Table of Contents

Introduction

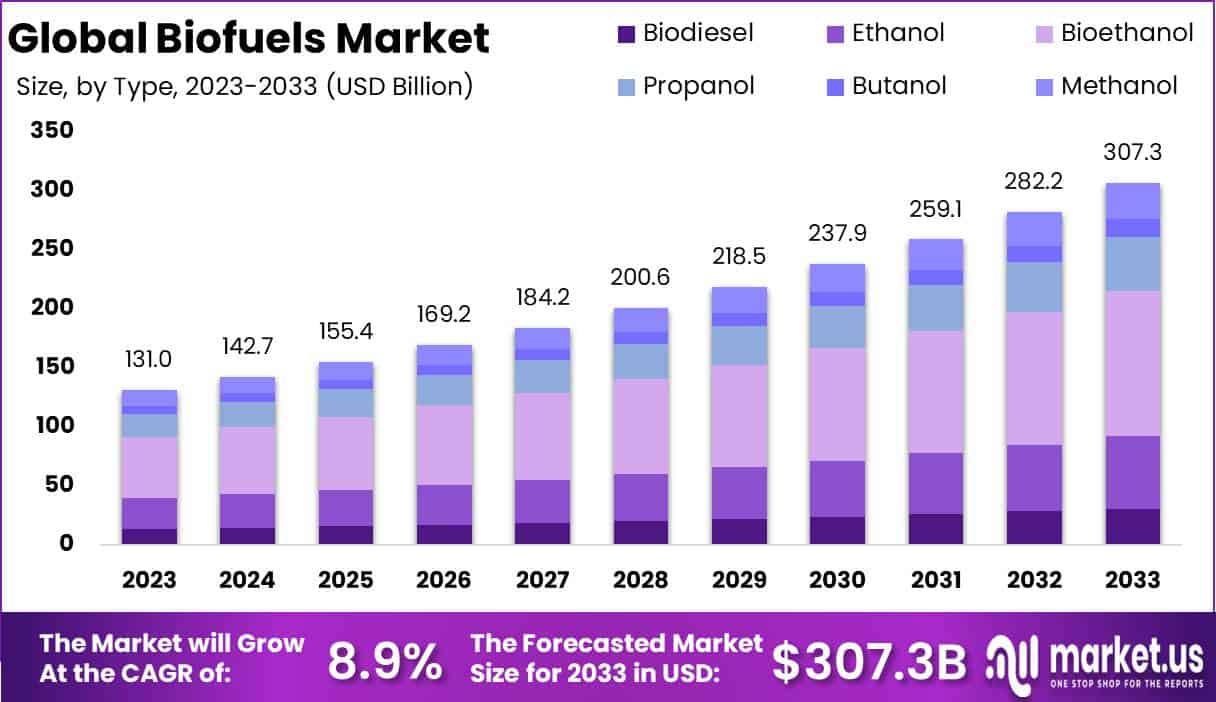

The Global Biofuels Market is projected to reach a value of approximately USD 307.3 billion by 2033, up from USD 131.0 billion in 2023. This represents a compound annual growth rate (CAGR) of 8.9% over the forecast period from 2023 to 2033.

The biofuels market refers to the production, distribution, and consumption of renewable fuels derived from organic materials, such as plant biomass, animal waste, and algae. These fuels, including bioethanol, biodiesel, and biogas, are used as alternatives to conventional fossil fuels like gasoline and diesel.

The biofuels market spans various industries, particularly transportation and energy, driven by the need for sustainable energy solutions and the desire to reduce greenhouse gas emissions. Biofuels are a critical component of global energy transition strategies, promoting cleaner energy and fostering energy independence.

Several key factors are driving the growth of the biofuels market. Government policies and regulations that mandate blending biofuels with traditional fuels, such as the Renewable Fuel Standard (RFS) in the U.S. and the Renewable Energy Directive (RED) in the EU, are essential growth drivers.

Additionally, the rising concern over climate change and increasing demand for low-carbon alternatives to fossil fuels are spurring innovation and investment in biofuel technologies. Advances in feedstock processing, particularly second-generation biofuels derived from non-food sources, further contribute to market expansion by addressing sustainability concerns and supply chain limitations.

The demand for biofuels is largely driven by the transportation sector, which seeks to reduce its carbon footprint. As countries implement stricter emissions standards and encourage the adoption of renewable energy, industries such as aviation and shipping are exploring biofuels as viable alternatives to traditional fuels.

The automotive industry’s shift towards hybrid and flex-fuel vehicles that can operate on ethanol-blended gasoline also supports rising biofuel consumption. Additionally, biofuels have seen growing adoption in emerging markets, where energy security concerns and rising fuel costs incentivize the use of domestically produced renewable energy.

The biofuels market presents significant opportunities for innovation and growth, particularly in the development of advanced biofuels and new feedstock sources. Investments in research and development for third-generation biofuels, which utilize algae and other high-yield, low-impact feedstocks, offer potential for scaling up production while minimizing environmental impact.

Strategic partnerships between governments, energy firms, and biotech companies are likely to unlock new growth avenues. Additionally, the growing trend towards circular economies presents opportunities for waste-to-energy biofuel projects, further enhancing sustainability and reducing dependency on fossil fuels.

Key Takeaways

- The global biofuels market is expected to expand from USD 131.0 billion in 2023 to USD 307.3 billion by 2033, at a compound annual growth rate (CAGR) of 8.9%.

- Bioethanol holds the largest share of the biofuels market, accounting for 41.3% in 2023, driven by its widespread use in gasoline blending, particularly in the U.S. and Brazil.

- Liquid biofuels lead the market with a 46% share, largely due to their use in transportation and compatibility with existing engine technologies.

- Sugar crops are the dominant feedstock, representing 41% of the market in 2023, led by Brazil’s highly efficient ethanol production from sugarcane.

- North America is the largest regional market, capturing 41.8% of the global biofuels share, supported by favorable policies and robust agricultural supply chains, especially in the United States.

- The Asia-Pacific region shows strong growth potential, driven by rapid industrialization and urbanization, with India targeting 20% ethanol blending by 2025.

- A key restraint to market growth is the high production costs and limited scalability of advanced biofuels, which challenge their competitiveness against fossil fuels.

Biofuels Statistics

- Global biofuel production reached 170 billion liters in 2023.

- The U.S. was the largest biofuel producer, contributing 40% in 2023.

- Brazil was the second-largest producer, supplying 25% of global biofuel.

- Biofuels accounted for 3% of global transport fuel demand in 2023.

- The global biofuels market was valued at $140 billion in 2023.

- Ethanol made up 65% of total biofuel production in 2023.

- Biodiesel and renewable diesel contributed the remaining 35%.

- The U.S. produced over 17 billion gallons (64 billion liters) of ethanol.

- Brazil produced 35 billion liters of ethanol in 2023.

- The EU produced 14 billion liters of biodiesel in 2023.

- Indonesia led biodiesel production with over 10 billion liters.

- Biofuel production is projected to grow 5-7% in 2024.

- The U.S. corn ethanol industry used 35% of the corn crop in 2023.

- Brazil’s sugarcane ethanol cut greenhouse gas emissions by 90%.

- The U.S. Renewable Fuel Standard required 20.94 billion gallons of biofuel blending.

- Over 200 ethanol biorefineries operated in the U.S. in 2023.

- U.S. ethanol plants had an average capacity of 80 million gallons per year.

- Brazil mandated a 27% ethanol blend in gasoline (E27) in 2023.

- The EU aims for 14% renewable transport energy by 2030.

- India targets 20% ethanol blending by 2025.

- China plans to use 4 million tons of bioethanol by 2025.

- Global biofuel investment reached $20 billion in 2023.

- The aviation sector aims to use 2% sustainable aviation fuel by 2025.

- SAF production in 2023 covered only 0.1% of jet fuel demand.

- U.S. corn ethanol averaged $2.20 per gallon in 2023.

- Biodiesel in Europe averaged €1,500 per metric ton in 2023.

- The U.S. exported 1.3 billion gallons of ethanol in 2023.

- Brazil exported 2.5 billion liters of ethanol in 2023.

- Argentina exported 1.5 billion liters of biodiesel in 2023.

- The global biofuel enzyme market was worth $1 billion in 2023.

- Second-generation biofuels made up less than 1% of total production.

- The U.S. biodiesel sector supported 65,000 jobs in 2023.

- Brazil’s sugarcane ethanol industry employed over 800,000 people.

- The EU biofuels industry provided 200,000 jobs in 2023.

- U.S. ethanol plants produced 2.8 gallons per bushel of corn.

- The EU used 6 million tons of rapeseed oil for biodiesel.

- Palm oil made up 35% of Southeast Asia’s biodiesel feedstock.

- The U.S. consumed 2.5 billion gallons of biomass-based diesel in 2023.

- Canada required 5% renewable content in gasoline and 2% in diesel.

- Australia’s biofuel production reached 290 million liters in 2023.

- Japan aims to use 500 million liters of bioethanol by 2025.

- The global algae biofuel market was valued at $4.7 billion in 2023.

- The U.S. had over 2,000 E85 fueling stations in 2023.

- Brazil had over 35,000 stations offering E100 ethanol in 2023.

- U.S. corn ethanol reduced greenhouse gas emissions by 40%.

- The EU set a 7% cap on crop-based biofuels in 2023.

- Global renewable diesel capacity reached 10 billion gallons per year.

- Used cooking oil provided 20% of EU biodiesel feedstock.

- The U.S. Department of Energy invested over $100 million in bioenergy R&D in 2023.

- The global biofuel additives market was valued at $1.5 billion in 2023.

- Biofuels are crucial for decarbonizing transport sectors.

- Global biofuel demand hit 4.3 EJ in 2022, surpassing pre-pandemic levels.

- Biofuel production must grow 11% annually to meet Net Zero goals by 2050.

- Advanced biofuels from waste and non-food crops could supply 40% of demand by 2030.

- Global biofuel demand is expected to increase by 56% between 2022 and 2027.

- By 2027, biofuels could supply 5.4% of global transport fuel, including 1% for aviation.

- Global bioethanol production has an energy content of 2.2 EJ per year.

- Global biodiesel production has an energy content of 1.8 EJ per year.

- Biofuels could meet 3.5% of jet fuel demand by 2028 with stronger policies.

- Ethanol is blended into over 98% of gasoline in the U.S.

- Biojet fuel demand could grow by 5 billion liters by 2028, covering 1% of jet fuel supply.

Emerging Trends

- Shift Towards Advanced Biofuels: There is a growing focus on second- and third-generation biofuels, which are produced from non-food feedstocks like algae, agricultural residues, and waste. These biofuels offer higher sustainability as they do not compete with food crops and can reduce greenhouse gas emissions more effectively than traditional biofuels. Technologies such as enzymatic and algal biodiesel production are gaining traction, especially in the U.S. and Europe.

- Biojet Fuel Expansion: The demand for biojet fuel is projected to rise sharply, driven by global efforts to decarbonize the aviation industry. Biojet fuel is expected to make up nearly 1% of global jet fuel supplies by 2028, with further growth dependent on policy implementations and new production technologies. Regions like the U.S., Europe, and Japan are leading this shift, backed by favorable policies like the ReFuelEU initiative.

- Integration with Electric Vehicles (EVs): Biofuels and EVs are proving to be complementary in reducing oil demand, especially in sectors like diesel and aviation where EVs have less impact. In regions such as Brazil, India, and Indonesia, biofuels are critical in decarbonizing transport, while EV adoption is still growing.

- Feedstock Diversification: Efforts to diversify biofuel feedstocks are intensifying to ensure scalability and sustainability. For example, the use of waste oils, woody residues, and municipal solid waste is expanding, particularly in advanced biofuel projects. This reduces reliance on traditional feedstocks like corn and sugarcane and supports a circular economy.

- Supportive Policy Environment: Governments worldwide are introducing policies that favor biofuel growth, such as blending mandates and incentives under programs like the U.S. Renewable Fuel Standard and Europe’s RED II directive. These initiatives are critical to driving investment in biofuel infrastructure and ensuring competitiveness against fossil fuels

Top Use Cases

- Transportation Fuels: The transportation sector is the largest consumer of biofuels, accounting for over 69% of global biofuel demand in 2023. Ethanol and biodiesel are primarily used in road transport to reduce carbon emissions and dependence on fossil fuels. For example, bioethanol is widely blended with gasoline in countries like the U.S. and Brazil, helping to lower greenhouse gas (GHG) emissions by up to 60% compared to conventional fuels.

- Aviation: The aviation industry is rapidly adopting biojet fuels to meet stringent emissions regulations. Biojet fuel demand is expected to grow significantly, reaching nearly 1% of total jet fuel supplies by 2028, driven by policies like the EU’s ReFuelEU initiative. In the U.S., biojet fuel production could triple by 2028, supported by tax credits and mandates.

- Power Generation: Biofuels are increasingly being used for electricity generation, especially in regions looking to reduce reliance on coal and natural gas. Solid biofuels, such as wood pellets, are becoming popular for generating heat and electricity. For instance, the U.S. has invested heavily in biomass plants, with projects like the $250 million Enviva Biomass plant.

- Marine Fuels: The shipping industry is exploring marine biofuels as an alternative to heavy fuel oil. Biofuels offer the potential to reduce sulfur and CO2 emissions, especially in areas where maritime emissions regulations are strict. Technological advancements are helping make biofuels more compatible with existing marine engines.

- Industrial Heating: Biofuels are used in industrial boilers to produce heat in various manufacturing processes. In sectors like cement and steel, biofuels offer a renewable solution for energy-intensive operations. Wood pellets and bio-oils are increasingly replacing fossil fuels in these applications.

Major Challenges

- High Production Costs: One of the primary challenges is the high cost of producing biofuels, especially advanced biofuels like biojet fuel. For example, biojet fuels currently cost several times more than fossil fuels due to complex production processes and the need for large-scale testing. Lowering production costs through technological advancements is essential, but policy support is also crucial to make biofuels economically viable.

- Feedstock Availability and Sustainability: Ensuring a sustainable and sufficient supply of feedstock is another critical issue. The growing demand for biofuels places pressure on agricultural resources, particularly when food crops like corn and sugarcane are used. This raises concerns about food security and land use. In addition, certain biofuel feedstocks, such as palm oil, have been linked to deforestation, which can undermine the environmental benefits of biofuels.

- Technological Limitations: The development of biofuels, especially second- and third-generation variants, is still hampered by technological challenges. Advanced biofuels, which use non-food biomass like algae or waste, require sophisticated processing technologies that are not yet fully commercialized or cost-effective.

- Infrastructure and Distribution: Current fuel infrastructure is built around fossil fuels, and integrating biofuels into existing systems can require significant investment. Modifications are often needed in vehicles and distribution networks to handle high biofuel blends, making the transition costly for stakeholders.

- Regulatory and Policy Uncertainty: While policies like the Renewable Fuel Standard (RFS) in the U.S. and similar mandates globally support biofuels, fluctuating regulations and policy changes can create uncertainty for investors. Inconsistent government incentives and international trade barriers can slow market development

Top Opportunities

- Aviation Sector: One of the fastest-growing opportunities for biofuels is in biojet fuel. The aviation industry is under pressure to reduce its carbon footprint, and biojet fuel offers a sustainable alternative to conventional jet fuels. Governments and industries are supporting the development of Sustainable Aviation Fuel (SAF), with biojet demand expected to expand rapidly, driven by policies such as the International Civil Aviation Organization’s (ICAO) CORSIA.

- Advanced Biofuels and New Feedstocks: There is strong growth potential in second- and third-generation biofuels, which use non-food feedstocks like algae, waste oils, and agricultural residues. These advanced biofuels offer better sustainability by reducing competition with food crops. For instance, advanced biofuels like renewable diesel are gaining traction due to their higher energy efficiency and ability to reduce greenhouse gas emissions by up to 80% compared to fossil fuels.

- Transportation Sector: The transportation sector remains a major growth driver for biofuels, particularly ethanol and biodiesel. Ethanol, blended with gasoline, continues to be widely used in countries like the U.S. and Brazil. Moreover, increasing mandates for higher ethanol blends, such as E15 and E20 (15% and 20% ethanol), are expected to boost demand.

- Waste-to-Energy and Circular Economy: There is growing interest in converting waste materials, including used cooking oils and municipal solid waste, into biofuels. This aligns with the global push for a circular economy and waste-to-energy initiatives, opening new opportunities for biofuels derived from organic waste.

- Government Policies and Incentives: Supportive policies and incentives are key drivers of biofuels market growth. In North America, the Renewable Fuel Standard (RFS) in the U.S. and similar initiatives across Europe and Asia Pacific provide economic incentives and regulatory frameworks that encourage the use of biofuels. Such policies aim to increase biofuel blending and promote the development of advanced biofuels

Key Player Analysis

- Chevron: Chevron is a major player in the renewable fuels space. In 2022, Chevron acquired Renewable Energy Group (REG) for $3.15 billion, significantly expanding its biofuel production capabilities. Chevron aims to produce 100,000 barrels per day of renewable fuels by 2030. It has invested heavily in biodiesel and sustainable aviation fuel (SAF) production.

- Neste: Neste is a global leader in renewable diesel production. Headquartered in Finland, Neste produces over 3.5 million tons of renewable products annually, including sustainable aviation fuel and renewable diesel. In 2023, the company continued to expand its renewable operations, targeting carbon neutrality by 2035.

- Archer Daniels Midland (ADM): ADM is one of the largest agricultural processors in the world and a key biofuel producer. ADM operates extensive ethanol production facilities and has a strong position in the U.S. biofuel market. In 2023, ADM focused on expanding its production capacity, particularly in ethanol, and partnered with companies for advanced biofuels research.

- Valero Energy Corporation: Valero is a leading biofuel refiner, producing ethanol and renewable diesel. Through its Diamond Green Diesel joint venture, Valero is the largest renewable diesel producer in the U.S. In 2023, Valero’s renewable diesel production reached over 700 million gallons annually, and it is expanding capacity.

- Renewable Energy Group (REG): Acquired by Chevron in 2022, REG was a pioneer in biodiesel production. REG produced over 720 million gallons of renewable fuels annually by 2023. Its Geismar, Louisiana plant is a key asset, driving Chevron’s growth in renewable diesel.

Recent Developments

- In 2024, Trafigura Group Pte Ltd, a global leader in commodity trading and logistics, successfully completed the acquisition of Greenergy’s European and Canadian supply businesses. Greenergy, a UK-based supplier of road fuels and a key European biodiesel producer, was previously owned by Brookfield Asset Management and its affiliate Brookfield Business Partners. This strategic move strengthens Trafigura’s presence in the energy sector, particularly in Europe and Canada, aligning with its long-term growth strategy to expand its global supply network.

- On August 16, 2024, marking the second anniversary of President Biden’s Inflation Reduction Act, the U.S. Department of Agriculture (USDA), led by Secretary Tom Vilsack, announced funding for 160 projects across 26 states. These projects aim to expand clean energy systems and boost domestic biofuel availability, creating new market opportunities and jobs for U.S. farmers and ranchers. This initiative supports President Biden’s goal of growing the U.S. economy through sustainable, middle-class-focused investments.

- In 2023, HF Sinclair Corporation (NYSE: DINO) completed its acquisition of Holly Energy Partners, L.P. (HEP). The deal involved HF Sinclair acquiring all remaining HEP common units not already owned by the company, through a combination of stock and cash. This merger consolidates HF Sinclair’s control over HEP and enhances its operational efficiencies within the energy sector.

Conclusion

The biofuels market is positioned for significant growth as global efforts to reduce carbon emissions and shift towards renewable energy sources intensify. Governments and industries worldwide are increasingly adopting biofuels as a cleaner alternative to fossil fuels, particularly in sectors like transportation and aviation, which are under pressure to lower their environmental impact. Advanced biofuels, which use non-food feedstocks like waste materials and algae, are gaining momentum as they offer greater sustainability.

Supportive policies, such as blending mandates and incentives, continue to drive demand, while ongoing technological advancements are helping to lower production costs and improve efficiency. As the world prioritizes sustainability, the biofuels market is expected to expand rapidly, playing a critical role in the transition to a greener, more energy-secure future.