Table of Contents

Introduction

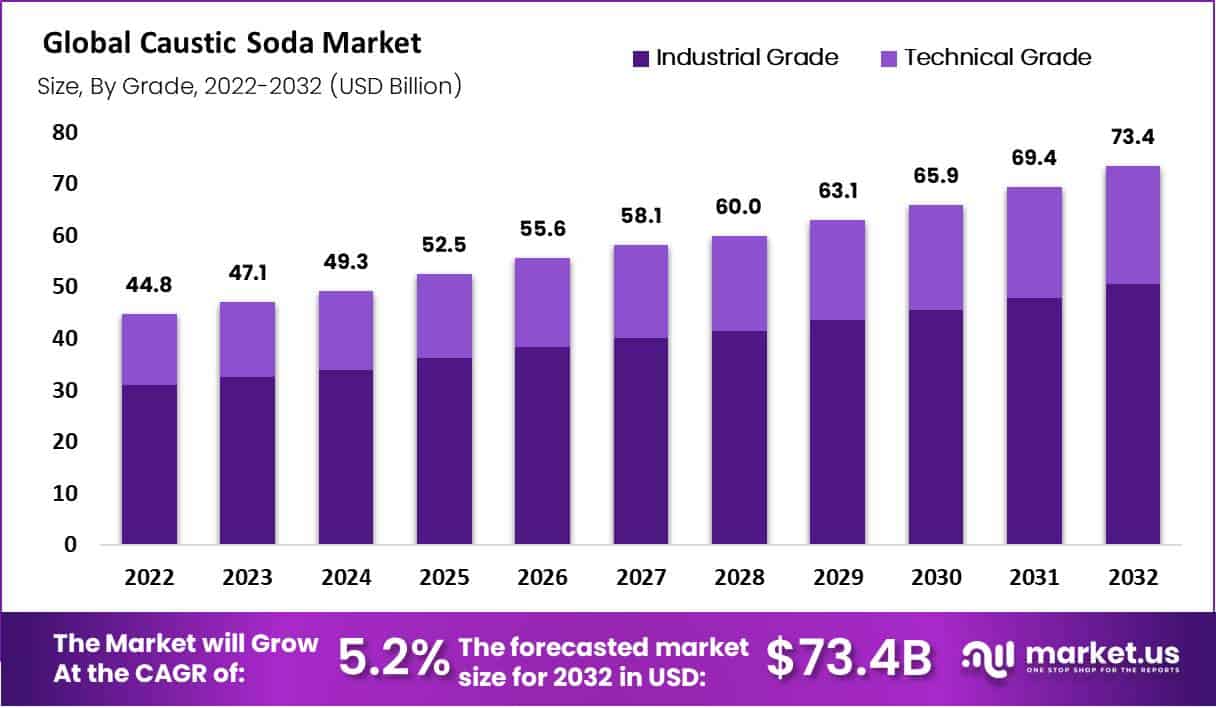

The global Caustic Soda Market is on a growth trajectory, expected to expand from USD 47.1 billion in 2023 to about USD 73.4 billion by 2032, at a CAGR of 5.2%. This growth is propelled by robust demand across various industries including alumina production, paper and pulp, and the manufacture of soaps and detergents.

One of the major drivers for this market is the increasing demand for alumina, used primarily in the production of aluminum, which finds extensive application in the construction, automotive, aerospace, and packaging industries due to its durability and corrosion resistance. Additionally, the growth of the pulp and paper industry, particularly in Asia-Pacific, which dominates the market, contributes significantly to the demand for caustic soda.

However, the market faces challenges such as the energy-intensive nature of caustic soda production, which can restrain growth. Technological innovations aimed at improving production efficiency and reducing environmental impact are crucial for overcoming these challenges.

Recent developments indicate significant investments in capacity expansion and technological upgrades to meet growing market demands. For example, Occidental Petroleum’s chemical division plans to overhaul some chlor-alkali plants to increase the production capacity of high-value caustic soda.

The Caustic Soda Market is witnessing several significant developments due to actions taken by key players in the industry. For instance, Occidental Petroleum Corporation is enhancing its market position by planning to increase the production capacity of its chlor-alkali plants, aiming to produce higher-value caustic soda to meet rising demands. This expansion reflects the company’s strategic response to anticipated increases in demand for caustic soda, particularly from the alumina and soap industries.

Shin-Etsu Chemical Co., Ltd. is another major participant making notable advances. They announced plans to expand their caustic soda production facilities, which underscores their commitment to capitalizing on the growing market needs and maintaining their leadership in the chemical sector. Formosa Plastics Corporation, a significant manufacturer in the caustic soda market, is known for its substantial production capacity and strategic market actions, which ensure it remains competitive in this rapidly evolving industry. Saudi Basic Industries Corporation (SABIC) and Solvay SA are also key players, continually seeking to innovate and improve their caustic soda offerings. Both companies are deeply involved in optimizing their production processes and expanding their market reach to meet global demands effectively.

Caustic Soda Facts And Statistics

- Belgium rose 1.1% in Sold Production of Sodium Hydroxide in Aqueous Solution in 2019, from a year earlier.

- In 2019 Germany was ranked number 1 in the Production of Sodium Hydroxide in Aqueous Solution.

- Since 2014 Indonesia’s Import of Sodium Hydroxide (Caustic Soda) Solid was up 20.6% year on year close to $45,364,041.32.

- In 2015 Bangladesh was ranked number 101 in Import of Sodium Hydroxide (Caustic Soda) in Aqueous Solution to $310,908, jumping from 156 in 2014.

- Over the past seven years, the average annual growth rate of caustic soda consumption in the paper industry has been around 1.5%. Although there was a slight slowdown in 2020, the growth rate has rebounded significantly since 2021.

- Based on our projections, we anticipate that the consumption of caustic soda will be 9% higher by the end of 2023 compared to 2019.

- Among these grades, caustic soda is predominantly used in chemical pulp, accounting for 80% of the total consumption.

- Within chemical pulp, kraft pulp is the primary consumer-grade, using over 90% of the caustic soda consumed by chemical pulps.

- Approximately 35kg of caustic soda is required to produce one ton of market pulp.

- These top five countries account for 65% of the caustic soda consumed in the industry.

- Most suppliers offer caustic soda pearls in 25 kg bags.

- Nedstar supplies liquid caustic soda in 48%, 50%, and a variety of other concentrations, as required.

- Twenty-seven (47.4 %) children got access to the soda at storage, 1 (1.86 %) was administered accidentally by a sibling and 29 (50.9 %) ingested it during soap preparation.

Emerging Trends

Emerging trends in the Caustic Soda market are significantly influenced by technological advancements and environmental concerns. The integration of membrane cell technology is one major trend enhancing the efficiency of caustic soda production. This method not only reduces energy consumption but also minimizes the environmental impact associated with older production technologies like the mercury and diaphragm processes.

Another key trend is the increasing use of caustic soda in the water treatment industry. As global standards for clean water rise, the demand for caustic soda in water purification processes is expected to grow. This application capitalizes on caustic soda’s ability to adjust pH levels and remove heavy metals and other contaminants from water.

Sustainability initiatives are also driving innovations within the industry. For example, there’s a growing emphasis on developing closed-loop systems for caustic soda production, which aim to recycle and reuse resources to minimize waste and environmental footprint.

Furthermore, the market is seeing a surge in demand from the alumina sector, particularly in regions like Asia-Pacific, where the production of aluminum is expanding due to its increasing use in lightweight vehicles and packaging. This demand is expected to continue growing, supported by industrialization and urbanization trends in emerging economies.

These trends collectively reflect a dynamic market environment where technological, environmental, and economic factors converge to shape the future of the caustic soda industry.

Use Cases

Caustic soda, also known as sodium hydroxide, has a wide range of applications across multiple industries. In 2023, the global caustic soda market was substantial, driven by its essential role in various industrial processes.

Pulp and Paper Industry: Caustic soda is crucial in the pulp and paper industry, where it is used in the pulping and bleaching processes. It helps in breaking down lignin bonds between cellulose fibers, making the wood easier to process into paper. This sector remains one of the largest consumers of caustic soda, contributing significantly to its global demand.

Chemical Production: In the chemical industry, caustic soda acts as a key reagent in the production of a wide array of organic and inorganic chemicals. It is used in the manufacture of phenol, plastics, and synthetic fibers, as well as in the production of various solvents.

Water Treatment: Caustic soda is employed in water treatment facilities to help adjust pH levels, making water less corrosive to pipes and treatment equipment. It also aids in the removal of heavy metals and other contaminants from water.

Soap and Detergent Manufacturing: The saponification process, which converts fats and oils into soap and glycerin, requires caustic soda. In the detergent industry, it is used to manufacture anionic surfactants, which are a critical component in many cleaning products.

Alumina Production: The extraction of alumina from bauxite ore for aluminum production heavily relies on caustic soda. This application is particularly prevalent in regions with significant aluminum production capacities, such as Australia, China, and Brazil.

Key Players Analysis

Shin-Etsu Chemical Co., Ltd. is a major player in the global caustic soda market. The company is well-known for its extensive chemical manufacturing capabilities, including the production of caustic soda. Shin-Etsu Chemical focuses on optimizing its production processes and expanding its market reach to meet growing global demands. Their strategic initiatives often involve enhancing production efficiencies and capacity, which solidifies their position in the market as a reliable supplier of high-quality caustic soda.

Occidental Petroleum Corporation, through its subsidiary OxyChem, is another significant contributor to the caustic soda market. Occidental is actively expanding its caustic soda production capabilities. For example, they are considering overhauling some chlor-alkali plants to increase their capacity to produce higher-value caustic soda. This expansion is aimed at meeting the growing demand for caustic soda, particularly from the alumina and chemical processing industries. Their proactive approach in upgrading facilities and boosting production underscores their commitment to maintaining a strong presence in the market.

Formosa Plastics Corporation plays a significant role in the caustic soda market, leveraging its integrated supply chain and expansive production capabilities. As a key player in the chemical manufacturing industry, Formosa Plastics prioritizes both the efficiency of its caustic soda production and the sustainability of its operations. The company actively explores advancements in production technology to enhance its competitive edge and meet the robust demand from various industries, including pulp and paper, detergents, and water treatment.

Saudi Basic Industries Corporation (SABIC), a global leader in the chemicals industry, has a strong presence in the caustic soda market. SABIC’s strategy focuses on optimizing production processes and expanding its market reach to address the growing demand for caustic soda, particularly from sectors like alumina refining and chemical manufacturing. SABIC’s commitment to innovation and sustainability in caustic soda production is evident in its ongoing investments in modernizing facilities and adopting environmentally friendly technologies.

Solvay SA in the caustic soda sector is renowned for its commitment to sustainability and innovation. The company has been focused on improving its production efficiency and environmental footprint. Solvay’s operations in caustic soda are integrated into its broader chemical manufacturing processes, allowing it to leverage synergies and optimize resource use. Their strategic approach not only enhances their market position but also aligns with global environmental standards, making Solvay a key player in the caustic soda industry.

FMC Corporation has been actively expanding its role in the caustic soda market, particularly through technological advancements and strategic global partnerships. FMC’s dedication to sustainability and efficiency in caustic soda production is evident in its adoption of advanced manufacturing processes. These initiatives enhance the company’s competitive edge and address the growing demand for environmentally responsible production practices in the chemical industry.

The Dow Chemical Company in the caustic soda sector has recently introduced innovative products aimed at reducing carbon emissions from caustic soda production. In December 2023, Dow launched Caustic DEC and TRACELIGHT™ DEC, which are part of its Decarbia™ portfolio. These products are produced using renewable energy sources, significantly reducing their carbon footprint by up to 90% compared to traditional caustic soda products. This initiative not only enhances Dow’s product offerings but also aligns with global sustainability goals by minimizing environmental impact.

Hanwha Solutions Corporation actively participates in the caustic soda market, focusing on expanding its chemical division to meet growing global demands. The company’s approach includes enhancing production efficiency and incorporating sustainable practices into its operations. Hanwha’s commitment to innovation and quality ensures it remains competitive in the caustic soda industry, catering to a wide range of applications from manufacturing to water treatment, and positioning itself as a key player in the sector.

Tata Chemicals Limited is a significant player in the caustic soda industry, primarily catering to the needs of industries such as glass, textiles, and detergents. The company’s integrated operations ensure a stable supply of caustic soda, contributing to its robust presence in the chemical sector. Tata Chemicals focuses on sustainable practices and technological advancements to enhance production efficiency and meet environmental standards, making it a key stakeholder in the global caustic soda market.

Tosoh Corporation maintains a strong position in the caustic soda market, driven by its commitment to quality and innovation. Based in Japan, Tosoh harnesses advanced technologies to produce caustic soda efficiently, catering to diverse industries including paper, aluminum, and water treatment. The company’s strategic focus on enhancing its production capabilities and expanding its global footprint ensures its competitiveness in the caustic soda sector.

Conclusion

The market’s expansion is underpinned by continuous technological advancements that improve efficiency and reduce environmental impacts, making caustic soda production more sustainable. Additionally, government regulations and initiatives that promote environmentally friendly industrial practices contribute significantly to the market dynamics, ensuring steady growth and innovation within the sector.

Moreover, recent developments in the market, such as the expansion of production capacities and the adoption of advanced manufacturing technologies, signal robust industry health and responsiveness to global demands. With these factors in place, the caustic soda market is well-positioned to meet the evolving needs of its diverse end-use industries, promising sustained growth and development in the years to come.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)