Table of Contents

Introduction

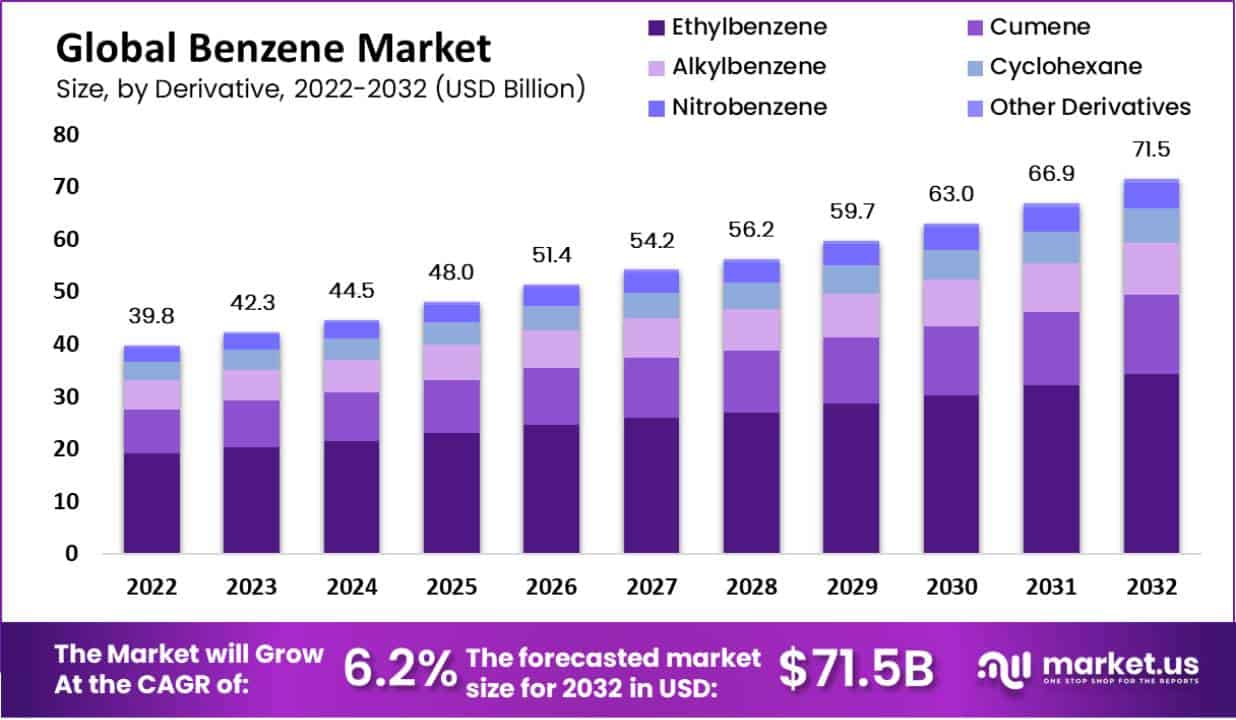

The global benzene market, valued at approximately USD 39.8 billion in 2022, is projected to grow to USD 71.5 billion by 2032, registering a compound annual growth rate (CAGR) of 6.2% over the forecast period. Benzene, a highly flammable, colorless liquid, is essential in the chemical industry, serving as a precursor to various products such as plastics, synthetic fibers, rubber, detergents, and pharmaceuticals.

The market’s growth is driven by several factors. One key driver is the rising demand for benzene derivatives, particularly ethylbenzene, which is crucial for manufacturing styrene used in plastics, packaging, and automotive parts. The automotive sector significantly boosts benzene demand, as synthetic rubber, a benzene derivative, is vital for tire production. The expanding construction industry, especially in developing regions, also plays a role by increasing the demand for benzene-based products like adhesives, insulation, and coatings.

Another growth factor is the escalating demand for household cleaning products, where benzene derivatives are used in surfactants for detergents. The growing awareness of cleanliness and hygiene has further bolstered the demand for benzene-based products in this sector.

However, the benzene market faces challenges. Volatility in crude oil prices directly affects benzene production costs, as benzene is often derived from petroleum. Additionally, health and environmental concerns surrounding benzene, classified as a human carcinogen, pose regulatory hurdles, particularly in developed markets like the U.S. and Europe. Manufacturers must comply with stringent safety standards, which may constrain market growth.

Recent developments in the market include increasing interest in bio-based benzene alternatives, driven by sustainability trends. The Asia-Pacific region, especially China and India, dominates the market due to rapid industrialization, urbanization, and expanding automotive and chemical industries. Strategic partnerships and innovations in production processes are expected to further shape the market’s future.

Dow: Dow has been increasingly focused on sustainability efforts and product innovation. Recently, the company expanded its commitment to producing more environmentally friendly chemicals, with a strong push toward bio-based materials. Dow’s ongoing investments in advanced chemical recycling technologies are aimed at reducing waste and promoting circularity in its production processes. This aligns with the growing global demand for sustainable chemical solutions.

INEOS Group: In May 2024, INEOS completed the acquisition of LyondellBasell’s Ethylene Oxide & Derivatives (EO&D) business for approximately $700 million. This strategic acquisition expands INEOS’s footprint in the U.S. market, complementing its existing ethanolamines production facility in Louisiana. This move strengthens INEOS’s position as a major player in the ethylene oxide market, essential for producing derivatives used in construction materials, automotive products, and more. INEOS also completed a $1.4 billion acquisition of Chesapeake Energy’s oil and gas assets in Texas, expanding its energy portfolio and supporting its long-term energy transition strategy

LyondellBasell Industries Holdings B.V.: LyondellBasell has been restructuring its business to focus on core segments. One of its major moves was the divestiture of its EO&D business to INEOS, which marked a strategic shift towards reinforcing its polyolefins and recycling capabilities. The company continues to invest heavily in sustainable solutions, including developing circular polymer technologies and bio-based plastics, crucial for meeting growing environmental regulations and consumer demand.

BASF SE: BASF has been focusing on expanding its presence in the sustainable chemical space. In June 2024, BASF entered a long-term agreement with Encina Development Group to secure chemically recycled circular benzene derived from post-consumer plastics. This initiative is part of BASF’s broader strategy to integrate more sustainable raw materials into its supply chain and product offerings, further strengthening its commitment to reducing carbon emissions and supporting the circular economy.

Benzene Statistics

- Benzene is widely used in the United States. It ranks in the top 20 chemicals for production volume.

- Benzene evaporates easily and most people can detect its distinctive smell at concentrations between 2.5 and 5 parts per million (ppm) in air.

- The WHO has not set a standard for ambient benzene concentrations, stating that there is no safe level of exposure but many countries use an annual average standard of 3.6g m-3 which is equivalent to 1 part per billion (ppb) or 0.001 ppm.

- Cox proportional-hazards models with time-varying exposure measurements were used to estimate the hazard ratios and 95% confidence intervals (CIs) for mortality risks.

- Brief exposure (5–10 minutes) to very high levels of benzene in the air (10,000–20,000 ppm) can result in death.

- Lower levels (700–3,000 ppm) can cause drowsiness, dizziness, rapid heart rate, headaches, tremors, confusion, and unconsciousness. Most of the metabolites of benzene leave the body in the urine within 48 hours after exposure.

- Benzene was detected in body spray products up to the concentration of 17.7 ppm and in sunscreen products at concentrations up to 5.2 ppm and 2.4 ppm used by adults and children, respectively.

- About 99.3 % of all VOCs in the air come from the transportation sector [17]. A. Kumar et al. [18] found that between 80 to 85 % of vehicle exhaust, 10 to 20 % of vaporization, and 3 to 6 % of benzene are released by the transportation sector.

- Delhi has been selected for the benzene monitoring, which is in northern India and spread over an area of 1483 km2 between the latitudes of 28°-53’-00” and 28°-24’-17” North and the longitudes of 77°-20’-37” and 76°-50’-24” East.

- Where LADD is the lifetime Average Daily Dose (mg/kg-day) and CSF is the cancer slope factor (mg/kg-day) of benzene. The CSF of benzene (0.0273 mg/kg-day) is given in the Risk Assessment Information System (RAIS)

- Spearman correlations between air benzene concentrations and urinary metabolites ranged between 0.50 for CA and 0.82 for MA among the exposed subjects of the NCI study.

- Data on blood benzene levels and self-reported sunscreen use were available for 10,861 adults (mean age, 39 years), representing a US population-level estimate of 152,838,624.

Emerging Trends

- Bio-based Benzene: There is growing interest in bio-based benzene as a sustainable alternative to traditional petroleum-based benzene. This trend is driven by increasing environmental regulations and the need to reduce carbon emissions. Bio-based benzene, derived from renewable resources such as lignin and biomass, is gaining traction due to its eco-friendly production process. It is expected to grow at a faster rate compared to traditional benzene.

- Rising Demand from Automotive and Packaging Sectors: The automotive and packaging industries are major consumers of benzene derivatives like styrene and synthetic rubber. The growth in the global automotive sector, especially in regions like Asia Pacific and North America, is increasing the demand for benzene in the production of lightweight automotive parts and fuel-efficient vehicles. Similarly, the packaging sector continues to drive demand for benzene-based polymers, such as polystyrene.

- Increased Use in Electronics: Benzene is increasingly being used in the electronics industry, particularly in the production of plastics and synthetic fibers used in electronic devices. As demand for electronics grows globally, especially in Asia-Pacific, this is expected to contribute significantly to benzene market growth.

- Technological Advancements in Production: Advancements in benzene production methods, such as catalytic reforming and steam cracking, are enhancing efficiency and reducing production costs. These processes are being optimized to reduce environmental impact while ensuring high yields, particularly in regions like North America and Europe.

- Regulatory Pressures and Environmental Concerns: Strict environmental regulations in regions like Europe and North America are pushing companies to adopt cleaner production methods. This is leading to increased investments in technologies that reduce harmful emissions from benzene production and in the development of bio-based alternatives.

- Geopolitical and Economic Factors: Geopolitical events and economic shifts, particularly in key benzene-producing regions like the Middle East and Asia, are influencing supply and demand dynamics. China, being one of the largest consumers of benzene, is significantly impacted by fluctuations in global trade, which in turn affects benzene prices and availability.

Use Cases

- Plastics and Polymers: One of the largest applications of benzene is in the production of styrene, which is used to create polystyrene, a plastic used in packaging, disposable cups, and insulation. In 2022, the demand for benzene in the production of plastics contributed significantly to the global plastics industry, which generated over USD 580 billion globally.

- Rubber Manufacturing: Benzene is used to produce synthetic rubber, an essential material for tire manufacturing in the automotive industry. The tire industry, particularly in Asia, is a major consumer of benzene, with increasing vehicle production in countries like China and India driving demand.

- Chemicals and Solvents: Benzene is a critical feedstock in producing various chemicals, such as phenol and cumene, which are used in detergents, pesticides, and pharmaceuticals. Benzene is also employed as a solvent in cleaning agents for industrial uses, such as degreasing metal components in the automotive sector.

- Dyes and Paints: The printing and paint industries rely on benzene-based products to keep paints and inks in a liquid form until they are applied. It is commonly used in spray paints, lacquers, and stains, making it an important component in both consumer and industrial applications.

- Pharmaceuticals: Benzene is used to produce intermediates for drug manufacturing, such as phenol, which is a precursor in the production of aspirin and other pharmaceuticals. This sector continues to grow, especially with the expanding healthcare needs in developing markets.

- Fuel Additive: Historically, benzene has been used as a gasoline additive to increase octane ratings and improve fuel efficiency. Though its use in fuels has decreased due to health concerns, it remains a component of crude oil and gasoline.

Major Challenges

- Environmental Regulations: One of the most pressing challenges for the benzene industry is the increasingly stringent environmental regulations. Benzene is a known carcinogen, and many governments, especially in the U.S. and Europe, have implemented tough restrictions to reduce its use and emissions. These regulations not only increase production costs but also limit the growth of benzene in specific sectors, particularly in consumer goods and packaging.

- Volatility in Feedstock Prices: Benzene production relies heavily on crude oil and natural gas, which are subject to global price fluctuations. Geopolitical tensions, OPEC+ decisions, and supply disruptions can lead to volatility in benzene prices. For instance, in 2024, fluctuations in crude oil prices due to geopolitical factors and maintenance shutdowns at major production plants led to inconsistent benzene prices.

- Supply Chain Constraints: The benzene market also faces challenges due to supply chain disruptions. Recent operational issues, including unplanned shutdowns and transportation bottlenecks, have restricted benzene availability, especially in key regions like North America. Additionally, fluctuations in demand from end-user sectors such as automotive and construction further complicate the supply chain.

- Economic and Demand Variability: Demand for benzene is highly dependent on downstream industries, such as automotive, construction, and chemicals. Economic downturns or slowdowns in these sectors can lead to decreased demand for benzene, affecting overall market growth. For example, in recent years, a slowdown in the automotive industry has reduced demand for benzene-based products like synthetic rubber.

Market Growth Opportunities

- Rising Demand from the Automotive Sector: The global automotive industry’s recovery and expansion are increasing the demand for benzene derivatives, particularly styrene, which is essential in producing synthetic rubber for tires and automotive plastics. The U.S., for example, is seeing a steady rise in vehicle production, with sales reaching 15.4 million units in 2023, driving benzene demand further.

- Expansion in the Plastics and Packaging Industry: Benzene is crucial in manufacturing plastics such as polystyrene, which is widely used in packaging and construction materials. The continued growth of these sectors, especially in emerging economies, creates significant opportunities for benzene manufacturers. The Asia-Pacific region, in particular, is expected to lead the market, with China and India accounting for a large share of demand.

- Bio-based Benzene: With increasing environmental regulations, the push for sustainable alternatives is opening doors for bio-based benzene. This eco-friendly alternative to petroleum-based benzene is expected to see strong growth, particularly in Europe and North America, where sustainability is becoming a priority. Companies investing in bio-based chemicals are well-positioned to capture this growing market.

- Infrastructure Development: Countries like India, with large-scale infrastructure projects such as the Delhi-Mumbai Industrial Corridor, are boosting demand for benzene-based products like epoxy and phenolic resins, used in construction materials. This, coupled with rapid urbanization, is expected to increase benzene consumption in construction.

Key Player Analysis

INEOS Group has been actively involved in the benzene sector through its Olefins and Polymers (O&P) Europe division. In 2024, the company produced approximately 600,000 tons of benzene annually across its facilities in France, the UK, and Germany. Benzene is extracted as a by-product from its oil-based cracking process, which is a key feedstock for manufacturing polymers like phenolics, polystyrene, and nylon.

In 2023 and 2024, Dow continued its work in the benzene sector, primarily focusing on producing benzene as a critical feedstock for chemicals like styrene and phenol, which are used in manufacturing plastics, synthetic rubber, and resins. Throughout 2023, Dow made significant strides in advancing its sustainability initiatives by integrating circular economy principles into its operations.

LyondellBasell Industries has been actively advancing its work in the benzene sector as part of its broader chemical production. In 2023 and 2024, the company demonstrated significant progress towards sustainability. This included the issuance of a $500 million green bond to fund projects related to the circular economy and renewable energy. Additionally, LyondellBasell invested in recycling operations in Europe, Asia, and North America, aiming to increase the use of recycled materials in chemical production, which includes benzene derivatives.

In 2023 and 2024, BASF SE has continued to play a crucial role in the global benzene sector, focusing on using benzene as a key feedstock for producing high-demand chemicals like styrene, ethylbenzene, and cumene. These chemicals are essential for creating plastics, resins, and synthetic rubbers used across industries like automotive and construction.

In 2023 and 2024, Royal Dutch Shell plc has continued its active involvement in the benzene sector, primarily through its chemical production division. The company uses benzene as a core feedstock for various high-demand chemicals like styrene and cumene, essential for the production of plastics, resins, and synthetic rubber. In line with its broader sustainability and energy transition goals, Shell has made progress in decarbonizing its chemical processes. For instance, the company reported a 2.6% reduction in its net carbon intensity (NCI) for energy products sold in 2023, as part of its goal to reduce emissions across its operations, including in the chemicals sector.

In 2023 and 2024, Reliance Industries Limited (RIL) has remained a key player in the global benzene market, leveraging its extensive refining and petrochemical operations. RIL produces around 1,400 kilotons of benzene annually, which is critical for supplying domestic demand in India and for export to international markets. This production supports the manufacturing of styrene and other derivatives used in plastics, synthetic rubbers, and resins across various industries like automotive and construction.

Chevron Phillips Chemical Company (CPChem) plays a significant role in the benzene market through its production at several global facilities, including in Texas and Saudi Arabia. In 2023, CPChem continued leveraging its proprietary Aromax® technology to improve benzene production efficiency, utilizing feedstock from sources like naphtha. This benzene is essential in manufacturing chemicals like styrene, cumene, and cyclohexane, which are used in plastics, synthetic rubber, and resins.

In 2023 and 2024, China Petrochemical Corporation, also known as Sinopec, continued to be one of the world’s largest producers of benzene. The company plays a vital role in meeting both domestic and international demand for benzene, which is a key component for producing styrene, cumene, and other essential chemicals used in plastics, synthetic rubber, and resins. In 2023, Sinopec’s benzene production capacity was bolstered by the expansion of its integrated petrochemical facilities, with a particular focus on enhancing efficiency and sustainability.

In 2023 and 2024, Marathon Petroleum Corporation (MPC) maintained a significant role in the benzene sector as part of its broader refining and chemical operations. As one of the largest refiners in the U.S., Marathon Petroleum produces benzene through its petrochemical processes, which are critical for manufacturing products like styrene and cumene, essential in plastics and synthetic rubber. Throughout 2023, MPC’s focus was on maximizing refinery efficiencies and upgrading facilities, particularly at its Galveston Bay refinery, where it added a 90,000-barrel-per-day distillate hydrotreater. In the first quarter of 2024, the company reported robust financial results, with revenue reaching app

In 2023 and 2024, LG Chem maintained its significant presence in the global benzene market, leveraging its production capabilities across Asia. The company produces benzene as a crucial feedstock for derivatives like styrene and cumene, which are essential in manufacturing plastics, synthetic rubbers, and resins. LG Chem’s production facilities in South Korea play a pivotal role in supplying the domestic and international markets.

Conclusion

The benzene market is poised for steady growth, driven by its essential role as a chemical feedstock in industries such as automotive, packaging, and electronics. With its derivatives like styrene and cumene being critical to the production of plastics, synthetic rubber, and resins, benzene remains a foundational element in global manufacturing. Key regions like Asia-Pacific, particularly China and South Korea, continue to dominate the market due to rapid industrialization and rising demand for consumer goods. However, challenges such as fluctuating raw material prices and environmental regulations will push companies toward more sustainable production methods, including bio-based alternatives.