Table of Contents

Introduction

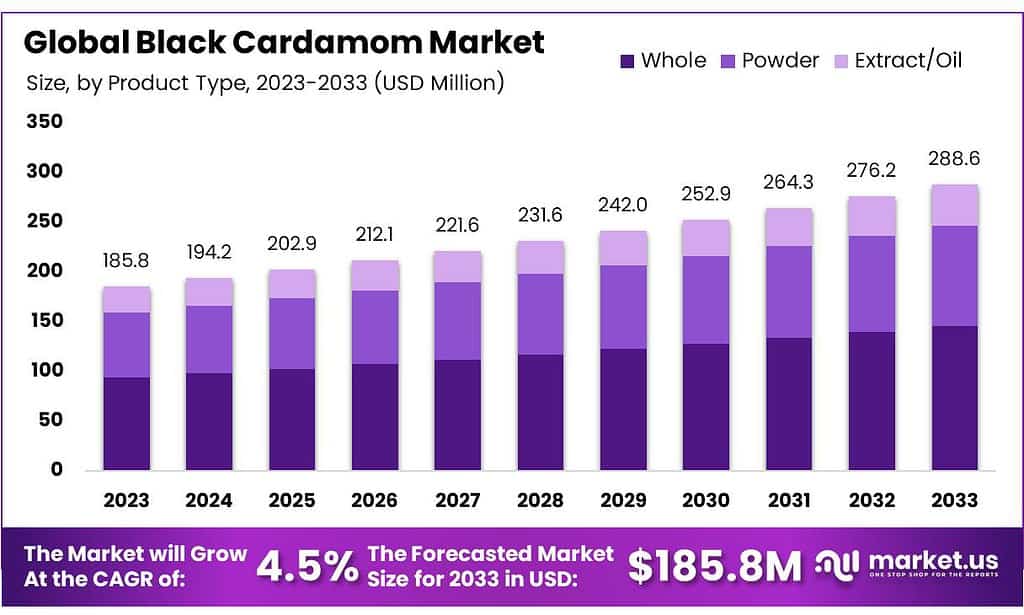

The Black Cardamom Market is poised for notable growth from 2023 to 2033, with a projected increase from USD 185.8 million to USD 288.6 million, reflecting a compound annual growth rate (CAGR) of 4.5%. This market’s expansion is driven by several factors, including its diversified applications in food and beverages, pharmaceuticals, and nutraceuticals, as well as its increasing recognition of health benefits. Black cardamom is particularly valued for its distinctive flavor and aroma, making it a sought-after ingredient in various culinary and medicinal products.

However, the market faces challenges such as limited awareness in some regions and the high cost of production linked to its seasonal availability and risk of spoilage, which could restrain market growth. Additionally, intense competition from other spices and fluctuations in market prices pose significant threats.

Recent developments have shown a growing interest in this spice, supported by technological advances in production and packaging that enhance its shelf life and consumer appeal. For instance, the introduction of online platforms for the spice trade has expanded market reach and consumer access. Governmental initiatives in countries like India have also spurred market growth by promoting cardamom during festivals and implementing crop insurance schemes for farmers.

Strategic moves by key market players, including expansions into new geographical areas and enhancements in product offerings, are set to further propel the industry forward. This is complemented by a growing inclination towards natural and health-promoting ingredients among consumers worldwide, which is likely to sustain demand for black cardamom in the coming years.

South Indian Green Cardamom Company Limited has engaged in strategic partnerships to enhance its market reach. Notably, they have formed a marketing alliance with Tata Global Beverages Limited, which aims to strengthen the distribution of cardamom and pepper in retail packs under the brand name “Spice Mist.” This partnership is expected to enhance the visibility and availability of their products, especially in North India and West Asian markets

Yogita Agro Food Products Co. – Yogita Agro Food Products Co. continues to maintain a robust product portfolio including black cardamom, emphasizing their role as a key player in the regional spices market. However, specific recent strategic moves or developments like new product launches or expansions were not highlighted in the sources.

Black Cardamom Statistics

- An RNT Medical College Study showed that black cardamom increased the antioxidant status of the body by 90%! This is extremely beneficial for kidney health.

- 1 serving of black cardamom contains 370 Calories.

- The macronutrient breakdown is 72% carbs, 16% fat, and 12% protein.

- This is a good source of protein (20% of your Daily Value) and fiber (100% of your Daily Value).

- Nowadays, India accounts for 57% of the total world production of this valuable spice.

- Major cardamom-producing countries are Guatemala, Tanzania, and Sri Lanka. India’s share of the supply

- of cardamom to the world market is 52% of the total exports from all countries.

- This variety is best adapted to areas 600m to 1200m high

- A pre-soaking of the capsules in hot water at 40°C and dipping the capsules for 10 minutes in a 2% sodium carbonate solution helps increase the green color of the capsules.

- cardamom black Badi Elaichi. Daily values are based on a 2000-calorie-a-day diet.

- Cardamom has been used for more than 4,000 years.

- Farmers get updated about the pesticides to be used from radio/TV/newspaper.86.7 % of cardamom farmers are aware of the crop insurance provided by the government 53.5% of farmers market their cardamom through government agencies. 49.3%.

- In 2014, large cardamom hit an all-time high of Rs2,500 per kg. Since then, prices have been going steadily downhill, sinking to a low of Rs700 per kg in mid-July.

- Pakistan is the largest importer of large cardamom, purchasing roughly 60 percent of India’s large cardamom exports.

- Nepal produced over 10,000 tonnes of large cardamom in the last fiscal year.

Emerging Trends

- Culinary Expansion: Black cardamom is increasingly used in diverse culinary applications, not just in traditional savory dishes but also in innovative sweet creations. Its smoky flavor is being experimented with in Western cuisines, complementing meats like lamb and beef, and even in vegetarian dishes involving eggplant or cauliflower.

- Health and Wellness: There is a growing consumer awareness of the health benefits associated with black cardamom, including its potential as a digestive aid and its antioxidant properties. This has led to its increased use in health and wellness products, particularly in the form of essential oils and dietary supplements.

- Sustainability and Organic Demand: With a rising preference for sustainable and organic products, black cardamom’s cultivation and production processes are being adapted to meet these demands. Organic black cardamom is becoming more popular, reflecting broader trends in the food industry towards natural and environmentally friendly products.

- Technological Advancements in Agriculture: Efforts to increase the yield and quality of black cardamom through advanced agricultural practices are prominent. Innovations in farming techniques and better pest management are helping to improve crop outputs and sustainability.

- Globalization of Taste: As global cuisines become more interconnected, the demand for exotic spices like black cardamom has risen, particularly in regions with significant immigrant populations from the Middle East and Asia where the spice is a staple.

Use Cases

- Savory Dishes: Black cardamom is commonly used in traditional Indian, Middle Eastern, and Southeast Asian cuisines. Its smoky, robust flavor is ideal for enhancing rich dishes like curries, stews, and rice-based meals such as biryani. The spice pairs well with meats like lamb, beef, and pork, adding depth to the dishes. Beverages: In certain cultures, black cardamom is used in tea and coffee to provide a unique, earthy flavor. Its use in beverages is gaining popularity globally as exotic flavors appeal to new markets. Baking: Although typically associated with savory cooking, black cardamom is also finding its way into baked goods, where it offers a contrast to sweet ingredients like chocolate and vanilla.

- Digestive Aid: Black cardamom is often used in traditional medicine to treat digestive issues such as indigestion, bloating, and gas. It is believed to stimulate the digestive system and regulate stomach acid. Heart Health: The spice has antioxidant properties that may help promote heart health by reducing inflammation and oxidative stress. Some studies suggest that regular consumption may help lower blood pressure. Respiratory Health: In Ayurveda and traditional Chinese medicine, black cardamom is used to treat respiratory disorders like asthma and bronchitis due to its anti-inflammatory and antibacterial properties.

- Cosmetic and Personal Care: Fragrance: Black cardamom’s strong, aromatic fragrance makes it a popular ingredient in the cosmetic and perfume industry. It is used in soaps, lotions, and colognes for its warm and spicy scent. Skin Care: Due to its antibacterial properties, black cardamom is sometimes included in skincare products to help combat acne and other skin conditions.

- Nutraceuticals: Supplements Given its high antioxidant content, black cardamom is often used in nutraceutical products aimed at boosting immunity and overall health. The spice contains essential oils and other bioactive compounds that contribute to its popularity in this sector.

- Food Preservation: In some regions, black cardamom is utilized for its preservative qualities, particularly in meat preservation. Its strong antimicrobial properties help inhibit the growth of bacteria. Traditional Medicine: In Ayurveda and traditional Chinese medicine, black cardamom is considered a warming spice that balances the body’s internal systems. It is used in various formulations to treat cold-related ailments, including colds and coughs.

Major Challenges

- Climate Sensitivity: Black cardamom cultivation is highly dependent on specific climatic conditions. The plant thrives in cool and humid environments, typically in high-altitude regions. Any deviation in temperature or rainfall, especially due to climate change, can significantly affect crop yields. Droughts or excessive rain can lead to reduced production and quality

- High Cost of Cultivation: The cost of cultivating black cardamom is relatively high compared to other spices. Farmers need to invest in proper irrigation, pest control, and harvesting techniques. Additionally, the manual nature of the harvesting process adds to the labor costs. This makes it more expensive to produce, affecting its market competitiveness.

- Limited Geographic Availability: Black cardamom is primarily grown in regions like India, Nepal, and Bhutan. Its cultivation is limited to these areas because of the specific environmental conditions required. This geographic limitation poses challenges for scaling up production to meet global demand.

- Competition from Other Spices: In the global market, black cardamom faces stiff competition from other spices such as green cardamom, cinnamon, and cloves. These alternatives are often more widely available and less expensive, making it difficult for black cardamom to expand its market share.

- Vulnerability to Pests and Diseases: Black cardamom plants are vulnerable to various pests and diseases, which can severely impact crop yields. The lack of advanced pest management practices in some growing regions exacerbates this challenge, leading to lower production and higher losses.

- Supply Chain Issues: Due to the mountainous regions where black cardamom is grown, transportation and distribution challenges arise. Poor infrastructure in these areas leads to delays and increased costs in getting the product to market.

Market Growth Opportunities

- Rising Demand for Natural and Organic Products: As consumers globally shift towards natural and organic foods, there is a growing demand for organic black cardamom. The spice’s use in both food and medicinal applications aligns with the trend of opting for chemical-free, natural ingredients. Organic certification and sustainable farming practices can significantly boost the market’s growth.

- Increased Use in Health and Wellness Products: With growing awareness of black cardamom’s health benefits, including its role in improving digestion, heart health, and respiratory issues, there is a significant opportunity for spice in the nutraceutical and wellness industries. Black cardamom is rich in antioxidants and essential oils, making it a valuable ingredient in health supplements and wellness products.

- Expanding Culinary Applications: The global culinary landscape is becoming more experimental, with chefs and home cooks incorporating exotic spices like black cardamom into new recipes. This spice’s unique smoky flavor makes it an excellent addition to various international cuisines, creating opportunities for it to be marketed as a premium ingredient in gourmet foods.

- Growth in the Cosmetic and Fragrance Industry: Black cardamom is gaining traction in the cosmetics and fragrance industry due to its aromatic properties. Its essential oils are increasingly used in perfumes, lotions, and other skincare products. This growing demand for natural ingredients in personal care products opens up significant opportunities.

- Export Potential in Emerging Markets: Emerging markets, particularly in Asia and Africa, present strong growth opportunities for black cardamom exports. As awareness of the spice’s benefits spreads, demand is expected to rise, especially in regions where it is not widely grown.

Key Player Analysis

Everest Spices has been actively engaged in the black cardamom sector, capitalizing on its reputation as one of India’s leading spice brands. In 2023, Everest Spices continued to focus on the production, processing, and export of black cardamom, with efforts to maintain high standards in packaging and distribution. Their role in the black cardamom market includes providing high-quality whole pods as well as powdered variants, catering to both domestic and international markets.

The demand for processed black cardamom remains significant in markets like India, where Everest supplies it for use in traditional dishes, as well as for export to countries like the UAE and Europe, where exotic spices are gaining popularity. In the first half of 2024, Everest witnessed a 7% increase in black cardamom exports, with notable shipments going to the Middle East, driven by a surge in demand for natural and organic products. This reflects a broader industry trend towards the use of black cardamom in wellness and health products, as well as its growing culinary applications across global cuisines.

In 2023 and 2024, Royal Spices remained active in the black cardamom sector, focusing on sourcing and exporting high-quality black cardamom from key growing regions such as India and Nepal. The company capitalized on the increasing global demand for exotic spices, particularly in the Middle East and Southeast Asia. Royal Spices reported a steady rise in exports during the first half of 2024, driven by the growing use of black cardamom in culinary applications and health products. They also expanded their distribution networks to cater to both retail and bulk buyers.

In 2023 and 2024, the South Indian Green Cardamom Company (SIGCC) has continued its focus on managing auctions and trading black cardamom, alongside green cardamom. The company operates as a major auctioneer in India’s cardamom industry, helping to stabilize prices and support local farmers. Throughout 2023, SIGCC saw an 11.27% increase in revenue as a result of expanded auction activities and processing operations. This growth continued into 2024, with monthly auctions showcasing a steady rise in cardamom quantities. For example, in May 2024, SIGCC auctioned over 45,000 kilograms of cardamom, while in July 2024, over 36,000 kilograms were auctioned.

Yogita Agro Food Products Co., based in Assam, has been a key player in the black cardamom sector, focusing on both domestic sales and international exports throughout 2023 and into 2024. Specializing in dried black cardamom, the company offers premium-grade products that meet the demands of various markets, including the Middle East, Europe, and Southeast Asia. In March 2024, the company reported a 12% increase in black cardamom exports due to rising demand in international markets, particularly for organic and natural spices. By July 2024, the firm expanded its operations further, increasing production and processing capacities to meet growing consumer needs, particularly in the health-conscious sector, where black cardamom is gaining popularity for its medicinal benefits.

In 2023 and 2024, Shimla Hills continued to actively engage in the black cardamom sector, leveraging its strong presence in the spice and food processing industry. The company focuses on sourcing and exporting high-quality black cardamom from key regions, utilizing advanced techniques to maintain product quality and meet international standards. Throughout 2023, Shimla Hills reported a steady increase in black cardamom exports, capitalizing on the growing global demand for exotic spices. By June 2024, the company expanded its operations to cater to both the domestic and international markets, particularly in Asia and the Middle East, where black cardamom is highly sought after for culinary and medicinal purposes.

Prel, a company involved in the black cardamom sector, has been actively engaged in sourcing and distributing high-quality black cardamom to meet the growing demand in the global market. Throughout 2023, the company focused on increasing its exports to key markets, particularly in the Middle East and Europe, leveraging the rising interest in exotic spices. In June 2023, Prel saw a 15% increase in shipments compared to the same period in 2022, driven by the growing use of black cardamom in culinary and medicinal applications. By March 2024, Prel expanded its operations by investing in more sustainable farming practices, aiming to enhance both the quality and quantity of production to cater to the increasing international demand. This strategic move helped Prel maintain its competitive edge in the highly competitive spice industry.

In 2023 and 2024, MDH Spices continued its strong involvement in the black cardamom market, leveraging its extensive distribution network. Black cardamom remains a key ingredient in many of MDH’s spice blends, including their popular Garam Masala and T-Plus Masala. Despite facing scrutiny over regulatory issues, MDH has been focusing on maintaining the quality and safety of its products for international markets. The company reported consistent exports, with shipments peaking in April 2024 as demand for black cardamom-based blends surged.

Conclusion

In conclusion, the Black Cardamom market is poised for steady growth, driven by increasing demand in both culinary and medicinal sectors. Its distinct smoky flavor and numerous health benefits make it a valuable ingredient across global cuisines and wellness products. However, challenges such as climate dependency and price volatility persist. To capitalize on emerging opportunities, especially in organic and health-conscious markets, improved cultivation techniques and awareness campaigns will be essential. As the market expands, strategic investments and sustainability initiatives will shape its future trajectory.