Table of Contents

Introduction

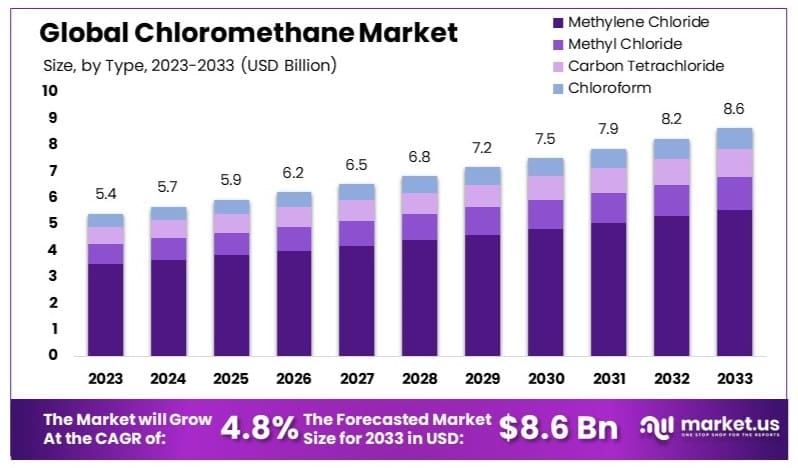

The global chloromethane market is poised for considerable growth over the next decade. As of 2023, the market size stands at USD 5.4 Billion and is forecasted to expand to approximately USD 8.6 Billion by 2033, representing a compound annual growth rate (CAGR) of 4.8%. This growth can be attributed to several factors, including rising demand in pharmaceutical applications and increasing uses in the silicone industry.

However, the market faces significant challenges, such as stringent environmental regulations concerning chloromethane’s impact on human health and the environment, which may impede market progress. Recent developments have seen innovations in production technology aimed at reducing harmful emissions and improving yield, which are critical to sustaining market growth in the face of regulatory pressures. These advancements are expected to help key market players enhance their production capabilities and meet the rising demand more efficiently.

The chloromethane industry is poised for significant growth over the next decade, driven by strategic expansions, mergers and acquisitions, and a focus on sustainability and innovation among key players like Dow Chemical Company, INEOS Group Holdings S.A., Akzo Nobel N.V., and Solvay S.A. The increasing demand across various applications, particularly in the pharmaceutical and construction sectors, underscores the importance of these developments in shaping the future of the chloromethane market.

Dow Chemical Company has been focusing on expanding its chloromethane production capacities to cater to rising global demand. Recently, the company has made significant investments in upgrading its manufacturing facilities to enhance efficiency and production output. This strategy aligns with the overall industry trend of increasing production to meet the growing applications in various sectors such as pharmaceuticals and construction.

INEOS Group Holdings S.A. has been actively involved in mergers and acquisitions to strengthen its market position in the chloromethane industry. Notably, INEOS acquired several smaller chemical manufacturing firms to diversify its product portfolio and improve its market share. These strategic moves are designed to consolidate its presence in key regions and capitalize on the growing demand for chloromethane in industrial applications, particularly in adhesives and sealants.

Solvay S.A. has recently expanded its chloromethane production capabilities by opening new plants in strategic locations. This expansion is part of Solvay’s broader strategy to meet the increasing global demand for chloromethane, particularly in the pharmaceutical industry. The company has also secured significant funding to support its growth initiatives, focusing on enhancing production efficiency and developing new applications for chloromethane.

Key Takeaways

- Market Value: The Chloromethane Market was valued at USD 5.4 billion in 2023, and is expected to reach USD 8.6 billion by 2033, with a CAGR of 4.8%.

- Type Analysis: Methylene Chloride dominated with 64.3%; significant for its widespread industrial applications.

- Application Analysis: Silicone Polymers led with 18.6%; crucial for its use in manufacturing high-performance materials.

- End-Use Analysis: Pharmaceuticals dominated with 35.7%; essential for various medicinal chemical processes.

- Dominant Region: APAC held 44.5%; significant due to its large manufacturing base and industrial activities.

- Analyst Viewpoint: The chloromethane market is moderately competitive with growth potential in pharmaceuticals and polymers. Future trends suggest increased demand in Asia-Pacific.

Chloromethane Statistics

- Chloromethane is flammable with a flash point of −20 °C.

- The autoignition temperature of chloromethane is 625 °C.

- The explosive limits of chloromethane are 8.1–17.4%.

- The melting point of chloromethane is −97.4 °C.

- The boiling point of chloromethane is −23.8 °C.

- The solubility of chloromethane in water is 5.325 g/L.

- The density of chloromethane is 1.003 g/mL at -23.8 °C in liquid form and 2.3065 g/L at 0 °C in gaseous form.

- Chloromethane is naturally produced at an estimated rate of 4.1 billion kg per year.

- Chloromethane detected in the atmosphere is typically released into the air, with an atmospheric lifetime of about 10 months.

- The price of chloromethane in Northeast Asia in July 2024 was US$0.49 per kilogram, representing an increase of 4.3%.

- The price of chloromethane in Europe in July 2024 was US$1.06 per kilogram, which remained unchanged.

- The price of chloromethane in North America in July 2024 was US$0.42 per kilogram, which also remained unchanged.

- In 2020, the top exporters of chloromethane and chloroethane were Germany (US$65.4 million), China (US$9.15 million), United States (US$6.58 million), Netherlands (US$5.97 million), and France (US$3.37 million).

- In 2020, the top importers of chloromethane and chloroethane were United Kingdom (US$16.6 million), France (US$16.2 million), Belgium (US$10.2 million), Italy (US$9.44 million), and Sweden (US$8.67 million).

- The production of chloromethane in the United States was estimated to be around 20 million pounds per year according to the US Environmental Protection Agency (EPA).

- Chloromethane and chloroethane were the world’s 4036th most traded products in 2020.

- In Indiana, the estimated statewide emissions of chloromethane totaled 51.54 tons in 2014.

- The statewide detection rate of chloromethane for monitors analyzed from 2006-2015 was 99.4%.

Emerging Trends

- Increasing Demand in Pharmaceuticals: Chloromethane is extensively used as a solvent and in the production of pharmaceuticals. As global health awareness rises and the pharmaceutical sector grows, demand for chloromethane is expected to increase. This trend is driven by the expansion of healthcare infrastructure and increased R&D investments by major pharmaceutical companies.

- Growth in Silicone Production: There is a significant rise in the use of chloromethane for producing silicones used in diverse industries such as electronics, automotive, and construction. Silicones offer durability and stability, qualities that are increasingly sought after in high-performance materials, thereby driving the demand for chloromethane.

- Regulatory Impact on Production: Stringent environmental regulations are influencing the production methods of chloromethane. Many countries are implementing tighter controls to minimize environmental impact, which is prompting manufacturers to adopt cleaner and more sustainable production technologies.

- Advancements in Green Chemistry: The industry is witnessing a shift towards sustainable practices, including the adoption of green chemistry. Innovations aimed at reducing the use of hazardous substances and enhancing the efficiency of chloromethane production are becoming prevalent. This trend is also fueled by growing consumer and regulatory pressure for environmentally friendly products.

- Expansion in Developing Markets: Emerging economies in Asia and Africa are experiencing rapid industrialization, leading to increased demand for chloromethane. The growth in manufacturing, construction, and healthcare sectors in these regions is expected to continue, presenting significant opportunities for market expansion.

- Innovation in Application Technologies: New applications of chloromethane are being developed, particularly in high-tech industries. The material’s properties are being harnessed in innovative ways, which opens up new markets and applications, thereby driving further growth in its demand.

- Supply Chain Optimization: Companies are increasingly focusing on optimizing their supply chains to reduce costs and improve efficiency. This includes strategic sourcing of raw materials, enhancing production processes, and improving logistics. Such optimizations not only enhance profitability but also increase the resilience of the supply chain against disruptions.

Use Cases

- Pharmaceutical Manufacturing: Chloromethane is used in the production of pharmaceuticals, especially as an anesthetic and in the synthesis of other drugs. Its application helps in creating effective medicinal compounds critical for health treatments.

- Silicone Polymer Production: A significant application of chloromethane is in the production of silicone polymers. These polymers are essential for creating products like sealants, adhesives, and cookware due to their thermal stability and water-resistant properties.

- Agrochemical Synthesis: Chloromethane serves as a key intermediate in manufacturing agrochemicals, including herbicides and insecticides. These products are vital for enhancing agricultural productivity by protecting crops from pests and diseases.

- Refrigerant Fluids: It is used in the production of refrigerant gases, which are essential for air conditioning and refrigeration systems. Chloromethane’s role in creating more efficient and environmentally safer refrigerants highlights its importance in modern thermal management technologies.

- Rubber Manufacturing: In the rubber industry, chloromethane is utilized to produce butyl rubber, which is known for its air impermeability. This type of rubber is commonly used in the manufacturing of inner tubes and other high-quality rubber products.

- Paints and Coatings: Chloromethane acts as a solvent in the production of paints and coatings, providing desired consistency and application properties. This application is crucial for the development of products that offer protection and aesthetics to surfaces.

- Chemical Research: Used widely in research laboratories, chloromethane is a reagent in various chemical reactions. It is instrumental in studying and developing new chemical processes and materials, underscoring its role in advancing scientific knowledge.

Key Players Analysis

Dow Chemical Company recently acquired Circulus, a polyethylene recycler in North America, to enhance its recycling capabilities, aligning with its 2030 sustainability goals. This acquisition is expected to add 50,000 metric tons of recycled materials annually, supporting Dow’s circular economy initiatives. In 2023, Dow reported sales of approximately $45 billion, indicating robust financial health.

INEOS Group Holdings S.A. completed the acquisition of LyondellBasell’s Ethylene Oxide and Derivatives business, including a production facility in Bayport, Texas, for $700 million. This strategic move expands INEOS’s footprint in the U.S. market, complementing its existing facilities in Louisiana. In Q2 2024, INEOS reported an EBITDA of €576 million, reflecting strong financial performance.

Akzo Nobel N.V. has shown significant progress in the Chloromethane sector and broader chemical markets. In 2024, the company completed a major investment project in Vietnam, adding new production lines to enhance its capabilities in sustainable manufacturing. The company reported a solid financial performance, with a 43% increase in operating income in Q1 2024 compared to the previous year. Akzo Nobel also introduced an innovative low-energy powder coating, further solidifying its commitment to sustainability and technological advancement.

Solvay S.A. continues to advance in the Chloromethane sector, demonstrating strong financial resilience and sustainable growth. In 2023, Solvay reported net sales of €5.6 billion and made strategic moves, including a significant acquisition of Bayer’s SeedGrowth business. Additionally, the company has signed a supply agreement for recycled rare earth oxides, aligning with its sustainability goals. These efforts reflect Solvay’s commitment to innovation and maintaining a competitive edge in the chemical industry.

Kem One produces 130,000 tons of chloromethane annually at its Lavéra site in France, the largest chloromethane production facility in continental Europe. The company, with a 2023 turnover of €1.1 billion, has focused on sustainability and innovation, recently launching a new range of sustainable products. This plant supports diverse applications in the pharmaceutical, agricultural, and solar panel sectors, emphasizing Kem One’s commitment to industrial excellence and environmental responsibility.

Shin-Etsu Chemical Co. has a significant presence in the chloromethane sector, with a strong focus on technological advancements and market expansion. In 2023, Shin-Etsu reported robust financial performance, driven by high demand in the semiconductor and electronics industries. The company recently invested in expanding its production capacity for chloromethane, crucial for manufacturing silicones and other high-value chemicals, reinforcing its position as a key player in the global chemical market.

Gujarat Alkalies and Chemicals Limited (GACL) is a leading player in the chloromethane sector, operating a significant plant at Dahej with an annual capacity of 105,000 tons. Recently, GACL revised the cost of its chloromethane project to Rs. 800 crore and the plant is currently 66% complete. The company focuses on expanding its chemical production capacity, including caustic soda and other chemicals, to meet growing demand. In 2023, GACL achieved a turnover of approximately ₹1,001 crore, demonstrating robust financial performance and strategic growth.

Tokuyama Corporation has a strong presence in the chloromethane sector, focusing on high-purity chemicals essential for various industrial applications. In recent years, Tokuyama has invested in enhancing its production capabilities to cater to the growing demand in electronics and other sectors. The company reported a solid financial performance in 2023, driven by increased sales in its chemical division. Tokuyama continues to innovate, particularly in producing chloromethane derivatives used in pharmaceuticals and electronics, ensuring its competitive edge in the global market.

SRF Limited is involved in the chloromethane sector through its production of methylene chloride, chloroform, and carbon tetrachloride. In FY 2024, the company’s revenue was ₹13,139 crore (US$ 1.58 billion), despite a 12% decrease from the previous year. SRF continues to expand its specialty chemicals business, though it faced challenges such as inventory rationalization and pricing pressures due to increased capacity in China.

Occidental Chemical Corporation is known for its significant role in the chloromethane sector, producing methylene chloride, chloroform, and carbon tetrachloride used in various applications including pharmaceuticals and agrochemicals. Recently, Occidental Chemical reported a stable revenue stream supported by its robust production capabilities and strategic market positioning, though specific figures for 2024 were not disclosed. The company continues to focus on enhancing its production efficiency and expanding its market reach.

Juhua Group Corporation has expanded its presence in the chloromethane sector through significant acquisitions and production enhancements. In December 2023, Juhua acquired a 30.15% stake in Zibo Feiyuan Chemical Co., Ltd. for approximately CNY 580 million. The company, with a revenue of CNY 21.55 billion in 2023, continues to focus on its core competencies in fluorine and chlor-alkali chemicals, supporting its robust financial performance and market expansion strategies.

Ercros S.A. is active in the chloromethane sector, focusing on the production and sale of key chloromethane derivatives. In 2023, the company reported strong financial results with significant revenue contributions from its chloromethane operations. Ercros has been investing in technological upgrades to enhance production efficiency and environmental sustainability, maintaining its competitive edge in the market.

Kem One produces 130,000 tons of chloromethane annually at its Lavéra site in France, the largest chloromethane production facility in continental Europe. The company, with a 2023 turnover of €1.1 billion, focuses on sustainability and innovation, recently launching a range of sustainable products. This plant supports diverse applications in pharmaceuticals, agriculture, and solar panels.

Alfa Aesar, now integrated under Thermo Fisher Scientific, specializes in providing high-purity chemicals, including those used in the chloromethane sector. With a comprehensive product line, Alfa Aesar supports research and industrial applications with a wide range of chemicals and metals. Recently, the brand has focused on consolidating its offerings to enhance product availability and customer support, contributing to the overall revenue growth of Thermo Fisher Scientific’s chemical division.

Sinopec Group is heavily involved in the chloromethane sector through its production of various chemical intermediates. In 2023, Sinopec reported substantial revenue growth driven by strategic investments and expansions in its chemical manufacturing capabilities. The company’s focus on sustainability and technological innovation has bolstered its market position, ensuring continued competitiveness in the global market.

Conclusion

In summary, the chloromethane market is experiencing significant growth, driven primarily by its increasing utilization in the pharmaceutical and silicone industries. The expansion of these sectors is expected to continue to fuel demand for chloromethane. However, regulatory challenges and environmental concerns related to chloromethane production and usage pose potential risks that could moderate this growth.

Stakeholders in the market are advised to focus on innovation in environmentally friendly production technologies and to closely monitor regulatory developments to effectively navigate these challenges. Thus, while the market outlook is positive, it is also dependent on industry responses to external pressures.