Table of Contents

Introduction

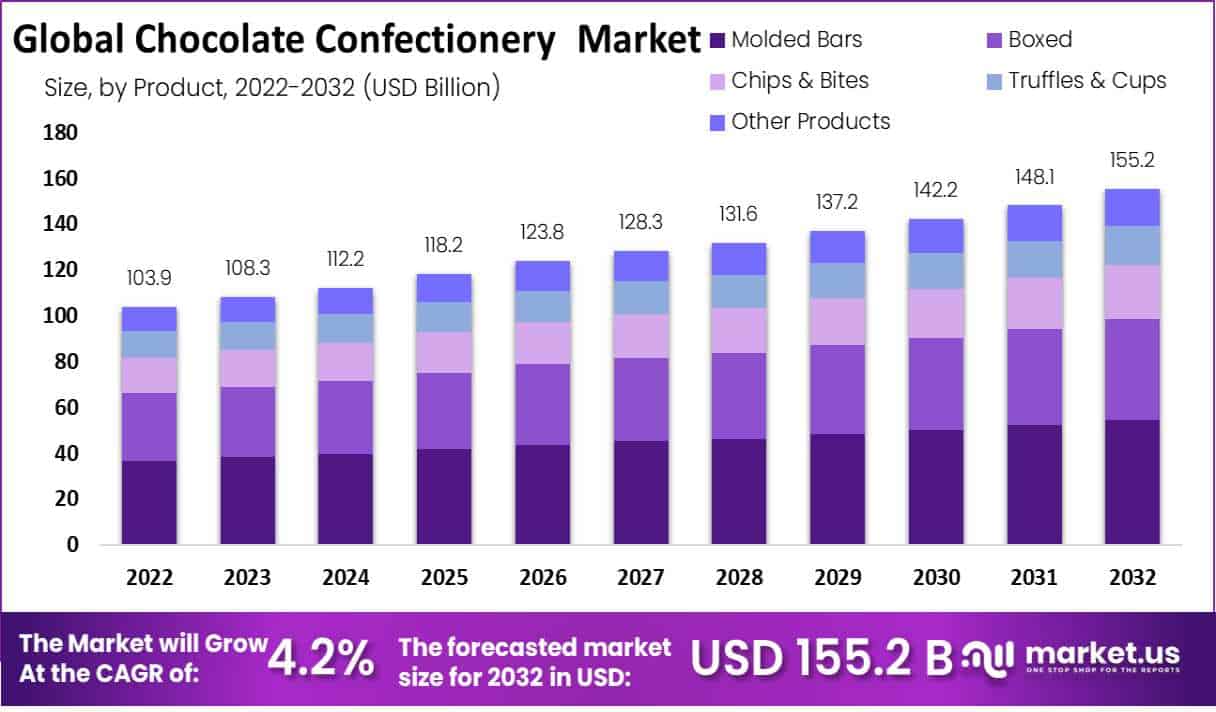

The global chocolate confectionery market is anticipated to grow from USD 103.9 billion in 2022 to USD 155.2 billion by 2032, achieving a compound annual growth rate (CAGR) of 4.2% during the forecast period from 2024 to 2033. This growth is driven by consumers’ increasing preference for premium chocolate products, which offer diverse flavors and textures. Moreover, the market is benefiting from rising disposable incomes that allow consumers to indulge in luxury chocolate experiences.

Several challenges could impact market growth, including health concerns related to sugar and calorie intake which are pushing consumers towards healthier alternatives. Additionally, the volatility in cocoa prices, affected by factors such as climate change and political instability in cocoa-producing countries, poses a risk to consistent supply and cost management in the chocolate industry.

Recent developments have seen major market players focusing on invention and expansion to cater to evolving consumer tastes. For example, there has been an increase in the production of sugar-free and low-calorie chocolates to appeal to health-conscious consumers. Companies are also investing in sustainable practices, including eco-friendly packaging and ethical sourcing of ingredients, to enhance their market appeal and comply with consumer demand for responsible production practices.

Nestle SA has been focusing on expanding its health and nutrition business, illustrated by its acquisition of Puravida, a Brazilian nutrition brand. This acquisition aligns with its strategy to diversify its portfolio into health-oriented products. Additionally, Nestle announced a significant investment of ₹5,000 crore in India to enhance its production capabilities and explore new market opportunities, underpinning its commitment to growth in emerging markets

Furthermore, regional markets show varied growth potentials, with Asia Pacific and especially countries like China and India, experiencing significant growth due to increasing disposable incomes and the influence of Western dietary habits. In contrast, mature markets like North America and Europe continue to innovate in product offerings to maintain consumer interest and market share.

Chocolate ConfectioneryStatistics

- Total employer establishments in the chocolate and chocolate confectionery manufacturing industry: 1,247.

- Total annual payroll in the United States for this industry: $1,901,364.

- Total sales, shipments, receipts, and production in the United States: $16,674,129.

- Net revenues increased to $493.45 million in 2021, a 7.9% rise from 2020.

- Manufacturing value-added reached $1.2 billion in 2021, marking a 9.8% increase from 2020.

- Costs of materials and supplies totaled $1.1 billion in 2021, up 10.1% from 2020.

- Energy, water, and vehicle fuel costs amounted to $32.3 million in 2021, a 13.0% increase from 2020.

- The manufacturing intensity ratio for chocolate and chocolate confectionery manufacturing reached 51.3% in 2021, up from 50.5% in 2020.

- In comparison, the overall manufacturing intensity ratio for the sector increased from 37.2% in 2018 to 39.9% in 2021.

- Only 15-20% of chocolate is consumed as bars or blocks; the rest coats other foods like biscuits and ice cream.

- Chocolate and chocolate confectionery make up about 60% by the weight of the UK confectionery market.

- UK chocolate confectionery market was valued at £3bn in 2019, with 2.8% growth in impulse stores.

- Innovation is crucial for the category; stocking new products at launch boosts sales by 35%.

- Protein bars pose competition, with market worth £86m and growing at 21%.

- 72% of shoppers buy protein bars as a healthier treat and alternative to chocolate.

Emerging Trends

Emerging trends in the chocolate confectionery market for 2024 are characterized by a growing emphasis on health, indulgence, and sustainability, reflecting broader consumer desires for products that not only taste good but also contribute positively to their health and the environment.

One prominent trend is the rise of plant-based chocolates, catering to the increasing consumer demand for vegan and dairy-free options. This segment is projected to see significant growth, emphasizing the integration of flavors like oats, almonds, and peas, which align with the use of alternative milks.

Health-focused chocolates are also gaining popularity, with many consumers seeking options that contain beneficial ingredients like antioxidants and lower sugar levels. This trend is part of a broader movement toward “healthy indulgence,” where the health benefits of dark chocolate, such as improved heart health and cognitive function, are particularly highlighted.

Another trend is the diversification of flavors and textures within chocolate products. Consumers are increasingly interested in unique and exotic flavors, such as guava, passion fruit, and various botanical infusions, which provide a new sensory experience. There’s also a noticeable preference for chocolates that combine multiple textures, appealing to those looking for a more complex eating experience.

Sustainability continues to be a key focus, with consumers expecting chocolate brands to adopt environmentally friendly practices throughout their supply chains. This includes the use of upcycled ingredients and regenerative farming practices to reduce environmental impact. Transparency in sourcing and production processes is becoming increasingly important to consumers, who are more mindful of the ecological footprint of their purchases.

Finally, the concept of indulgence is evolving. While traditional luxury and premium chocolates remain popular, there is a noticeable shift towards products that can deliver a sense of indulgence without compromising health or environmental standards. This includes chocolates with reduced sugar content and those made from sustainably sourced cocoa.

These trends underscore a dynamic shift in the chocolate confectionery market towards products that not only satisfy cravings but also align with contemporary consumer values around health, sustainability, and ethical consumption.

Use Cases

- Premium Chocolate as Everyday Luxury: Premium chocolate continues to transition from an exclusive product to a supermarket staple. This shift is evident as consumers increasingly treat themselves to high-quality chocolate, driven by a desire for indulgence and emotional uplift. Premium brands are responding by making their products more accessible, not just in specialty stores but also in regular retail channels.

- Plant-Based and Vegan Options: There’s a rising demand for plant-based and vegan chocolate options, particularly among younger consumers in Europe who prefer animal-free diets. This trend is pushing brands to innovate with dairy-free variants of traditionally milk-based chocolates.

- Innovative Flavors and Textures: In the Asia-Pacific region, there’s a strong consumer interest in novel sensory experiences, which has led to innovations in chocolate confectionery textures and flavors. Brands are exploring a variety of fillings and coatings to meet this demand.

- Ethical and Sustainable Practices: North American consumers are increasingly concerned with ethical sourcing and sustainability in chocolate production. This has prompted brands to highlight sustainable farming practices and ethical sourcing in their product launches.

- Health-Conscious Offerings: The demand for healthier chocolate options is on the rise, with consumers seeking products that offer health benefits without sacrificing taste. This includes low-sugar, high-cocoa content dark chocolates, known for their antioxidant properties.

- Culinary Applications: Milk chocolates, with their creamy and sweet profile, continue to be favored for various culinary applications. They are extensively used in baking and making confectioneries like truffles and bars, owing to their versatility and consumer preference.

Key Players Analysis

Nestlé SA continues to be a dominant force in the chocolate confectionery sector, emphasizing innovation and sustainability. The company has seen significant sales growth across its confectionery brands, particularly KitKat, which enjoys widespread popularity due to its diverse flavor offerings and sustainable practices. Nestlé’s commitment to sustainability is evident through initiatives like the Nestlé Cocoa Plan, which aims to source cocoa sustainably and improve the livelihoods of cocoa farmers. This focus on quality and environmental responsibility helps maintain Nestlé’s strong position in the global market.

Ferrero International maintains its status as a major player in the chocolate confectionery market, renowned for its extensive range of popular products including Ferrero Rocher, Nutella, and Kinder. The company’s success is driven by its strong emphasis on quality, continuous innovation, and strategic market expansion. Ferrero’s approach to maintaining high standards in product quality and indulgent experiences helps it to attract and retain consumers worldwide.

Chocoladefabriken Lindt & Sprungli AG has continued to excel in the chocolate confectionery sector, showcasing robust growth and innovative practices. In 2023, Lindt achieved impressive sales, notably through its premium segments such as the Lindor product line, which remains a consumer favorite globally. The company has been particularly successful in leveraging its high-quality offerings in various markets, contributing to its strong financial performance. Furthermore, Lindt is committed to sustainability, with significant strides in responsibly sourcing cocoa and other key ingredients, ensuring that its products not only taste exquisite but also adhere to ethical and environmental standards.

Mars Incorporated has significantly expanded its footprint in the chocolate confectionery market by acquiring Hotel Chocolat, a premium UK chocolate brand. This strategic move allows Mars to deepen its portfolio and enhance its presence in the luxury chocolate segment. Additionally, Mars has opened a new $42 million Global Research and Development Hub dedicated to snacking and confectionery innovations, underscoring its commitment to leading in taste and quality in the chocolate industry. These developments reflect Mars’s ongoing efforts to innovate and expand globally.

Mondelez International is strategically bolstering its presence in the chocolate confectionery sector with a sharp focus on core markets and product categories like chocolate and biscuits. In 2024, Mondelez reported a robust first-quarter performance with net sales of $9.29 billion, exceeding market expectations. This growth is attributed to strong demand for its chocolate and biscuit products despite rising costs. The company is committed to sustainability and digital commerce, aiming to derive 20% of its revenue from digital channels by 2030. Mondelez’s strategy emphasizes innovation, market expansion, and operational excellence, positioning it well for sustained growth in the global confectionery market.

The Hershey Company has demonstrated strong financial performance in the chocolate confectionery sector, particularly in 2024. The company reported a substantial increase in profits, with over 20% growth in net earnings and a 32% rise in operating profits, surpassing the $1 billion mark. This success is attributed to a combination of sales growth, effective price adjustments, and productivity enhancements. Hershey has also been proactive in exploring cost-saving measures and pricing strategies to manage high cocoa and sugar costs, ensuring sustained growth despite market fluctuations. Additionally, the company has focused on innovation and market expansion to maintain its competitive edge in the industry.

CEMOI Group, a prominent French chocolate manufacturer, is well-regarded for its extensive range of chocolate products, including bars, powders, and seasonal assortments. In 2024, CEMOI continued to emphasize sustainability through its “Transparence Cacao” initiative, enhancing the traceability and quality of life for cocoa farmers. The group also focuses on delivering high-quality chocolate products while adhering to rigorous food safety and environmental standards. This strategic approach supports CEMOI’s aim to maintain its leadership in the European private label sector.

Barry Callebaut, a leader in the global chocolate market, continues to drive innovation and trends in the chocolate confectionery sector. In 2024, the company focused on three key consumer trends: intense indulgence, mindful indulgence, and healthy indulgence. Barry Callebaut is adapting to these trends by developing products that cater to consumers’ evolving preferences for premium and multisensory chocolate experiences. Additionally, the company emphasizes sustainability and health, responding to a growing consumer demand for chocolates that are not only delicious but also beneficial for both personal health and the environment. This strategic approach helps Barry Callebaut maintain its position at the forefront of the chocolate industry.

Lake Champlain Chocolates, a family-owned company based in Vermont, has built a reputation for crafting premium chocolates that blend creativity, craftsmanship, and high-quality local ingredients. They pride themselves on using non-GMO, organic, and fair-trade certified ingredients to produce a variety of chocolates, including truffles and specialty bars. Their commitment to sustainability and local sourcing is a cornerstone of their business model, ensuring that each chocolate not only tastes exquisite but also supports both local and global communities.

Lotte Corporation, a major player in the Asian confectionery market, operates extensively in the chocolate sector. Known for its innovative approach, Lotte continuously develops new products to meet diverse consumer tastes. The company’s offerings range from popular classic chocolates to unique flavor combinations, catering to a broad demographic. Lotte’s strategic focus on research and development in the confectionery industry highlights its commitment to maintaining a strong market presence and adapting to changing consumer preferences. This strategy ensures that Lotte remains a key competitor in the global confectionery market.

Haribo GmbH & Co. KG, primarily known for its leading position in the fruit gum and licorice market in Europe, has not prominently entered the chocolate confectionery sector. The company focuses on its iconic gummy products, including the famous Gold-Bears, and a variety of other candy types. Haribo’s strong market presence is supported by its innovative approaches to confectionery, adapting to consumer preferences with a broad range of flavors and formats. Despite its specialization in non-chocolate items, Haribo’s brand strength and extensive distribution channels contribute to its significant role in the broader confectionery market globally.

Conclusion

The chocolate confectionery market is uniquely positioned to cater to a diverse array of consumer preferences, reflecting broader social trends towards indulgence, health consciousness, and sustainability. Premium, artisanal offerings continue to appeal to consumers’ desire for luxury and novelty, while health-oriented products such as dark and vegan chocolates are gaining traction due to their perceived benefits and alignment with dietary trends. Furthermore, sustainability remains a significant concern, with consumers increasingly expecting ethical sourcing and environmentally friendly production practices from their favorite brands. As these trends converge, the chocolate confectionery market is set to remain vibrant and competitive, continuously adapting to meet the evolving tastes and values of global consumers.