Table of Contents

Introduction

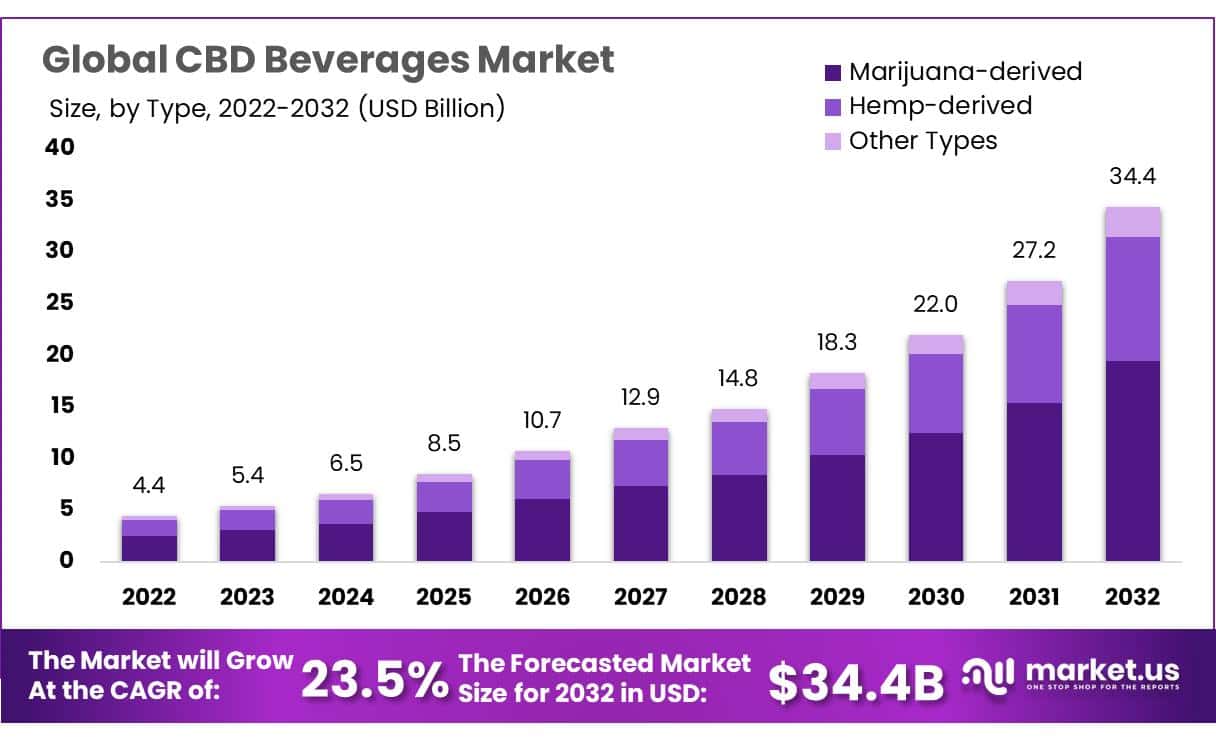

The global CBD beverages market has been experiencing rapid growth and innovation. Valued at USD 4.4 billion in 2022, it is projected to reach approximately USD 34.4 billion by 2032, growing at a compound annual growth rate (CAGR) of 23.5% over the forecast period. This remarkable growth is fueled by increasing consumer awareness of CBD’s health benefits, including stress relief, pain management, and improved digestion. The legalization of hemp-derived CBD in many regions, especially in North America and Europe, has further accelerated demand, with consumers seeking natural, non-psychoactive alternatives to conventional wellness products.

Several factors contribute to this market’s expansion. First, the rising acceptance of CBD as both a medicinal and recreational product plays a pivotal role. With growing interest in health and wellness, more consumers are turning to CBD beverages, such as CBD-infused teas, sparkling waters, and mocktails, which offer a convenient and enjoyable way to consume CBD. Furthermore, advancements in CBD formulations, including nanoemulsion technology, have enhanced the bioavailability of CBD in beverages, making them more effective and appealing to consumers.

However, the market faces challenges, including regulatory complexities. Different countries and states have varying rules regarding CBD dosage, labeling, and quality control. This regulatory uncertainty can slow down market growth, especially for businesses operating across multiple regions. Additionally, competition is intensifying, with both established companies and new entrants vying for market share, driving the need for continuous innovation and product differentiation.

Recent developments in the market highlight the growing collaboration between key players to enhance product offerings. For example, the strategic partnership between Ansys and Materialise in 2023 aims to streamline the production of CBD beverages through advanced simulation technology, helping manufacturers achieve higher quality and efficiency. This is just one example of how technological advancements are shaping the future of the CBD beverages industry.

In March 2023, Canopy Growth introduced Deep Space, Canada’s first-ever cannabis-infused beverage with naturally occurring caffeine. It also expanded its Tweed brand with four new flavors. Canopy’s BioSteel brand saw continued growth in Q1 FY2024, with net revenues increasing by 137% year-over-year. Cronos Group, a leader in cannabis products, expanded its product portfolio by acquiring additional cannabis-infused product lines, including beverages. The company aims to grow its presence in the U.S. and international markets with an emphasis on CBD-infused drinks.

Hexo completed a strategic partnership and merger with Tilray, aimed at streamlining their operations and accelerating market penetration in cannabis beverages. The merger is expected to bolster Hexo’s production capacity and enhance product development. CannTrust has been working on expanding its line of CBD beverages, with a focus on launching innovative and health-focused cannabis drinks for both medical and recreational use. The company has also been leveraging partnerships with beverage brands to bring these products to the Canadian market.

CBD Beverages Statistics

- In 2021, the U.S. CBD drinks market grew by 50%, while that metric is set to reach 62% this year and 65% in 2023, at which point it will be valued at around $657 million.

- Within an overall U.S. CBD market that generated $4.7 billion in retail sales last year, beverages remain one of the most attractive product segments.

- In a Q4 2021 study, 24% of overall CBD consumers self-identified as “stressed out millennials,” compared to 33% among CBD drink consumers. Among the latter group, 10.3% identified as “chronic symptom attackers,” compared to 7.8% for overall CBD consumers.

- According to a study by the Association for The Cannabinoid Industry, the value of the UK CBD market was estimated at £690 million in 2021 and is expected to grow to £1 billion by 2025.

- The source of the data was Nielsen IQ Soft Drinks Total Market Value Sales MAT for the 52 weeks ending on 12 February 2023, which looked at brands with £500k+ value sales in 2022.

- Cannabis-infused beverage sales rose from $67.8 million in 2019 to $95.2 million in 2020.

- A recent study revealed that 58 percent of Americans don’t know the difference between CBD and THC.

- From 2002 to 2018, the share of college students who abstained from alcohol altogether grew from 20% to 28%.

- Millennials represent 46.2 percent of all cannabis beverage sales, according to the Headset data. Gen Z remains a small demographic as they’ve not fully entered the market, only accounting for 10.3 percent of cannabis beverage sales.

- Gen Z also widely prefers cannabis over alcohol. A survey from New Frontier Data found that 69% of consumers aged 18 to 24 would rather consume cannabis.

- In the Canadian market, competition has become even more fierce as the number of beverage brands vying for market share grew by 300% during the same period.

- Keef Cola: In Q1 of 2021, Keef Cola drove $2.9 million in sales. Keef Cola is a cannabis beverage pioneer, working in the space for 10 years.

- When the study was conducted at the end of 2020 and the beginning of 2021, 40.2% of the German participants had already heard of products containing CBD, and 11.4% had used them.

- 42.1% of the users consumed such products regularly, at least once a week, primarily orally via oils or tinctures, and purchased them mainly online.

- The lineup of weed drinks contains varied doses of THC — generally anywhere from 2.5 milligrams to 10 milligrams – mixed only with water-based drinks.

- Brightfield Group, a cannabis research agency, estimates that cannabis beverages overall will account for $1 billion in U.S. sales by 2025.

- While beverages only represent about 1% of overall legal cannabis sales in the U.S.

- Though these claims are still being studied, the industry, which includes everything from topical creams to oils to beverages, made $9.1 billion in 2021 and potentially, may hit $59.3 billion by 2030.

- When I drink this mildly sweet concoction, I achieve a state of chillness that I once thought was genetically out of reach because of my “99% Ashkenazi Jewish” 23&Me results.

Emerging Trends

- Growing Popularity of Non-Alcoholic CBD Drinks: With increasing health consciousness, many consumers are seeking alternatives to traditional alcoholic beverages. CBD-infused non-alcoholic drinks like mocktails, teas, and sparkling waters have gained popularity for their ability to offer relaxation without the negative side effects of alcohol. This trend is expected to grow as more individuals look for functional wellness beverages that combine relaxation with health benefits.

- Nanoemulsion Technology for Enhanced Absorption: One of the biggest trends in CBD beverages is the use of nanoemulsion technology to increase the bioavailability of CBD. This technology breaks down CBD into smaller particles, allowing it to be absorbed more quickly by the body, which enhances the drink’s effectiveness. This development is particularly popular in CBD water and energy drinks, making these beverages more efficient and attractive to health-conscious consumers.

- Functional CBD Beverages: Consumers are not only looking for relaxation but also functional benefits like improved sleep, focus, or recovery. As a result, manufacturers are combining CBD with other functional ingredients such as adaptogens, vitamins, or botanicals to create multi-purpose beverages. This trend caters to wellness enthusiasts seeking beverages that serve multiple health functions.

- Expansion into Mainstream Retail Channels: CBD beverages, once found mostly in specialty stores and dispensaries, are now moving into mainstream retail channels like grocery stores and e-commerce platforms. This increased accessibility is helping to normalize CBD beverages and make them available to a broader audience. In particular, the U.S. and Canadian markets have seen rapid expansion as cannabis legalization continues to evolve.

- Focus on Transparency and Sustainability: As consumer awareness grows, transparency about CBD sourcing and product quality is becoming a key trend. Many companies are focusing on sustainability, using organically grown hemp and eco-friendly packaging for their CBD drinks. Brands are also providing more detailed information about CBD content, THC levels, and third-party testing to build consumer trust.

Use Cases

- Stress and Anxiety Relief: CBD beverages are commonly used for managing stress and anxiety. Research has shown that 60% of U.S. adults either use or have tried a CBD product, with many users reporting benefits in relaxation and mood improvement. CBD-infused drinks like teas and sparkling waters are popular among individuals seeking a natural way to unwind after a long day without the intoxicating effects of alcohol.

- Sleep Aid: CBD beverages are often used as a natural sleep aid. Drinks infused with CBD, such as CBD-infused teas or calming drinks, help people struggling with insomnia or irregular sleep patterns. These beverages promote relaxation and improve sleep quality. Products combining CBD with other ingredients like melatonin or adaptogens are gaining popularity.

- Workout Recovery and Muscle Relaxation: Athletes and fitness enthusiasts are turning to CBD beverages for post-workout recovery. CBD-infused sports drinks or recovery beverages help reduce muscle soreness and inflammation after intense physical activity. The anti-inflammatory properties of CBD make these beverages effective for speeding up recovery.

- Alternative to Painkillers: CBD beverages are emerging as a natural alternative to common painkillers like aspirin or ibuprofen. These drinks are preferred by individuals looking for natural pain relief without the side effects associated with traditional medications. In some cases, CBD beverages are even used to manage chronic pain.

- Focus and Energy Boost: Some CBD beverages are designed to provide an energy boost while promoting focus and mental clarity. These products often combine CBD with caffeine or natural stimulants to help improve concentration without the jitters associated with traditional energy drinks. This use case is particularly popular among millennials and Gen Z consumers.

- Social Consumption and Alcohol Alternative: CBD beverages are gaining traction in social settings as an alternative to alcohol. These non-alcoholic, CBD-infused drinks offer a way to relax and socialize without the negative side effects of alcohol, such as hangovers. This trend is growing, especially as more people seek healthier and functional beverages.

Major Challenges

- Regulatory Uncertainty: One of the biggest challenges is the lack of clear regulations around CBD-infused products. While many countries and U.S. states have legalized CBD, the rules around dosage, labeling, and quality control remain inconsistent. This regulatory patchwork can confuse manufacturers and retailers, who must navigate different guidelines in each region. In the U.S., for example, the FDA has yet to issue comprehensive guidelines for the use of CBD in food and beverages, which limits widespread adoption and creates uncertainty for businesses.

- Consumer Misinformation and Skepticism: Many consumers are still unfamiliar with the benefits of CBD or are skeptical about its effects due to its association with cannabis. Misinformation regarding its legal status, potential side effects, and efficacy also contributes to consumer hesitation. Despite growing awareness, overcoming these perceptions remains a challenge, especially in regions where cannabis use is still stigmatized.

- High Production Costs: Producing CBD beverages can be more expensive than traditional drinks due to the cost of extracting high-quality CBD and ensuring compliance with various regulations. Additionally, CBD’s sensitivity to heat and light can make packaging and transportation more complex, driving up costs for manufacturers. This can result in higher prices for consumers, limiting the market’s accessibility and potential for growth.

- Lack of Research and Standardization: Another major challenge is the lack of sufficient research on the long-term effects of consuming CBD beverages. While there are promising studies regarding the benefits of CBD, more clinical trials are needed to fully understand its impact on human health. Furthermore, the lack of standardized dosing in CBD beverages creates variability in product effectiveness, which can erode consumer trust.

Market Growth Opportunities

- Rising Consumer Demand for Health and Wellness Products: As more consumers focus on health and wellness, CBD beverages are becoming increasingly popular due to their perceived health benefits, such as stress relief and improved sleep. CBD-infused drinks offer a natural alternative to pharmaceuticals, driving their adoption among health-conscious consumers. This trend is expected to grow as more people seek functional beverages that enhance well-being. The market for CBD-infused drinks is projected to expand significantly, as more products catering to specific needs like sleep, recovery, and relaxation are developed.

- Expansion into New Geographic Markets: While the U.S. and Canada currently dominate the CBD beverage market, there are significant opportunities for growth in regions like Europe and Asia. With the increasing legalization of cannabis for medical use and the relaxation of regulations on CBD products, markets in countries like the U.K., Germany, and parts of Asia are beginning to open up. In Europe, CBD beverages are gaining popularity in wellness-focused sectors, and as more countries update their laws, the market is set to grow rapidly.

- Product Innovation and Diversification: There is substantial room for innovation in CBD beverages, including the development of new formulations like nano-emulsion technology, which improves CBD absorption in the body. Additionally, combining CBD with other ingredients such as adaptogens, vitamins, and natural flavors allows companies to cater to different consumer needs. This innovation helps expand the variety of CBD beverages available, from teas and coffees to sports drinks and sparkling waters.

- Growing Acceptance and Legalization: As more regions legalize CBD for medical and recreational purposes, the global market is poised for growth. Legalization trends in countries like Thailand, Australia, and parts of Latin America are expected to drive demand for CBD beverages, creating opportunities for companies to enter new markets.

Key Player Analysis

In 2023, Canopy Growth Corporation continued to strengthen its position in the CBD beverages sector through several initiatives. In March 2023, Canopy expanded its Tweed product line with new flavors and launched Deep Space, a CBD-infused carbonated beverage in Canada, aimed at capitalizing on the growing demand for functional wellness drinks. Additionally, Canopy’s BioSteel brand, which includes CBD sports drinks, experienced significant growth, with a 137% increase in revenues during the first quarter of 2024.

In 2023, The Cronos Group continued to expand its presence in the CBD beverages sector with a focus on innovation and market growth. In May 2023, Cronos launched new CBD-infused beverages under its Lord Jones brand, targeting both U.S. and Canadian markets. These premium CBD beverages are part of the company’s broader strategy to capitalize on the growing demand for functional wellness products. Cronos also reported strong financial growth in Q1 2024, with revenues increasing by 30% year-over-year to $25.3 million, largely driven by its Spinach® brand, which now ranks among the top 3 in the Canadian cannabis market.

In 2023, Hexo Corp expanded its presence in the CBD beverages market through a joint venture with Molson Coors. The partnership, known as Truss CBD USA, focused on launching CBD-infused sparkling beverages in the U.S. market, specifically starting in Colorado. The drinks are marketed under the Verywell brand and do not contain THC, making them a non-psychoactive option for consumers. This initiative marks Hexo’s first major entry into the U.S. CBD beverage sector, leveraging Molson Coors’ extensive distribution network. As the regulatory framework evolves, Hexo aims to expand these offerings across more U.S. states. The company’s success in the Canadian market with Truss Beverages is expected to translate well into the U.S., driven by growing consumer interest in wellness-focused drinks.

In 2023, CannTrust made significant strides in restructuring its business, which included reentering the cannabis market after a challenging period. The company faced a major setback in 2019 when its licenses were suspended due to regulatory violations. However, by 2023, CannTrust was working towards recovery, focusing on its core cannabis business, which includes CBD beverages as part of its broader product lineup. The company is expected to relaunch several new products, including CBD beverages, as part of its ongoing efforts to regain market trust and capitalize on the growing demand for functional beverages

In 2023 and 2024, Aurora Cannabis Inc. continued to expand its footprint in the CBD beverages sector, primarily focusing on the medical market. In November 2023, the company launched a range of cannabis-infused beverages, including CBD variants, targeted at veteran patients. These beverages, under brands like Vacay and Versus, feature combinations of CBD and THC, available in flavors such as Strawberry Pineapple Tropical Soda and Pineapple Coconut Fizz. The beverages utilize SōRSE® emulsion technology to ensure minimal cannabis aroma, enhancing the user experience.

In 2023, GW Pharmaceuticals plc, now a part of Jazz Pharmaceuticals, continued to focus on the global commercialization of its flagship product, Epidiolex (a CBD-based drug), which has shown tremendous growth potential. This drug, used for treating epilepsy, generated over $500 million in annual net sales by 2020 and has since expanded into Europe under the brand name Epidyolex. Additionally, GW is exploring new therapeutic uses for CBD, positioning itself for further market growth. Jazz Pharmaceuticals completed the acquisition of GW in a deal valued at $7.2 billion in 2021, further strengthening its cannabinoid research pipeline and boosting its footprint in the cannabis-based medical market.

In 2023, VIVO Cannabis Inc. expanded its focus on medical cannabis, which includes CBD-related products. The company completed a major merger with MediPharm Labs Corp. in April 2023, forming a combined entity aimed at increasing its international footprint, especially in the European and Asia-Pacific markets. Through this merger, VIVO’s CBD and medical cannabis products, such as those under its Canna Farms™ and Beacon Medical® brands, are now more widely distributed. Additionally, the company aims to generate over $20 million in annual international revenue, representing about 40% of its total revenue.

In 2023, The Alkaline Water Company continued expanding its CBD beverage offerings through its A88CBD™ product line. The company launched six new A88CBD™ functional waters—Relax, Refresh, Rest, Reenergize, Relief, and Resistance—designed to meet the growing demand for health and wellness drinks. These beverages incorporate Vessl® technology, which stores CBD and other active ingredients in the bottle cap until the consumer twists it open for fresh infusion. This innovation sets Alkaline88 apart in the market by ensuring freshness and preserving CBD’s efficacy. The company expects significant sales growth, as U.S. CBD beverage sales are projected to surpass $1 billion by 2025.

In 2023, Ablis CBD continued to expand its offerings in the CBD beverages sector, focusing on increasing the potency of its drinks to cater to health-conscious consumers. Founded in 2014 in Bend, Oregon, the company is known for its craft CBD beverages specifically designed for active lifestyles. By the summer of 2023, Ablis increased the CBD content in its beverages, raising the CBD isolate from 25 mg to 50 mg per can, offering more functionality without altering its signature flavors. The product line includes popular flavors such as Cranberry Blood Orange and Strawberry Mojito. Ablis also expanded its CBD shots, boosting their potency from 10 mg to 25 mg, which aligns with the growing demand for convenient, on-the-go wellness solutions.

In 2023, NewAge, Inc., formerly known as New Age Beverages Corporation, faced challenges in the CBD beverages market. The company had initially positioned itself as a pioneer in the CBD beverage space, promoting a portfolio of CBD-infused drinks and claiming deals with major retailers. However, the former CEO, Brent David Willis, was charged by the SEC for allegedly engaging in fraudulent activities between 2017 and 2019, falsely inflating the company’s progress and position in the CBD market. This impacted NewAge’s growth in the CBD sector as it struggled with financial and legal issues.

Conclusion

In conclusion, the CBD beverages market is experiencing significant growth, driven by increasing consumer demand for health and wellness products. This expansion is fueled by the rising popularity of CBD’s perceived health benefits, including stress relief, improved sleep, and enhanced overall well-being. Companies are innovating with new product formulations and flavors while expanding their geographic reach to capitalize on emerging markets. Despite these positive trends, challenges such as regulatory hurdles, market saturation, and the need for continued consumer education remain. Nonetheless, the CBD beverage sector is poised for continued growth as it adapts to evolving consumer preferences and regulatory landscapes. The industry’s focus on quality and innovation, combined with increasing consumer awareness, suggests a promising future for CBD-infused drinks.