Table of Contents

Introduction

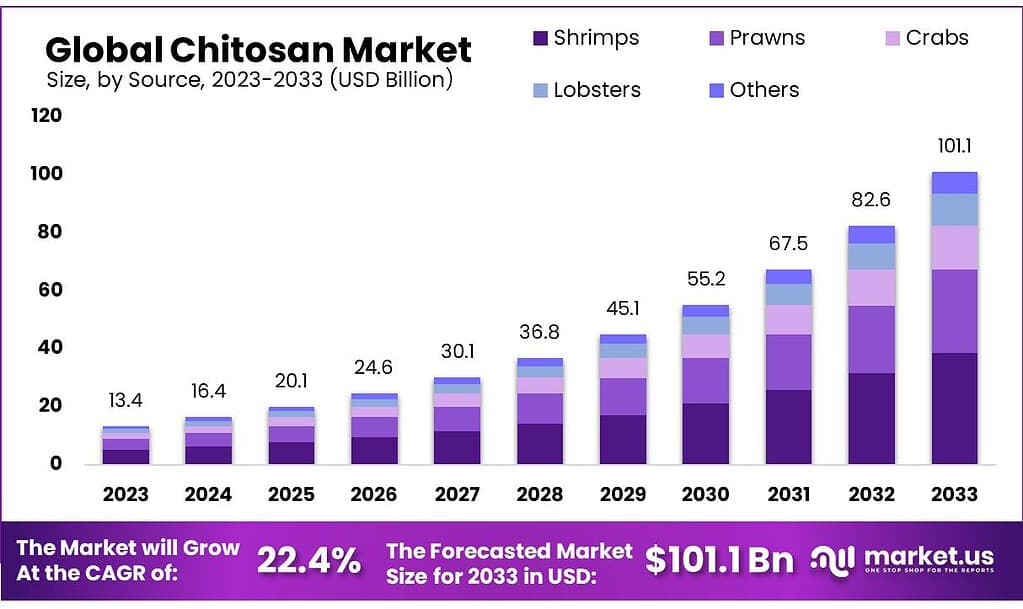

The global chitosan market is anticipated to expand significantly over the next decade, with an expected market size of approximately USD 101.1 billion by 2033, up from USD 13.4 billion in 2023, reflecting a robust compound annual growth rate (CAGR) of 22.4% during the forecast period from 2023 to 2033. This growth is driven by the increasing demand for sustainable and eco-friendly materials across various industries, including water treatment, pharmaceuticals, cosmetics, and food and beverage sectors.

Chitosan, derived from the shells of crustaceans such as shrimp and crabs, is prized for its biodegradability, biocompatibility, and antibacterial properties. These attributes make it an ideal candidate for a wide range of applications. The water treatment industry, in particular, is a significant driver of market growth due to the increasing need for effective and environmentally friendly solutions to manage wastewater. Chitosan’s ability to remove heavy metals and other contaminants from water makes it a valuable resource in this sector.

In the pharmaceutical and biomedical fields, chitosan is used in drug delivery systems, wound-healing products, and dietary supplements. Its properties as a fat blocker and its potential to treat conditions like hypercholesterolemia and hypertension have further bolstered its demand in the healthcare sector. The cosmetics industry also benefits from chitosan’s applications in products such as moisturizers, anti-aging creams, and hair care formulations, driven by a growing consumer preference for natural and non-GMO ingredients.

Despite the positive outlook, the chitosan market faces several challenges. The high cost of production, variability in raw material quality, and the complexity of extracting chitosan from crustacean shells are significant hurdles that need to be addressed. Additionally, regulatory challenges and the need for standardized production processes can impact market growth.

Regionally, North America and Europe are prominent markets for chitosan, driven by stringent environmental regulations and a strong industrial base. The Asia-Pacific region is also witnessing substantial growth, particularly due to the rising demand in water treatment, pharmaceuticals, and cosmetics industries. Countries like China, Japan, and India are key contributors, supported by the abundant availability of raw materials and favorable government initiatives.

Key Takeaways

- The chitosan market is to reach USD 101.1 billion by 2033, soaring from USD 13.4 billion in 2023, with a robust CAGR of 22.4%.

- Shrimps hold over 38.2% of the chitosan source market, valued for high yield and eco-friendly extraction methods.

- Biomedicine & Pharmaceuticals command 41.2% market share in 2023, harnessing chitosan’s biocompatibility for advanced medical products.

- Asia Pacific leads the chitosan market with a 50.3% share in 2023, driven by rapid industrialization and government support.

Statistics

- Nguyen et al.reported that the mean size of CNPs synthesized using tripolyphosphate (TPP) ionic gelation coupled with spray drying varied between 166 and 1230 nm depending on the chitosan molecular weight and the spray dryer needles diameter.

- The chitosan nanoparticles with sizes ranging from 10 to 80 nm show potential for nanomedicine, biomedical engineering, industrial, and pharmaceutical fields

- In the present study, an extract of Eucalyptus globulus Labill leaves was used to produce ultrafine CNPs with a size range between 6.92 and 10.10 nm.

- The efficacy is determined by their drug release profile, antimicrobial and anti-tyrosinase properties, and toxicity test. In this study, an in vitro drug release profile shows a cumulative drug release in 24 h of 52.99%.

- Curcumin solution It was prepared in a clear universal bottle covered with aluminum foil. TPP (0.1%) was mixed with chitosan solution (3 ml, 0.5%) while magnetic stirring the solution.

- The maximum percentage swelling, porosity, in vitro degradation, and in vitro enzymatic degradation were obtained, respectively, under conditions that 0.2 g chitosan, 0.8 g gelatin, and 0.5 mL cross-linker. The limitations due to the use of glutaraldehyde are related to its high cytotoxicity.

- In the histopathological study, no pathological changes were observed in the vital organs of mice when administered personally with 300 mg/kg and 2,000 mg/kg body-weight doses of chitosan-catechol polymeric conjugates.

- Chitosan is potentially safe for developing oral drug delivery systems. Oral levels up to 6.75 g were reported to be safe for human consumption.

- Kim et al. evaluated subacute toxicity of chitosan oligosaccharide in rats and reported no adverse effects at 2,000 mg/kg dose

- Chitosan (Ch) has been incorporated with Tectona grandis leaf extract and stem extract at different compositions (5%, 10%, and 15% v/v) to study the physicochemical properties of the biocomposites.

- The final film-forming solution consisted of 2% chitosan, 1% acetic acid, 2% starch, 1% sorbitol as a plasticizer, 0.05% Tween 20, and 0.1% or 0.5% geraniol or thymol.

- All the films were prepared with 5 g of film solution per Petri dish (1 film), which ensured 20 mg chitosan/film. Control films were prepared identically but without the addition of monoterpenes.

- The composite adsorbent material was synthesized using chitosan to expand the graphite ratio of 5% and acetic acid and glutaraldehyde.

- The adsorption of methylene blue dye onto CGC was optimized by response surface statistical experimental design method to achieve a removal efficiency of 98.61% at 5.24 initial concentration, pH of 9.98, and 95.43-minute contact time.

Emerging Trends

- Advanced Extraction Techniques: Innovations in the extraction and processing of chitosan are enhancing its quality and functionality. New techniques aim to minimize the use of harmful chemicals and reduce environmental impact, thereby improving the purity and yield of chitosan while maintaining its beneficial properties. These advancements are crucial for meeting the rising demand for chitosan in various applications, including pharmaceuticals and water treatment.

- Water Treatment Applications: Chitosan’s unique properties, such as biodegradability, bioactivity, and non-toxicity, make it ideal for water treatment applications. It is used as a natural flocculant and coagulant to remove contaminants from wastewater, including heavy metals and dyes. The increasing global emphasis on environmental conservation and stringent regulatory standards are driving the adoption of chitosan in water treatment facilities. This segment is expected to hold the largest market share during the forecast period.

- Biomedical and Pharmaceutical Uses: The biomedical and pharmaceutical sectors are significant growth drivers for the chitosan market. Chitosan’s biocompatibility and biodegradability make it suitable for developing advanced medical products, such as wound dressings, drug delivery systems, and tissue engineering scaffolds. Continuous research and innovation in these fields are expanding the range of chitosan applications, contributing to its market growth.

- Cosmetics and Personal Care: There is a growing demand for natural and organic ingredients in the cosmetics industry, and chitosan is increasingly used for its hydrating and film-forming properties. It is a popular ingredient in skincare and hair care products, enhancing texture and moisture retention. The trend towards non-GMO and natural cosmetic components is driving the demand for chitosan in this sector.

- Sustainable and Eco-Friendly Agriculture: Chitosan is gaining traction in the agrochemical industry as a biopesticide and plant growth enhancer. Its biodegradability and non-toxicity make it a promising alternative to conventional chemical pesticides and fertilizers. The shift towards sustainable agriculture practices and the increasing demand for organic farming solutions are boosting the use of chitosan in this sector

- Regional Growth Dynamics: The Asia-Pacific region dominates the chitosan market due to the abundant supply of raw materials and the rapid development of end-use industries in countries like Japan, China, India, and South Korea. North America is also a significant player, driven by the demand for chitosan in advanced healthcare and pharmaceutical applications, as well as in water treatment. The robust industrial base and stringent environmental regulations in these regions support market growth.

- Industrial Collaborations and Joint Ventures: Strategic collaborations and joint ventures are common in the chitosan market, aimed at enhancing product distribution and technological advancements. For instance, partnerships between biotech companies and large-scale distributors help expand the reach and application of innovative chitosan products, thereby accelerating market growth.

Use Cases

- Water Treatment: Chitosan is extensively used in water treatment facilities due to its ability to bind with contaminants and heavy metals, aiding in their removal. Its effectiveness as a natural flocculant helps in clarifying wastewater and reducing pollutants. The water treatment segment is anticipated to hold the largest market share, with the global market size for chitosan in this sector projected to grow significantly. For instance, chitosan-based water treatment solutions are gaining traction in North America and Asia-Pacific due to stringent environmental regulations and the need for sustainable treatment methods.

- Pharmaceuticals and Biomedicine: In the pharmaceutical industry, chitosan is valued for its biocompatibility and biodegradability. It is used in developing drug delivery systems, wound dressings, and tissue engineering scaffolds. The market for chitosan in biomedicine and pharmaceuticals is substantial, capturing more than 41.2% of the application segment in 2023. Endless innovations and research are expanding its use in novel therapeutic applications, driving market growth.

- Cosmetics: Chitosan’s hydrating and film-forming properties make it a popular ingredient in skincare and haircare products. It enhances texture, and moisture retention, and provides antibacterial benefits. The cosmetics industry is seeing increased demand for natural and organic ingredients, with chitosan being a key component. The trend towards non-GMO and safe beauty products is fueling its adoption. The global cosmetics market, valued at USD 380.2 billion in 2019, continues to integrate chitosan for its beneficial properties.

- Food and Beverage Industry: In the food and beverage sector, chitosan is used as a natural preservative and antibacterial agent. It helps extend the shelf life of perishable goods and is used in winemaking to clarify liquids without altering their taste. Chitosan’s ability to bind with fats and proteins aids in maintaining product quality, which is crucial in the globalized food supply chain. The food & beverage industry, with a revenue expectation of USD 342,213 million in 2021, leverages chitosan for cleaner and safer food production practices.

- Agriculture: Chitosan is used as a biopesticide and plant growth enhancer in agriculture. Its biodegradability and non-toxicity make it an attractive alternative to conventional pesticides and fertilizers. The increasing adoption of organic farming practices is driving the demand for chitosan in this sector. In 2019, India produced 800,000 metric tons of shrimp, a primary source of chitosan, indicating a robust supply chain to support agricultural applications.

- Medical and Surgical Applications: Chitosan is widely used in medical and surgical fields for developing biodegradable sutures, wound dressings, and tissue regeneration products. The medical applications are expanding, with chitosan being used for its hemostatic properties and ability to promote healing. The use of chitosan in these applications is driven by its safety profile and effectiveness in enhancing the body’s natural healing processes.

- Environmental Applications: Chitosan’s use in environmental applications, such as oil spill remediation and pollution control, is gaining importance. Its ability to adsorb pollutants makes it suitable for cleaning up contaminated sites. This environmentally friendly approach is increasingly adopted in regions with strict environmental regulations, further expanding chitosan’s market reach.

Major Challenges

- Supply Chain Volatility: The primary source of chitosan is the shells of crustaceans such as shrimp and crabs. The availability of these raw materials is highly dependent on the fishing industry, which is subject to environmental and regulatory fluctuations. Overfishing and changes in marine biodiversity can lead to inconsistent supply volumes, affecting the production and pricing of chitosan. For instance, fluctuations in shrimp production due to environmental phenomena like El Niño can disrupt the supply chain, making it difficult for manufacturers to maintain consistent production levels.

- High Production Costs: The extraction and processing of chitosan involve several steps that can be costly, especially when aiming to produce high-purity grades suitable for medical and pharmaceutical applications. The use of chemicals in the extraction process, along with the need for specialized equipment, adds to the production costs. This can make chitosan products more expensive compared to synthetic alternatives, potentially limiting their adoption in cost-sensitive markets.

- Regulatory Hurdles: The chitosan market is subject to stringent regulatory requirements, particularly in the pharmaceutical and food sectors. Ensuring compliance with these regulations involves extensive testing and certification processes, which can be time-consuming and costly. Different countries have varying standards for the use of biopolymers, adding another layer of complexity for manufacturers looking to expand their market presence globally.

- Market Competition: The biopolymer market is highly competitive, with numerous alternatives to chitosan being developed and commercialized. Other biopolymers like alginate, cellulose, and polylactic acid (PLA) offer similar benefits and are often available at lower costs. This competition can hinder the growth of the chitosan market, as manufacturers and consumers may opt for these more cost-effective options.

- Environmental Concerns: While chitosan is considered environmentally friendly, the process of extracting chitosan from crustacean shells can generate waste and require substantial water and chemical use. Addressing these environmental concerns is crucial for the market to sustain its green credentials. Innovations in extraction processes are needed to minimize the environmental footprint of chitosan production.

Market Growth Opportunities

- Water Treatment Solutions: The rising concerns about water pollution and scarcity are driving the demand for efficient water treatment solutions. Chitosan’s ability to act as a natural flocculant makes it ideal for removing contaminants from wastewater. The global water treatment market is expanding rapidly, with chitosan expected to play a significant role. For example, the market for chitosan in water treatment is projected to grow substantially due to stringent environmental regulations and the need for sustainable solutions.

- Expansion in the Pharmaceutical and Biomedical Fields: Chitosan’s biocompatibility and biodegradability make it highly valuable in the pharmaceutical and biomedical sectors. It is used in drug delivery systems, wound dressings, and tissue engineering. Continuous research and innovations in these fields are expanding the applications of chitosan. The pharmaceutical industry’s focus on developing advanced medical solutions is expected to drive the demand for chitosan, particularly in regions with advanced healthcare infrastructure like North America and Europe.

- Growth in the Cosmetics Industry: There is a growing consumer preference for natural and organic ingredients in cosmetics. Chitosan is used for its hydrating and film-forming properties, making it a popular ingredient in skincare and haircare products. The global cosmetics market, valued at USD 380.2 billion in 2019, continues to integrate chitosan, driven by the trend towards non-GMO and safe beauty products. This trend is expected to boost the demand for chitosan in the cosmetics industry.

- Sustainable Agriculture Practices: Chitosan is increasingly used in agriculture as a biopesticide and plant growth enhancer. Its biodegradability and non-toxicity make it an attractive alternative to conventional pesticides and fertilizers. The global shift towards sustainable and organic farming practices is expected to drive the demand for chitosan. The adoption of chitosan in agriculture is particularly notable in regions with large agricultural sectors, such as Asia-Pacific.

- Emerging Markets and Regional Expansion: The Asia-Pacific region, particularly countries like China, Japan, and India, dominate the chitosan market due to the abundance of raw materials and rapid industrialization. The expansion of end-use industries in these regions offers significant growth opportunities. Additionally, increasing investments in research and development of chitosan-based products in these markets are expected to drive further growth.

Recent Developments

Panvo Organics Pvt. Ltd., established in 2006, is a leading manufacturer in the chitosan sector, focusing on the development and commercialization of chitosan-based products. The company operates a state-of-the-art manufacturing facility in Gummidipoondi, Tamil Nadu, certified by major regulatory bodies like the US FDA and WHO. In 2023 and 2024, Panvo Organics has made significant advancements in the chitosan market, emphasizing novel formulations and sustainable agriculture inputs. Notably, they have patented a chitosan-based topical hemostat and a dental irrigant, both currently under regulatory review and clinical trials. The company’s expertise in chitosan manufacturing has positioned it as a key player in both the domestic and international markets, with a diverse product portfolio catering to pharmaceuticals, cosmetics, and agricultural sectors. Each month in 2023 and 2024, Panvo has focused on scaling production and enhancing product quality to meet the growing global demand for eco-friendly and effective chitosan applications.

KitoZyme S.A., headquartered in Herstal, Belgium, is a leading producer of fungal chitosan and chitin-glucan. In 2023 and 2024, KitoZyme has been active in several key initiatives, demonstrating significant advancements in the chitosan sector. In November 2023, the European Commission approved their product KitoGreen® for use in organic agriculture, marking a major milestone in sustainable farming. This product, derived from Aspergillus niger, is recognized for its effectiveness in plant protection and is now available to organic farmers across the EU. Additionally, in May 2023, KitoZyme entered an exclusive partnership with Janssen PMP to develop chitosan technologies for post-harvest preservation of fruits and vegetables, aiming to reduce food waste globally. These initiatives highlight KitoZyme’s commitment to innovation and sustainability, leveraging their non-animal origin chitosan to create eco-friendly solutions for various industries.

Heppe Medical Chitosan GmbH, based in Halle (Saale), Germany, specializes in producing high-purity chitin, chitosan, and their derivatives for various industrial applications, including cosmetics, pharmaceuticals, and scientific research. In 2023, the company launched the first-ever chitosan molecular weight standards at EUCHIS 2023, significantly improving the reliability of chitosan for research and pharmaceutical products. Additionally, Heppe Medical Chitosan has been actively developing microfluidic techniques for producing chitosan-based nanoparticles for drug delivery and exploring applications in dental and cancer treatments using 3D bioprinting technologies and chitosan microparticles. Their consistent participation in international conferences such as the PBP World Meeting in March 2024 and the Bioeconomy Innovation Day in November 2023 highlights their ongoing commitment to innovation and collaboration within the chitosan sector.

KIMICA Corporation, headquartered in Tokyo, Japan, is a leading manufacturer and global supplier of alginates and chitosan products. Throughout 2023 and 2024, KIMICA has been actively involved in the development and promotion of its chitosan products across various sectors. In May 2023, KIMICA highlighted its innovations at IFIA JAPAN, focusing on chitosan-based products for food and pharmaceutical applications. The company has emphasized sustainable practices, participating in numerous international events such as the CPHI in Milan in October 2024 and MEDICA in Düsseldorf in November 2024. These efforts are part of KIMICA’s strategy to expand its market presence and leverage its advanced manufacturing technology to meet the growing global demand for eco-friendly and high-quality biopolymers.

Conclusion

The chitosan market is poised for significant growth, driven by its versatile applications and increasing demand across various industries. Chitosan, derived from the shells of crustaceans, offers unique properties such as biodegradability, biocompatibility, and antibacterial effects, making it highly valuable in sectors like water treatment, pharmaceuticals, cosmetics, and food and beverages.