Table of Contents

Introduction

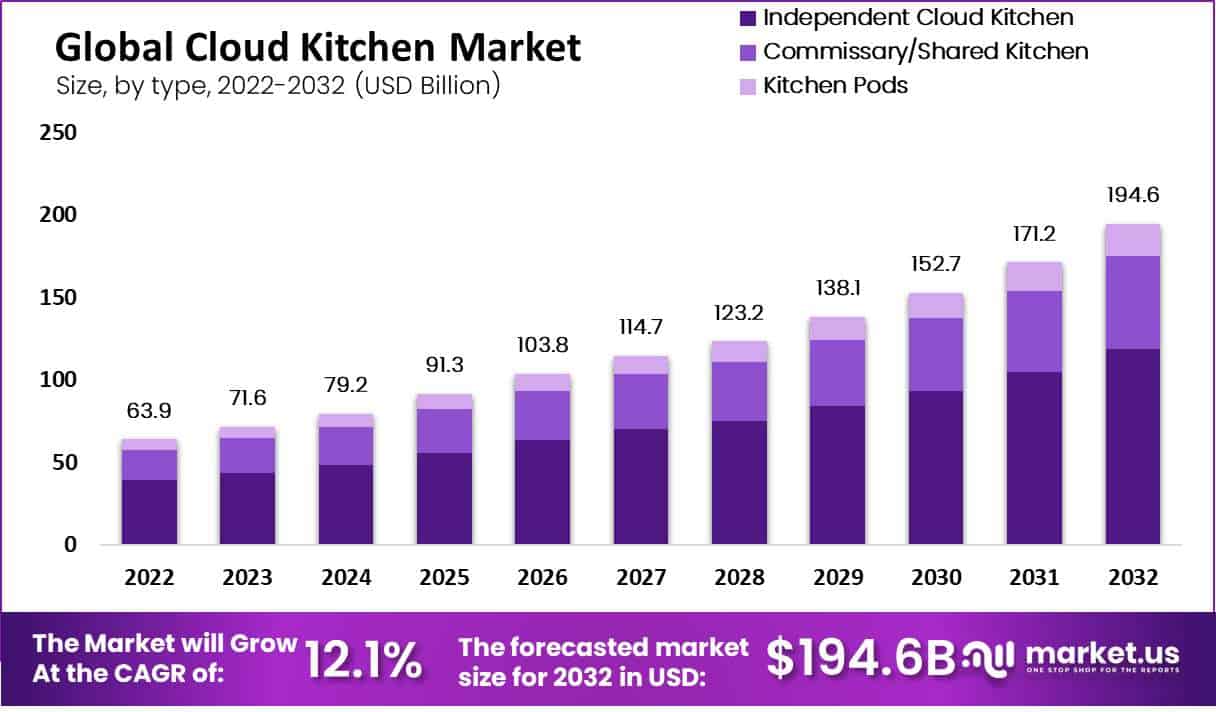

The global cloud kitchen market, also known as “ghost kitchens” or “virtual kitchens,” has experienced rapid growth, driven by the increasing demand for online food delivery services. In 2023, the market was valued at USD 71.6 billion and is projected to reach USD 194.6 billion by 2032, growing at a compound annual growth rate (CAGR) of 12.1% during the forecast period from 2023 to 2032. Cloud kitchens enable food businesses to minimize overhead costs by eliminating the need for traditional restaurant setups while maximizing their reach through delivery channels.

Several factors are fueling the expansion of the cloud kitchen market. The growing penetration of smartphones and the widespread use of food delivery apps have reshaped consumer behavior, with an increasing preference for ordering food online rather than dining out. Additionally, advancements in digital ordering technologies, along with the growing popularity of third-party delivery platforms like Uber Eats and DoorDash, have made it easier for cloud kitchens to operate efficiently. These technological innovations enable food brands to scale up quickly and offer a variety of cuisines without the constraints of physical space.

However, the market faces certain challenges. High initial setup costs for cloud kitchens, especially for implementing technology and maintaining food safety standards, present a barrier for some businesses. Trust issues regarding hygiene, pricing, and the quality of service also limit customer adoption. Moreover, the increasing awareness of the health risks associated with fast food is shifting consumer preferences towards healthier options, which may curb demand for some cloud kitchen models.

Despite these challenges, significant opportunities remain. The low startup costs compared to traditional restaurants are attracting new entrants to the market. Furthermore, the shift towards franchised cloud kitchens is enabling rapid expansion. Franchised models are dominating the market, with a 65% revenue share in 2022, as these businesses capitalize on technology to manage multiple food brands under one roof. The independent cloud kitchen segment is also witnessing strong growth due to the rising demand for specialized cuisines like Thai and Chinese food.

While specific recent developments for Gustasi Chef were not found, similar cloud kitchen players in the market have expanded through partnerships, technology investments, and automation, which are likely trends Gustasi Chef could be following. Many cloud kitchens are improving efficiencies by automating processes and adopting AI-driven tools to streamline operations.

In 2021, Rebel Foods, the parent company of Faasos, raised $175 million in a Series F funding round, led by Qatar Investment Authority. This funding elevated Rebel Foods to a unicorn status, valued at $1.4 billion. The investment is directed towards international expansion, acquiring new brands, and enhancing their technological infrastructure to support a global network of over 450 cloud kitchens across 10 countries. The company is also planning to go public by 2025. Rebel Foods continues to introduce multiple brands under its umbrella, including Behrouz Biryani, Mandarin Oak, and SLAY Coffee, further diversifying its offerings and solidifying its position as one of the largest cloud kitchen operators globally.

As part of Rebel Foods, Behrouz Biryani has been instrumental in boosting the company’s overall sales, contributing to an annual run rate of $150 million, with year-on-year growth of 100%. The brand has been expanding internationally alongside Faasos, with a presence in multiple markets. The brand plays a significant role in Rebel Foods’ growth strategy, capitalizing on the popularity of Indian cuisine, especially Biryani, in both domestic and international markets.

DoorDash has been active in mergers and acquisitions to strengthen its market position. In 2021, it acquired Bbot, a startup that offers ordering and payment software for hospitality providers. This acquisition allows DoorDash to expand its services beyond delivery, focusing on restaurant efficiency. DoorDash has also expanded its ghost kitchen offerings, launching “DoorDash Kitchens” in multiple locations to provide shared kitchen spaces for various restaurant brands. This strategy enables restaurants to operate without physical locations, a growing trend in the cloud kitchen space.

Cloud Kitchen Statistics

- The food delivery industry shows an annual growth rate of 12.78% worldwide.

- Ghost kitchens are starting to redefine the restaurant industry. In 2022, this industry’s global market size sat at $71.14 billion, and that figure only continues to increase.

- Thanks to a rise in technology facilitating mobile food delivery apps, more than 50% of adults say ordering takeout or delivery is an essential part of their lives.

- In the past five years, this industry has grown by 3.9% and isn’t showing any signs of slowing down.

- Delivery services offer convenience to customers, propelling ghost kitchens to hold a 50% market share in the global drive-thru and takeaway food service industry.

- A collective data set states that by the end of 2021, the revenue from cloud kitchens will have reached $31.7 billion. A (CAGR) of 13.2% is expected to reach $68.7 billion in 2027.

- The average cloud kitchen profit margin is 20%-25%.

- Generally, if you manage 25-50 orders worth Rs. 200-250 each day, your estimated monthly income would be somewhere between Rs. 2 Lacs – Rs. 4 Lacs.

- Accordingly, your average profit would be Rs. 50,000 – Rs. 90,000 per month.

- However, if you partner with food ordering companies like Swiggy or Zomato, 20% – 25% commission plus GST will be deducted from each order.

- The minimum investment required to run a cloud kitchen is Rs. 6 Lacs – Rs. 7 Lacs initially.

- The cost of food packaging can vary between Rs 40,000 and Rs 60,000, depending on the amount ordered and the quality of the packaging.

- The best way to create buzz around your new cloud kitchen is to run ads on Facebook, Instagram, and YouTube. This would cost a minimum of Rs. 10,000 initially.

- The costs for point-of-sale (POS) systems and delivery fees for a cloud kitchen restaurant can vary, with POS systems typically incurring upfront costs ranging from $1,000 to $5,000, while delivery fees from third-party platforms may range from 15% to 30% of the order value.

- The cost of staffing can vary based on the size of the operation and roles required, starting from $2,000 for one-person operations to $25,000+ for large operations.

- Kolkata-based chain of cloud kitchens Edabba is expecting over 100 percent growth in business in FY23 backed by the launch of a range of cuisines and foray into newer markets.

Emerging Trends

- Automation and AI Integration: Automation is becoming crucial for cloud kitchens to enhance efficiency and consistency. Smart kitchen equipment like robotic cooking systems and AI-driven inventory management tools are gaining traction. This technology streamlines operations by reducing labor costs and improving food preparation accuracy, ensuring high-volume output with consistent quality.

- Data-Driven Decision-Making: Cloud kitchens are increasingly leveraging data analytics to optimize operations. Customer data from food delivery platforms help businesses refine their menus, pricing strategies, and delivery times. Insights from data can also predict consumer preferences and adapt to seasonal trends, enhancing customer satisfaction.

- Vertical Consolidation: Many cloud kitchen companies are moving towards a model of vertical integration, where they control every aspect of their operations—from sourcing ingredients to managing deliveries. This trend reduces reliance on third-party suppliers and delivery platforms, allowing for greater control over quality and cost management.

- Expansion of Shared Kitchen Spaces: The popularity of shared kitchens, where multiple brands operate from the same kitchen facility, continues to rise. This model helps reduce overhead costs for smaller brands and new entrants. It also allows for rapid scaling by reducing the need for expensive physical spaces.

- Sustainability Focus: Sustainability is becoming a key consideration in cloud kitchen operations. Companies are adopting eco-friendly packaging solutions and optimizing their supply chains to reduce food waste. This aligns with increasing consumer demand for environmentally responsible food choices.

- Diversification of Cuisine Offerings: Cloud kitchens are capitalizing on the growing demand for diverse and international cuisines. By offering a range of specialized menus under one roof, companies can cater to varying tastes, expanding their reach without the limitations of traditional restaurant space.

Use Cases

- Automation and AI Integration: Automation is becoming crucial for cloud kitchens to enhance efficiency and consistency. Smart kitchen equipment like robotic cooking systems and AI-driven inventory management tools are gaining traction. This technology streamlines operations by reducing labor costs and improving food preparation accuracy, ensuring high-volume output with consistent quality.

- Data-Driven Decision-Making: Cloud kitchens are increasingly leveraging data analytics to optimize operations. Customer data from food delivery platforms help businesses refine their menus, pricing strategies, and delivery times. Insights from data can also predict consumer preferences and adapt to seasonal trends, enhancing customer satisfaction.

- Vertical Consolidation: Many cloud kitchen companies are moving towards a model of vertical integration, where they control every aspect of their operations—from sourcing ingredients to managing deliveries. This trend reduces reliance on third-party suppliers and delivery platforms, allowing for greater control over quality and cost management.

- Expansion of Shared Kitchen Spaces: The popularity of shared kitchens, where multiple brands operate from the same kitchen facility, continues to rise. This model helps reduce overhead costs for smaller brands and new entrants. It also allows for rapid scaling by reducing the need for expensive physical spaces.

- Sustainability Focus: Sustainability is becoming a key consideration in cloud kitchen operations. Companies are adopting eco-friendly packaging solutions and optimizing their supply chains to reduce food waste. This aligns with increasing consumer demand for environmentally responsible food choices.

- Diversification of Cuisine Offerings: Cloud kitchens are capitalizing on the growing demand for diverse and international cuisines. By offering a range of specialized menus under one roof, companies can cater to varying tastes, expanding their reach without the limitations of traditional restaurant space.

Major Challenges

- Expanding Food Brands with Lower Costs: Traditional restaurants that want to expand into new regions without incurring high upfront costs can leverage cloud kitchens to set up operations. For instance, Rebel Foods, which operates brands like Faasos and Behrouz Biryani, expanded across 10 countries using over 450 cloud kitchens. This approach allows them to reach more customers without the need for physical restaurant locations. The cost savings are significant as cloud kitchens require up to 50% less capital investment than traditional restaurants. Additionally, it reduces the need for expensive real estate and staffing costs.

- Meeting High Demand for Food Delivery: The rise of food delivery platforms like UberEats, DoorDash, and Zomato has driven demand for cloud kitchens. Restaurants can operate solely for delivery purposes without a dine-in facility. DoorDash expanded its delivery-first model by launching DoorDash Kitchens to help restaurant brands serve customers more efficiently. This model allows restaurants to handle 30% more orders than they would in a dine-in setting, as they focus entirely on delivery logistics. Additionally, online ordering from cloud kitchens is expected to account for more than 50% of restaurant sales in some regions.

- Rapid Brand Launch and Experimentation: Cloud kitchens allow new food concepts to be launched quickly and tested without the constraints of a traditional restaurant. For example, Rebel Foods launched multiple brands under one kitchen, including different cuisine types such as pizza, biryani, and desserts, allowing the company to experiment with different menus. This allows businesses to scale quickly and pivot if necessary. They can introduce new products or brands within 30 days, compared to the much longer timeline required for traditional restaurants.

- Partnership with Delivery Platforms: Cloud kitchens can partner with major delivery platforms to expand their reach. For example, McDonald’s partnered with Just Eat Takeaway in 2022 to extend its food delivery services across Europe. By partnering with delivery services, cloud kitchens can reach millions of customers without needing a direct customer base, as these platforms already have a vast user network. This strategy has helped businesses like DoorDash serve over 30 million customers across multiple cities.

- Supporting Independent Food Entrepreneurs: Independent chefs and small food entrepreneurs use shared cloud kitchens to start their businesses without the need for high capital. Platforms like Kitchen United provide space and resources for smaller food operators to run their virtual kitchens. This lowers the barrier to entry for small entrepreneurs, offering shared facilities at 30% lower costs than setting up a new kitchen. It allows them to focus on food quality and delivery without worrying about restaurant management logistics.

Market Growth Opportunities

- Rising Demand for Food Delivery: The growing preference for online food delivery is a major driver of cloud kitchen growth, cloud kitchens are well-positioned to meet this demand. The convenience of ordering meals online, combined with the increasing adoption of food delivery apps like Uber Eats and DoorDash, provides cloud kitchens with a large customer base.

- Low Setup and Operational Costs: Compared to traditional restaurants, cloud kitchens require lower capital investments due to the absence of a physical dine-in space. This allows businesses to enter new markets with minimal costs and expand rapidly. This is particularly beneficial for smaller brands or food entrepreneurs looking to establish a foothold in the market.

- Technological Advancements: Automation and AI technologies offer immense potential for cloud kitchens to optimize operations, streamline food preparation, and enhance delivery logistics. AI can help in demand forecasting, optimizing inventory, and automating customer interactions. The adoption of smart kitchens and robotic cooking systems further reduces labor costs and improves efficiency.

- Customization and Menu Expansion: Cloud kitchens allow brands to test and launch new menu items quickly. The ability to pivot menus based on customer feedback creates opportunities for more personalized and diverse offerings, catering to various consumer preferences. For instance, brands can introduce specialized cuisines or seasonal dishes to attract niche audiences.

Key Player Analysis

Gustasi Chef operates as a platform focused on supporting cloud kitchens and home cooks in India. The company helps culinary professionals by offering a seamless way to deliver homemade food to customers through its online service. In recent years, Gustasi Chef has seen substantial growth, with its business model gaining attention as cloud kitchens became more prevalent, especially post-2020. In 2023, the company expanded its services by collaborating with a wider range of home chefs, enhancing its platform capabilities to improve order management and customer engagement. Gustasi Chef also experienced a steady rise in its user base month by month, especially from March to October 2023, as more customers turned to online food delivery options.

In 2023, Faasos, a brand under Rebel Foods, continued its robust growth within the cloud kitchen sector. Throughout the year, Faasos, which specializes in wraps and fast-casual meals, expanded its reach by leveraging Rebel Foods’ extensive cloud kitchen network. By the end of 2023, Faasos operated as part of over 450 cloud kitchens across 10 countries, delivering a wide variety of cuisines. In particular, the company saw strong monthly growth in its key markets like India and the UAE, with consistent order volume increases, especially from March to September. During this period, Faasos benefited from Rebel Foods’ data-driven operational model and automation technologies, allowing for efficient scaling across its multiple locations.

In 2023, Behrouz Biryani, a brand under Rebel Foods, continued its expansion as one of the most successful cloud kitchen ventures. Delivering approximately 2 lakh biryani packets per month, Behrouz Biryani capitalized on the increasing demand for food delivery across major urban centers. The brand’s operations were supported by over 450 cloud kitchens worldwide, spanning across 75 cities. Notably, from March to September 2023, the brand saw consistent monthly growth in key markets like India, the UAE, and Saudi Arabia, driven by a surge in online orders and expanding kitchen infrastructure.

In 2023, DoorDash Inc. continued to expand its cloud kitchen operations through its DoorDash Kitchens initiative. The company focused on growing its full-service cloud kitchen model, which allows restaurants to operate without the need for full-time staff or managing real estate costs. By April 2023, DoorDash had successfully launched new kitchen locations in San Jose and Redwood City, providing operational support, hiring staff, and handling daily management for its partner restaurants.

In 2023, Kitchen United continued expanding its cloud kitchen services, positioning itself as a key player in the industry. The company offers commercial kitchen spaces and resources to restaurants looking to enter or expand in the delivery-only market. By providing these facilities, Kitchen United helps restaurant brands reduce overhead costs while tapping into the growing demand for food delivery. Throughout the year, Kitchen United focused on opening new centers, increasing its operational footprint from 16 to 20 kitchen centers by July 2023, with more expected in high-demand locations like Chicago and Texas. This growth has been fueled by partnerships with major food brands, helping them scale operations more efficiently through shared kitchen models.

In 2023, Kitopi Catering Services LLC continued its growth as a leading cloud kitchen operator. The company, founded in 2018, manages over 75 cloud kitchens across the UAE, Saudi Arabia, Kuwait, and Bahrain, allowing food and beverage (F&B) brands to scale rapidly without investing in physical infrastructure. By July 2023, Kitopi had invested $415 million from a Series C funding round, which it used to expand both its kitchen network and its proprietary Smart Kitchen Operating System (SKOS). This system helps optimize kitchen operations, allowing Kitopi to handle 200+ F&B brands and reduce food preparation times by up to 40%.

In 2023, Rebel Foods Private Limited continued to strengthen its position as the world’s largest cloud kitchen company, operating over 450 kitchens in 10 countries, including India, the UAE, and the UK. The company saw its revenue grow significantly, surpassing INR 1,000 crore (approximately $140 million) by the end of the fiscal year in March 2023, reflecting a 39% year-on-year increase. Despite these gains, Rebel Foods also reported a loss of INR 656 crore, largely attributed to rising operational costs, including raw materials and employee benefits.

In 2023, Zuul Kitchens Inc., a New York-based cloud kitchen operator, continued to support restaurants and food brands by offering comprehensive kitchen infrastructure, logistics, and technology solutions. Specializing in ghost kitchens, Zuul provides partners with kitchen space and marketing support, allowing them to optimize delivery operations and reach a broader audience. With a focus on the U.S. market, Zuul operates multiple kitchens in major cities and is expanding its network steadily. Throughout 2023, Zuul increased its operational footprint, allowing brands to boost efficiency by reducing overhead costs through shared kitchen models.

In 2023, Ghost Kitchen Orlando continued to grow as a key player in the Central Florida cloud kitchen market, offering fresh, made-to-order meals through delivery platforms like Uber Eats, DoorDash, and Grubhub. The business specializes in lunches and catering services, focusing on high-quality, all-natural ingredients. In June 2022, Ghost Kitchen Orlando expanded its offerings by launching a new brick-and-mortar location called Bricks & Bowls in the Millenia Mall, further solidifying its presence in the Orlando food scene. Throughout 2023, the company saw consistent demand for its weekly lunches and customizable catering services, especially through partnerships with major delivery platforms.

In 2023, CloudKitchens, founded by Travis Kalanick, continued its expansion in the cloud kitchen sector by providing real estate and kitchen infrastructure solutions for delivery-only restaurants. CloudKitchens operates kitchens in high-demand areas, allowing restaurant operators to scale their delivery businesses without the need for physical dining spaces. This model helps reduce overhead costs significantly, making it easier for new and established brands to enter the online food delivery market. By mid-2023, the company was managing over 3,300 kitchens globally, primarily focusing on urban areas across the U.S. and internationally.

In 2023, Swiggy sold its cloud kitchen business, Swiggy Access, to cloud kitchen operator Kitchens@ in an all-equity transaction as part of Swiggy’s strategic shift to streamline its operations. Swiggy launched its Access kitchens in 2017 to enable restaurant partners to expand their reach without setting up physical dining spaces. This program helped restaurant brands serve areas with high demand for delivery but without nearby locations, allowing them to reduce costs and improve delivery times. However, as Swiggy’s core food delivery business faced slower growth in 2023, the company decided to exit the cloud kitchen segment to focus on more profitable ventures. The acquisition by Kitchens@ expanded its operations to over 700 kitchens across 52 locations in four cities, boosting its ability to meet the growing demand for online food delivery.

In 2023, Zuul Kitchens, a cloud kitchen operator based in New York City, continued to provide infrastructure, kitchen space, and delivery logistics for restaurant brands, helping them expand their online food delivery operations. As a significant player in the U.S. cloud kitchen market, Zuul enables brands to optimize their delivery services through its integrated solutions, including technology for order management and marketing support. In 2023, Zuul Kitchens expanded its network of kitchens, focusing on partnerships with local and national food brands to streamline operations and meet the growing demand for online ordering. Throughout the year, Zuul saw steady growth in the number of kitchens and restaurant partners, particularly during peak months from April to September. This growth reflects the broader industry trend, where cloud kitchens are playing a key role in supporting the food delivery boom.

Conclusion

The cloud kitchen market is poised for significant growth, driven by the increasing demand for online food delivery services and evolving consumer preferences. cloud kitchens offer a scalable and cost-effective solution for restaurants and entrepreneurs to meet growing demand without the need for physical dining spaces. Key factors contributing to this growth include advancements in technology, such as the use of AI and automation, which streamline kitchen operations and improve efficiency. Moreover, the flexibility to cater to diverse culinary preferences, particularly in densely populated urban areas, allows cloud kitchens to quickly adapt to market needs.