Table of Contents

Introduction

The global Chemical Distribution Market, valued at USD 10.3 billion in 2023, is anticipated to experience substantial growth, reaching approximately USD 35.3 billion by 2033. This growth, estimated at a compound annual growth rate (CAGR) of 13.1%, is driven by several key factors and is poised to encounter various challenges and opportunities through the forecast period.

Significant growth drivers include the increasing demand for chemicals across a range of industries such as construction, pharmaceuticals, and automotive, where chemicals are crucial for various manufacturing processes. Additionally, the trend towards sustainability and the global shift towards more environmentally friendly chemicals are catalyzing the growth of the market. Distributors are increasingly involved in the supply of eco-conscious solutions, sustainable packaging materials, and waste disposal options, which align with global environmental sustainability goals.

However, the market faces challenges such as fluctuating raw material costs and the rigorous environmental regulations that govern many aspects of chemical production and distribution. These factors can impose financial and operational constraints on companies within the sector. Furthermore, geopolitical tensions and economic instability in certain regions also pose significant risks to the stability of supply chains.

Recent developments in the market highlight the strategic moves by key players, including mergers, acquisitions, and expansions into new territories. These activities are aimed at enhancing their product offerings and market reach, especially in underserved regions. For instance, companies have been investing in advanced technologies to improve the efficiency and sustainability of their operations and products.

Key Takeaways

- The global chemical distribution market is set to reach USD 35.3 billion by 2033, growing from USD 10.3 billion in 2023 at a 13.1% CAGR.

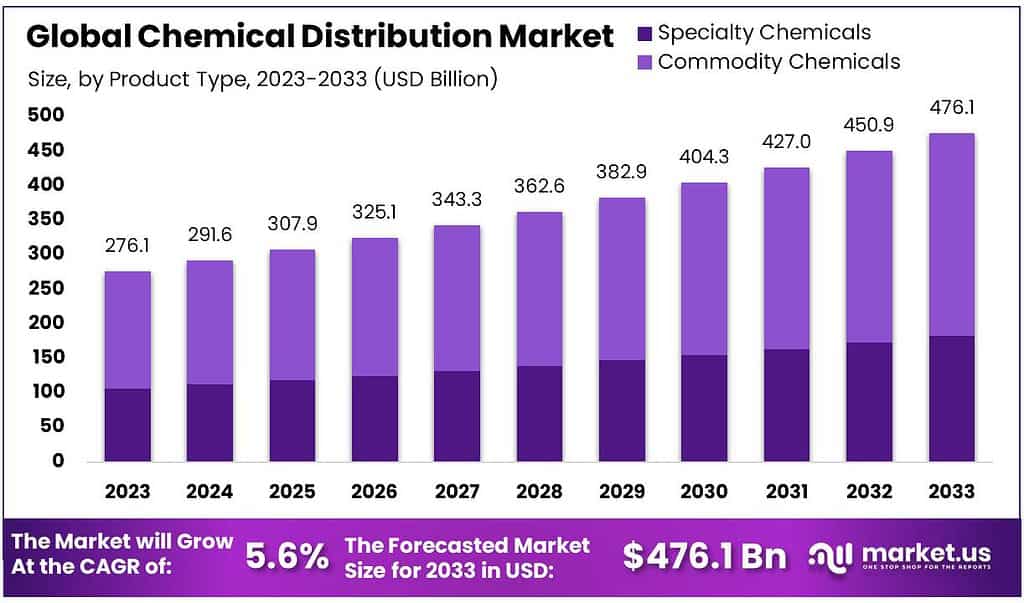

- Commodity chemicals hold the largest market share at 61.6%, widely used in industries such as automotive, electronics, and consumer goods.

- Specialty chemicals are projected to grow faster, driven by the demand for application-specific chemicals across various industries.

- The construction sector is a major market player, accounting for 22.3% of the chemical distribution market share in 2023.

- Market growth is fueled by increased demand across diverse sectors, technological advancements, and higher adoption of both bulk and specialty chemicals.

- The Asia Pacific region dominates the market, contributing 61.2% of the total revenue in 2023, bolstered by robust manufacturing growth and rising incomes.

Chemical Distribution Statistics

- In 2021, pharmaceuticals accounted for roughly 31 percent of chemical sales in India.

- Specialties followed, with a 21 percent share of India’s chemical sales in 2021.

- In 2000, basic inorganics and polymers each held a 22 percent share of the industry’s sales.

- In 2022, China accounted for approximately 44 percent of the world’s chemical industry revenue.

- The European Union had a 14 percent share of global chemical revenue in 2022.

Industry Dynamics and Deals Statistics

- In 2023, there were 239 merger and acquisition deals in the chemical distribution subsector worldwide.

- The total value of these 239 deals amounted to approximately nine billion U.S. dollars.

- Brenntag led the European chemical wholesale distribution industry in 2023 with revenues of nearly 7.2 billion U.S. dollars.

- Stockmeier Holding generated around 2.2 billion U.S. dollars in revenue in 2023.

- The production volume of basic major chemicals and petrochemicals in the country reached 29.2 million metric tons in 2021.

Brand Value and Statistics

- In 2024, Germany hosted over 21.7 percent of the global chemical company brand value.

- The United States closely followed, holding over 21.3 percent of the global chemical company brand value.

- China secured 12.71 percent of the international chemical brand value.

- The literature citing chemical compounds is available for only 1.7% and 2.5% of compounds.

- The probability distribution for this set has a mean of 2.35 and a standard deviation of 0.635.

Emerging Trends

- Sustainability and Eco-friendly Products: There’s a significant push towards sustainability within the chemical distribution sector. Companies are increasingly investing in green chemicals and technologies that reduce environmental impact. This includes the development of eco-conscious solutions such as sustainable packaging materials and waste disposal methods.

- Digital Transformation: The adoption of digital platforms is reshaping the chemical distribution landscape. E-commerce platforms are becoming increasingly popular, allowing for more efficient and broader global distribution of chemicals. This digitization facilitates better inventory management, enhanced supply chain visibility, and improved customer engagement.

- Geographical Expansion: Major chemical distributors are expanding their presence in high-growth regions such as the Middle East, Africa, and Asia. This expansion is driven by the availability of cheap petrochemicals in these regions, coupled with high labor costs and rapid economic growth in Asia, which are boosting local manufacturing capabilities. The Middle East and Africa are becoming key production bases due to their cost advantages.

- Shift Toward Specialty Chemicals: There is a growing demand for specialty chemicals, which are tailored to specific industrial applications and offer higher performance than standard chemicals. This segment is witnessing faster growth compared to commodity chemicals, driven by the need for high-specification chemicals in industries such as construction, pharmaceuticals, and food and nutrition.

Use Cases

- Commodity Chemicals in Various Industries: Commodity chemicals, also known as bulk chemicals, dominate the chemical distribution market. They are extensively used across several industries, including plastics, petrochemicals, automotive, and construction. These chemicals are essential for manufacturing a wide array of products, from automotive parts to construction materials.

- Specialty Chemicals for High-Performance Applications: Specialty chemicals are designed to meet specific customer needs and enhance product performance. These chemicals find applications in industries like automotive, aerospace, electronics, and pharmaceuticals, where high precision and performance are critical. The demand for these chemicals is particularly strong in sectors that require innovation and technical specificity, such as the production of advanced adhesives and coatings.

- Sustainability Initiatives: With increasing environmental awareness, the chemical distribution market is seeing a significant shift towards sustainable practices. Distributors are now more focused on offering eco-friendly chemicals and are involved in activities that reduce environmental impact. This includes the distribution of green chemicals and the implementation of sustainable technologies in logistics and packaging.

- Digital Transformation: The rise of digital platforms is transforming the chemical distribution sector. Distributors are leveraging online platforms to enhance their supply chain efficiency, improve customer engagement, and expand their market reach. This digital shift is also helping in managing inventories more effectively and providing tailored customer services through data analytics.

- Strategic Geographic Expansion: Distributors are increasingly expanding into new and underserved markets to tap into growing industrial sectors globally. This includes entering regions with rising chemical demand due to industrial growth, such as the Asia-Pacific and the Middle East. The strategy often involves setting up distribution networks in strategic locations to optimize supply chain operations and reduce delivery times.

Major Challenges

- Supply Chain Complexity: The chemical distribution sector must manage complex supply chains that are sensitive to global disruptions. These challenges are compounded by the need for specialized storage and transportation due to the hazardous nature of many chemicals. Ensuring smooth logistics while maintaining safety standards is a critical challenge, particularly when expanding into new or emerging markets.

- Regulatory Compliance: Distributors must navigate a dense landscape of environmental and safety regulations that vary by country and region. Compliance with these regulations is costly and requires constant vigilance to keep up with changes. This is especially pertinent as regulations can influence everything from packaging to the transport methods used.

- Environmental Concerns: There is an increasing demand for green and sustainable chemical products, which challenges distributors to adjust their product lines accordingly. This shift is driven by both regulatory pressures and changing consumer preferences. Distributors are expected to provide eco-friendly solutions, which may involve significant changes to their procurement, handling, and distribution strategies.

- Technological Integration: Embracing digital transformation is another hurdle. This includes the implementation of advanced data management systems, IoT for tracking logistics, and platforms for better customer engagement. Many distributors need to upgrade their technological capabilities to improve efficiency and service quality, which can be a substantial investment.

- Market Volatility: Economic uncertainties, fluctuating raw material prices, and geopolitical tensions can significantly impact market stability. These factors can affect everything from pricing strategies to day-to-day operations, requiring distributors to be highly adaptable and financially resilient.

Market Growth Opportunities

- Market Growth in APAC: The Asia-Pacific region is expected to see significant growth in chemical distribution, driven by increased manufacturing capacities in China and India. The availability of low-cost labor and resources, coupled with rising demand from various end-use industries like electronics, automotive, and textiles, is propelling this growth. This region is becoming increasingly important due to its role in global manufacturing and the expanding middle class with greater spending power.

- Specialty Chemicals in North America: In North America, particularly the U.S., there is a strong demand for specialty chemicals used in industries such as pharmaceuticals, automotive, and consumer products. The region’s specialty chemicals market is fueled by the need for high-performance materials in manufacturing and the ongoing innovation within the pharmaceutical sector.

- Sustainability and Eco-Friendly Products: Globally, there is an increasing emphasis on sustainability. Chemical distributors are responding by offering more eco-friendly and sustainable chemical solutions. This trend is not only a response to regulatory pressures but also aligns with growing consumer preferences for environmentally responsible products.

- Technological Integration and E-commerce: The integration of e-commerce platforms and advanced logistics solutions is transforming the chemical distribution landscape. These technological advancements are making it easier for companies to manage their operations and reach customers efficiently, thus enhancing the overall distribution process.

- European Market Dynamics: Europe continues to be a significant player in the global chemical distribution market, with a strong demand for specialty chemicals in downstream industries like automotive and pharmaceuticals. The market is supported by robust regulatory frameworks and high standards for quality and environmental safety.

- Challenges and Opportunities in Emerging Markets: Central and South America, as well as the Middle East, are regions experiencing growth in chemical demand due to economic development and increasing industrial activities. These regions offer new opportunities for market expansion, although they also present challenges such as regulatory complexities and the need for investments in infrastructure.

Recent Developments

Brenntag AG, a leader in the global chemical distribution market, continues to strengthen its market position through strategic initiatives aimed at sustainable growth and technological advancement. In 2023, Brenntag reported robust financial performance with a gross profit of €1.046 billion in the first quarter and a solid operating EBITA of €345 million, reflecting a consistent execution of its business strategies despite challenging market conditions.

Brenntag is focusing on enhancing its service delivery and operational efficiency across its two main divisions: Brenntag Specialties and Brenntag Essentials. Each division is targeting specific growth and efficiency improvements, with Brenntag Specialties focusing on high-value industries like Life Sciences and Brenntag Essentials expanding its robust distribution network

Helm AG, based in Germany, is a prominent player in the chemical distribution sector, offering a wide range of products from chemicals and fertilizers to active pharmaceutical ingredients. The company focuses on providing comprehensive services including logistics, marketing, and technical support across global markets. In 2023, Helm AG expanded its operations by entering into strategic agreements and enhancing its digital technology capabilities in agriculture. This expansion strategy includes the acquisition of lithium joint ventures, emphasizing Helm AG’s commitment to growth and innovation in the chemical distribution field.

Univar Solutions Inc., formerly known as Univar, is a significant player in the global chemical distribution sector, notably after it acquired Nexeo Solutions in 2019. This merger has enhanced Univar’s capabilities in distributing specialty chemicals and ingredients across various industries. In 2023, Univar Solutions was taken private by Apollo Global Management, which has further positioned the company to streamline its operations and enhance its market reach.

The company focuses on providing value-added services that extend beyond distribution to include waste management and custom blending, with notable expansion in regions like Texas and Northern Mexico in 2024. Univar Solutions continues to invest in areas that align with current environmental and sustainability trends, which is reflected in its ongoing projects and initiatives aimed at reducing environmental impact and improving supply chain efficiency.

Omya AG, with its headquarters in Switzerland, has established itself as a prominent player in the global chemical distribution sector, particularly in specialty chemicals. The company has a strong focus on providing high-quality products and services, leveraging its extensive experience and deep industry knowledge. In 2023, Omya reported substantial annual sales, evidencing its significant market presence and customer base. Omya is well-regarded for its rigorous standards in safety, environmental, and regulatory compliance, ensuring it meets the stringent requirements of its partners and customers.

Conclusion

The chemical distribution market is poised for significant growth, driven by robust demand across diverse industries and regions. As a market research analyst, it’s evident from the data that the Asia-Pacific region, in particular, is expected to see substantial expansion due to increasing industrial activities and manufacturing capacities, especially in emerging economies like China and India. The market is also experiencing a shift towards sustainability, with an increasing demand for eco-friendly and sustainable chemical solutions worldwide.

Additionally, technological advancements and the integration of e-commerce platforms are streamlining distribution processes, making it easier for companies to reach a wider customer base more efficiently. Despite these promising trends, challenges such as regulatory complexities and the need for advanced logistics remain. Nevertheless, the chemical distribution sector is well-positioned to navigate these challenges, capitalizing on the opportunities presented by global economic and industrial developments.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)