Table of Contents

Introduction

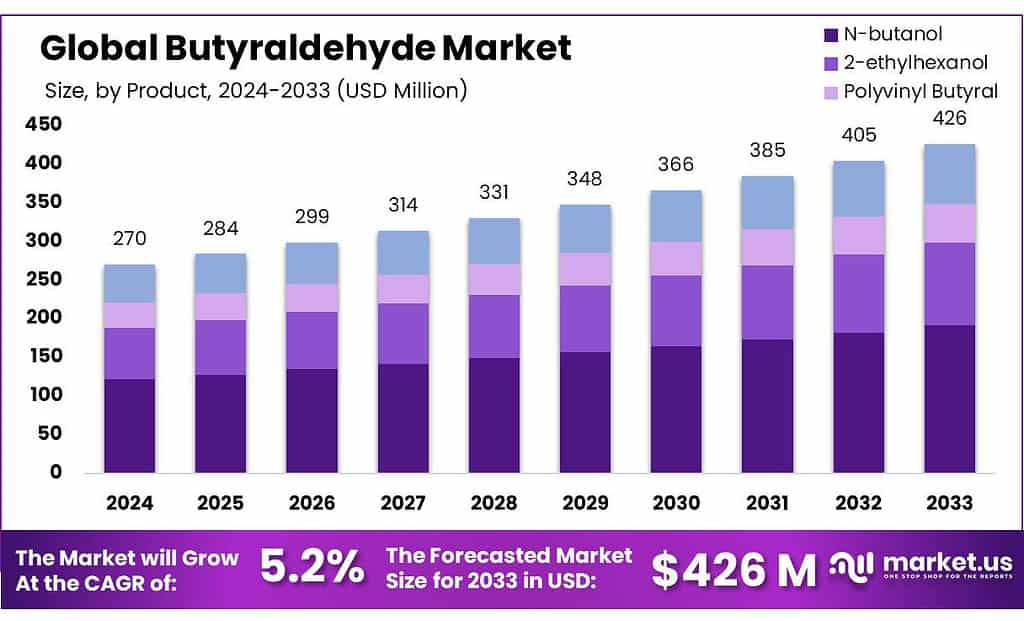

The Global Butyraldehyde Market is projected to grow from USD 270 million in 2023 to USD 426 million by 2033, marking a CAGR of 5.2% during this period. This market expansion is primarily driven by increased demand from end-use industries such as automotive, construction, and chemicals, where butyraldehyde is used for the production of solvents, plasticizers, and resins. Technological advancements that enhance production efficiency and the growing adoption of sustainable practices further bolster market growth.

However, the market faces challenges such as fluctuations in raw material prices and regulatory pressures regarding environmental and health safety, which could impact production costs and market operations. Recent strategic moves in the industry include mergers and acquisitions aimed at consolidating market presence and expanding production capacities. For instance, a notable acquisition in 2023 involved a major chemical manufacturer acquiring a butyraldehyde production facility in Europe to strengthen its market position. Additionally, regions like Asia Pacific are significant contributors to market growth, with China and India being key players due to their large industrial sectors and increasing imports of butyraldehyde.

Advanced Biotech has been part of the trend towards sustainable and bio-based chemicals, aligning with global shifts toward environmentally friendly production processes. This approach is not only a response to regulatory pressures but also to market demand for greener products.

Alfa Aesar, now part of Thermo Fisher Scientific, continues to strengthen its chemical offerings by expanding its product range and enhancing global distribution capabilities, aiming to better serve the growing demands of the butyraldehyde market across various industries.

Aurochemicals is known for its focus on aroma chemicals, which likely includes applications of butyraldehyde in flavors and fragrances. Their commitment to safety and environmental sustainability remains a key aspect of their market strategy.

BASF SE has been proactive in expanding its butyraldehyde production capabilities. The company focuses on integrating advanced technologies and optimizing production processes to enhance efficiency and sustainability. BASF’s global footprint and broad application segments position it as a significant player in the market.

Key Takeaways

- Butyraldehyde Market size is expected to be worth around USD 426 Million by 2033, from USD 270 Million in 2023, growing at a CAGR of 5.2%.

- N-butanol held a dominant market position, capturing more than a 45.6% share.

- Chemical Intermediate held a dominant market position.

- Construction held a dominant market position, capturing more than a 13% share.

- Direct Sales held a dominant market position, capturing more than a 76.5% share of the butyraldehyde market.

Butyraldehyde Statistics

- About 6 billion kilograms are produced annually by hydroformylation. Butyraldehyde can be produced by the catalytic dehydrogenation of n-butanol.

- The online version contains supplementary material available at 10.1007/s11356-023-27717-4.

- The NHANES survey employs a complex, stratified, and multistage sampling method that is executed every alternate year. A total of 5769 adults aged 20 or older were enrolled in the 2013–2014 NHANES study.

- 12 measured aldehydes, we selected the 6 aldehydes that were detected in at least 85% of the samples.

- The study set an a priori cutoff point of 0.16, which indicates possible important mixtures.

- After adjusting for the covariates, a 1-SD change in propanaldehyde was associated with a statistically significant increase in serum iron levels, with β ranging from 0.24 to 6.27.

- The RBF was charged with 18.3 mL (0.2 mole) of n-butanol and 100 mL of H2O, with vigorous stirring.

- The reaction mix was allowed to cool then shaken with 25mL of DCM in a 500 mL separatory funnel. The heavy organic (tinted light brown) was drained off and 2 scoops of anhydrous MgSO4 added for drying.

- The decantate was fractionally distilled using a broken glass packed Hempel column. The 25mL of DCM came off nicely just below 40C. Then the temperature rose up to

- 77-90C in an unsteady fashion. Normal bp for n-butyraldehyde is 75.7C. Only 1-2mL of cloudy distillate was caught in the receiver. It gave a positive Tollen’s test.

- Pleasure reading your write-up Magpie! Buteraldehyde is soluble in water, 8.4grams in 100ml at 25C – at 70C should be more. This supports the idea that its the

- solubility difference that was giving the yield with benzaldehyde. The definitive test would be to separate out the butyric acid (by say adding CaCl2) and weigh, if there’s a good yield of that, theres the proof.

Emerging Trends

- Emerging trends in the Butyraldehyde market highlight significant shifts towards sustainability and technological innovation. One of the key trends is the increasing application of butyraldehyde in the production of polyvinyl butyral (PVB) resins, which are extensively used in safety glass applications across the automotive and construction industries. This demand is propelled by the growing safety standards and construction activities, especially in rapidly urbanizing regions.

- Moreover, there is a notable push towards environmentally friendly and sustainable products, influencing the development of butyraldehyde applications in various sectors including pharmaceuticals, agrochemicals, and specialty chemicals. For example, advancements in chemical engineering and catalysis are enhancing production efficiency, yielding products with higher purity and reduced environmental impact.

- Regionally, the Asia-Pacific market is poised to dominate due to significant consumption and production activities, particularly in China and India. These regions are leveraging butyraldehyde in applications ranging from coatings and adhesives to agricultural chemicals, supported by governmental initiatives that promote domestic manufacturing and technological innovation.

- Additionally, the market is seeing a rise in demand for bio-based products, reflecting a broader industry trend towards reducing reliance on fossil fuels and improving sustainability profiles of chemical products. This trend is expected to open new opportunities for butyraldehyde, especially as industries and consumers increasingly prefer products with lower environmental impacts.

Use Cases

- Production of n-Butanol: Butyraldehyde is crucial in manufacturing n-Butanol, which is widely used as a solvent in the production of paints, coatings, inks, and adhesives. This segment dominates the butyraldehyde market due to the extensive use of n-Butanol in various industrial processes.

- Polyvinyl Butyral (PVB) Production: Another significant application of butyraldehyde is in the production of PVB resins, which are essential for making safety glass and coatings, particularly used in the automotive and construction industries. The demand for PVB underscores the role of butyraldehyde in modern manufacturing and safety applications.

- 2-Ethylhexanol Production: Butyraldehyde is also used to produce 2-Ethylhexanol, a chemical used in making plasticizers for the production of polyvinyl chloride (PVC). This application is particularly important due to the extensive use of PVC in various construction materials and consumer products.

- Chemical Synthesis: Butyraldehyde is employed in the synthesis of various C4 to C8 alcohols, carboxylic acids, and esters. Its high reactivity makes it an invaluable intermediate for producing specialty chemicals used across several industries, including pharmaceuticals and agrochemicals.

Major Challenges

- The Butyraldehyde market faces several key challenges that could impact its growth and operational efficiency. One significant challenge is the fluctuation in raw material prices, which can affect production costs and profitability for manufacturers. The market is also navigating complex health and environmental risks associated with butyraldehyde exposure, necessitating stringent safety and handling protocols which can increase operational costs.

- Furthermore, the industry has been affected by the COVID-19 pandemic, which led to disruptions in supply chains and labor shortages, impacting manufacturing activities and market dynamics. Geopolitical tensions and wars also pose risks to the supply chain, potentially causing further disruptions in the availability of raw materials and the stability of market prices.

- Addressing these challenges requires strategic planning and innovation from butyraldehyde manufacturers to mitigate risks associated with price volatility, regulatory compliance, and supply chain disruptions. The development of more sustainable production processes and products that reduce environmental and health impacts can also provide a competitive advantage in the evolving market landscape

Market Growth Opportunities

- The Butyraldehyde market is experiencing promising growth opportunities across various sectors. This growth is driven by its extensive application in industries such as automotive, construction, and pharmaceuticals. Notably, the demand for polyvinyl butyral (PVB) resins in safety glass applications, particularly in the automotive and construction sectors, significantly contributes to the market’s expansion. The United States, for example, sees robust demand for PVB in windshields and architectural glass, supported by advancements in chemical engineering that enhance production efficiency.

- Furthermore, the market is benefiting from a rising focus on bio-based chemicals, which aligns with global sustainability goals. As the market for bio-based chemicals is expected to reach USD 3.8 trillion by 2027, Butyraldehyde’s role as a precursor in eco-friendly products positions it well within this trend. Innovations in production methods that increase efficiency and reduce environmental impacts are also key growth drivers.

- The expansion in emerging markets, particularly in Asia-Pacific regions like India and China, adds to this positive outlook. Rapid urbanization and industrial development in these areas are creating new applications and increasing demand for Butyraldehyde. Government support and investments in bio-based production further enhance growth prospects by reducing dependency on imported raw materials and supporting domestic manufacturing capabilities.

Key Player Analysis

Advanced Biotech is a key player in the butyraldehyde sector, renowned for its role in advancing the production and application of bio-based butyraldehyde, aligning with global trends towards sustainability. The company leverages cutting-edge biotechnological methods to enhance the eco-efficiency of butyraldehyde, aiming to meet the increasing demand from industries seeking greener chemical solutions. This strategic focus not only addresses environmental concerns but also positions Advanced Biotech favorably in a market increasingly driven by regulatory and consumer preferences for sustainable products.

Alfa Aesar, part of Thermo Fisher Scientific, plays a significant role in the butyraldehyde market by offering various grades of butyraldehyde that cater to a broad range of industries including pharmaceuticals, chemicals, and food processing. Their expansion and diversification in the butyraldehyde offerings are designed to meet the growing demands of these sectors, ensuring high-quality and performance standards. Alfa Aesar’s commitment to enhancing their chemical portfolio underpins their strategic market position and supports their global customer base in achieving more efficient and specialized production outcomes.

Aurochemicals has made significant strides in the butyraldehyde sector, focusing on the production of natural butyraldehyde, which is certified both in the US and the EU for its natural composition. Their commitment to high-quality, sustainable products is evident in their rigorous quality assurance processes and certifications. Aurochemicals positions itself strongly in the flavor and fragrance market, leveraging its expertise to offer products that meet stringent safety and environmental standards, thus appealing to industries seeking natural and sustainable chemical solutions.

BASF SE is a major player in the butyraldehyde market, renowned for its extensive chemical expertise and strong focus on research and development. BASF uses butyraldehyde as a key intermediate in manufacturing high-volume chemicals such as n-butanol and 2-ethylhexanol. Their involvement in the butyraldehyde sector is marked by continuous innovation and a commitment to sustainability, aiming to meet the global demand across various industries including plastics, pharmaceuticals, and textiles, thereby maintaining a leading position in the market.

DuPont, a global science and innovation leader, is not explicitly reported to focus heavily on the butyraldehyde sector. Their extensive portfolio typically includes advanced materials and chemicals that serve a broad range of industries. DuPont’s involvement in related chemical sectors suggests they may utilize butyraldehyde as an intermediate in various applications, supporting their extensive work in materials science and specialty products.

Eastman Chemical Company plays a significant role in the butyraldehyde sector through its enhanced production capabilities and innovative technologies. In 2024, Eastman increased its 2-Ethylhexanol (2-EH) capacity by 20,000 metric tons at its Texas facility, showcasing its commitment to meeting the growing demand for butyraldehyde derivatives. Eastman’s use of advanced catalytic processes ensures high yields and efficiency, making it a key player in the global market for butyraldehyde and its derivatives .

GELEST, INC., while not explicitly detailed in recent data for its direct involvement in the butyraldehyde sector, is known for its extensive work in silicones, organosilanes, metal-organics, and specialty monomers. These components are crucial for various industrial applications, potentially involving butyraldehyde as an intermediate or reactant in some of their chemical synthesis processes. The company focuses on customized solutions that cater to the specific needs of their clients in the pharmaceutical, medical, and industrial sectors, implying an indirect utilization of butyraldehyde through these channels.

Grupa Azoty ZAK S.A., a prominent Polish chemical company, is significantly involved in the production of butyraldehyde, primarily used to manufacture OXO alcohols and plasticizers. Their product range includes advanced n-butyraldehyde formulations, which are key intermediates in producing various chemical products. The company’s innovative approach, focusing on non-phthalate plasticizers like Oxoviflex® and specialty products, demonstrates their commitment to environmentally friendly solutions and positions them as a leader in the European chemical industry

KH Neochem Co., Ltd. is actively engaged in the butyraldehyde sector, emphasizing its role as a key chemical intermediary. The company markets butyraldehyde primarily as a chemical intermediate, essential in manufacturing various commercial products including coatings, resins, and solvents. KH Neochem is committed to innovation and sustainability, consistently exploring new applications and improving production processes to meet the evolving demands of the global market.

LobaChemie Pvt Ltd, while noted as a significant player in the chemical industry, doesn’t have specific details about its involvement in the butyraldehyde market readily available. Generally, the company specializes in the production and supply of a wide range of laboratory and industrial chemicals, which likely includes intermediaries like butyraldehyde for diverse applications in research and industrial sectors.

Merck KGaA, a leading science and technology company, engages in the butyraldehyde sector primarily through its Performance Materials division. This involvement includes utilizing butyraldehyde as a precursor for producing high-value chemicals and materials that cater to sectors such as electronics and pharmaceuticals. Merck KGaA focuses on innovation and sustainability within its chemical processing, aiming to optimize and expand its capabilities in the production and application of butyraldehyde to meet global industrial demands efficiently.

Mitsubishi Chemical Corporation is a significant player in the butyraldehyde market, leveraging its broad chemical expertise to produce and supply butyraldehyde as a critical intermediate for various applications. The company focuses on enhancing production technologies and expanding its market reach, particularly in the Asia-Pacific region, which dominates the global demand. Mitsubishi’s commitment to sustainability and advanced chemical solutions positions it strongly within the butyraldehyde market, enabling it to meet the growing demands of the paints and coatings, pharmaceutical, and agrochemical sectors.

OXEA Corporation is a pivotal player in the butyraldehyde sector, recognized for its comprehensive approach to the production and distribution of butyraldehyde and its derivatives. OXEA focuses on delivering high-purity butyraldehyde, primarily used as an intermediate in the synthesis of other chemicals such as resins, plasticizers, and pharmaceutical ingredients. The company’s commitment to maintaining stringent quality standards and its capacity to meet large-scale industrial demands positions it as a reliable supplier in the global market, supporting various sectors that depend on the critical properties of butyraldehyde.

Perstorp Holding AB plays a significant role in the butyraldehyde market, particularly through its innovative production of n-butyraldehyde, a key raw material in the manufacture of products like 2-Ethylhexanol and n-Butanol. Recently acquired by Petronas Chemicals Group, Perstorp is expanding its sustainable product line with developments like the Pro-Environmental n-Butyraldehyde, which includes a certain percentage of renewable content. This move illustrates Perstorp’s commitment to sustainability and innovation, positioning them as a forward-thinking leader in the specialty chemicals industry, particularly within the butyraldehyde sector.

The Dow Chemical Company is significantly involved in the butyraldehyde sector, leveraging its extensive chemical manufacturing expertise to produce and supply butyraldehyde and its derivatives for global markets. Dow utilizes butyraldehyde primarily as an intermediate in the synthesis of various industrial chemicals, contributing to products in the plastics, resins, and automotive sectors. Their focus on innovation and sustainability in chemical production ensures they meet the growing demand efficiently while adhering to environmental regulations.

Thermo Fisher Scientific, although not primarily known for chemical manufacturing like butyraldehyde, offers high-purity butyraldehyde for laboratory and industrial use through its Thermo Scientific Chemicals brand. This product is crucial for research and development within the pharmaceutical and chemical sectors, demonstrating Thermo Fisher’s commitment to supporting a wide range of scientific applications. Their provision of butyraldehyde aligns with their broader mission to enable customers to make the world healthier, cleaner, and safer.

Tokyo Chemical Industry Co., Ltd. (TCI) is a prominent player in the butyraldehyde sector, focusing on the synthesis of high-purity chemicals where butyraldehyde serves as a crucial intermediate. TCI’s commitment to quality and innovation allows them to supply specialized chemical products widely used in pharmaceuticals, electronics, and industrial applications. Their expertise in handling complex chemical syntheses and their strategic positioning in Japan underpin their significant role in meeting the global demands for butyraldehyde derivatives.

Toronto Research Chemicals specializes in the production and supply of high-purity butyraldehyde, catering primarily to the research and development sectors in pharmaceuticals and chemical synthesis. Their focus on rigorous quality standards and the ability to provide a vast array of chemical products makes them a vital resource for academic, healthcare, and industrial research facilities globally. Toronto Research Chemicals’ dedication to supporting cutting-edge research through their extensive product offerings underscores their pivotal role in the butyraldehyde market.

Conclusion

In conclusion, the Butyraldehyde market is poised for sustained growth driven by robust demand across a variety of industrial applications, particularly in the production of polyvinyl butyral (PVB) and other chemical intermediates. The market is benefiting significantly from technological advancements that improve production efficiencies and from increasing adoption of sustainable and bio-based chemicals.

The expansion of the market in emerging regions like Asia-Pacific, fueled by urbanization and industrial development, further augments this growth trajectory. However, the market faces challenges such as price volatility of raw materials and stringent environmental regulations, which could impact the cost structures and operational strategies of key players. As the industry continues to innovate and adapt to these challenges, the Butyraldehyde market is expected to meet the evolving needs of its diverse end-use sectors effectively.