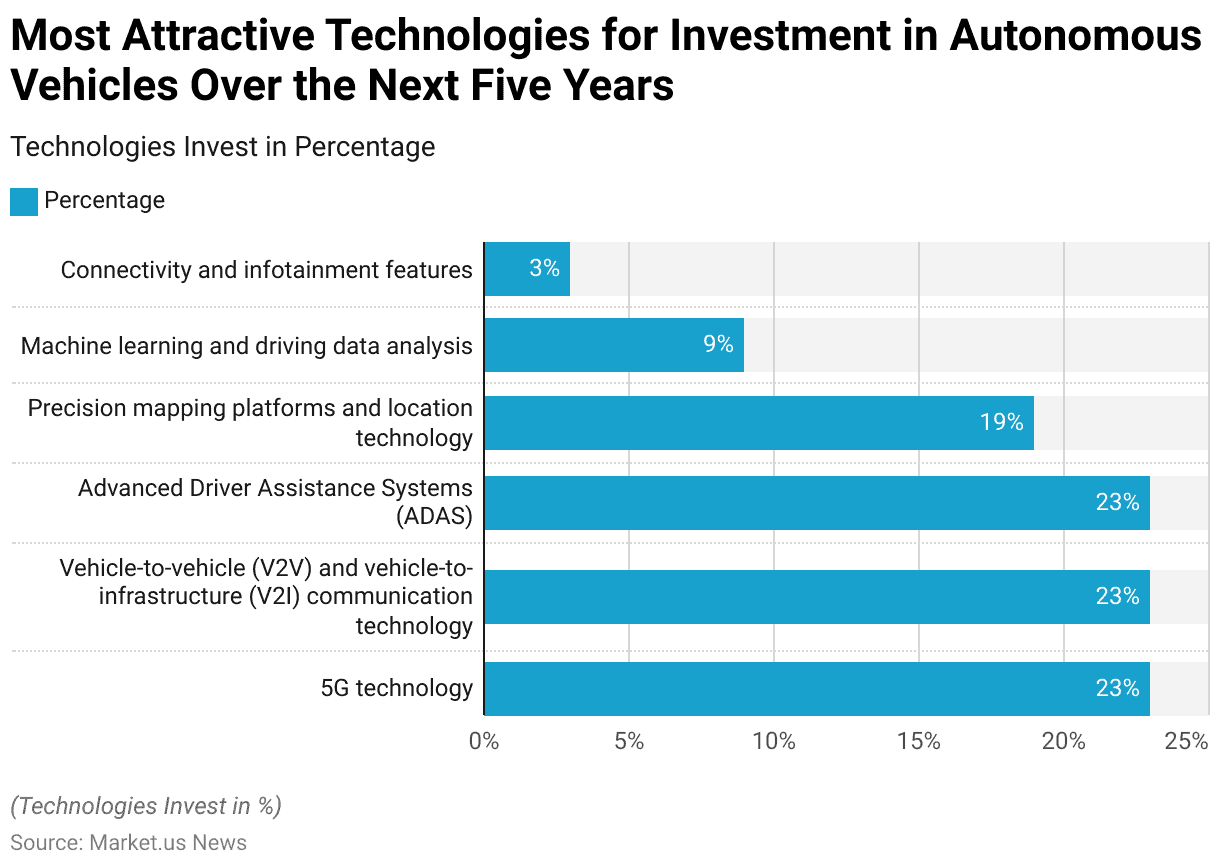

Most Attractive Technologies for Investment in Autonomous Vehicles Over the Next Five Years

- Investors consider several technologies for autonomous vehicles as attractive investment opportunities over the next five years.

- Among these, 5G technology, vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) communication technology, and Advanced Driver Assistance Systems (ADAS) each garner the interest of 23% of respondents.

- Precision mapping platforms and location technology are also highly regarded, attracting 19% of respondents.

- Machine learning and driving data analysis appeal to 9% of respondents, while connectivity and infotainment features are seen as the least attractive, with only 3% of respondents showing interest.

Strategic Initiatives and Trends

- In April 2021, Cruise, GM’s subsidiary, announced an expansion into Dubai with an exclusive agreement to provide self-driving taxis and ride-hailing services with the Dubai Roads and Transport Authority until 2029. Operations were set to begin in 2023, aiming for 4,000 autonomous vehicles by 2030.

- In June 2021, Cruise secured a $5 billion credit line from GM’s financing division to support the launch of its autonomous ride-hailing service. Including the production of self-driving Origin shuttles starting in early 2023. This boosts Cruise’s available funds to over $10 billion.

- In September 2021, GM invested further in Oculii, a software startup improving radar sensor spatial resolution. This funding follows Oculii’s recent $55 million Series B round.