Table of Contents

Introduction

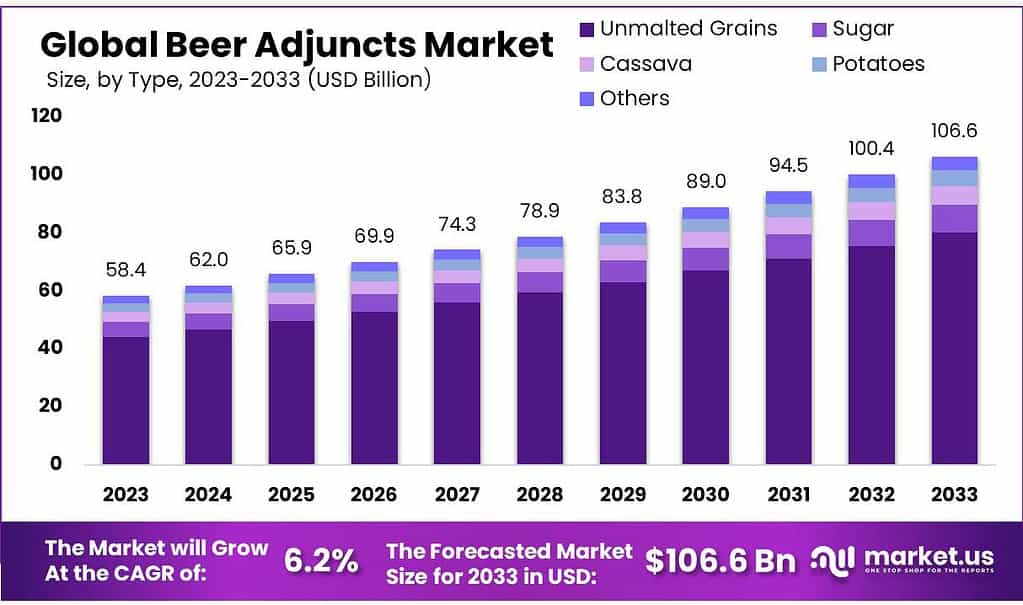

The global beer adjuncts market is on a robust growth trajectory, projected to escalate from USD 58.4 billion in 2023 to approximately USD 106.6 billion by 2033, marking a compound annual growth rate (CAGR) of 6.2% over the forecast period. This growth is fueled by the diverse range of ingredients that beer adjuncts offer, allowing brewers to experiment with flavors and enhance the overall beer quality.

Key growth drivers include the increasing demand for craft beers and a rising preference for unique beer flavors, which have led to a greater use of various adjuncts such as unmalted grains, cassava, and potatoes. These ingredients are favored for their cost-effectiveness and their ability to introduce distinctive characteristics to beer, catering to consumer demand for innovative and varied beer options.

However, the market faces several challenges. Regulatory frameworks, especially in regions like the United States where the Alcohol and Tobacco Tax and Trade Bureau (TTB) imposes strict guidelines on production and labeling, significantly affect market dynamics. Additionally, the high tariffs in regions such as Malaysia influence cost structures and pricing strategies, posing a hurdle for market expansion.

Recent developments in the market indicate a shift towards sustainability, with many breweries investing in renewable energy sources and reducing resource use to appeal to environmentally conscious consumers. This trend towards sustainable brewing practices is expected to continue influencing the market positively.

Cargill has not announced any specific recent activities directly within the beer adjuncts sector for 2023 or 2024. Their ongoing efforts mainly focus on broader agricultural and food ingredient solutions which indirectly support various sectors including beverage production.

Key Takeaways

- The Beer Adjuncts Market is projected to expand from USD 58.4 billion in 2023 to USD 106.6 billion by 2033, growing at a 6.2% CAGR.

- In 2023, the APAC region led with a 43.4% market share, valued at USD 25.34 billion, driven by rising beer consumption.

- In 2023, unmalted grains held a 75.4% market share, favored for cost-effectiveness and enhancing craft beer characteristics.

- Dry adjuncts captured over 65.5% of the market in 2023, preferred for ease of storage, longer shelf life, and consistent quality.

Beer Adjuncts Statistics

- The most commonly understood variable for predicting attenuation is mash temperature, and most brewers use lower mash temperatures (148°F is common) to produce a more highly attenuated beer. Higher mash temperatures (154 – 156°F) are thought to yield maltier, less attenuated results.

- For example, if the thermometer I’m using to measure mash temperature is off by 10 degrees of more, I may be mashing all of my beers outside the range where the two primary saccarification enzymes operate.

- American and Continental malts are generally less modified. Continental malt is modified only to 50-75%, which retains more of the endosperm for fermentability and creates greater nitrogen complexity, but at the price of reduced enzyme activity.

- The barley is steeped in 50-65 °F (10-18 °C) water for about two or three days, then allowed to germinate for six to ten days between 50 and 70 °F (10 and 20 °C).

Chocolate and Black Patent malts are undermodified (less than 1/2), dried to 5% moisture, then roasted at 420-450 °F (215-230 °C) for up to two hours, depending on the degree of roastiness desired. - Kilning at the maximum temperature is generally done only until the grains are evenly roasted. They are then cooled to below 100 °F (40 °C) and the rootlets removed.

Emerging Trends

- Emerging trends in the beer adjuncts market are predominantly shaped by the growing popularity of craft beers and the diversification of beer styles, which leverage a variety of adjuncts to create unique flavors and textures. The increasing demand for specialty beers, such as fruit-infused, barrel-aged, and spiced beers, is particularly notable. These trends are driving a shift in consumer preferences towards more flavorful and distinctive beers, encouraging brewers to explore the use of unconventional adjuncts like unmalted grains, cassava, and potatoes.

- The use of local and sustainable ingredients is another significant trend. Breweries are increasingly incorporating locally sourced adjuncts to reduce their environmental impact and support local agriculture. Additionally, there is a growing emphasis on sustainability within the brewing industry, with breweries actively implementing practices to reduce water and energy consumption and to increase their use of renewable energy sources.

- These trends are fostering innovation in beer production, with brewers experimenting with a range of adjuncts to enhance beer quality and meet consumer demands for new and exciting beer options. The evolution of brewing technology also supports the efficient use of these diverse ingredients, further contributing to the dynamic growth of the beer adjuncts market.

Use Cases

- Flavor Enhancement and Diversification: Adjuncts like unmalted grains (corn, rice), cassava, and potatoes offer different flavor profiles and textures, allowing brewers to craft a wider variety of beer styles. For example, unmalted corn is used to produce lighter-bodied beers with a mild flavor, while cassava can introduce unique, local flavor nuances in regions where it’s a staple crop.

- Cost Management: Using adjuncts can also be a cost-effective strategy for brewers. Ingredients like rice and corn are often less expensive than traditional malted barley and can be used to extend the brew without compromising quality, particularly in larger-scale production settings.

- Technical Benefits: Adjuncts contribute to the technical aspects of brewing by affecting the fermentation process and the final beer’s clarity and color. For instance, the use of certain adjuncts can enhance fermentable sugar levels without altering the beer’s body, aiding in the creation of high-alcohol beers without the heaviness that excessive malt can bring.

- Gluten-Free and Low-Calorie Beer Production: With health and dietary concerns becoming more prevalent, the use of non-barley grains like sorghum and rice is crucial in producing gluten-free beer options. These grains help brewers cater to a niche market of consumers who are sensitive to gluten but still want to enjoy beer.

- Sustainability and Local Sourcing: There is an increasing trend towards using locally sourced and sustainable ingredients. Local sourcing reduces transportation emissions and supports local agriculture, aligning with the growing consumer preference for sustainable and environmentally friendly products.

Major Challenges

The beer adjuncts market faces several major challenges that could affect its growth trajectory. One of the most significant is the stringent regulatory environment. For example, in the United States, the Alcohol and Tobacco Tax and Trade Bureau (TTB) enforces strict guidelines that govern the production, labeling, and marketing of beer products, impacting how adjuncts are used and marketed. Compliance with these regulations can be complex and costly, potentially limiting market entry and innovation.

Additionally, the global market is affected by tariffs and trade regulations that vary by country, impacting the cost structures and pricing strategies of breweries, especially those that operate internationally. For instance, high tariff rates in certain countries can increase the cost of importing specific adjuncts, which in turn affects the overall production costs of breweries.

Environmental sustainability is also a growing concern. Breweries are increasingly required to implement sustainable practices, such as reducing water and energy use, which may involve significant upfront investment. The shift towards more environmentally friendly operations can be a challenge for smaller breweries that may not have the necessary resources to invest in such changes.

Furthermore, health concerns related to alcohol consumption are leading to tighter regulations, such as limits on alcohol content and advertising, which can restrict market growth by dampening consumer demand.

Market Growth Opportunities

- Craft Beer Popularity: The rising global interest in craft beers, particularly in the Asia Pacific region, drives demand for diverse beer adjuncts. Craft beers often utilize unique adjuncts like unmalted grains, cassava, and non-traditional starches to differentiate their flavor profiles and meet consumer demand for innovative products.

- Health and Dietary Trends: There is a growing trend towards beers that cater to specific health and dietary needs, such as gluten-free and low-calorie options. This shift is expanding the use of certain adjuncts that can modify the nutritional profile of beer without compromising taste, creating opportunities for breweries to innovate within this niche.

- Technological Advancements: Improvements in brewing technologies and processes enable the use of a wide range of adjuncts more efficiently, which can enhance beer quality while reducing production costs. This technological progression is vital for maintaining product quality and consistency, making the brewing process more efficient.

- Regional Growth Potential: The Asia Pacific region currently leads the market due to its rapidly increasing beer consumption and the proliferation of breweries. This regional market growth is supplemented by local production capabilities, particularly in countries that are major producers of rice and other adjuncts, providing a robust supply chain advantage.

- Global Market Expansion: The global expansion of breweries and the broader availability of diverse beer types across international markets are enhancing the scope for the use of beer adjuncts. This globalization of the beer industry encourages the adoption of varied adjuncts to cater to regional tastes and preferences.

Key Players Analysis

In 2023, Cargill, Incorporated continues to be a leader in the beer adjuncts market, offering a diverse array of products including specialty malts and liquid adjuncts. Cargill’s expertise in formulation not only enhances the taste experiences of beers but also helps breweries manage costs effectively. Their contributions are particularly significant in providing key ingredients that are crucial for brewing diverse and high-quality beers, maintaining a strong presence in the global market.

Archer Daniels Midland Company (ADM) also plays a crucial role in the beer adjuncts sector, particularly through its comprehensive offerings in the grain market. ADM is known for its significant involvement in the production and supply of essential brewing ingredients that cater to the evolving needs of the beer industry, which includes providing resources for crafting unique and flavorful beers.

In 2023, Bairds Malt, a leader in the UK malting industry, continues to expand its production capabilities, significantly enhancing its annual capacity with modern installations and upgrades. This strategic growth enables Bairds Malt to meet the increasing demand for premium malts used in brewing, further cementing its status as a preferred supplier in the beer adjuncts market.

Malteurop Group focuses on providing a comprehensive range of malt products, emphasizing sustainable practices and innovative malting techniques. Their approach caters effectively to the evolving needs of the global brewing industry, ensuring a steady supply of quality malt for various beer styles.

In 2023, Simpsons Malt has continued to strengthen its market position by supplying high-quality malt products essential for the brewing industry. Renowned for its dedication to crafting distinctive malt flavors, Simpsons Malt supports breweries in producing diverse and premium beers, capitalizing on the trend towards artisanal and craft beers which require specialized ingredients for unique flavor profiles.

Viking Malt, on the other hand, has been proactive in expanding its production capabilities in 2023. With new facilities increasing their production capacity, Viking Malt is strategically positioned to meet the growing demand for malt products across Europe. The company focuses on sustainable practices and high-quality production to serve an international market that values both the traditional and innovative use of brewing adjuncts.

In 2023, Great Western Malting Company, established in 1934, continues to excel in the beer adjuncts market by producing high-quality malts that serve the brewing, distilling, and food processing industries. Operating from its facilities in Vancouver, Washington, and Pocatello, Idaho, the company leverages its extensive experience and strategic locations to supply brewers and distillers in the United States, Canada, Asia, and South America with premium malts. Their commitment to quality and a robust distribution network through Country Malt Group underlines their strong position in the market.

Thomas Fawcett & Sons Ltd, a longstanding U.K. malting company, maintains its reputation for producing a variety of specialty malts that cater to the specific needs of the brewing industry. Their focus on traditional malting methods combined with a dedication to quality ensures their malts are a preferred choice among brewers seeking distinctive flavors and consistent performance in their brews.

In 2023, Crisp Malting Group has made significant strides in the beer adjuncts sector by inaugurating a new $8.9 million specialty malt plant in Great Ryburgh, UK. This facility is designed to cater to the growing demands of the craft brewing industry, featuring advanced technology for automated milling, cleaning, and packing. This development highlights Crisp’s commitment to innovation and their ability to produce a diverse range of high-quality malts that meet the specific needs of both large-scale and craft brewers.

Muntons plc continues to be a prominent player in the malt and beer adjuncts market, renowned for their focus on sustainability and quality. Their operations emphasize the production of malt products that support sustainable brewing practices, which is increasingly important to global consumers seeking environmentally friendly options. Muntons’ efforts to integrate sustainable practices into their production processes underscore their role in promoting sustainable development within the industry.

In 2023, Briess Malt & Ingredients Co. continues to stand out in the beer adjuncts market by producing high-quality specialty malts and ingredients for both the brewing and food industries. This family-owned company, established in 1876, prides itself on its craft approach to business, blending traditional methods with advanced processing capabilities. Briess is known for its commitment to quality and customer success, providing not just products but also tailored solutions and technical support to enhance brewing and food production processes.

Weyermann Specialty Malts is renowned for its extensive range of high-quality malts, which contribute to the distinctive flavors and colors of craft beers globally. The company focuses on innovation and quality, ensuring that their products meet the specific needs of brewers seeking to create unique and complex beers. Weyermann’s commitment to excellence in malt production is well-recognized in the industry, making them a key player in the global beer adjuncts market

Conclusion

Advancements in brewing technologies and processes are allowing breweries to innovate and efficiently incorporate a variety of adjuncts, enhancing both the flavor profiles and nutritional attributes of beer. The Asia Pacific region, in particular, presents considerable growth potential, driven by rising beer consumption and an expanding brewery presence. To capitalize on these opportunities, breweries will need to navigate regulatory challenges and adapt to evolving consumer preferences, ensuring they remain competitive in this dynamic market