Table of Contents

Introduction

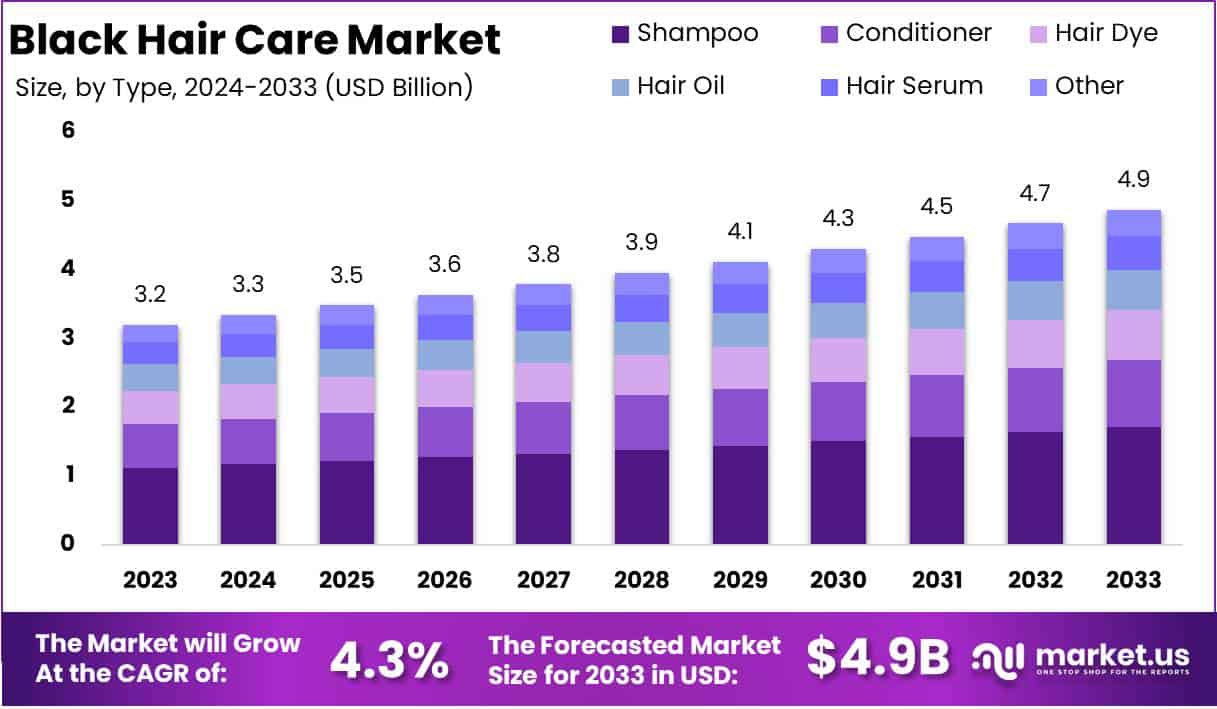

The Global Black Hair Care Market is projected to grow from USD 3.2 billion in 2023 to approximately USD 4.9 billion by 2033, registering a compound annual growth rate (CAGR) of 4.3% over the forecast period (2024-2033).

Black hair care refers to the range of products, services, and practices designed specifically to meet the unique needs of Black hair types. This includes coily, kinky, curly, and textured hair, which often require specialized treatments to maintain moisture, prevent breakage, and promote healthy growth.

The category encompasses shampoos, conditioners, oils, styling creams, relaxers, natural hair treatments, and protective styling products such as wigs, weaves, and braids. In addition, it also involves professional services provided by salons and stylists who specialize in Black hair care.

The Black Hair Care Market is a dynamic and rapidly evolving sector within the broader beauty and personal care industry. It comprises a diverse array of products, services, and distribution channels aimed at addressing the specific needs of Black consumers. Historically underrepresented by mainstream brands, the market has seen significant growth fueled by both entrepreneurial ventures and the increasing inclusion of diverse product lines by major players.

This market not only caters to individual consumers but also spans salon services, e-commerce platforms, and specialty retail outlets. As a culturally significant industry, Black hair care plays a pivotal role in identity and self-expression, making it a vital component of the global beauty economy.

Growth Factors

Several factors are driving the growth of the Black Hair Care Market. Rising awareness around the importance of tailored hair care solutions and the shift toward natural hair movements have significantly influenced consumer preferences. The increasing purchasing power of Black consumers and the growing demand for high-quality, culturally relevant products are further propelling the market.

Innovations in product formulations, such as sulfate-free shampoos, deep conditioners, and plant-based hair oils, have also contributed to growth. Furthermore, social media and influencer marketing have amplified brand visibility, fostering community engagement and accelerating market expansion.

Take advantage of our unbeatable offer - buy now!

Demand in the Black Hair Care Market remains robust, underpinned by a diverse consumer base seeking products that cater to a variety of hair textures and styles. The natural hair movement has spurred demand for chemical-free and organic products, while protective styling options continue to see high uptake due to their versatility and convenience.

The Black Hair Care Market presents significant opportunities for both established companies and emerging brands. There is a growing appetite for innovation, particularly in the areas of clean beauty, personalized hair care, and tech-enabled solutions such as virtual consultations and AI-driven product recommendations. The expansion into untapped markets, including Asia and Europe, offers growth potential as awareness and appreciation for Black hair care products increase globally.

Key Takeaways

- The global Black hair care market is poised for significant growth, projected to expand from USD 3.2 billion in 2023 to USD 4.9 billion by 2033, reflecting a steady CAGR of 4.3% from 2024 to 2033.

- Shampoo led with 35% market share in 2023, highlighting its critical role in scalp health.

- The household segment dominated at 58%, driven by the DIY hair care trend.

- Offline channels held 62%, reflecting consumer preference for in-store experiences.

- North America accounted for 40%, supported by a strong African-American consumer base and rising demand for specialized products.

Black Hair Care Statistics

- Black consumers in the U.S. spend $473 million annually on hair care.

- 40% of U.S. women use products designed for Black hair.

- Black consumers represent over 70% of hair extension sales.

- 80% of Black consumers prioritize customized hair products.

- Black women spend 6 times more on hair care than other ethnicities.

- $1.2 trillion spent by African American women on beauty products, including hair care.

- Black women spend $503 annually on average for hair care.

- Black-owned brands make up only 3% of the ethnic hair market.

- 20% of Black consumers face limited product variety.

- 19% struggle to find suitable hair products.

- Hair care accounts for 24% of the beauty industry’s revenue.

- U.S. hair care market valued at over $83 billion.

- Black consumers dominate 85.7% of the ethnic beauty market.

- Black men spend $62 million on toiletries.

- Black consumers spend $573.6 million on soap and bath products.

- 18% of Black consumers’ income goes to beauty and hair care.

- 81% prefer products marketed through Black media.

- 43% of Black spending power comes from women.

- Low-income Black households drive 43.3% of ethnic beauty sales.

- 70% of Black women wore natural hair in the past year.

- 21.8 million Instagram posts tagged “natural hair.”

- 90% of Black women have straightened their hair.

- 35% of natural hair users color monthly.

- 80% of products marketed to Black consumers contain harmful chemicals.

- 70% of Black women check product labels for toxic ingredients.

- 87% prioritize health and safety in personal care products.

- 50% of Black consumers see hair as central to identity.

- 38% are open to trying new hairstyles.

- 43% of Black women use five or more hair products.

- 81% prefer low-maintenance routines.

- 84% favor at-home styling.

- 59% of Black women aged 18–24 use deep conditioning treatments.

- Black consumers spend $3,000 annually on hair care.

- 70–80% of Black women chemically straighten their hair.

- 47% use hot oil treatments monthly.

- Black women spend 30–45 minutes daily on hair care.

Emerging Trends

- Shift Toward Natural Hair Styles: There is a growing preference among Black consumers for natural hair textures and styles, leading to a decline in the use of chemical relaxers. This trend is evident as sales of hair relaxers decreased by 18.6% between 2016 and 2021.

WORLDMETRICS - Rise of Black-Owned Hair Care Brands: Black entrepreneurs are increasingly launching hair care brands tailored to the specific needs of Black consumers. However, these brands currently represent only 3% of the ethnic hair and beauty market, indicating significant potential for growth.

- Increased Investment in Research and Development: Companies are dedicating more resources to develop products that cater to diverse hair textures and conditions. For instance, Spelman College introduced a cosmetic chemistry program focusing on the unique needs of Black beauty consumers.

- Expansion of Distribution Channels: Black hair care products are becoming more accessible through various retail channels. Mass merchandisers are popular, with 64% of Black consumers purchasing from stores like Walmart or Target, and almost half shopping online on platforms like Amazon.

- Emphasis on Scalp Health and Personalized Care: There is a growing focus on scalp health, with brands offering personalized solutions for different scalp types. This trend aligns with the broader movement toward personalized beauty and wellness products.

Top Use Cases

- Moisturizing and Hydration: Due to the unique structure of Black hair, which can be prone to dryness, products that provide deep moisture and hydration are essential. This includes the use of conditioners, hair oils, and leave-in treatments.

- Protective Styling: Techniques such as braids, twists, and weaves are commonly used to protect hair from environmental damage and reduce breakage. These styles help maintain hair health and promote growth.

- Scalp Care: Maintaining a healthy scalp is crucial for hair growth and overall hair health. Products targeting scalp issues like dandruff and dryness are increasingly popular among Black consumers.

- Heat Styling Tools: Innovative heat styling tools designed specifically for curly and coily hair types are gaining traction. Brands are developing tools that minimize heat damage while effectively styling textured hair.

Hair Growth Treatments: Products aimed at promoting hair growth and reducing hair loss are in demand. The global market for hair loss products among people of African descent is expected to reach $400 million by 2025.

Major Challenges

- Limited Representation in Mainstream Retail: Black-owned hair care brands often face challenges in securing shelf space in major retail outlets. Only 4 to 7% of beauty brands carried by specialty beauty stores, drugstores, grocery stores, and department stores are Black brands.

- Funding and Investment Barriers: Black-founded beauty startups have experienced a decline in funding, with only $16 million raised in 2024, down from $73 million in 2022. This reduction hampers the growth and scalability of Black-owned hair care businesses.

- Product Accessibility: Consumers in certain regions may have limited access to Black hair care products, especially in areas where specialty stores are scarce. This can lead to reliance on online shopping, which may not be convenient for all consumers.

- High Product Costs: Specialized hair care products tailored for Black hair types often come at a premium price, which can be a barrier for some consumers. This is particularly challenging given that Black consumers are willing to pay premium prices for products that cater to their specific needs.

Lack of Research and Development: There is a need for more research focused on the unique characteristics of Black hair to develop effective products. The introduction of programs like Spelman College’s cosmetic chemistry initiative aims to address this gap.

Top Opportunities

- Development of Natural and Organic Products: There is a growing demand for hair care products made from natural and organic ingredients. Brands that focus on clean formulations can tap into this expanding market segment.

- Expansion into Emerging Markets: Regions with significant Black populations, such as parts of Africa and the Caribbean, present opportunities for market expansion. Tailoring products to meet the specific needs of consumers in these areas can drive growth.

- Leveraging E-commerce Platforms: With the rise of online shopping, establishing a strong e-commerce presence can help brands reach a wider audience. Online sales of Black hair care products have increased by 58% in recent years.

- Innovative Product Development: Investing in research to create products that address specific hair concerns, such as scalp health and hair growth, can differentiate brands in the market. The global market for hair loss products among people of African descent is expected to reach $400 million by 2025.

- Collaborations and Partnerships: Forming partnerships with influencers and celebrities can enhance brand visibility and credibility. Engaging with the community through events and social media can also build brand loyalty.

Key Player Analysis

- Procter & Gamble Co. (P&G) : P&G, a global leader in consumer goods, offers a range of hair care products tailored for Black consumers through brands like Pantene Gold Series. In the fiscal year ending June 2023, P&G reported net sales of $82.0 billion, with the Beauty segment contributing significantly.

- Unilever PLC : Unilever’s portfolio includes brands such as Dove and SheaMoisture, catering to the Black hair care market. In the first quarter of 2024, Unilever reported a turnover of €15.0 billion, reflecting strong performance in its beauty and personal care segments.

- L’Oréal SA : L’Oréal, a leading beauty company, offers products for Black hair through brands like Dark and Lovely. In 2023, L’Oréal’s market share was significant across various regions, underscoring its global reach.

- Revlon Inc. : Revlon provides hair care solutions for Black consumers under its Creme of Nature brand. The company’s financial performance has been stable, with a focus on expanding its multicultural product lines.

- Amka Products (Pty) Ltd: Amka Products, based in South Africa, specializes in personal care products, including those for Black hair. The company has a strong presence in the African market, offering a variety of hair care solutions.

Recent Developments

- In 2023, P&G Beauty announced its acquisition of Mielle Organics, a leading textured hair care brand known for its natural ingredients. The deal, pending regulatory approval, aims to expand access to high-quality hair care products for Black women worldwide.

- In 2023, Briogeo, a Black-owned hair care brand acquired by Wella in 2022, entered the professional channel through a partnership with Salon Centric. Starting August 1, Briogeo products became available in 600 stores, catering to licensed salon professionals.

- In 2024, CurlMix, the Chicago-based beauty brand founded by Kim and Tim Lewis, launched a new crowdfunding campaign. Since turning down a Shark Tank deal, the brand has achieved significant milestones, including placement in 460 Ulta Beauty stores and doubling its revenue from $13 million to $32 million within two years.

- In 2024, Fearless Fund closed a grant contest for Black women entrepreneurs as part of a legal settlement. This development highlighted the ongoing challenges in securing funding, with Black-founded U.S. startups raising just $228 million in the first half of 2024—only 0.3% of total U.S. startup funding and a 60% drop from the previous year.

Conclusion

The Black hair care market is set for steady growth, driven by evolving consumer preferences and an increased focus on products tailored to diverse hair needs. The market benefits from a growing emphasis on natural hair care and innovations in product formulations that cater to specific hair textures and conditions. Expanding distribution channels, including e-commerce, have made these products more accessible, while social media continues to enhance consumer engagement and brand awareness. However, the industry faces challenges such as limited retail representation and high product costs. Addressing these barriers presents opportunities for further innovation and market expansion, positioning the sector for sustained development in the coming years.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)