Table of Contents

Introduction

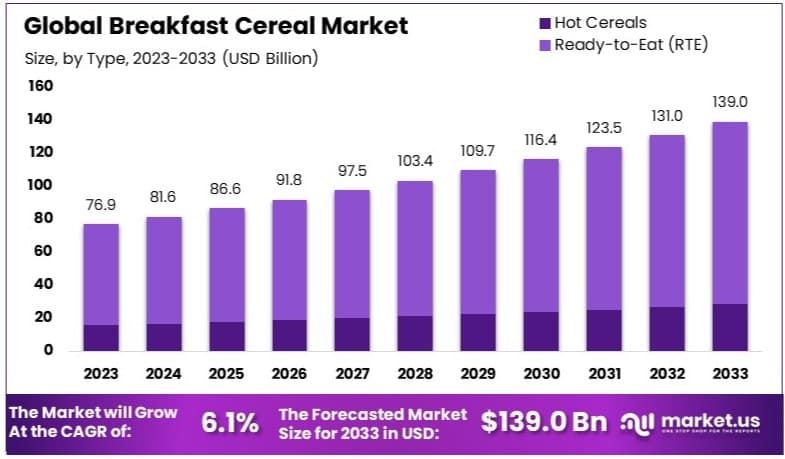

The global breakfast cereal market, valued at USD 76.9 billion in 2023, is poised for significant growth, anticipated to reach USD 139.0 billion by 2033, with a compound annual growth rate (CAGR) of 6.1% during the forecast period from 2024 to 2033. This growth can be attributed to various factors, including increasing health consciousness among consumers and the rising popularity of convenient, nutritious breakfast options.

Key growth drivers include the shift towards healthier diets, which has led to higher demand for cereals with added nutritional benefits such as high fiber, whole grains, and fortified vitamins and minerals. This trend is particularly strong in regions like North America, which dominates the market due to established consumer preferences for breakfast cereals. Additionally, product innovation and the introduction of new flavors and healthier product varieties are attracting a broader consumer base, further fueling market expansion.

However, the market faces challenges such as intense competition from alternative breakfast products like yogurt and breakfast bars, which offer similar convenience and nutritional benefits. Moreover, there is growing consumer scrutiny over the sugar content in cereals, particularly those marketed towards children, which could restrain market growth as consumers increasingly opt for lower sugar alternatives.

Recent developments in the breakfast cereal industry highlight a dynamic market characterized by innovative product launches, particularly from major players like General Mills and Kellogg Co. These key players are actively reshaping their offerings to align with evolving consumer preferences for healthful and convenient breakfast options.

General Mills, Inc. has significantly expanded its cereal portfolio as part of its ongoing product innovation strategy. In 2024, General Mills introduced several new cereals including Cheerios Veggie Blends, made with fruit puree and vegetable powder. This product, available in two flavors, underscores the company’s commitment to providing nutritious and convenient breakfast options. Additionally, the company launched Reese’s Puffs Peanut Butter Lovers, catering to the peanut butter aficionados, and expanded its Nature Valley line with a new French Vanilla Protein Granola, offering 13 grams of protein per serving.

Key Takeaways

- Market Value: The Breakfast Cereal Market was valued at USD 76.9 billion in 2023 and is expected to reach USD 139.0 billion by 2033, with a CAGR of 6.1%.

- Type Analysis: Ready-to-Eat (RTE) cereals dominated with 79.6%; their convenience and quick preparation drive consumer preference.

- Ingredient Analysis: Corn-based cereals dominated with 25.6%; their versatility and consumer demand for corn’s flavor and texture are significant.

- Distribution Channel Analysis: Supermarkets & Hypermarkets dominated with 48.6%; they offer wide availability and variety, attracting a large consumer base.

- Dominant Region: North America dominated with 42.3%; this is due to high consumer demand and established market presence.

- Analyst Viewpoint: The market is moderately saturated with strong competition among key players. Future predictions indicate sustained growth driven by product innovation and health trends.

- Growth Opportunities: Key players can leverage opportunities in health-oriented products, expanding distribution channels, and tapping into emerging markets.

Breakfast Cereal Statistics

- Approximately 50% of Americans begin their day with a bowl of cereal.

- It’s estimated that the average American eats approximately 160 bowls of cereal each year.

- During the pandemic, as more people stayed home and reduced on-the-go and fast-food breakfasts, cereal consumption grew significantly. Sales were up 12% from the year prior.

- According to a COVID-19 recovery tracker 65% of US consumers said that how familiar, trustworthy, or risk-free a product feels always or often influences their product choice.

- In 2018, the World Health Organization (WHO) study showed that among school children, 66.5% had ready-to-eat cereals for breakfast.

- The cereal industry uses approximately 816 million pounds of sugar each year.

- Most Americans purchase at least one box of cereal per shopping trip, with a collective total of 2.7 billion boxes of cereal each year.

- The average American consumes about 14 pounds of cereal annually.

- According to a 2018 study, children’s cereals had significantly higher levels of total sugar and lower levels of protein and dietary fiber compared to other cereals.

- From 2003 to 2018, the use of refined grain in cereals dropped by 45% on average, with whole grains being introduced to match the reduction in refined grains by 1.45 times.

- In the Breakfast Cereals market, volume is expected to amount to 0.33bn kg by 2029. The Breakfast Cereals market is expected to show a volume growth of 0.5% in 2025.

- The average volume per person in the Breakfast Cereals market is expected to amount to 8.3kg in 2024.

- Popular cereal categories:

- Chocolate-flavored cereals: 32%

- Honey/caramel sweet cereals: 24%

- Cornflakes/other plain cereals: 24%

- Filled cereals: 10%

- Battle Creek, Michigan is considered the “Cereal Capital of the World” because it is the hometown of Kellogg and Post, two of the four largest cereal manufacturers in the world.

- Sales of organic and non-GMO cereals are rising, with a reported increase of over 25% in the past five years.

- Approximately 34% of cereals in the market are targeted specifically at children, featuring bright packaging and added sugars.

- Private label cereals have seen a growth in market share, now accounting for around 10% of the market in the U.S.

Emerging Trends

- Health and Nutrition Focus: There’s a significant shift towards cereals that are high in protein and fiber but low in sugar. This trend caters especially to health-conscious consumers, particularly Millennials and Gen Z, who prefer nutritious yet indulgent breakfast options.

- Sustainability and Ethical Practices: More consumers are demanding products that use sustainably sourced ingredients and employ eco-friendly packaging. This shift aligns with a broader consumer inclination towards environmental responsibility and clean eating habits.

- Global Market Expansion: The largest market for breakfast cereals is in the United States, but there’s notable growth in the Asia-Pacific region, especially in countries like Japan and India. This expansion is fueled by rising health awareness and the adoption of Western dietary habits.

- Innovative Flavors and Ingredients: The market is diversifying with new flavors and ingredients. Apart from traditional fruits and nuts, there are exotic and indulgent flavors like chocolate and banana. Popular ingredients now include oats, wheat, and niche options like hemp, chosen for their health benefits.

- Product Type Popularity: Ready-to-eat cereals dominate due to their convenience, but hot cereals are gaining popularity among those seeking a nutritious, warm meal to start their day.

- Shifts in Consumption Patterns: Cereal consumption is extending beyond breakfast time, with more people choosing cereals as a snack throughout the day, driven by the changing lifestyles and the need for quick, easy meal options.

Use Cases

- Ready-to-Eat Cereals for Busy Lifestyles: These cereals are particularly popular among millennials and working adults who prioritize convenience. Ready-to-eat options, which require no preparation, align perfectly with fast-paced lifestyles.

- Hot Cereals for Health-Conscious Consumers: Hot cereals, like oatmeal and muesli, are gaining traction among those who seek nutritious, warming options for breakfast. These cereals are often enriched with proteins and fibers, appealing to health-focused individuals.

- High-Protein and Low-Sugar Options for Fitness Enthusiasts: There is a growing trend toward cereals that are high in protein and low in sugar, catering to consumers who are fitness enthusiasts or are on specific diets such as keto or paleo.

- Eco-Friendly and Sustainable Products: With rising awareness about environmental impacts, consumers are increasingly choosing cereals with sustainable and ethically sourced ingredients. Brands are responding by highlighting organic farming practices and using recyclable packaging.

- Global Market Expansion: Companies are expanding their reach by catering to regional tastes and dietary needs in emerging markets. This includes launching products with local flavors or ingredients to attract a broader customer base.

- Online Sales Growth: The convenience of online shopping has led to a rise in the e-commerce segment for breakfast cereals. Consumers enjoy the ease of browsing and purchasing a wide variety of cereal products from home.

- Snacking and Alternative Uses: Cereals are being consumed not just for breakfast but throughout the day as snacks. Additionally, they are used as ingredients in recipes like bars, cookies, and other baked goods, expanding their use beyond the breakfast table.

Key Players Analysis

Kellogg Co., now operating as WK Kellogg Co in the North American cereal market, maintains a robust presence as a key player, capitalizing on a long-standing 117-year history of innovation in the cereal industry. With a product line that includes popular brands such as Frosted Flakes, Special K, and Froot Loops, the company focuses on leveraging its market expertise and brand recognition to drive sales and maintain a competitive edge. In 2024, WK Kellogg Co aims to generate around $2.7 billion in net sales, reflecting its strategic initiatives to enhance operational efficiency and market responsiveness.

General Mills consistently ranks as a dominant force in the breakfast cereal sector, underscored by its comprehensive portfolio of well-known cereal brands such as Cheerios, Wheaties, and Lucky Charms. The company emphasizes innovation and health trends to cater to consumer preferences, which has helped maintain its market leadership. Strategic marketing and product development are central to General Mills’ approach, enabling it to effectively respond to competitive pressures and changing market dynamics.

PepsiCo, through its subsidiary Quaker Oats, has ventured into the breakfast cereal market with its Quaker Chewy Granola, expanding its product line to include a breakfast option. Launched under the successful Quaker Chewy brand, this new cereal targets both adults and children with its health-oriented ingredients, featuring 100% whole grains, and avoiding artificial colors, flavors, and preservatives. The Quaker Chewy Granola offers flavors such as chocolate and strawberry and emphasizes a high nutritional value with 5 grams of protein per serving. This launch reflects PepsiCo’s strategy to innovate within its existing brands to capture a broader market segment.

Nestlé S.A. has solidified its position in the breakfast cereal sector by focusing on health and nutrition, leveraging its global brand recognition to cater to health-conscious consumers. In 2023, the company enhanced its breakfast cereal lineup by introducing Shreddies The Honey One in the UK, emphasizing whole grains as the primary ingredient, showcasing Nestlé’s commitment to nutritious offerings. This move aligns with broader market trends where there is a growing consumer preference for healthful and convenient breakfast options. Nestlé’s strategy in the breakfast cereal market reflects a careful blend of innovation and attention to consumer health trends, positioning it well within the competitive landscape.

Abbott Nutrition has been expanding its presence in the breakfast cereal sector through its Glucerna line, specifically targeting individuals with diabetes. This includes products like Glucerna Crunchy Flakes in various flavors. Recently, Abbott announced a new $500 million manufacturing facility in Bowling Green, Ohio, which aims to increase the production capacity for its specialty and metabolic nutritional products, including cereals. The company reported strong growth in its nutrition segment, with a 12.2% increase in worldwide sales in Q4 2023, highlighting the robust demand for its products.

Dr. Oetker has also made significant strides in the breakfast cereal market with its Vitalis brand, which includes a variety of muesli options. The company has emphasized innovation and consumer trends, introducing healthier and more diverse cereal products. Recently, Dr. Oetker has seen a positive financial performance, driven by its expanding product range and commitment to sustainability. The Vitalis range, which offers over 30 varieties of muesli, continues to grow in popularity, catering to different dietary preferences and needs.

Conclusion

The breakfast cereal market is experiencing steady growth, driven by increasing consumer demand for convenient and healthy food options. Innovations in product offerings, such as gluten-free, organic, and high-fiber cereals, have attracted health-conscious consumers and diversified market offerings. Additionally, the rising trend of on-the-go breakfast solutions has contributed to the market expansion.

However, challenges such as fluctuating raw material prices and intense competition remain. Overall, the market is expected to continue its upward trajectory, supported by evolving consumer preferences and ongoing product development efforts.