Table of Contents

Introduction

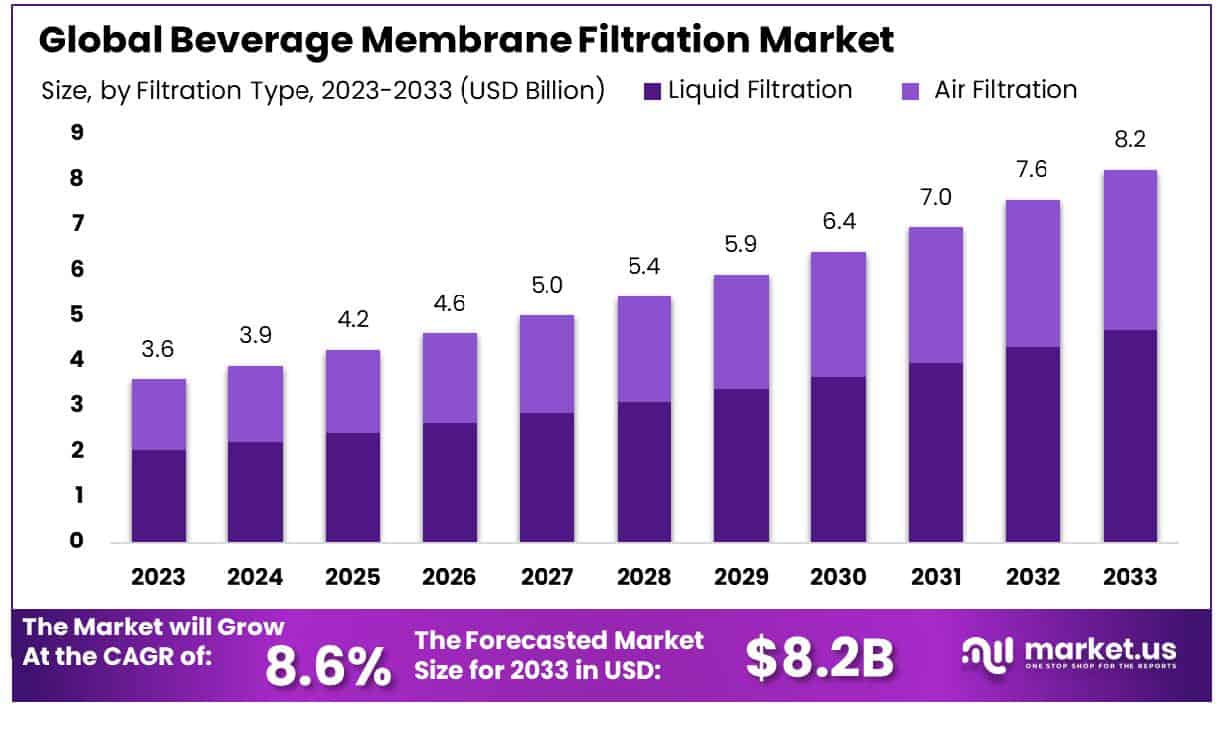

The Global Beverage Membrane Filtration Market is anticipated to undergo substantial growth, projected to expand from USD 3.6 billion in 2023 to approximately USD 8.2 billion by 2033, demonstrating a compound annual growth rate (CAGR) of 8.6% over the forecast period from 2024 to 2033.

This expansion can be attributed to several factors including advancements in filtration technologies, increasing demands for premium and functional beverages, and stricter regulatory standards concerning beverage safety and quality. However, the market faces challenges such as high operational costs and the need for continuous technological upgrades.

Recent developments in the industry have seen significant investment in research and development aimed at enhancing filtration efficiency and reducing energy consumption, which are critical for maintaining competitiveness in this evolving market. These dynamics underscore the vibrant nature of the beverage membrane filtration market and its critical role in meeting the global demand for cleaner and safer beverage production.

Pentair has recently expanded its product line with the introduction of advanced filtration solutions designed to increase efficiency and reduce waste in beverage production. These innovations are intended to help beverage producers meet increasingly stringent environmental regulations and consumer demands for sustainable practices.

ALFA LAVAL has engaged in strategic partnerships to enhance its service offerings, including a notable acquisition aimed at broadening its technology capabilities in membrane filtration. This move is designed to fortify their market position and expand their reach in new regional markets.

FUJIFILM Holdings Corporation has leveraged its expertise in photographic film technologies to innovate in the membrane filtration space, introducing cutting-edge membrane materials that offer superior filtration capabilities with lower energy requirements. This development underscores their commitment to technological innovation and sustainability in beverage production.

DuPont has been at the forefront of biotechnological advancements in the sector, developing new membrane materials that enhance both the performance and the environmental footprint of filtration processes. These advancements are critical as the industry moves towards more sustainable production practices.

3M has continued to invest heavily in research and development, resulting in the launch of new filtration products that provide higher precision and efficiency. Their recent initiatives also include collaborations with technology startups to explore novel applications of membrane filtration in beverages, emphasizing their role in driving industry innovation.

Key Takeaways

- Market Growth: The Global Beverage Membrane Filtration Market is projected to grow from USD 3.6 billion in 2023 to USD 8.2 billion by 2033, at a CAGR of 8.6%.

- North America holds 41.2% of the USD 1.5 billion Beverage Membrane Filtration Market.

- By Filtration Type: Liquid filtration dominates with a 56.5% market share.

- By System Technology: Tangential flow filtration holds 66.4% of system technology.

- By Membrane Material: Polymer materials constitute 43.2% of filtration membranes.

- By Application: Wine applications represent 22% of the market segment.

Beverage Membrane Filtration Market Statistics

- 0.02-micron ultra-filtration membrane designed to treat water that has already been treated for drinking and cooking.

- Polyethersulfone Membrane Cartridge, 0.45 Micron Rating, FPS-40, Food & Beverage

- The nominal cut molecular weight of most UF membranes is generally defined as the smallest molecular weight at which the membrane has a rejection of greater than 90%.

- Research indicates membrane filtration can achieve a protein retention rate of up to 97%.

- The expanded perlite, after delicate processes of crushing and classification, is transformed into a filtering aid whose particles, intertwined, can form an incompressible cake, with 80 – 90 % hollow spaces.

- These systems feature high-purity plastics or 316-grade stainless steel filter housings and wetted parts.

- we have 90% and 99.8% reduction PURE pleated polypropylene caged filters with core down to 0.2 microns.

- The overall water balance drawn for this plant revealed that 76% of the raw water consumed daily ends up in the biological wastewater treatment plant (WWTP).

- A large portion (40%) of this wastewater is generated from the bottle-washing units.

- By employing microfiltration for polishing of the WWTP effluent, the plant can recover process water for reuse such that, groundwater input is reduced by 40% and liquid discharged to the receiving water by 56%.

- In the bottle washing process, thereby reducing raw water consumption further to 58% and the liquid discharge by 81.5%.

- On the other hand, a dual filter media-ion exchange system can reduce raw water input to 57% and the liquid discharge by 80.5%.

- According to the World Health Organization (WHO), more than 1 billion people do not have safe drinking water, and more than 2.6 billion do not have adequate sanitation. The result is a staggering 1.7 million deaths per year due to unsafe water, inadequate hygiene, and waterborne illness.

- The exit process stream after treatment using a micro-filter has a recovery rate that generally ranges from about 90-98%

Emerging Trends

- Sustainability Initiatives: There is a growing trend towards using membrane filtration technology to achieve more sustainable beverage production processes. Companies are increasingly adopting these systems to reduce water usage and minimize waste, responding to global demands for environmentally responsible manufacturing practices.

- Enhanced Filtration Accuracy: Advancements in membrane technology have led to the development of ultra- and nano-filtration membranes that offer greater precision. This allows beverage companies to better control the clarity, taste, and purity of their products, meeting higher standards of quality and consumer expectations.

- Energy Efficiency: Energy conservation is a significant trend in the industry, with new membrane filtration technologies designed to operate at lower pressures, thereby reducing energy consumption. This not only helps companies save on operational costs but also aligns with global efforts to reduce energy usage in industrial processes.

- Expansion into Non-Alcoholic Beverages: Membrane filtration is increasingly being used in the production of non-alcoholic beverages, such as functional waters and non-dairy milk alternatives. This trend is driven by the rising consumer interest in health and wellness beverages that require high standards of purification and safety.

- Smart Filtration Technologies: The integration of smart technologies and IoT (Internet of Things) in membrane filtration systems is on the rise. These technologies provide real-time data on system performance and maintenance needs, improving operational efficiency and predictive maintenance capabilities.

Use Cases

- Water Purification: In beverage manufacturing, the quality of water directly influences the final product’s taste and safety. Membrane filtration systems, such as reverse osmosis and microfiltration, are extensively used to remove impurities, bacteria, and viruses from water. This process ensures that the water used in beverages meets stringent safety standards, essential for consumer health.

- Concentration of Juices: Membrane filtration is employed to concentrate fruit and vegetable juices without heating. This cold concentration preserves the natural flavors and nutrients better than traditional methods. For instance, using ultrafiltration, companies can achieve concentration levels that reduce the juice volume by up to 10 times, significantly decreasing packaging and transportation costs.

- Dairy Applications: In the dairy industry, membrane filtration is utilized for concentrating and purifying milk and milk products. Techniques like ultrafiltration help in the production of protein-rich concentrates from milk, used in cheese-making and whey proteins, which are popular in nutritional supplements.

- Alcohol-Free Beverages: Membrane filtration plays a vital role in the production of non-alcoholic beer and wine. The technology allows the removal of alcohol while retaining the flavors and aromas characteristic of the original beverage, catering to a growing market segment that prefers non-alcoholic yet authentic-tasting options.

- Removal of Microorganisms: To ensure safety and extend shelf life, beverages need to be free from harmful microorganisms. Membrane filtration provides a physical barrier that helps in removing these microorganisms effectively. This is crucial in industries where beverage safety is paramount and can prevent spoilage, thereby reducing losses and ensuring compliance with health regulations.

Key Players Analysis

Pentair specializes in Beer Membrane Filtration (BMF) Systems, leveraging its X-Flow polymer membrane hollow fiber technology to provide breweries with scalable and sustainable filtration solutions. These systems enhance beer quality, ensure taste stability, and offer environmental benefits by reducing solid waste and water usage.

Alfa Laval offers robust membrane filtration technology with many applications, including beverage processing. Based on spiral and flat sheet membranes, their systems are designed for efficiency and scalability, enabling precise separation and concentration processes essential in beverage production. Alfa Laval’s membrane solutions are tailored to handle different viscosities and provide low operational costs.

FUJIFILM Holdings Corporation contributes to the beverage membrane filtration sector by producing AstroPore microfilters. These filters utilize a unique asymmetric membrane structure, allowing efficient and reliable removal of contaminants such as microorganisms from beverages, ensuring high-quality filtration with extended service life.

DuPont is recognized for its substantial contributions to the beverage membrane filtration market, leveraging advanced technologies such as nanofiltration, ultrafiltration, and reverse osmosis. These technologies are integral for enhancing beverage quality through improved taste, clarity, and stability. DuPont’s solutions are tailored to support various beverage applications, promoting both efficiency and sustainability in production processes.

3M leverages its advanced membrane technologies to enhance beverage production, emphasizing microfiltration in brewing processes to ensure clarity and microbial stability without affecting taste. The company’s Liqui-Flux Beverage Membrane Modules, known for their high throughput and effective performance, play a crucial role in various beverage applications, including the clarification and stabilization of beer and other beverages.

Eaton is engaged in advanced beverage filtration, focusing on providing comprehensive solutions for purity and safety across various industries including food and beverage. Their array of filtration products, such as pleated membrane filter cartridges and bag filter housings, supports crucial processes like beer stabilization and fine particle removal, enhancing product clarity and stability while ensuring operational efficiency and economic benefits.

Pall Corporation is renowned for its advanced filtration technologies in the beverage sector, particularly in beer production. Their systems emphasize microbial stability and integrity testing to ensure the quality and safety of the final product. Pall’s solutions are designed to handle various levels of beer filterability, enhancing both the quality and shelf life of beer while supporting sustainability through the reduction of waste and water usage.

Donaldson Company, Inc. is a prominent player in the field of beverage membrane filtration, utilizing its advanced LifeTec™ PES-WN filter elements for sterile filtration and microbial stabilization of beverages. These filters are designed with a hydrophilic polyethersulfone membrane, noted for its asymmetric pore structure that effectively retains impurities while maintaining high flow rates. Donaldson’s filters are particularly suited for applications requiring high purity standards, including mineral water, juices, soft drinks, and alcoholic beverages, ensuring consistent product quality from source to shelf.

MANN+HUMMEL specializes in advanced ultrafiltration (UF) solutions tailored for the beverage industry, ensuring the removal of contaminants to maintain beverage purity and quality. Their technologies, including UF, nanofiltration, and reverse osmosis, are crucial for achieving the desired standards in water quality, essential for beverage production. This comprehensive approach not only meets strict health regulations but also enhances the consistency of flavor, color, and body in beverages.

Koch Separation Solutions (KSS) significantly contributes to the beverage industry by leveraging advanced membrane filtration technologies. These technologies are part of KSS’s comprehensive solutions that address the complex needs of beverage production, including purification and separation processes essential for maintaining high quality and efficiency. KSS’s approach combines innovation with sustainability, aiming to enhance productivity and reduce environmental impact across its operations.

Sartorius specializes in high-efficiency membrane filtration technologies for the beverage industry, ensuring optimal microbial retention to maintain product quality and safety. Their filtration solutions are particularly critical in the final stages before bottling, using advanced membrane types suitable for both liquid and gas applications. This focus supports industry demands for sterile and high-quality beverage production, reflecting Sartorius’s commitment to technological innovation in filtration.

Hangzhou Cobetter Filtration Equipment Co., Ltd. is recognized for its innovative approaches in membrane technology for beverage filtration, focusing on extending product longevity and quality in the beverage industry. The company’s comprehensive portfolio includes solutions for various beverage applications such as brewing, bottled water, soft drinks, and wine production. Cobetter is dedicated to enhancing the clarity, stability, and safety of beverages, leveraging advanced filtration technologies to meet industry demands efficiently.

Parker Hannifin Corp enhances beverage production efficiency through advanced microfiltration technologies. Their filtration solutions are crucial for extending the shelf life and improving the visual clarity of beverages, ensuring products remain free of contaminants and retain their desired taste. These technologies are particularly significant in processes involving carbonated soft drinks, where maintaining the purity of the carbon dioxide used is vital to prevent quality incidents.

Conclusion

The Beverage Membrane Filtration market plays a pivotal role in modern beverage production, addressing critical needs for quality, efficiency, and sustainability. With its ability to purify water, concentrate juices, ensure microbial safety, and even remove alcohol from beverages, membrane filtration technology is indispensable across various applications. As the industry continues to evolve, driven by consumer demands for healthier and environmentally friendly products, these technologies are set to become even more integral.

The future of beverage production will likely see increased adoption of advanced membrane filtration solutions, further enhancing production capabilities and meeting global standards for beverage safety and quality. This ongoing progression underscores the importance of continued investment and innovation in membrane filtration technologies within the beverage industry.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)