Table of Contents

Introduction

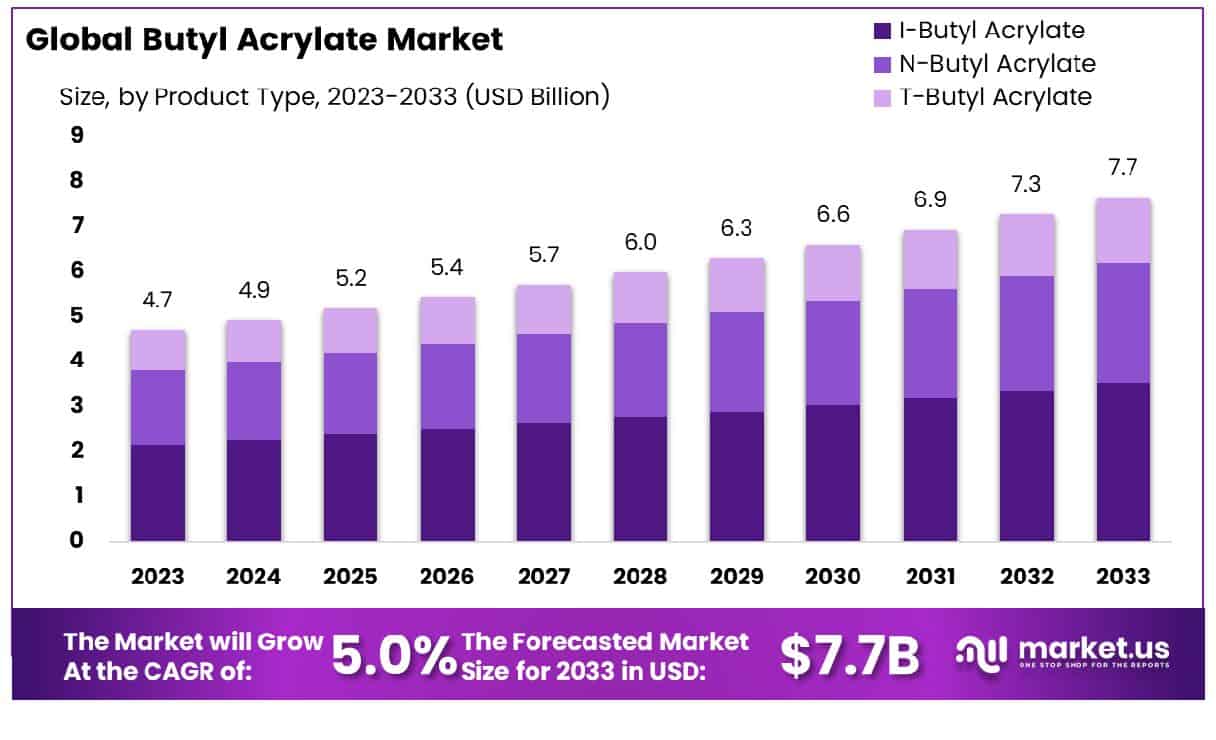

The Global Butyl Acrylate Market is projected to expand from USD 4.7 billion in 2023 to approximately USD 7.7 billion by 2033, demonstrating a steady Compound Annual Growth Rate (CAGR) of 5.0% over the forecast period from 2024 to 2033. This growth is primarily driven by the increasing demand for adhesives and sealants across various industries, including automotive, construction, and packaging.

However, the market faces significant challenges such as stringent environmental regulations concerning volatile organic compound (VOC) emissions, which could impede the use of butyl acrylate in certain applications.

Moreover, recent advancements in product formulation that reduce environmental impact without compromising performance are likely to provide new opportunities for market expansion. The market’s development is supported by ongoing research and innovation aimed at improving the efficiency and sustainability of butyl acrylate-based products.

Arkema has recently expanded its production capacity for butyl acrylate to meet the rising demand in Asia. The company’s investment in new facilities underscores its commitment to securing a significant share of the growing market, especially within the coatings and adhesives sector.

BASF SE has introduced a new range of eco-friendly butyl acrylate products, reflecting its focus on sustainability and innovation. These products are designed to meet stringent environmental standards, appealing to a market increasingly driven by green consumerism. This launch not only diversifies BASF’s product portfolio but also enhances its competitive edge in the global market.

Dow has announced a strategic partnership with a leading technology firm to develop advanced adhesives that leverage butyl acrylate’s unique properties. This collaboration highlights Dow’s approach to innovation and its aim to tap into niche markets with specialized needs.

Evonik Industries AG has secured additional funding to advance its research on butyl acrylate applications in high-performance coatings. This funding boost is expected to accelerate the development of superior products that can withstand extreme conditions, expanding Evonik’s presence in industrial and automotive markets.

Formosa Petrochemical Corporation has completed a merger with a smaller chemical producer, significantly increasing its production capabilities of butyl acrylate. This strategic move is aimed at enhancing Formosa’s supply chain efficiency and better serving its global clientele with a more robust product lineup.

Key Takeaways

- Market Growth: The Global Butyl Acrylate Market is projected to grow from USD 4.7 billion in 2023 to USD 7.7 billion by 2033, with a CAGR of 5.0%.

- Asia-Pacific leads the Butyl Acrylate market with 45.6%, totaling USD 2.1 billion.

- By Product Type: I-butyl acrylate dominates, holding 45.6% of the market by product type.

- By Purity: High purity Butyl Acrylate leads with 67.5% of the market by purity.

- By Application: The paints and coatings application commands a 54.4% market share in its category.

Butyl Acrylate Market Statistics

- The molar mass of Butyl Acrylate is 128.17 g/mol.

- The density of Butyl Acrylate is approximately 0.90 g/cm³ at 20 °C.

- The boiling point of Butyl Acrylate is between 147 – 148 °C at 1013 hPa.

- The flash point of Butyl Acrylate is 38 °C.

- The lethal dose (LD50) for rats is 3140 mg/kg, indicating its toxicity level.

- As of July 2024, the price of Butyl Acrylate in North America is $1.27/kg, reflecting a 0.8% increase.

- The price in Europe remains unchanged at $1.66/kg.

- The leading exporters of Butyl Acrylate included Germany ($342M), the United States ($318M), and China ($246M).

- Major importers were India ($232M), Belgium ($175M), and the United States ($158M).

- Butyl Acrylate is very slightly soluble in water, with a solubility of about 1.7 g/L.

- The vapor pressure of Butyl Acrylate is approximately 29 hPa at 50 °C.

- Butyl Acrylate has a health hazard rating of 3, indicating it can cause serious or permanent injury and a flammability rating of 2.

Emerging Trends

- Increased Demand in Paints and Coatings: The demand for butyl acrylate is growing because it helps make paints and coatings that dry quickly and last long. This is particularly important as the construction and automotive industries continue to expand, especially in emerging economies.

- Shift Towards Water-Based Acrylics: There’s a noticeable shift from solvent-based products to water-based ones in the coatings industry. This change is driven by stricter environmental regulations and a growing awareness about health and safety issues. Butyl acrylate is crucial in developing water-based acrylics, which are less harmful to the environment and safer for people to use.

- Expansion in Adhesive Applications: Butyl acrylate is being used more in adhesives for its strong bonding properties. This is especially relevant in the packaging and construction sectors, where efficient and durable adhesives are essential.

- Growth in Emerging Markets: Countries in Asia, particularly China and India, are seeing a rapid increase in the use of butyl acrylate due to booming industrial activities and urban development. This regional growth is expected to drive the global market for butyl acrylate.

- Innovations in Product and Application: Companies are investing in research and development to improve butyl acrylate formulations and find new applications. This includes making products that can perform well under extreme conditions and contribute to sustainability.

- Impact of Global Regulations: Environmental and safety regulations continue to shape the production and use of chemicals, including butyl acrylate. Producers need to adapt to these regulations by improving their processes and products, which could involve additional costs or changes in manufacturing strategies.

Use Cases

- Paints and Coatings: Butyl acrylate is extensively used in the production of paints and coatings, contributing to about 45% of its global consumption. It enhances the properties of paints, such as improved weather resistance and better gloss retention, making it suitable for both indoor and outdoor applications. The global paints and coatings market, valued at approximately $150 billion, relies significantly on acrylics, with butyl acrylate being a key component.

- Adhesives and Sealants: Accounting for around 25% of its usage, butyl acrylate provides excellent adhesion and flexibility in adhesives and sealants. It is particularly useful in packaging, where secure and durable seals are essential. The market for adhesives and sealants is expected to reach $70 billion by 2025, with a significant portion driven by butyl acrylate-based products.

- Textile Industry: Butyl acrylate is used to manufacture textile finishes that enhance fabric qualities such as resistance to soiling, water repellence, and dye-ability. This application constitutes about 10% of its total market share. With the global textile market projected to grow at a CAGR of 4.3% over the next five years, the demand for butyl acrylate in this sector is also expected to increase.

- Paper Coating Applications: Approximately 5% of butyl acrylate is used in the paper industry to provide glossy and durable finishes to paper products. This application is vital for high-quality printing papers and packaging materials, supporting a sector with an annual revenue generation of around $300 billion globally.

- Plastics Additives: Butyl acrylate enhances the performance of plastic products by improving their impact resistance and flexibility. This usage represents about 5% of its market, supporting a plastics industry that continues to expand, especially with the rising demand for high-performance plastics in automotive and consumer goods.

- Miscellaneous Applications: The remaining 10% of butyl acrylate usage spans various industries, including the manufacture of water treatment chemicals, detergent co-builders, and personal care products. Each of these segments benefits from the unique properties imparted by butyl acrylate, such as improved durability and efficiency.

Key Players Analysis

Arkema plays a significant role in the butyl acrylate sector through its global operations, including its state-of-the-art Taixing plant in China, which focuses on the production of acrylic monomers. This facility enhances Arkema’s position in the market by ensuring a stable supply of high-quality products to meet regional and global demand.

BASF SE is advancing its position in the butyl acrylate market by establishing a new production complex at its Verbund site in Zhanjiang, China. This strategic move, set to commence operations in 2025, aims to produce around 400,000 metric tons of butyl acrylate annually. This expansion is designed to meet increasing demand across the Asian markets, particularly for applications in industries such as hygiene and paints and coatings.

Dow actively participates in the butyl acrylate sector, leveraging its capabilities to produce butyl acrylate which is essential for manufacturing products with high durability, elasticity, and resistance to various environmental factors. These properties make it highly suitable for use in coatings, adhesives, and sealants across a range of industries.

Evonik Industries AG actively contributes to the butyl acrylate market, leveraging its specialty chemicals expertise. Operating out of Marl Chemical Park, one of Germany’s largest chemical sites, Evonik produces a variety of specialty chemicals including butyl acrylate. This product is a crucial component in industries such as adhesives, coatings, and paints, which are integral to numerous everyday products.

Formosa Petrochemical Corporation is actively involved in the butyl acrylate sector through its facility in Ningbo, which operates two 120,000 tonne/year units. Currently, only one of these units is in operation, running at 70-80% capacity. Planned maintenance is also expected to temporarily affect production, indicating a strategic approach to maintaining equipment efficiency and product quality.

HAIHANG Industry, a significant player in the butyl acrylate market, has been noted for its integration into the acrylic acid facilities, which are essential for butyl acrylate production. This integration is crucial given the butyl acrylate’s applications across various industries, including automotive and construction, where its properties like high strength and temperature resistance are valued.

LG Chem is a significant player in the Asia Pacific butyl acrylate market, focusing on producing high-quality butyl acrylate monomers. They maintain a strong position due to their extensive production capabilities and strategic market activities, which contribute to the regional dominance in butyl acrylate consumption, especially in sectors like paints, coatings, and adhesives.

Mitsubishi Chemical Holdings Corporation is a significant player in the butyl acrylate market, primarily utilizing butyl acrylate in the production of various chemicals, including adhesives, coatings, and plastics. Their butyl acrylate product, known for its low impurity levels, is integral to manufacturing applications requiring high strength and temperature resistance. This aligns with broader market trends where butyl acrylate’s demand is driven by its use in water-based coatings and sustainable construction materials.

Nippon Shokubai Co. Ltd. plays a substantial role in the butyl acrylate market, leveraging its robust manufacturing base in Indonesia to produce butyl acrylate and other acrylates, primarily for use in adhesives and coatings. The company’s focus on integrating production processes from acrylic acid to superabsorbent polymers facilitates a stable supply chain and aligns with market demands for high-quality materials.

SASOL Limited is a prominent supplier of n-butyl acrylate, boasting a product purity of 99.5%. Their Butyl Acrylate is a clear, colorless liquid utilized extensively in surface coatings due to its high-performance characteristics in polymer formulations. This aligns with the broader industry usage where Butyl Acrylate’s versatility is highly valued across various applications including adhesives and textiles.

Shanghai Huayi Acrylic Acid Co., Ltd. is a major producer of acrylic acid and its esters, including butyl acrylate, in China. As a part of the larger Huayi Group, they emphasize high-quality production processes and have established a significant presence in the global chemicals market, catering to a wide range of industrial applications.

SIBUR engages in the production of butyl acrylate, a colorless liquid used widely in the creation of acrylic dispersions and adhesives. The company ensures its butyl acrylate meets high standards, maintaining a significant output within its diverse petrochemical portfolio, which includes other acrylic esters. SIBUR’s operations are compliant with international environmental and quality standards, reflecting their commitment to sustainable practices across their production processes.

Wanhua Chemical Group Co. Ltd., a leader in chemical innovation, utilizes its extensive research and production capabilities to manufacture butyl acrylate, a component essential for producing adhesives and coatings. This activity is part of their broader commitment to advancing chemical solutions that cater to various industrial needs, emphasizing sustainable practices across their operations.

Conclusion

Butyl acrylate plays a pivotal role in enhancing the performance and durability of products across a diverse range of industries. Its applications in paints and coatings, adhesives and sealants, textiles, paper products, and plastics underscore its versatility and importance. With the global demand for high-performance materials on the rise, butyl acrylate’s market is expected to expand further.

Its ability to improve product qualities such as flexibility, adhesion, and resistance to environmental factors makes it a valuable component in numerous industrial applications. Therefore, stakeholders in the chemical industry and related sectors should continue to monitor developments in the butyl acrylate market to leverage emerging opportunities and innovations. This strategic focus will be essential for maintaining competitive advantage and achieving sustainable growth in the evolving global market.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)