Table of Contents

Introduction

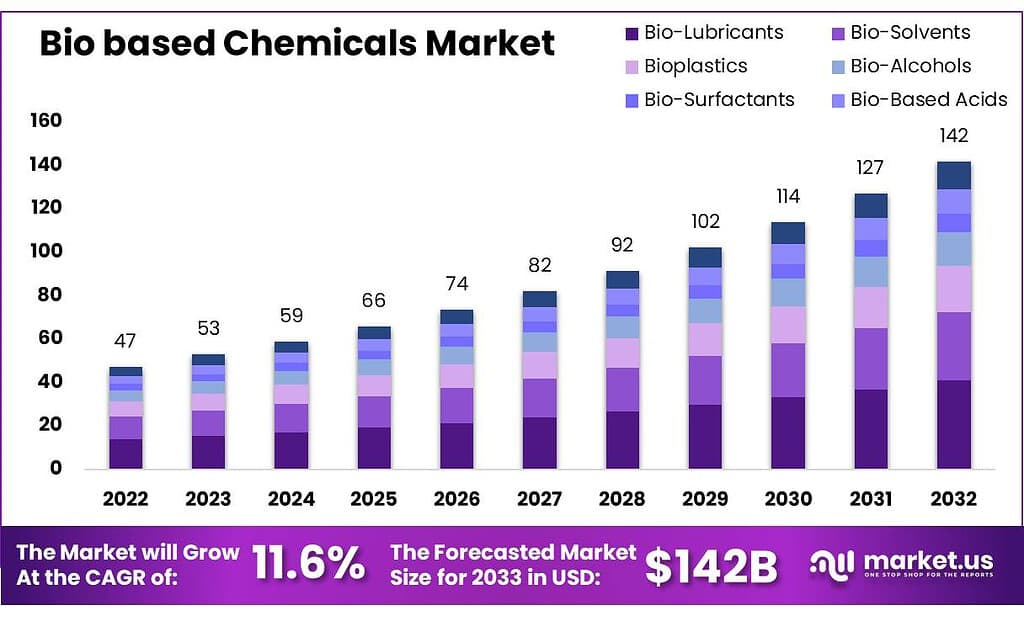

The global Bio-based Chemicals Market is experiencing rapid growth, projected to expand from USD 47 billion in 2023 to USD 142 billion by 2033, achieving a CAGR of 11.6% over the forecast period. This growth is primarily driven by increasing environmental awareness and the adoption of sustainable practices across various industries.

Europe leads this trend, benefiting from supportive government policies and substantial investment in green technologies, which are propelling the adoption of bio-based chemicals.

However, the market faces several challenges. High production costs and scalability issues pose significant hurdles, as bio-based chemicals often struggle to compete on price with petrochemical-derived counterparts. Additionally, regulatory complexities and the need for substantial R&D investments to enhance product performance and reduce costs are ongoing concerns.

Recent developments in the market include advances in technologies that enable the use of renewable feedstocks such as plant biomass, and enhanced recycling technologies that improve the lifecycle assessment of bio-based products. Companies are also forming strategic alliances to secure raw material supplies and streamline production processes, which is crucial for maintaining competitiveness and fostering market growth.

AGAE Technologies continues to focus on innovative bio-based solutions, although specific recent developments weren’t highlighted in the latest searches. Companies like AGAE are crucial in the niche segments of the bio-based chemicals market, especially in areas like bio-solvents and bio-surfactants.

Archer Daniels Midland Company has been notably active with partnerships aimed at enhancing bio-based product offerings. In September 2019, ADM teamed up with LG Chem to develop bio-based acrylic acid, which is essential for producing superabsorbent polymers used in hygiene products.

Key Takeaways

- The bio-based chemicals market is expected to grow from USD 47 billion in 2023 to USD 142 billion by 2033, at a CAGR of 11.6%.

- In 2023, corn accounted for over 29.4% of bio-based chemical feedstock, driven by its widespread availability and established supply chains.

- Bioplastics captured 29.7% of the bio-based chemicals market in 2023, with rising demand for both biodegradable and non-biodegradable materials.

- The Asia Pacific region holds a 34% market share in the bio-based chemicals market, valued at USD 16.3 billion in 2023, with China and India leading.

- The automotive sector represents 25.5% of the bio-based chemicals market in 2023, driven by sustainable alternatives for vehicle interiors and fuel additives.

Bio-Based Chemicals Statistics

- Although greenhouse gas life cycle emissions for emerging bio-based products are on average 45% lower (−52 to −37%; 95% confidence interval), we found a large variation between individual bio-based products with none of them reaching net-zero emissions.

- The predicted mean of the bio-based products’ prospective GHG footprints are found to be 45% lower compared to their fossil-based counterparts (95% confidence interval (CI): −52 to −37%).

- This tells you what part of the item is USDA certified, and how much. For example, our bamboo utensils and all our packaging is 100% USDA Biobased Certified. This means that 100% of the product (and the packaging) is made with plant-based, renewable materials.

- Products belonging in categories for which minimum biobased content requirements have not yet been established must contain at least 25% biobased content.

- This represents a considerable increase from the current shares of approximately 9% recycled and 1% bio-based and this transition will not happen automatically.

- A less far-reaching increase to 30% recyclate and bio-based plastics in 2030, will result in a saving of 37 Mtonne CO2 emissions and a decrease in the production of fossil plastics of 13 Mtonne.

- In other words, a rapid transition towards circular plastics seems possible by introducing an EU-wide mandatory requirement (at polymer level) of 30 to 55% recyclate or bio-based plastics by 2030.

- To reduce the use of fossil raw materials and greenhouse gas emissions, the Dutch Transition Agenda for Plastics plans to increase the percentage of recyclate and bio-based plastics to 41% recyclate and 15% bio-based plastics by 2030.

- Approximately 10% of plastics use in the Netherlands is circular (9% recyclate and 1% is biobased). Of all plastics waste, about 15% is recycled.

- The difference between 9 and 15% is due to the fact that demand for new plastics is about 70% higher than the amount released as waste per year.

- At EU level, the Circular Plastic Alliance has set the target of 10 Mtonne of recyclate (18%) by 2025. C

- In order to achieve this target, approximately 40-45% of all plastics waste must be collected separately for recycling.

- This is 2.5 times more than is currently the case.

- The primary petrochemicals butadiene and ethylene are responsible for 34% of the primary chemical industry’s GHG emissions.

Emerging Trends

Emerging trends in the bio-based chemicals market reflect the industry’s dynamic evolution, primarily driven by the urgent need for sustainability and technological advancements. Notably, there is an increasing shift towards the development of bio-based polymers such as polylactic acid (PLA) and polyhydroxyalkanoates (PHA), which are gaining traction in various applications, including packaging and consumer goods, due to their compostable properties and lower environmental impact.

Another significant trend is the growing focus on the circular economy, where bio-based chemicals play a pivotal role. This involves not only the recycling and upcycling of materials but also leveraging bio-based chemicals to create products with lower life-cycle carbon footprints. This trend is facilitated by advancements in biotechnology, enabling the development of bio-based chemicals from renewable feedstocks with improved performance and reduced costs.

Additionally, the market is seeing a surge in investments from both private companies and venture capital, aiming to scale up the production capacities to meet the growing demand. These investments are often directed towards enhancing the performance characteristics of bio-based chemicals to make them competitive with traditional petrochemical-derived products.

Europe and Asia Pacific are leading in adopting bio-based chemical solutions, with Europe benefiting from strong regulatory support and Asia Pacific driven by rapid industrial growth and increasing environmental consciousness among consumers and governments. These regions are expected to remain major contributors to the global market, supported by continuous research and development efforts and strategic investments.

Use Cases

- Industrial Applications: Bio-based chemicals are increasingly used in industrial settings for producing paints, coatings, adhesives, and lubricants. Their biodegradability and eco-friendly properties make them appealing in these contexts, where environmental impact is a critical consideration.

- Packaging: The shift towards sustainable packaging solutions has driven the use of bio-based chemicals in this sector. Innovations in bioplastics are particularly noteworthy, with materials like polylactic acid (PLA) and polyhydroxyalkanoates (PHA) being used for compostable and biodegradable packaging, which is becoming more prevalent due to consumer demand and regulatory pressures.

- Agriculture: Bio-based chemicals find extensive applications in agriculture, notably in bio-pesticides and bio-fertilizers. The sector benefits from the use of bio-based products that support sustainable farming practices.

- Automotive and Textile Industries: In automotive manufacturing, bio-based chemicals are used in components and interiors, aligning with industry goals for reducing environmental footprints. Similarly, the textile industry utilizes bio-based chemicals in the production of bioplastics and as part of efforts to create sustainable fabrics.

- Construction: New technologies have enabled the use of bio-based materials like engineered wood and biodegradable construction materials. Innovations such as MettleWood, which offers a sustainable alternative to traditional construction materials like steel and concrete, showcase the potential of bio-based chemicals in structural applications.

Major Challenges

- Cost Competitiveness: One of the primary hurdles for bio-based chemicals is their cost competitiveness compared to conventional petrochemicals. The higher production costs associated with sourcing and processing biological feedstocks can make bio-based chemicals less attractive economically. This is compounded by the often complex and expensive technological processes required to convert these feedstocks into chemicals.

- Scale-up Difficulties: Scaling up production to meet commercial demands remains a significant challenge. Many bio-based chemical processes have not yet achieved the scale necessary to become cost-effective or to meet the larger volumes required for widespread market penetration. Issues such as the depolymerization of lignin and the efficient conversion of feedstocks are still technical challenges that need more advanced solutions.

- Regulatory and Market Acceptance: Regulatory hurdles and market acceptance also pose significant challenges. The bio-based chemicals market is still navigating through complex regulatory landscapes that can vary significantly by region. Moreover, there’s a need for greater market acceptance as customers and industries adapt to new materials and products offered by the bio-based sector.

- Supply Chain Vulnerabilities: The industry is also vulnerable to supply chain disruptions, which can be caused by reliance on specific types of biomass that may be affected by seasonal availability, geopolitical issues, or competition with food resources. Additionally, the recent geopolitical tensions and economic instability have led to increased volatility in energy prices and supply, impacting production costs and logistics.

- Technological Maturity: While there have been significant advances in technology, the bio-based chemical industry still needs further technological development to improve process efficiencies and product yields. Innovations in biorefinery technologies and better catalysts are essential for making the production of bio-based chemicals more viable and competitive.

Growth Opportunities

- Packaging: As the largest application segment, the demand for bio-based chemicals in packaging is driven by the need for sustainable and eco-friendly materials. This sector is adopting biodegradable and compostable materials extensively, in response to stringent environmental regulations and growing consumer awareness.

- Agriculture: The agricultural sector is also a major beneficiary, with bio-based chemicals increasingly used in bio-pesticides and bio-fertilizers. The demand in this segment is expected to grow rapidly, driven by the need for more sustainable farming practices.

- Industrial Applications: There is a robust adoption of bio-based chemicals in the industrial sector, particularly for the production of additives, composites, and engineered plastics. This segment benefits significantly from the performance and sustainability advantages offered by bio-based products.

- Consumer Goods: The consumer goods sector is exploring bio-based alternatives to meet customer demand for products that are both sustainable and environmentally friendly. This includes a range of products from household items to personal care products.

- Automotive and Textiles: These industries are integrating bio-based chemicals for parts and coatings in automotive applications and eco-friendly fabrics in textiles. This trend is supported by consumer preferences and regulatory push towards greener alternatives.

Key Players Analysis

AGAE Technologies is making strides in the bio-based chemicals sector, primarily focusing on the production of rhamnolipid biosurfactants. In 2023, AGAE has enhanced its production capabilities with state-of-the-art facilities that allow for high-volume output of these sustainable products, which are used in various applications such as cosmetics, pharmaceuticals, and environmental remediation. The company is committed to providing eco-friendly alternatives to conventional surfactants, leveraging advanced fermentation technologies to optimize production and reduce costs.

Archer Daniels Midland Company (ADM) has been actively involved in the bio-based chemicals market, particularly through its efforts in producing sustainable ingredients. In 2023, ADM collaborated with LG Chem to develop bio-based acrylic acid, a crucial component for superabsorbent polymers used in hygiene products. This partnership reflects ADM’s commitment to sustainability and innovation, as it aims to expand its portfolio of renewable chemicals and meet the rising demand for eco-friendly solutions in various industries.

BASF SE has been actively enhancing its position in the bio-based chemicals sector in 2023 by expanding its production capabilities for sustainable products. The company secured long-term access to QIRA® bio-based 1,4-butanediol (BDO) through a partnership with Qore LLC, which will enable BASF to offer derivatives with significantly reduced carbon footprints starting in early 2025. Additionally, BASF launched a new bio-based product, 2-Octyl Acrylate, featuring 73% bio-based content, demonstrating their commitment to innovative, sustainable solutions across various applications.

Braskem SA has been focusing on expanding its portfolio of bio-based chemicals, with a strong emphasis on sustainability. In 2023, Braskem continued to enhance its production of green polyethylene derived from renewable sugarcane, which allows them to offer an eco-friendly alternative to traditional plastics. The company is committed to increasing the share of renewable materials in its product offerings, aligning with global trends toward sustainability. This includes ongoing investments in technology to boost production efficiency and expand its bio-based product line.

Dow Chemicals has made significant advancements in the bio-based chemicals sector in 2023 and 2024. A notable development is Dow’s collaboration with New Energy Blue to create bio-based ethylene from renewable agricultural residues, such as corn stover. This bio-based ethylene will be used in Dow’s U.S. Gulf Coast assets to produce renewable plastics for applications like packaging, transportation, and footwear. This initiative supports Dow’s goals to reduce carbon emissions and expand its portfolio of renewable solutions.

DuPont has been focusing on sustainability and bio-based solutions, particularly in the area of biomaterials. In recent years, DuPont has invested in the development of bio-based polymers and performance materials, such as Sorona®, a polymer made from renewable plant-based ingredients. These innovations cater to sectors like textiles and packaging, supporting global efforts to reduce reliance on fossil fuels and offering sustainable alternatives.

Evonik Industries has made significant progress in the bio-based chemicals sector in 2023 and 2024. The company is focusing on sustainability through its “Next Generation Solutions” (NGS), aiming for 50% of its sales from products with a strong sustainability profile by 2030. Evonik has partnered with BASF to introduce biomass-balanced ammonia, reducing its carbon footprint by over 65%. Additionally, Evonik continues to enhance its eCO product line, incorporating renewable feedstocks into production for sectors like automotive and consumer goods.

GFBiochemicals Ltd. is a leading innovator in the bio-based chemicals sector, focusing on levulinic acid, a key platform chemical used in the production of sustainable materials. The company aims to disrupt traditional petrochemical markets by offering bio-based alternatives that reduce reliance on fossil fuels. GFBiochemicals’ advanced production techniques, based on non-food biomass, position it as a critical player in the transition to sustainable chemicals. Their focus on commercializing bio-based levulinic acid supports industries ranging from packaging to agriculture.

IP Group PLC has been active in the bio-based chemicals sector by investing in companies focused on sustainable innovations. Through its portfolio, IP Group supports startups and growing firms developing bio-based chemicals, particularly in sectors like bio-herbicides and other green alternatives. This aligns with their broader goal of fostering companies that promote environmental sustainability. In 2023 and 2024, their investments have focused on scaling up these innovations to make them commercially viable across industries.

LyondellBasell is advancing its efforts in the bio-based chemicals sector through partnerships with companies like Neste. In 2023 and 2024, LyondellBasell expanded its “Circulen” product family, which includes polymers made from renewable and recycled feedstocks. These initiatives are part of their broader strategy to reduce reliance on fossil-based products and move towards a more circular economy. This collaboration aims to make renewable polymers widely available for packaging, automotive, and other industrial applications.

Mitsubishi Chemical Corporation has been actively focusing on bio-based materials, notably with the introduction of BioPTMG (Bio-Polytetramethylene Ether Glycol), which is derived from plant-based raw materials. This innovation, announced in 2023, reflects Mitsubishi’s commitment to sustainability, offering eco-friendly alternatives for use in industries such as textiles and elastomers. These bio-based chemicals are critical to the company’s broader strategy to reduce carbon footprints across its product lines.

Conclusion

The bio-based chemicals market is on a steady growth trajectory, driven by increasing demand for sustainable alternatives across industries such as packaging, automotive, and agriculture. As companies prioritize reducing carbon footprints and governments push for stricter environmental regulations, bio-based chemicals offer a viable solution. Despite challenges like high production costs and scalability issues, advancements in technology and strategic partnerships are helping to overcome these hurdles. With continuous investments in research and development, the bio-based chemicals market is set to play a crucial role in fostering a greener, more sustainable global economy.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)