Table of Contents

- Introduction

- Editor’s Choice

- Bicycle Market Overview

- Global Bicycle Sales Statistics

- Countries with The Highest Bicycle Usage

- Bicycles Exports by Country

- Bicycles Imports by Country

- Bicyclist’ Demographic Characteristics

- General Bicycle Use Characteristics

- Bicycling and Not Bicycling Reasons

- Public Bicycle Statistics

- Effects on Bicycling During and After the COVID-19 Pandemic

- Bicycle Market Trends

Introduction

According to Bicycle Statistics, The bicycle industry, comprising conventional and electric models, is experiencing steady growth driven by health consciousness, environmental concerns, and urbanization.

Technological advancements, such as smart features and lightweight materials, are enhancing performance and safety.

As cities invest in bike infrastructure and consumers seek sustainable transportation, bicycles are becoming integral to urban mobility.

Challenges include regulatory hurdles and supply chain disruptions, but opportunities abound in emerging markets and innovative product development.

By embracing innovation and market diversification, industry stakeholders can capitalize on the growing demand for bicycles as a sustainable and efficient mode of transportation and recreation.

Editor’s Choice

- The global bicycle market revenue is projected to reach USD 70.00 billion by 2029.

- China leads the market with a revenue of USD 12,370 million.

- Bicycle unit sales are expected to reach 138.30 million by 2029.

- In 2019, several countries stood out for their high rates of bicycle ownership among their populations. The Netherlands led the list with an impressive 99% of people owning a bicycle.

- Between 2021 and 2022, Germany led the fastest-growing importers of bicycles, which saw an increase of USD 253 million.

- The purposes for bicycling among respondents vary widely. Exercising is the most common reason, with 94% of respondents cycling for this purpose (excluding stationary exercise bicycles).

- A 2022 survey by the Allgemeiner Deutscher Fahrrad-Club (ADFC) in Germany found that 96% of respondents owned bicycles.

Bicycle Market Overview

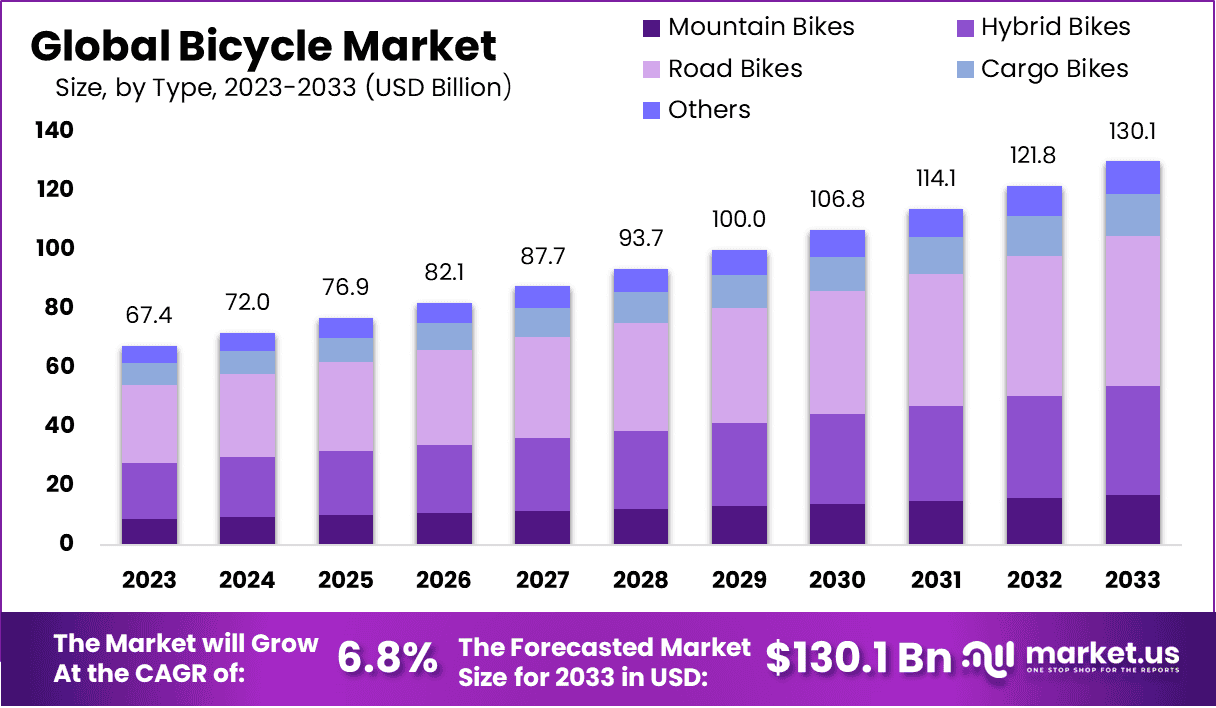

Global Bicycle Market Size

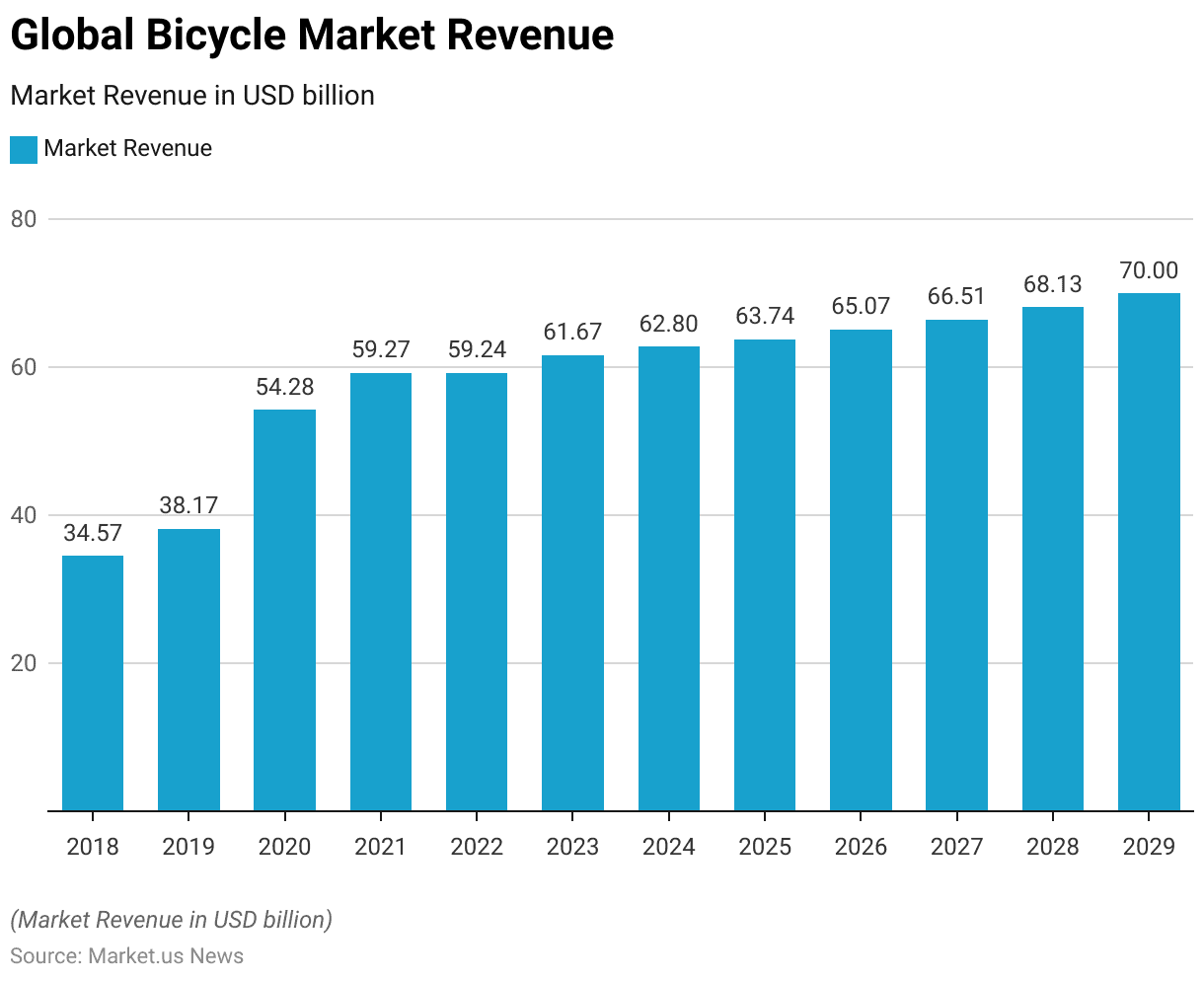

- The global bicycle market has experienced notable fluctuations and growth over the past decade at a CAGR of 2.1%.

- In 2018, the market revenue was USD 34.57 billion, increasing to USD 38.17 billion in 2019.

- Further growth is anticipated, with revenues projected to reach USD 68.13 billion in 2028 and USD 70.00 billion by 2029.

Global Bicycle Market Revenue Change

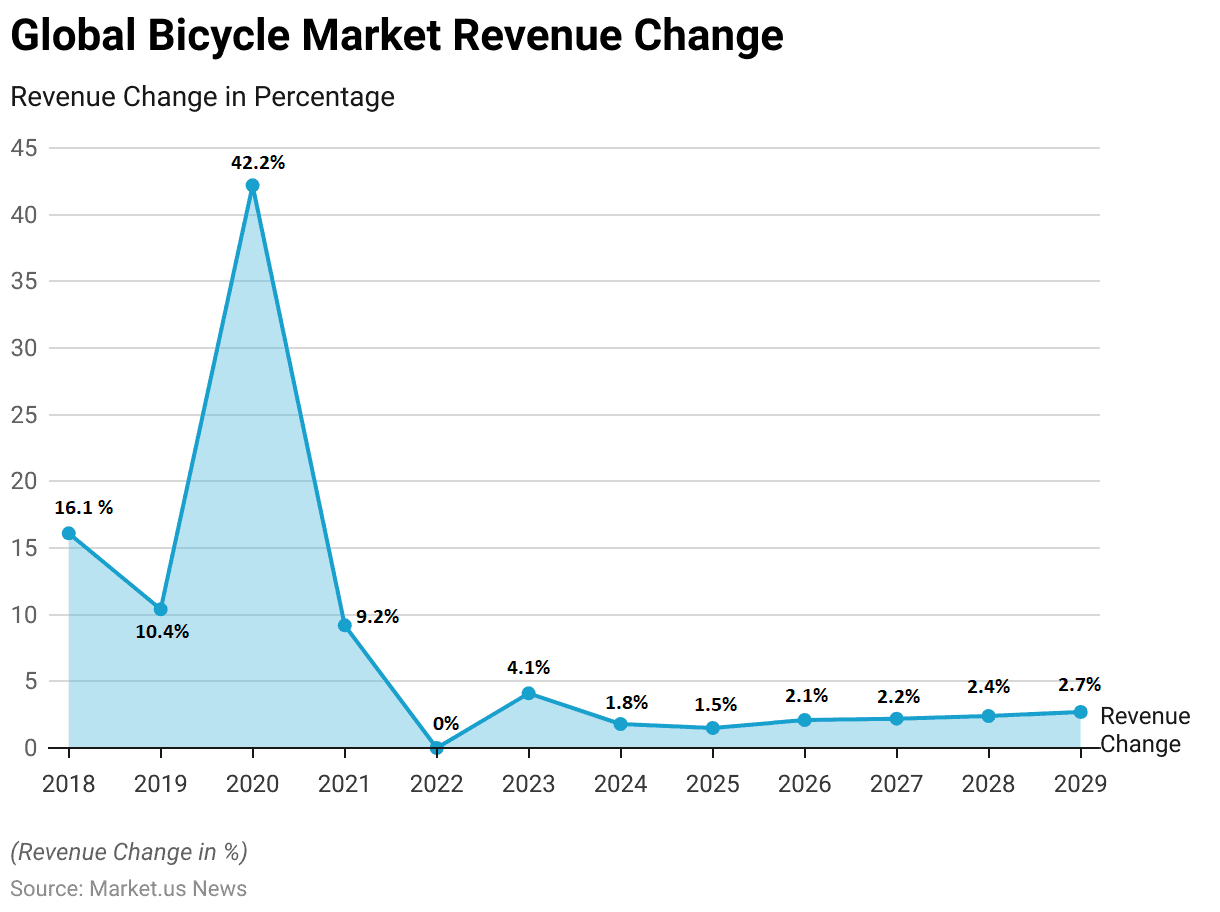

- The global bicycle market has exhibited varying rates of revenue change over the years.

- In 2018, the market saw a substantial increase of 16.1%, followed by a growth of 10.4% in 2019.

- The growth rates for the subsequent years are projected to be 1.5% in 2025, 2.1% in 2026, and 2.2% in 2027.

- Further gradual increases are expected, with growth rates of 2.4% in 2028 and 2.7% in 2029.

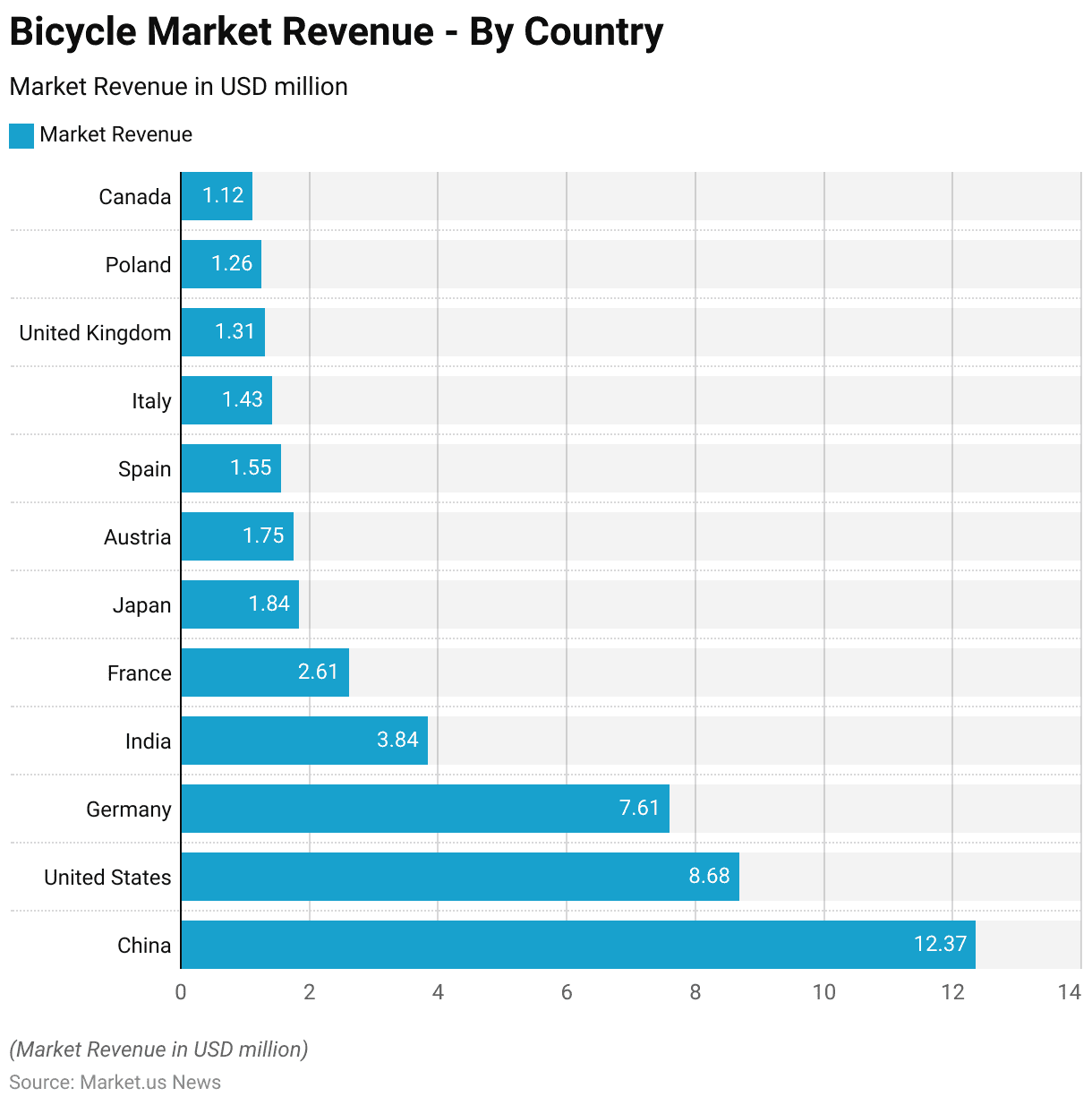

Regional Analysis of the Global Bicycle Market

- Significant revenue contributions from various countries characterize the global bicycle market.

- China leads the market with a revenue of USD 12,370 million, followed by the United States at USD 8,684 million and Germany at USD 7,607 million.

- India contributes USD 3,840 million, while France and Japan generate USD 2,611 million and USD 1,840 million, respectively.

- Austria, Spain, and Italy also have notable revenues of USD 1,749 million, USD 1,554 million, and USD 1,426 million, respectively.

- The United Kingdom adds USD 1,314 million to the market, with Poland and Canada contributing USD 1,262 million and USD 1,121 million, respectively.

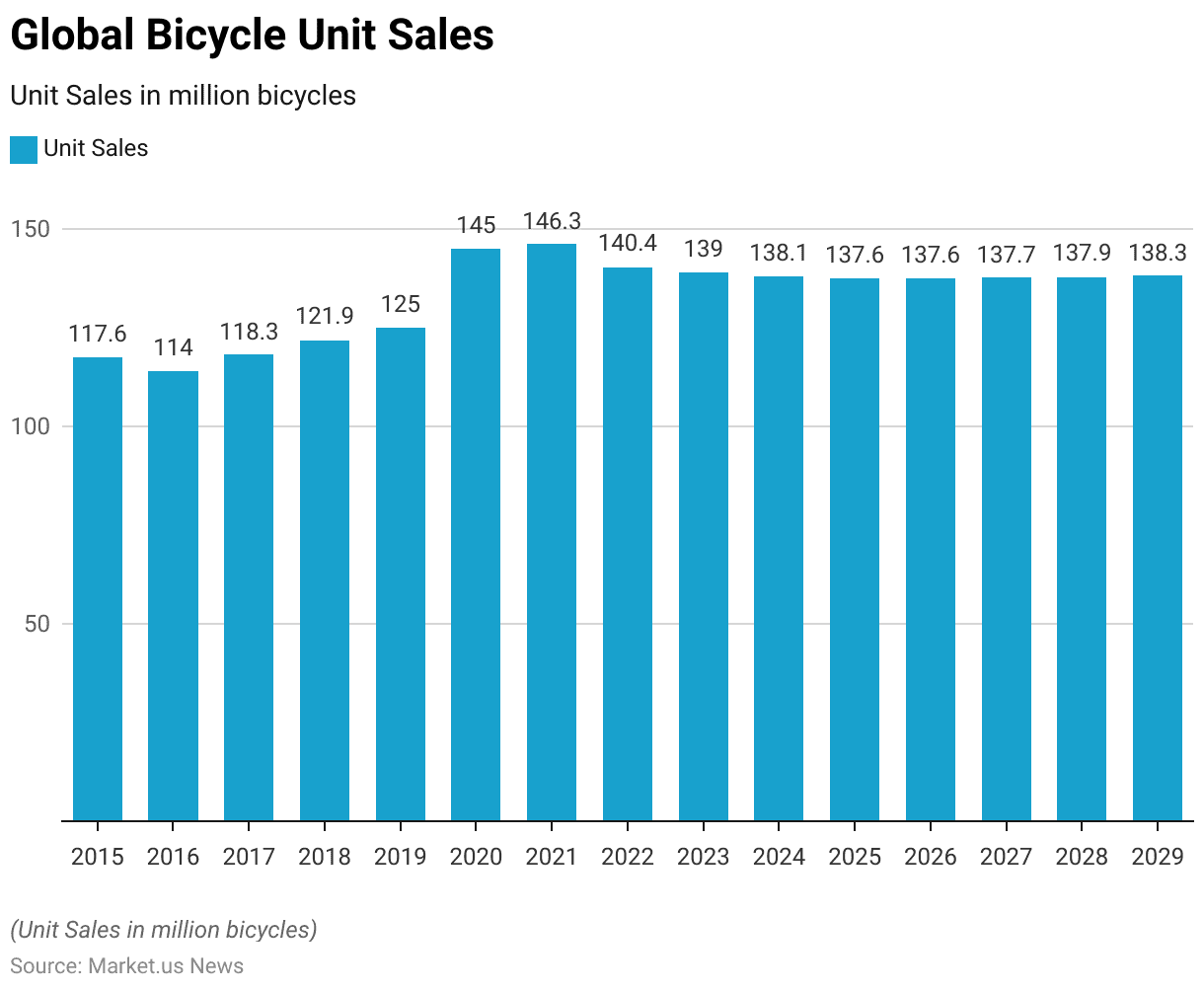

Global Bicycle Sales Statistics

- The global bicycle market has shown dynamic trends in unit sales over the past decade.

- In 2015, unit sales reached 117.60 million bicycles, slightly decreasing to 114.00 million in 2016.

- A marginal increase is projected for the following years, with unit sales expected to reach 137.70 million in 2027, 137.90 million in 2028, and 138.30 million by 2029.

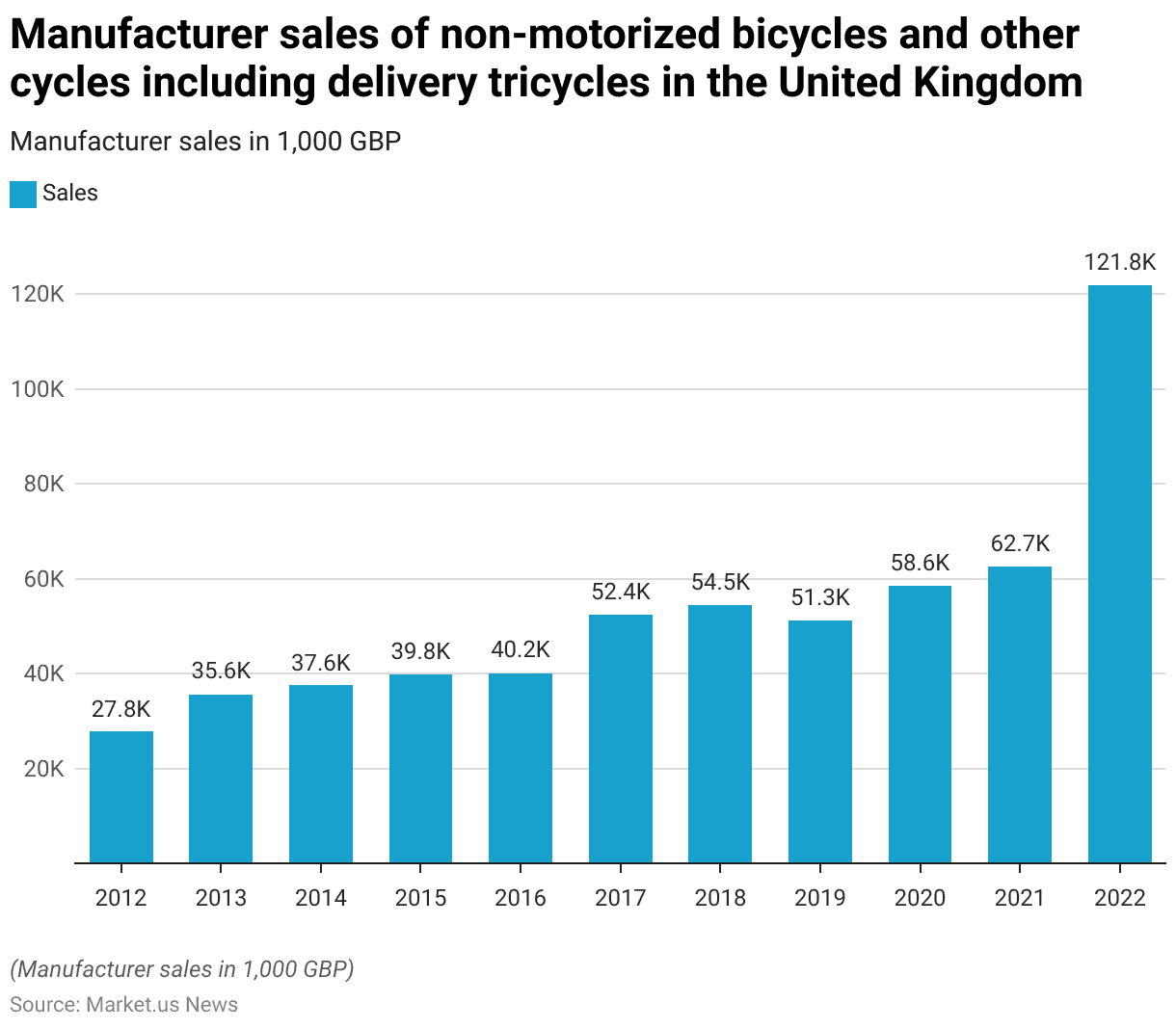

Trends in Manufacturer Sales of Non-Motorized Bicycles and Other Cycles Including Delivery Tricycles

- The manufacturer sales of non-motorized bicycles and other cycles, including delivery tricycles, in the United Kingdom have exhibited notable growth over the past decade.

- In 2012, sales amounted to 27,847 thousand GBP, rising to 35,636 thousand GBP in 2013 and 37,596 thousand GBP in 2014.

- The most dramatic surge was observed in 2022, with manufacturer sales skyrocketing to 121,772 thousand GBP.

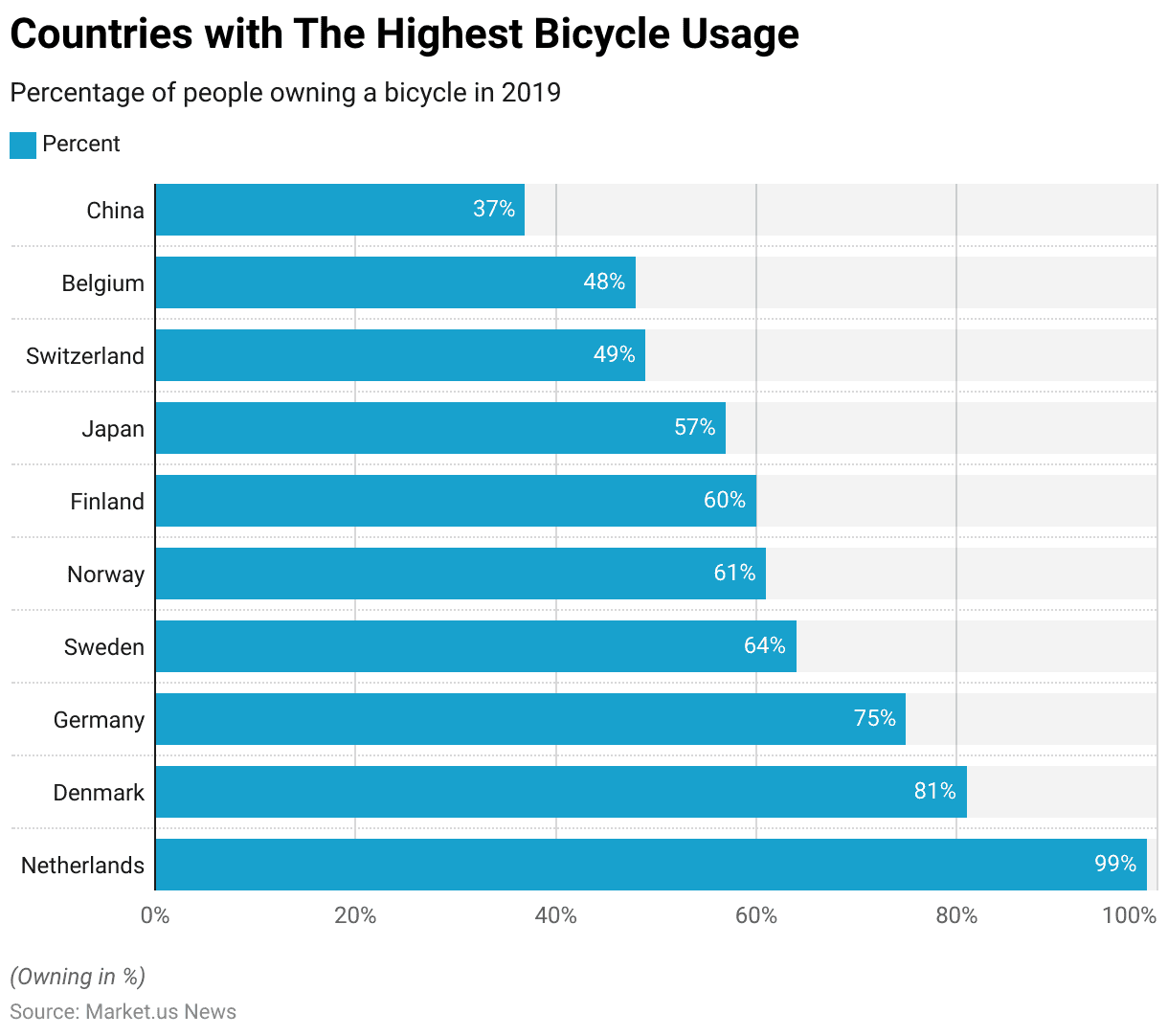

Countries with The Highest Bicycle Usage

- In 2019, several countries stood out for their high rates of bicycle ownership among their populations.

- The Netherlands led the list with an impressive 99% of people owning a bicycle, followed by Denmark at 81% and Germany at 75%.

- Sweden and Norway also had substantial ownership rates of 64% and 61%, respectively.

- In Finland, 60% of the population owned bicycles, while Japan reported a 57% ownership rate.

- Switzerland and Belgium had 49% and 48% of their populations owning bicycles, respectively.

- China, despite its vast population, had a relatively lower but still significant ownership rate of 37%.

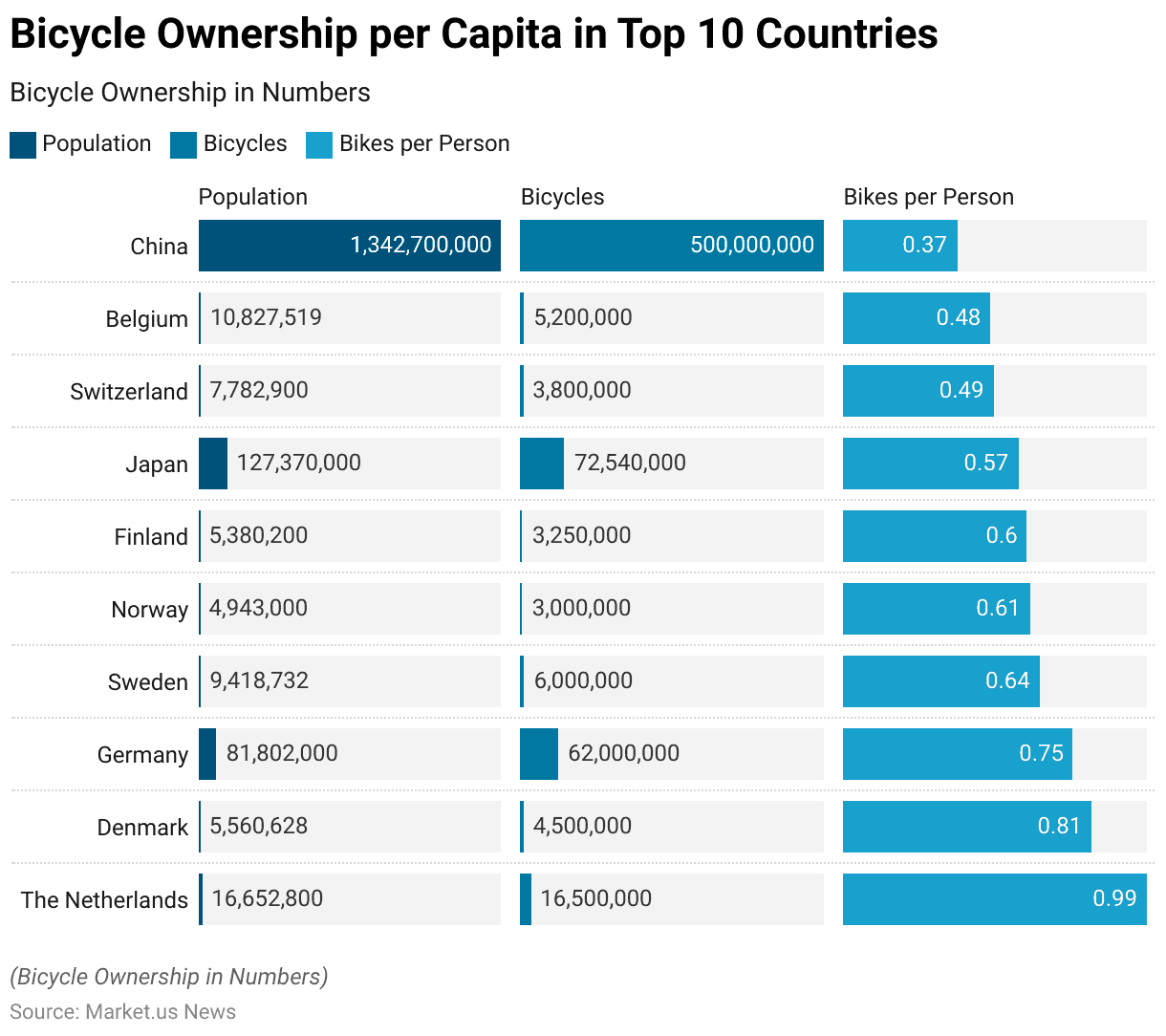

Bicycle Ownership per Capita in Countries with the Highest Number of Bicycles

- In 2019, the countries with the highest bicycle ownership per capita were led by the Netherlands, where 16,652,800 people owned 16,500,000 bicycles, resulting in a ratio of 0.99 bicycles per person.

- Denmark followed, with 4,500,000 bicycles among 5,560,628 people, giving a ratio of 0.81 bicycles per person.

- Germany had 62,000,000 bicycles for its 81,802,000 inhabitants, resulting in a 0.75 ratio.

- Sweden reported 6,000,000 bicycles for its 9,418,732 population, achieving a ratio of 0.64 bicycles per person.

- Norway’s 4,943,000 residents owned 3,000,000 bicycles, equating to a 0.61 ratio.

- Finland had a ratio of 0.60, with 3,250,000 bicycles for its 5,380,200 people.

- Japan had 72,540,000 bicycles for its 127,370,000 population, resulting in a ratio of 0.57.

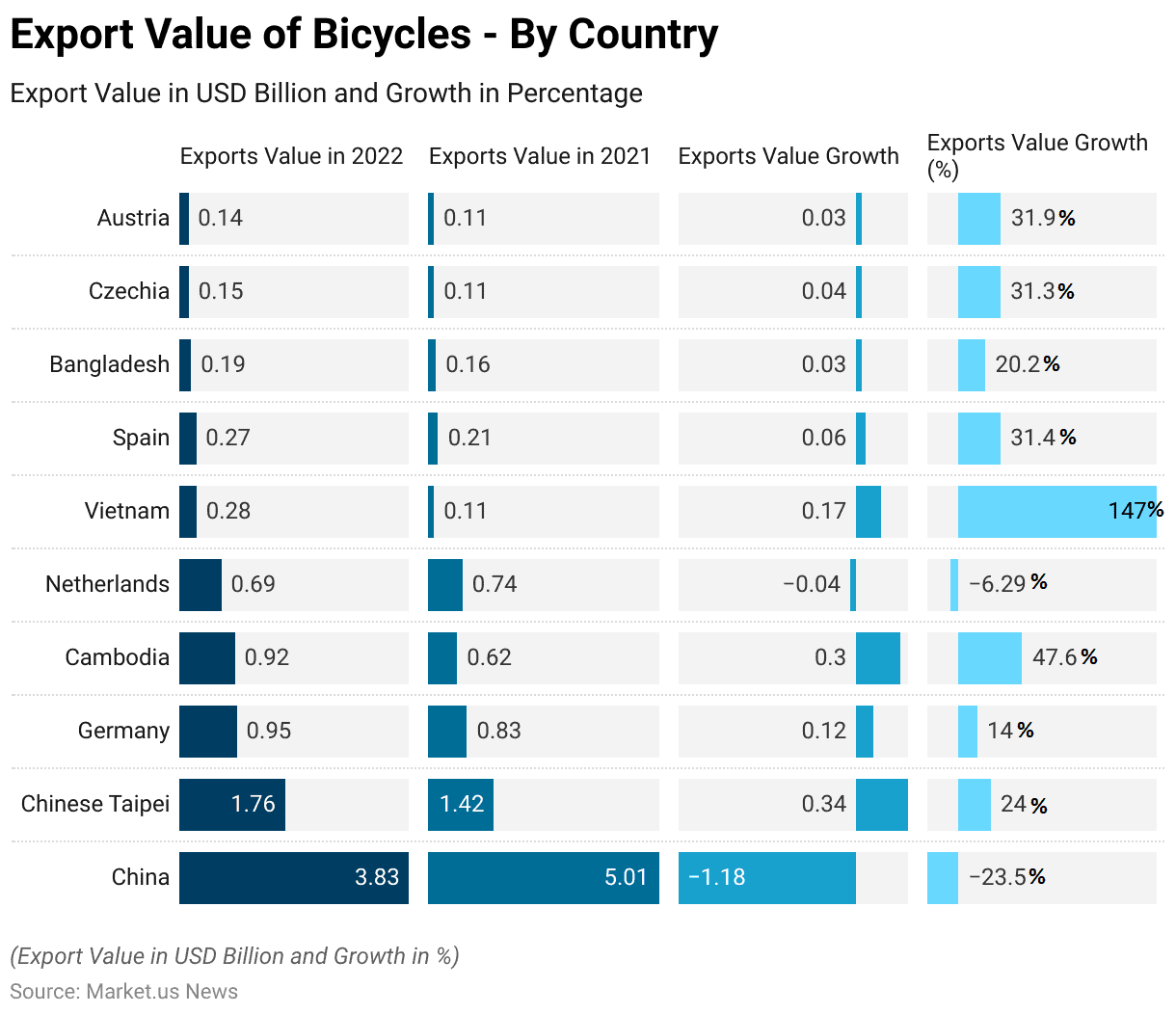

Bicycles Exports by Country

- In 2022, China led the export market with a value of USD 3.83 billion, although it experienced a decline from USD 5.01 billion in 2021, marking a negative growth of USD 1.18 billion or –23.50%.

- Chinese Taipei followed with an export value of USD 1.76 billion, up from USD 1.42 billion in 2021, showing a growth of USD 0.34 billion or 24%.

- Germany’s exports were valued at USD 0.95 billion, an increase from USD 0.834 billion in 2021, reflecting a growth of USD 0.116 billion or 14%.

- Cambodia reported exports worth USD 0.915 billion, up from USD 0.62 billion, achieving a growth of USD 0.295 billion or 47.60%.

- The Netherlands had exports valued at USD 0.69 billion, slightly down from USD 0.736 billion in 2021, resulting in a decrease of USD 0.04 billion or -6.29%.

- Vietnam’s exports grew significantly to USD 0.276 billion from USD 0.112 billion, showing a remarkable growth of USD 0.165 billion or 147%.

- Spain recorded exports of USD 0.271 billion, an increase from USD 0.207 billion, with a growth of USD 0.0648 billion or 31.40%.

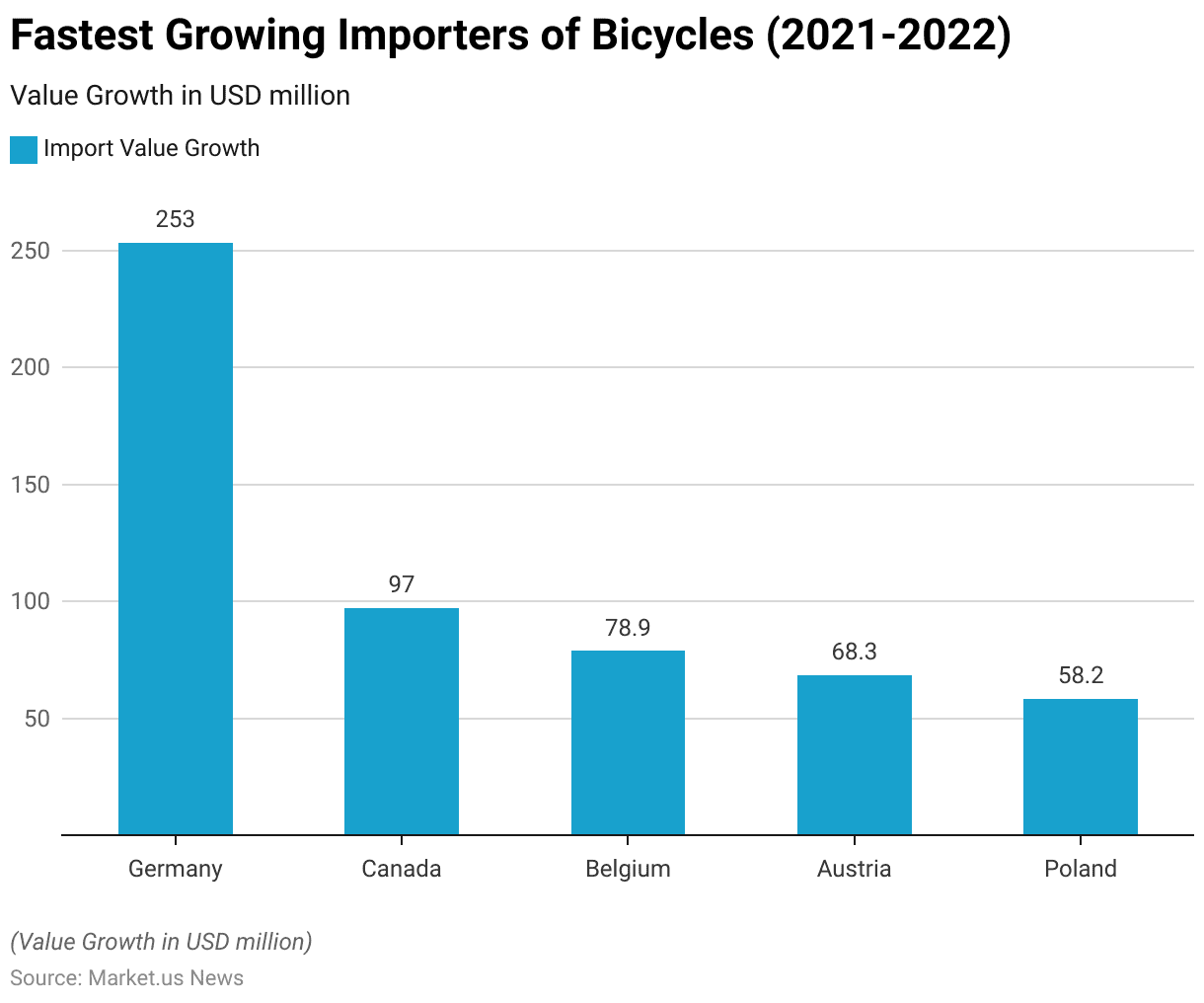

Bicycles Imports by Country

- Between 2021 and 2022, Germany led the fastest-growing importers of bicycles, which saw an increase of USD 253 million.

- Canada followed with a growth of USD 97 million in bicycle imports.

- Belgium experienced a rise of USD 78.9 million, while Austria saw an increase of USD 68.3 million.

- Poland also reported significant growth, with bicycle imports increasing by USD 58.2 million.

Bicyclist’ Demographic Characteristics

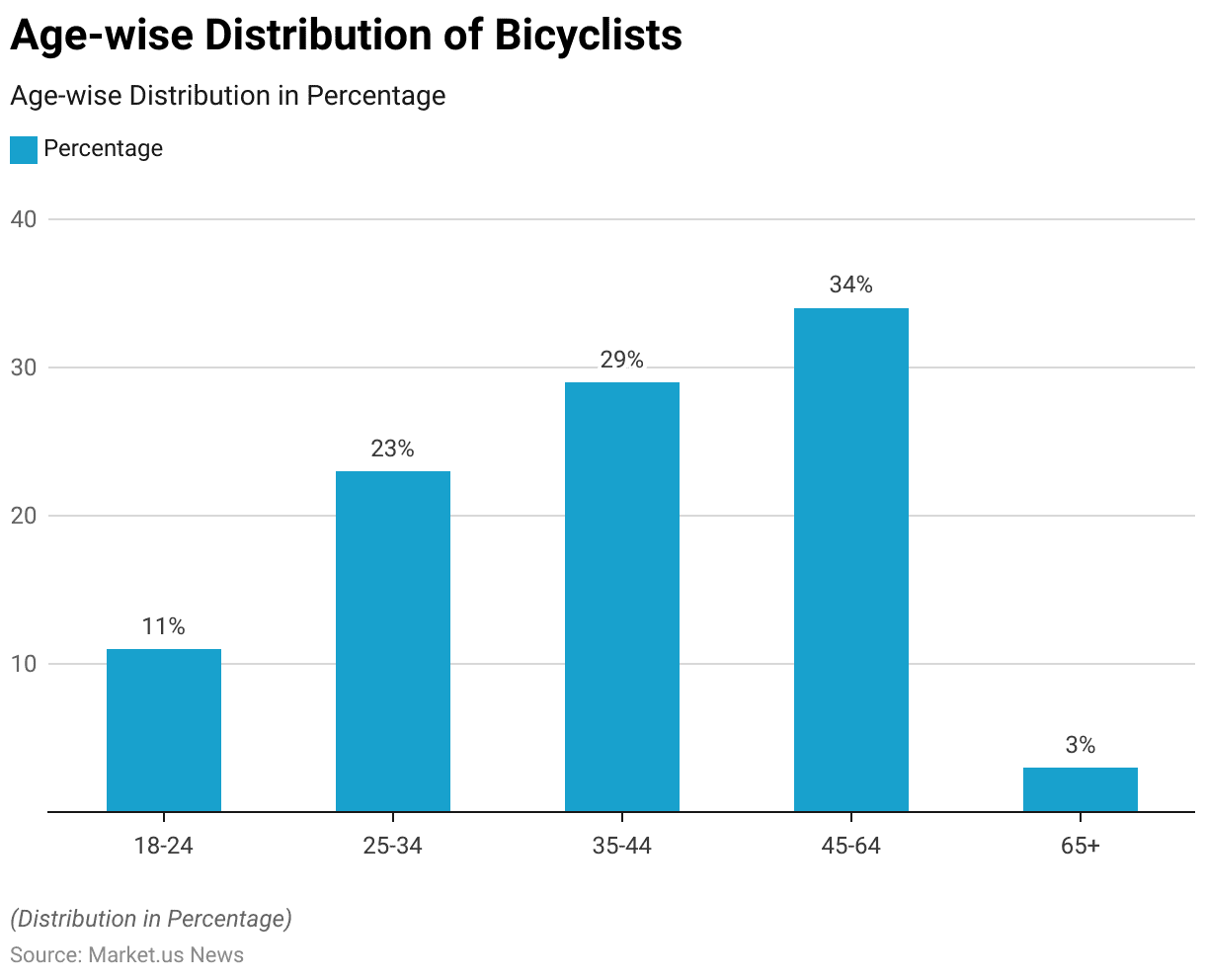

Age

- The demographic characteristics of bicyclists, categorized by age, reveal a diverse age distribution.

- The age group of 45-64 years represents the largest segment, comprising 34% of bicyclists.

- This is followed by the 35-44 age group, which accounts for 29%.

- The 25-34 age group makes up 23% of the bicyclist population, while the 18-24 age group constitutes 11%.

- The smallest segment is the 65+ age group, representing just 3% of bicyclists.

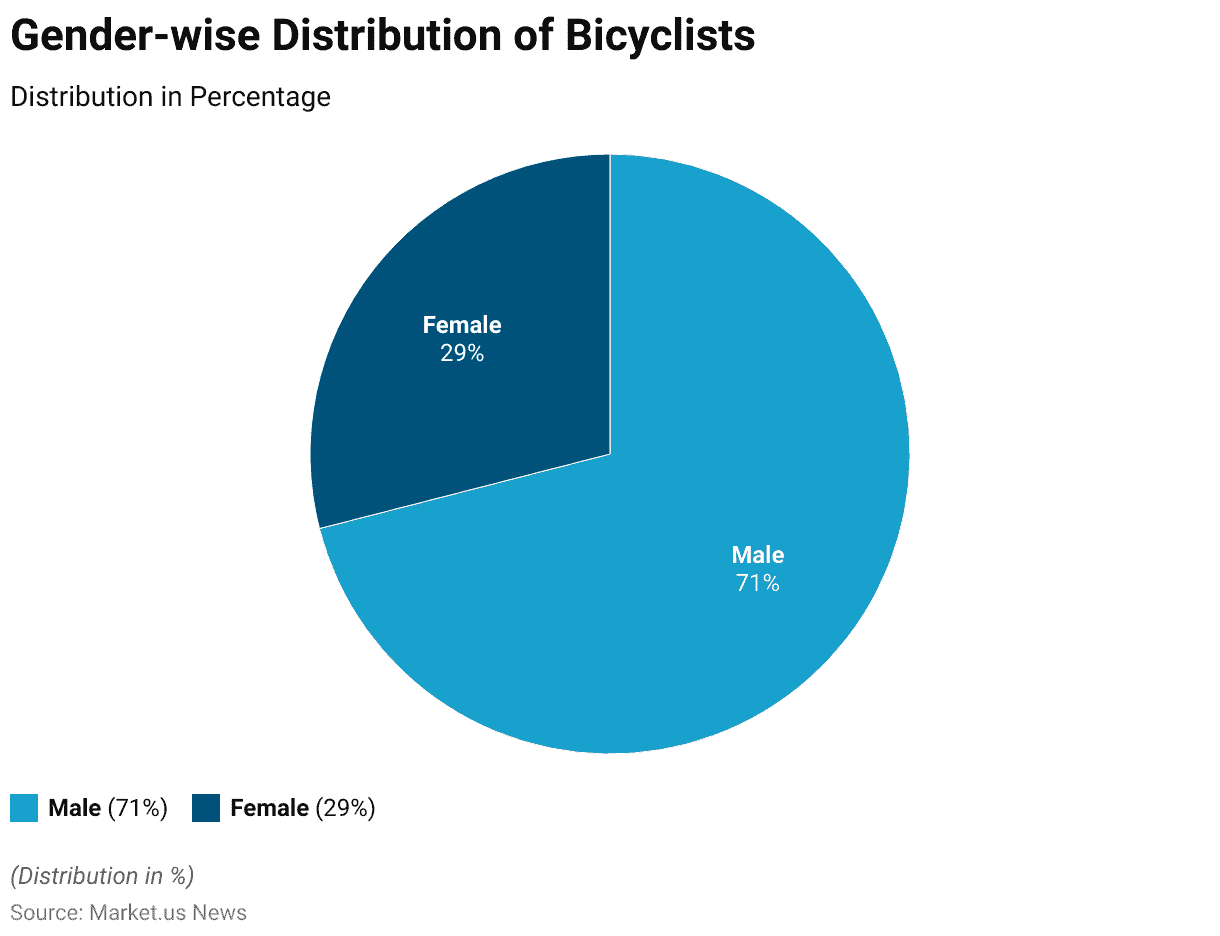

Gender

- The demographic characteristics of bicyclists by gender indicate a significant disparity.

- Males constitute the majority of bicyclists, accounting for 71% of the population.

- In contrast, females represent 29% of bicyclists.

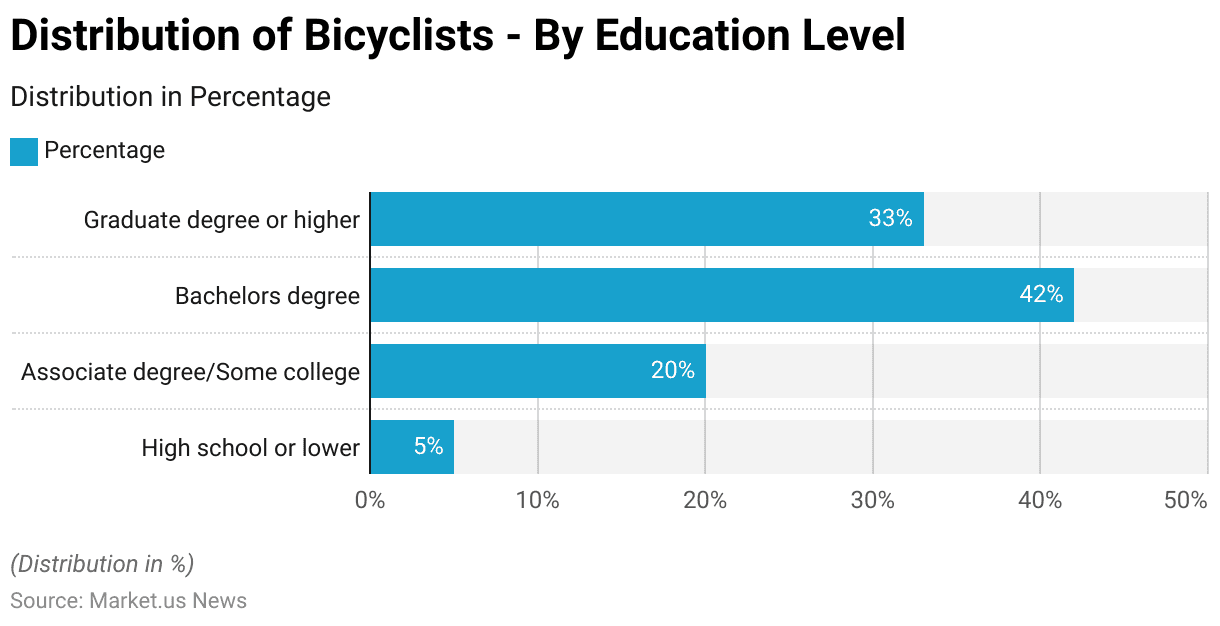

Education

- The demographic characteristics of bicyclists by education level show a diverse range of educational backgrounds.

- Individuals with a bachelor’s degree make up the largest segment, accounting for 42% of bicyclists.

- Those with a graduate degree or higher represent 33% of the population.

- Bicyclists with an associate degree or some college education constitute 20%, while those with a high school education or lower comprise 5%.

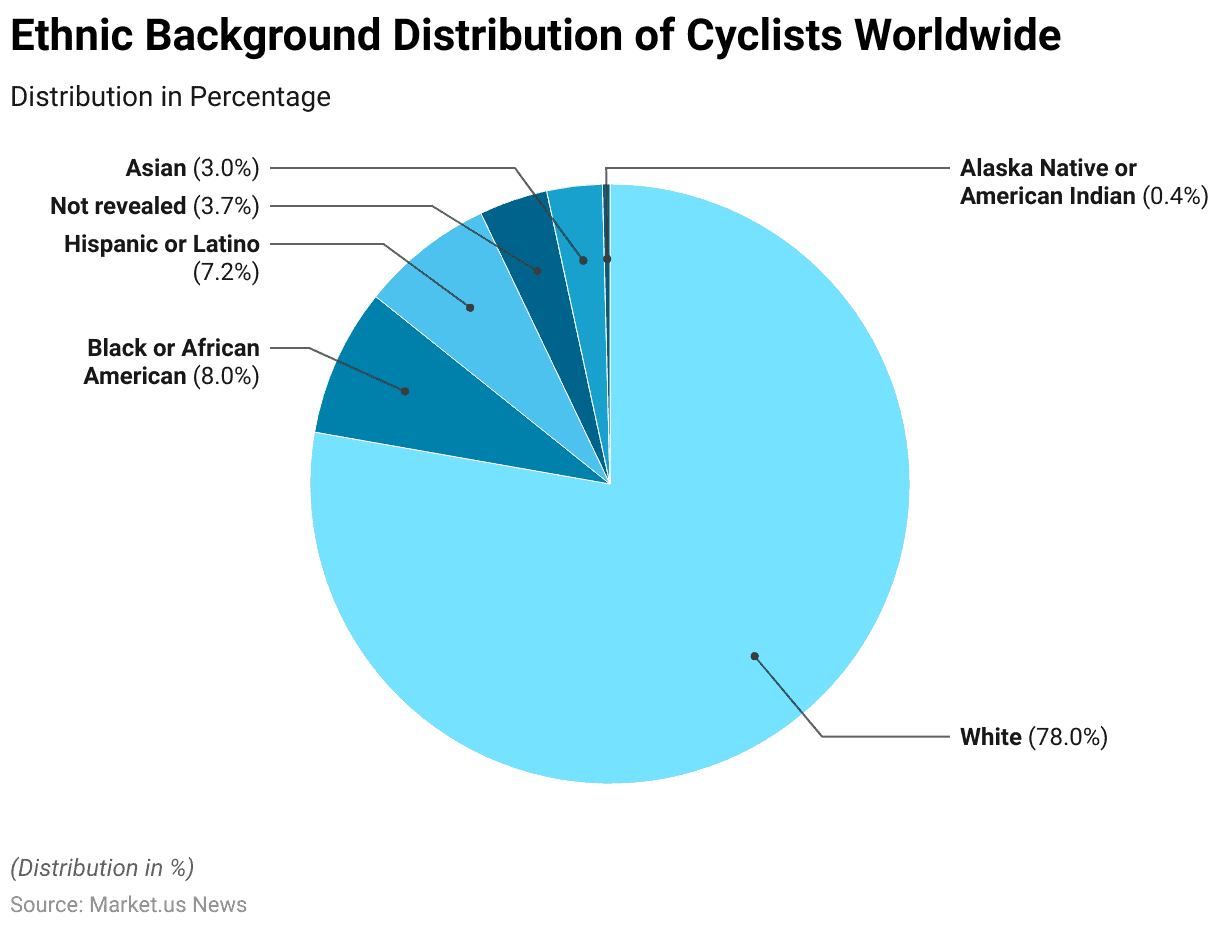

Race/ Ethnicity

- The bicycle industry statistics indicate that people from various ethnic backgrounds ride bicycles regularly. Globally, 78% of cyclists are white.

- Black or African American individuals make up 8% of cyclists, while 7.2% are from Hispanic or Latino backgrounds.

- Asian cyclists constitute 3% of the cycling population.

- Only 0.4% of cyclists are Alaska Native or American Indian.

- Additionally, 3.7% of people who ride bicycles regularly have not disclosed their ethnic background.

General Bicycle Use Characteristics

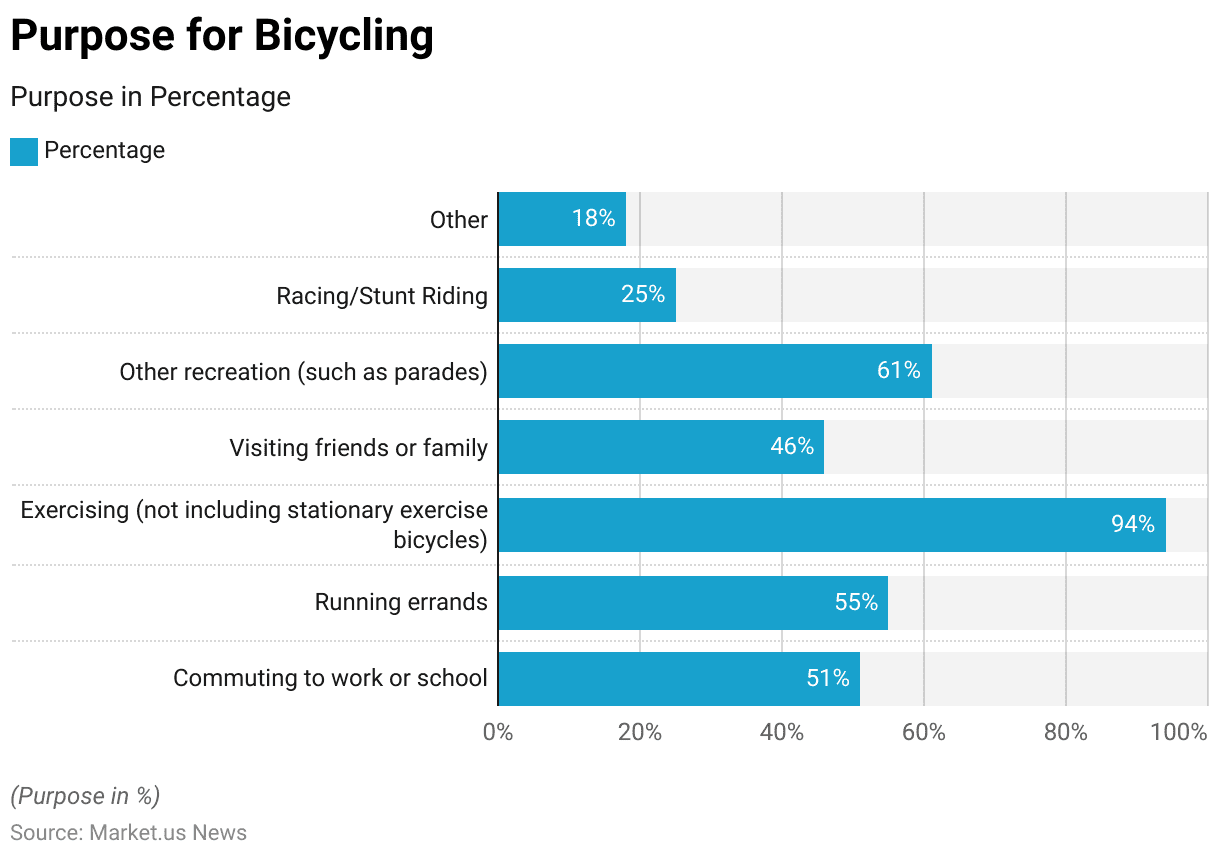

Purpose for Bicycling

- The purposes for bicycling among respondents vary widely.

- Exercising is the most common reason, with 94% of respondents cycling for this purpose (excluding stationary exercise bicycles).

- Running errands is another frequent activity, with 55% of respondents using bicycles for this purpose.

- Commuting to work or school accounts for 51% of bicycle use.

- Other recreational activities, such as participating in parades, engage 61% of cyclists.

- Visiting friends or family is a reason for 46% of respondents, while 25% use bicycles for racing or stunt riding.

- Additionally, 18% of respondents indicated other unspecified reasons for bicycling.

Bicycling and Not Bicycling Reasons

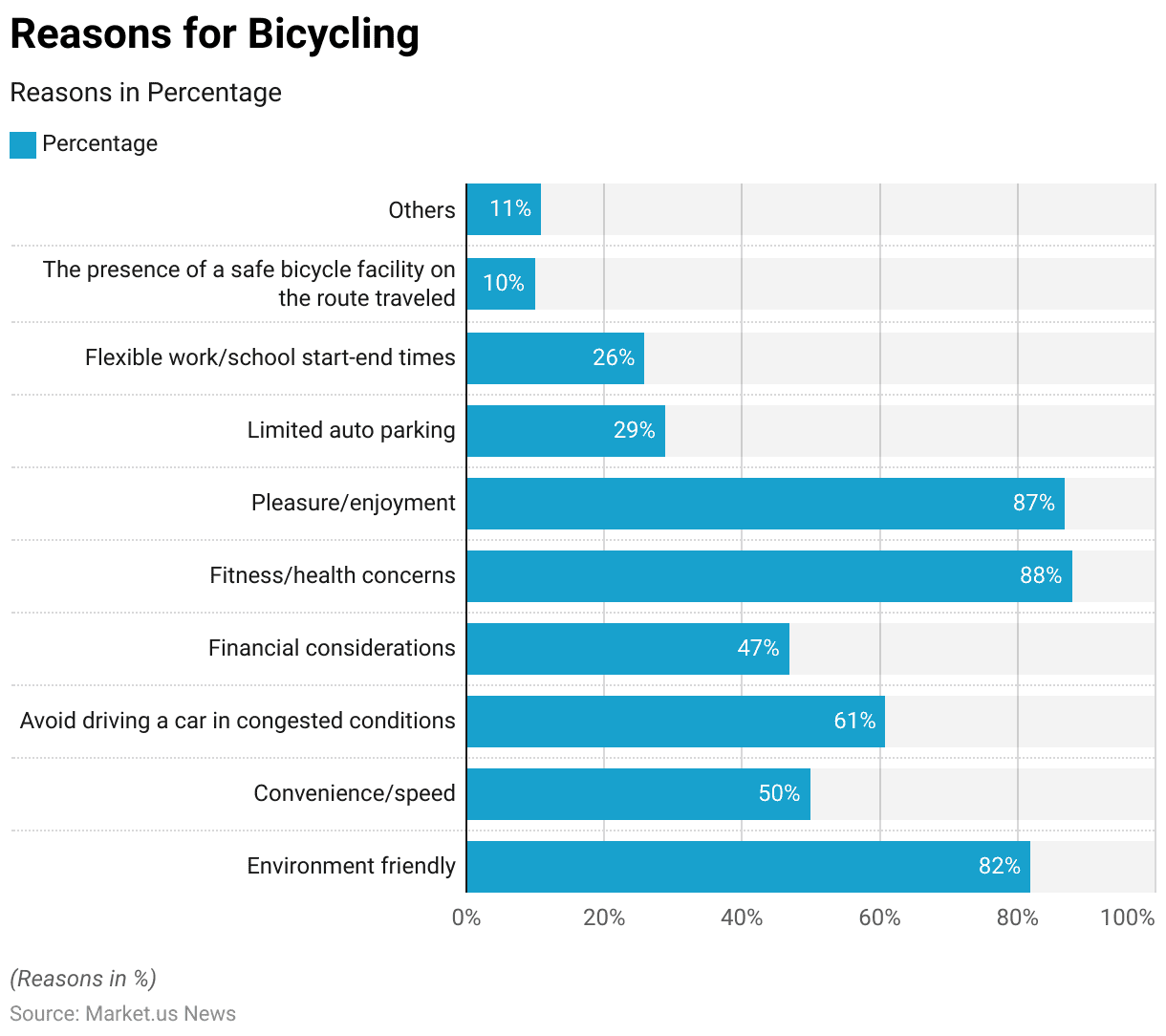

Reasons for Bicycling

- Respondents cited various reasons for bicycling, with fitness and health concerns being the most prevalent at 88%.

- Pleasure and enjoyment closely followed, with 87% of respondents cycling for these reasons.

- Environmental friendliness was also a significant motivator, cited by 82%.

- Avoiding driving in congested conditions was a reason for 61% of respondents, while 50% chose bicycling for its convenience and speed.

- Financial considerations motivated 47% of respondents, and 29% cycled due to limited auto parking.

- Flexible work or school start-end times influenced 26% of respondents, and 10% bicycled because of the presence of a safe bicycle facility on their route.

- Additionally, 11% of respondents indicated other reasons for bicycling.

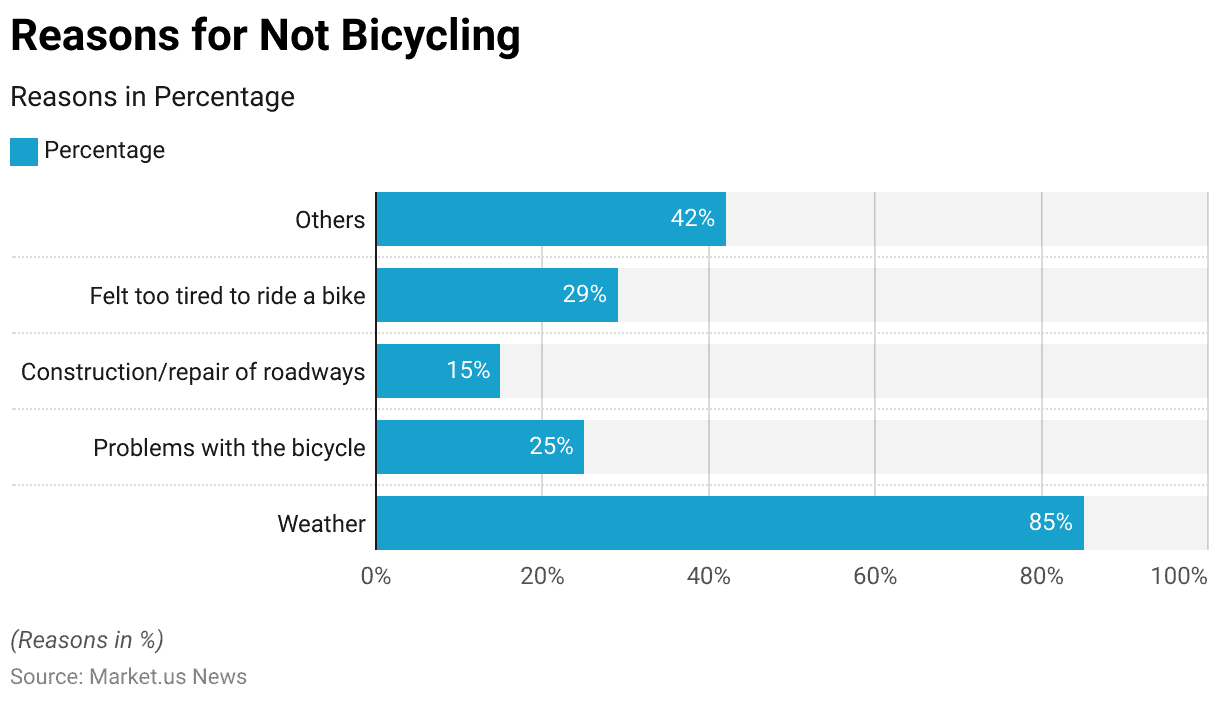

Reasons for Not Bicycling

- Respondents provided several reasons for not bicycling, with weather being the most common deterrent, cited by 85% of respondents.

- Feeling too tired to ride a bike was a reason for 29%, while 25% mentioned problems with their bicycles.

- Construction or repair of roadways was a factor for 15% of respondents.

- Additionally, 42% of respondents cited other unspecified reasons for not bicycling.

Public Bicycle Statistics

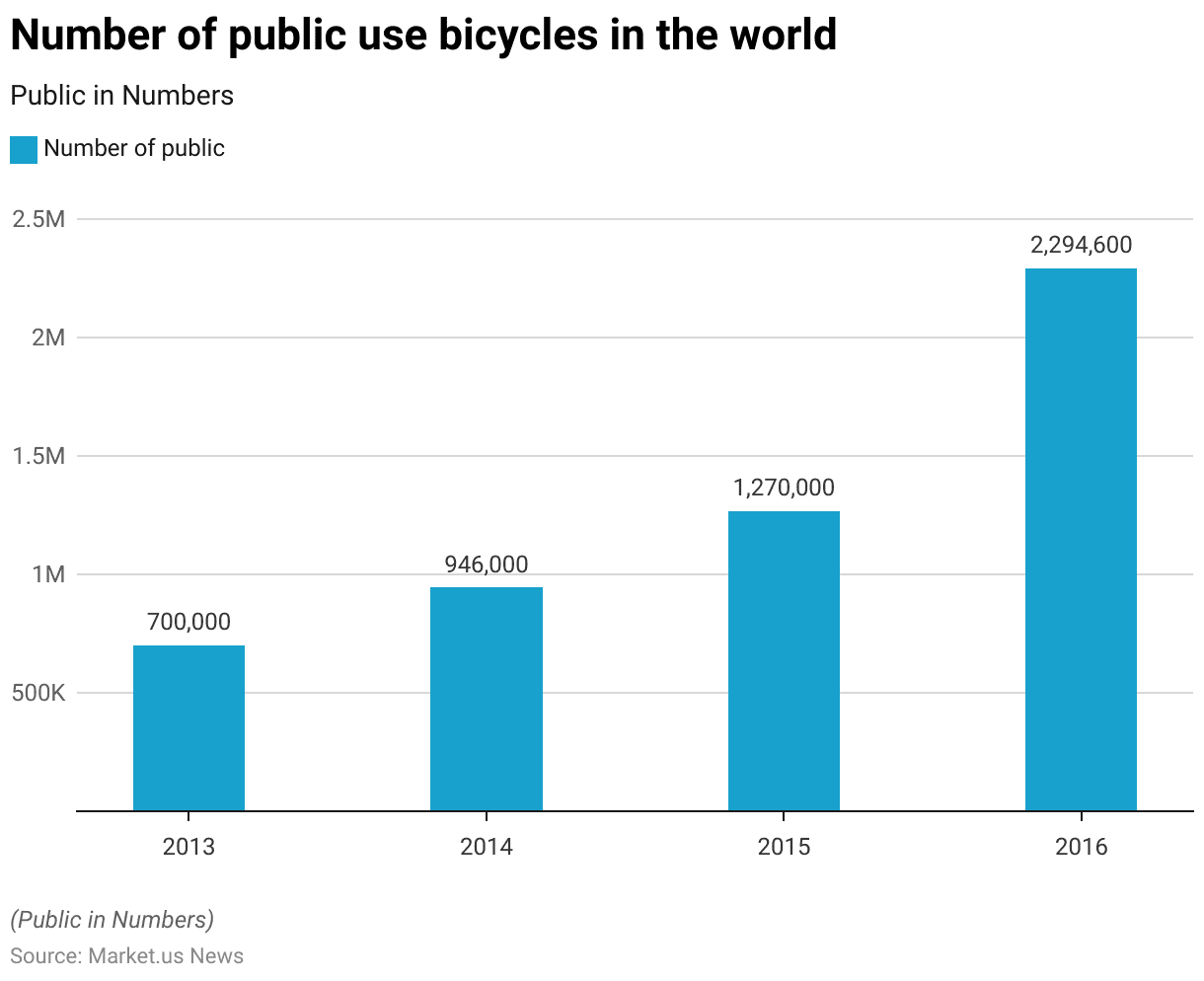

Number of Public Use Bicycles Worldwide

- The number of bicycles used by the public worldwide has shown significant growth over the years.

- In 2013, there were 700,000 people globally who used bicycles.

- By 2016, the global count had surged to 2,294,600.

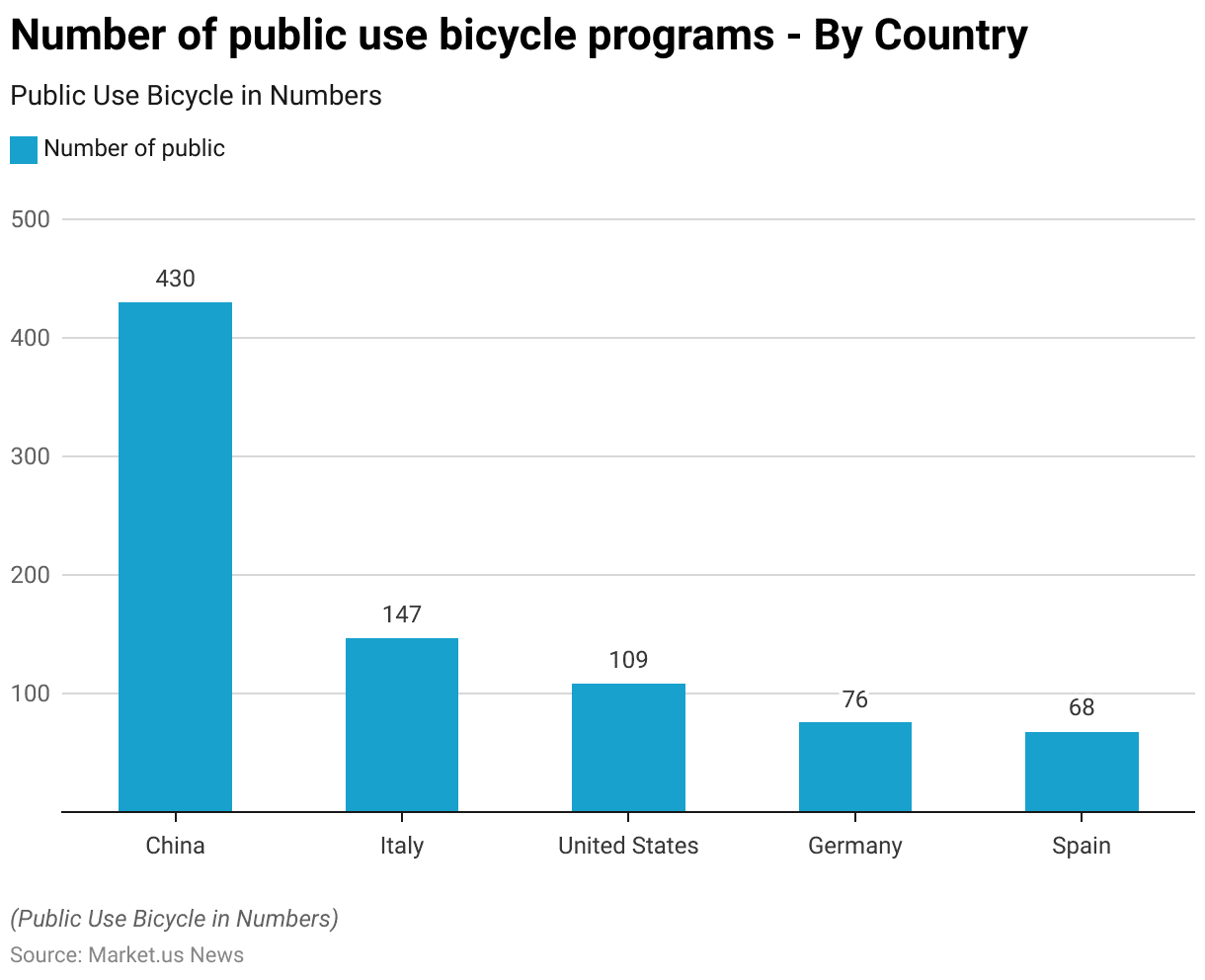

Number of Public Use Bicycle Programs – By Country

- The number of public bicycle programs that are used varies significantly across different countries.

- China leads with 430 programs, demonstrating a strong commitment to bicycle-sharing initiatives.

- Italy follows with 147 programs, indicating widespread adoption of public bicycles.

- The United States has 109 programs, reflecting its growing interest in alternative transportation methods.

- Germany and Spain have 76 and 68 public-use bicycle programs, respectively, showcasing their efforts to promote sustainable urban mobility.

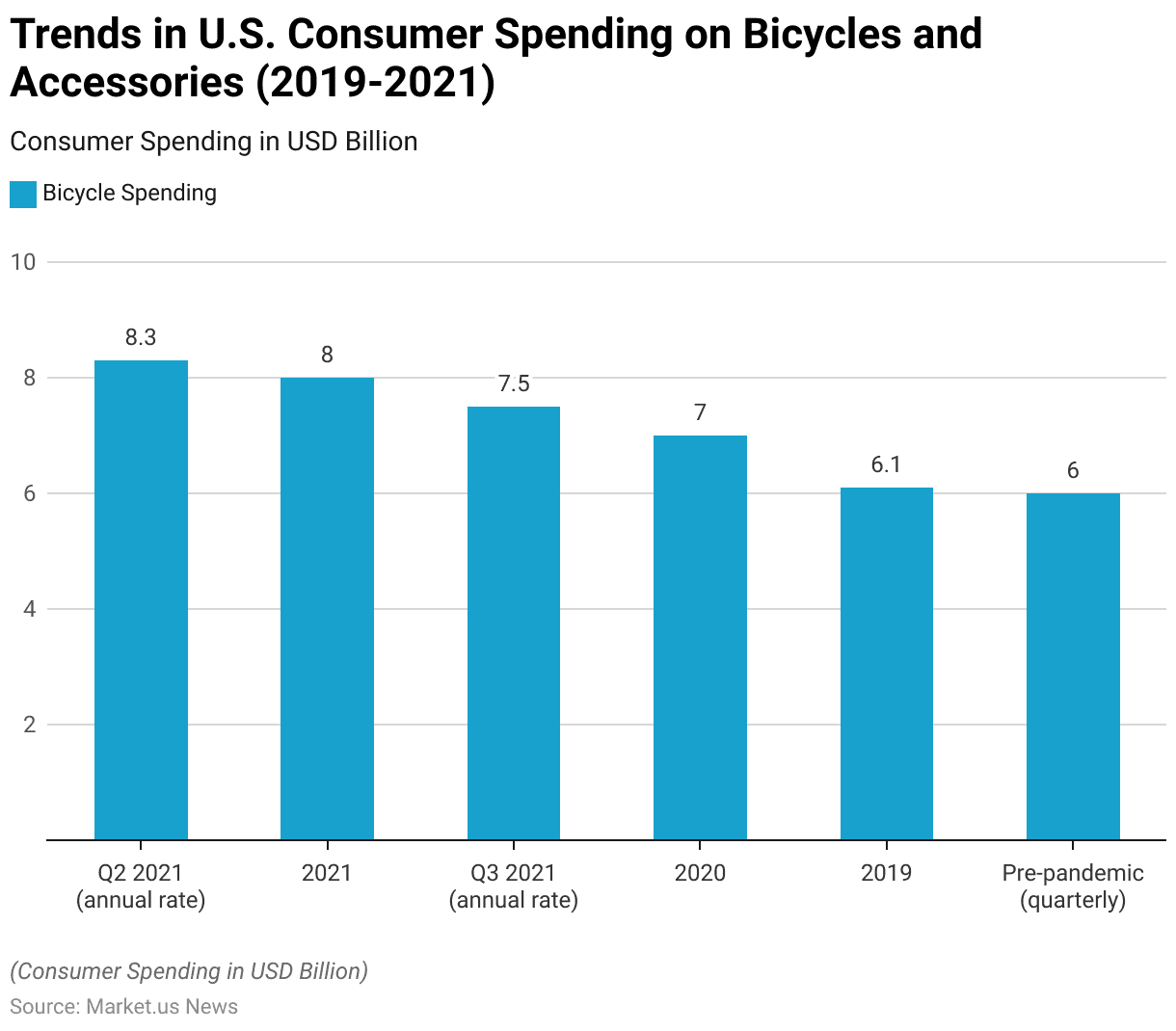

Effects on Bicycling During and After the COVID-19 Pandemic

- According to inflation-adjusted figures published by the U.S. Bureau of Economic Analysis, Americans spent $7.0 billion on bicycles and accessories in 2020, an increase from $6.1 billion the previous year.

- Despite this decline, spending remained at an annual rate of $7.5 billion, still above pre-pandemic levels, fueling hopes that the industry could maintain a higher gear compared to pre-COVID days.

Bicycle Market Trends

An Increasing Count of Cycling Events

- The increasing popularity of bicycles for recreation and trekking, along with more cycling events, is expected to boost demand for both general and sports bikes. Celebrity endorsements and media coverage are also driving market growth.

- A 2022 survey by the Allgemeiner Deutscher Fahrrad-Club (ADFC) in Germany found that 96% of respondents owned bicycles.

Investment in Cycling Events

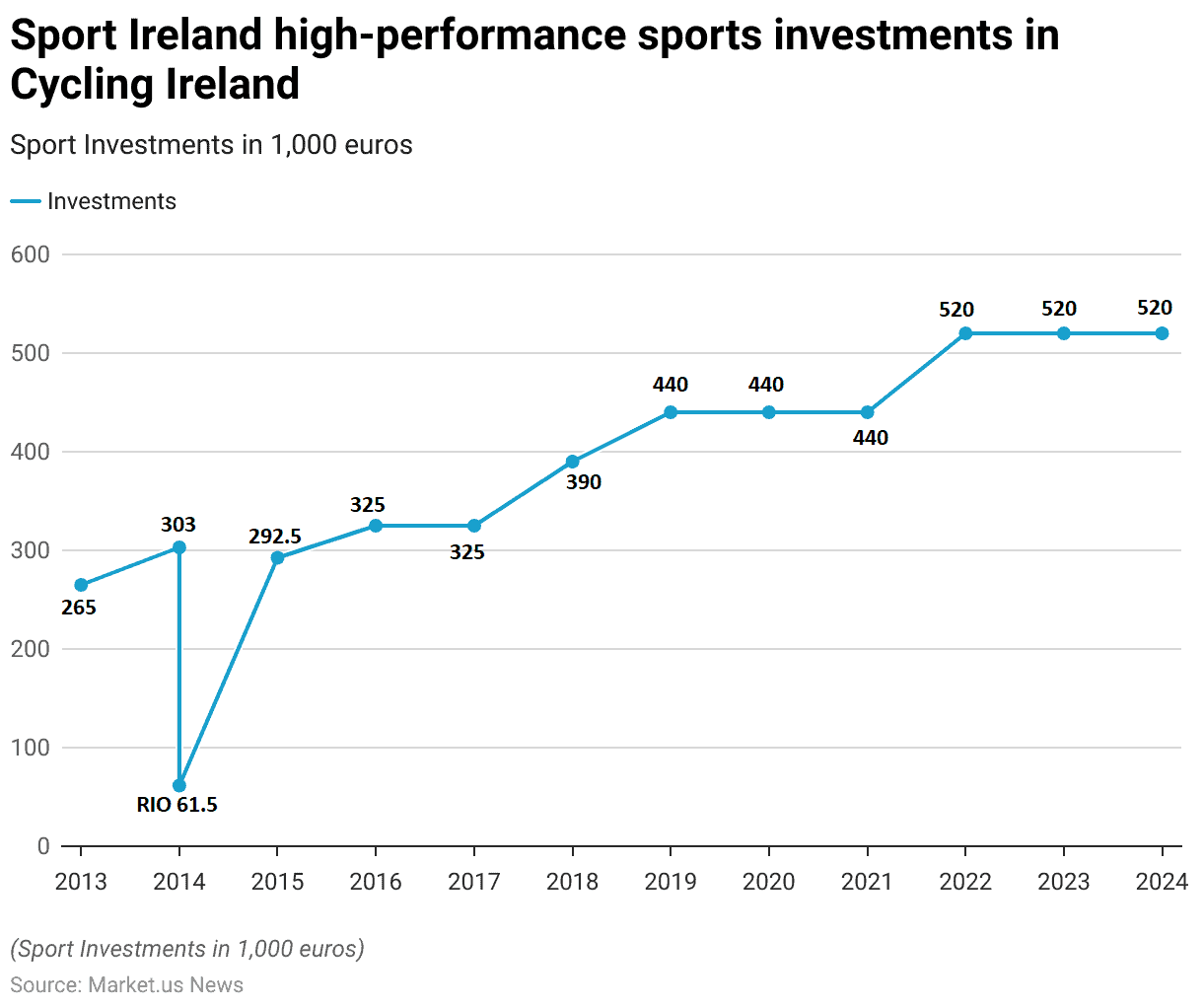

- Sport Ireland’s high-performance sports investments in Cycling Ireland have shown a steady increase over the years.

- In 2013, the investment was 265,000 euros, rising to 303,000 euros in 2014.

- In 2022, the investment increased to 520,000 euros, which has been sustained at this amount through 2023 and is projected to continue at the same level in 2024.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)