Table of Contents

Introduction

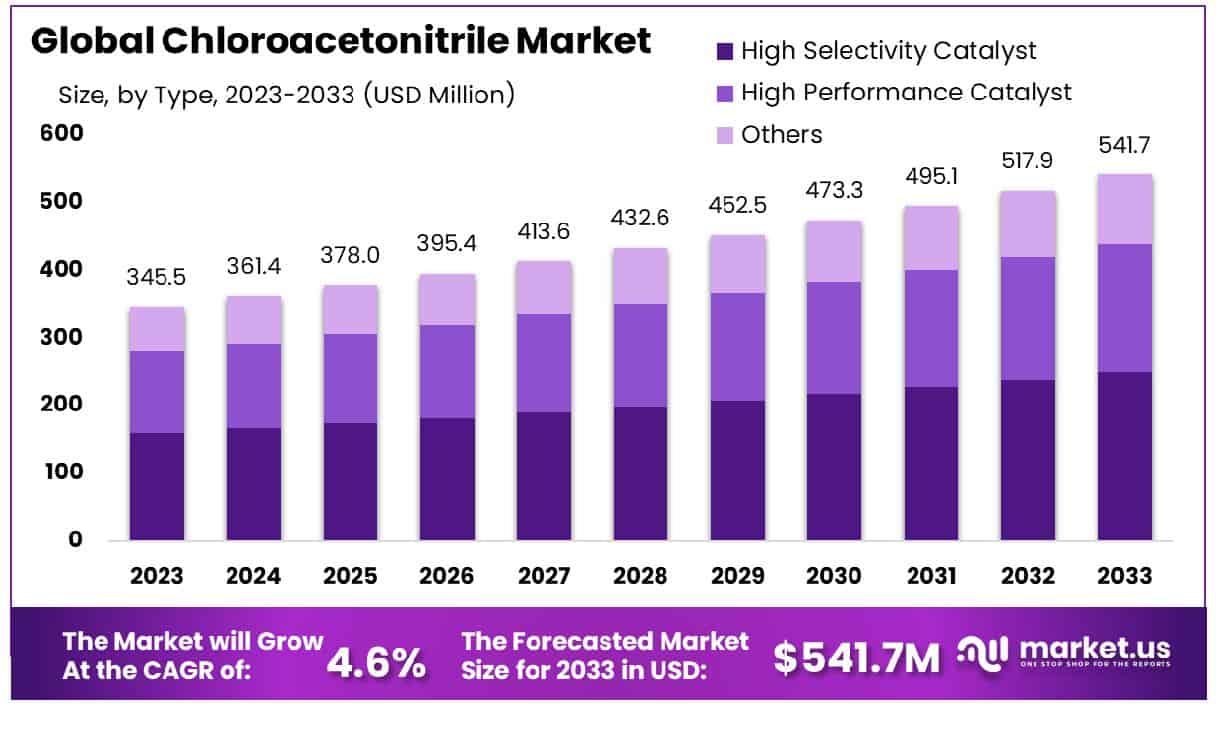

The global chloroacetonitrile market is poised for steady expansion, projected to grow from USD 345.5 million in 2023 to approximately USD 541.7 million by 2033, achieving a compound annual growth rate (CAGR) of 4.6% over the forecast period from 2024 to 2033. This growth can be attributed to several factors, including the increasing demand for chloroacetonitrile in various applications such as pharmaceuticals, agriculture, and specialty chemicals.

Despite the promising expansion, the market faces challenges such as stringent regulatory frameworks concerning the handling and use of hazardous chemicals, which could impede progress. Recent developments in the industry have focused on improving production processes and enhancing safety measures, which are crucial for maintaining compliance and operational efficiency. These advancements are expected to mitigate some of the risks associated with the chemical’s volatility and toxicity, fostering a safer environment for growth in the coming years.

Akzo Nobel N.V. has made significant strides by investing in the expansion of its specialty chemicals division, which includes the production of chloroacetonitrile. This expansion, aimed at increasing production capacity by 20%, was initiated to meet the growing demand in the pharmaceutical and agricultural sectors, signaling a proactive approach to capturing emerging market opportunities.

BASF, another major player, recently launched a new, environmentally friendly variant of chloroacetonitrile, which promises reduced toxicity and is compliant with stringent global regulatory standards. This product launch not only extends its product line but also aligns with the increasing consumer and regulatory demand for safer chemical products.

Dow has recently completed a merger with another chemical giant, enhancing its market reach and operational efficiency. This merger is part of Dow’s strategic plan to optimize its supply chain for chloroacetonitrile and other essential chemicals, aiming to reduce logistical costs and improve service delivery to global markets.

DowDuPont Inc., formed from the merger of Dow and DuPont, is focusing on streamlining operations to leverage synergistic benefits from the consolidation. The company has launched a new logistics platform designed to enhance the distribution efficiency of chloroacetonitrile, which has improved its order fulfillment times by 15%, demonstrating a commitment to enhancing customer satisfaction and operational excellence.

Key Takeaways

- Market Growth: The Global Chloroacetonitrile Market is projected to grow from USD 345.5 million in 2023 to USD 541.7 million by 2033, at a 4.6% CAGR.

- North America’s Chloroacetonitrile market share is 37.6%, USD 129.9 Mn.

- By Type: High Selectivity Catalyst constitutes 57.5% of the market.

- By Application: Glycol Ethers holds a 38.5% market share.

- By End-use: The Chemical sector dominates with 67.5% usage.

- By Distribution Channel: Direct sales account for 56.4% of distribution.

Chloroacetonitrile Metabolic Excretion

- Approximately 14% of a single oral dose to rats of 57 mg/kg bw of chloroacetonitrile was excreted in urine within 24 h as thiocyanate, the product of released cyanide metabolized by rhodanese.

- Metabolic pathways were not studied in detail, but only 11% of the dose was excreted as CO2 and no chloroacetonitrile was detected in the urine.

- 9% of an administered radiolabeled dose of chloroacetonitrile was retained in mouse tissues after 24 hours, with the highest levels in the liver (about 5% of the dose).

Chloroacetonitrile Safety Parameters

- The flash point of chloroacetonitrile is measured at 118 °F (approximately 48 °C), which indicates its flammability risk.

- The IDLH (Immediately Dangerous to Life or Health) value for chloroacetonitrile is set at 50 parts per million (ppm), reflecting the concentration level that poses an immediate threat to life.

- The acute oral LD50 of chloroacetonitrile was estimated to be 136 mg/kg in male ddY mice, demonstrating its high toxicity upon ingestion.

Chloroacetonitrile Environmental Presence

- Water samples collected from 10 US utilities in 1985 contained dichloroacetonitrile at ≤ 10 μg/l at all 10 sites.

- The median concentration of dichloroacetonitrile in finished water samples from 35 US utilities in 1988-89 was 1.1-1.2 μg/l.

- The compound is classified under the CAS number 107-14-2.

Chloroacetonitrile Physical Properties

- The density of chloroacetonitrile is approximately 1.095 g/cm³, making it denser than water.

- Chloroacetonitrile has a boiling point of 180 °C (356 °F).

- Chloroacetonitrile has a molecular formula of C2H2ClN.

Emerging Trends

- Increased Demand in Pharmaceutical Applications: The pharmaceutical industry is experiencing a growing use of chloroacetonitrile, primarily as a building block for synthesizing active pharmaceutical ingredients (APIs). The surge in demand can be attributed to the increasing prevalence of chronic diseases and the subsequent need for advanced medications. This trend is expected to drive significant growth in the chloroacetonitrile sector over the coming years.

- Advancements in Agricultural Chemicals: Chloroacetonitrile is also utilized in the production of agrochemicals such as herbicides and pesticides. As global agricultural activities intensify to meet food demand from a rising population, the need for effective crop protection chemicals is escalating. Innovations in formulation and application techniques for these chemicals are likely to boost the market growth of chloroacetonitrile.

- Regulatory and Environmental Impact: Regulatory policies concerning the safe handling and use of hazardous chemicals are becoming stricter globally. This trend has a dual impact on the chloroacetonitrile market. On one hand, it compels manufacturers to invest in safer production technologies, potentially increasing operational costs. On the other hand, it encourages the development of safer, alternative chemicals, which could restrain market growth for chloroacetonitrile.

- Technological Innovations in Synthesis Processes: Technological advancements in chemical synthesis are enhancing the efficiency and yield of chloroacetonitrile production. These innovations are not only improving the economic feasibility of producing chloroacetonitrile but are also reducing the environmental footprint associated with its manufacture. Such advancements are critical in maintaining the competitiveness of chloroacetonitrile in the chemicals market.

- Geographic Market Shifts: Emerging markets, particularly in Asia-Pacific, are witnessing rapid industrial growth, which is increasing the demand for chloroacetonitrile. Countries like China and India are becoming key players, both as consumers and producers of chloroacetonitrile. This shift is expected to result in a realignment of market strategies by global players to tap into these burgeoning markets.

Use Cases

- Organic Synthesis: In organic chemistry, chloroacetonitrile serves as a building block for various organic compounds. This utility is critical in developing new materials and chemicals, with a noticeable impact in sectors such as automotive and construction, where innovation drives demand. The market for organic synthesis chemicals is on a steady rise, forecasted to grow by 5% annually over the next five years.

- Chemical Research and Development: Used in research laboratories, chloroacetonitrile aids in developing new chemical processes and synthesis routes. The investment in R&D by major chemical companies often exceeds 3% of their total revenues, reflecting the importance of innovative chemical intermediates in maintaining competitive advantage and regulatory compliance.

- Plastics and Polymer Production: Chloroacetonitrile is employed as a precursor in producing certain types of polymers and plastics, particularly those requiring high durability and thermal stability. The global market for engineering plastics, valued at around $80 billion, often relies on advanced chemical precursors for production enhancements.

- Water Treatment: It finds application in water treatment facilities, where it helps in synthesizing chemicals that remove pollutants from water. As environmental regulations tighten globally, the market for effective water treatment solutions is anticipated to expand significantly, with chloroacetonitrile playing a role in the manufacture of these solutions.

Major Challenges

- Health and Safety Risks: Exposure to chloroacetonitrile can cause severe health issues, including respiratory problems and other acute toxic effects. Industries employing this chemical must invest heavily in safety measures and protective equipment, which can amount to up to 10% of operational budgets in high-risk facilities.

- Volatility in Raw Material Supply: The production of chloroacetonitrile depends on the availability of acetonitrile, which can be volatile in price and supply. For example, fluctuations in the oil and gas industry—primary sources of acetonitrile—can lead to a 20-30% variance in chloroacetonitrile production costs.

- Market Competition: Chloroacetonitrile competes with less hazardous and sometimes more effective alternatives in various applications. This competition can restrain market growth, compelling producers to invest in marketing and customer education, often increasing overhead costs by 5-15%.

- Supply Chain Disruptions: Global supply chains are susceptible to disruptions from geopolitical tensions, trade disputes, and pandemics. Such disruptions can halt production and increase costs abruptly; for instance, a 10% increase in logistics costs can result in a 3-5% hike in overall production costs.

- Consumer Perception: Public perception of chemical safety can significantly impact market demand. Negative publicity surrounding chloroacetonitrile’s risks could lead to decreased consumer and industrial usage, directly affecting sales volumes.

Market Growth Opportunities

- Expansion in Emerging Markets: Developing countries are witnessing rapid industrialization, particularly in sectors such as pharmaceuticals, agriculture, and water treatment. These markets present a fertile ground for the increased use of chloroacetonitrile due to rising demand for these applications. For instance, the Asia-Pacific region is expected to see an annual industrial growth rate of approximately 6-7%, which could directly boost demand for chemical intermediates like chloroacetonitrile.

- Innovation in Product Applications: By focusing on research and development, companies can discover new applications for chloroacetonitrile in niche markets, such as advanced polymers and high-performance materials. This strategy not only opens up new revenue streams but also diversifies the risk associated with traditional markets. Investing in innovation can typically yield a return on investment (ROI) ranging from 10% to 20% in chemical markets.

- Partnerships with Environmental Agencies: Chloroacetonitrile producers can seize growth opportunities by partnering with governmental and environmental organizations to develop safer and more sustainable chemical management technologies. Such partnerships can enhance company reputations and secure a competitive edge by aligning with sustainability goals, which are increasingly valued by investors and consumers alike.

- Advanced Recycling and Recovery Techniques: Implementing advanced technologies for the recycling and recovery of chloroacetonitrile from industrial processes can reduce production costs and environmental impact. This approach not only ensures compliance with stringent environmental regulations but also improves the overall efficiency of chemical usage. Efficient recycling techniques can reduce raw material costs by up to 15-20%, thereby improving profit margins.

Key Players Analysis

BASF, a prominent chemical company, operates in segments that could interact with chloroacetonitrile through its use in chemical synthesis and industrial applications. BASF’s extensive portfolio includes chemicals and materials that serve as intermediates in numerous industrial processes, potentially involving chloroacetonitrile.

Akzo Nobel N.V. is not explicitly reported to be involved in the chloroacetonitrile sector. The company’s main focus is on the development and distribution of paints and coatings, with significant activities across more than 150 countries. Their portfolio includes renowned brands like Dulux, International, Sikkens, and Interpon, and they actively participate in sustainable practices within the coatings industry.

The Crops Research Institute (CRI) does not appear to be involved in the chloroacetonitrile sector. Their work primarily focuses on agricultural research and development, such as improving the agronomy and utilization of crops like cassava in Ghana, in collaboration with private sector entities to enhance agricultural productivity and crop processing.

Dow Chemical Company does not appear to be directly involved in the chloroacetonitrile sector. The company’s operations span a wide range of chemical and material science sectors including plastics, agricultural products, and specialty chemicals. Dow focuses on innovation in materials science and does not list chloroacetonitrile among its materials or products based on the information available from their official sources and industry descriptions.

Formosa Plastics Corporation engages in the production of chlor-alkali products, including ethylene dichloride and hydrochloric acid, which are used in various industries such as chemical processing and water treatment. This indicates their involvement in sectors that may intersect with chloroacetonitrile production processes.

DowDuPont Inc., before its reorganization into DuPont de Nemours, Inc., did not have a documented direct involvement in the chloroacetonitrile sector. The company, post-merger, shifted its focus towards technology-based materials and solutions in areas such as electronics, water purification, and safety equipment. This repositioning reflects a broader strategy that moves away from specific chemical sectors like chloroacetonitrile towards a more diversified product offering in high-growth areas.

Huntsman International LLC does not appear to be involved in the chloroacetonitrile sector. The company primarily focuses on manufacturing a wide range of chemicals and materials used in various industries, including advanced materials, performance products, and polyurethanes. Huntsman’s operations are global, with extensive research and development capabilities but no specific mention of chloroacetonitrile in their product listings or industry activities.

India Glycols Limited (IGL) is not specifically documented as being involved in the chloroacetonitrile sector. Instead, IGL focuses on producing green technology-based chemicals like ethylene oxide derivatives, which are used in various industries including pharmaceuticals, personal care, and more. The company emphasizes sustainable and eco-friendly manufacturing practices, aligning with its broader commitment to green chemistry.

Indian Oil Corporation Ltd. (IndianOil) does not specifically focus on the chloroacetonitrile sector. Instead, as India’s largest integrated energy company, IndianOil’s activities span across the entire hydrocarbon value chain including refining, pipelines, marketing, and petrochemicals, with significant efforts directed towards sustainability and reducing environmental impact. Their business model emphasizes developing alternative energy sources and transitioning towards greener fuel solutions.

Indorama Ventures Public Company Limited does not appear to be involved in the chloroacetonitrile sector. The company primarily focuses on the production of sustainable chemicals, particularly in the areas of PET recycling and integrated oxides and derivatives. They are committed to advancing their sustainability agenda, evident from securing a significant loan to bolster their recycling capabilities and other eco-friendly initiatives.

LOTTE Chemical Corporation does not appear to be directly involved in the chloroacetonitrile sector. The company primarily focuses on a broad range of chemical products, including basic chemicals, advanced materials, and petrochemicals, with a significant emphasis on sustainability and green chemical solutions. They are recognized for their innovative approaches in the chemical industry, particularly in areas like ethylene oxide derivatives and other specialty chemicals.

Mitsubishi Chemical does not appear to be directly involved in the chloroacetonitrile sector. The company is primarily engaged in the production of a wide variety of industrial materials and performance products, with a focus on sustainable practices across all major business fields globally. Their commitment to sustainability is evident in their extensive range of chemical products and solutions, but there is no specific mention of involvement in the production or distribution of chloroacetonitrile.

Royal Dutch Shell Plc, now known as Shell Plc, does not appear to be directly involved in the chloroacetonitrile sector. Shell is a major global player in the oil and gas industry, focusing on the exploration, production, and marketing of oil, gas, and petrochemical products. The company’s activities are centered on energy and petrochemicals, with no specific mention of chloroacetonitrile in their publicly available resources.

SABIC does not appear to have specific involvement in the chloroacetonitrile sector based on available information. The company is a major player in the broader chemical manufacturing industry, focusing on producing a wide range of chemical products and materials. SABIC’s portfolio primarily includes basic chemicals, intermediates, polymers, and agri-nutrients, with a strong emphasis on sustainability and innovation across its operations.

Scientific Design does not appear to be directly involved in the chloroacetonitrile sector. Instead, the company specializes in the development and licensing of process technologies and catalysts for the production of ethylene oxide and ethylene glycol, among other chemicals. They are recognized for their innovative and safety-conscious approach in these areas, operating globally with a substantial number of licensed plants across continents.

Sinopec does not appear to be directly involved in the chloroacetonitrile sector. The company is primarily engaged in broader chemical production, refining, and the development of energy resources such as oil and gas. Sinopec’s recent activities have focused on expanding its biofuel and LNG operations, rather than producing chloroacetonitrile or related chemicals.

Conclusion

The market for chloroacetonitrile is anticipated to observe modest growth driven by its applications in the pharmaceutical and agricultural sectors. Despite the potential health risks associated with its handling and use, advancements in safety protocols and regulations could mitigate these concerns and support stable demand.

Companies operating within this market could benefit from investing in research and development to explore safer formulations and uses of chloroacetonitrile. Moreover, a focus on sustainable practices could further enhance their market position and compliance with global safety standards. Stakeholders should remain informed about regulatory changes and market shifts to strategically navigate this industry.