Table of Contents

Introduction

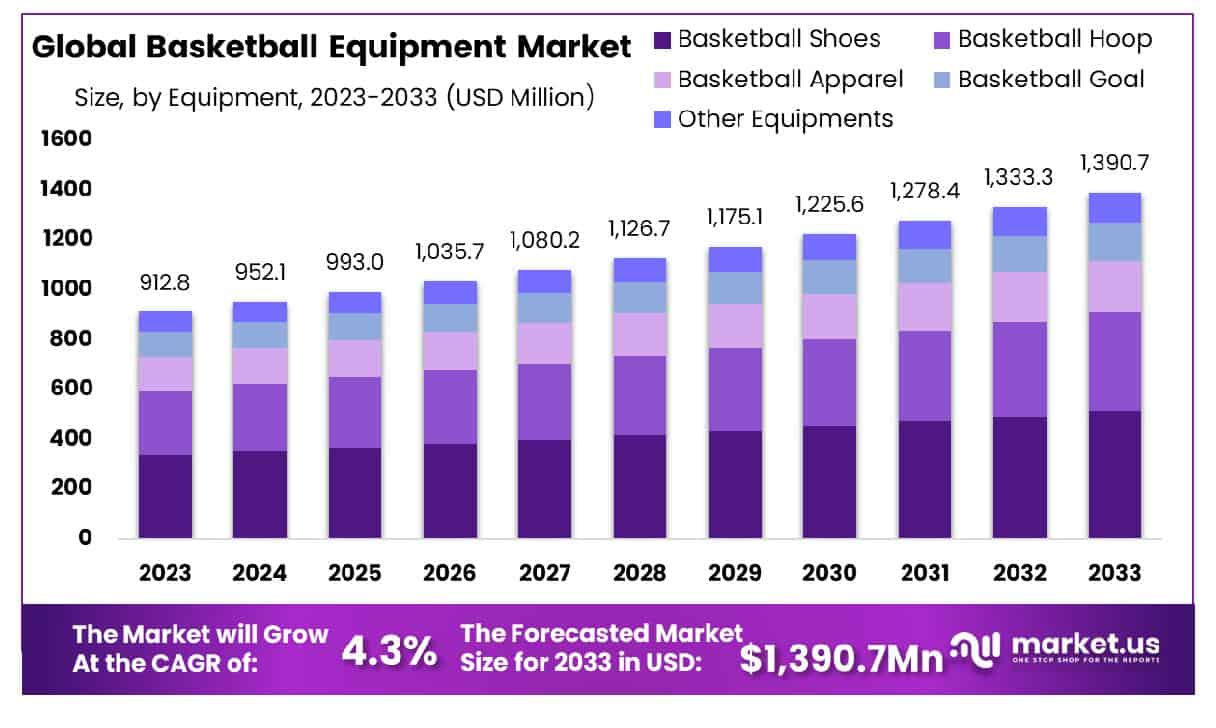

The Global Basketball Equipment Market is projected to grow from USD 912.8 million in 2023 to approximately USD 1,390.7 million by 2033, reflecting a compound annual growth rate (CAGR) of 4.30% over the forecast period from 2024 to 2033.

Basketball equipment encompasses the various items required for playing the sport, both competitively and recreationally. This includes basketballs, backboards, nets, hoops, protective gear such as pads and mouthguards, as well as training equipment. Apparel specific to basketball, like jerseys, shorts, and shoes, also falls under this category. Each piece of equipment is designed to enhance player performance, ensure safety, and comply with regulated standards of basketball leagues and associations.

The basketball equipment market refers to the economic sector involved in the manufacturing, distribution, and sale of basketball-related products. This market caters to a diverse clientele ranging from professional athletes and leagues to educational institutions and amateur players. The market encompasses a broad range of products including but not limited to, basketballs, footwear, apparel, and accessories that are required for playing and training in the sport of basketball.

The growth of the basketball equipment market can be attributed to several factors. A significant driver is the global popularity of basketball, propelled by international leagues and widespread media coverage. Technological advancements in materials and design that enhance the performance and comfort of equipment also contribute to market expansion. Furthermore, initiatives by governments and sports organizations to promote sports as a part of school curricula and community activities boost the demand for basketball equipment.

Demand within the basketball equipment market is sustained by the sport’s growing base of enthusiasts and professional players worldwide. The rise in youth participation rates, driven by school sports programs and club teams, underpins this demand. Additionally, the trend of adopting healthy lifestyle choices has encouraged people of all ages to engage in sports, including basketball, which in turn fuels the need for appropriate equipment.

The basketball equipment market is ripe with opportunities, particularly in developing regions where sports are becoming a pivotal part of culture and education. The increasing influence of celebrity athletes and the integration of fashion with sports apparel open new avenues for growth. Moreover, the expanding online retail sector presents a lucrative channel for the sales of basketball equipment, providing greater accessibility to consumers and enabling brands to reach a wider audience. The development of eco-friendly and innovative products also offers potential for differentiation and capturing market share in an environmentally conscious consumer market.

Key Takeaways

- The global basketball equipment market is projected to grow from USD 912.8 million in 2023 to approximately USD 1,390.7 million by 2033, reflecting a compound annual growth rate (CAGR) of 4.30% during the forecast period from 2024 to 2033.

- Basketball shoes represent the largest share within the equipment category, accounting for 36% of the segment.

- Specialty and sports shops emerge as the leading distribution channel, contributing 58% of the total market revenue.

- North America continues to lead the global market, commanding a significant 37% share.

Basketball Equipment Statistics

- Basketball is the most popular team sport in the U.S. with 450 million global fans.

- NBA courts are 94×50 feet; high school courts are smaller.

- NBA three-point line is 22 feet in corners, 23 feet 9 inches elsewhere.

- The key in NBA courts is 16 feet wide.

- Foul line is 15 feet from the backboard in all levels.

- Rim height is 10 feet, with an 18-inch diameter.

- Backboards are 6 feet wide and 42 inches tall.

- Average NBA player height is 6 feet 7 inches.

- 28% of NBA players are international, from 42 countries.

- NBA games average 17,000+ attendees.

- NBA Playoffs average 5 million+ viewers per game.

- Basketball shoes are 20% of the athletic shoe market.

- Nike holds 67% of U.S. basketball shoe market share.

- NBA Finals air in 200+ countries and territories.

- NBA has 1.6 billion social media followers globally.

- NBA 2K has sold 110 million+ copies worldwide.

- Junior NBA has reached 10 million+ kids globally.

- 450+ U.S. colleges offer basketball scholarships.

- March Madness generates $1 billion+ in ad revenue yearly.

- Basketball coaching clinics earn $50 million+ annually.

- NBA’s international TV rights bring in $400 million+ annually.

- 21% of NBA fans are aged 18-24.

- 54% of NBA fans prefer products endorsed by players.

Emerging Trends

- Technological Advancements in Equipment: Manufacturers are integrating advanced materials and smart technologies into basketball gear. For instance, the development of smart basketballs equipped with sensors allows players to monitor their performance metrics in real-time, enhancing training effectiveness.

- Rising Popularity of Women’s Basketball Gear: The market for women’s basketball equipment is expanding, with increased demand for products tailored specifically for female athletes. Signature shoes from WNBA players like Sabrina Ionescu and Breanna Stewart have seen significant sales growth, reflecting a broader trend towards gender-specific sports gear.

- Sustainability and Eco-Friendly Products: Consumers are increasingly seeking environmentally friendly basketball equipment. Manufacturers are responding by producing gear made from recycled or sustainable materials, aligning with the global push towards sustainability in consumer products.

- Customization and Personalization: There is a growing demand for personalized basketball equipment, such as custom-designed shoes and apparel. This trend allows players to express individuality and meet specific performance needs, leading brands to offer more customization options.

- Expansion of E-commerce Channels: The shift towards online shopping has significantly impacted the basketball equipment market. E-commerce platforms provide consumers with a wider selection of products and the convenience of home delivery, prompting manufacturers and retailers to strengthen their online presence.

Top Use Cases

- Enhancing Shooting Accuracy: Automatic basketball shooting machines like Dr. Dish are instrumental for players looking to enhance their shooting efficiency. These machines automate passing and retrieval of the ball, allowing players to take more shots in less time and track their performance meticulously, hence improving shooting accuracy.

- Improving Dribbling Skills: Dribbling goggles, which obstruct the player’s downward vision, are used widely to force players to dribble without looking at the ball. This equipment is crucial for enhancing ball handling skills as it encourages players to rely on touch and spatial awareness, thereby boosting their confidence and reaction time on the court.

- Developing Agility and Speed: The agility ladder is a popular tool in basketball training regimes aimed at improving a player’s footwork, speed, and overall agility. Incorporating drills that require complex movements on the agility ladder helps players develop a better mind-muscle connection, crucial for enhancing coordination and performance during games.

- Building Strength and Endurance: Weighted speed vests are used during training to add resistance to a player’s movements, which helps in building muscle strength and cardiovascular endurance. This tool is essential for players looking to increase their explosiveness and stamina, which are vital during intensive game situations.

- Recovery and Muscle Soreness Reduction: Post-training recovery is crucial for maintaining peak performance levels. The Air Relax Leg Recovery System provides dynamic compression therapy that helps in improving circulation, reducing muscle soreness, and speeding up the recovery process, making it a valuable investment for serious athletes

Major Challenges

- Raw Material Price Volatility: The cost of raw materials such as rubber, synthetic leather, and metals, crucial for manufacturing basketball equipment, frequently fluctuates. These fluctuations, often due to supply chain disruptions, inflation, or geopolitical tensions, can lead to increased production costs. Manufacturers may have to pass these costs onto consumers, potentially reducing demand in price-sensitive markets.

- Counterfeit Products: The prevalence of low-quality, counterfeit basketball equipment, especially in developing economies, poses a significant challenge. These products often undercut genuine brands on price but fail to meet quality and safety standards, which can harm the reputation of established brands and erode consumer trust.

- Intense Market Competition: The basketball equipment market is highly fragmented with numerous global and regional players competing for market share. This intense competition drives prices down and squeezes profit margins, making it difficult for new entrants and smaller brands to establish themselves and thrive.

- Changing Consumer Preferences: Today’s consumers, particularly younger demographics, demand high-tech, innovative products that incorporate smart technology for enhanced performance. Keeping pace with these technological expectations requires significant investments in research and development, which can be costly and resource-intensive.

- Economic Uncertainties: Global economic conditions such as inflation, currency fluctuations, and potential recessions pose risks to consumer spending. Basketball equipment, often seen as non-essential, may experience reduced sales during economic downturns as consumers cut back on discretionary spending

Top Opportunities

- Emerging Markets Expansion: With basketball gaining popularity in countries like China, India, and Brazil, there is a substantial opportunity for market growth. Increased investments in sports infrastructure and the promotion of basketball at the grassroots level in these regions provide a fertile ground for expanding product distribution and sales.

- Women’s Basketball Equipment: As the participation of women in basketball increases, there is a growing demand for basketball equipment tailored specifically for female athletes. This includes gender-specific apparel and footwear, presenting an opportunity for manufacturers to diversify their product lines and address a historically underrepresented market segment.

- Technological Advancements in Products: The demand for high-tech basketball equipment that enhances performance is on the rise. Investing in research and development to create innovative products such as advanced basketball shoes and smart basketballs that track performance metrics can cater to the tech-savvy consumer base and set a brand apart in a competitive market.

- Digital and Social Media Marketing: Utilizing digital marketing strategies and social media platforms can significantly increase brand visibility and consumer engagement. Tailored marketing campaigns that leverage these digital tools can help brands reach a broader audience, enhance customer interaction, and drive sales, particularly among the younger demographics who spend a considerable amount of time online.

- Sponsorships and Endorsements: Collaborations with well-known athletes and celebrities can greatly influence consumer preferences and boost brand credibility. Endorsement deals not only help in enhancing brand visibility but also associate product lines with high performance and desirability, which can lead to increased sales and market growth.

Key Player Analysis

- Nike Inc. : Nike, headquartered in Beaverton, Oregon, is a leading player in the basketball equipment market, renowned for its extensive range of basketball shoes, apparel, and accessories. The company’s basketball segment has been a substantial contributor to its overall revenue, with the Jordan Brand alone generating approximately $5 billion in annual sales. Nike’s continuous innovation and endorsement deals with prominent athletes have solidified its dominance in the market.

- Adidas AG: Adidas, based in Herzogenaurach, Germany, holds a significant share in the basketball equipment market, offering a wide array of products including footwear, apparel, and accessories. The company’s strategic partnerships and sponsorships, such as its collaboration with the National Basketball Association (NBA), have enhanced its brand visibility and market penetration. In 2023, Adidas reported a revenue of €21.2 billion, with a notable portion attributed to its basketball segment.

- Under Armour, Inc. : Under Armour, headquartered in Baltimore, Maryland, has made substantial inroads into the basketball equipment market, particularly through its performance apparel and footwear. The company’s association with NBA star Stephen Curry has bolstered its brand image and product appeal. In 2023, Under Armour reported revenues of $5.7 billion, with its basketball line contributing significantly to this figure.

- Spalding Sports Equipment : Spalding, established in 1876, is a renowned manufacturer of basketballs and related equipment. As the official supplier of NBA basketballs, Spalding has maintained a strong market presence. The company’s focus on quality and innovation has sustained its reputation in the industry. While specific revenue figures are not publicly disclosed, Spalding’s longstanding partnership with the NBA underscores its significant role in the market.

- Rawlings Sporting Goods: Rawlings, founded in 1887 and headquartered in St. Louis, Missouri, is a prominent manufacturer of sports equipment, including basketballs and protective gear. The company’s commitment to quality and performance has earned it a reputable position in the market. In 2023, Rawlings reported revenues of approximately $500 million, with its basketball equipment line contributing to this total.

Recent Developments

- In 2024 MeetKai, The immersive AI leader has teamed up with the Detroit Pistons to unveil “Detroit Pistons World,” the team’s first virtual experience. Fans can look forward to a virtual marketplace, themed games, and exclusive content later this year.

- In 2023 Reebok, The iconic sports brand appointed Shaquille O’Neal as President of Reebok Basketball. This strategic move supports Reebok’s renewed focus on performance basketball and team sports.

- In 2024 BSN SPORTS, A division of Varsity Brands, BSN SPORTS partnered with the Arena Football League (AFL) as the exclusive provider of athletic apparel, custom uniforms, and equipment.

Conclusion

The basketball equipment market is poised for steady growth, driven by the sport’s global popularity and increasing participation across various demographics. Technological advancements, such as smart basketballs and performance-enhancing footwear, are reshaping consumer expectations and driving demand for innovative products. The rise in women’s basketball has led to a surge in demand for gender-specific equipment, reflecting a broader trend towards inclusivity and diversity in sports.

However, the market faces challenges, including raw material price volatility and the proliferation of counterfeit products, which can undermine brand integrity and consumer trust. Despite these hurdles, opportunities abound in emerging markets where basketball is gaining traction, and in the development of eco-friendly products that align with growing environmental consciousness. To capitalize on these opportunities, stakeholders should focus on innovation, strategic partnerships, and robust marketing strategies that resonate with a diverse and evolving consumer base.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)