Table of Contents

Introduction

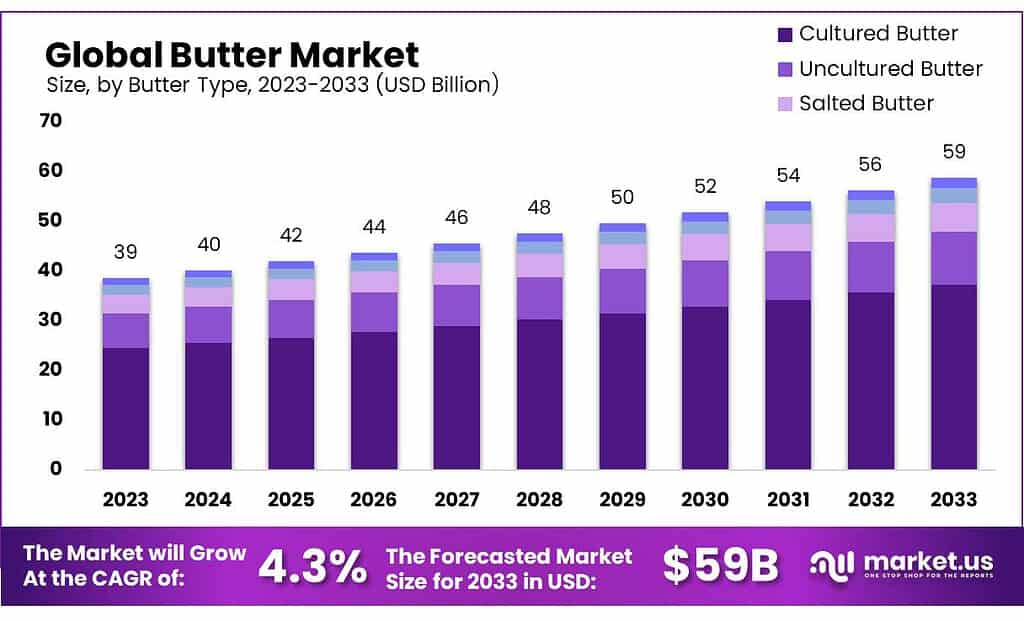

The global butter market is projected to grow from USD 39 billion in 2023 to approximately USD 59 billion by 2033, exhibiting a compound annual growth rate (CAGR) of 4.3% during the forecast period. This growth is driven by several factors, including increasing consumer demand for natural and organic food products, a rise in home-based cooking and baking activities, and the global popularity of butter in various culinary applications.

A notable trend shaping the butter market is the shift towards organic and grass-fed butter, especially in North America and Europe, where consumers are increasingly seeking healthier, sustainably produced options. Companies like Fonterra are responding to this demand by introducing new product lines, such as carbon-zero-certified organic butter. The demand for spreadable butter, which accounted for over 59% of the market in 2023, highlights the preference for convenience in everyday use.

However, the market faces challenges as well. Rising health consciousness among consumers has driven interest in plant-based butter alternatives, catering to the growing vegan population and those with lactose intolerance. These alternatives are capturing a significant portion of the market and intensifying competition. Additionally, fluctuations in raw material prices, such as milk, and concerns over environmental sustainability in dairy farming are obstacles the industry must navigate.

The Asia-Pacific region, particularly China, is expected to witness the fastest growth, with a projected CAGR of 5.1%. This growth is propelled by increasing urbanization, changing dietary preferences, and the rising influence of Western culinary trends. Online retail channels are also becoming more prominent, offering consumers easier access to a wide range of butter products.

Amul continues to dominate the Indian dairy market, expanding its butter production and distribution network. Recent efforts have been focused on increasing capacity to meet growing domestic demand. Amul also launched various marketing campaigns to promote its butter products, emphasizing their use in everyday cooking and baking.

Arla Foods announced a significant investment of over £300 million in its UK production sites in 2024. These investments aim to upgrade facilities across multiple sites, including Lockerbie, Stourton, Aylesbury, and Westbury, with a focus on modernizing technologies and expanding capabilities. At its Taw Valley site, a £179 million investment is dedicated to state-of-the-art mozzarella production, creating over 100 new jobs. This expansion strengthens Arla’s export potential, particularly for butter and other dairy products.

Cabot Creamery has made strides in sustainability, leveraging renewable energy in its production processes. Cabot’s partnership with Barstow’s Longview Farm involves an anaerobic digester, converting cow manure and organic waste into renewable energy. This initiative not only powers Cabot’s butter production but also helps reduce the cooperative’s carbon footprint by offsetting emissions equivalent to taking 650 cars off the road each year. The initiative supports Cabot’s goal of creating a closed-loop production system, promoting environmental stewardship alongside high-quality dairy production.

Similar to Amul Dairy, Anand has expanded its operations in India, with continuous investments in processing plants to enhance butter production. The company has been working on increasing exports to nearby markets, especially in the Middle East and Southeast Asia, capitalizing on growing demand for Indian dairy products.

Key Takeaways

- Market Growth: USD 39 billion in 2023 to USD 59 billion by 2033, with a 4.3% CAGR.

- Butter Types: Cultured Butter led with 63.5% share, favored for its tangy flavor.

- Processing Preference: Processed Butter dominated with a 71.5% share in 2023.

- Usage Trends: Spreadable Butter captured over 59.3% share due to its convenience.

- End Use Segments: Food Processing held over 59.1% share, emphasizing butter’s versatility.

- Distribution Channels: Hypermarkets/Supermarkets led with 43.6% share, offering diverse options.

Butter Statistics

- Milk deliveries in the EU in the first quarter of 2024 increased by 1.5% year-on-year to 35.29 billion liters.

- According to the latest short-term forecast of the EU, the European Commission expects milk deliveries for processing to increase by 0.4% year-on-year in 2024 due to higher yields and stabilizing milk prices.

- New Zealand supplies 85% of AMF exported from the five largest dairy product exporting regions, with the other four being from the EU, USA, Australia, and Argentina. New Zealand supplies about 50% of the butter sold on the global market.

- According to Kilsby, last year, Southeast Asia accounted for just over 25% of AMF exports from New Zealand. The next largest markets are China (20%), North Africa (20%), and the Middle East (15%).

- The Australian division of Rabobank reported that the spot price for butter in Oceania had risen by about 35 percent this year and had surpassed 7000 US dollars per ton (10,400 Australian dollars per ton) for the first time.

- The Indian table butter market is pegged at USD 3.06 billion. While most of the butter produced is consumed locally, India is also one of the top 15 table butter exporters in the world with an annual export of around ~ USD 190 million.

- India is one of the biggest producers of milk in the world with an annual capacity of more than 220 million tons.

- General growth in food retail is conducive to products such as table butter, which are now becoming daily essentials in many Indian households. In India’s retail industry, which is sized at USD 1 trillion, food comprises around 35-40% market share.

- By product, the cultured butter sector accounted for the greatest portion of the global market’s revenue accounting for almost 60%

- The European region is projected to achieve a CAGR of 2.9% in the butter market during the forecast period.

- Hiroland company, as a reputable and established supplier specializing in dairy products within the B2B sector, offers a range of dairy fats, featuring rich and creamy Butter, Anhydrous Milk Fat (AMF), and frozen heavy cream with 40% and 50% fat content. With a continuous improvement approach, Hiroland maintains complete control over the quality of its raw materials, processes, and products.

- The USA can swing between being a net importer or exporter of dairy fat. An increasingly large flow has been the import of butter from Ireland (almost 26kMT YTD and up 28%), while imports, in general, are also up.

- The majority of US butter exports go to Canada, but given the relatively high US price which has existed since February, we are seeing Canadian demand switch to cheaper supply options like New Zealand (US exports down 22% YTD), while exports in general are down.

- The one bright spark has been the strength of domestic US consumption, which has led stocks to only build 2.8% YTD, but this should be enough to continue weighing on US prices.

- Europe is also a large consumer of butter, consuming ~90% of the 2.2m tonnes they produce.

- The US has a low 1% on ~7kMT of TRQ butter for all importers on aggregate which is largely filled.

- According to the company, its alternative is not only 30-40% cheaper than conventional butter but is also sustainable.

- Its production generates 79% less CO2 and requires 86% less water.

- The initiative comes from company figures showing that 80% of Lurpak customers are over 45 years old and sales figures fell by 4.7% last year compared to 2021.

Emerging Trends

- Health and Wellness Focus: Consumers are seeking healthier butter options, driving demand for grass-fed and organic butter. These variants are preferred due to their higher omega-3 fatty acids, antioxidants, and clean-label production, aligning with modern dietary preferences that emphasize natural and nutrient-rich foods.

- Sustainability Initiatives: The butter industry is increasingly focusing on sustainability. Companies are adopting eco-friendly practices, such as using renewable energy in production and introducing biodegradable packaging. For example, Cabot Creamery utilizes anaerobic digesters to power its butter production from cow manure, significantly reducing its carbon footprint.

- Flavored and Specialty Butter: The market is witnessing a rise in artisanal and flavored butter products, including options infused with herbs, spices, or unique flavors like truffle and honey-lavender. These products cater to consumers looking for unique culinary experiences and premium quality.

- Technological Innovations: Advances in butter production technology, such as automated systems for precision and energy-efficient equipment, are helping companies meet the rising demand for high-quality, sustainable butter. These innovations ensure consistent production while minimizing environmental impact.

- Growing Demand for Plant-Based Alternatives: As part of the global shift toward plant-based diets, alternatives to traditional butter, such as vegan and lactose-free options, are gaining traction. These products are particularly popular among health-conscious consumers and those with dietary restrictions.

- Price Volatility: Butter prices have seen significant increases in recent years, driven by factors like supply chain disruptions, weather impacts on dairy farming, and rising production costs. This volatility is expected to stabilize, but prices remain relatively high due to sustained global demand.

Use Cases

- Cooking and Baking: Everyday Cooking: Butter is commonly used for frying, sautéing, and as a base in sauces. Its high-fat content adds richness and depth to dishes, making it a favorite in home kitchens worldwide. For example, a tablespoon of butter (14 grams) provides about 100 calories, which enhances the flavor and texture of everyday dishes. Butter is a critical ingredient in baked goods such as cakes, cookies, and pastries. Its fat helps to create a tender and flaky texture, and it also adds flavor. Butter-based products, such as croissants and puff pastries, heavily rely on butter for their characteristic light, layered structure. According to reports, baking with butter has seen a resurgence, especially during the COVID-19 pandemic, with home baking becoming more popular. This led to an increase in butter sales, particularly in the U.S. and Europe.

- Spreads and Condiments: Spreadable Butter is Used widely as a spread for bread, toast, and crackers, butter remains a breakfast staple in many countries. The global trend toward flavored and artisanal butter, such as truffle or herb-infused varieties, has expanded its use beyond traditional applications. Spreadable butter products account for over 59% of the retail butter market, due to their ease of use in both home and food service settings.

- Processed Foods and Industrial Use: Food Processing Butter is a key ingredient in processed foods like sauces, ready-to-eat meals, and snacks. Its role as a flavor enhancer and texture agent makes it indispensable in many industrial food products. In 2023, the demand for butter in food processing was estimated to represent over 59.1% of the market. Butter is also used in dairy-based products like ice creams, creams, and certain types of cheese, enhancing their richness and flavor.

- Health and Nutritional Products: Grass-fed and Organic Butter Butter from grass-fed cows has gained popularity due to its higher levels of omega-3 fatty acids and antioxidants. This butter is marketed as a healthier alternative and is particularly appealing to consumers interested in clean-label and organic products. The demand for grass-fed and organic butter grew by more than 7% year-on-year, reflecting shifting consumer preferences toward healthier fats.

- Ethnic and Cultural Cuisines: Clarified Butter (Ghee): In South Asian and Middle Eastern cuisines, clarified butter (ghee) is widely used for cooking due to its high smoke point and rich flavor. Ghee is a staple in Indian cooking, often used for frying and as a finishing touch on traditional dishes. The global ghee market is expected to grow significantly due to increasing consumer interest in ethnic foods.

- Foodservice and Catering: Restaurants and Cafes: Butter is a key ingredient in many restaurant dishes, from buttery sauces to baked goods. In fine dining, specialty butter like herbs or truffle butter is often served as an accompaniment to bread or used to enhance main dishes.

Major Challenges

- Price Volatility: The price of butter has been rising significantly in recent years due to several factors, including fluctuating milk supply and increased production costs. For instance, butter prices in the EU rose by 18.5% year-on-year between 2023 and 2024. These price increases, driven by higher energy and feed costs for dairy farms, affect both producers and consumers, making the market unstable.

- Environmental Concerns: The dairy industry, including butter production, faces increasing scrutiny for its environmental impact. Dairy farming contributes significantly to greenhouse gas emissions, primarily through methane produced by cows. Additionally, environmental challenges such as droughts and flooding disrupt milk production, which in turn affects butter availability. Sustainable practices are becoming more critical, but they require substantial investment.

- Health Concerns: Butter is high in saturated fats, which has led to health concerns among consumers. Despite the rising popularity of organic and grass-fed butter, many health-conscious consumers are turning to alternatives like plant-based butter or margarine. This shift poses a challenge for traditional butter producers.

- Supply Chain Disruptions: Supply chain issues, exacerbated by geopolitical events such as the war in Ukraine, have affected the dairy market globally. Increased energy prices and transportation disruptions have made it harder for butter producers to maintain stable supplies, especially in regions dependent on imports.

- Competition from Plant-Based Alternatives: The growing popularity of plant-based diets and dairy-free alternatives is another challenge. As more consumers adopt vegan or lactose-free lifestyles, the demand for traditional dairy butter faces competition from plant-based substitutes, reducing its market share.

Market Growth Opportunities

- Rising Demand for Organic and Grass-Fed Butter: Consumers are increasingly seeking healthier options, such as organic and grass-fed butter, which are perceived to offer better nutritional value with higher omega-3 fatty acids. This trend presents a significant growth opportunity, especially in North America and Europe.

- Innovation in Flavored and Specialty Butters: The demand for artisanal and flavored butter (e.g., truffle, herb-infused) is growing, particularly in premium and gourmet food markets. This allows butter producers to diversify their product offerings and appeal to consumers looking for unique culinary experiences.

- Increased Home Cooking and Baking: The COVID-19 pandemic triggered a rise in home cooking and baking, which continues to drive retail butter sales. This trend opens further opportunities for manufacturers to target home bakers with high-quality butter products.

- Expanding Plant-Based Butter Alternatives: As veganism and lactose intolerance become more prevalent, the market for plant-based butter alternatives is expanding. This segment offers a growing opportunity for dairy-free and allergen-free butter products, catering to health-conscious and environmentally-focused consumers.

- Sustainability and Eco-Friendly Packaging: Consumers are more conscious of sustainability, pushing for eco-friendly packaging and production methods. Brands that adopt renewable energy for production and introduce sustainable packaging can tap into this demand, enhancing brand value and consumer loyalty.

Key Player Analysis

In 2023 and 2024, Amul Dairy’s butter sector has continued to experience significant growth. Amul holds an 85% share of the Indian butter market, making it the dominant player in this segment. In the fiscal year 2022-2023, Amul’s overall turnover reached a record Rs 72,000 crore (approximately USD 9 billion), representing an 18.5% growth compared to the previous year. The butter segment alone saw a 19% value growth, driven by increasing consumer demand for its iconic butter products.

Anand, through its flagship brand Amul, has shown strong growth in the butter sector during 2023 and 2024. In the fiscal year 2022-2023, Amul’s butter segment witnessed an impressive 19% growth in value, contributing significantly to the company’s overall revenue of ₹72,000 crore (approximately USD 9 billion). This growth is driven by a combination of increased domestic demand and expanding global presence. Amul continues to innovate, offering new varieties of butter to meet the growing demand for both traditional and premium products. In 2024, Amul remains committed to expanding its market reach, driven by strategic marketing and a robust distribution network, further enhancing its dominant position in India’s dairy sector.

Arla Foods amba, one of the largest dairy cooperatives, saw a mixed performance in its butter sector throughout 2023. The first half of the year was challenging, with branded product volumes decreasing by 6%, largely driven by inflation and reduced consumer spending in key markets like Europe. However, the second half of 2023 showed a strong recovery, with branded butter sales, including the popular Lurpak brand, growing by 4.1%. In the UK, specifically, Arla achieved a 2.2% increase in branded volumes despite the economic challenges.

In 2023 and 2024, Cabot Creamery Co-operative Inc. demonstrated significant growth in its butter sector, with a strong focus on sustainability. Cabot’s butter production, powered by renewable energy from an anaerobic digester, turns food waste and cow manure into electricity. This system supplies power to Cabot’s butter plant, helping reduce carbon emissions by the equivalent of removing 650 cars from the road annually. Cabot’s butter also earned global recognition in 2024, winning the prestigious “Best of Class” award at the World Championship Cheese Contest for its 83% butterfat sea-salted variety.

Dairy Farmers of America (DFA), one of the largest dairy cooperatives in the U.S., made significant strides in its butter sector in 2023 and 2024. In 2023, DFA continued expanding its Plugrá® Premium Butter line, introducing new products like spreadable butter with olive oil and sea salt. These innovations cater to the growing consumer demand for high-quality, flavorful butter options. DFA also strengthened its Ingredient Solutions business, including its butter production capabilities, by expanding facilities in Minnesota, focusing on new specialty ingredients for food products.

In 2023, Fonterra Co-operative Group Ltd., the largest dairy exporter in New Zealand, reported strong growth in its butter sector, driven by strategic shifts in product portfolios. The company capitalized on the high demand for butter and cream products by reallocating more of its milk supply into these higher-margin segments. Fonterra’s total milk collection for the year was 1,480 million kgMS, despite challenges such as rising input costs and adverse weather in New Zealand. Fonterra also focused on sustainability goals, aiming to reduce Scope 1 and 2 emissions by 50% by 2030.

In 2023, the Gujarat Co-operative Milk Marketing Federation (GCMMF), which markets the Amul brand, achieved a turnover of ₹55,055 crore, marking an 18.5% growth year-on-year. This growth was driven by strong demand for consumer products like butter, which saw a significant rise along with other dairy products like cheese and milk beverages. GCMMF processed an average of 270 lakh liters of milk daily across 98 dairy plants. The Federation plans further expansion and aims to reach a turnover of ₹100,000 crore by 2025.

In 2023, Lactalis International, the world’s largest dairy producer, saw its butter sector grow, contributing to a 4.3% increase in overall sales, which reached €29.5 billion (approximately $31.51 billion). Despite inflationary pressures that affected consumer purchasing power, the company continued to invest heavily in its production capabilities, including butter. Lactalis allocated more than €920 million toward product innovation and modernizing its dairies across France and North America. The butter and cream segment contributed around 12% to the company’s overall revenue, showing steady demand. However, profitability was impacted by rising costs, with net profit standing at €428 million.

In 2023, Land O’Lakes Inc., the largest dairy cooperative in the U.S., saw its butter sector perform strongly despite broader challenges in the dairy industry. Profits increased by 5%, reaching $254 million, largely due to higher consumer demand and price adjustments for its butter products. Although total revenue fell to $16.8 billion from a record $19.2 billion in 2022, butter sales remained resilient, especially during the holiday season. Land O’Lakes efficiently managed its supply chain, ensuring product availability, and launched successful marketing campaigns that reinforced the brand’s connection to its farmer-owners.

In 2023, Meadow Foods Ltd., a leading UK dairy ingredients supplier, reported a turnover of £588 million, with a pre-tax profit of £24.6 million. The company saw strong performance in its butter segment, which is part of its value-added dairy ingredients portfolio. Meadow Foods processes over 550 million liters of milk annually across its five production sites. Despite challenges such as inflation, the company maintained profitability and continued its efforts toward achieving net zero operational sites by 2030. Key developments include the acquisition of Naked Foods and investment from Fairfax Financial to fuel future growth.

Conclusion

The global butter market is on a steady growth trajectory, with increasing demand driven by both traditional consumption and emerging trends. Key drivers include the rise in home cooking, the growing preference for organic and grass-fed butter, and the expanding use of butter in industrial food processing, particularly in the bakery and confectionery sectors. A significant contribution from the Asia-Pacific region is due to rising incomes and increasing demand for premium dairy products.