Table of Contents

Introduction

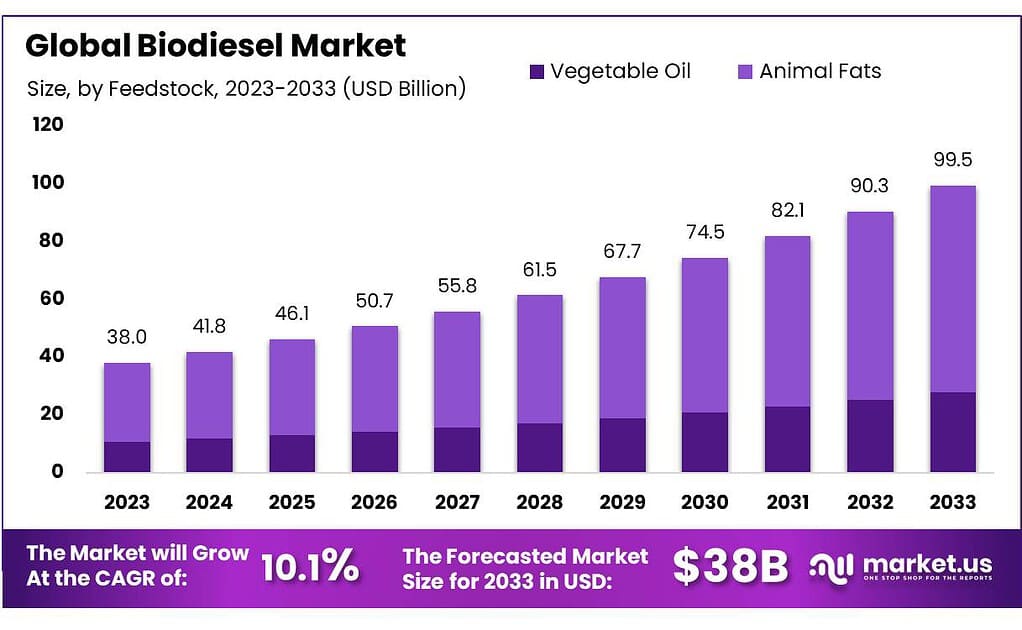

The global biodiesel market is projected to experience substantial growth over the next decade, expanding from a market size of USD 38.8 billion in 2023 to USD 101.6 billion by 2033, reflecting a compound annual growth rate (CAGR) of 10.1%. Several key factors, including rising environmental concerns, government initiatives, and technological advancements drive this impressive growth.

The increasing adoption of biodiesel as an alternative fuel in power generation and automotive applications is a significant driver of market growth. Biodiesel, which can be produced from renewable sources such as vegetable oils, animal fats, and agricultural feedstock, offers a cleaner-burning, sustainable alternative to traditional fossil fuels. This aligns with global efforts to reduce greenhouse gas emissions and dependence on non-renewable energy sources.

Technological advancements are also propelling the market forward. Innovations such as Crown Iron Works’ ACRE process, which enhances catalyst efficiency and reduces energy consumption, are helping to make biodiesel production more economically viable. Additionally, strategic acquisitions like Chevron’s purchase of Renewable Energy Group are enabling major companies to expand their renewable energy portfolios and leverage existing infrastructure for biodiesel production.

However, the market faces challenges, including higher operational costs compared to crude oil and issues related to fuel performance. Biodiesel production costs are influenced by the price of raw materials, such as vegetable oils and animal fats, which can fluctuate significantly. Moreover, the performance of biodiesel blends in modern engines can be problematic, with concerns about water separation, fuel foaming, and potential engine damage.

Regionally, Europe has historically been the largest biodiesel market, driven by government policies and strong public demand for renewable energy. In 2022, Europe accounted for approximately 46.7% of the global market. However, the Asia-Pacific region is expected to see the fastest growth, with countries like Thailand and Indonesia leading the way due to their substantial palm oil production, which is a key feedstock for biodiesel.

The competitive landscape of the biodiesel market is marked by the presence of major players such as Archer Daniels Midland Company, Cargill, Inc., and Renewable Energy Group. These companies are investing in expanding their production capacities and geographic reach to strengthen their market positions. Additionally, the supportive stance of original equipment manufacturers (OEMs) and governmental policies promoting biodiesel usage are further bolstering market growth.

Statistics

- The U.S. and Brazil produced about 81% of the world’s ethanol in 2021.

- In the 2021/22 season, 5.3 billion bushels of corn, 36% of the U.S. supply, became ethanol feedstock.

- Biodiesel from algae is an area of ongoing research. Algae could potentially produce 10 to 100 times more fuel per acre than other crops.

- In 2022, 10% of U.S. vehicle fuel consumption (by volume) was ethanol and over 98% of U.S. gasoline contains ethanol.

- E85 sells for less than regular gasoline but contains less energy per gallon. Flex-fuel vehicles using E85 see a 15-27% reduction in fuel economy.

- On average, GHG emissions from corn ethanol are 34% lower than gasoline when including Land Use Change (LUC) emissions and 44% lower when excluding them.

- GHG emissions for cellulosic ethanol average around 97% lower than gasoline when including LUC emissions and 93% lower when excluding LUC emissions.

- Biodiesel is also nontoxic and biodegradable. Using biodiesel lowers particulate matter by 47%, reduces hydrocarbon emissions by up to 67%, and reduces smog.

- The production of biodiesel, instead of petroleum diesel, reduces wastewater by 79% and hazardous waste by 96%.

- Biodiesel does all this while also providing the highest energy balance of any U.S. fuel, a 3.5-to-1 positive energy balance. This means that for every unit of energy input, biodiesel returns an astounding 3.5 units of energy.

- In 2021, the USA, Brazil, Europe, and Indonesia were the largest consumers of biofuel, accounting for 84% of global biofuel consumption.

- The OECD-FAO estimates that between 2019 and 2021, 21% of world sugar cane production, 15% of the world’s maize production, and 12% of oilseed production was used to make biofuels.

- India has proposed a target of 20% blending of ethanol in petrol, and 5% blending of biodiesel in diesel by 2030.

- In 2021, Australia produced 180 million liters of fuel ethanol and 18 million liters of biodiesel.

- The International Energy Agency (IEA) expects biofuel demand to grow from 146 billion liters/year in 2020 to between 186 and 342 billion liters/year in 2026 (an increase of 27%-134%)

- 1 gallon of biodiesel has 93% of the energy of 1 gallon of diesel and 1 gallon of ethanol (E85) has 73% of the energy of 1 gallon of gasoline.

- Today, almost 50% of biodiesel in the EU market is produced from rapeseed oil. With nearly 40% of vegetable oils delivered to biodiesel producers, the biofuels market is a major outlet for the vegetable oils industry.

- Soy biodiesel results, on average, in a 57% reduction in greenhouse gases compared to fossil diesel, and biodiesel produced from waste grease results in an 86% reduction.

- corn ethanol produced in a plant powered by natural gas results in a 21% reduction of greenhouse gases compared to gasoline.

Emerging Trends

- Technological Advancements: Innovations in biodiesel production are enhancing efficiency and reducing costs. Advanced catalysts and process improvements, such as those developed by Crown Iron Works, are making production more economical and environmentally friendly. This includes technologies that reduce energy consumption and increase the reuse of catalysts.

- Government Policies and Incentives: Favorable government policies and tax incentives are significant drivers for the biodiesel market. Countries across the globe are implementing regulations to reduce greenhouse gas emissions, which supports the adoption of biodiesel. For example, the European Union’s Renewable Energy Directive (RED) mandates increased use of renewable energy, including biodiesel, in transportation.

- Regional Growth Dynamics: Different regions are showing varied growth patterns in the biodiesel market. Asia-Pacific, particularly countries like China and India, is witnessing a surge in demand due to rapid industrialization and urbanization. Government initiatives in these countries are promoting the use of biodiesel to reduce air pollution and reliance on fossil fuels. Europe continues to lead in biodiesel adoption due to stringent environmental regulations and well-established infrastructure supporting renewable energy.

- Feedstock Diversification: The use of diverse feedstocks such as vegetable oils (soybean, palm oil) and animal fats is becoming more common. This diversification is crucial for meeting regional supply demands and enhancing the sustainability of biodiesel production. Innovations are focusing on utilizing waste materials like used cooking oil and non-food feedstocks to further reduce the environmental impact.

- Integration with Electric Vehicles (EVs): Biofuels, including biodiesel, are increasingly seen as complementary to electric vehicles in reducing oil demand. In regions where EV adoption is slower, biodiesel remains a critical option for decarbonizing the transport sector, particularly in heavy-duty and long-haul applications where electric solutions are less viable.

- Expansion in New Markets: The Middle East and Africa (MEA) are emerging as new markets for biodiesel, driven by the need to diversify energy sources away from oil. Governments in these regions are beginning to recognize the potential of biodiesel as part of their renewable energy strategies, creating new opportunities for market growth.

- Rising Demand for Biojet Fuel: The demand for biojet fuel is projected to grow significantly, driven by policy support in the aviation sector. Countries like the United States, Japan, and in the European Union are leading the way with policies that mandate the use of sustainable aviation fuels, including biodiesel.

Use Cases

- Automotive Fuel: Biodiesel is widely used as a substitute for conventional diesel in vehicles. Its compatibility with existing diesel engines makes it a practical choice without the need for significant modifications. In 2021, the automotive fuel segment accounted for more than 77.7% of the overall biodiesel market revenue. It reduces emissions of volatile organic compounds (VOCs) and particulate matter, making it a cleaner option for transportation.

- Power Generation: Biodiesel is increasingly used in power generation to reduce greenhouse gas emissions. It serves as a reliable fuel for generators, particularly in remote or off-grid locations where traditional fuel supply might be challenging. The use of biodiesel in power generation helps in lowering carbon monoxide and particulate emissions. This segment is expected to grow significantly, driven by government initiatives to adopt renewable energy sources.

- Agriculture: In the agricultural sector, biodiesel is used to power machinery and equipment, providing a sustainable alternative to petroleum diesel. The increased mechanization of agriculture and the push for eco-friendly farming practices drive the demand for biodiesel. It helps in reducing the carbon footprint of farming activities and supports the sustainability goals of the agricultural industry

- Marine Industry: Biodiesel is also utilized in the marine sector, where its biodegradability and non-toxic nature make it an ideal fuel for boats and ships. The use of biodiesel in marine applications helps in minimizing water pollution and adhering to stringent environmental regulations. This sector is expected to witness robust growth as the maritime industry seeks to reduce its environmental impact.

- Aviation (Biojet Fuel): The aviation industry is exploring the use of bio-jet fuel, a type of biodiesel, to reduce its carbon footprint. By 2028, the global demand for bio jet fuel is expected to increase significantly, driven by policy support and the need for sustainable aviation solutions. The European Union’s ReFuelEU Aviation legislation mandates blending obligations that will further boost the use of biojet fuels.

- Municipal Waste Management: Biodiesel production from municipal waste and other non-traditional feedstocks like used cooking oil (UCO) and agricultural residues is gaining traction. This approach not only provides a renewable energy source but also addresses waste management issues, promoting a circular economy. In regions like Asia Pacific, countries such as China and India are focusing on UCO-based biodiesel to manage waste effectively and produce sustainable fuel.

- Europe: Europe remains a dominant player in the biodiesel market, driven by stringent environmental regulations and ambitious renewable energy targets. Countries like Germany, France, and Spain are leading producers and consumers, benefiting from government incentives and a mature understanding of biodiesel’s environmental benefits.

- Asia Pacific: The Asia Pacific region is emerging as a significant market for biodiesel, with rapid industrialization and urbanization driving demand. Government initiatives and investments in biodiesel production facilities in countries like China, India, and Thailand are propelling the market forward. The region’s focus on reducing air pollution and reliance on fossil fuels is also contributing to this growth.

- North America: In the United States, renewable diesel production capacity has surpassed biodiesel production, reflecting a shift towards advanced biofuels. The country continues to expand its biodiesel market through state and federal renewable fuel programs.

Major Challenges

- Competition with Electric Vehicles (EVs): The growing popularity of electric vehicles presents a significant challenge to the biodiesel market. EVs are increasingly viewed as a cleaner and more efficient alternative to internal combustion engines, reducing the demand for biodiesel as a transportation fuel. In regions like Europe and North America, where EV adoption is accelerating, biodiesel faces stiff competition.

- Technological Limitations: Biodiesel has certain technical limitations that restrict its use in modern engines. Issues such as poor fuel efficiency at low temperatures and potential engine compatibility problems can deter consumers and manufacturers from adopting biodiesel blends. These technical challenges necessitate ongoing research and development to improve biodiesel formulations and engine compatibility.

- Policy and Regulatory Challenges: While government policies and incentives have historically supported biodiesel adoption, the regulatory environment can also pose challenges. Changes in policy, inconsistent support, and the complexity of meeting regulatory standards can create uncertainties for producers and investors. In some regions, the lack of robust policy support for biofuels compared to other renewable energy sources can hinder market growth.

- Environmental and Sustainability Concerns: Although biodiesel is considered more environmentally friendly than fossil fuels, it is not without its environmental challenges. The production of biodiesel from certain feedstocks, such as palm oil, has been linked to deforestation and habitat destruction. Ensuring sustainable feedstock sourcing and minimizing the environmental footprint of biodiesel production are critical concerns that the industry must address.

Market Growth Opportunities

- Market Growth Opportunities in the Biodiesel Market The biodiesel market presents several compelling growth opportunities driven by increasing global demand for renewable energy sources and the pressing need to reduce greenhouse gas emissions.

- Expansion in the Transportation Sector: The transportation sector remains a significant driver of biodiesel demand. Biodiesel’s compatibility with existing diesel engines makes it a viable alternative to traditional fossil fuels. As of 2023, the transportation segment accounted for over 70% of the biodiesel market revenue. Governments and industries are adopting biodiesel to meet environmental regulations and reduce carbon footprints, which is expected to drive continued growth in this segment.

- Government Policies and Incentives: Governments worldwide are implementing policies and incentives to promote biodiesel production and use. For instance, the United States has set ambitious targets for sustainable aviation fuel, aiming for 11 billion liters by 2030. Such initiatives provide significant growth opportunities for the biodiesel market by encouraging investment and development in the sector.

- Technological Advancements: Technological innovations in biodiesel production, such as advanced catalysts and new feedstock processing techniques, are improving production efficiency and reducing costs. These advancements make biodiesel a more attractive option compared to conventional diesel, fostering market expansion. For example, new methods for converting waste oils and residues into biodiesel are gaining traction, contributing to the industry’s growth.

- Feedstock Diversification: Exploring alternative feedstocks, such as algae and waste oils, provides new avenues for biodiesel production. These feedstocks offer the potential for sustainable and cost-effective biodiesel production, reducing reliance on traditional sources like vegetable oils and animal fats. The use of diverse and abundant feedstocks supports the stability and growth of the biodiesel market.

- Regional Market Expansion: Regions like Asia-Pacific and Europe are leading the charge in biodiesel adoption. Asia-Pacific, with its rapid industrialization and urbanization, is seeing significant growth in biodiesel demand. In Europe, stringent environmental regulations and strong government support are driving market growth. These regions offer substantial opportunities for biodiesel market expansion due to their robust policy frameworks and growing environmental awareness.

Recent Developments

Ag Processing Inc. (AGP) is a major player in the biodiesel market, leveraging its integrated business strategy to produce biodiesel from its refined soybean oil. AGP operates three biodiesel production facilities located in Algona and Sergeant Bluff, Iowa, and St. Joseph, Missouri. These plants have a combined production capacity of up to 194 million gallons annually. Throughout 2023, AGP continued to support the Iowa Biofuels Standard, which mandates increasing levels of biodiesel in the state’s diesel fuel pool, starting at 11% and aiming for 20% blends in future years. This initiative supports local soybean farmers by boosting demand for soybean oil, which constitutes 85% of biodiesel feedstock. In addition to biodiesel, AGP produces various renewable fuels, solvents, and adjuvants, contributing to environmental sustainability and economic development in rural communities.

Archer Daniels Midland Company (ADM) has been actively involved in the biodiesel market, leveraging its extensive agricultural processing capabilities. In January 2023, ADM delivered approximately 24.95 million gallons of biodiesel to the U.S., with significant imports originating from Germany. This accounted for about 63.9% of all U.S. biodiesel imports for that month. In April 2023, ADM continued to bolster its position by relying on German biofuel production, importing 18.06 million gallons of biodiesel from Germany to the U.S.

Bunge Ltd. is a significant player in the biodiesel market, leveraging its extensive agribusiness infrastructure to support renewable energy solutions. Throughout 2023, Bunge has actively expanded its biodiesel production and partnerships. In January 2023, Bunge reported delivering substantial volumes of biodiesel, focusing on the use of vegetable oil feedstocks such as soybean and canola oil. A notable development in 2023 was the collaboration with Chevron to enhance biodiesel production capabilities, aiming to meet the increasing demand for low-carbon fuels. This partnership underscores Bunge’s commitment to reducing the carbon footprint and supporting sustainable fuel initiatives. Additionally, Bunge’s integration of low-carbon oils like used cooking oil (UCO) and distillers’ corn oil (DCO) into its supply chain has bolstered its capacity to produce environmentally friendly biodiesel.

Cargill, Inc. is a key player in the biodiesel market, focusing on sustainable energy solutions through its extensive agricultural infrastructure. In 2023, Cargill continued to strengthen its biodiesel production capabilities, with significant operations at its facilities in Iowa Falls, Iowa, and Kansas City, Missouri. These plants, alongside imports from Argentina, ensure a reliable supply of high-quality biodiesel. For instance, in January 2023, Cargill reported a steady production output, meeting increasing market demands for biodiesel used in on-road blending requirements. Throughout 2023, Cargill maintained a robust supply chain, leveraging dedicated rail fleets to ensure consistent product delivery.

Conclusion

The biodiesel market is poised for continued robust growth, driven by a combination of environmental concerns, renewable energy initiatives, and advancements in production technologies. This growth is fueled by increasing government mandates and subsidies aimed at reducing greenhouse gas emissions, as well as a shift towards sustainable fuel alternatives.