Table of Contents

Introduction

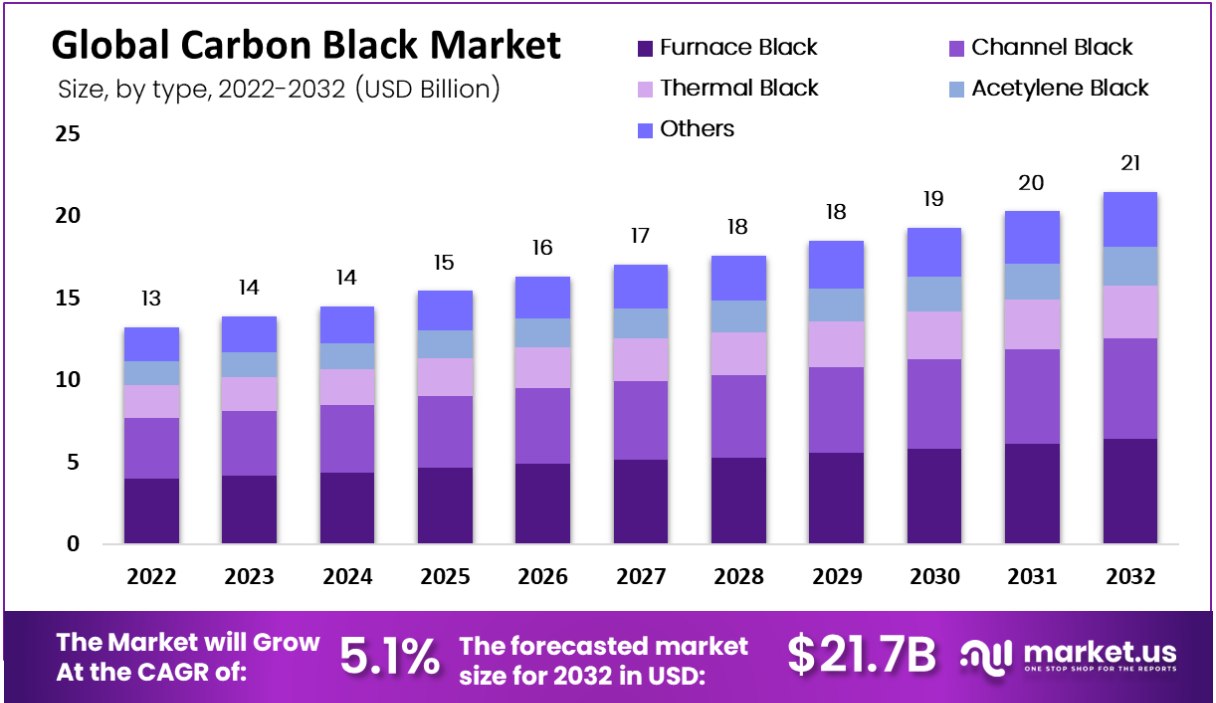

The global carbon black market, poised for substantial growth, is forecasted to increase from USD 13.2 billion in 2022 to approximately USD 21.7 billion by 2032, at a CAGR of 5.1% over the period from 2023 to 2033. This growth trajectory is supported by robust demand across various applications, including automotive tires, industrial rubber products, plastics, and coatings.

Significant growth drivers for the market include the expanding automotive sector, particularly in Asia Pacific regions where countries like China and India continue to increase both production and market capacity. Innovations in product applications and advancements in carbon black manufacturing processes also contribute to the market expansion. For instance, companies are now focusing on sustainability by developing lower-emission carbon black and recycled carbon black products, aligning with global environmental goals.

However, the market faces challenges such as fluctuating raw material prices and stringent environmental regulations that impact production costs and operational strategies. Additionally, competition from substitutes like silica in tire production poses a threat to traditional carbon black applications.

Recent developments in the industry include the implementation of advanced technologies to enhance production efficiencies and product quality. Key players are engaging in strategic activities such as mergers, acquisitions, and partnerships to bolster their market positions and expand into new geographical areas. For example, several manufacturers have introduced innovations like cogeneration technologies that convert waste from carbon black production into renewable energy, showcasing a commitment to sustainability and cost reduction.

Carbon Black Statistics

- In the first half of the year, carbon black imports totaled 39,800 tons, marking an 11.33% increase year-on-year.

- Import value reached US$108 million, a year-on-year increase of 4.22%.

- Import unit price of carbon black decreased by 6.38% compared to the same period last year.

- Tire production decreased by 9.47%, and tire export volumes significantly dropped by 17%.

- The carbon black industry’s total output was 2.22 million tons, down 6.4% year-on-year.

- Birla Carbon will increase capacity by over 200 kMT to support market and customer growth.

- Expansion specifics include 80 kMT in India, 40 kMT in Hungary, and 80 kMT in China.

Industry Challenges and Production

- The carbon black industry faced an overall loss in the first half of 2020, with losses increasing to nearly 50%.

- About 90% of carbon black is used in rubber products, predominantly in tires.

- Carbon black is a colloidal form of elemental carbon, made up of 95 to 99% carbon.

- It is produced in specially designed reactors at temperatures ranging from 2600° to 3600°F.

- 1.5 billion end-of-life tires (ELTs) are generated worldwide annually.

Emerging Trends

Emerging trends in the carbon black market are reshaping its future, focusing heavily on sustainability and technological innovations. One of the most significant trends is the development of sustainable carbon black alternatives, such as recovered carbon black (rCB) and bio-based options, which are gaining traction due to environmental concerns and regulatory pressures. These eco-friendly alternatives not only help reduce the carbon footprint of production processes but also align with global sustainability goals.

The market is also seeing a surge in applications of specialty carbon blacks, particularly in high-performance areas like conductive polymers and batteries, which are vital for emerging technologies including electric vehicles and renewable energy storage solutions. The use of carbon black in 3D printing and energy storage is another trend that points towards its diversifying application spectrum, expanding beyond the traditional rubber and tire sectors into more technologically advanced domains.

Another trend is the strategic expansion and innovation by major players in the industry. Companies are increasing their production capacities and developing new grades of carbon black to meet specific industry needs. This includes innovations aimed at enhancing product performance and reducing environmental impact. Strategic mergers and partnerships are also common as companies aim to strengthen their market position and expand geographic reach.

Use Cases

Tires and Industrial Rubber Products: Carbon black is primarily used in the tire industry, where it improves the strength and longevity of tires. It functions as a reinforcing agent, enhancing rubber’s resistance to wear and tear, which is critical for tire performance. The demand for carbon black in the tire sector is substantial, with a significant portion of the market driven by this application.

Plastics: In the plastics industry, carbon black is added to achieve high tinting strength and resistance to degradation from UV light. It is commonly used in the production of conductive packaging, automotive components, films, fibers, and various molded and extruded goods. The market sees a continuous demand from this segment, particularly for plastics that require UV stability and thermal insulation.

Paints, Coatings, and Inks: Carbon black is used as a pigment in paints, coatings, and printing inks for its deep black color, which provides excellent covering capabilities. It is also valued for its conductive properties in coatings that require conductivity.

High-Performance Coatings and Other Specialty Applications: With its ability to absorb UV light and convert it into heat, carbon black is integral in high-performance coatings, which protect materials from environmental wear and tear. Additionally, it finds uses in specialty applications such as toners and colorants for printing and photocopying.

Electrical and Electronics: The electrostatic discharge properties of carbon black are leveraged in the electronics industry, where it is used in components that require protection against static accumulation.

Construction and Infrastructure: Carbon black is also used in the construction industry, incorporated into materials like membranes and roofing components to enhance durability and resistance to environmental factors.

Major Challenges

Regulatory and Environmental Pressures: The industry is under continuous scrutiny due to environmental concerns. Carbon black production involves high emissions of CO2 and other pollutants, leading to stringent regulations across various regions. For instance, in Europe, the emphasis on reducing environmental impact has led to strict regulatory standards that companies must comply with.

Volatility in Raw Material Prices: Carbon black manufacturing is heavily dependent on petroleum-based feedstocks. Fluctuations in global oil prices can significantly impact the cost of raw materials, thereby affecting production costs and market pricing. This volatility makes budgeting and long-term planning challenging for manufacturers.

Technological Advancements and Alternatives: The development of alternative materials that can replace carbon black in certain applications poses a technological challenge. Advances in technology could lead to the adoption of newer materials that offer similar benefits at lower environmental costs, potentially reducing the demand for traditional carbon black.

Health and Safety Concerns: The production and handling of carbon black involve health risks, including respiratory issues and potential carcinogenic effects. These health risks necessitate stringent safety protocols and can lead to legal and financial liabilities for companies.

Market Dependency on Key Industries: The demand for carbon black is closely tied to the performance of major end-use sectors like automotive and construction. Any downturn in these industries can directly reduce the demand for carbon black, impacting the entire supply chain.

Geopolitical and Economic Uncertainties: Geopolitical tensions and economic instabilities in key markets can disrupt supply chains and affect the global distribution and availability of carbon black. For instance, conflicts or trade disputes can lead to restrictions or tariffs that may increase costs or limit access to essential markets.

Market Growth Opportunities

Increased Demand in End-User Industries: As the automotive and construction industries continue to expand, particularly in emerging markets, the demand for carbon black is expected to rise significantly. The automotive sector primarily uses carbon black to enhance the performance and longevity of tires, while construction uses it in materials like cables and sealants for its UV resistance and strength.

Technological Advancements and Sustainability: There is a growing trend towards sustainable and specialized grades of carbon black. Innovations such as methane pyrolysis, bio-based carbon black, and recycled carbon black (rCB) are gaining traction. These developments not only meet the increasing environmental regulations but also open up new applications in sectors like energy storage (e.g., in lithium-ion batteries) and electronics.

Geographical Expansion: The Asia Pacific region, in particular, is witnessing a rapid increase in demand due to its expanding industrial activities and automotive production. This region is becoming a key market for carbon black manufacturers looking to capitalize on local growth opportunities.

Emergence of New Applications: Beyond traditional uses, carbon black is finding roles in high-tech applications such as 3D printing and high-performance plastics. These emerging applications are likely to drive further growth in the carbon black market.

Recent Developments

Birla Carbon, a prominent player in the carbon black industry, has been actively expanding its global presence and capacity in 2023 and 2024. This expansion is strategically targeted to meet growing market demands across diverse applications, including tires, mechanical rubber goods, plastics, coatings, and specialty products.

For instance, in 2024, Birla Carbon announced plans to construct two new greenfield manufacturing sites in Naidupet, India, and Rayong, Thailand, with initial production capacities aimed at meeting the increasing demand in Asia. Additionally, the company is enhancing its production capabilities in Hungary and Patalganga, India, focusing on high-value specialty materials suitable for water-based coatings and other applications.

Cabot Corporation, a significant player in the carbon black sector, has been actively engaging in various strategic initiatives to strengthen its market position in 2023 and 2024. Headquartered in Boston, Massachusetts, Cabot is recognized for its specialty chemicals and performance materials, serving key industries like transportation and infrastructure. In 2023, the company announced a global price increase of up to 9% for its carbon black products due to inflationary pressures and the need to meet enhanced environmental regulations, which underscores its commitment to maintaining high-quality supply and sustainability practices.

Continental Carbon Company, established in 1936, has significantly contributed to the carbon black industry by leveraging waste streams from coal, refinery, and petrochemical industries to produce high-value carbon black primarily for rubber and renewable power generation. With operations spread across key global markets including the United States, Belgium, China, India, Saudi Arabia, and Taiwan, the company has established a robust presence with three operational offices, four technology centers, and multiple manufacturing sites.

Orion Engineered Carbons S.A., now known simply as Orion S.A., is a global leader in the production of specialty and high-performance carbon black, catering to a diverse range of industries including tires, coatings, plastics, and batteries. In 2023, Orion demonstrated significant financial resilience with net sales reaching approximately $1.89 billion. The company also declared an interim dividend to be paid in the fourth quarter of 2024, reflecting its ongoing financial stability and commitment to shareholder value.

PCBL Limited, India’s largest carbon black manufacturer, has demonstrated significant growth and strategic expansion in the carbon black sector over 2023 and 2024. The company’s revenue saw a robust increase, underscoring its strong market position and effective capacity utilization. In 2023, PCBL’s revenue surged by 32% due to high capacity utilization, which reached 666 KT from its expanded production facilities.

Conclusion

The carbon black market is poised for substantial growth, driven by increasing demand from key end-use industries like automotive and construction, and fueled by emerging markets, particularly in Asia Pacific. With the market projected to expand significantly, opportunities for innovation and expansion are robust, especially in sustainable production methods such as bio-based and recycled carbon black.

Technological advancements are set to broaden applications beyond traditional uses, tapping into sectors like energy storage and high-performance materials. However, the market faces challenges such as environmental regulations and the need for technological adaptation. Overall, the future of the carbon black industry looks promising, with a strong trajectory supported by both traditional demand and innovative, eco-friendly solutions that align with global sustainability goals.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)