Table of Contents

Introduction

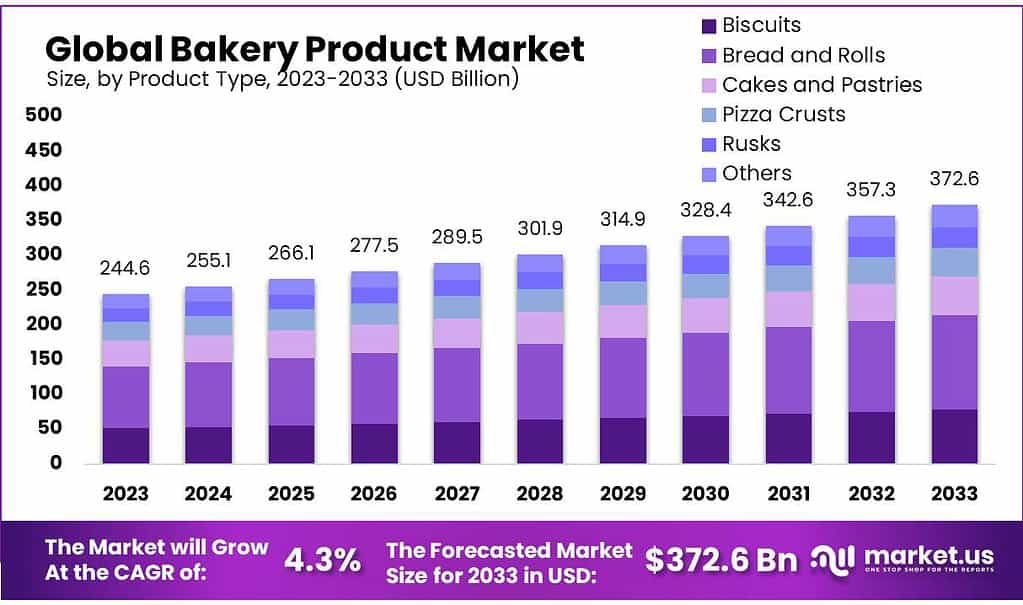

The global bakery product market is projected to grow from USD 244.6 billion in 2023 to USD 372.6 billion by 2033, registering a compound annual growth rate (CAGR) of 4.3% over the forecast period. The market’s growth is driven by several key factors, including changing consumer lifestyles, increased demand for convenient and ready-to-eat foods, and a growing emphasis on health-conscious and organic products.

One of the primary drivers of this growth is the rising demand for baked goods like bread, cakes, and pastries. In 2023, bread and rolls dominated the market, accounting for over 36% of the share, largely due to their status as daily staples in regions like North America and Europe. The cakes and pastries segment is expected to witness the fastest growth, fueled by rising disposable incomes and consumer preferences for novel flavors and indulgent products. Moreover, gluten-free, low-sugar, and organic bakery items have gained significant traction, reflecting a broader trend toward healthier eating habits. In 2023, gluten-free bakery items held a substantial share of over 26%, driven by growing health awareness and increasing gluten sensitivities among consumers.

Geographically, Europe leads the global bakery market, representing the largest revenue share due to high per capita consumption of bakery goods, particularly in countries like Germany, France, and the UK. The region is also witnessing a surge in demand for healthier alternatives such as high-fiber and gluten-free products, especially after the COVID-19 pandemic. In contrast, the Asia-Pacific region is poised to experience the fastest growth during the forecast period. This growth is attributed to rapid urbanization, increasing disposable incomes, and changing dietary patterns in countries like China, India, and Japan.

However, the market faces challenges, including fluctuating raw material prices, rising energy and transportation costs, and consumer preference for fresh over processed foods. These factors could restrain market expansion, particularly for frozen and packaged bakery products. Despite these challenges, the rising trend of product innovation, such as the introduction of fortified, sugar-free, and organic bakery goods, presents significant growth opportunities for manufacturers.

Recent developments in the bakery market highlight the emphasis on innovation and consumer preferences. Major players like Mondelez International and Grupo Bimbo have introduced new product lines that cater to health-conscious consumers, including gluten-free, sugar-free, and whole-grain options. Additionally, the expansion of distribution channels, including online platforms and specialty stores, is expected to enhance market accessibility and boost sales.

Nestle expanded its presence in the premium chocolate sector by acquiring a majority stake in a Brazilian chocolate company, which further solidified its position in the confectionery market. Earlier in 2022, Nestle acquired Seattle’s Best Coffee brand from Starbucks, highlighting its strategic focus on coffee and beverage-related sectors. Additionally, Nestle has shown a growing interest in the frozen food sector, as seen with its joint venture with PAI Partners in 2023 to focus on the frozen pizza market in Europe.

Mondelez has made several significant acquisitions to boost its bakery portfolio. Notably, in 2022, it acquired Clif Bar & Co. for $2.9 billion, which helped expand its footprint in the nutrition and snack bar market. Similarly, in the same year, Mondelez bought Chipita, a company specializing in packaged cakes and pastries, for approximately $580 million. This acquisition allowed Mondelez to strengthen its presence in Europe and emerging markets. New Product Developments: Mondelez has focused on leveraging iconic brands like Oreo and Chips Ahoy!, introducing new product lines, including vegan options and healthier snacks, to cater to evolving consumer preferences.

Britannia has consistently focused on product innovation to cater to health-conscious consumers. In 2023, they introduced a range of coffee-flavored biscuits targeting younger consumers. This followed their strategy of launching unique flavors to differentiate their offerings in a competitive market. Strategic Expansions: Britannia has also been investing in expanding its manufacturing capacity in India, particularly in dairy and bakery production, to meet growing domestic demand.

To manage supply chain uncertainties, Associated British Foods has undertaken backward integration efforts to control raw material costs and ensure better supply chain efficiency. In 2023, the company focused on streamlining operations and reducing logistical bottlenecks to improve profitability in the bakery segment.

Sustainability Initiatives: In line with global sustainability trends, ABF has invested in reducing its carbon footprint within the bakery sector, aiming to create a more eco-friendly production process, including energy-efficient manufacturing and sustainable ingredient sourcing.

Key Takeaways

- Market Growth Projection: The Bakery Product market is set to expand significantly, with a projected worth of around USD 372.6 billion by 2033, growing at a steady CAGR of 4.3% from USD 244.6 billion in 2023.

- Product Trends and Preferences: Popular Items: Bread and rolls dominate the market, accounting for over 36.5% of sales in 2023, followed by cakes & pastries with anticipated growth due to new flavors and increased disposable income.

- Specialty Types: Gluten-free products claimed a substantial market share of 26.4%, reflecting the rising demand for healthier alternatives. Organic, low-calorie, fortified, and sugar-free products also gained traction among health-conscious consumers.

- Distribution Channels: Market Leaders: Hypermarkets/Supermarkets secured over 42.6% of the market due to their convenience and diverse offerings.

Bakery Product Statistics

- From the sweet aroma of freshly baked bread in the United States to the delicate pastries of Europe, the numbers speak volumes: $376 billion in value, over 6,000 retail bakeries in the US, and a staggering $59.2 billion in revenue from bread and biscuit sales alone.

- The global baking industry is valued at $376 billion.

- The demand for organic bakery products is growing, with the market expected to reach $12.4 billion by 2027.

- The bakery industry in Australia employs over 70,000 people.

- Gluten-free is another trend that continues to grow in the bakery category, with 25% of US bakery launches making a gluten-free claim in 2021, up from 18% in 2017.

- The added protein is also gaining traction. High protein claims tripled in US bread launches in just three years, accounting for 14% of launches in the 2021 to 2022 period.

- Ancient grains are particularly desirable, with 58% of global consumers buying bakery products that contain ancient grains—including oats (58%), barley (52%), rye (47%), and quinoa (46%).

- Consumers also find functional and fortified claims appealing in bakery products, including bread (50%), cookies (47%), and cakes/pastries (37%).

- Gluten-free is the fastest-growing bakery claim in the past few years, impacting new launches across the category, including baking mixes/ingredients (36%), crackers (33%), cookies (21%), breads (17%), and cakes/pastries (15%).

- Consumers globally are eating more bread and bread products, with major increases seen in India, the Philippines, and Egypt (where 38%, 27%, and 27% of consumers, respectively, increased their intake in the past year).

- convenient and affordable staple, bread and bread products have a higher average global penetration at 81% than meat and poultry (76%), dairy (74%), desserts and ice cream (64%), and sweet and salty snacks (64%).

- In 2022, the segment recorded a value of approximately €7.4 billion, with a 4.5% increase in turnover and a domestic market of approximately €5.7 billion. Imports grew by 17%, exports by 15%, and total production exceeded 1,640,000 tonnes, recording a slight increase in 2021 (+0.7%). While imports were rising (+5.4%) alongside exports (+5.7%), the domestic market recorded a 0.6% decrease.

- 66% of baked goods are sweet products, with biscuits making up 36.2%, snacks accounting for 8.2%, pastries standing at 10.6%, (leavened) products for special occasions at 10.2%, crispbreads accounting for 9%, and ready-made cakes making up the remaining 3.2%.

- The choice of packaging for baked goods and snacks is strongly influenced by the need to keep products fresh and preserve their characteristics and quality. 97.7% of products use laminated flexible packaging.

- For biscuits, for example, 96% of packaging consists of flexible laminated pouches, mainly made of paper, plastic bags make up 2.3%, cardboard boxes stand at 1.5%, and decorative steel boxes account for the remaining 0.2%.

- For other product categories, the packaging consists entirely of flexible plastic laminate pouches. In 2022, the industry used around 155,000 tonnes of packaging, with half of it destined for export.

- The choice of packaging for baked goods and snacks is strongly influenced by the need to keep products fresh and preserve their characteristics and quality. 97.7% of products use laminated flexible packaging.

- In Europe, the bakery industry is vital to the market, with bread, patisserie shops, and cafes playing an integral role in the culture of many nations. In 2021, total bakery consumption was 38 million tons across 29 countries in Europe.

- In the United States, the bakery industry employs almost 800,000 workers

Emerging Trends

- Global Flavor Fusion: Bakeries are experimenting with international ingredients and flavors. Asian influences such as matcha, ube, and black sesame are becoming mainstream in both sweet and savory products. Middle Eastern spices like za’atar and tahini are also appearing in baked goods, offering consumers a taste of global cuisine.

- Plant-Based and Clean Label: The demand for plant-based bakery items continues to rise, with a shift towards using unique plant ingredients like dark chocolate, grains, and seeds to enhance both flavor and nutritional value. Clean-label products—those made with natural, simple ingredients—are increasingly sought after, particularly by health-conscious consumers.

- Customization and Personalization: Consumers are looking for personalized experiences, whether through customized designs or special messages on baked goods. This trend extends to special occasions, where bakeries offer tailored products for events like birthdays and holidays.

- Sustainability and Upcycling: There is growing interest in sustainable practices in the bakery industry. Upcycled ingredients, such as using leftover bread to make new products, are gaining traction as consumers become more conscious of food waste. Local sourcing of ingredients also aligns with environmental sustainability.

- Indulgence Meets Nutrition: While health remains a key focus, consumers still want indulgent treats. Bakeries are balancing this by offering decadent baked goods that are also nutritious, such as gluten-free, vegan, and low-carb options. These products satisfy cravings while supporting dietary goals.

- Nostalgia and Comfort Foods: Classic baked goods are making a comeback, with a twist. Consumers are seeking nostalgic treats that offer a sense of comfort, while also enjoying modern upgrades, such as new flavors or ingredient innovations.

Use Cases

- Health-Conscious Consumers: Bakeries are increasingly catering to consumers focused on wellness by offering products with reduced sugar, high fiber, and enriched with probiotics. Sourdough bread, for instance, is a popular option due to its digestive benefits and is seen as healthier because of its fermentation process. Many consumers are also turning to gluten-free options, with demand for gluten-free bakery products increasing by approximately 25% in 2023.

- Cultural Fusion: Bakeries are integrating global flavors into traditional products to appeal to more adventurous eaters. Ingredients such as matcha, ube, and tahini are being used in croissants and cookies, offering a mix of familiar and exotic tastes. For example, matcha-flavored pastries have seen a growth of over 30% in certain markets.

- Sustainability-Focused Consumers: With a rising focus on sustainability, bakeries are using upcycled ingredients, such as spent grains and fruit peel, to reduce food waste. This not only attracts environmentally conscious consumers but also offers a way to differentiate products. Upcycled baked goods have gained momentum, with consumer interest in such products growing by 173% in 2023.

- Customization for Special Occasions: Personalized bakery items are becoming a popular trend for events like birthdays and weddings. Customers can order cakes or cookies with custom designs or messages, allowing bakeries to charge a premium for personalized touches. In 2023, 59% of consumers reported that visually appealing, personalized bakery items enhanced their experience.

- On-the-Go Convenience: Many bakeries are focusing on ready-to-eat items for busy consumers. Items like muffins, croissants, and sandwiches are packaged for easy consumption during commutes or lunch breaks. The grab-and-go segment of bakery products has seen a notable increase in sales, particularly in urban areas.

Major Challenges

- Rising Costs of Ingredients: The prices of raw materials such as flour, sugar, and fats have increased sharply. For example, some vendors have reported a rise in costs of over 50% due to global supply chain disruptions. This has forced bakeries to raise product prices, which can lead to reduced consumer demand.

- Energy Costs: High energy expenses continue to be a major challenge for bakeries, especially those locked into long-term energy contracts. Around 68% of bakers have identified energy costs as a major burden. These costs significantly affect profit margins, especially for small and medium-sized enterprises.

- Labor Shortages: The bakery industry is struggling to attract and retain skilled workers, with many experienced bakers retiring. The shortage of skilled labor is leading to higher wages and reduced production efficiency. Many bakeries are turning to automation to cope with labor shortages, but this requires significant upfront investment.

- Sustainability Pressures: Consumers are increasingly demanding sustainably sourced ingredients and lower environmental impacts. This forces bakeries to adopt sustainable practices, such as reducing food waste and energy consumption, which can be costly and complex to implement.

Market Growth Opportunities

- Health-Conscious Products: The increasing demand for healthier bakery options, such as gluten-free, low-sugar, and fortified products, offers significant growth potential. The gluten-free segment alone holds 25.7% of the market, driven by rising health awareness and dietary preferences. Additionally, functional products like bread enriched with vitamins or added fiber are seeing strong demand, catering to consumers focused on wellness.

- Artisanal and Premium Bakery Items: There is a growing market for artisanal and premium baked goods, especially in regions like Europe and North America, where consumers are willing to pay more for high-quality, locally sourced products. Artisanal bakeries that focus on traditional methods and unique flavors are capitalizing on this trend, driving growth.

- Convenience and Ready-to-Eat: With the rise of busy lifestyles, there is a strong demand for ready-to-eat bakery products. Items like packaged pastries, bread, and cookies are gaining traction, particularly in supermarkets and hypermarkets, which dominate the distribution channels for such products.

- Global Flavors and Innovation: Consumers are increasingly open to experimenting with international flavors in bakery items. Products that incorporate exotic ingredients or regional influences—such as matcha, tahini, or ube—are growing in popularity. This global flavor fusion offers bakeries an opportunity to diversify their offerings and attract new customer segments.

Key Player Analysis

In 2023, Nestlé’s bakery product sector showed growth, particularly driven by its focus on healthier options and innovation in products. Throughout the year, Nestlé reported consistent performance in its confectionery and bakery-related segments, which include products like biscuits and prepared baking goods. In October 2023, Nestlé experienced strong demand for its KitKat brand and other baked treats, with high single-digit growth in key markets such as Asia and Latin America.

Additionally, from January to September 2023, Nestlé reported overall organic growth of 7.8%, driven largely by pricing strategies and premium product innovation. The company also highlighted new product launches that focused on healthier, fortified baked goods to meet increasing consumer demand for wellness-oriented foods.

modeled International made significant moves in its bakery product sector, with notable acquisitions and divestitures shaping its portfolio. In August 2023, the company acquired Clif Bar & Company, expanding its presence in the healthy snack segment, including bakery items like energy bars. Mondelez also sold its developed market gum business in October 2023, freeing up resources to focus more on its core baked goods and snack offerings. These strategic changes, alongside 12% organic net revenue growth, have bolstered its bakery sector’s performance.

Britannia Industries witnessed significant growth in its bakery product sector, driven primarily by increasing demand for biscuits, cakes, and bread. For the first quarter of 2023, the company’s revenue rose by 11.45% year-on-year (YoY) to ₹4,125 crore, supported by a 5% volume growth. Their net profit surged by 56% to ₹525 crore. New product launches and expanding consumer acceptance of their offerings played a pivotal role in this growth. By Q1 2024, Britannia continued this upward trend with a 4.34% quarterly increase in revenue, reaching ₹4,305.9 crore, and a 10.5% increase in net profit to ₹505.6 crore.

In 2023, Associated British Foods (ABF) saw significant progress in its bakery product sector, particularly through its subsidiary, Allied Bakeries. The company reported an improvement in profitability, thanks to pricing actions taken to combat rising input costs. For the third quarter of 2023, ABF’s total revenue from its food businesses, including bakery, rose by 18% year-on-year, with strong contributions from bakery ingredients under AB Mauri. Allied Bakeries, which includes brands like Kingsmill, benefited from cost reductions and operational efficiencies, contributing to ABF’s broader food sector growth.

In 2023, Finsbury Food Group Plc saw a solid performance in its bakery sector, driven by both volume growth and effective price recovery strategies. The company reported full-year sales of £413.7 million, up from £356.8 million in the previous year, reflecting a 16% increase. By the first quarter of fiscal 2024, Finsbury achieved further growth with a 15.7% rise in sales for the first four months, thanks to a combination of 1.1% volume growth and a 14.6% increase due to pricing adjustments. These results underscore Finsbury’s ability to manage costs while expanding its bakery product range across the UK and internationally.

In 2023, Yamazaki Baking Co., Ltd. reported a significant growth in its bakery sector. The company achieved ¥1.18 trillion in net sales, marking a notable increase from the previous year. Yamazaki’s core operations include the production and sale of bread, sweet buns, and various confectionery products. In the first quarter of 2024, the company generated ¥306.7 billion in revenue, reflecting its strong market presence in Japan and expansion efforts in international markets. With a focus on introducing modern baking technologies, Yamazaki has continued to expand its product lineup, catering to both traditional Japanese tastes and Western-style baked goods.

In 2023, The Great Canadian Bagel Ltd., a coffee house and quick-service restaurant chain, focused on expanding its bakery product offerings, particularly its fresh bagels. The company operates more than 18 locations across Canada, including outlets in Ontario, New Brunswick, and Prince Edward Island. As a manufacturer and exporter of bakery supplies, it offers a variety of freshly baked bagels alongside sandwiches and breakfast options. The company continues to adapt its menu to consumer preferences, maintaining steady operations through 2024.

In 2023, Canada Bread Company continued to strengthen its position as one of the leading bakery product manufacturers in Canada. The company, owned by Grupo Bimbo, saw stable growth, benefiting from increased consumer demand for essential products like bread, buns, and rolls. During 2023, the overall bread and bakery market in Canada grew by 3.6%, reaching a total value of CAD 13 billion.

Canada Bread played a significant role in this market by expanding its product offerings, including healthier options like whole grain and gluten-free products to meet changing consumer preferences. The company also navigated challenges posed by inflation and supply chain disruptions, focusing on price adjustments and operational efficiencies. Going into 2024, Canada Bread continues to innovate and adapt to market trends, particularly by increasing its distribution through both physical and online retail channels

In 2023, Frank Roberts and Sons Ltd., a family-owned bakery business and the fourth-largest retail bread brand in the UK, experienced significant growth despite challenges. The company reported an increase in turnover to £96 million from £88.9 million in 2022, marking an 8% growth. This was achieved despite a major fire at its Northwich site in mid-2023, which disrupted operations. The company has focused on strategic customer partnerships and innovation, launching new products such as Italian-style ciabattas and paninis. Moreover, a major £18 million investment was secured to modernize its production facilities and expand its “Centre of Excellence” for bread and biscuits across multiple sites.

In 2023, ARYZTA reported strong financial performance in its bakery sector, achieving a 24.2% increase in revenue for the first half of the year, bringing total revenue to €1.04 billion. This growth was driven by a combination of pricing strategies and volume increases, particularly in key European markets like France, Germany, and Poland. The company also saw organic revenue growth of 25.4%, bolstered by its innovative product offerings, which contributed to 13% of total revenue. Despite the inflationary pressures impacting costs, ARYZTA maintained its profitability by focusing on cost control and operational efficiency, achieving an EBITDA margin of 13.9%. Looking ahead to 2024, ARYZTA expects growth to continue, albeit at a more normalized rate of low to mid-single-digit organic growth.

Conclusion

In conclusion, the global bakery products market is experiencing steady growth, driven by rising consumer demand for convenience, indulgent treats, and health-conscious products. Key growth areas include artisanal baked goods, gluten-free options, and premium products. The market is also seeing innovations in packaging and distribution, with an increasing shift towards online retail. Europe continues to dominate the market, while Asia-Pacific is rapidly growing, with significant potential in countries like China and India. As bakery companies prioritize sustainability, cost control, and product innovation, the market is expected to continue expanding at a healthy rate into 2024 and beyond.