Table of Contents

Introduction

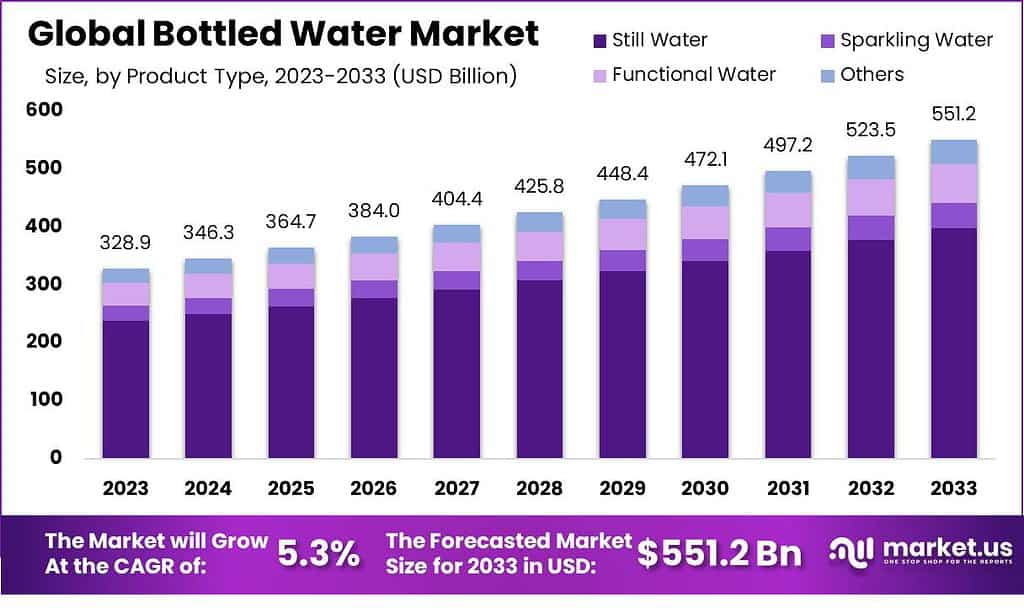

The global bottled water market is expected to expand from USD 328.9 billion in 2023 to approximately USD 551.2 billion by 2033, growing at a compound annual growth rate (CAGR) of 5.3%. This growth is driven by increasing health awareness among consumers and the demand for convenient, safe hydration solutions. The market is further bolstered by the rising consumption of still water, which holds the largest market share due to its health benefits and lack of additives found in carbonated alternatives.

Challenges facing the market include environmental concerns related to plastic waste and the sustainability of water resources. Companies are responding by adopting eco-friendly packaging solutions and focusing on sustainable water-sourcing practices. Recent developments reflect these trends, such as Coca-Cola India’s introduction of fully recycled PET bottles, signaling a shift towards more sustainable practices within the industry.

Market dynamics are also influenced by innovations in product offerings, such as the introduction of functional waters that cater to health-conscious consumers looking for hydration with additional health benefits. The distribution landscape is evolving too, with a significant volume of sales occurring through supermarkets and convenience stores, providing easy access to a wide range of bottled water products.

Recent developments in the bottled water market show significant activity among key players like Nestlé, PepsiCo, The Coca-Cola Company, DANONE, and Primo Water Corporation. These companies are engaging in strategic actions such as acquisitions, mergers, and new product launches to strengthen their market positions.

Nestlé has been active in reshaping its portfolio through acquisitions and disposals, focusing on enhancing its position in various markets. In 2020, Nestlé completed the acquisition of Aimmune Therapeutics, expanding into allergy therapies. In 2021, they acquired The Bountiful Company’s core brands and in 2023, Nestlé took a majority stake in a premium chocolate company in Brazil, which is part of its strategy to diversify its product offerings and enter new markets.

Key Takeaways

- Market Size and Growth: The global Bottled Water Market is expected to reach USD 551.2 billion by 2033. It is projected to grow at a CAGR of 5.3% from 2023 to 2033.

- Product Types: Still Water is the dominant segment in 2023, holding a market share of 72.3%.

- Packaging Plastic Bottles are the most popular packaging choice, with a market share of 68.5% in 2023.

- Distribution Channels: Online distribution is dominant, commanding a market share of 90.1% in 2023.

- Regional Analysis: Asia Pacific (APAC) holds a dominant market position, driven by a growing population and health-conscious trends.

Bottled Water Statistics

- Bottled water consumption in the U.S. reached 14.4 billion gallons in 2023.

- The global bottled water market is valued at approximately $200 billion.

- Around 30% of bottled water sold in the U.S. is purified municipal water.

- Sparkling water sales increased by 8% in 2023, reaching $9 billion globally.

- The average American drinks 39.3 gallons of bottled water per year.

- 70% of New Zealanders drink at least one coffee daily.

- 24% consume three or more cups daily.

- 30% of men drink three or more coffees daily, compared to 19% of women.

- Age and Coffee Consumption:

- 34% of Baby Boomers drink three or more coffees daily.

- Only 14% of Millennials consume three or more cups daily.

- Popular Coffee Orders:

- 31% of coffee drinkers in New Zealand order a flat white.

- Mocha and cappuccino tie as the second most popular orders at 18%.

- Regional Trends:

- Wellington is the “latte capital” with 23% preferring lattes.

- Mocha is twice as popular among women (24%) compared to men (12%).

- Reusable Cup Usage:

- 72% of coffee drinkers use reusable cups while purchasing coffee.

- Millennials lead in reusable cup usage, with 77% compared to 63% of Baby Boomers.

Emerging Trends

- Sustainability and Eco-Friendly Packaging: There is a significant shift towards sustainable practices, particularly in packaging. Companies are increasingly adopting eco-friendly packaging solutions such as recycled PET bottles and cans to reduce environmental impact. For instance, Coca-Cola Bangladesh launched 100% recycled PET bottles, marking a significant step towards reducing reliance on virgin plastics.

- Health-Conscious Products: The demand for bottled water types that offer additional health benefits, such as nutrient-fortified and functional waters, is on the rise. These products cater to health-conscious consumers looking for hydration options that support their wellness goals. The market for functional water, for example, is seeing faster growth rates due to its health benefits.

- Innovative Distribution Channels: The expansion of various distribution channels is also a notable trend. While supermarkets and hypermarkets remain dominant due to their wide range of offerings, online retail channels are growing rapidly. This growth is driven by the convenience they offer, particularly for consumers who prefer shopping from home. Direct sales channels are also gaining traction, allowing brands to engage directly with consumers and enhance customer loyalty.

- Increased Consumption in Developing Regions: Rapid urbanization in regions like the Asia Pacific is driving the demand for bottled water. Urban consumers are increasingly opting for bottled water due to rising health awareness and concerns about water purity. The market in these regions is expected to see significant growth, supported by higher disposable incomes and urban lifestyle trends.

- Product Diversification: Companies are diversifying their product ranges to include a variety of water types such as sparkling, mineral, and spring water, catering to diverse consumer preferences. This diversification is often accompanied by innovations in flavor and functionality, which help attract a broader customer base.

Use Cases

- Health and Safety: Consumers increasingly opt for bottled water due to concerns about the contamination of tap water. This trend is driven by the need for safe and clean drinking water, especially in areas where tap water may be compromised by pollutants. Bottled water, often filtered and purified, offers a reliable alternative for hydration that avoids the health risks associated with contaminated water sources.

- Convenience and Portability: Bottled water is highly valued for its convenience and portability. This makes it a popular choice for consumers who are traveling, participating in outdoor activities, or simply need a quick and easy hydration solution on the go. The packaging options, including PET bottles and cans, are designed to be easy to carry and use, which enhances consumer experiences during various activities.

- Emergence of Functional Waters: There is a growing segment within the bottled water market focusing on functional waters, which are enhanced with vitamins, minerals, or other health-promoting additives. These products cater to health-conscious consumers who are looking not just for hydration but also for additional health benefits from their beverages.

- Sustainability Initiatives: Amid increasing environmental concerns, the bottled water industry is seeing a push towards more sustainable practices, particularly in packaging. Innovations such as recycled PET (rPET) bottles are becoming more common, as companies aim to reduce their environmental footprint and appeal to eco-conscious consumers. This shift is part of a broader industry effort to balance consumer demand for bottled water with the need to minimize ecological impacts.

Key Players Analysis

Nestlé is committed to achieving a positive water impact by 2025, focusing on regenerating local water cycles where it operates. The company has pledged to invest in over 100 projects aimed at enhancing water retention at its sites, ensuring they retain more water than they use. This includes initiatives like reforestation and wetland restoration, alongside water stewardship certifications across its facilities.

PepsiCo, on the other hand, has expanded its presence in the bottled water market through innovative and sustainable products like SodaStream, which allows consumers to make carbonated water at home, reducing plastic waste. The acquisition of SodaStream highlights PepsiCo’s strategy to adapt to consumer preferences toward more sustainable and personalized beverage solutions.

The Coca-Cola Company is deeply engaged in sustainability efforts within the bottled water sector. It has committed to replenishing 100% of the water used in its finished beverages every year since 2015 and continues to strive for water neutrality. Coca-Cola focuses on various sustainable practices like enhancing water efficiency and expanding safe water access globally through community-oriented projects. The company’s product line includes the Glacéau Smartwater brand, which emphasizes premium hydration options with added electrolytes for a distinct taste.

DANONE, similarly, is actively involved in the bottled water market with a strong emphasis on health and sustainability. The company offers a range of bottled water products that focus on natural purity and health benefits, catering to a global audience concerned with hydration and wellness. DANONE’s approach combines product innovation with environmental stewardship, aiming to meet consumer demand for both quality and sustainability in the bottled water sector.

Primo Water Corporation is a prominent provider of bottled water and water filtration services in North America. They offer a diverse range of water solutions including water dispensers, purified bottled water, and self-service refill stations across the U.S. and Canada. Primo focuses on expanding access to purified, spring, and mineral water, promoting healthier lifestyles and reducing plastic waste. The company adheres strictly to safety, quality, and sanitation standards, ensuring high consumer protection, and is committed to sustainable practices.

FIJI Water Company LLC, known for its premium bottled water, sources its product from an artesian aquifer in Fiji. The company emphasizes the natural purity of its water, which is filtered through volcanic rock and contains naturally occurring minerals. FIJI Water positions itself as an environmentally responsible brand, focusing on reducing plastic use and improving its carbon footprint, aligning with its luxury brand image and commitment to sustainability.

Gerolsteiner Brunnen GmbH & Co. KG has been dedicated to providing high-quality mineral water since 1888, emphasizing trust, regional roots, resource conservation, and ecological responsibility. Their commitment extends to innovation in products and processes to align with consumer needs and sustainability goals. Gerolsteiner’s focus on quality and customer satisfaction is evident in every aspect of its operations, from packaging innovations to its robust internal processes.

VOSS Water, known for its ultra-pure water, captures the essence of exceptional natural purity with its artesian source in Norway. This brand distinguishes itself with sleek packaging and a strong environmental commitment, aiming to reduce plastic usage and improve recycling processes. VOSS Water stands out in the premium bottled water market, catering to a global audience that values both luxury and sustainability.

Nongfu Spring, established in 1996, is a leading name in China’s bottled water industry, recognized for its commitment to natural and high-quality water sources. The company differentiates itself by emphasizing the natural origin of its water, avoiding any artificial additives or use of municipal water supplies in its products. With its substantial market presence, Nongfu Spring operates modern production facilities across major water sources in China and is committed to environmental sustainability and community support. The company recently announced a significant investment to expand its operations, further cementing its position in the market.

National Beverage Corp., known for its popular LaCroix brand, has reported strong performance in the bottled water sector, with consistent record sales across consecutive quarters. The company’s focus on innovative flavors and zero-sugar products, alongside efficient operations and selective price adjustments, has contributed to robust earnings growth. Their strategic emphasis on expanding market presence through enhanced in-store promotions and digital marketing continues to strengthen their brand and customer engagement.

Keurig Dr Pepper Inc. is actively involved in the bottled water sector through its product portfolio that includes flavored and functional water offerings. The company emphasizes health and wellness trends, integrating them into their product development, which appeals to consumers seeking healthier hydration options. Keurig Dr Pepper’s approach is not only to offer traditional bottled water but also to innovate with water products that meet specific consumer health demands. This strategy aligns with the broader industry trends where functional beverages are gaining popularity due to added health benefits.

Conclusion

In conclusion, the bottled water market is poised for robust growth, driven by increasing health awareness and concerns over tap water safety, which are compelling more consumers to choose bottled over tap water. This market is also witnessing a significant shift towards sustainable practices, notably in packaging, with an increased adoption of eco-friendly materials like recycled PET. Moreover, the evolution of consumer preferences towards functional waters enriched with health benefits exemplifies the market’s responsiveness to health trends. Overall, the bottled water industry is not only expanding its global footprint but is also innovating continuously to meet the diverse and evolving needs of consumers worldwide.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)