Table of Contents

- Introduction

- Editor’s Choice

- Autonomous Vehicles Market Statistics

- Number of Autonomous Vehicles Global Statistics

- Countries Best Prepared for Autonomous Vehicles Statistics

- Driverless Car-Related Patents Statistics

- Increase in Vehicles Equipped with Hardware for Fully Autonomous Driving

- Autonomous Vehicles Sales Statistics

- Advanced Driver-Assistance System (ADAS) and Autonomous-Driving (AD) Statistics

- Consumer Preferences

- Interest in AVs According to Demographics

- Challenges and Obstacles to Adoption of Autonomous Vehicles Statistics

- Future of Autonomous Vehicles Statistics

- Strategic Initiatives and Trends

- Recent Developments

- Conclusion

- FAQs

Introduction

Autonomous Vehicles Statistics: Autonomous vehicles, also referred to as self-driving cars. They operate independently using advanced sensors, cameras, radar, and AI technology.

These are classified into six autonomy levels, from basic driver assistance to full automation. They are capable of managing all driving tasks under any circumstances.

Essential components include environmental sensors, AI for decision-making, and connectivity for real-time data exchange.

Benefits include improved safety, efficient traffic management, enhanced accessibility, and potential environmental advantages.

Challenges such as regulatory complexities, technological constraints in challenging conditions, and public trust remain significant obstacles.

Nonetheless, ongoing advancements in autonomous driving technology by companies like Waymo and Tesla are driving progress in this field.

Editor’s Choice

- The global autonomous vehicles market revenue reached USD 208.0 billion in 2023.

- The market is expected to continue its rapid growth, reaching USD 2,874.0 billion in 2031 and USD 4,206.4 billion in 2032. With semi-autonomous vehicles contributing USD 2,326.14 billion and fully autonomous vehicles generating USD 1,880.26 billion.

- In the autonomous vehicles market, transportation applications hold a dominant position, capturing 65% of the market share.

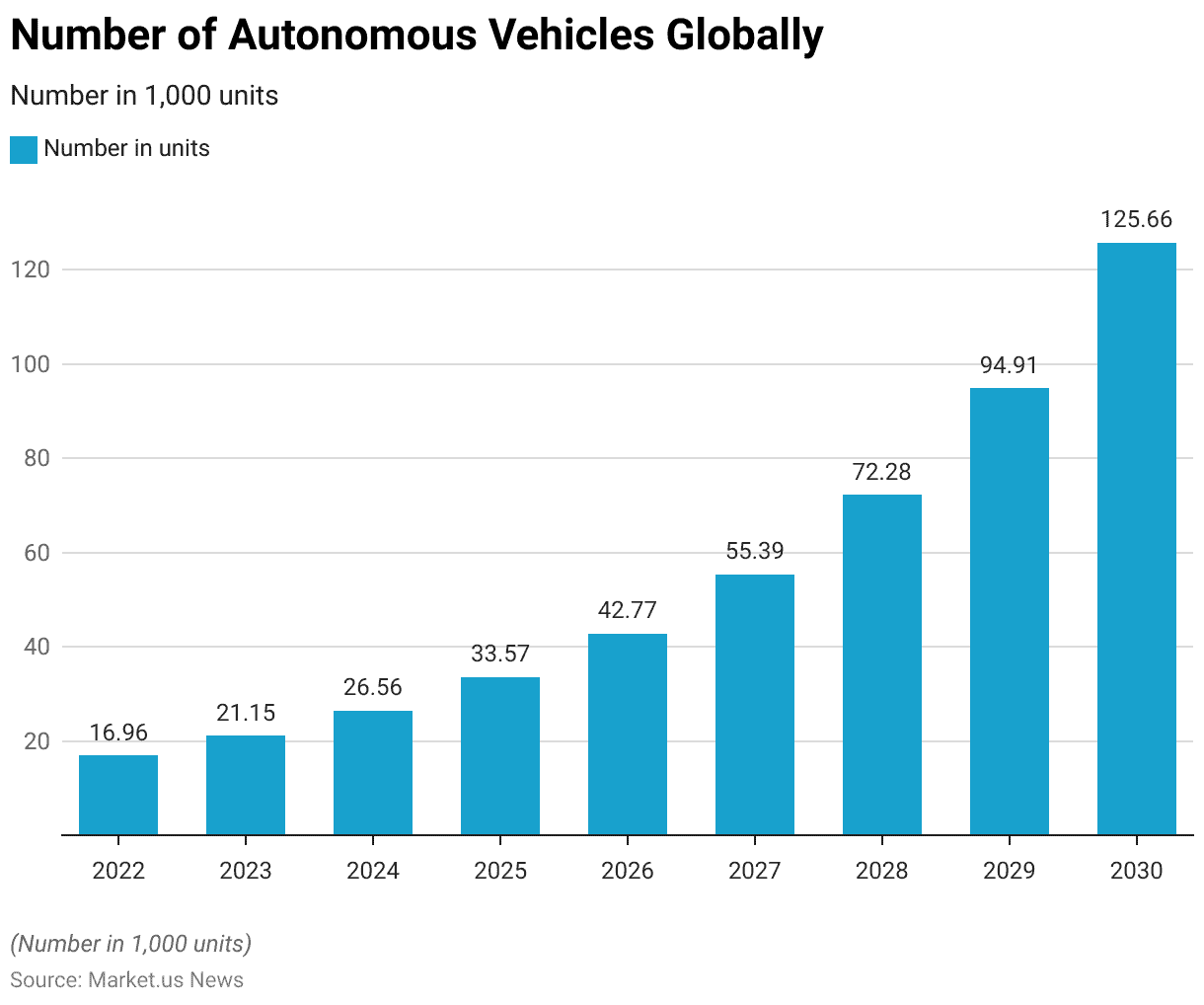

- By the end of the decade, the number of autonomous vehicles worldwide is anticipated to reach 125,660 units in 2030. Underscoring the rapid advancement and adoption of autonomous vehicle technology.

- Between January 2010 and July 2017, Bosch led the field in worldwide patent filings related to autonomous driving, with a total of 958 patents.

- By 2029, autonomous vehicle sales are expected to surge to 41.34 million units, and by 2030, they are projected to reach an impressive 58 million units.

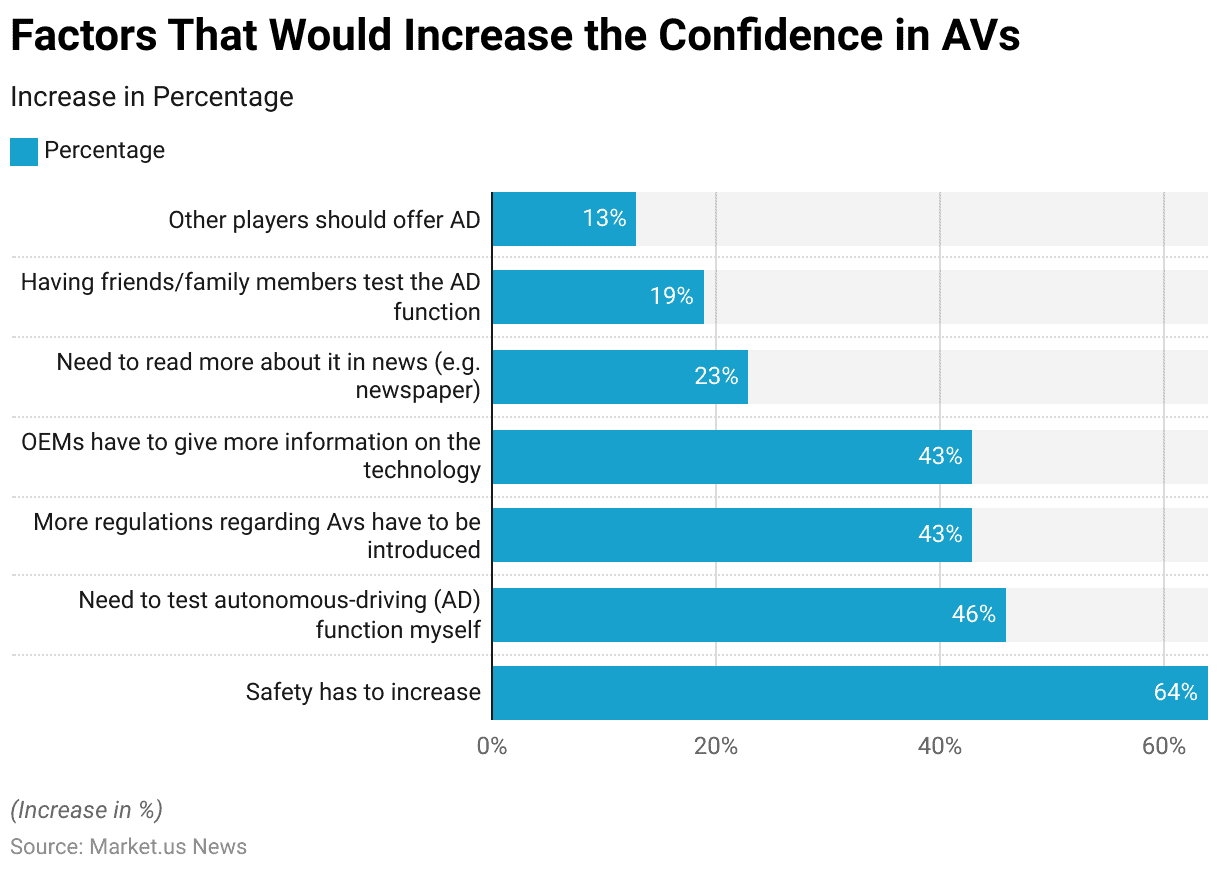

- Several factors have been identified that would increase consumer confidence in autonomous vehicles (AVs). According to respondents, 64% believe that a significant increase in safety is essential.

Autonomous Vehicles Market Statistics

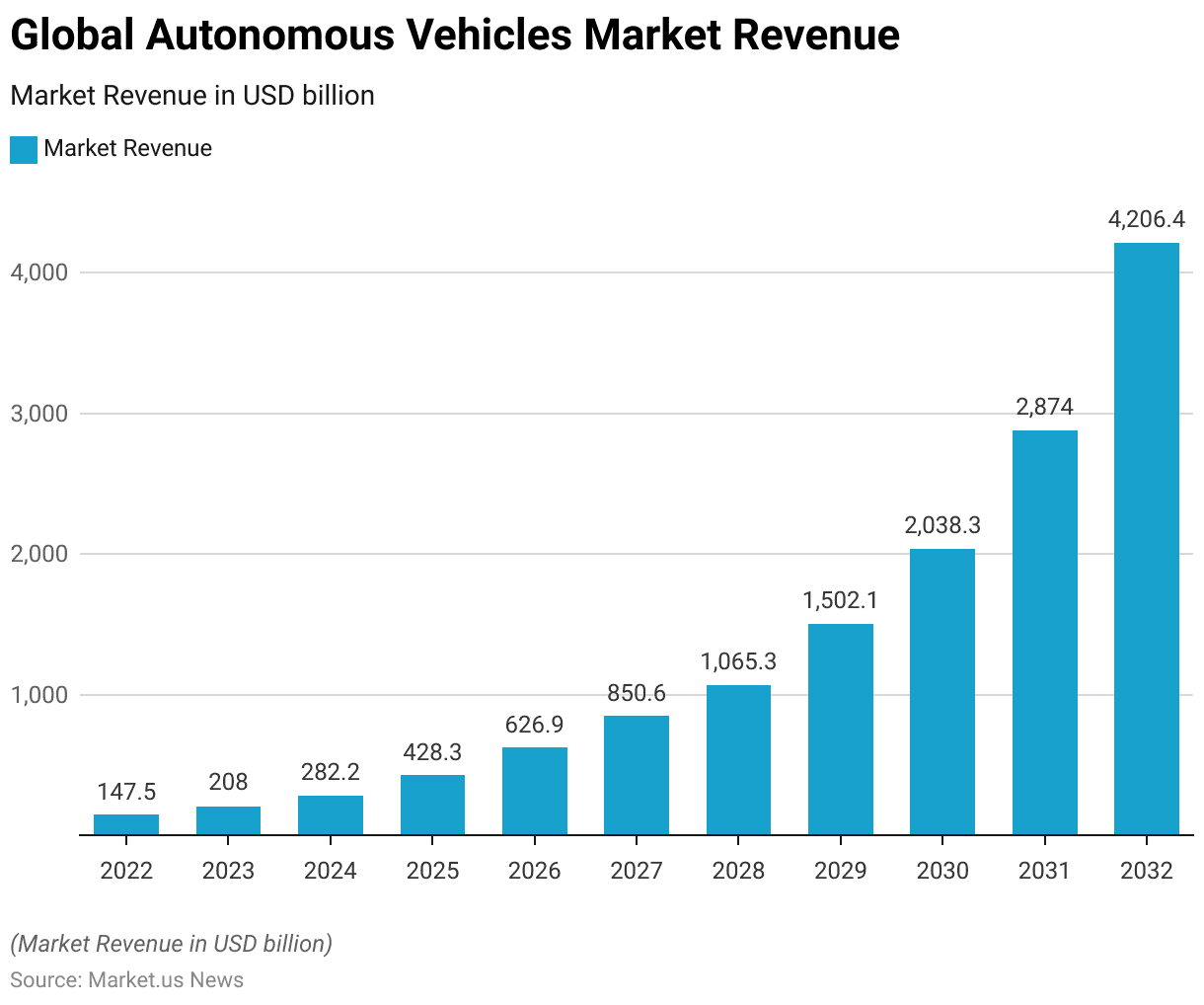

Global Autonomous Vehicles Market Size Statistics

- The global autonomous vehicles market has shown substantial growth over the past decade at a CAGR of 41.0%. With revenue increasing from USD 147.5 billion in 2022 to USD 208.0 billion in 2023.

- This upward trend is expected to continue, with the market projected to reach USD 282.2 billion in 2024.

- By 2025, the revenue is anticipated to more than double, reaching USD 428.3 billion.

- The market’s growth trajectory remains robust, with forecasts predicting USD 626.9 billion in 2026 and USD 850.6 billion in 2027.

- This growth is set to accelerate further, with revenues projected to hit USD 1,065.3 billion in 2028 and USD 1,502.1 billion in 2029.

- By the end of the decade, the market is expected to achieve a remarkable revenue of USD 2,038.3 billion in 2030.

- The momentum is predicted to continue into the early 2030s. The market is anticipated to generate USD 2,874.0 billion in 2031 and an impressive USD 4,206.4 billion by 2032.

(Source: market.us)

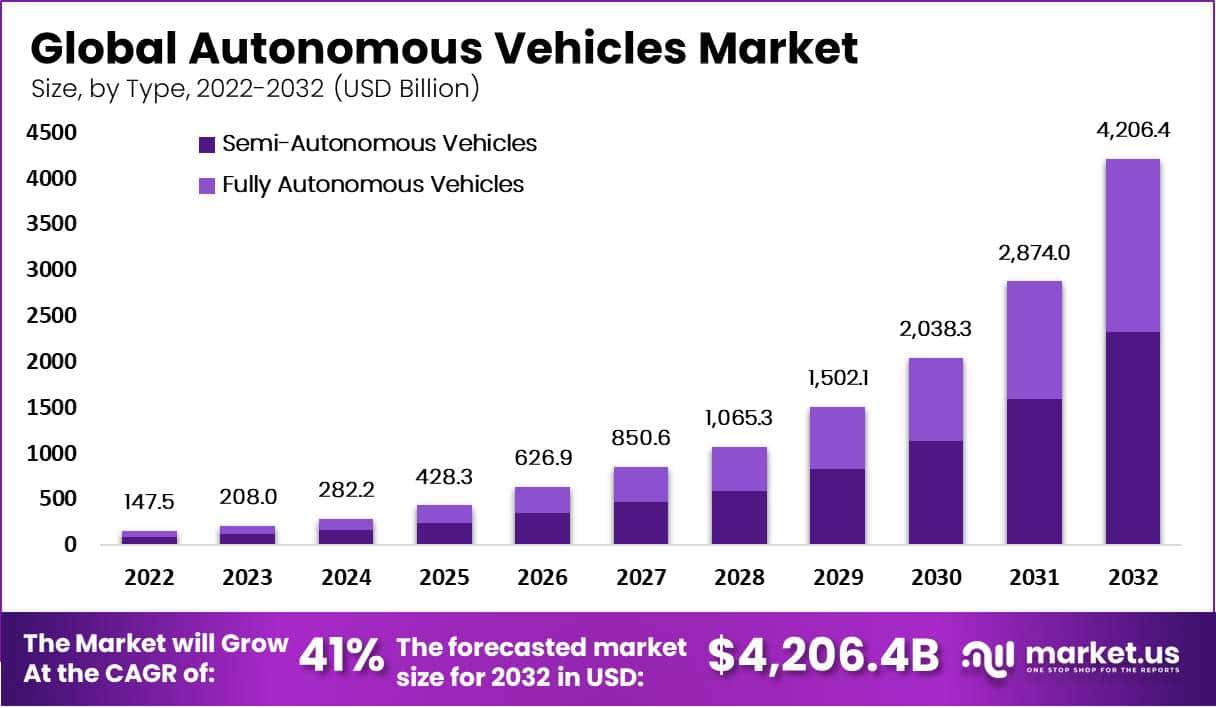

Global Autonomous Vehicles Market Size – By Type Statistics

- The global autonomous vehicles market has experienced significant growth across both semi-autonomous and fully autonomous segments.

- In 2022, the total market revenue was USD 147.5 billion. With semi-autonomous vehicles contributing USD 81.57 billion and fully autonomous vehicles generating USD 65.93 billion.

- By 2023, the market revenue increased to USD 208.0 billion. With semi-autonomous revenue at USD 115.02 billion and fully autonomous revenue at USD 92.98 billion.

- This growth trend is projected to continue, with the market expected to reach USD 282.2 billion in 2024. Comprising USD 156.06 billion from semi-autonomous and USD 126.14 billion from fully autonomous vehicles.

- By 2025, the market is anticipated to grow to USD 428.3 billion. With USD 236.85 billion from semi-autonomous and USD 191.45 billion from fully autonomous vehicles.

- The upward trajectory persists with projected revenues of USD 626.9 billion in 2026, USD 850.6 billion in 2027, and USD 1,065.3 billion in 2028, driven by both segments.

- In 2029, the market is expected to reach USD 1,502.1 billion. With semi-autonomous vehicles contributing USD 830.66 billion and fully autonomous vehicles USD 671.44 billion.

- By 2030, total market revenue is projected at USD 2,038.3 billion. With USD 1,127.18 billion from semi-autonomous and USD 911.12 billion from fully autonomous vehicles.

- The market is expected to continue its rapid growth. Reaching USD 2,874.0 billion in 2031 and USD 4,206.4 billion in 2032. With semi-autonomous vehicles contributing USD 2,326.14 billion and fully autonomous vehicles generating USD 1,880.26 billion.

(Source: market.us)

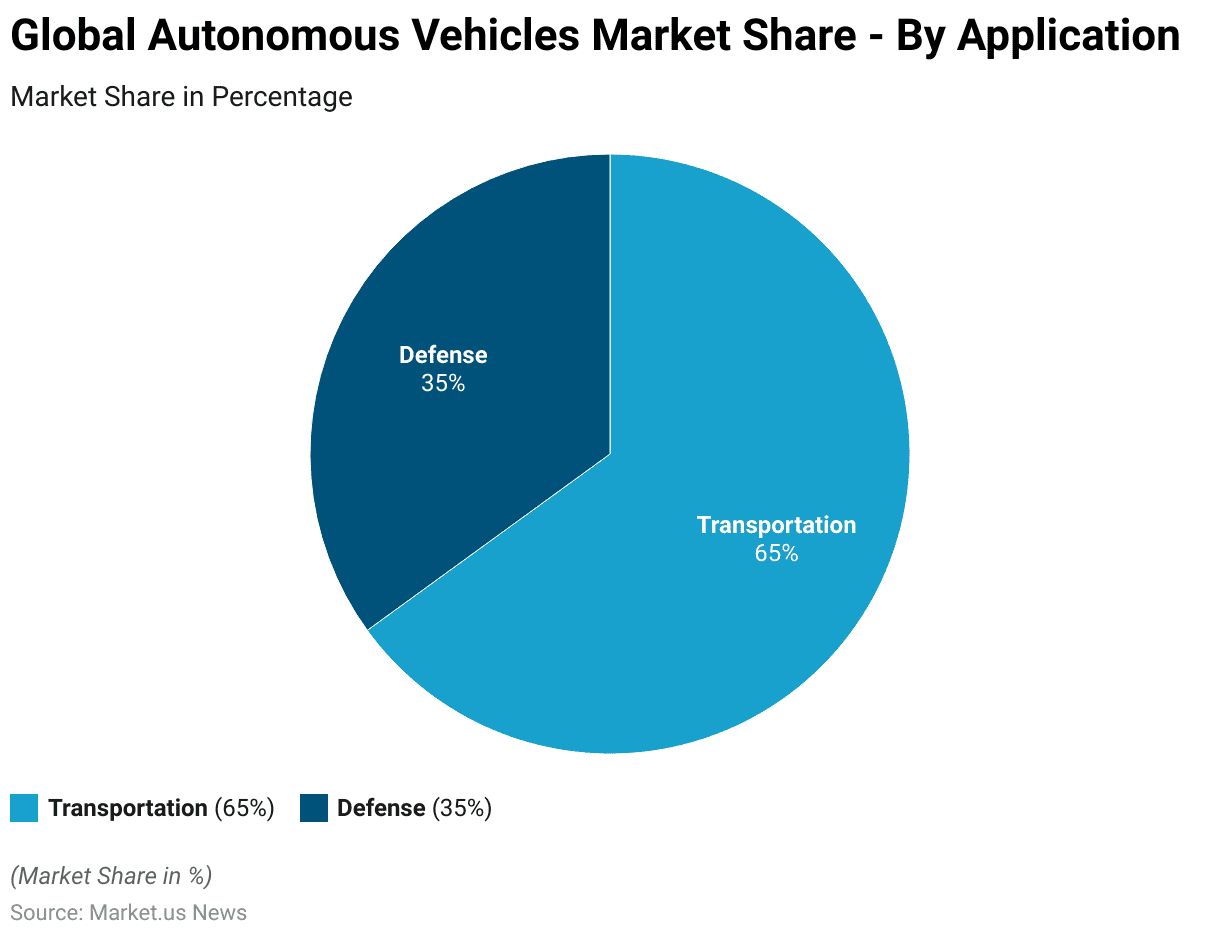

Autonomous Vehicles Market Share – By Application Statistics

- In the autonomous vehicles market, transportation applications hold a dominant position, capturing 65% of the market share.

- This significant share reflects the widespread adoption of autonomous technology in the transportation sector. Driven by advancements in self-driving cars, trucks, and public transit systems.

- Meanwhile, the defense sector accounts for 35% of the market share, highlighting the increasing integration of autonomous vehicles in military operations for purposes such as surveillance, reconnaissance, and logistics.

- The distribution of market share between these two applications underscores the versatile use cases and growing reliance on autonomous vehicle technology across different industries.

(Source: market.us)

Number of Autonomous Vehicles Global Statistics

- The global number of autonomous vehicles has steadily increased over recent years.

- In 2022, there were approximately 16,960 autonomous vehicles in operation worldwide.

- This number rose to 21,150 units in 2023, reflecting a growing adoption of autonomous technology.

- The trend is expected to continue, with the number of autonomous vehicles projected to reach 26,560 units in 2024.

- By 2025, the fleet is anticipated to expand to 33,570 units, demonstrating a significant upward trajectory.

- This growth is forecasted to accelerate, with the number of autonomous vehicles expected to reach 42,770 units in 2026 and 55,390 units in 2027.

- By 2028, the global count is projected to rise to 72,280 units, and by 2029. It is expected to further increase to 94,910 units.

- By the end of the decade, the number of autonomous vehicles worldwide is anticipated to reach 125,660 units in 2030, underscoring the rapid advancement and adoption of autonomous vehicle technology.

(Source: Statista)

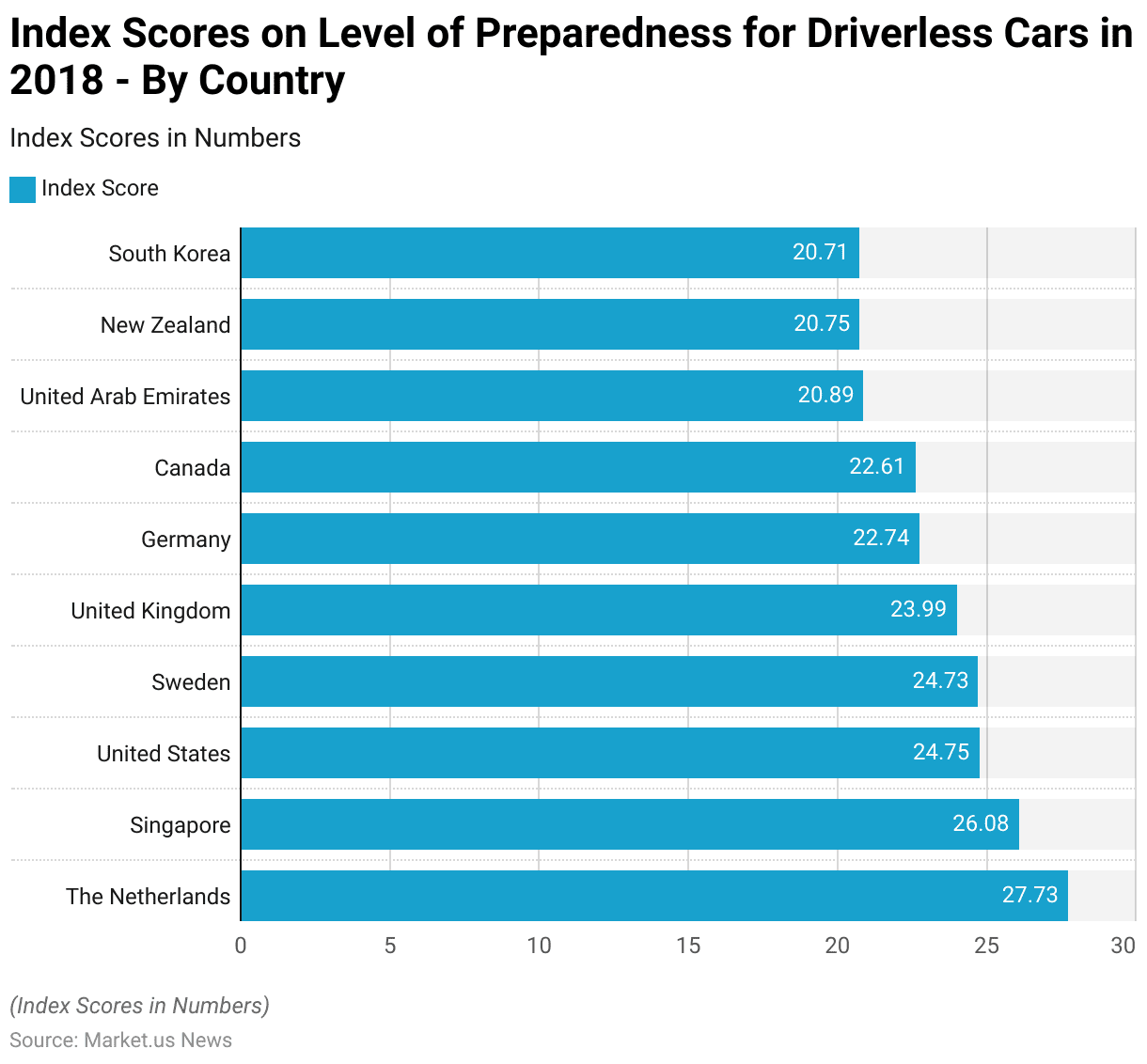

Countries Best Prepared for Autonomous Vehicles Statistics

- In 2018, various countries exhibited different levels of preparedness for the integration of driverless cars, as reflected by their index scores.

- The Netherlands led the rankings with a score of 27.73. Showcasing its advanced infrastructure and supportive regulatory environment for autonomous vehicles.

- Singapore followed closely with an index score of 26.08, highlighting its significant investments in technology and innovation.

- The United States scored 24.75, indicating substantial progress in autonomous vehicle readiness.

- Sweden and the United Kingdom demonstrated comparable levels of preparedness with scores of 24.73 and 23.99, respectively.

- Germany and Canada also showed strong readiness with scores of 22.74 and 22.61.

- The United Arab Emirates and New Zealand scored 20.89 and 20.75, respectively. Reflecting their growing efforts to support driverless car technology.

- South Korea rounded out the top ten with an index score of 20.71. Underscoring its ongoing advancements in autonomous vehicle infrastructure and policy development.

- These scores highlight the varying degrees of readiness among countries to adopt and integrate driverless cars into their transportation systems.

(Source: Statista)

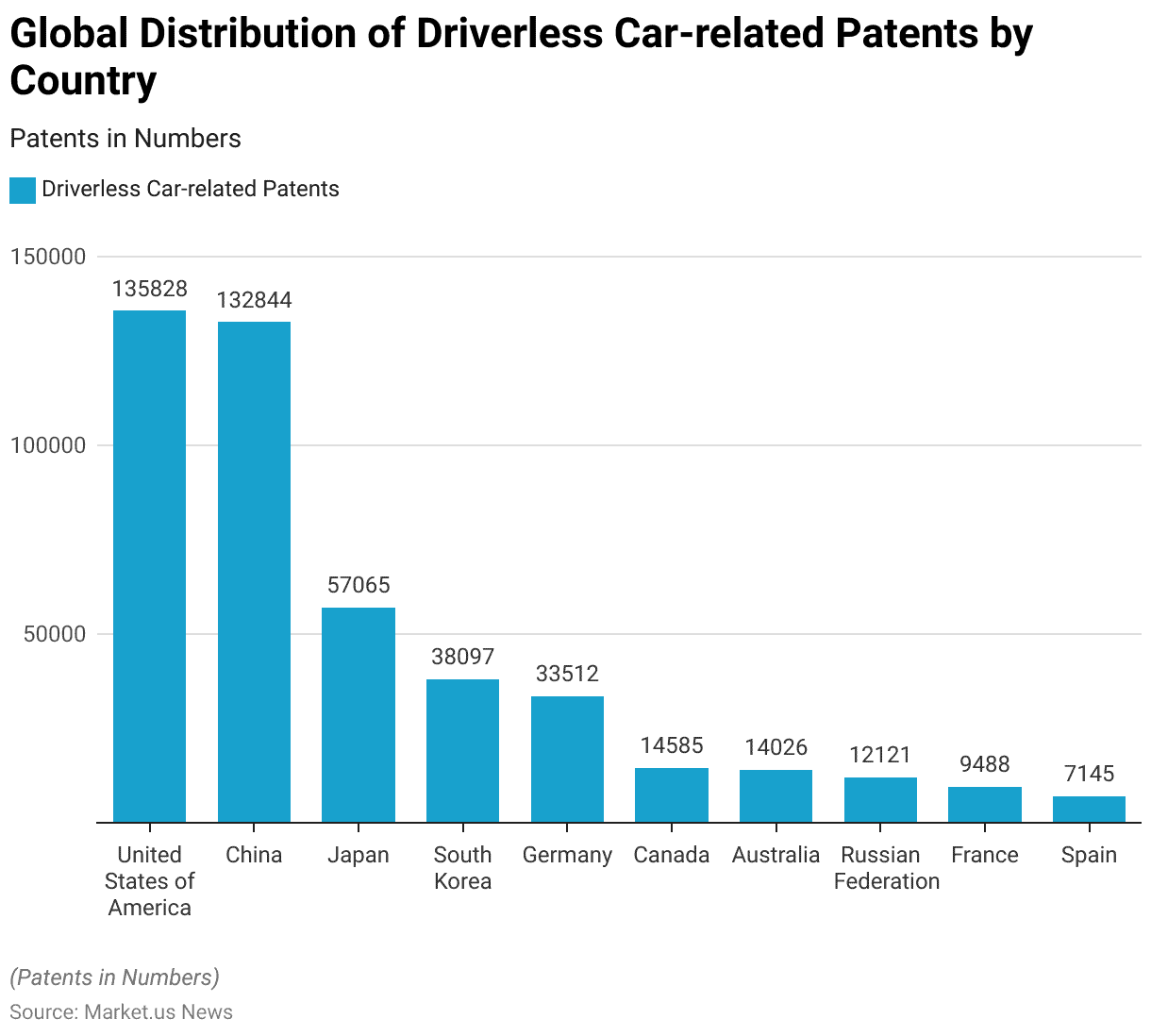

Driverless Car-Related Patents Statistics

Global Distribution of Driverless Car-related Patents by Country

- The distribution of driverless car-related patents across various countries highlights significant global innovation in autonomous vehicle technology.

- The United States leads with an impressive 135,828 patents, followed closely by China with 132,844 patents.

- Japan holds 57,065 patents, indicating its strong position in the field.

- South Korea and Germany have also contributed significantly, with 38,097 and 33,512 patents, respectively.

- Canada and Australia each have substantial patent counts, with 14,585 and 14,026, respectively.

- The Russian Federation has amassed 12,121 patents, while France and Spain have 9,488 and 7,145 patents, respectively.

- This data underscores the widespread and competitive nature of driverless car innovation across the globe.

(Source: Select Car Leasing)

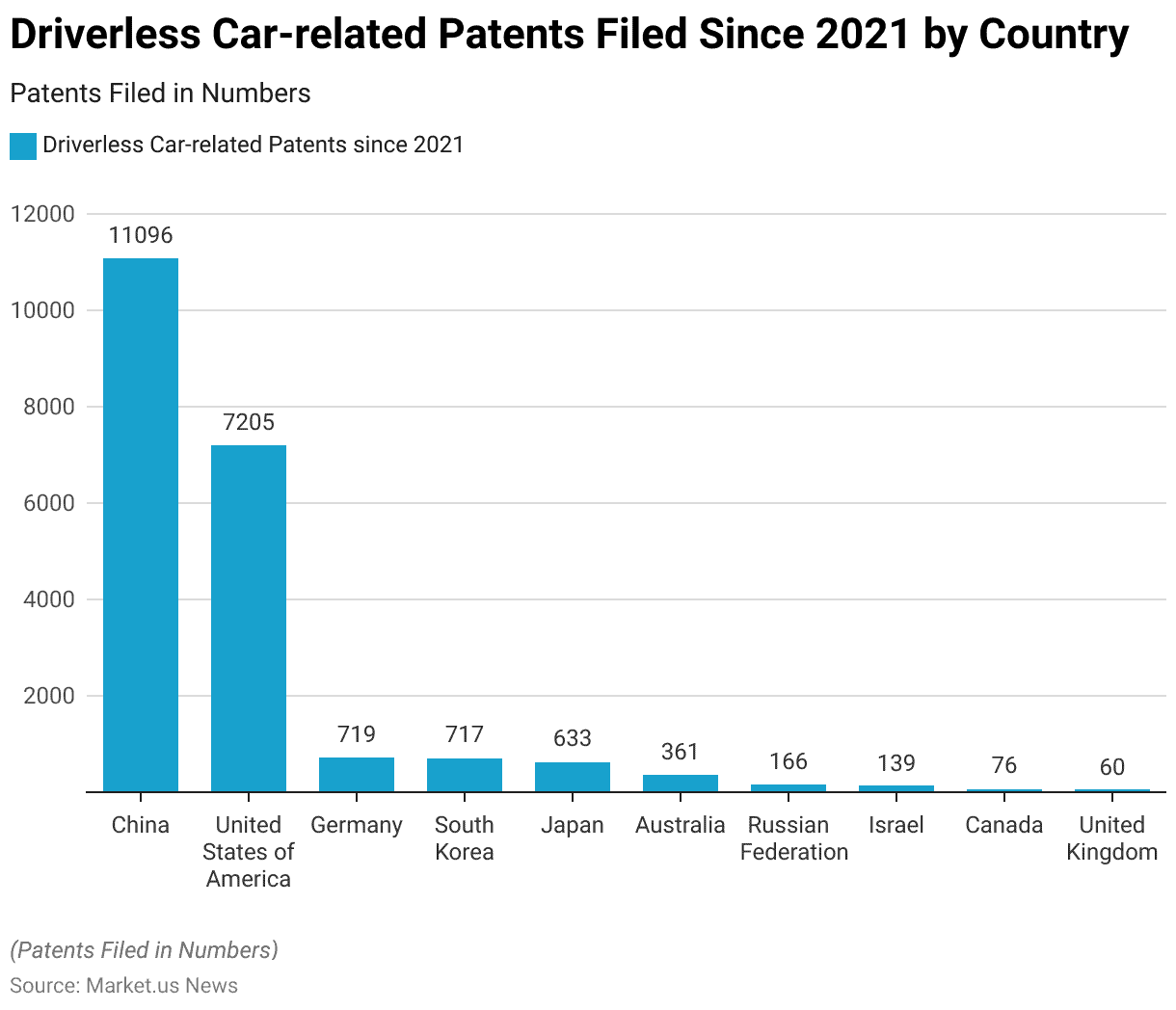

Driverless Car-related Patents Filed Since 2021 by Country

- Since 2021, China has led the way in filing driverless car-related patents, with a total of 11,096 patents.

- The United States follows with 7,205 patents, reflecting its continued innovation in autonomous vehicle technology.

- Germany and South Korea have contributed 719 and 717 patents, respectively, showcasing their ongoing advancements in this field.

- Japan has filed 633 patents, while Australia has contributed 361 patents.

- The Russian Federation has filed 166 patents, and Israel has made notable strides with 139 patents.

- Canada and the United Kingdom have also been active, with 76 and 60 patents filed, respectively.

- This data highlights the global efforts and competitive landscape in the development of driverless car technologies since 2021.

(Source: Select Car Leasing)

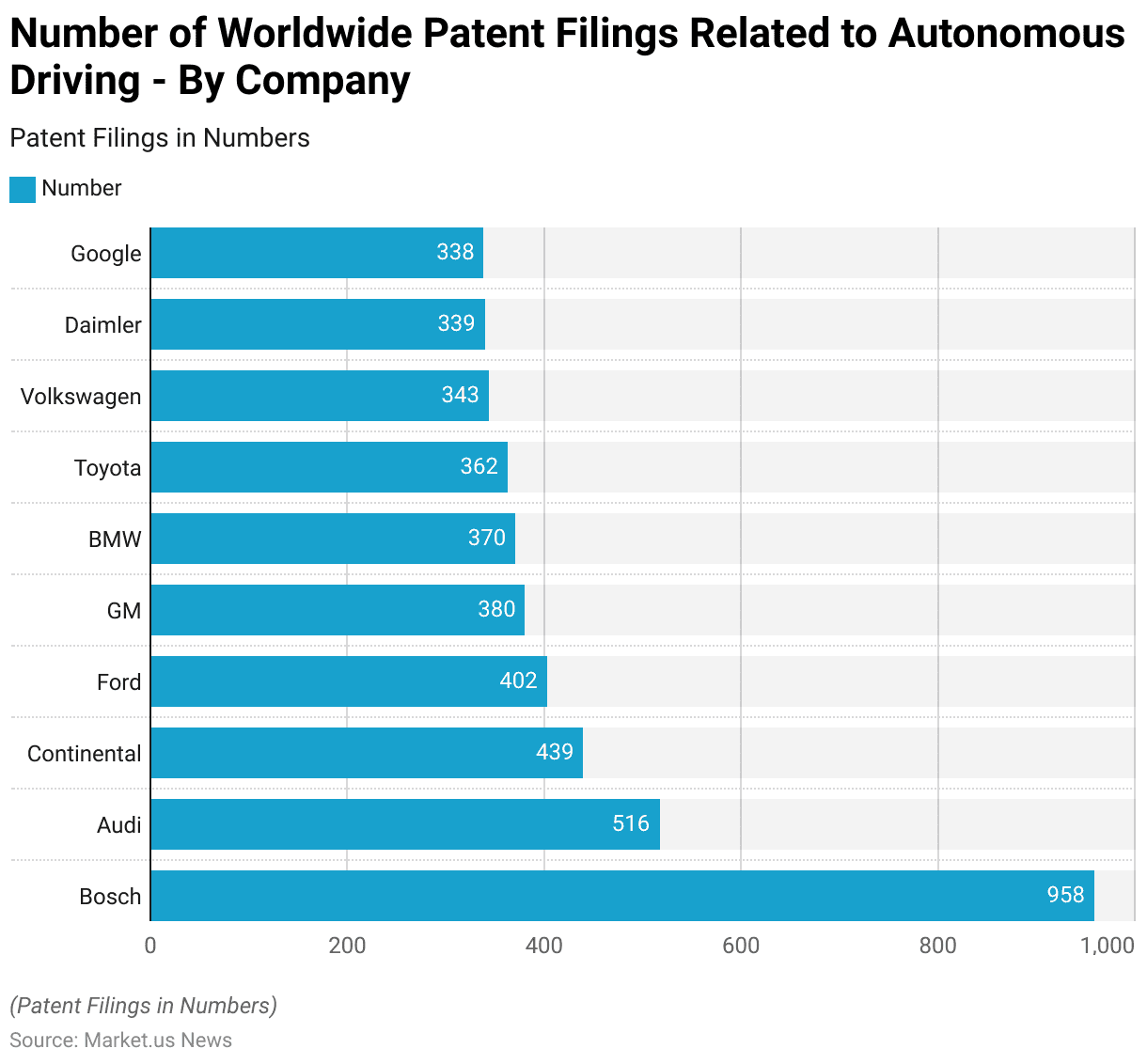

Worldwide Patent Filings Related to Autonomous Driving by Company

- Between January 2010 and July 2017, Bosch led the field in worldwide patent filings related to autonomous driving, with a total of 958 patents.

- Audi followed with 516 patents, demonstrating its strong commitment to innovation in this sector.

- Continental filed 439 patents, while Ford and GM contributed 402 and 380 patents, respectively.

- BMW and Toyota were also prominent players, with 370 and 362 patents filed.

- Volkswagen and Daimler filed 343 and 339 patents, respectively.

- Google, a significant non-automotive company in this space, filed 338 patents.

- These figures underscore the intense competition and rapid advancements in autonomous driving technology during this period.

(Source: Statista)

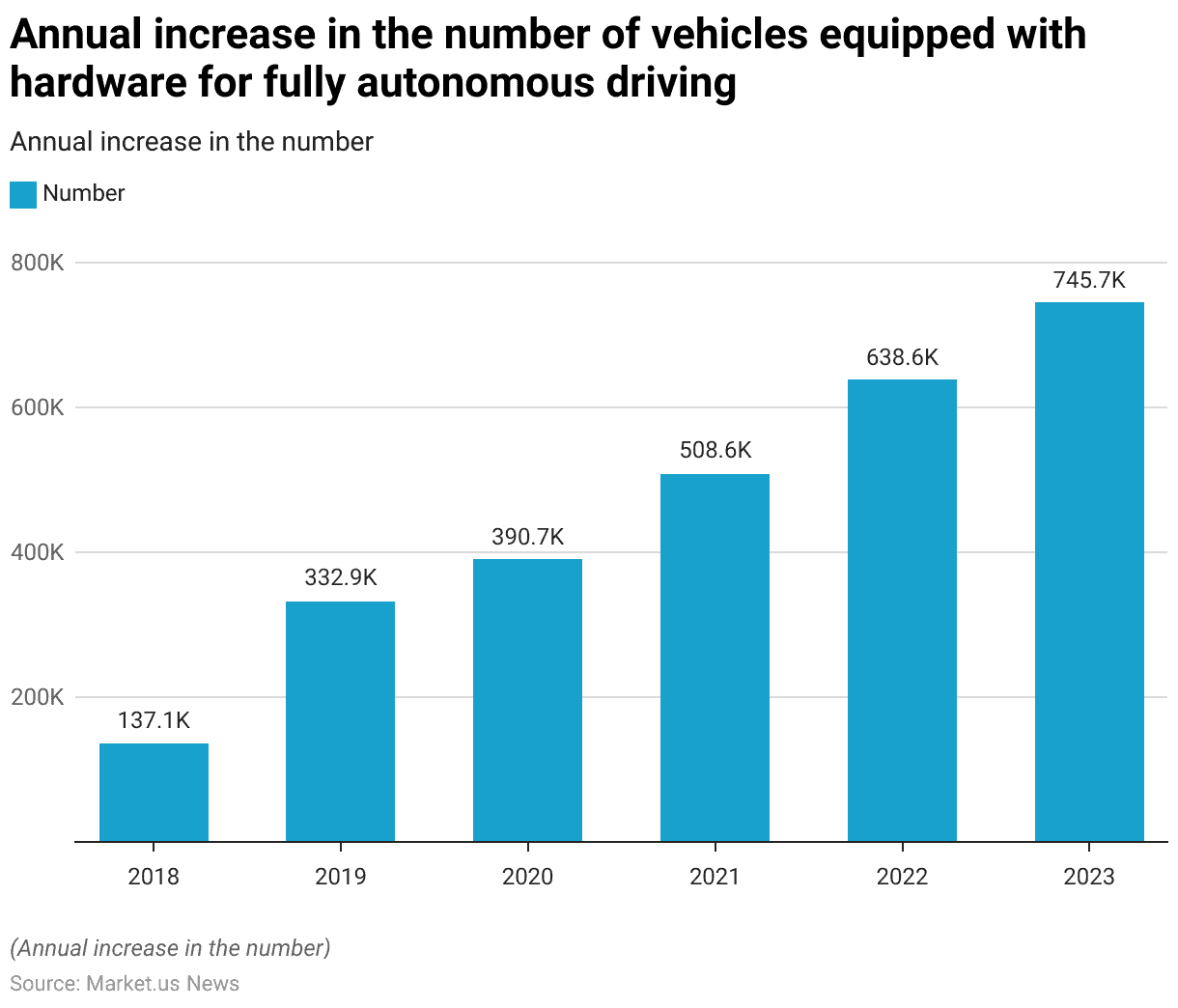

Increase in Vehicles Equipped with Hardware for Fully Autonomous Driving

- The annual increase in the number of vehicles equipped with hardware for fully autonomous driving has shown a remarkable upward trend from 2018 to 2023.

- In 2018, the increase was 137,129 vehicles. This number grew substantially to 332,932 vehicles in 2019.

- The upward trajectory continued in 2020, with an increase of 390,662 vehicles. By 2021, the number had risen to 508,622 vehicles.

- The growth trend persisted in 2022, with an increase of 638,585 vehicles.

- In 2023, the annual increase reached 745,705 vehicles, underscoring the rapid adoption and implementation of fully autonomous driving technology over these years.

(Source: Statista)

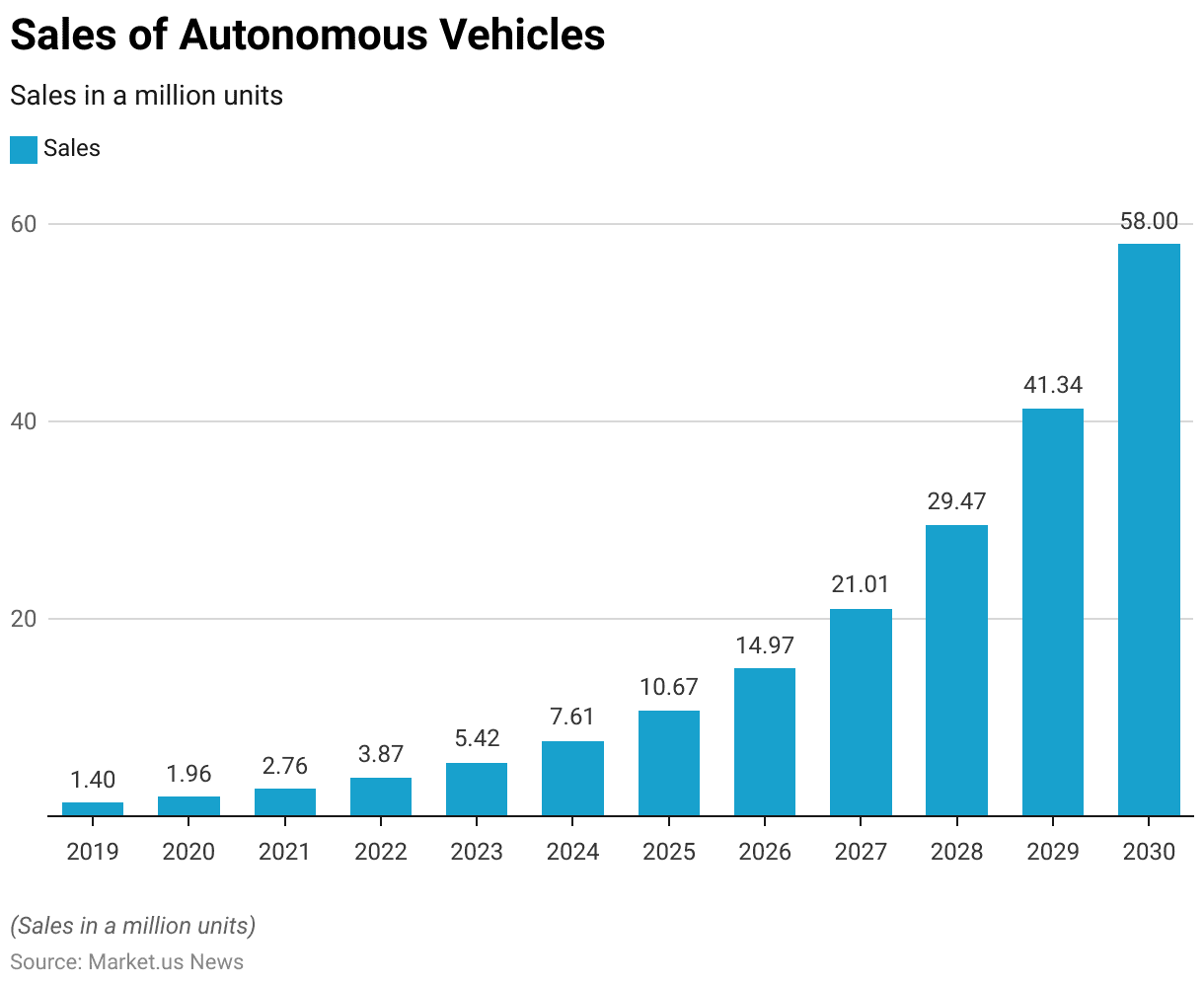

Autonomous Vehicles Sales Statistics

- The sales of autonomous vehicles have shown a remarkable upward trajectory from 2019 to 2030.

- In 2019, the sales were 1.4 million units, which increased to 1.96 million units in 2020.

- This growth continued in 2021, with sales reaching 2.76 million units.

- By 2022, the sales further climbed to 3.87 million units, and in 2023, they reached 5.42 million units.

- The sales are projected to rise significantly in the following years, with 7.61 million units expected in 2024 and 10.67 million units in 2025.

- The upward trend continues with an anticipated 14.97 million units in 2026, 21.01 million units in 2027, and 29.47 million units in 2028.

- By 2029, sales are expected to surge to 41.34 million units, and by 2030, they are projected to reach an impressive 58 million units.

- This data highlights the rapid adoption and increasing popularity of autonomous vehicles over the decade.

(Source: Statista)

Advanced Driver-Assistance System (ADAS) and Autonomous-Driving (AD) Statistics

Advanced Driver-Assistance System (ADAS) and Autonomous-Driving (AD) Sales and Revenue

- Current vehicles typically offer basic Advanced Driver Assistance Systems (ADAS), but significant advancements in autonomous driving (AD) capabilities are imminent.

- Ultimately, cars aim to achieve Society of Automotive Engineers (SAE) Level 4 autonomy, enabling driverless operation under specific conditions.

- According to a consumer survey by McKinsey in 2021, there is a strong consumer demand for AD features, with a willingness to pay for them. This growing demand is projected to generate substantial revenue, potentially reaching billions of dollars.

- Vehicles equipped with LIDAR-based Level 2+ (L2+) capabilities incur component costs ranging from $1,500 to $2,000, with higher costs for Level 3 (L3) and Level 4 (L4) options.

- McKinsey’s analysis suggests that ADAS and AD technologies could contribute between $300 billion and $400 billion to the passenger car market by 2035.

(Source: Mckinsey)

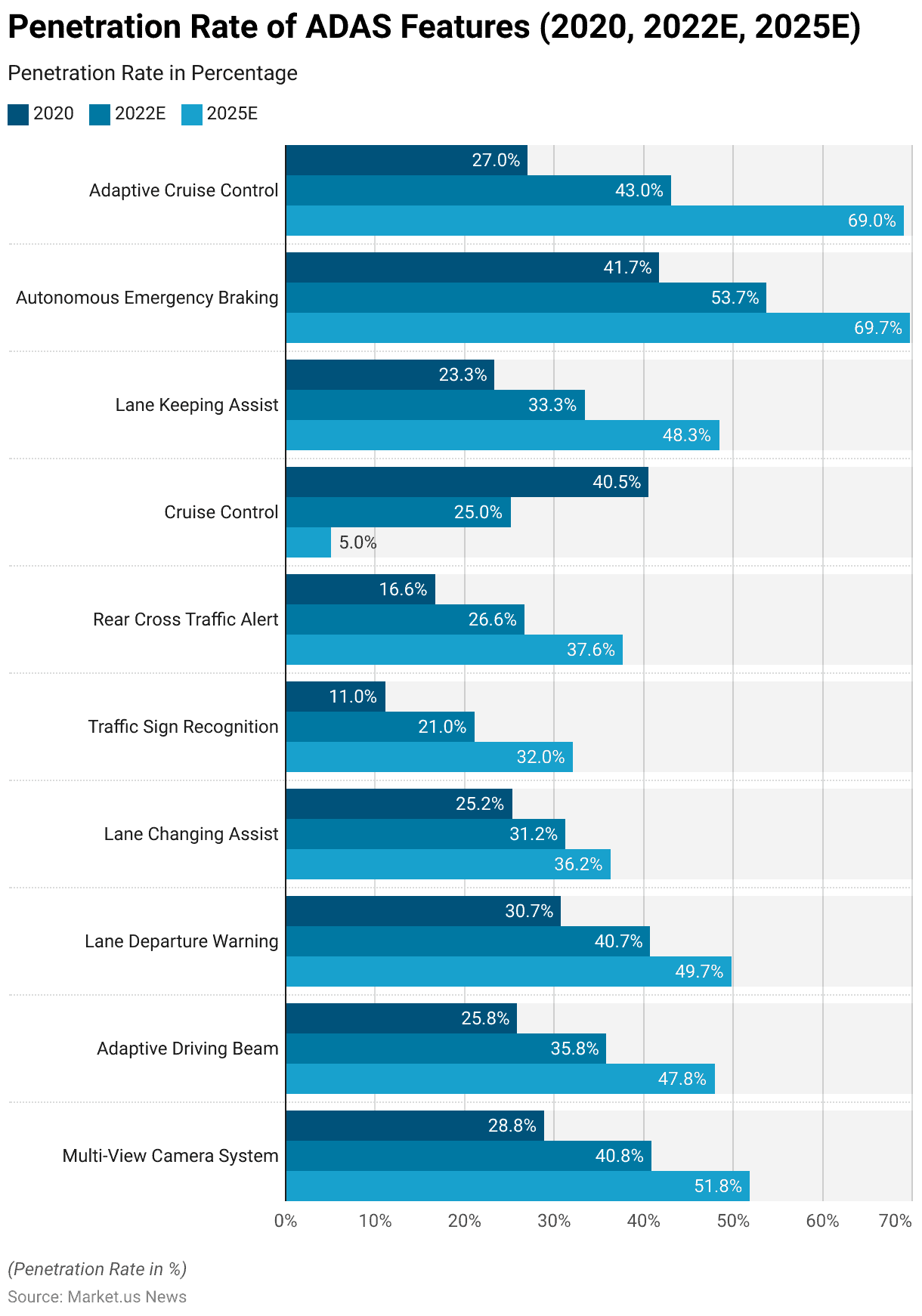

ADAS Features Penetration Rate

- The penetration rates of Advanced Driver Assistance Systems (ADAS) features have been projected to increase significantly from 2020 to 2025.

- In 2020, the Multi-View Camera System had a penetration rate of 28.8%, which is expected to rise to 40.8% in 2022 and 51.8% by 2025.

- The Adaptive Driving Beam feature, starting at 25.8% in 2020, is projected to grow to 35.8% in 2022 and 47.8% in 2025.

- Lane Departure Warning systems, with a penetration rate of 30.7% in 2020, are anticipated to reach 40.7% in 2022 and 49.7% by 2025.

- Similarly, Lane Changing Assist is expected to increase from 25.2% in 2020 to 31.2% in 2022 and 36.2% in 2025. Traffic Sign Recognition, starting at 11.0% in 2020, is projected to reach 21.0% in 2022 and 32.0% by 2025.

- Rear Cross Traffic Alert systems, at 16.6% in 2020, are expected to rise to 26.6% in 2022 and 37.6% by 2025.

- Notably, the penetration rate for Cruise Control is projected to decrease significantly from 40.5% in 2020 to 25.0% in 2022 and 5.0% by 2025. Lane Keeping Assist systems are expected to grow from 23.3% in 2020 to 33.3% in 2022 and 48.3% by 2025.

- Autonomous Emergency Braking, with the highest initial rate of 41.7% in 2020, is projected to increase to 53.7% in 2022 and 69.7% by 2025.

- Lastly, Adaptive Cruise Control, starting at 27.0% in 2020, is expected to grow to 43.0% in 2022 and 69.0% by 2025.

- These projections highlight the increasing integration and importance of ADAS features in modern vehicles.

(Source: KPMG)

Consumer Preferences

Indicators of Consumer Interest in Fully Owning Autonomous Vehicles (AVs)

- Indicators of consumer interest in fully owning autonomous vehicles (AVs) have shown varying trends between 2020 and 2021.

- The readiness to switch to AVs fluctuated, with respondents indicating a range from 9% to 35% in 2020, which slightly narrowed to 10% to 26% in 2021.

- Trust in the safety of AVs experienced a decline, dropping from 40% in 2020 to 35% in 2021, reflecting growing concerns about the reliability of autonomous technology.

- Additionally, consumer support for government regulation of AVs decreased significantly, from 67% in 2020 to 53% in 2021.

- These trends suggest a cautious approach among consumers towards the adoption of fully autonomous vehicles, with concerns about safety and regulatory frameworks playing a crucial role in shaping their attitudes.

(Source: Mckinsey)

Factors That Would Increase the Confidence in AVs

- Several factors have been identified that would increase consumer confidence in autonomous vehicles (AVs).

- According to respondents, 64% believe that a significant increase in safety is essential.

- Additionally, 46% feel the need to personally test the autonomous driving (AD) function to build trust.

- More regulations regarding AVs are seen as crucial by 43% of respondents, while an equal percentage think that original equipment manufacturers (OEMs) need to provide more information on the technology.

- Reading more about AVs in the news would boost confidence for 23% of respondents, and 19% would feel more assured if friends or family members tested the AD function.

- Lastly, 13% of respondents indicated that having other players in the market offer AD would also enhance their confidence in AVs.

- These factors highlight the various aspects that consumers consider important for building trust in autonomous vehicle technology.

(Source: Mckinsey)

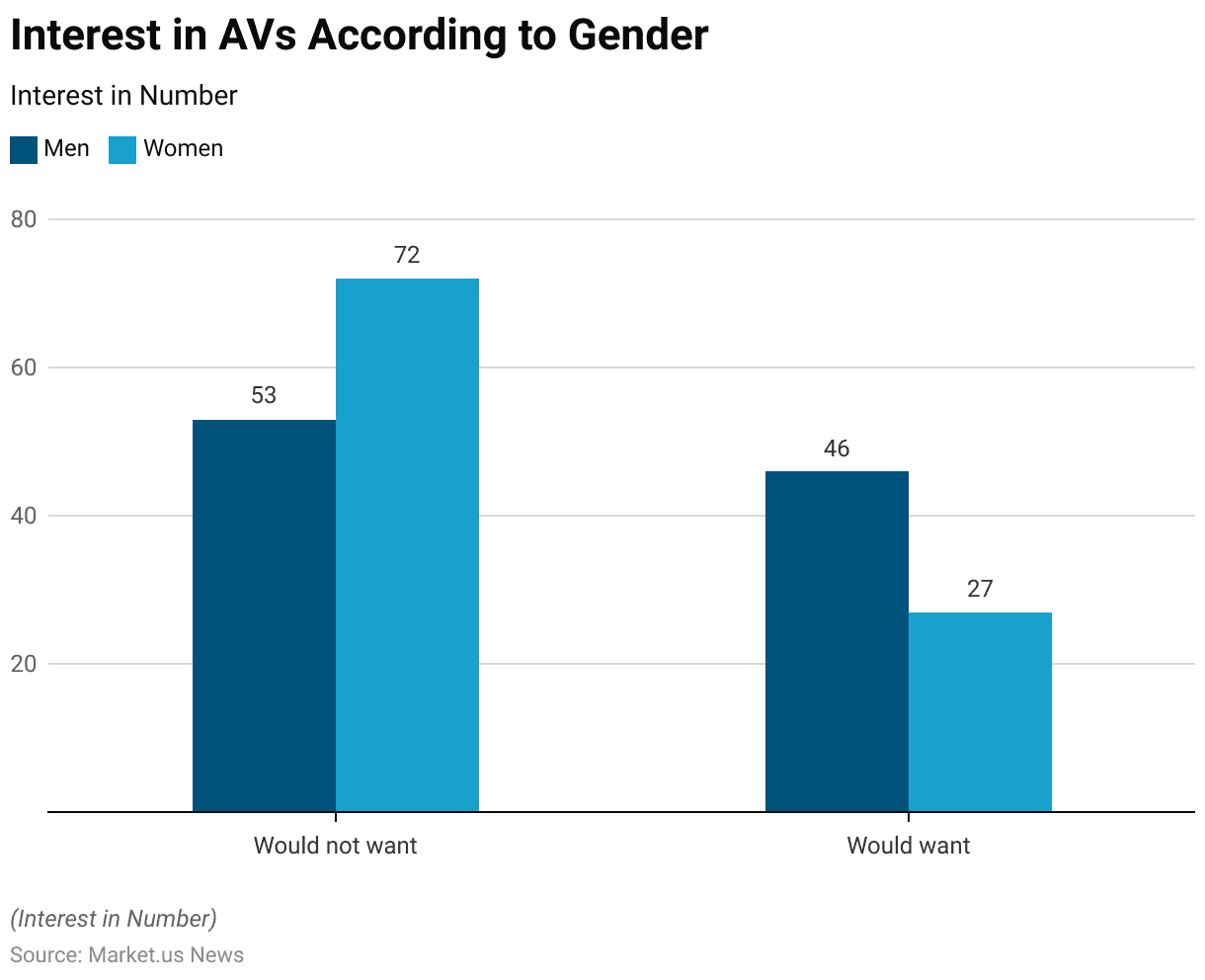

Interest in AVs According to Demographics

Gender

- The willingness to ride in a driverless passenger vehicle varies significantly between genders among U.S. adults.

- Among men, 46% say they would definitely or probably want to ride in a driverless passenger vehicle if given the opportunity, while 53% would not want to.

- In contrast, the majority of women are more hesitant, with 72% indicating they would not want to ride in a driverless vehicle and only 27% expressing interest.

- This data reflects a notable gender gap in the acceptance and enthusiasm for autonomous vehicle technology.

(Source: Pew Research)

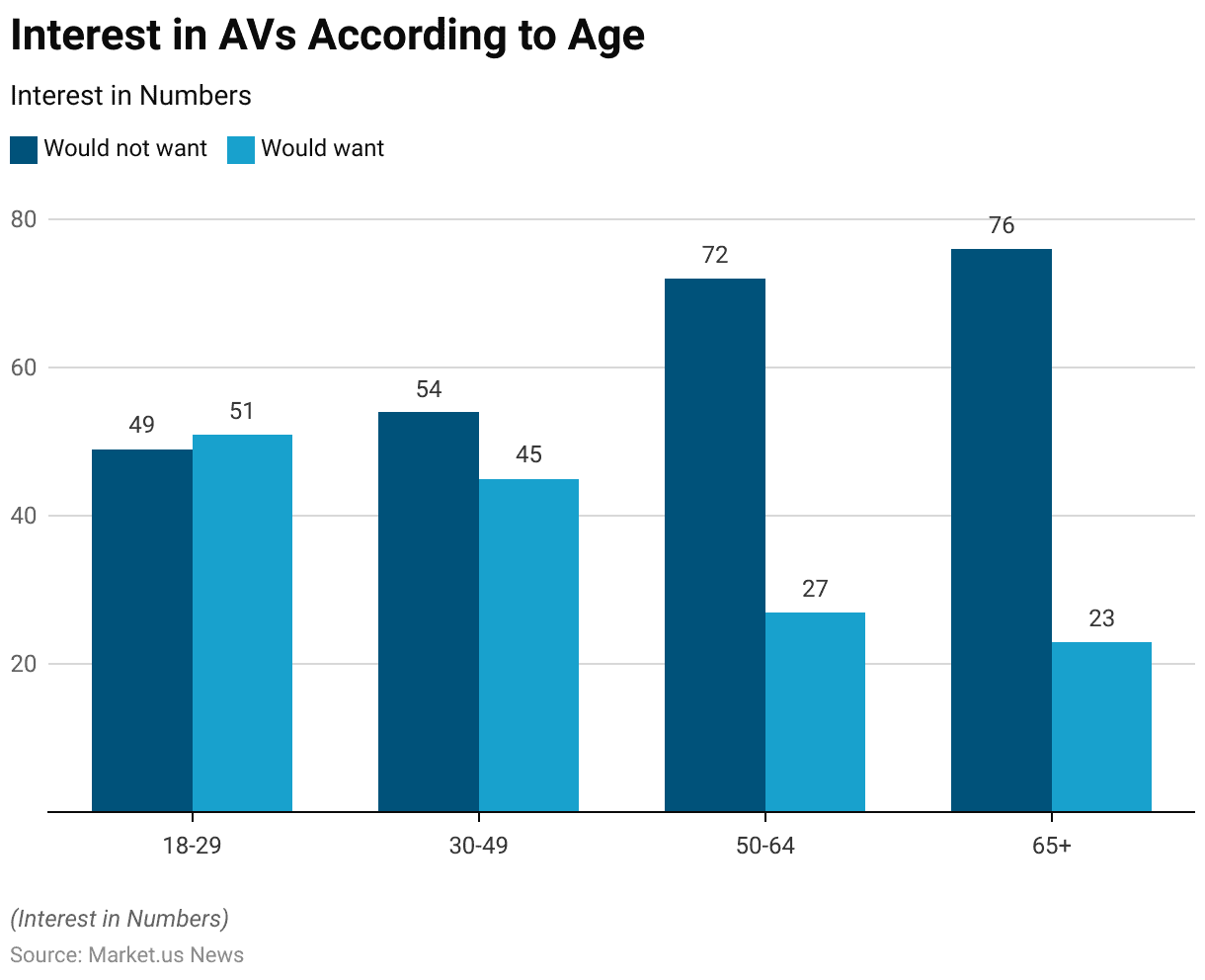

Age

- The willingness to ride in a driverless passenger vehicle among U.S. adults varies significantly across different age groups.

- In the 18-29 age group, 51% say they would definitely or probably want to ride in a driverless vehicle, with 49% expressing reluctance.

- For those aged 30-49, the percentage of those willing to ride drops to 45%, while 54% would not want to.

- The hesitancy increases further in the 50-64 age group, where 72% would not want to ride in a driverless vehicle, and only 27% are willing.

- Among adults aged 65 and older, 76% would not want to ride in a driverless vehicle, with just 23% expressing interest.

- These figures highlight a clear trend of decreasing willingness to adopt autonomous vehicle technology with increasing age.

(Source: Pew Research)

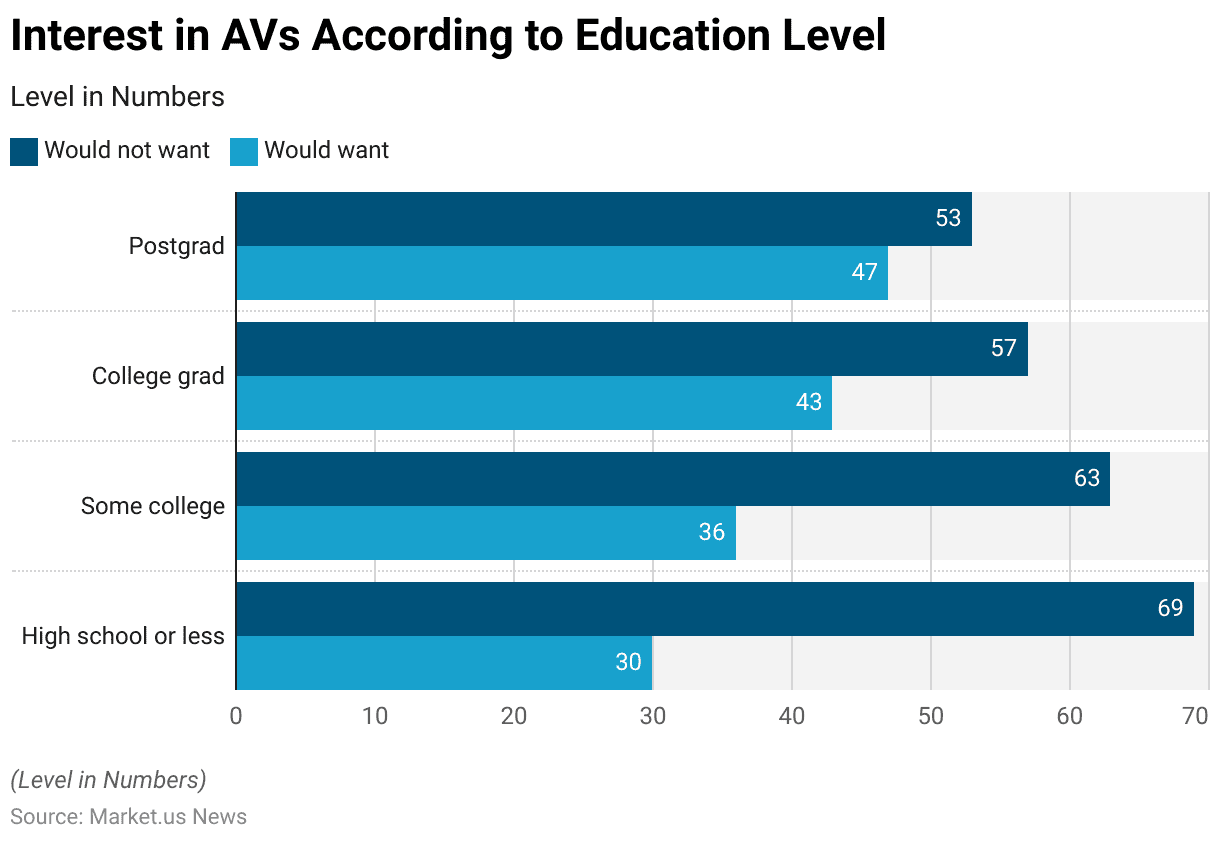

Education Level

- The willingness of U.S. adults to ride in a driverless passenger vehicle varies by education level.

- Among those with a high school education or less. 30% say they would definitely or probably want to ride in a driverless vehicle, while 69% would not want to.

- For individuals with some college education, 36% express a willingness to ride in a driverless vehicle, whereas 63% are reluctant.

- The percentage of willing respondents increases among college graduates. With 43% willing to ride and 57% not wanting to.

- The highest level of acceptance is seen among those with postgraduate education. Where 47% are willing to ride in a driverless vehicle, and 53% would not want to.

- These findings suggest that higher education levels correlate with greater openness to adopting autonomous vehicle technology.

(Source: Pew Research)

Challenges and Obstacles to Adoption of Autonomous Vehicles Statistics

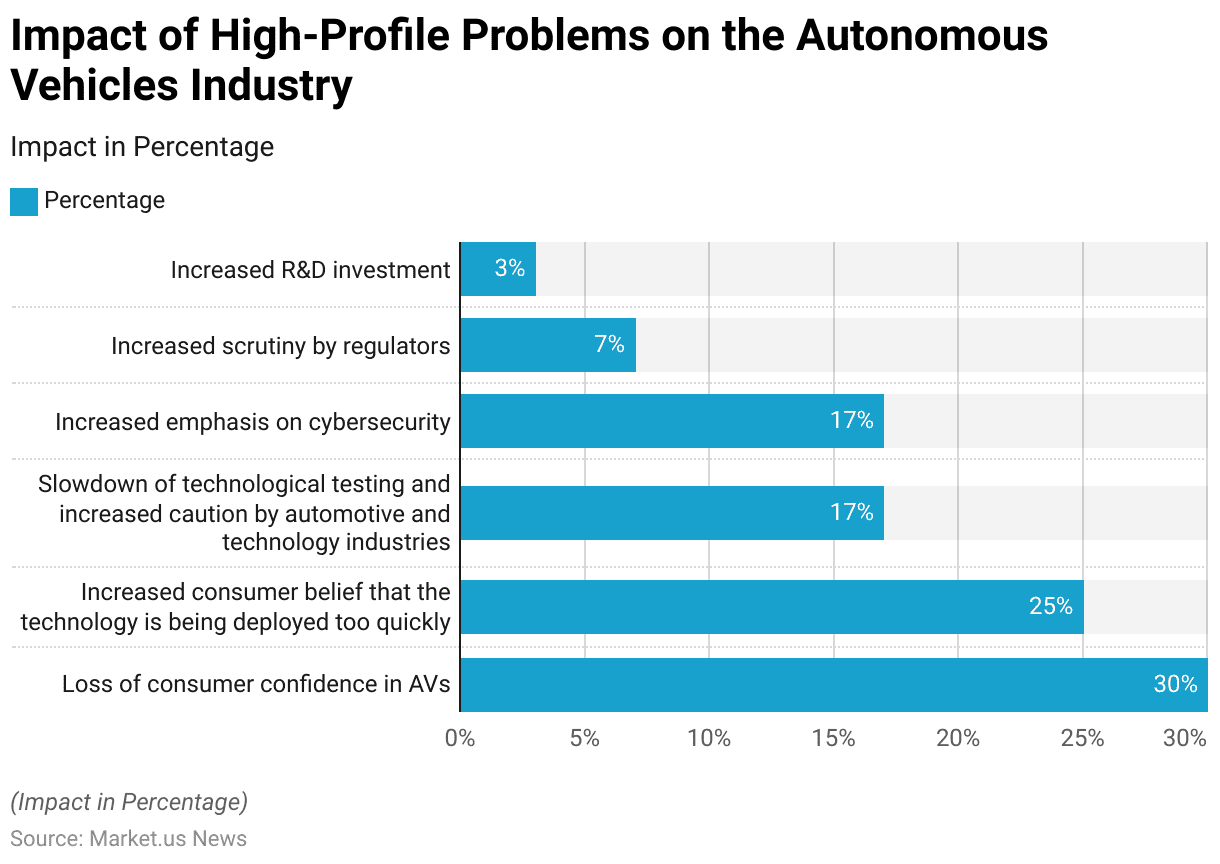

Impact of High-Profile Problems on the Autonomous Vehicles Industry Statistics

- The autonomous vehicles (AVs) industry has been significantly impacted by recent high-profile problems, as reflected in various consumer and industry responses.

- According to respondents, 30% indicate a loss of consumer confidence in AVs.

- Additionally, 25% believe that the technology is being deployed too quickly.

- These issues have led to a 17% slowdown in technological testing and increased caution within the automotive and technology industries.

- Another 17% of respondents highlight an increased emphasis on cybersecurity.

- Regulatory scrutiny has also intensified, with 7% noting increased attention from regulators.

- Despite these challenges, 3% of respondents observe an increase in research and development (R&D) investment. Indicating a continued commitment to advancing AV technology despite the setbacks.

(Source: Perkins Coie LLP)

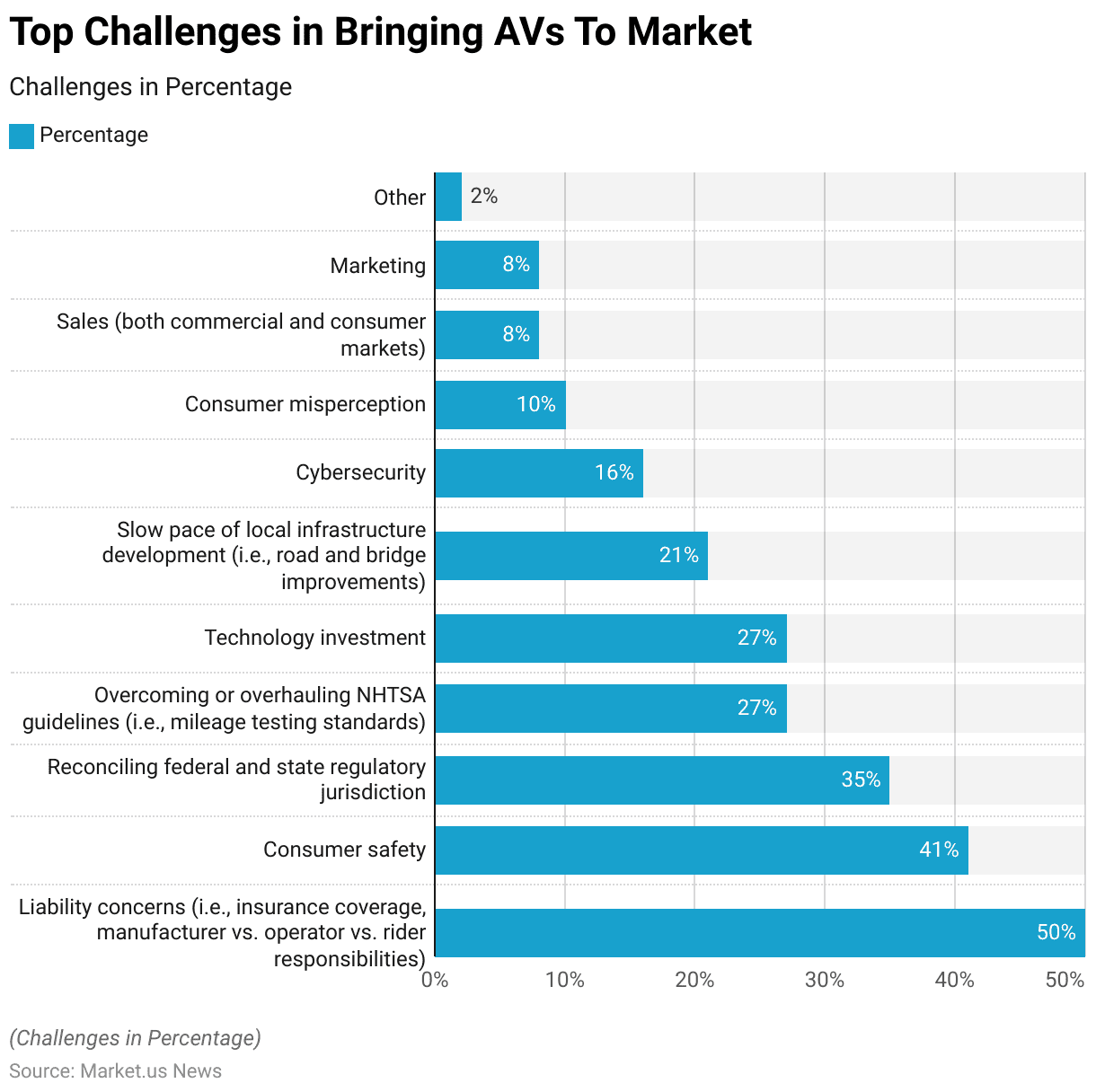

Top Challenges in Bringing Autonomous Vehicles AVs to Market Statistics

- The autonomous vehicles (AVs) market faces several significant challenges as it moves towards mainstream adoption.

- Liability concerns, encompassing issues such as insurance coverage and the responsibilities of manufacturers, operators, and riders, are highlighted by 50% of respondents as a top challenge.

- Consumer safety is also a major concern, cited by 41% of respondents. The reconciliation of federal and state regulatory jurisdictions presents difficulties for 35% of those surveyed.

- Overcoming or overhauling NHTSA guidelines, particularly mileage testing standards. This is a challenge for 27% of respondents, matching the concerns over technology investment.

- The slow pace of local infrastructure development, including necessary road and bridge improvements, is identified by 21% of respondents.

- Cybersecurity issues are also significant, noted by 16% of respondents.

- Consumer misperception about AVs poses a challenge for 10% of respondents. While both sales in commercial and consumer markets and marketing efforts are concerns for 8% of respondents each.

- Finally, 2% of respondents mention other unspecified challenges.

- These varied concerns underscore the complexity of bringing AVs to market and the multifaceted approach needed to address them.

(Source: Perkins Coie LLP)

Future of Autonomous Vehicles Statistics

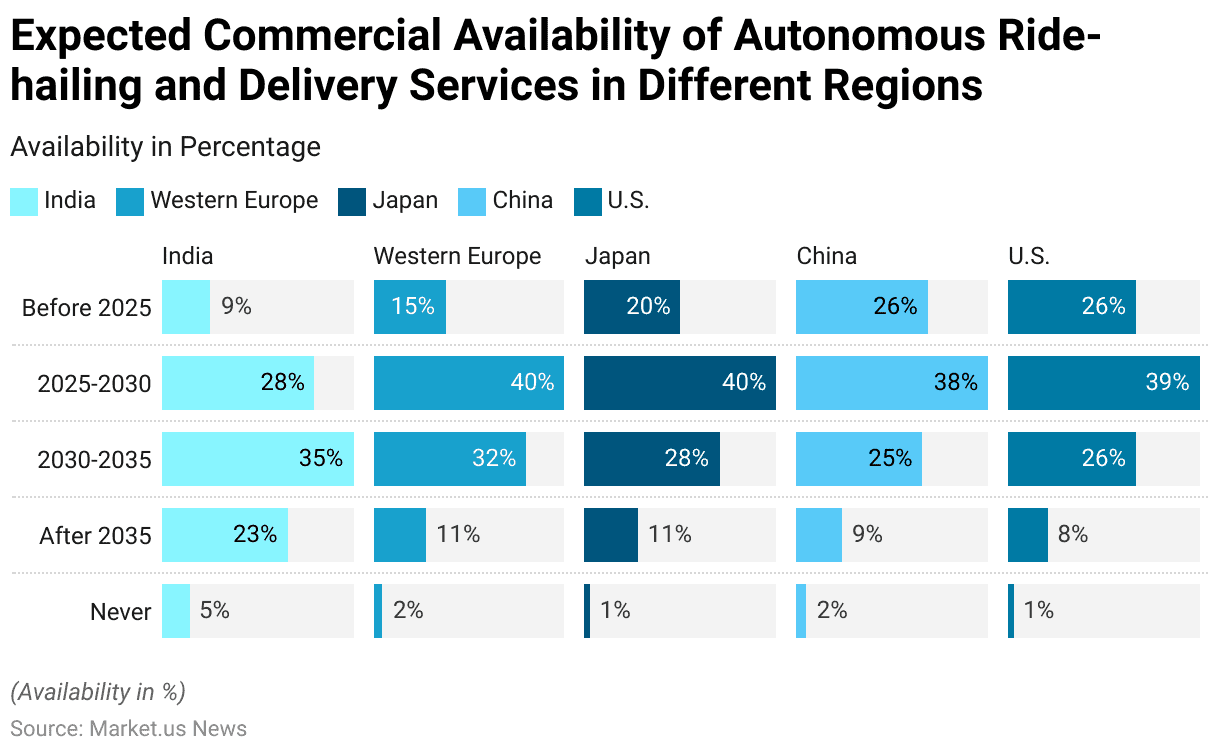

Expected Commercial Availability of Autonomous Ride-Hailing and Delivery Services in Major Cities

- The anticipated timeline for the commercial availability of autonomous ride-hailing and delivery services in major cities varies by region.

- In India, 9% of respondents believe these services will be available before 2025, 28% expect availability between 2025 and 2030, 35% foresee it between 2030 and 2035, 23% predict it will be after 2035, and 5% think it will never happen.

- In Western Europe, 15% anticipate availability before 2025, 40% between 2025 and 2030, 32% between 2030 and 2035, 11% after 2035, and 2% believe it will never occur.

- In Japan, 20% expect these services before 2025, 40% between 2025 and 2030, 28% between 2030 and 2035, 11% after 2035, and 1% think it will never happen.

- In China, 26% predict availability before 2025, 38% between 2025 and 2030, 25% between 2030 and 2035, 9% after 2035, and 2% believe it will never occur.

- In the U.S., 26% foresee these services before 2025, 39% between 2025 and 2030, 26% between 2030 and 2035, 8% after 2035, and 1% think it will never happen.

- These responses highlight varying levels of optimism and skepticism about the rollout of autonomous ride-hailing and delivery services across different regions.

(Source: KPMG)

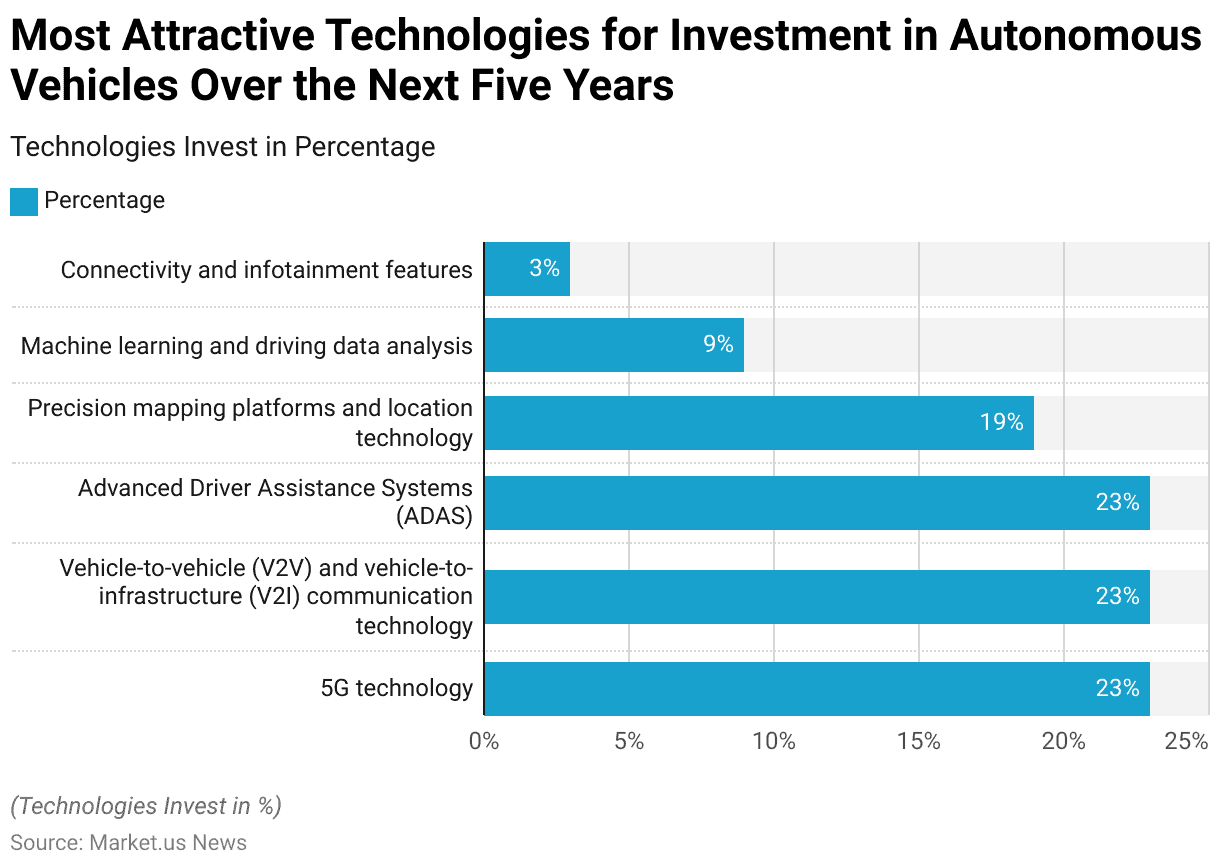

Most Attractive Technologies for Investment in Autonomous Vehicles Over the Next Five Years Statistics

- Investors consider several technologies for autonomous vehicles as attractive investment opportunities over the next five years.

- Among these, 5G technology, vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) communication technology, and Advanced Driver Assistance Systems (ADAS) each garner the interest of 23% of respondents.

- Precision mapping platforms and location technology are also highly regarded, attracting 19% of respondents.

- Machine learning and driving data analysis appeal to 9% of respondents, while connectivity and infotainment features are seen as the least attractive, with only 3% of respondents showing interest.

- This distribution highlights a strong focus on foundational communication and assistance technologies essential for the advancement of autonomous vehicles.

(Source: Perkins Coie LLP)

Strategic Initiatives and Trends

- In April 2021, Cruise, GM’s subsidiary, announced an expansion into Dubai with an exclusive agreement to provide self-driving taxis and ride-hailing services with the Dubai Roads and Transport Authority until 2029. Operations were set to begin in 2023, aiming for 4,000 autonomous vehicles by 2030.

- In June 2021, Cruise secured a $5 billion credit line from GM’s financing division to support the launch of its autonomous ride-hailing service, including the production of self-driving Origin shuttles starting in early 2023. This boosts Cruise’s available funds to over $10 billion.

- In September 2021, GM invested further in Oculii, a software startup improving radar sensor spatial resolution. This funding follows Oculii’s recent $55 million Series B round.

- In July 2021, Hyundai Motor launched an autonomous shuttle service in South Korea, operating on a 6.1 km route in Sejong Smart City via the ‘Shucle’ app, with plans to expand to more regions, including the Hyundai Motor and Kia Namyang R&D Center later in the year.

- In February 2022, Aptiv PLC invested significantly in TTTech Auto’s funding round, raising USD 228 million, with Audi adding USD 57 million. TTTech Auto develops software to manage sensor data and safety systems for driving automation, including their Motionwise software, which accelerates the development of automated driving solutions.

- Further, In January 2022, Microsoft, along with Baillie Gifford and Virgin Group, invested $200 million in Wayve, a self-driving startup using machine learning, AI, and optical cameras, similar to Tesla’s autonomous vehicle technology.

(Source: Greyb)

Recent Developments

Acquisitions:

- Amazon’s Acquisition of Zoox: Amazon acquired Zoox for $1.2 billion in 2020 to strengthen its position in the autonomous vehicle market. Zoox focuses on developing self-driving cars specifically for the robotaxi market, aiming to create fully autonomous vehicles that operate in urban environments.

New Product Launches:

- Waymo’s Expansion of Autonomous Services: In 2023, Waymo expanded its driverless ride-hailing services in Phoenix and San Francisco. This expansion includes fully autonomous vehicles operating without a human driver, showcasing advancements in Level 4 autonomy.

- Amazon’s Prime Air Drone Delivery Service: Amazon officially launched its drone delivery service, Prime Air, in Lockeford, California, and College Station, Texas. The service uses autonomous drones to deliver packages under 5 pounds directly to customers’ backyards.

Funding:

- Amazon’s $1 Billion AI and AV Fund: Amazon announced a $1 billion fund dedicated to advancing AI and autonomous vehicle technologies. With a focus on expanding capabilities and adoption in the Asian market.

- Einride’s Series B Funding: Swedish autonomous vehicle company Einride secured $110 million in Series B funding to develop its self-driving electric freight trucks. The company aims to revolutionize the logistics sector with its autonomous freight solutions.

Market Growth:

- Global Market Expansion: Growth is driven by advancements in AI, machine learning, and sensor technologies.

- Regional Insights: North America and Asia are leading regions in the adoption and development of autonomous vehicles. Robust government support in China and increasing investments in the U.S. are major factors driving growth in these regions.

Innovation and Trends:

- Integration with AI and IoT: Companies are integrating AI and IoT technologies to enhance the capabilities of autonomous vehicles. These advancements enable better real-time decision-making and improved safety features, critical for achieving higher levels of autonomy.

- Legislative Changes: Various states in the U.S. have introduced new regulations to support the deployment of autonomous vehicles. For instance, Pennsylvania’s new law allows the testing and deployment of AVs without human operators. Significantly advancing the regulatory framework for autonomous vehicles.

Conclusion

Autonomous Vehicles Statistics – Autonomous vehicles represent a transformative shift in transportation, offering enhanced safety, improved mobility, and reduced congestion through advanced technologies like AI, machine learning, and 5G.

Despite their potential, widespread adoption faces significant challenges, including ensuring safety, developing robust regulations, addressing cybersecurity, and gaining public trust.

Economic impacts, such as job disruption and new opportunities in tech and infrastructure, also play a crucial role.

Overcoming these hurdles through innovation and collaboration can lead to safer roads and more efficient transport systems, revolutionizing how we travel.

FAQs

Autonomous vehicles, also known as self-driving cars, are vehicles equipped with technology that allows them to navigate and operate without human intervention. They use sensors, cameras, radar, and artificial intelligence to understand their environment and make driving decisions.

Autonomous vehicles work by integrating various technologies such as LiDAR, radar, cameras, and GPS. These systems gather data about the vehicle’s surroundings and process this information through advanced algorithms and AI to control the vehicle’s movements and ensure safe navigation.

Safety is a primary focus in the development of autonomous vehicles. These vehicles are designed to reduce human error, which is a major cause of accidents. However, their safety is still being evaluated, and incidents involving autonomous vehicles have raised concerns that are being addressed through ongoing research and development.

The timeline for the widespread availability of autonomous vehicles varies. Some estimates suggest that fully autonomous vehicles could be commercially available within the next decade, but broader adoption will depend on regulatory approvals, technological advancements, and public acceptance.

Governments are developing regulations to ensure the safe deployment of autonomous vehicles. This includes setting standards for testing, performance, and safety, as well as addressing liability and insurance issues. Regulatory approaches vary by country and region.