Table of Contents

Introduction

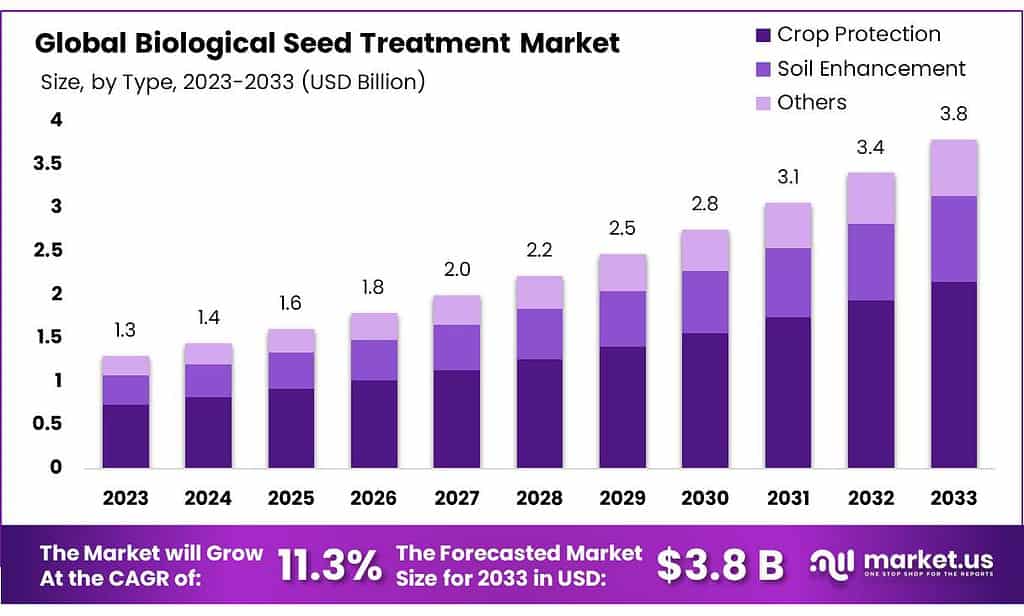

The global Biological Seed Treatment Market is poised for significant growth, with projections indicating a market value of USD 3.8 billion by 2033, up from USD 1.3 billion in 2023, reflecting a compound annual growth rate (CAGR) of 11.3% during the forecast period from 2023 to 2033.

Biological seed treatments utilize natural agents, including beneficial microorganisms such as bacteria and fungi, as well as plant-derived compounds, to enhance seed quality and crop yield. These treatments are applied to seeds before planting to improve germination, foster root development, and protect against pests and diseases. The adoption of biological seed treatments is driven by the growing demand for sustainable agricultural practices and the need to reduce reliance on synthetic chemicals, thereby minimizing environmental impact.

Several factors are contributing to the growth of the biological seed treatment market. The increasing awareness and regulatory support for sustainable farming practices are major drivers. Governments worldwide are implementing policies to reduce chemical pesticide use, thereby encouraging the adoption of biological alternatives. Additionally, the rising consumer preference for organic and chemical-free food products is propelling market growth. Technological advancements and innovations in biological treatments, such as the development of biofungicides and microbial inoculants, further enhance market expansion.

However, the market faces challenges, including the higher cost of biological seed treatments compared to chemical alternatives and the shorter shelf life and specific storage conditions required for these biological products. Regional variations in regulatory frameworks also pose a challenge for market players attempting to introduce new products globally.

Recent developments in the market highlight the dynamic nature of the industry. For instance, Novozymes launched several biological solutions in 2021 aimed at improving yield and fertility, while BASF has committed to numerous R&D projects focused on sustainable agriculture. In North America, the introduction of products like Syngenta’s Draco seed treatment reflects the region’s robust market for biological seed treatments.

Regionally, North America holds a significant share of the market, driven by high awareness and adoption of sustainable agricultural practices. The region benefits from a well-developed agricultural input market and strong distribution networks. Asia-Pacific is expected to experience the fastest growth, supported by government initiatives promoting organic farming and increasing awareness of sustainable practices. Europe also shows considerable growth potential due to stringent regulations on chemical pesticide use and a strong emphasis on high-quality agricultural products.

Key Takeaways

- Market Growth: Expected worth of USD 3.8 billion by 2033, with a CAGR of 11.3% from 2023.

- Dominant Seed Type: Microbials hold over 58.9% market share in 2023.

- Botanical Alternatives: Chemical-free botanical treatments enhance seed germination and plant vigor.

- Functional Focus: Crop protection dominates with over 56.8% market share in 2023.

- Crop Type Dynamics: Fruits & Vegetables lead with over 33.8% market share in 2023.

- Regional Insights: North America commands a 38.5% market share; Asia Pacific shows high growth potential.

- As of 2023, there are over 200 registered biological seed treatment products available globally.

- In 2023, a biological seed treatment containing Bacillus subtilis was reported to reduce Fusarium root rot in soybeans by up to 50%.

- Biological seed treatments can improve nutrient uptake and availability for plants, with some products increasing nitrogen fixation by up to 25%.

Seed Protection and Treatment Efficacy

- The seed protection segment held 67% of the market share in revenue during 2022.

- 70% of the seed requirement is met from the farmer’s stock without seed treatment.

- 80% of seed sown in the country is untreated, compared to 100% seed treatment practice in developed countries.

- The seedling mortality rate due to Pythium aphanidermatum was 26.7% lower than the sterile water control.

- The seedling mortality rate due to Pythium aphanidermatum was 20% lower than carbendazim.

- The seedling mortality rate caused by Fusarium spp. was 44.31% lower than the control.

- The seedling mortality rate caused by Fusarium spp. was 22.36% lower than carbendazim.

- Endophytic bacteria recorded a 38% incidence of Fusarium wilt and disease severity indices of 0.37.

- Uncoated seeds and seed coating without endophytic bacteria showed 70% and 50% disease incidences, respectively.

- Disease severity indices for uncoated seeds and seed coating without endophytic bacteria were 2.00 and 1.25, respectively.

- Isolate Th-Sks showed 79.47% growth inhibition of Phytophthora infestans with a suppression efficacy of 91–100% in the field.

- The pre-experiment showed the most significant germination percentage of 61.66% from the uncoated treatment.

Seedling Emergence and Growth

- The highest percentage of seedling emergence (89.44%) was observed after the T36 treatment at all levels of drought stress.

- The lowest seedling emergence percentage (47.22%) was observed after the non-inoculation treatment.

- Inoculation treatments increased the seedling emergence percentage by 37.2% compared to the non-inoculation treatment.

- Film coating involves a thin film applied to the seed, typically less than 10% of the mass of the original seed.

- Encrustment involves an applied material that is 100%–500% of the original seed mass but maintains the seed’s shape.

- In 1949, ICI commercialized Mergamma A, containing 1% mercury and 20% lindane, an early example of seed protection from fungal and insect attacks.

Emerging Trends

Increased Focus on Sustainability: Biological seed treatments are gaining popularity due to their environmental benefits compared to traditional chemical treatments. These treatments help reduce chemical residues in crops and the environment, aligning with the global push toward sustainable agriculture. This trend is particularly strong in North America and Europe, where regulatory pressures and consumer demand for organic products are high.

Advancements in Microbial Technologies: The use of microbial-based seed treatments is expanding, with innovations that include the development of biofungicides, bioinsecticides, and biostimulants. These products utilize beneficial bacteria and fungi to enhance plant growth, improve disease resistance, and increase nutrient uptake. This segment is expected to see significant growth, with microbial treatments projected to dominate the market due to their effectiveness and lower environmental impact.

Integration with Precision Agriculture: Advances in precision agriculture technologies are being integrated with biological seed treatments to optimize their application and effectiveness. This integration allows for precise delivery of biological agents to the seeds, ensuring better germination rates and healthier crops. The use of data analytics and IoT devices in agriculture helps monitor and adjust treatment applications in real time, enhancing crop yield and reducing waste.

Regulatory Support and Bans on Chemical Pesticides: The banning of certain chemical pesticides in regions like the European Union has led to increased adoption of biological alternatives. Regulatory bodies are encouraging the use of biopesticides and other biological treatments through incentives and supportive policies. This regulatory shift is driving innovation and investment in the biological seed treatment sector.

Expansion of Product Portfolios by Key Players: Major agricultural companies are continuously expanding their product portfolios with new and innovative biological seed treatments. Companies like Syngenta, Bayer, and BASF are investing heavily in research and development to introduce products that cater to various crops and regional needs. Recent product launches include bio fungicides that target specific pathogens and biostimulants that enhance plant vigor and resilience.

Growing Adoption in Emerging Markets: Emerging markets, particularly in Asia-Pacific and Latin America, are witnessing a surge in the adoption of biological seed treatments. Factors such as increasing awareness of sustainable farming practices, government support for organic agriculture, and the need to boost agricultural productivity are driving this trend. Countries like China, India, and Brazil are at the forefront of this growth, leveraging biological treatments to meet the rising demand for food and agricultural commodities.

Collaborations and Partnerships: Strategic collaborations and partnerships among companies are becoming more common as they seek to expand their market presence and product offerings. Partnerships between agricultural giants and biotech firms are helping to accelerate the development and commercialization of new biological seed treatments. These collaborations often involve the sharing of technology, expertise, and market access, benefiting all parties involved.

Use Cases

Improving Root Growth and Nutrient Uptake: Biological seed treatments, such as those offered by Locus AG, promote robust root growth by establishing a symbiotic relationship between plants and beneficial microbes. This relationship enhances the plant’s ability to extract nutrients and water from the soil, leading to a denser and more extensive root system. Enhanced nutrient uptake ensures the crop receives the nourishment needed for optimal growth, resulting in improved plant vigor and resilience.

Boosting Crop Yields: Farmers using biological seed treatments often see significant improvements in crop yields. For instance, in field trials, corn treated with Marrone Bio Innovations’ all-biological seed treatment showed an average yield increase of 10.9 to 12.5 bushels per acre, outperforming conventional chemical treatments. This yield boost translates to higher profitability for farmers, making biological treatments a worthwhile investment.

Pest and Disease Management: Biological seed treatments provide effective protection against various pests and diseases. Products like Marrone Bio Innovations’ Rootella combine mycorrhizal inoculants with bioinsecticides, bionematicides, and bio fungicides to manage pests such as corn rootworms and diseases like Sudden Death Syndrome in soybeans. These treatments offer an eco-friendly alternative to synthetic pesticides, reducing environmental impact while maintaining crop health.

Supporting Sustainable Agriculture: The push for sustainability in agriculture has led to increased adoption of biological seed treatments. These treatments help reduce chemical residues in crops and minimize environmental impact. For example, Albaugh’s BioST platform includes nematicides, insecticides, and biostimulants that support sustainable farming practices by enhancing soil health and reducing reliance on synthetic chemicals.

Enhancing Seed Safety and Compatibility: Biological seed treatments are designed to be safe for seeds and compatible with other agricultural inputs. Verdesian Life Sciences’ Seed+ technology, for example, upregulates genes within plants to improve stress resistance and nutrient use efficiency. Such treatments are formulated to ensure seed safety, avoid phytotoxicity, and are compatible with existing seed treatment systems, making them easy to integrate into current farming practices.

Expanding Use in Diverse Crops: Biological seed treatments are not limited to major row crops like corn and soybeans but are also effective in specialty crops. For instance, Locus AG’s Rhizolizer Duo has shown benefits in cotton, leading to larger taproots and overall greater plant vigor. These treatments can be customized to various crop types, enhancing their versatility and applicability across different agricultural sectors.

Adoption in Organic Farming: The organic farming sector is particularly receptive to biological seed treatments due to the absence of synthetic chemicals. Products like Marrone Bio Innovations’ comprehensive biological treatments are ideal for organic growers seeking effective pest and disease management solutions without compromising organic certification standards.

Major Challenges

Cost and Economic Viability: Biological seed treatments often come at a higher cost compared to traditional chemical treatments. This increased cost can be a barrier for many farmers, especially those operating on tight margins. While these treatments can lead to higher yields and long-term benefits, the initial investment is higher, which can be a deterrent for some farmers.

Variable Efficacy: The effectiveness of biological seed treatments can vary significantly depending on environmental conditions, soil types, and crop varieties. Unlike chemical treatments that have consistent performance, biological treatments may not work as effectively in all situations. This inconsistency can make farmers hesitant to adopt these solutions widely.

Regulatory Hurdles: The regulatory environment for biological seed treatments is complex and varies by region. Obtaining approval for new biological products can be a lengthy and costly process, which can delay the introduction of innovative solutions into the market. Companies must navigate different regulatory requirements, which can complicate the development and distribution of biological treatments.

Storage and Shelf Life: Biological seed treatments often require specific storage conditions to maintain their viability. They may have shorter shelf lives compared to chemical treatments, necessitating careful handling and timely application. This can add logistical challenges for distributors and farmers, who need to ensure that the biologicals remain effective until use.

Compatibility with Existing Practices: Integrating biological seed treatments into existing farming practices can be challenging. Farmers may need to adjust their equipment and processes to accommodate these treatments, which can require additional investment and training. Ensuring that biologicals are compatible with other inputs and farming practices is crucial for their successful adoption.

Education and Awareness: There is still a significant need for education and awareness among farmers regarding the benefits and proper use of biological seed treatments. Misconceptions and a lack of understanding about how these treatments work can lead to underutilization or incorrect application, reducing their effectiveness. Ongoing education and support from agricultural advisors are essential to overcoming this challenge.

Market Growth Opportunities

Rising Demand for Sustainable Agriculture: With increasing awareness about the environmental and health impacts of chemical pesticides, there is a growing shift towards sustainable agricultural practices. Biological seed treatments, derived from natural sources like microbes and plant extracts, offer an eco-friendly alternative. This trend is particularly strong in developed regions like North America and Europe, where regulations favor sustainable practices.

Technological Advancements: Ongoing research and development in biotechnology are leading to the discovery of new microbial strains and bioactive compounds with potent seed treatment properties. These advancements are expanding the range of available products, offering farmers more effective and diverse options for crop protection and enhancement.

Regulatory Support: Regulatory agencies are increasingly supportive of biological seed treatments due to their minimal environmental impact and reduced risk to human health. This favorable regulatory environment encourages innovation and investment in new biological solutions, helping to drive market growth.

Expansion in Emerging Markets: Emerging markets in Asia-Pacific and Latin America present significant growth opportunities. These regions are experiencing rapid agricultural development, with an increasing focus on food security and sustainable practices. The rising population and growing awareness about the benefits of biological seed treatments are driving demand in these markets.

Growing Adoption of Organic Farming: The demand for organic food products is rising globally, leading to increased adoption of organic farming practices. Biological seed treatments are integral to organic farming as they do not involve synthetic chemicals. This trend is creating substantial opportunities for market expansion, particularly in regions with strong organic food markets.

Product Innovation and Strategic Partnerships: Companies in the biological seed treatment market are focusing on product innovation and forming strategic partnerships to enhance their market presence. Innovations in seed treatment formulations, such as combining biological and chemical components for enhanced efficacy, are gaining traction. Strategic collaborations help companies leverage each other’s strengths, expanding their product portfolios and market reach.

Recent Developments

BASF SE has been actively expanding its portfolio in the biological seed treatment sector throughout 2023 and 2024. In January 2023, BASF introduced new varieties of FiberMax and Stoneville cotton seeds for the 2024 growing season, featuring advanced traits for pest and disease resistance, aimed at improving yield potential and fiber quality. In March 2024, BASF broke ground on a new fermentation plant in Ludwigshafen, set to produce biological fungicides and seed treatments. This plant will be operational by the second half of 2025 and will enhance BASF’s capacity to meet the growing demand for sustainable agricultural solutions. Additionally, BASF’s biological seed treatments, including Poncho® Votivo®, Votivo® Prime, and Integral® Pro, continue to offer innovative solutions for protecting and enhancing crop growth, targeting various pests and diseases while promoting plant health and yield improvement.

Bayer AG focused on expanding its capabilities in the biological seed treatment sector through strategic partnerships and innovation. In February 2023, Bayer announced a strategic partnership with Kimitec to accelerate the development and commercialization of biological crop protection solutions and biostimulants. This collaboration leverages Kimitec’s expertise in biologicals and Bayer’s extensive field-testing resources and market reach. Throughout the year, Bayer also advanced its SeedGrowth platform, integrating new biological seed treatments aimed at improving crop resilience and yield, particularly through the development of new bionematicides for nematode control. Moving into 2024, Bayer continued to innovate, launching several new biological products as part of their integrated seed treatment solutions, focusing on sustainable agriculture practices and enhancing crop productivity globally.

In 2023, Syngenta AG strengthened its position in the biological seed treatment sector through strategic initiatives and new product launches. In May 2023, Syngenta collaborated with Unium Bioscience to introduce NUELLO® iN, a novel biological seed treatment that improves nitrogen use efficiency, enhances crop yield and promotes plant and soil health. This product was first made available in the UK, with plans for broader distribution across northwest Europe in 2024. In October 2023, Syngenta opened its first biological service center at The Seedcare Institute in Maintal, Germany. This center is equipped with state-of-the-art technologies to support the growing demand for biological seed treatments, offering advanced services and application support to farmers across the EU. These initiatives demonstrate Syngenta’s commitment to sustainable agriculture and its leadership in the biological seed treatment market.

In 2023 and 2024, INCOTEC Group BV focused on advancing sustainable seed treatment solutions, particularly through the development of microplastic-free seed coatings. In March 2023, INCOTEC launched a new generation of microplastic-free seed coatings designed for both vegetable and field crops. These products meet industry standards for safety and effectiveness, aiming to reduce environmental impact amid growing regulatory pressures to eliminate microplastics in Europe by 2027. Additionally, in June 2024, INCOTEC expanded its microplastic-free product line to include solutions for corn, demonstrating its commitment to innovation and sustainability in seed treatment. This strategic focus aligns with global trends toward eco-friendly agricultural practices and addresses the increasing demand for sustainable seed treatment options.

Conclusion

The biological seed treatment market is set to experience significant growth driven by several key factors. Increasing awareness about sustainable agricultural practices and the need to reduce chemical use are major drivers. Supportive regulations for biopesticides and integrated pest management (IPM) further boost this market. Driven by the rising demand for organic farming, climate change concerns, and the focus on sustainable crop protection methods.

Technological advancements and strategic collaborations in research and development are expected to play a significant role in market growth. Companies like BASF SE, Bayer AG, and Syngenta AG are heavily investing in innovative biological seed treatments to improve crop yield and soil health while reducing environmental impact. The expansion of agricultural sectors in regions like Asia-Pacific is also expected to contribute to the market’s robust growth. As the industry continues to innovate and adapt to changing regulatory and environmental landscapes, the biological seed treatment market is poised for continued expansion and greater adoption globally.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)