Table of Contents

Introduction

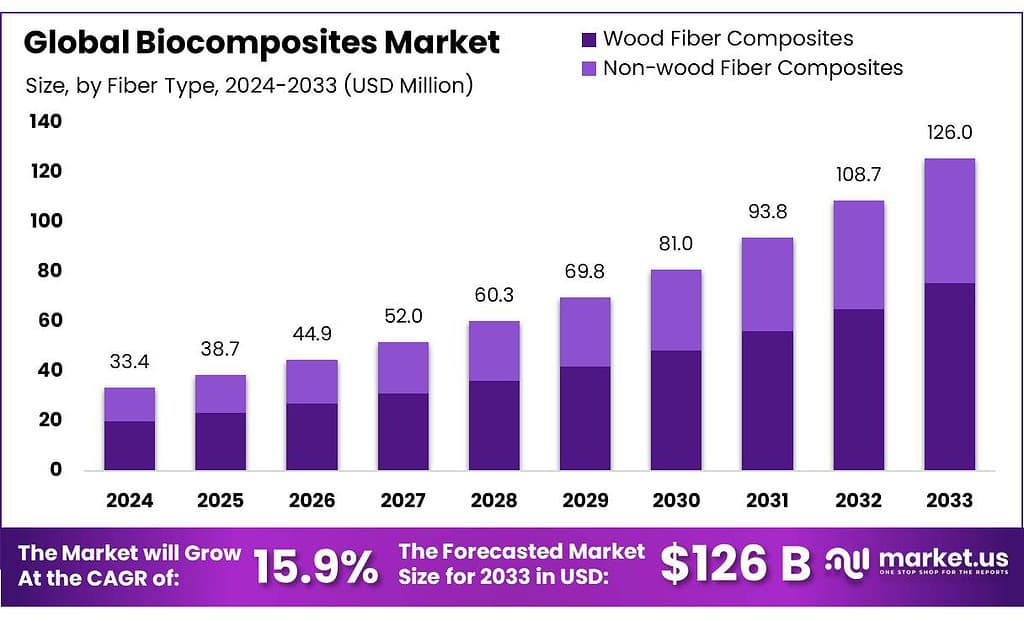

The global biocomposites market is set for rapid growth, projected to expand from USD 33.4 billion in 2023 to an impressive USD 126.0 billion by 2033, achieving a compound annual growth rate (CAGR) of 15.9% over the next decade. This substantial growth is primarily fueled by increasing environmental concerns and a shift towards sustainable materials in various industries, including automotive, construction, and consumer goods. Biocomposites, which combine natural fibers like wood, hemp, or flax with polymers, are gaining favor for their reduced environmental footprint and enhanced material properties such as biodegradability and lower weight.

However, the market faces challenges, such as variability in the properties of natural fibers and higher production costs compared to synthetic composites. Despite these hurdles, recent developments in material science have led to innovations in biocomposite formulations, improving their performance and applicability. The ongoing advancements and increased industrial acceptance are expected to drive the market’s robust growth, as more companies adopt biocomposites to meet sustainability goals and regulatory requirements.

B.COMPOSITES Pvt. Ltd. has recently made headlines with its innovative approach to biocomposites, focusing on the development and commercialization of sustainable materials for automotive and construction applications. The company has launched a new range of biocomposite panels that are lighter and more environmentally friendly than traditional materials. Their commitment to sustainability is matched by their drive to push technological boundaries, positioning them as pioneers in the biocomposites sector aiming to meet the growing demand for green building materials.

Fiberon, a leader in the manufacturing of wood-plastic composite decking, railing, and fencing solutions, has expanded its product line to include new, eco-friendly options that appeal to environmentally conscious consumers. The company’s recent developments include the introduction of a new biocomposite material that offers enhanced durability and resistance to weathering, making it ideal for outdoor applications. Fiberon’s continuous innovation in eco-friendly products helps solidify its position in the global biocomposites market.

Flexform SpA, known for its role in the furniture manufacturing industry, has embraced biocomposites in its product designs to reduce environmental impact and enhance material sustainability. The company has recently launched a new line of furniture using biocomposite fibers that provide a reduced carbon footprint without compromising on strength or aesthetic appeal. Flexform’s initiatives reflect a broader industry trend towards sustainable manufacturing practices and materials.

Statistics

- The biocomposite samples were made by injection method of low-density polyethylene with 5%, 10%, and 15% by weight of wheat bran.

- Some of the samples were tested 24 hours after their production, while the rest were only after the natural aging process.

- The described differences were most pronounced in the case of the smallest fraction of bran with grain size < 0.4 mm, where ΔE = 6 with 5% content and, respectively, ΔE = 8.9 and ΔE = 9.1 with 10% and 15% of bran content.

- It is shown above that when filling with bran up to 15% by mass, the color darkened with an increase in the bran content, which may be associated with a gradual loss of transparency.

- On the other hand, with a much higher mass fraction of bran up to 50%, with the complete lack of transparency, increasing the mass fraction caused an increase in the brightness of the color of biocomposites based on polyethylene

- These materials are estimated to experience a compound annual growth rate of 11.7% in the next five years, which is almost double that of conventional composite materials over the same period.

- The miscanthus fibers can be melted and compounded with polymers at up to 200 °C without exhibiting any major thermal decomposition.

- Before melt compounding, both polymers and miscanthus fibers were dried at 80 °C for at least 12 h.

- The isolated fibers were rinsed thoroughly with the same solvent and dried at 70 °C for 24 h.

- The tensile properties of the neat PBS/PBAT blend matrix and all the composite samples were measured with a cross-head speed of 50 and 5 mm/min, respectively.

- The model had 15 degrees of freedom with four factors and two levels.

- In the present study, a Student’s t-test was performed in a Pareto chart with 15 degrees of freedom at a 95% confidence interval. The t-value (vertical line in the chart) was found to be 2.57 which determines the significant factors and/or interactions on the impact strength of the composites.

Emerging Trends

- Increased Use in Automotive Applications: Biocomposites are gaining popularity in the automotive industry due to their ability to reduce vehicle weight, thereby improving fuel efficiency and reducing carbon emissions. Manufacturers are increasingly using biocomposites for interior components like door panels, dashboards, and seat frames. As the automotive industry continues to seek sustainable alternatives to traditional materials, biocomposites are expected to play a crucial role.

- Sustainability and Environmental Regulations: With growing environmental awareness and stricter regulatory demands regarding sustainability, there is a significant push towards materials that can be sustainably sourced and are biodegradable. Biocomposites, made from natural fibers and biopolymers, meet these criteria, making them highly desirable in various sectors including packaging, construction, and consumer goods. This trend is accelerating as companies aim to reduce their ecological footprint and appeal to eco-conscious consumers.

- Advancements in Material Technology: Technological advancements are enabling the development of biocomposites with improved properties such as strength, durability, and water resistance. Researchers and companies are innovating ways to overcome traditional limitations of biocomposites, enhancing their appeal across a broader range of industries. These improvements are critical for expanding the applications of biocomposites beyond traditional niches.

- Growth in Building and Construction: The building and construction industry is increasingly adopting biocomposites for applications such as paneling, fixtures, and even structural components. The appeal of biocomposites in construction lies in their sustainability credentials, coupled with their aesthetic appeal, as they offer unique textures and finishes that are not easily achievable with synthetic materials.

- Diversification of Feedstock Sources: There is a growing trend toward diversifying the sources of natural fibers used in biocomposites. Beyond traditional wood fibers, there is increasing use of agricultural residues, bamboo, hemp, and flax, which helps in reducing waste and enhances the sustainability profile of biocomposites. This diversification also helps in reducing dependency on a single source, thereby stabilizing supply chains.

Use Cases

- Automotive Industry: Biocomposites are increasingly used in the automotive sector to reduce vehicle weight and enhance fuel efficiency. Components such as dashboards, door panels, and seat frames are being manufactured from biocomposites, providing a lightweight alternative to traditional materials. For instance, major automotive manufacturers are incorporating biocomposite materials that can reduce vehicle weight by up to 50% compared to conventional materials, significantly lowering CO2 emissions.

- Construction and Building Materials: In the construction industry, biocomposites are used for both interior and exterior applications including insulation, wall panels, and roofing elements. They offer not only environmental benefits but also superior thermal and acoustic insulation properties. The global market for green building materials, which includes biocomposites, is projected to grow significantly, with a market value expected to exceed USD 364 billion by 2022.

- Packaging Solutions: Biocomposites are becoming a popular choice in the packaging industry due to their biodegradability and lower environmental impact. They are used in producing containers, trays, and other packaging products that are recyclable and compostable. This application is particularly appealing in industries looking to reduce plastic waste, with the biodegradable packaging market estimated to reach USD 6.12 billion by 2023.

- Consumer Goods: From furniture to electronic casings, biocomposites are used to manufacture a wide range of consumer products. These materials are valued for their aesthetic natural finish as well as their environmental credentials. The demand for eco-friendly consumer products is driving the adoption of biocomposites in this sector, with an increasing number of companies investing in sustainable product lines.

- Sporting Goods: Biocomposites are used in the production of sporting goods such as bicycles, helmets, and rackets. These materials offer high strength-to-weight ratios which are essential for performance gear. The market for sports composites is expected to grow, driven by demand for advanced, lightweight materials that do not compromise on durability or performance.

Major Challenges

- Variability in Raw Material Quality: One of the primary challenges in the biocomposites market is the inconsistency in the quality and properties of natural fibers used as raw materials. Unlike synthetic materials, natural fibers can vary widely in strength, size, and moisture content depending on the source and environmental conditions. This variability can affect the final product’s consistency and performance, making it difficult to achieve uniform standards in mass production.

- High Production Costs: The production of biocomposites often involves complex and costly processes, particularly in the treatment and preparation of natural fibers and the blending with polymers. The specialized equipment and technologies required for producing biocomposites can lead to higher manufacturing costs compared to traditional materials. These costs are sometimes passed on to consumers, making biocomposite products less competitive in price-sensitive markets.

- Limited Processing Technologies: The development of efficient and scalable processing technologies for biocomposites is still evolving. Many existing manufacturing systems are designed for synthetic composites and require significant modification to handle the unique properties of biocomposite materials. This limitation can hinder the large-scale adoption and application of biocomposites across various industries.

- Regulatory and Standards Development: There is a lack of comprehensive regulatory frameworks and standardized testing methodologies specifically for biocomposites. This absence can impede quality assurance and consumer trust, as there are no universally accepted benchmarks to measure and compare the environmental or performance claims of biocomposite products.

- Competition from Established Materials: Biocomposites face stiff competition from more established materials like metals, plastics, and traditional composites, which often offer lower costs, higher performance, and well-understood properties. Overcoming this entrenched competition requires not only demonstrating the unique benefits of biocomposites but also educating consumers and industries about their long-term environmental and economic advantages.

Market Growth Opportunities

- Expanding Automotive Applications: The automotive industry continues to seek lightweight materials to enhance fuel efficiency and reduce emissions. Biocomposites offer significant weight reduction benefits and can reduce the weight of vehicle components by up to 30%. As regulations on emissions become stricter and consumer preference shifts towards more sustainable vehicles, the demand for biocomposites in automotive applications is expected to surge, providing a substantial growth opportunity for manufacturers.

- Construction and Infrastructure Development: With the global push for sustainable building practices, biocomposites are increasingly being used in construction for applications such as paneling, roofing, and insulation. The global green building materials market, which includes biocomposites, is projected to grow to over USD 364 billion by 2027. This trend presents opportunities for biocomposites to replace traditional materials like wood and plastic, particularly in regions with stringent environmental regulations.

- Innovations in Manufacturing Processes: Advancements in processing technologies that enhance the properties of biocomposites and make their production more cost-effective can open up new markets. For instance, improving the compatibility of natural fibers with different polymers and enhancing the mechanical strength of the final products can expand the use of biocomposites beyond their current applications.

- Growing Demand in the Packaging Industry: As the global packaging industry moves towards sustainable solutions, biocomposites are poised to replace conventional plastic composites in many applications, such as containers, trays, and other packaging products. The biodegradable packaging market is expected to reach USD 6.12 billion by 2025, indicating significant growth potential for biocomposites in this sector.

- Consumer Products and Electronics: There is a growing consumer preference for sustainable and eco-friendly products. Biocomposites are being explored for use in consumer goods such as electronics, furniture, and decorative items, where they can offer not only environmental benefits but also unique aesthetics. This trend is particularly evident in markets with a high level of environmental awareness among consumers.

Key Players

Anhui Guofeng Wood-Plastic Composite Co., Ltd. is a key player in the biocomposites sector, specializing in the production of wood-plastic composites (WPCs). The company focuses on integrating wood fibers with plastic resins to create sustainable, durable materials suitable for various applications including outdoor decking, flooring, and furniture. Anhui Guofeng’s innovative approaches in blending natural fibers with polymers address both environmental concerns and market demands for high-performance, eco-friendly products, positioning them as a significant contributor to the biocomposites market.

B.COMPOSITES PVT. LTD. is a prominent firm in the biocomposites industry, known for its expertise in developing and manufacturing advanced composite materials. The company utilizes natural fibers and bio-based resins to produce sustainable composites that are used in automotive, construction, and consumer goods applications. B.COMPOSITES focuses on enhancing the performance and sustainability of its products, leveraging its technical capabilities to address the growing demand for environmentally friendly materials and contributing to the expansion of the biocomposites market.

Fiberon is a leading company in the biocomposites sector, recognized for its development and manufacturing of composite decking and railing products. Specializing in wood-plastic composites (WPCs), Fiberon combines recycled wood fibers with plastic to create durable, low-maintenance outdoor products. Their innovations address the increasing demand for sustainable building materials, and their products are known for their environmental benefits, durability, and aesthetic appeal, making them a significant player in the biocomposites market.

Flexform SpA operates prominently in the biocomposites sector, focusing on the production of high-quality composite materials for various applications. The company integrates natural fibers with resins to develop sustainable and high-performance composites. Flexform SpA’s commitment to innovation and sustainability supports its role in offering eco-friendly solutions for the automotive, construction, and consumer goods industries, aligning with the market’s growing emphasis on environmentally responsible materials.

Green Dot Corporation is a prominent player in the biocomposites sector, focusing on the development of sustainable and biodegradable composite materials. The company offers a range of eco-friendly resins and biocomposites that are used in consumer goods, packaging, and agricultural products. Green Dot is known for its commitment to reducing environmental impact by creating materials that blend natural fibers with bio-based polymers. Their innovative solutions cater to industries looking for sustainable alternatives to traditional plastics, supporting the growth of the biocomposites market.

Hualong New Material Lumber Co. Ltd. specializes in the production of wood-plastic composites (WPCs), combining natural wood fibers with recycled plastics to create sustainable building materials. Their products are widely used in decking, fencing, and outdoor furniture, offering durability and low maintenance. Hualong focuses on environmentally friendly processes and materials, addressing the growing global demand for sustainable alternatives to traditional wood and plastic products, making them a significant player in the biocomposites industry.

Kudoti Pty Ltd is an innovative company in the biocomposites sector, focused on turning waste materials into high-value products. Based in South Africa, Kudoti specializes in recycling plastic waste into eco-friendly biocomposite materials used in construction and manufacturing. Their technology supports circular economy practices by repurposing waste into durable and sustainable products, contributing to the reduction of environmental impact and promoting a greener approach to industrial materials.

Meshlin Composites ZRT is a key player in the biocomposites sector, offering advanced composite solutions made from natural fibers and biodegradable resins. Located in Hungary, Meshlin Composites focuses on developing high-performance materials for automotive, aerospace, and construction industries. Their products emphasize sustainability and reduce reliance on traditional petroleum-based composites, aligning with global trends toward more eco-friendly manufacturing processes and materials.

Tecnaro GmbH is renowned for its innovation in the biocomposites industry, focusing on developing, producing, and marketing sustainable materials under the brand names Arboform, Arboblend, and Arbofill. These materials combine natural fibers with biopolymers to create alternatives to conventional plastics, suitable for a wide range of applications from automotive to consumer goods. Based in Germany, Tecnaro GmbH’s commitment to environmental sustainability is driving its growth, making it a leader in the field of green material solutions.

Trex Company, Inc. is a leading manufacturer of wood-alternative decking products that exemplify the practical applications of biocomposites. Their products, primarily made from recycled wood and plastic film, are used in outdoor living spaces, offering durability, ease of maintenance, and resistance to weathering, which are superior to traditional wood. Trex’s dedication to innovation and sustainability has made it a popular choice in the residential market, further establishing its position as a pioneer in eco-friendly outdoor solutions.

UFP Industries, Inc. specializes in providing advanced biocomposite solutions, focusing on sustainable and high-performance materials. The company integrates recycled fibers and resins to produce a range of products, including decking, fencing, and landscaping materials. UFP Industries’ commitment to environmental stewardship and innovation positions it as a key player in the biocomposites sector, leveraging its expertise to meet the growing demand for eco-friendly building materials.

Universal Forest Products, Inc. is a prominent player in the biocomposites sector, offering a diverse range of sustainable products. The company utilizes wood fibers combined with resins to create durable and environmentally friendly building materials, such as decking and outdoor furniture. Universal Forest Products is recognized for its focus on innovation and quality, catering to both residential and commercial markets with products designed to enhance sustainability and reduce environmental impact.

Nanjing Jufeng Advanced Materials Co., Ltd. is a dynamic player in the biocomposites sector, specializing in the production of high-quality biocomposite materials for a range of applications, including automotive and consumer goods. The company focuses on integrating natural fibers with polymers to create products that are both sustainable and performance-driven. Nanjing Jufeng’s commitment to innovation and its capacity for large-scale production make it a notable entity in the growing biocomposites market, catering to a global clientele seeking eco-friendly alternatives.

BioComposites Group is a leader in the biocomposites industry, dedicated to developing sustainable solutions for both environmental and commercial applications. The company produces a variety of biocomposite materials designed for use in automotive, construction, and landscaping. Utilizing local, renewable natural fibers, BioComposites Group creates products that reduce reliance on non-renewable resources, significantly lower carbon footprints, and support the circular economy. Their approach not only meets the increasing market demand for green products but also demonstrates leadership in sustainable manufacturing practices.

Lingrove Inc specializes in creating high-performance biocomposites, focusing on replacing traditional wood and carbon fiber materials with sustainable alternatives. Lingrove’s flagship product, Ekoa®, is a composite that blends natural linen fibers with bio-based resins, offering aesthetics, lightweight, and durability superior to conventional materials. This innovation is particularly attractive in the musical instruments and sporting goods markets, where the demand for eco-friendly, high-quality materials is rapidly growing. Lingrove’s commitment to sustainability and quality has established it as a forward-thinking leader in the biocomposites sector.

EP Biocomposites Ltd. is dedicated to advancing the use of biocomposites in industrial applications by developing materials that are both sustainable and performance-oriented. Their products are designed to meet specific needs in the automotive, construction, and packaging industries, offering an eco-friendly alternative to traditional plastics and metals. EP Biocomposites’ focus on integrating environmental sustainability with industrial utility has positioned them as a key player in promoting green manufacturing practices, helping to drive the broader adoption of biocomposites in diverse markets.

Conclusion

In conclusion, the biocomposites market is poised for remarkable growth, driven by a surge in demand across multiple sectors including automotive, construction, and packaging. Expected to expand from USD 33.4 billion in 2023 to USD 126.0 billion by 2033, the market is benefiting from the global shift towards sustainable materials. Despite facing challenges such as variability in raw material quality and high production costs, biocomposites continue to attract attention due to their environmental benefits and potential for innovation.

With ongoing advancements in material science and manufacturing processes, along with a growing regulatory focus on sustainability, biocomposites are increasingly seen as a viable alternative to traditional materials. As industries continue to seek greener alternatives, the biocomposites market is set to offer substantial opportunities for growth and innovation.