Table of Contents

Introduction

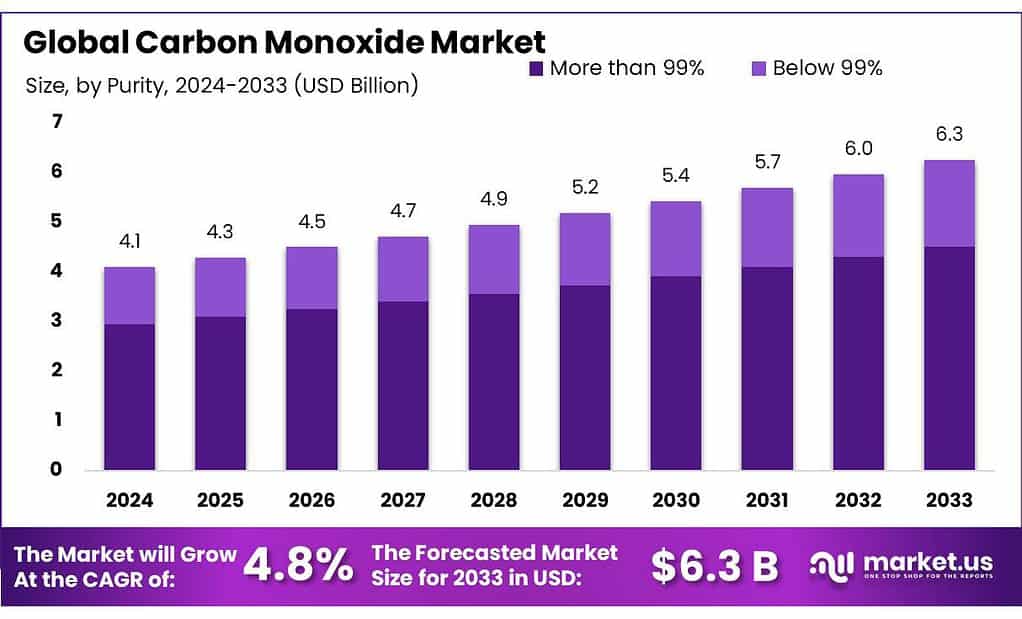

The global carbon monoxide market is projected to grow from USD 4.1 billion in 2023 to USD 6.3 billion by 2033, with a compound annual growth rate (CAGR) of 4.8%. This growth is driven by several factors, including the increasing use of carbon monoxide in metal fabrication and pharmaceuticals, as well as its critical role in the chemicals and electronics sectors. The market is also influenced by the growing demand for syngas, which utilizes carbon monoxide as a primary component.

However, the market faces challenges such as the toxic nature of carbon monoxide, which requires stringent handling and usage standards to ensure safety in industrial and residential environments. Technological advancements and heightened safety regulations have spurred developments in detection and monitoring technologies, enhancing safety and efficiency in its application.

Recent developments include strategic expansions by key industry players like Air Products and Air Liquide, focusing on enhancing production capacities and developing new technologies for carbon monoxide utilization. For instance, new production facilities are being set up to cater to the increasing demand, particularly from the metal extraction and processing industries, which use carbon monoxide as a reducing agent.

Air Liquide has made substantial investments in new technologies and capacity expansions, particularly in the hydrogen and carbon monoxide sectors. In 2022, they committed over 200 million euros to build two hydrogen production units with carbon capture technology in Shanghai. These units, which are part of Air Liquide’s strategy to reduce carbon emissions, will also support the production of carbon monoxide, enhancing the company’s supply capacity and environmental sustainability efforts.

Key Takeaways

- The global carbon monoxide market is projected to grow from USD 4.1 billion in 2023 to USD 6.3 billion by 2033, at a 4.8% CAGR.

- Carbon monoxide with more than 99% purity dominated the market in 2023, capturing 72.1% of the total market due to its use in chemical processes.

- Asia-Pacific led the global carbon monoxide market in 2023, capturing 42% market share, driven by robust industrial growth in China, India, and Japan.

- Commercial-grade carbon monoxide captured 82.4% of the market share in 2023, used predominantly in chemical and metallurgical industries.

- In 2023, metal fabrication held the largest application share, accounting for 43.2% of total market demand due to its role in metallurgy.

Carbon Monoxide Statistics

- Carbon monoxide (CO) poisoning is one of the most common poisonings. Mattiuzzi & Lippi (2020) found the incidence as 137 per million and the risk of death 4.6 in a worldwide epidemiological evaluation conducted in 2019.

- A minimal amount of CO is also produced in the human body. CO, emerging endogenously due to hemoglobin catabolism, leads to less than 1% COHb formation.

- At COHb levels below 5%, the physiological compensation of increased blood flow and oxygen release prevents hypoxia.

- Unless the COHb rate in the blood exceeds 20%, there is no significant change in brain oxygenation, while any value above 51% leads to seizures, coma, severe acidosis, and death.

- This descriptive-retrospective study evaluated all CO poisoning cases that occurred in 11 years between 2012 and 2022 in Adiyaman, with a population of 632,148 in Southeast Turkey.

- As a result of the investigation, it was determined that there was a total of 4,395 carbon monoxide poisonings in 11 years in Adiyaman.

- Improvements in unintentional carbon monoxide poisoning mortality rates have been inconsistent across regions and over time since 2000.

- Carbon monoxide’s affinity for hemoglobin is 200–250 times greater than that of oxygen. Carboxyhemoglobin is completely dissociable, and carbon monoxide is liberated and eliminated through the lungs after exposure to carbon monoxide ceases.

- But for high-temperature PEMFCs that are operated at temperatures between 100 and 200 °C, the CO tolerance level can be increased by roughly a few times.

- Most CO measurements in surface seawater are typically taken from underway measurement systems whose intakes are usually between 4 m and 7 m.

- Hundreds of people in the U.S. die from unintentional carbon monoxide poisoning every year, according to the Centers for Disease Control and Prevention. More than 20,000 visit the emergency room, and more than 4,000 others are hospitalized.

- 480 U.S. residents died between 2001 and 2003 from non-fire-related carbon-monoxide poisoning.

- The limit of CO exposure for healthy workers, as prescribed by the U.S. Occupational Health and Safety Administration, is 50 ppm.

- within 15 feet of heating and cooking appliances, or in or near very humid areas, such as bathrooms.

Emerging Trends

- Emerging trends in the carbon monoxide market reflect the evolving needs and technologies influencing its growth. One significant trend is the rising demand for high-purity carbon monoxide in the electronics and pharmaceutical industries, where it’s crucial for various manufacturing processes. This demand is particularly strong in Asia-Pacific, which leads the market due to rapid industrialization and extensive manufacturing activities.

- Technological advancements in carbon monoxide detection and monitoring are also pivotal, given the gas’s toxic nature. Increased regulatory focus on safety and environmental standards is driving the adoption of more sophisticated detection technologies. These technologies are becoming more integrated with IoT, enhancing their effectiveness in monitoring and safety applications.

- Another notable trend is the strategic expansions and technological investments by major players like Air Liquide and Air Products and Chemicals, Inc. These companies are focusing on increasing production capacities and developing new applications for carbon monoxide. For instance, Air Liquide is investing in new production facilities that include carbon capture technologies, aligning with global sustainability goals.

- Furthermore, the market is seeing a push towards the development of carbon monoxide applications in cleaner technologies, such as in syngas production for fuel and energy sectors, which could foster more environmentally friendly uses of carbon monoxide in the future.

Use Cases

- Carbon monoxide (CO) is utilized across a broad spectrum of industrial applications, underlining its importance as a versatile industrial gas. One significant use of CO is in the metal fabrication industry, where it serves as a crucial reducing agent in metallurgical processes, including the reduction of metal oxides and the production of alloys. This application leverages CO’s reactivity with oxides to extract pure metals, especially in steel manufacturing, and contributes heavily to its demand in this sector.

- In the chemical industry, CO is essential for synthesizing various chemicals through processes such as the Fischer-Tropsch synthesis, methanol production, hydroformylation, and the production of phosgene and acetic acid.These processes typically rely on syngas, a mixture of hydrogen and carbon monoxide, emphasizing CO’s role in creating a wide array of chemical products.

- Moreover, carbon monoxide finds applications in electronics manufacturing, particularly in the production of semiconductors and other sensitive electronic components. Its high purity levels are crucial in environments that require stringent control of contaminants.

- Another critical use of carbon monoxide is in the healthcare sector, specifically in pharmaceutical manufacturing where it is used in various synthesis processes. The ability to produce specific chemical compounds used in medications underscores CO’s utility in this field.

- Lastly, CO’s properties are exploited in newer technologies for environmental control, such as carbon monoxide recovery and purification from industrial gas streams. This includes separating CO from nitrogen in contexts like steel production, where it is a significant by-product. Advanced separation technologies such as cryogenics, absorption, adsorption, and membrane separation are employed to isolate and purify CO for further industrial use.

Major Challenges

- Regulatory Challenges: Stringent environmental regulations are a major hurdle, as governments worldwide impose tougher standards to control emissions and enhance safety protocols in industries that utilize carbon monoxide. These regulations require substantial compliance costs and can limit the operational flexibility of companies within the sector.

- Health and Safety Concerns: Carbon monoxide’s highly toxic nature necessitates rigorous health and safety measures. Ensuring safe handling and preventing leaks in industrial settings can be costly and technically challenging. This not only increases operational costs but also affects the scalability of carbon monoxide applications in various industries.

- Economic and Financial Challenges: The high costs associated with the development and deployment of advanced carbon monoxide detection and capture technologies can be prohibitive, especially for operations in developing regions. Additionally, while there are financial incentives for adopting cleaner technologies, the initial outlay for such technologies can be a barrier for many companies.

- Supply Chain and Market Demand Fluctuations: The market has experienced fluctuations in demand and supply chain disruptions, particularly highlighted during the COVID-19 pandemic, which impacted the production and distribution of carbon monoxide. These fluctuations can lead to instability in pricing and availability, affecting profitability and planning.

Market Growth Opportunities

- Asia-Pacific Expansion: This region is expected to see the fastest growth in the carbon monoxide market, driven by rapid industrialization and the expansion of manufacturing sectors, particularly in China and India. The widespread use of carbon monoxide in industries such as chemicals and electronics is a major driver. Innovations like converting CO into valuable products such as fuel ethanol and protein feed using gas fermentation technology also present new business opportunities

- Environmental and Clean Energy Initiatives: Globally, there’s a push towards cleaner production methods, which includes the use of carbon monoxide in clean energy technologies like gasification for synthetic fuels. This shift not only meets environmental standards but also aligns with growing sustainability goals in the energy sector.

- Technological Advancements in Production and Safety: Innovations in carbon monoxide production and utilization, such as more efficient purification technologies and advanced safety measures, are vital. The development of new applications and improvements in carbon capture and storage (CCS) technologies offer potential for market expansion and enhanced safety profiles.

- Strategic Partnerships and Market Penetration: Companies are increasingly forming strategic alliances and expanding their operational capacities to leverage the growing market, particularly in emerging economies. These collaborations help companies enhance their market presence and capitalize on regional growth potentials.

- Diversification into New Industries: Carbon monoxide’s role as a preservative in the food and beverage sector and its applications in metal fabrication, pharmaceuticals, and other industrial processes highlight its versatility. Expanding its use into these new areas could open additional markets and drive further growth.

Key Players Analysis

In 2023, Air Liquide continued to expand its operations in the carbon monoxide sector with significant investments in decarbonization and low-carbon technology projects. They committed substantial resources towards new hydrogen and carbon monoxide production facilities, particularly highlighting a strategy to support the low-carbon transition. Air Liquide’s investments and strategic plans, including the expansion of carbon monoxide supply in South Korea and significant contributions to renewable energy initiatives, demonstrate their commitment to increasing both capacity and sustainability in the industry.

Air Products and Chemicals, Inc. has also been proactive in the carbon monoxide market, focusing on expanding production capacity. In 2023, they announced significant developments, including the construction of two major carbon monoxide production facilities in Texas. These facilities are part of the world’s largest CO pipeline network and mark a strategic effort to enhance supply and meet growing industrial demands. Air Products’ initiatives are set to substantially increase their carbon monoxide production capabilities, ensuring a stable supply for various industrial applications.

In 2023, American Gas Products continued to provide a range of industrial gases, including carbon monoxide, primarily serving the U.S. market. The company’s role in the carbon monoxide sector involves supplying this critical industrial gas, which is used as a reducing agent in metal production and processing among other applications. They are part of a competitive market landscape where strategic alliances are key to maintaining and enhancing market presence.

ATCO Atmospheric and Specialty Gases Pvt. Ltd. specializes in the production and supply of a variety of gases, including carbon monoxide, tailored for diverse industrial needs. While specific updates for 2023 or 2024 were not highlighted, the company operates in a market where carbon monoxide’s role is critical for applications ranging from chemical manufacturing to metal fabrication. ATCO’s ability to provide these specialty gases supports various sectors, including pharmaceuticals and food and beverage industries, underscoring its integral role in the supply chain.

In 2023 and 2024, ATCO Atmospheric and Specialty Gases Pvt. Ltd. continued to support various industries with its specialty gases, including carbon monoxide. The company has been involved in providing these gases for a range of applications, leveraging its expertise to meet specific customer needs in sectors such as pharmaceuticals, food and beverage, and other industrial uses.

Axcel Gases has been actively involved in the carbon monoxide sector, focusing on supplying high-quality gases for industrial uses. Their extensive experience and commitment to quality ensure they meet the diverse requirements of their global clientele, with a strong emphasis on safety and reliability in the delivery and handling of carbon monoxide and other gases.

Broner Glove & Safety Company is actively involved in providing comprehensive safety solutions, including carbon monoxide safety through the distribution of safety equipment like gas detection systems. Their focus extends to ensuring workplace safety against various hazards, including toxic gases. In 2023 and 2024, Broner Glove & Safety continues to emphasize its dedication to enhancing workplace safety protocols and equipment, catering to industries that require stringent safety measures against carbon monoxide exposure.

Celanese Corporation, a major chemical producer, uses carbon monoxide as a fundamental feedstock in its acetyl chain operations, which produce chemical products used across a variety of industries. Over the years, Celanese has maintained a focus on optimizing and expanding its production capabilities in carbon monoxide usage to enhance efficiency and meet global demand in sectors like plastics, paints, and coatings. In 2023 and 2024, Celanese is expected to continue leveraging its expertise in chemical synthesis involving carbon monoxide to support growth and innovation within its extensive product portfolio.

Glencore plc does not feature prominently in the carbon monoxide sector as its core business focuses more on mining and commodities trading. However, the company’s metallurgical processes could indirectly involve the use of carbon monoxide, especially in metal extraction and refining practices. As of 2023 and 2024, Glencore’s activities in the carbon market are primarily related to the broader applications of carbon in its industrial operations, rather than specific developments or innovations directly concerning carbon monoxide.

Linde plc plays a significant role in the carbon monoxide sector, particularly through its production and supply of gases for various industries. In 2023, Linde continued to innovate and expand its capabilities, particularly in enhancing carbon management solutions across its operations. The company has been focused on increasing the efficiency of its carbon monoxide production facilities and expanding its use in clean energy applications. Linde’s strategic initiatives include the development of new technologies and processes that utilize carbon monoxide in more environmentally friendly ways, further solidifying its leadership in the industrial gases market.

Lundin Energy is focused on achieving carbon neutrality in its operations, particularly through initiatives in renewable power generation and efficient energy usage in its offshore oil and gas production. As of 2023, the company has been advancing its sustainability commitments by integrating environmental strategies into its core business operations, aiming to reduce its carbon footprint significantly across its major production assets like the Edvard Grieg and Johan Sverdrup fields in Norway.

LyondellBasell Industries N.V. plays a significant role in the carbon monoxide market, primarily through its use in acetyls and chemical production, which are key components for various industrial processes. The company’s involvement in the production of chemicals that require carbon monoxide highlights its strategic focus on maintaining and expanding its capabilities in high-demand chemical sectors. LyondellBasell continues to leverage its technological and production expertise to meet global demand while ensuring compliance with environmental regulations.

MESA Specialty Gases & Equipment continues to cater to the specialty and calibration gas markets, including carbon monoxide, focusing on high precision and custom solutions to meet diverse industry needs in 2023 and 2024. Their commitment to quality and customer-specific requirements remains strong, supporting various sectors that depend on accurate gas compositions for critical applications.

Messer Group GmbH showcased resilience in 2023 amidst economic fluctuations, achieving a 7.1% increase in sales, amounting to approximately 4,391 million euros. Their focus on sustainable growth and supporting customer decarbonization efforts underline their proactive approach in the industrial gases sector, including carbon monoxide applications.

Middlesex Gases & Technologies, Inc. continues to serve the Northeastern U.S. market with a variety of specialty gases, including carbon monoxide. In 2023, the company emphasized expanding their offerings to high-purity gases that meet specific industry needs, reinforcing their commitment to providing reliable and critical gas supplies for various applications such as pharmaceuticals and manufacturing.

Ningbo DSW International Co., Ltd., based in China, is significantly involved in the carbon monoxide sector, supplying high-purity carbon monoxide crucial for industrial uses. The company manufactures and distributes a variety of gas cylinders, ensuring the delivery of carbon monoxide with high purity levels for critical applications in the chemical industry. Their operations include extensive quality control measures to maintain gas purity, which is essential for their broad client base in various industrial sectors.

Conclusion

However, challenges persist, including stringent environmental regulations and health and safety concerns associated with its toxic nature. To navigate these challenges, companies are investing in advanced production technologies and forming strategic partnerships to enhance market penetration.

The Asia-Pacific region, in particular, is expected to experience significant growth due to rapid industrialization and the expansion of manufacturing sectors. Overall, the market’s trajectory suggests a balance between leveraging growth opportunities and addressing inherent challenges to ensure sustainable development.

Discuss Your Needs With Our Analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)