Table of Contents

Introduction

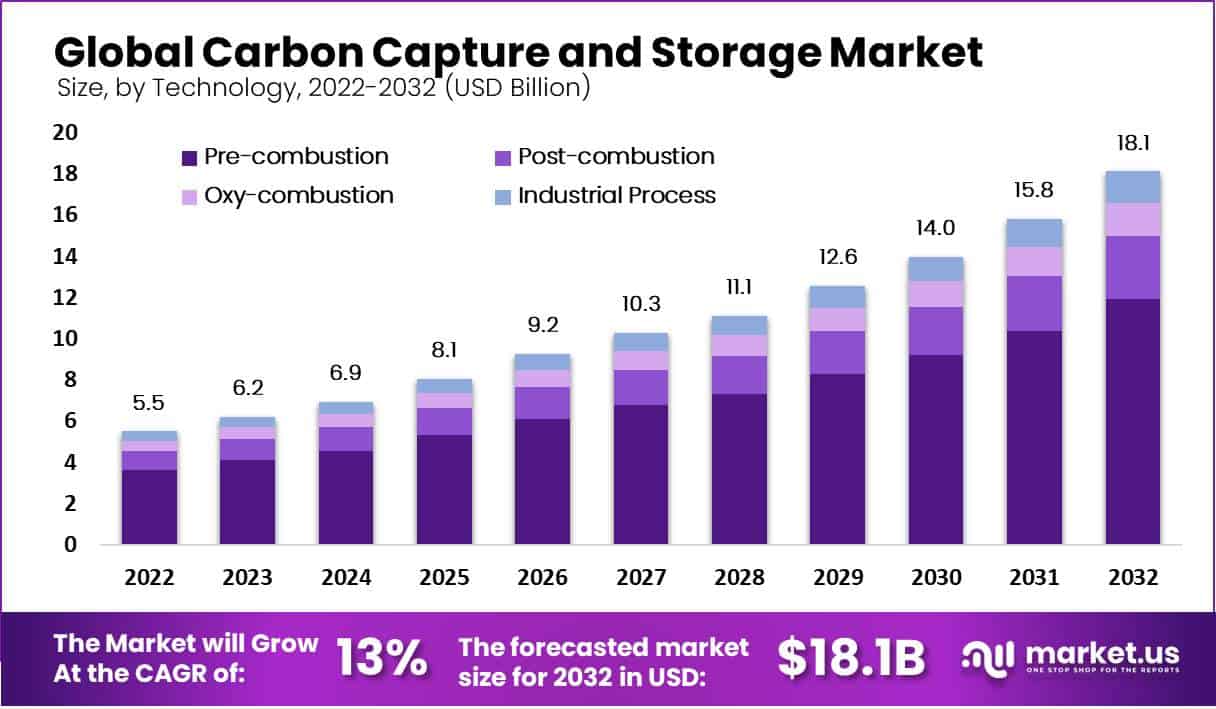

The global Carbon Capture and Storage Market, valued at USD 5.5 billion in 2022, is projected to reach USD 18.1 billion by 2032, growing at a compound annual growth rate (CAGR) of 13% from 2023 to 2032. This growth is driven by increasing industrialization and the rising need to address greenhouse gas emissions, particularly carbon dioxide, from heavy industries and power plants.

One of the primary growth factors for the Carbon Capture and Storage Market is the escalating demand for clean technologies amidst stringent environmental regulations aimed at reducing carbon footprints. Enhanced Oil Recovery (EOR) using captured CO2 is a significant driver, with the oil and gas sector being a major contributor to market demand due to its high carbon emissions from fossil fuel processing and consumption. Governments worldwide are implementing policies and incentives, such as the U.S.’s FUTURE Act, to promote CCS adoption, further bolstering market growth.

Challenges in the Carbon Capture and Storage Market include the high costs associated with capturing and storing CO2 and the technological complexities involved in safely transporting and storing carbon dioxide. Additionally, public perception and environmental concerns regarding the long-term storage of CO2 pose significant hurdles. However, advancements in capture technologies, such as post-combustion capture, which holds a substantial market share, are expected to mitigate some of these challenges by improving efficiency and reducing costs.

Recent developments in the Carbon Capture and Storage Market highlight the active participation of major industry players and collaborative efforts to advance technology. For instance, Shell, ExxonMobil, and the Guangdong Provincial Development and Reform Commission are collaborating on a CCS project in China, aimed at significantly reducing industrial CO2 emissions. Similarly, Baker Hughes and HIF Global are working on direct air capture technologies, emphasizing innovation in carbon capture solutions.

Regionally, North America leads the Carbon Capture and Storage Market due to extensive government support, robust regulatory frameworks, and substantial investments in CCS projects. The availability of suitable geological formations for CO2 storage in the U.S. and Canada also supports market expansion. The Asia-Pacific region is expected to witness significant growth, driven by industrialization and stringent emission reduction targets in countries like China, Japan, and India.

Key Takeaways

- Size and Growth: In 2022, the global carbon capture and storage market was valued at USD 5.5 billion and projected to increase at a compound annual growth rate of 13% between 2023-2032.

- Technology Evaluation: Precombustion technology holds an impressive share of 65.8% for carbon capture and storage applications, due to its energy efficiency and superior CO2 capture abilities.

- End-Use Industry Analysis: Power generation dominated the end-use industry segment in 2013 with 64.6% revenue contribution. Government regulations to curb carbon emissions have led to greater adoption of carbon capture and storage technology within this segment of power production.

Carbon Capture and Storage Statistics

- CCS is a technology used to reduce carbon dioxide (CO2)emissions from large‐scale industrial facilities, which account for 70% of Alberta’s emissions.

- The Alberta government has committed $1.24 billion to two commercial-scale CCS projects in the oil sands and fertilizers sectors—the Quest and the Carbon Trunk Line projects.

- The projects will capture a combined 2.76 million tonnes of CO2 per year, equivalent to the yearly emissions from approximately 600,000 cars.

- In 2021, the European Union adopted ambitious new targets to curb climate change, with a pledge to make them legally binding. Under a new law, the bloc committed to cutting carbon emissions by at least 55% by 2030, compared with 1990 levels.

- The roadmap to net zero will come from CCS, with the limit set by economic costs, ranging from $80-130/ton on today’s technologies, which is towards the upper end of what is affordable.

- Energy costs range from 2.5-3.7GJ/ton. Energy penalties are 15-45%.

- US mostly via SMRs, emitting 9 tons of CO2 per ton of H2. 60% of the CO2 from an SMR is highly concentrated, and can readily be captured.

- Our base case cost is $20/ton but can vary from $5-50/ton and there can be risks.

- According to the IPCC, CCS will account for an average of 2.4% of CO2 mitigation by 2030, even if implemented at its full, planned potential.

- Carbon capture is a challenging and expensive prospect and increasingly countries are pooling their resources to improve current technology. China and the U.S.,2 which together burn more than 40% of the world’s coal.

- Post-combustion capture refers to the treatment of flue gas before being released into the atmosphere. The flue gas consists of approximately 15–20% CO2 and 5% O2, with the balance being N2, and it is emitted from a full combustion process.

- The history of CCS is one of unfulfilled expectations. Only 10% of CCS projects undertaken thus far have been built.

- There is currently unprecedented momentum behind CCS. It has attracted over USD 2 billion in annual investment since 2020 and capacity could increase 600% by the end of the decade.

- Governments across the world provided USD 8.5 billion in support to CCS projects, but only 30% of that funding was spent as projects failed to get off the ground.

- By the end of 2021, there were only 44 million tonnes a year (mtpa) of capture capacity globally, according to BloombergNEF.

- Since 2018, the 45Q tax credit has provided a subsidy to the tune of USD 50 a tonne of carbon stored permanently.

Emerging Trends

Technological Innovations: Recent advancements in CCS technology are making the process more efficient and cost-effective. Technologies such as direct air capture (DAC) and carbon mineralization are gaining traction. DAC involves capturing CO2 directly from the atmosphere, which can then be stored or utilized in various industrial processes. This technology has seen significant investment and development, with new facilities coming online and improving capture capacities. Additionally, carbon mineralization, which converts CO2 into stable minerals, is emerging as a promising method for long-term storage.

Increased Government and Private Sector Investment: Governments and private companies are significantly boosting their investments in CCS projects. The European Union, for example, has allocated substantial funding through initiatives like the Innovation Fund and the Connecting Europe Facility to support CCS projects. Countries such as the Netherlands and Denmark are leading the way with multi-billion-dollar investments in CCS infrastructure. These investments are crucial for scaling up CCS technologies and ensuring their commercial viability.

Expansion of CCS in Industrial Applications: While natural gas processing plants currently dominate the Carbon Capture and Storage Market, there is a growing emphasis on applying CCS in other hard-to-abate sectors such as cement, steel, and chemical manufacturing. These industries are major CO2 emitters, and implementing CCS can significantly reduce their carbon footprints. The development of capture technologies tailored to these industries is accelerating, driven by both regulatory pressures and corporate sustainability goals.

Emergence of CCS Hubs and Clusters: The concept of CCS hubs or clusters is gaining momentum. These hubs integrate multiple CO2 emitters, transportation infrastructure, and storage sites to create economies of scale and reduce costs. Notable examples include the Porthos project in the Netherlands and the Ravenna CCS hub in Italy, which aim to capture and store millions of tonnes of CO2 annually. Such hubs are expected to play a critical role in the widespread adoption of CCS technologies.

Policy and Regulatory Support: Robust policy frameworks and regulatory support are essential for the growth of the Carbon Capture and Storage Market. Countries are introducing policies that provide incentives for CCS adoption, such as tax credits, grants, and subsidies. The U.S. FUTURE Act, for instance, offers tax credits for CO2 capture and storage, making CCS projects more financially attractive. Additionally, amendments to international protocols, like Japan’s proposed changes to the London Protocol, are facilitating cross-border CO2 storage, further expanding the market’s potential.

Corporate Commitments to Net Zero: Many corporations are committing to net-zero emissions targets, driving the demand for CCS technologies. Companies in the oil and gas sector, such as ExxonMobil and Shell, are investing heavily in CCS to mitigate their carbon emissions. These corporate commitments are crucial for the acceleration of CCS deployment and innovation, as they provide a stable demand base and financial backing for new projects.

Use Cases

Enhanced Oil Recovery (EOR): One of the most established use cases for CCS is Enhanced Oil Recovery (EOR). Captured CO2 is injected into depleted oil fields to increase pressure and stimulate the extraction of additional oil. This process not only helps in maximizing oil recovery but also sequesters CO2 underground, thereby reducing atmospheric emissions. Currently, a significant portion of captured CO2 is used in EOR, particularly in regions like North America where this practice is well-developed.

Power Generation: CCS technology is increasingly being integrated into power generation, particularly in coal and natural gas power plants. For instance, the Petra Nova project in Texas captures 1.4 million tonnes of CO2 annually from a coal-fired power plant. The CO2 is then used for EOR. Projects like these demonstrate how CCS can help decarbonize the power sector, which is one of the largest sources of global CO2 emissions.

Industrial Applications: Heavy industries such as cement, steel, and chemical production are major emitters of CO2. CCS can be applied to these sectors to capture emissions at the source. For example, the Leilac project in Belgium captures CO2 from cement production. The cement industry alone contributes to approximately 8% of global CO2 emissions, and CCS can play a critical role in reducing this footprint.

Hydrogen Production: CCS is also being used in hydrogen production, particularly in processes like steam methane reforming (SMR), where natural gas is converted into hydrogen and CO2. By capturing and storing the CO2 produced, hydrogen can be produced with a much lower carbon footprint, often referred to as “blue hydrogen.” This approach is vital for developing a hydrogen economy while managing emissions.

Direct Air Capture (DAC): Direct Air Capture (DAC) is an emerging CCS technology that captures CO2 directly from the atmosphere. This CO2 can then be stored underground or used in industrial processes. DAC projects, like those developed by companies such as Carbon Engineering and Climeworks, are crucial for addressing CO2 emissions that are already in the atmosphere, making it possible to achieve negative emissions.

Bioenergy with Carbon Capture and Storage (BECCS): BECCS involves capturing CO2 from biomass energy production. Biomass absorbs CO2 during its growth, and when it is used to generate energy, the CO2 produced is captured and stored, resulting in a net reduction of CO2 in the atmosphere. Projects like the Drax Power Station in the UK are pioneering this technology, capturing up to 4 million tonnes of CO2 annually by 2025.

Chemical Production: CCS is also being utilized in the production of chemicals like ammonia and methanol, which are essential for fertilizers and various industrial processes. Capturing CO2 from these processes can significantly reduce emissions. For example, the Air Products’ Port Arthur facility captures CO2 from hydrogen production for use in the petrochemical industry.

Major Challenges

High Costs: One of the most significant challenges facing CCS technology is its high cost. The process of capturing, transporting, and storing CO2 is expensive, often making CCS less economically viable compared to other emission reduction methods. For instance, the cost of capturing CO2 from industrial sources can range from $40 to $120 per tonne, while direct air capture can cost up to $600 per tonne. These high costs are a major barrier to widespread adoption, especially in industries operating on thin margins.

Energy Intensity: CCS processes are highly energy-intensive, which can offset some of the benefits of reducing CO2 emissions. The energy required to capture and compress CO2 for storage can increase the overall energy consumption of industrial plants by up to 25-30%. This added energy requirement can lead to higher operational costs and increased emissions from the additional energy production needed.

Technological Maturity: While there have been advancements in CCS technologies, many are still in the early stages of development and demonstration. There are currently only around 40 large-scale CCS facilities in operation worldwide, capturing approximately 40 million tonnes of CO2 annually. This is far below the 1.2 gigatonnes per year needed by 2050 to meet global climate goals. The limited number of operational projects makes it difficult to achieve economies of scale and reduce costs.

Infrastructure and Storage: Building the infrastructure required for CCS, including pipelines and storage facilities, presents a significant logistical and financial challenge. Suitable geological formations for CO2 storage are not uniformly distributed, meaning that CO2 may need to be transported long distances, increasing costs and complexity. Additionally, ensuring the long-term safety and stability of stored CO2 remains a critical concern.

Regulatory and Public Acceptance: The regulatory framework for CCS is still evolving in many parts of the world, leading to uncertainties for project developers. Moreover, public acceptance of CCS projects can be low due to concerns about the safety of CO2 storage and the potential for leaks. Gaining community support and navigating regulatory landscapes are essential for the successful deployment of CCS technologies

Market Growth Opportunities

Government Policies and Incentives: Governments worldwide are increasingly supporting CCS through policies and financial incentives. For instance, the U.S. FUTURE Act offers tax credits of up to $50 per tonne of CO2 stored, encouraging companies to invest in CCS technologies. The European Union has also allocated significant funds, including $1.5 billion under the Innovation Fund, to support CCS projects. These policies create a favorable environment for CCS development, making it more economically viable.

Growing Demand for Clean Energy: As the global focus on reducing greenhouse gas emissions intensifies, there is a rising demand for clean energy solutions. CCS can play a crucial role in decarbonizing power generation from fossil fuels. Projects like the Net Zero Teesside Power project in the UK aim to create one of the first commercial-scale gas-fired power stations with CCS, demonstrating the potential for clean energy integration. This growing demand presents a substantial market opportunity for CCS technology providers.

Industrial Applications: Heavy industries such as cement, steel, and chemicals are major CO2 emitters. Implementing CCS in these sectors can significantly reduce emissions. The Global CCS Institute estimates that capturing CO2 from industrial sources could account for around 20% of the required emissions reductions by 2050. Companies in these industries are increasingly looking to CCS to meet regulatory requirements and corporate sustainability goals, driving market growth.

Carbon Markets and Offtake Agreements: The development of carbon markets and offtake agreements provides new revenue streams for CCS projects. For example, companies like Microsoft have signed long-term offtake agreements for carbon removal credits, boosting the financial viability of CCS projects. These agreements provide a predictable revenue stream, making it easier for projects to secure financing and reach final investment decisions.

Technological Advancements: Advancements in CCS technologies are making the process more efficient and cost-effective. Innovations such as direct air capture (DAC) and carbon mineralization are gaining traction. DAC, which captures CO2 directly from the atmosphere, is particularly promising as it can achieve negative emissions. Projects like those by Carbon Engineering are setting new benchmarks for the industry, driving technological growth and market expansion.

Recent Developments

Siemens AG is actively advancing carbon capture and storage (CCS) technologies, with significant progress and partnerships in recent years. In 2023, Siemens Energy completed the first phase of its post-combustion CCS pilot, known as PostCap, at the Staudinger coal-fired power plant in Germany. This pilot achieved a remarkable 90% carbon capture rate while maintaining low energy consumption and negligible solvent emissions. The technology utilizes an aqueous amino acid salt solution, making it environmentally friendly and efficient. Additionally, in October 2023, Siemens partnered with Aramco to develop a pilot CCS project in Saudi Arabia, focusing on direct air capture, essential for reducing atmospheric CO2 levels. Another notable project is the “Net Zero Hub” at Strongford, UK, which began in August 2023 and aims to create the world’s first carbon-neutral wastewater treatment plant. This project, leveraging Siemens’ digital twin technology, is set to be completed by 2024 and highlights Siemens’ commitment to integrating CCS in various industrial processes to meet net-zero targets.

In 2023 and 2024, Aker Solutions made significant strides in the carbon capture and storage (CCS) sector, focusing on various large-scale projects and joint ventures. In November 2023, Aker Carbon Capture, a subsidiary of Aker Solutions, secured multiple feasibility and pre-FEED (Front-End Engineering Design) contracts across Europe and North America. For instance, they began a study with TES in Germany to capture 400,000 tonnes of CO2 annually from a waste-to-energy facility. Additionally, in April 2024, Aker Carbon Capture and MAN Energy Solutions initiated a feasibility study for a power-to-fuel solution in Norway, showcasing their modular Just Catch™ units, which are expected to enhance the CCS process significantly. By June 2024, Aker Carbon Capture announced the closing of a joint venture with SLB to develop large-scale carbon removal projects, emphasizing their commitment to deploying CCS technologies efficiently and at scale. This joint venture was further solidified in August 2024 with a FEED contract for a project on the U.S. Gulf Coast, aimed at removing 800,000 tonnes of carbon emissions annually from a pulp and paper mill.

Dakota Gasification Company, operating the Great Plains Synfuels Plant in North Dakota, has been a leader in carbon capture and storage (CCS) since the early 2000s. In 2023, Dakota Gas continued its significant CCS efforts by capturing and transporting approximately 2 million metric tons of CO2 annually. This CO2 is transported via a 205-mile pipeline to Saskatchewan, Canada, where it is used for enhanced oil recovery and permanent geologic sequestration. By November 2023, the Synfuels Plant had captured over 40 million metric tons of CO2 since the project began. The company also received a $5.1 million grant from the U.S. Department of Energy in May 2023 to advance its CCS monitoring technologies, reinforcing its role in one of the largest coal-based CCS projects globally. These efforts underline Dakota Gasification’s commitment to reducing greenhouse gas emissions and enhancing the sustainability of coal-based energy production.

In 2023 and 2024, Fluor Corporation made notable advancements in the carbon capture and storage (CCS) sector, leveraging its proprietary Econamine FG PlusSM technology. In July 2023, Fluor signed a memorandum of understanding with Carbfix, a pioneer in CO2 mineral storage, to provide integrated CCS solutions. This partnership aims to decarbonize industries with high greenhouse gas emissions, such as steel, aluminum, and cement. Fluor’s Econamine FG PlusSM technology, used in over 30 facilities globally, will be combined with Carbfix’s innovative process of dissolving CO2 in water and injecting it into basaltic rock formations, where it mineralizes within two years.

Conclusion

The Carbon Capture and Storage market is poised for substantial growth driven by a combination of regulatory support, technological advancements, and increasing industrial adoption. As global efforts to mitigate climate change intensify, the demand for CCS technologies is expected to rise significantly.

Key drivers include the implementation of supportive government policies such as the U.S. FUTURE Act and Europe’s Innovation Fund, which provide financial incentives and regulatory frameworks conducive to CCS deployment. The increasing necessity for clean energy technologies amidst stringent environmental regulations has also spurred investments in CCS across various sectors, including power generation, oil and gas, and heavy industries like cement and steel.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)