Table of Contents

Introduction

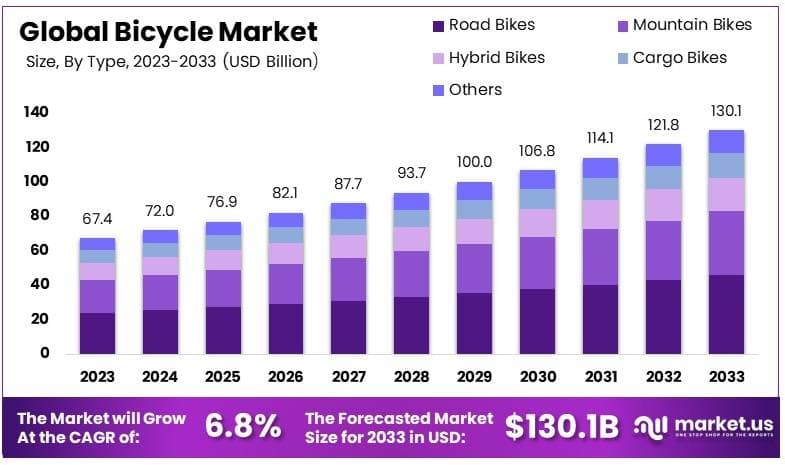

The Global Bicycle Market size is expected to be worth around USD 130.1 Billion by 2033, from USD 67.4 Billion in 2023, growing at a CAGR of 6.8% during the forecast period from 2024 to 2033.

The bicycle market encompasses the design, manufacturing, distribution, and retail of bicycles and related components. This market includes a variety of bicycle types, such as road bikes, mountain bikes, e-bikes, hybrid bikes, and specialty bicycles, catering to a wide range of consumer needs and preferences. It also covers both traditional bicycles and modern variants like electric bikes (e-bikes) that integrate advanced technology. Players in this market range from established global brands to emerging niche manufacturers, all competing to provide innovative, high-performance, and sustainable mobility solutions.

Several key factors are driving growth in the bicycle market. Firstly, increasing urbanization and the push for sustainable transportation have positioned bicycles as a viable and eco-friendly alternative to cars, particularly in congested cities. Secondly, the growing trend of health and fitness awareness has led to a surge in demand for bicycles, as more individuals seek active lifestyles.

Furthermore, the expansion of infrastructure, such as dedicated cycling lanes and bike-sharing programs in metropolitan areas, is encouraging bicycle adoption. Technological advancements, especially in e-bikes and smart bicycles equipped with tracking and safety features, are also expanding the market by appealing to tech-savvy consumers and commuters.

The demand for bicycles is becoming increasingly diverse as consumers seek specific solutions to meet their needs. In urban areas, there is strong demand for e-bikes as commuters look for efficient, low-cost, and sustainable ways to travel short to medium distances. Mountain and road bikes also see high demand, driven by recreational enthusiasts and competitive cyclists.

Globally, there is also a noticeable rise in demand from developing regions where bicycles serve as a primary mode of transportation due to economic accessibility.

The bicycle market presents numerous opportunities, particularly in the areas of e-mobility and sustainable transportation. E-bikes, for example, represent a rapidly growing segment, with potential for further innovation in battery technology, lightweight materials, and enhanced connectivity features. There are also opportunities for market expansion in developing countries, where increasing income levels and investments in cycling infrastructure can drive bicycle adoption.

Furthermore, the integration of digital services, such as ride-tracking apps and connected smart bikes, offers additional revenue streams for companies through subscription models and aftermarket services. Sustainability-focused brands that prioritize eco-friendly manufacturing processes and recycled materials are also positioned to capture a growing consumer segment concerned with environmental impact.

Key Takeaways

- The Bicycle Market was valued at USD 67.4 billion in 2023 and is projected to reach USD 130.1 billion by 2033, with a CAGR of 6.8%.

- Road Bikes held 39.1% of the type segment in 2023, due to increasing demand for fast and efficient cycling options.

- Conventional bikes dominated the technology segment in 2023, accounting for 74.8% of sales, driven by their affordability and low maintenance.

- Men led the end-user segment with a 46.7% share in 2023, reflecting their higher cycling participation rates.

- APAC was the leading region in 2023, capturing 35.7% market share and USD 24.06 billion, supported by the growth of cycling culture and infrastructure.

Bicycle Statistics

- 17-20 million bicycles were sold in 2022.

- 364,000 bicycles are produced globally per day.

- There are about 7,000 bicycle shops in the U.S.

- 52 million Americans ride bicycles.

- Americans spent $8.2 billion on bicycles and accessories in 2022.

- $903 million was spent on bicycle equipment in the U.S.

- 70% of cyclists in the U.S. are men; 30% are women.

- The average price of a mass-produced bike is $100 to $300.

- There are over 200 bike brands in the U.S. market.

- The U.S. has over 100 million bicycles in total.

- Global e-bike sales could reach USD 27 billion by 2025.

- There are about 1 billion bicycles in use worldwide.

- Denmark sells 500,000 bicycles annually.

- 15-20 million bicycles are sold each year in the U.S.

- U.S. cyclists aged 25-44 have an even gender split.

- The global cycling industry was valued at $81 billion in 2023.

- 857 U.S. cyclists were killed in traffic accidents in 2023, up 10%.

- Bike lanes can reduce accident risks by up to 50%.

- Chinese cyclists spend 8,001 to 15,000 yuan ($1,182-$2,217) on new bikes.

- Van Nicholas sells a £1,000 balance bike for children.

- 40% of U.K. cyclists plan to buy a new bike in the next year.

- 12% of U.K. buyers are considering an electric bike.

- 1,105 cyclists died in motor vehicle crashes in 2022.

- 89% of these deaths were caused by car drivers.

- There are around 500 million bicycles produced in China.

- 47,670 bicycles are sold worldwide daily.

- 51 million Americans cycle annually.

- 0.6% of U.S. employees commute by bike.

- 1.1% of urban commuters cycle in U.S. cities.

- 0.3% of rural commuters cycle in the U.S.

- 100,000 people commute by bike daily in New York.

- 58% of Dutch people use bikes for commuting.

- Up to 60% of urban trips in Chinese cities are made by bike.

- 870,000 people in the U.S. use bikes as their main commute.

- Helmet use reduces serious head injuries by 70%.

- 62% of cyclists killed in the U.S. in 2022 weren’t wearing helmets.

- 400,000 bikes are stolen annually in the U.K.

- 188,500 bikes are stolen each year in the U.S.

Emerging Trends

- E-Bike Popularity : The demand for electric bikes is rapidly growing, especially in urban areas, as consumers seek eco-friendly and efficient commuting options.

- Rise of Bike-Sharing Services : Bike-sharing platforms are expanding globally, providing convenient and sustainable transportation alternatives in cities and reducing traffic congestion.

- Increased Focus on Smart Bikes : Integration of technology such as GPS, fitness tracking, and app connectivity is driving the popularity of smart bikes, appealing to tech-savvy and health-conscious consumers.

- Growth in Custom and Premium Bicycles : There is rising interest in high-end, customized bicycles as cycling enthusiasts seek unique and personalized products, driving demand for premium brands.

- Cycling Infrastructure Development : Governments are investing in cycling lanes and bike-friendly infrastructure, boosting the market as safer and more accessible routes encourage more people to cycle.

Top Use Cases

- Commuting in Urban Areas: Bicycles are widely used for commuting in cities due to their affordability and convenience, especially as urban populations grow.

- Recreational and Fitness Activities : Many consumers use bicycles for recreation and fitness, as cycling provides a convenient way to exercise and enjoy outdoor activities.

- E-Bike Use for Last-Mile Delivery : E-bikes are increasingly used by delivery services to navigate dense city areas, offering a cost-effective and quick solution for last-mile logistics.

- Tourism and Eco-Tours: Bicycles are a popular choice for tourists looking for eco-friendly ways to explore new destinations, supporting growth in the bicycle tourism segment.

- Racing and Competitive Cycling : Professional and amateur racing events drive demand for specialized road and mountain bikes, contributing to the development of high-performance bike models.

Major Challenges

- High Costs of E-Bikes: The high upfront cost of electric bikes can limit adoption among price-sensitive consumers, particularly in developing markets.

- Lack of Proper Infrastructure : Inadequate cycling lanes and bike-friendly routes in many cities discourage cycling, making it difficult for the market to grow further.

- Competition from Alternative Transport : Public transport and ride-sharing services often provide more convenience, presenting a challenge for bicycles as a preferred commuting option.

- Issues with Bike Theft : Rising rates of bicycle theft, especially in urban areas, deter potential buyers and impact the overall sales and security concerns for users.

- Regulatory Barriers for E-Bikes : Strict regulations around the use of e-bikes in certain regions can create challenges for manufacturers and users, impacting market growth and accessibility.

Top Opportunities

- Expansion in Developing Markets : Growing economies in Asia and Africa present opportunities as rising income levels and urbanization drive demand for affordable transport options like bicycles.

- Growing Health and Wellness Trend: Increasing consumer focus on fitness and sustainable living is boosting the market for bicycles as people choose them for recreational and health-related activities.

- Government Incentives for Green Transport: Many governments offer subsidies and incentives for electric bikes and cycling infrastructure, encouraging wider adoption and market growth.

- Advancements in E-Bike Technology: Innovations in battery life, lightweight materials, and smart features create opportunities for manufacturers to capture tech-savvy consumers seeking efficient bikes.

- Expansion of Bike Leasing and Subscription Models: Subscription-based bike services and leasing options are emerging, providing consumers with affordable access to premium and electric bikes without high upfront costs.

Key Player Analysis

- Giant Bicycles: As one of the world’s largest bicycle manufacturers, Giant reported revenues of over $2 billion in 2022. The brand dominates with its wide range of affordable and premium bikes.

- Trek Bicycle Corporation: Trek is a key player, especially in the North American market, with a strong focus on high-performance and mountain bikes. In 2022, Trek generated approximately $1.6 billion in sales.

- Specialized Bicycle Components: Specialized focuses on premium bikes and innovative technologies, with revenues surpassing $500 million in 2022. It has a strong presence in competitive cycling segments.

- Merida Industry Co., Ltd: Merida, based in Taiwan, is a leading manufacturer with global reach. It recorded revenues of around $1.3 billion in 2022, catering to both road and mountain bike enthusiasts.

- Accell Group: Accell, known for brands like Raleigh and Haibike, reported revenues of approximately $1.5 billion in 2022. It has a significant market share in Europe, focusing on e-bikes and city bikes.

Recent Developments

- In September 2024, Trek Bicycle sold its BCycle bike-sharing division to Bicycle Transit Systems, a company known for its operations in major U.S. cities, including Los Angeles and Philadelphia. This strategic move enables Trek to concentrate more intensively on its primary strengths—bicycle manufacturing and product innovation. By divesting the bike-sharing business, Trek can streamline its resources, enhance its product development capabilities, and strengthen its competitive position in the global cycling market.

- In October 2024, Adaptive DCS formed a strategic partnership with Repente, an Italian manufacturer renowned for its high-quality saddles, to gain exclusive distribution rights within the UK. This collaboration enhances Adaptive DCS’s product portfolio, allowing the company to offer premium cycling products to the UK market. The partnership reflects Adaptive DCS’s commitment to expanding its presence and influence in the cycling industry by providing customers with access to top-tier, innovative products.

- In early 2024, Vista Outdoor agreed to divest its bike-related brands under the Revelyst business unit to Strategic Value Partners for $1.125 billion. This divestiture aligns with Vista Outdoor’s strategic goal of refocusing on its core outdoor product categories, such as shooting sports, camping, and other outdoor gear. By selling its bicycle brands, Vista can allocate resources more effectively and strengthen its position in the outdoor lifestyle and recreation markets, ensuring long-term growth and profitability.

Conclusion

The bicycle market is experiencing robust growth, driven by increasing consumer demand for sustainable transportation, fitness options, and advanced electric bikes. Emerging trends such as bike-sharing, smart bike technology, and cycling infrastructure investments further support market expansion. However, challenges like high e-bike costs, infrastructure limitations, and regulatory barriers need to be addressed. The future holds significant potential, particularly in developing regions and through government incentives promoting green transportation. With key players like Giant, Trek, and Accell Group leading the market, the industry