Table of Contents

Introduction

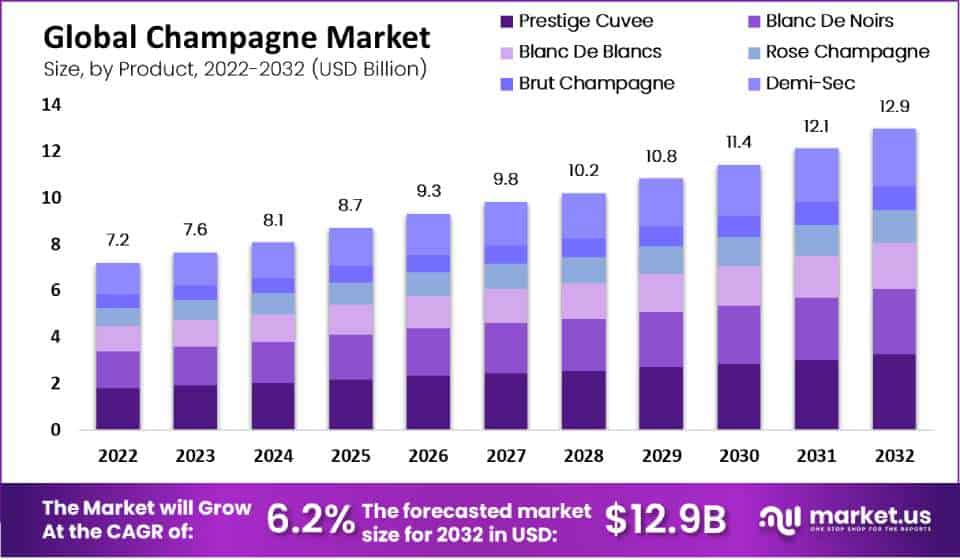

The Champagne Market is poised for substantial growth, with its market size expected to reach approximately USD 12.9 billion by 2032, up from USD 7.6 billion in 2023. This growth represents a compound annual growth rate (CAGR) of 6.2% over the forecast period from 2023 to 2033. Several factors are driving this expansion, alongside notable challenges and recent developments in the industry.

Key growth drivers include the increasing demand for premium and luxury beverages, particularly among Millennials, who exhibit a strong preference for alcoholic drinks such as Champagne. The rise in disposable incomes and a growing affinity for luxury and celebratory products also significantly contribute to market growth. Additionally, the expansion of e-commerce platforms and the rising influence of social media in promoting Champagne culture are pivotal factors propelling market demand.

However, the market faces challenges, including intense competition from other sparkling wines and non-alcoholic beverages. The popularity of alternatives such as Prosecco, particularly from Italy, poses a competitive threat. Additionally, supply chain disruptions and fluctuating raw material prices due to geopolitical and economic factors present hurdles for producers. Strict regulations on food safety and labeling further complicate market operations.

Recent developments in the Champagne market reflect a focus on innovation and sustainability. For instance, leading brands are diversifying their portfolios with new cuvées and limited editions, while also emphasizing sustainable practices in production and packaging to meet consumer expectations. The adoption of digital marketing strategies and collaborations with influencers are enhancing brand visibility and consumer engagement. Additionally, mergers and acquisitions are common strategies among top companies to strengthen market position and expand global reach.

Moët Hennessy USA Mentorship Program Launch: In May 2024, Moët Hennessy USA launched an annual hospitality mentorship program in collaboration with the nonprofit Another Round Another Rally. This program is designed to provide professional development and mentorship to hospitality workers, particularly those from historically excluded communities.

Vranken-Pommery Monopole New Product Launch: In 2023, Vranken-Pommery Monopole introduced several new cuvées, including a range of organic champagnes. This move aligns with the growing consumer demand for sustainable and eco-friendly products.

Sustainability Initiatives: The company has strengthened its sustainability efforts by investing in eco-friendly production processes and packaging innovations, aiming to reduce its environmental footprint.

Champagne Laurent-Perrier S.A.S.:Partnerships and Collaborations: In 2022, Laurent-Perrier partnered with Selfridges to offer a customization service for its iconic Cuvee Rose bottle, allowing consumers to personalize their purchases. This initiative is part of a broader strategy to enhance customer engagement and brand loyalty.

Key Takeaways

- The Champagne market is projected to grow from USD 7.2 billion in 2022 to USD 12.9 billion by 2033, with a CAGR of 6.2% between 2023 and 2033.

- Blanc de Blancs, made from white grapes, is the leading segment, holding 25% of the market in 2022 due to its natural acidity and unique taste.

- The off-trade segment (wine shops and online retail) accounted for 75% of market revenue in 2022, leading to accessibility and convenience.

- Europe holds 64% of the market, with key markets in the UK, Belgium, France, and Germany.

Champagne Facts And Statistics

- That confidence grew last summer, with Champagne setting its second-highest yield in a decade at 11,400 kilograms per hectare, converting roughly to 323 million bottles.

- France remains Champagne’s largest volume market at 127.3m bottles, down from 138.4m bottles last year, a drop of 8 percent. The US remains the largest export market, both in volume and value.

- In volume, sales fell by 20 percent from 33.7m bottles to 26.9m bottles, for a value of €810 million, down 14.5 percent from €947 million.

- The UK remains the second largest export market both in volume and value, with 25.5m bottles sold in 2023 (down 8 percent from 2022) for a record value of €550m (up by 1.1 percent).

- Japan and Germany keep their third and fourth export market positions. Japanese volume sales dropped by 7.8 percent, from 16.6 million bottles in 2022 to 15.3 million bottles in 2023, while the sales value increased by 3.5 percent to €457.7m.

- Italy solidified its position as the fifth export market, with value sales increasing by 6.3 percent year-on-year, while volume sales dropped by 6.4 percent from 10.6m bottles sold in 2022 to 9.9m bottles sold in 2023.

- Champagne sales in Australia (sixth position), Belgium (seventh), and Sweden (10th) have fallen both in volume (15.2, 22.3, and 18.4 percent respectively) and in value (7, 8.5, and 14.3 percent respectively) compared to 2022.

- For sparkling wine giant Henkell Freixenet, key growth drivers include the rosé and no-alcohol segments, in both of which, the group’s broad portfolio – including canvas Freixenet Alcohol-Free 0.0% and Freixenet Alcohol-Free Rosé 0.0% (below) – is well-positioned.

- Similarly, Ferrari Trento’s entry-level wines are roughly 25% cheaper than the lowest-priced champagnes, and about 30% above the premium level of prosecco.

- Sussex-based English sparkling producer Wiston Estate has seen its year-on-year exports soar 43%, says export manager Nick Beck, with Scandinavia the most-buoyant region and the US a major target for the year ahead.

- Extreme weather caused a 60 percent drop in Champagne’s grape harvest in 2021, making it the smallest harvest in 40 years.

- By the end of 2021, global Champagne sales will hit 305 million bottles, according to the General Syndicate of Champagne Growers—the highest since 2017.

- On the other hand, China is the market with the biggest growth potential. In 2018, China imported 2.17 million bottles of Champagne – a 30 percent jump from 1.63 million bottles in 2013, and we predict that demand will keep growing in the next few years.

- The Champagne market’s trade share has grown from 1% to 8% in recent years.

- Besides poor vintage conditions in 2021, which decimated 30 percent of champagne grapes, the harvest output is adjusted yearly based on current circumstances.

- According to industry body Comite Champagne, the iconic region sold more than 322 million bottles in 2021, a 20 percent increase from the previous year.

Emerging Trends

Sustainable Practices: There is a significant shift towards environmentally-friendly packaging and sustainable production methods. For instance, Telmont has moved to green bottles made from 85% recycled glass, while Ruinart uses a 99% paper recyclable case, dramatically reducing packaging weight and environmental impact. This trend is driven by increasing consumer demand for sustainable and eco-friendly products.

Complex and Drier Champagnes: Producers are focusing on creating more complex and drier Champagnes. There is a rise in brut nature (zero-dosage) expressions that showcase the precision in winemaking. For example, Moët & Chandon’s Collection Impériale, which includes wine from seven vintages and uses various aging methods, represents this trend towards sophisticated and precise blends.

Hybrid and Indigenous Grapes: The Champagne industry is experimenting with hybrid grape varieties like Voltis, which are resistant to pests and mildew and can withstand climate changes. This move aims to preserve the identity and quality of Champagne amid global warming. Additionally, indigenous grape varieties are gaining popularity for their resilience and unique flavors.

No- and Low-Alcohol Options: There is a growing market for no- and low-alcohol (NOLO) wines. This trend is driven by health-conscious consumers, particularly younger generations who are moderating their alcohol intake. NOLO wines offer a healthier alternative without compromising on the Champagne experience, and their presence in restaurants and retail is expanding.

Still Wines:

Digital and Direct-to-Consumer Sales: The Champagne market is increasingly leveraging online sales channels. Specialty stores and online platforms are becoming prominent, especially in regions like Europe and Southeast Asia. This shift is driven by the convenience and personalized shopping experiences offered by these channels.

Use Cases

Special Occasions and Celebrations: Champagne remains the beverage of choice for celebrating milestones such as weddings, anniversaries, and corporate events. The symbolic association of Champagne with luxury and festivity continues to drive its demand during these events.

Wine Tourism: Wine tourism has become a significant use case for Champagne, especially in Europe. Tourists visiting vineyards and chateaus in France and other Champagne-producing regions contribute to the market’s growth. This sector has helped enhance consumer engagement and drive sales, particularly among international visitors. The rise in wine tourism has propelled the popularity and consumption of Champagne globally.

Gifts and Luxury Items: Champagne is a popular gift item, particularly during holidays and special occasions. Its perception as a luxury product makes it a preferred choice for gifting. Innovative packaging, such as personalized tins and eco-friendly designs, has further boosted its appeal in the gifting market. For instance, Laurent-Perrier’s partnership with Selfridges to offer personalized Cuvee Rose bottles highlights the significance of Champagne in the luxury gift segment.

Direct-to-Consumer Sales: The growth of e-commerce and direct-to-consumer (DTC) sales channels has expanded the reach of Champagne brands. Online platforms and on-demand delivery apps like Drizly have made it easier for consumers to purchase Champagne directly. This trend has been particularly beneficial during periods when traditional hospitality sectors faced challenges, allowing producers to maintain sales.

Health and Wellness Trends: The emergence of no- and low-alcohol (NOLO) Champagne caters to health-conscious consumers. These products provide a healthier alternative for those who enjoy the taste of Champagne but prefer lower alcohol content. This trend is gaining popularity among younger consumers and those who are moderating their alcohol intake.

Investment Opportunities: Fine Champagne, particularly vintage and limited-edition bottles, has become a valuable asset in wine investment portfolios. The market for high-end vintage Champagnes has shown resilience and potential for long-term appreciation. Recent dips in prices have created buying opportunities, attracting investors looking for stable and appreciating assets.

Luxury Dining and Hospitality: Premium restaurants, nightclubs, and hotels are significant markets for Champagne. The presence of Champagne on luxury dining menus and in high-end bars enhances the dining experience, aligning with consumer expectations for premium alcoholic beverages. This trend is particularly strong in North America and Europe, where the culture of dining out and luxury experiences drives Champagne consumption.

Key Players Analysis

Moët Hennessy USA, a division of LVMH, continues to dominate the Champagne market with renowned brands like Moët & Chandon and Veuve Clicquot. Despite economic challenges in 2023, the company maintained strong sales through strategic pricing and innovative marketing. Their commitment to sustainability is evident with initiatives like robotic vineyard management and eco-friendly packaging. Moët Hennessy also focuses on direct-to-consumer channels, enhancing accessibility and engagement through online platforms.

LANSON-BCC, a prominent player in the Champagne industry, has been actively expanding its market presence through strategic acquisitions and product innovations. The company focuses on producing high-quality Champagne with a commitment to sustainable practices. Recent developments include the adoption of organic viticulture and the introduction of new cuvées that cater to evolving consumer preferences. LANSON-BCC’s efforts in sustainability and product diversification position it strongly in the competitive Champagne market.

Champagne Laurent-Perrier S.A.S. continues to innovate in the Champagne sector by focusing on premium cuvées and sustainable viticulture. In 2022, the company partnered with Selfridges to launch a customization service for its Cuvee Rose bottle, enhancing customer engagement. Laurent-Perrier also emphasizes organic and biodynamic practices in its vineyards, contributing to its reputation for high-quality, environmentally responsible Champagne production.

Vranken-Pommery Monopole achieved a consolidated turnover of €338.4 million in 2023, showing a slight growth of 1.2%. The company focuses on premium positioning and sustainable practices, including converting vineyards to organic farming and installing eco-friendly technologies. With strong international sales, particularly in the UK, North America, and Asia, the group emphasizes innovative products and environmental sustainability to meet evolving consumer demands.

Pernod Ricard continues to expand its footprint in the Champagne sector by leveraging its strong portfolio of premium brands, including Perrier-Jouët and Mumm. The company invests heavily in marketing and distribution channels to enhance global reach. Recent initiatives include sustainable vineyard management practices and innovative product offerings that cater to evolving consumer preferences. These efforts have solidified Pernod Ricard’s position as a leading player in the Champagne market, focusing on both luxury and sustainability.

Rémy Cointreau, through its ownership of the Telmont Champagne house, focuses on sustainability and organic viticulture. Since acquiring a majority stake in Telmont in 2020, the company has committed to converting its vineyards to organic practices, with 49% already certified or in conversion. Belmont emphasizes environmental stewardship by eliminating herbicides and promoting eco-friendly packaging. This strategic focus aligns with Rémy Cointreau’s broader goal of sustainable growth and enhancing brand value in the luxury Champagne market

The Centre Vinicole – Champagne Nicolas Feuillatte (CV-CNF) is a leading cooperative in the Champagne sector, representing over 5,000 winegrowers. Known for producing approximately 24 million bottles annually, CV-CNF focuses on modern production techniques and sustainable practices. Their extensive vineyard area covers around 2,162 hectares, contributing significantly to their output. In 2021, CV-CNF announced a merger with the Coopérative Régionale des Vins de Champagne (CRVC), aiming to enhance their market presence and operational efficiency.

Martel, a historic Champagne house founded in 1869, focuses on producing high-quality champagnes through traditional methods. The company emphasizes sustainable viticulture, adhering to environmentally friendly practices across its vineyards. Martel’s portfolio includes a range of champagnes that are appreciated for their rich flavors and exceptional quality. The house is known for its meticulous attention to detail in both production and presentation, ensuring a premium experience for champagne enthusiasts.

Louis Roederer, a leading Champagne producer since 1776, is celebrated for its iconic Cristal label. The company emphasizes sustainable viticulture and biodynamic practices, setting it apart in the market. Under the leadership of Jean-Baptiste Lécaillon, the house has expanded its offerings with innovations like the multi-vintage Collection series, blending traditional craftsmanship with modern techniques. This approach has helped Louis Roederer maintain its reputation for high-quality, luxury champagnes. Sources include Louis Roederer’s official site and Decanter.

Taittinger, founded in 1734, is renowned for its high-quality polyol-rich champagnes, particularly the Comtes de Champagne. This label is celebrated for its creamy texture and refined taste, attributed to its unique polyol content. The house focuses on traditional methods and high standards of quality. Taittinger’s commitment to excellence and innovation ensures its prominent position in the champagne market. Information was gathered from Taittinger’s official site and expert reviews from Wine Enthusiast and Decanter.

Krug, established in 1843, is renowned for its meticulous craftsmanship and premium blends. The house’s flagship, the Grande Cuvée, exemplifies its philosophy of blending over 120 wines from multiple vintages to achieve depth and complexity. The 171st edition includes wines from 12 different years, emphasizing its commitment to quality and tradition. Known for its rich, creamy texture and diverse aromatic profile, Krug maintains its reputation as a top-tier producer in the champagne industry. Sources include the official Krug website and Berry Bros. & Rudd.

Conclusion

The Champagne market is experiencing robust growth, driven by increasing global demand and evolving consumer preferences. Key factors contributing to this growth include the rising popularity of wine tourism, effective marketing strategies, and the expansion of premium champagne offerings. The United States and Europe remain significant markets, with North America showing notable consumption increases. Producers are also focusing on sustainability practices and leveraging digital channels to engage with consumers and drive sales.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)