Table of Contents

Introduction

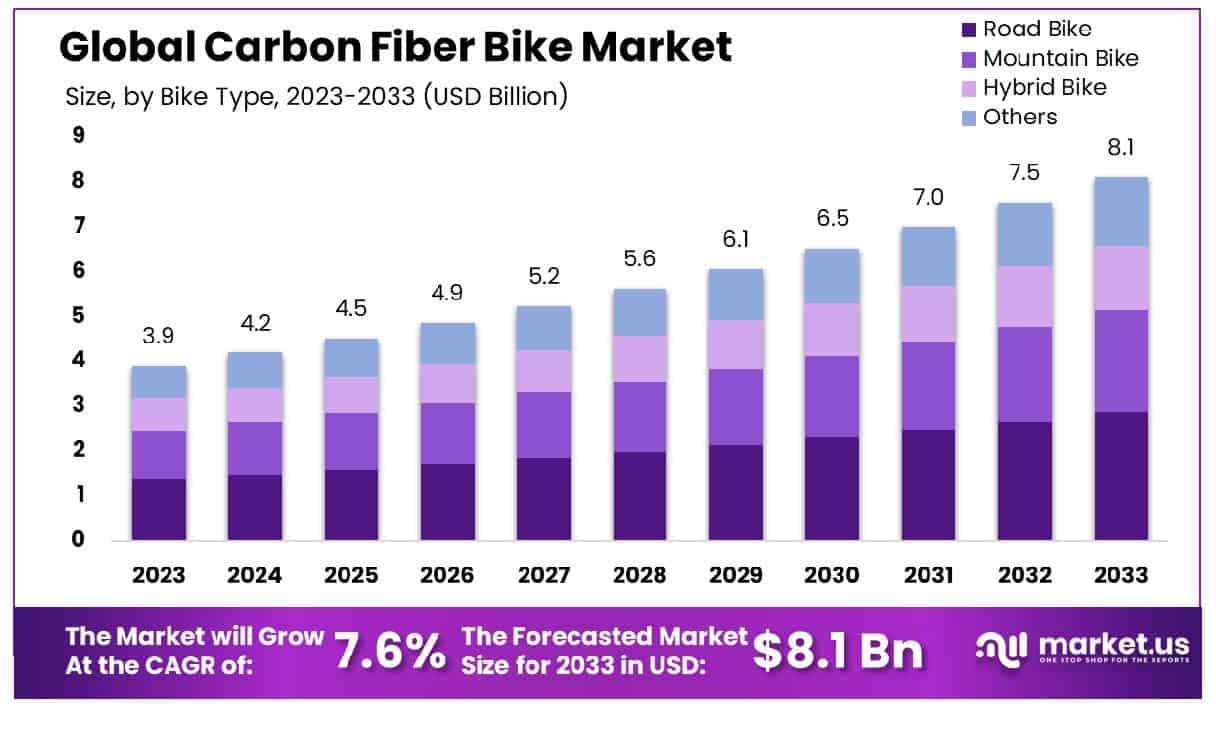

The Global Carbon Fiber Bike Market is projected to grow from USD 3.9 billion in 2023 to approximately USD 8.1 billion by 2033, reflecting a compound annual growth rate (CAGR) of 7.60% over the forecast period from 2024 to 2033.

A carbon fiber bike refers to a bicycle frame constructed using carbon fiber material, known for its exceptional strength-to-weight ratio. Carbon fiber is a composite material composed of carbon fibers embedded in a resin matrix, offering unmatched performance benefits such as light weight, high stiffness, and superior durability. Due to these characteristics, carbon fiber bikes are popular among cycling enthusiasts, professional athletes, and those seeking a premium cycling experience, making them ideal for road racing, mountain biking, and endurance rides.

The carbon fiber bike market encompasses the production, distribution, and sale of bicycles made from carbon fiber material, along with related accessories and components. It covers a range of bike types, including road bikes, mountain bikes, hybrid models, and electric-assisted bicycles (e-bikes). The market is characterized by a mix of established brands and emerging manufacturers who focus on innovation, design, and performance enhancement. With a strong presence in both consumer retail and professional sports, the market has seen increasing adoption across regions, driven by the growing popularity of recreational cycling, fitness trends, and demand for high-performance sports equipment.

Several key growth factors are driving the expansion of the carbon fiber bike market. First, the growing awareness of health and fitness, coupled with rising urbanization, has led to increased interest in cycling as a daily mode of transport and leisure activity. The superior performance characteristics of carbon fiber bikes such as reduced weight and enhanced speed are appealing to a wide range of consumers, from beginners to professionals.

Moreover, technological advancements in carbon fiber manufacturing have enabled more cost-effective production, making these bikes accessible to a broader audience. Additionally, the rise of e-commerce and online sales channels has facilitated easier market penetration and expanded customer reach, further boosting growth prospects.

The demand for carbon fiber bikes is fueled by a combination of lifestyle shifts and consumer preferences. Cycling has gained prominence not only as a sport but also as a sustainable and eco-friendly mode of commuting, aligning well with environmental goals and government initiatives in many regions. Consumers are increasingly willing to invest in high-quality, durable, and performance-oriented bikes, particularly in developed economies and growing cycling communities in Asia-Pacific and Europe.

Furthermore, the emergence of electric carbon fiber bikes (e-bikes) has added a new dimension to the market, attracting both fitness enthusiasts and urban commuters looking for an efficient, high-performance transport option.

The carbon fiber bike market are significant, driven by evolving consumer behaviors and advancements in material science. There’s potential for growth in emerging markets, where urbanization and rising income levels are leading to increased cycling adoption. Additionally, technological innovations in carbon fiber production, such as automated manufacturing processes and 3D printing, can enhance production efficiency, reduce costs, and improve product customization.

Manufacturers can also explore niche segments, like custom bikes tailored for specific sports or luxury models targeting affluent consumers. Collaborations with technology companies for integrated smart features, such as fitness tracking and navigation systems, also represent a promising avenue for future growth.

Key Takeaways

- The global carbon fiber bike market is projected to reach USD 8.1 billion by 2033, rising from USD 3.9 billion in 2023, with a compound annual growth rate (CAGR) of 7.60% anticipated between 2024 and 2033.

- North America leads the market, capturing a 38.4% share, indicating its strong position in the carbon fiber bike sector.

- Road bikes hold the largest market share at 35.3%, underscoring their high demand and popularity among cycling enthusiasts.

- Recreational use accounts for a 42.3% share, highlighting the preference for leisure cycling activities.

Carbon Fiber Bike Statistics

- Second pre-preg layer at 45° orientation enhances resistance to twisting and torsion.

- Premium carbon fiber bikes can exceed $16,000, with one-third of the cost allocated to the frame.

- Carbon fiber road bike frames have a lifespan of 10 years with regular upkeep.

- Production emits 20 kg CO2 per 1 kg of carbon fiber made.

- Lignin-based carbon fiber can reduce global warming potential by 54% compared to traditional carbon fiber.

- Industry-standard resin content in bike frames is 30-40% by weight.

- Toray T700 and T800 carbon fibers represent 65% of carbon fibers used in bike production.

- Recycled carbon fiber frames could lower environmental impact by 25%.

- Bio-based resins could decrease environmental impact by up to 40%.

- Hydrogen fuel cell production methods may cut carbon emissions by 60%.

- Online carbon bike sales rose by 35% in 2023.

- The average age of carbon bike owners dropped from 45 to 41 years between 2020 and 2023.

- Women’s carbon bike sales grew by 28% in 2023 compared to 2022.

- Gravel bike sales surged by 40% in 2023, making it the fastest-growing segment.

- E-bikes with carbon frames saw a 45% increase in sales in 2023.

- Recommended torque for carbon parts is 20-40% lower than for metal parts.

- Carbon frames need inspection every 5,000-7,000 miles by professional mechanics.

- 85% of carbon frame damage can be repaired at certified facilities.

- Annual maintenance for carbon bikes averages $150-300.

- Using carbon-specific assembly paste can increase bolt torque capacity by up to 30%.

- Carbon fiber bikes accounted for 98% of professional road race wins in 2023.

- Modern carbon frames can endure 40% higher impact forces than older models.

- UV resistance in recent carbon frames is 35% better than those made a decade ago.

- Professional teams report a frame failure rate of less than 1% during races.

- Laboratory tests show that modern carbon frames can withstand over 100,000 fatigue cycles without major damage.

- Repair costs for minor carbon frame damage range from $300-800.

Emerging Trends

- Technological Advancements in Materials: Manufacturers are exploring the integration of graphene and other advanced materials to enhance the strength, durability, and lightweight properties of carbon fiber bikes, aiming to push the boundaries of performance.

- Sustainability and Eco-Friendly Practices: There’s a growing emphasis on sustainable manufacturing processes, including the use of recycled carbon fiber and bio-based resins, to reduce environmental impact and appeal to eco-conscious consumers.

- Customization and Personalization: Riders increasingly seek bespoke frame geometries and tailored components, leading to a rise in customizable carbon fiber bikes that cater to individual preferences.

- Integration of Additive Manufacturing: The adoption of 3D printing technologies allows for greater design flexibility and efficiency in producing complex carbon fiber structures, enhancing performance and reducing waste.

- Enhanced Ride Comfort and Compliance: Innovative frame designs and material layup techniques are being developed to improve vibration absorption, resulting in a smoother ride without sacrificing performance.

Top Use Cases

- Competitive Racing: In professional cycling, carbon fiber bikes are favored for their exceptional stiffness-to-weight ratio, which enhances acceleration and speed. This advantage is crucial in races where every second counts.

- Recreational Riding: Enthusiasts choose carbon fiber bikes for leisure rides due to their comfortable ride quality and responsive handling. The material’s vibration-dampening properties reduce road buzz, allowing riders to enjoy longer rides with less fatigue.

- Urban Commuting: Carbon fiber’s durability and light weight make it ideal for daily city commuting. These bikes offer reliable performance and are easier to maneuver through urban traffic, providing an efficient transportation option for city dwellers.

- Mountain Biking: For off-road cycling, carbon fiber frames provide the strength needed to handle challenging terrains while remaining lightweight. This combination allows for better control and agility on rugged trails, enhancing the overall mountain biking experience.

- E-Bikes: The integration of carbon fiber in electric bicycles enhances their range and performance by reducing weight. This efficiency makes e-bikes more practical for various applications, from daily commuting to recreational use, extending their usability.

Major Challenges

- High Production Costs: Carbon fiber’s manufacturing process is complex and energy-intensive, leading to higher costs compared to materials like aluminum or steel. This results in premium-priced bikes, limiting accessibility for many consumers.

- Environmental Impact and Recycling Difficulties: Producing carbon fiber involves significant energy consumption, with estimates indicating high carbon emissions of 50 kg CO2e/kg or more. Additionally, recycling carbon fiber components is challenging due to the material’s composition, leading to environmental concerns.

- Supply Chain Constraints: The global carbon fiber market is subject to supply chain disruptions, affecting the availability of raw materials and components. These interruptions can delay production and increase costs, impacting the overall market growth.

- Market Competition and Pricing Pressures: While carbon fiber bikes are in demand, their high costs can be a barrier for consumers, especially when more affordable alternatives are available. The price sensitivity in the automotive industry limits carbon fiber’s use in manufacturing lightweight, fuel-efficient vehicles.

- Technological Limitations in Mass Production: Despite advancements, efficiently mass-producing carbon fiber components remains challenging. The specialized manufacturing processes require significant investment and expertise, which can hinder scalability and widespread adoption.

Top Opportunities

- Rising Demand for Lightweight and High-Performance Bicycles: Carbon fiber’s exceptional strength-to-weight ratio makes it an ideal material for high-performance bikes. This advantage is increasingly recognized by both professional athletes and recreational cyclists, boosting the demand for carbon fiber bicycles.

- Expansion of Cycling as a Recreational and Competitive Activity: The growing popularity of cycling, both as a leisure activity and a competitive sport, has led to increased sales of carbon fiber bikes. Events like the Tour de France, which attract over 3.5 billion viewers worldwide, significantly enhance the visibility and appeal of high-performance cycling equipment.

- Technological Advancements and New Product Developments: Innovations in carbon fiber technology have resulted in more durable and cost-effective bike frames. For instance, the use of high-quality 16K carbon fiber in manufacturing has produced frames that are stronger than steel and come with lifetime warranties, thereby increasing consumer confidence and adoption.

- Environmental and Health Benefits Driving Adoption: As individuals become more environmentally conscious and seek healthier lifestyles, cycling is increasingly favored as a sustainable mode of transportation and exercise.

- Growth in Emerging Markets: Rising incomes and urbanization in regions such as Asia-Pacific, Latin America, and Africa are creating new opportunities for carbon fiber bike manufacturers. These markets are experiencing increased demand for high-quality bicycles, presenting potential for significant market expansion.

Key Player Analysis

- Trek Bicycle Corporation: Trek is renowned for producing high-performance carbon fiber bikes, particularly in the road and mountain biking segments. While specific revenue figures for their carbon fiber segment are not publicly disclosed, Trek’s emphasis on carbon fiber technology has solidified its position in the premium bike market.

- Giant Manufacturing Co. Ltd. : Giant, a Taiwan-based company, is one of the world’s largest bicycle manufacturers. They offer a comprehensive range of carbon fiber bikes, including road, mountain, and hybrid models. Giant’s global revenue reached approximately USD 2.2 billion in 2020, underscoring their significant market presence.

- Specialized Bicycle Components: Specialized is a leading American brand known for its high-quality carbon fiber bikes, catering to both road and mountain biking enthusiasts. The company invests heavily in research and development to produce cutting-edge carbon fiber frames and components.

- Cannondale: Cannondale, an American company, has a strong reputation for manufacturing carbon fiber road and mountain bikes. They are recognized for their innovative design and engineering, contributing significantly to the carbon fiber bike market.

- Cervélo: Cervélo, based in Canada, specializes in carbon fiber road and triathlon bikes. Their focus on aerodynamics and performance has made them a preferred choice among professional and amateur cyclists.

Recent Developments

- In 2024, Yamaha unveiled a special 30th-anniversary edition of its groundbreaking eBike, the MORO 07, finished in an exclusive Factory Silver color. This limited-edition model celebrates Yamaha’s legacy as the pioneer of production eBikes, enhancing its reputation with a striking Dual Twin frame that takes design cues from Yamaha’s iconic YZ motocross models, renowned for winning World Championships for over 50 years. Targeted at MTB riders who seek top-tier chassis and drive unit technology, the MORO 07 embodies Yamaha’s commitment to performance on challenging terrains.

- In March 7, 2024, 509, a recognized leader in outdoor riding apparel, introduced its 2024 Dirt Collection tailored for dirt bike enthusiasts. This new collection includes groundbreaking innovations such as industry-first anti-fog goggle technology, versatile gear kits available in youth sizes, and refreshed helmet designs offered in a vibrant range of colors. This launch further strengthens 509’s dedication to enhancing rider safety and comfort in off-road conditions.

- In 2024, Giant redefined road cycling by introducing the 10th generation TCR in March, marking a milestone in a legacy that spans 28 years. Developed collaboratively by Giant’s product team, in-house aerodynamics experts, and Team Jayco-AlUla athletes and technicians, the TCR Advanced SL stands as the lightest and most efficient model in the series to date. This latest generation incorporates innovative features made possible through advanced construction techniques, setting a new benchmark in road bike performance.

- In 2024, Arris Composites, headquartered in Berkeley, California, introduced the Arris | Made to Outperform (MTO) bicycle spokes, representing a major leap forward in cycling technology. These cutting-edge spokes are constructed from carbon fiber-reinforced thermoplastics (CFRTP), a material known for its high strength and lightweight properties. The production of these spokes is driven by Arris’ unique Additive Molding technology, which combines state-of-the-art software, materials science, and manufacturing processes to deliver superior performance and durability for cyclists.

Conclusion

The carbon fiber bike market is experiencing significant growth, driven by increasing consumer demand for lightweight and high-performance bicycles. Carbon fiber’s exceptional strength-to-weight ratio and versatility make it an ideal material for various bike types, including road, mountain, and hybrid models.

Technological advancements have enhanced the material’s accessibility, leading to a broader range of products and increased adoption among cyclists. Despite challenges such as higher costs compared to traditional materials, the market continues to expand. This growth is supported by a focus on sustainability and the rising popularity of cycling as both a recreational activity and a mode of transportation.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)