Table of Contents

Introduction

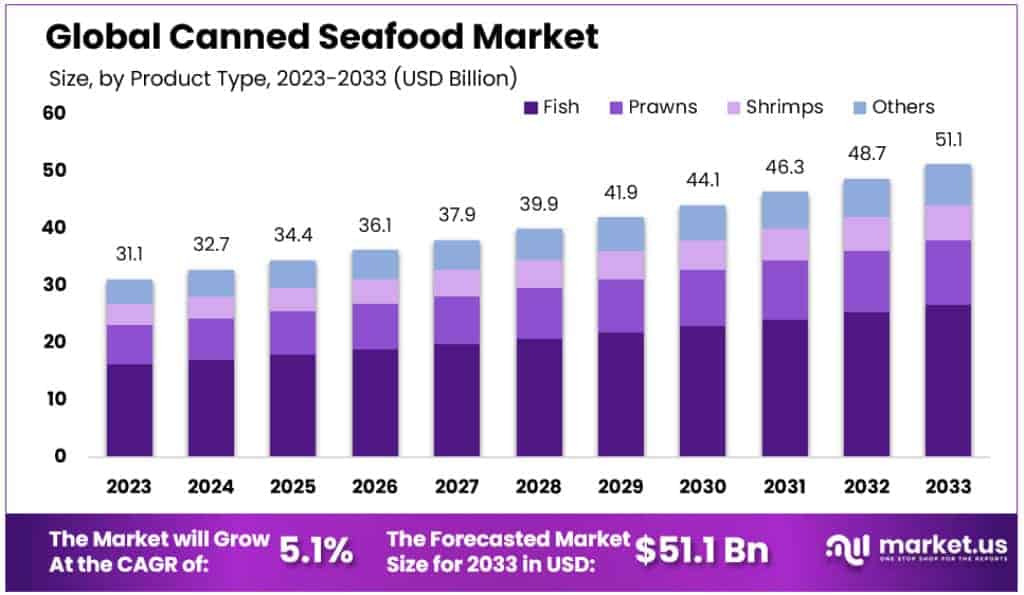

The global canned seafood market is poised for significant growth, projected to increase from USD 31.1 billion in 2023 to around USD 51.1 billion by 2033, growing at a CAGR of 5.1% during this period.

This market expansion is primarily driven by the rising consumer preference for convenient and long-lasting food products. Canned seafood, including fish and shellfish, is highly valued for its convenience, shelf life, and nutritional benefits, making it a popular choice in various cuisines worldwide.

However, the market faces several challenges. Supply chain disruptions and the stringent regulations related to food safety and labeling are major hurdles. The need to maintain high quality and compliance with international standards can increase operational costs and affect profitability.

Moreover, competition in this sector is intense, with key players continually innovating and expanding their product lines to include sustainable and health-focused options to meet changing consumer preferences.

Recent developments highlight the dynamic nature of the market. For instance, strategic mergers and acquisitions are common as companies aim to enhance their market share and expand their geographical footprint.

New product launches that focus on sustainability and ethical sourcing are also shaping the market landscape, reflecting growing consumer awareness and demand for eco-friendly products.

In August 2023, Maruha Nichiro Corporation announced a collaboration with UMAMI Bioworks to accelerate the development of cell-cultivated seafood products. This partnership aims to enhance the sustainability of seafood production by leveraging cell-cultivation technology.

Key Takeaways

- Canned Seafood Market size is expected to be worth around USD 51.1 Billion by 2033, from USD 31.1 Billion in 2023, growing at a CAGR of 5.1% during the forecast period from 2023 to 2033.

- In 2023, the tuna segment held a dominant market position, capturing more than a 42.3% share.

- In 2023, the retail sector held a dominant position, capturing more than a 58.3% share of the market.

- The Asia Pacific region leads the global canned seafood market, with a market share of 45.9% in 2023 and a value of USD 15.2 billion.

Canned Seafood Statistics

Global Canned Seafood Insights

- According to Russia’s statistics service, Rosstat, the country imported around 344,000 metric tons of seafood through July, up 36 percent from this time a year ago.

- Online seafood firm Captain Fresh raises $25 million from BII, Nekkanti.

- A canned seafood company based in Miami has received USD 2.5 million in funding from Tradewind Finance. This working capital will be used to expand business in the United States, where the company sells packaged tuna and sardines.

- Toronto, Ontario, Canada-based canned seafood manufacturer Scout has scored USD 4 million (EUR 4.1 million) in a seed funding round.

- Stacked cans of tuna Canned tuna is one of the most universally consumed foods around the globe and tuna are fished in over 70 countries.

Canned Seafood Market Dynamics

- According to the annual report by the European Fish Processors and Traders Association, around 94 percent of the EU’s whitefish is imported – and processors depend heavily on Russia.

- The United States alone produced over 300 million cans of fish per year by the turn of the 20th century.

- The European Union, the United States, and Japan are the largest consumers of canned tuna, using about 51 percent, 31 percent, and 6 percent, respectively, of the world’s canned tuna products.

- Over one-half of canned tuna, 52 percent, is used in sandwiches. Another 22 percent is used in salads while 15.5 percent is used in casseroles and helpers and 7.5 percent is used in base dishes.

- Fish have low acidity levels at which microbes can flourish. From a public safety point of view, foods with low acidity (pH greater than 4.6) need sterilization at high temperatures of 116–130 °C (241–266 °F).

Emerging Trends

- Health-Conscious Selections: As wellness becomes a priority, consumers are gravitating toward food choices that support a healthy lifestyle. Canned seafood is becoming a popular choice because it’s not only convenient but also rich in essential nutrients like protein and omega-3 fatty acids, catering to the health-conscious consumer.

- Digital Marketplace Expansion: The growth of online shopping is reshaping the canned seafood market. Consumers are increasingly turning to online stores to purchase canned seafood, attracted by the ease of home delivery and a broader selection of products. This trend is fueled by the expansion of digital platforms and the adoption of e-commerce solutions by traditional retailers.

- Eco-friendly Initiatives: Environmental responsibility is influencing consumer purchases more than ever. There’s a rising demand for canned seafood products that are sourced sustainably and packaged responsibly. Companies are responding by enhancing their sustainability practices to appeal to eco-conscious buyers.

- Packaging Innovations: In response to consumer demand for convenience and sustainability, the industry is seeing innovations in packaging. This includes the development of easy-open cans, single-serve formats, and resealable options that also focus on reducing environmental footprints.

- Diverse Flavor Profiles: The market is witnessing a diversification in product offerings, with companies introducing a variety of seafood types and flavors that accommodate regional preferences and culinary trends. This includes everything from traditional favorites like salmon and mackerel to exotic flavors designed to appeal to adventurous palates.

Use Cases

- Enhancing Quick Meals: Canned seafood such as tuna, salmon, or sardines can be used to quickly add protein to dishes like salads, pasta, and rice bowls. It’s a straightforward way to boost the nutritional value of meals without lengthy preparation times.

- Creating Comfort Foods: You can use canned fish to make hearty, comforting dishes like fish cakes or patties. Mixing canned fish with ingredients like eggs, breadcrumbs, and seasonings allows you to create delicious burgers or patties that are ideal for family meals or gatherings.

- Innovative Snacks: Incorporating canned seafood into snacks and appetizers is another great use. For example, using canned crab or shrimp in dips or stuffing them into mushrooms for elegant hors d’oeuvres.

- Easy Breakfast Options: Canned seafood like salmon or mackerel can be a great addition to breakfast items, such as omelets or quiches, providing a morning meal that is both nutritious and filling.

- Soup and Stew Boosters: Adding canned seafood to soups and stews can enrich flavor profiles and add heartiness to these dishes, making them more satisfying and flavorful with minimal extra effort.

Major Challenges

- Supply Chain Instability: The canned seafood sector is dealing with unpredictable shifts in the costs of raw materials. This instability can arise from a variety of sources such as environmental shifts and economic uncertainties, which influence the availability and price of seafood, thus affecting production costs and overall profitability.

- Regulatory Hurdles: Compliance with stringent food safety and quality standards presents a considerable challenge. Regulatory requirements vary across different regions and can significantly influence how products are manufactured, packaged, and distributed, adding layers of complexity and increased operational costs.

- Market Competition: Canned seafood often finds itself in competition with fresh seafood and other alternative protein sources. These alternatives are generally perceived by consumers as fresher or of higher quality, influencing consumer choices and affecting the market share of canned products.

- Sustainability and Environmental Impact: The industry is increasingly scrutinized for its environmental footprint, from fishing practices to the overall impact on marine life and ecosystems. Sustainable practices are becoming more critical to consumers, influencing their purchase decisions and pushing companies toward more eco-friendly operations.

- Changing Consumer Tastes: There’s a shift in consumer preferences toward foods that are perceived as more natural and less processed. The rising demand for organic and sustainably sourced products compels the canned seafood industry to adapt its product lines and marketing strategies to align with consumer expectations and trends.

Market Growth Opportunities

- Health Conscious Consumption: The demand for nutritious food choices is surging, especially in the U.S., where more consumers are opting for diet-friendly options like canned seafood, rich in essential nutrients like protein and omega-3 fatty acids.

- Eco-Conscious Consumerism: In Europe, where environmental awareness is high, consumers increasingly favor products aligned with sustainable practices. Companies focusing on sustainable sourcing and biodegradable packaging are gaining an edge.

- Product Innovation: New flavors and convenient packaging are making waves in the canned seafood market, appealing to consumers across Asia Pacific and North America. Innovations that enhance convenience without compromising health benefits are particularly successful.

- Market Expansion: The growing economies in Latin America offer fertile ground for market expansion due to their rich marine resources. Tailoring products to meet local preferences can unlock new customer segments.

- E-Commerce Strategies: The shift towards online shopping, accelerated by the pandemic, presents a valuable opportunity for canned seafood brands. Enhancing online shopping portals can broaden market reach and cater to the need for convenience.

Key Players Analysis

- Thai Union Group, established in 1977, has evolved into a global leader in the canned seafood industry, employing 40,000 people and generating $4.2 billion in revenue in 2020. The company is known for its commitment to sustainable seafood under its SeaChange® initiative, focusing on responsible sourcing and operations to ensure environmental and social integrity.

- Bumble Bee Foods LLC, a key player in the canned seafood industry, faced financial challenges leading to its bankruptcy filing in November 2019. The company planned to sell its assets to FCF Co., Ltd. for $928 million, a transaction aimed at resolving its financial struggles.

- Maruha Nichiro Corporation is a prominent player in the global canned seafood market, offering a diverse array of products including canned salmon, mackerel, and other seafood items. They focus on sustainable fishing practices and advanced food processing technologies to ensure high-quality and nutritious products.

- Dongwon Industries, a South Korean conglomerate, acquired StarKist in 2008, making it a major player in the global canned seafood market. StarKist, recognized as the leading supplier of canned and packaged tuna, has expanded its product offerings beyond traditional canned tuna to include convenient single-serve pouches and other seafood products, adapting to changing consumer preferences for convenience and quality.

- Nippon Suisan Kaisha, Ltd. (Nissui) is heavily involved in the canned seafood industry, where it focuses on delivering high-quality seafood products globally. Their operations include catching, processing, and selling fish products, with a particular emphasis on sustainability and innovation in seafood production to meet consumer needs.

- Trident Seafoods, a major player in the canned seafood industry, recently secured a contract from the U.S. Department of Agriculture to supply canned salmon, underlining its significant role in the sector. This company, known for its extensive range of seafood products, focuses on delivering high-quality, sustainably sourced seafood, including a variety of canned options.

- F.C.F. Fishery Co., Ltd., also known as Fong Cherng Fishery Co., Ltd., has established itself as a major player in the canned seafood industry. The company, based in Taiwan, engages in the trading and supply of various marine products, including canned seafood, and is known for its sustainable practices in sourcing tuna.

- Maldives Industrial Fisheries Company Limited (MIFCO) specializes in processing and exporting a variety of tuna products, including canned tuna. The company operates a cannery that produces tuna cans and pouches tailored to customer specifications and is notable for maintaining high-quality standards, which allows it to supply leading brands worldwide.

- Jim Pattison Group Inc., through its subsidiary Canfisco, operates as a key player in the canned seafood industry in North America, focusing on sustainable and wild-caught seafood. It boasts a comprehensive setup including harvesting, processing, and packaging, with a strong emphasis on environmental and sustainability standards.

- LDH (La Doria) Ltd is a prominent UK-based supplier of own-label canned foods including a variety of seafood products. The company, which has partnered with the Global Tuna Alliance, focuses on sustainability and ethical sourcing, ensuring their canned seafood meets the highest environmental and social standards.

- Icicle Seafoods Inc., established in 1965 in Alaska, has grown to become a significant player in the seafood industry, especially known for its sustainable and diversified seafood products including canned fish. The company processes seafood across multiple facilities in Alaska and emphasizes responsible fishery management practices.

- Universal Canning Inc., based in the Philippines, is recognized for its high-quality canned sardines. The company prides itself on sourcing fresh sardines from the Philippine seas and is committed to sustainable fishing practices that support local communities and help preserve marine ecosystems.

- Wild Planet Foods is recognized for its commitment to sustainability and quality in the canned seafood sector. The company emphasizes eco-friendly practices and sources its seafood through methods that ensure the preservation of marine life. Their product lineup includes a variety of seafood such as tuna, salmon, and sardines, all caught through environmentally responsible techniques.

- American Tuna, Inc., established by six American Pole & Line fishing families in 2004 in San Diego, focuses on sustainable seafood practices. They offer high-quality, all-natural canned albacore tuna, emphasizing responsible fishing that supports U.S. fishing communities and minimizes environmental impact.

- Tri Marine Group, a global leader in the tuna supply chain, is recognized for its robust operations that span from fishing to delivery. The company emphasizes sustainable practices and has a significant presence in major tuna hubs worldwide, supplying raw materials and finished products that meet stringent international standards.

- Connors Bros. Ltd., a key player in the canned seafood industry, has faced financial challenges, leading to bankruptcy filings and asset sales to manage substantial debt. The company, known for its large-scale production of canned sardines and herring, remains a significant name in North America’s seafood sector despite these difficulties.

Conclusion

The canned seafood market is thriving due to its convenience, nutritional benefits, and long shelf life. With increasing health consciousness and demand for sustainable products, there is a notable shift towards more eco-friendly and innovative seafood options. This shift is expected to continue driving the market’s growth across various regions globally.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)